Global Vitrectomy Devices Market Analysis By Product Type (Vitrectomy surgical platforms, Vitrectomy packs, Access and fluidics modules, Illumination and visualization modules, Laser and photocoagulation systems, Vitrectomy probes and cutters, Micro-instruments and surgical adjuncts, Others), By Application (Diabetic retinopathy, Retinal detachment, Macular hole, Vitreous haemorrhage, Others), By End-User (Hospitals, Ophthalmology Clinics, Ambulatory surgical centres) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163444

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

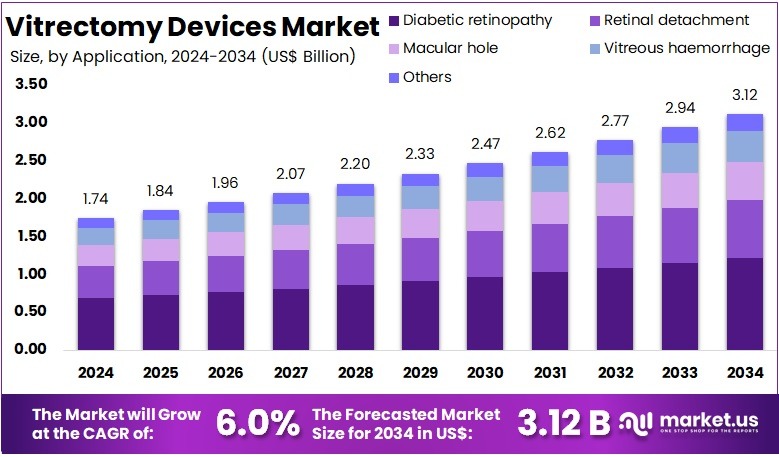

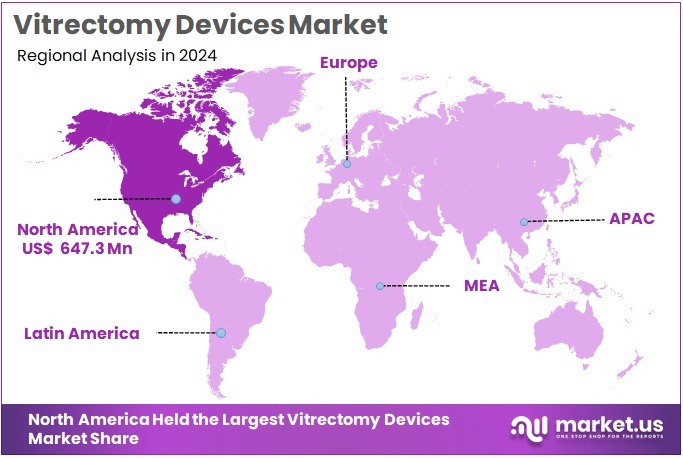

The Global Vitrectomy Devices Market size is expected to be worth around US$ 3.12 Billion by 2034, from US$ 1.74 Billion in 2024, growing at a CAGR of 6% during the forecast period from 2025 to 2034. North America held a dominant market position in the global vitrectomy devices market, capturing more than a 37.2% share and achieving a market value of approximately USD 647.3 million.

The vitrectomy devices market is expanding due to rising demand for vitreoretinal surgery. According to WHO, at least 2.2 billion people live with near or distance vision impairment, and 1 billion cases could have been prevented or remain untreated. Global blindness reached 43.3 million people in 2020, and 55% (23.9 million) were female. Moreover, 90% of individuals with vision impairment reside in low- and middle-income nations, creating substantial unmet need and future device demand.

Growth in diabetic eye disease is a major catalyst. WHO reported in November 2024 that over 800 million adults now live with diabetes, having more than quadrupled since 1990. For example, CDC estimates show 9.6 million people in the U.S. had diabetic retinopathy in 2021, including 1.84 million with vision-threatening disease. As advanced diabetic retinopathy increases, pars plana vitrectomy volumes grow, driving utilization of consoles, cutters, illumination systems, and single-use surgical packs.

Ageing demographics accelerate the need for vitreoretinal procedures. The United Nations projects that 1.2 billion people will be aged 60+ in 2025, rising to 2.1 billion by 2050. Study by the UN’s 2024 World Population Prospects confirms rapid growth in the 65+ cohort. Posterior vitreous changes, macular degeneration, and retinal tears increase with age. As a result, expanding elderly populations directly increase vitrectomy volumes and equipment consumption in both mature and emerging markets.

Retinal detachment epidemiology reinforces the trend. A national registry study from Denmark showed more than a 50% rise in rhegmatogenous retinal detachment incidence from 2000 to 2016. International data often report 10–18 cases per 100,000 people annually in high-income countries. In South Korea, the incidence of pars plana vitrectomy rose from 15.1 to 49.4 cases per 100,000 between 2002 and 2013. These increases support consistent demand for high-cut-rate probes, fluidics devices, and trocar-cannula systems.

Technology, Outcomes, and Regulatory Environment

Technology improvements are enhancing surgical efficiency. For instance, small-gauge micro-incision systems improve visualization, shorten recovery times, and reduce trauma. Evidence indicates that up to 52% of eyes may require cataract surgery within one year after vitrectomy, and up to 80% develop cataract within two years. This close postoperative link drives ongoing follow-up interventions and supports demand for integrated phaco-vitrectomy systems and consumables.

Clinical outcomes and complication monitoring highlight the importance of device precision. In a study of 137 patients undergoing pars plana vitrectomy with air tamponade, a 7.99% recurrent detachment rate was recorded. Missed retinal breaks accounted for 48.9% of recurrences, and reopening of original tears accounted for 43.8%. These data reinforce the role of high-performance cutters, advanced illumination, and reliable fluidics to improve safety and outcomes, particularly in complex retinal repair.

Screening program evolution is expanding treatment access. According to NHS reporting, England and Wales use a “lower-risk pathway” to screen low-risk diabetic patients every two years while maintaining closer surveillance for higher-risk groups. Annual key-performance-indicator releases for 2023–24 confirm sustained national oversight. As screening coverage strengthens, more patients reach surgery at appropriate time points, supporting broader procurement of vitrectomy consoles and premium consumables.

A stable regulatory environment supports consistent product innovation. In the United States, FDA assigns vitrectomy systems to 21 CFR 886.4150 under product code HQE. A Third-Party Review pathway expedites certain 510(k) submissions, while recognized standard IEC 80601-2-58 guides performance testing. Recent clearances in 2023–2024 for integrated vitrectomy–phaco platforms illustrate ongoing upgrades. Combined with productivity losses estimated at US$411 billion annually due to sight loss, investment in surgical technology remains a high priority globally.

Key Takeaways

- The Global Vitrectomy Devices Market is projected to reach US$ 3.12 Billion by 2034, growing at a CAGR of 6% from 2025 to 2034.

- In 2024, Vitrectomy surgical platforms led the Product Type segment, capturing over 31.4% of the total market share.

- Diabetic retinopathy dominated the Application Segment in 2024, holding more than 39.2% of the global Vitrectomy Devices Market share.

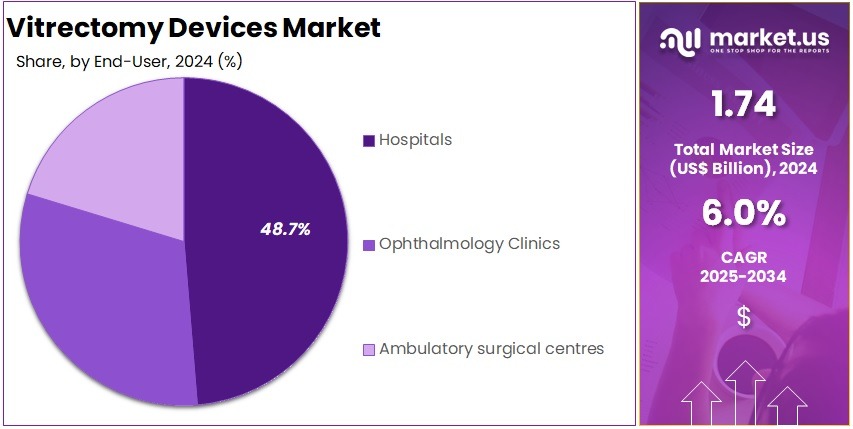

- Hospitals accounted for the largest share in the End-User Segment in 2024, representing over 48.7% of the market.

- North America led the global market in 2024, holding more than 37.2% market share, valued at approximately USD 647.3 million.

Product Type Analysis

In 2024, the Vitrectomy surgical platforms section held a dominant market position in the Product Type segment of the Vitrectomy Devices Market, and captured more than a 31.4% share. These systems were favored for integrated technology and high surgical precision. Surgeons used them for complex retinal procedures that required automation and stability. Vitrectomy packs also saw strong demand. Hospitals preferred sterilized single-use kits to improve safety and reduce infection risks. Procedure efficiency improved as disposable consumables supported consistent surgical workflows.

Steady growth was observed in access and fluidics modules. These modules ensured stable intraocular pressure and smooth fluid control. Real-time monitoring and enhanced pressure management increased surgeon confidence. Illumination and visualization modules also advanced. Surgeons adopted high-definition viewing systems and enhanced glare-free lighting. Digital visualization options improved precision and depth perception. As a result, improved visibility and control played a key role in surgical success across retinal procedures.

Laser and photocoagulation systems maintained stable adoption. Their ability to support retinal treatments strengthened usage. Surgeons relied on precise tissue targeting and compact laser systems that improved operating room efficiency. Vitrectomy probes and cutters expanded due to micro-incision technology. Faster cutting speeds and ergonomic designs supported safe tissue removal. Micro-instruments and surgical adjuncts, such as forceps and cannulas, remained essential. The others category grew gradually, driven by innovative accessories and surgeon-focused enhancements.

Application Analysis

In 2024, the Diabetic retinopathy section held a dominant market position in the Application Segment of the Vitrectomy Devices Market, and captured more than a 39.2% share. This growth was mainly driven by the increasing global prevalence of diabetes. As more patients develop diabetic eye complications, the demand for vitrectomy devices has risen. The early diagnosis of diabetic retinopathy and the use of advanced surgical instruments have significantly contributed to this trend.

Retinal detachment followed as a strong application area, recording steady growth. This segment benefited from the rise in trauma-related injuries and age-related retinal conditions. Moreover, the adoption of minimally invasive vitrectomy tools like 23-gauge and 25-gauge systems helped improve patient outcomes. As surgical techniques evolved, the use of these systems became more widespread, thus boosting their market share. This segment remains an essential area for vitrectomy device applications.

The Macular hole and Vitreous haemorrhage segments also contributed to the market. Surgeons increasingly prefer high-precision tools for macular hole surgeries, especially in elderly patients. The rise in retinal bleeding incidents linked to conditions like diabetes and hypertension supported the growth of vitreous haemorrhage treatments. Other applications, such as uveitis and ocular infections, represent a smaller portion of the market. However, advancements in fluid management and illumination systems have played a role in expanding these segments.

End-User Analysis

In 2024, the Hospitals segment held a dominant position in the End-User Segment of the Vitrectomy Devices Market, capturing more than 48.7% of the total market share. This dominance can be attributed to the high volume of surgeries performed in hospitals. Hospitals are well-equipped with specialized infrastructure and healthcare professionals, making them the preferred choice for vitrectomy procedures. The increasing prevalence of retinal diseases has further driven the demand for vitrectomy devices in hospital settings.

Ophthalmology clinics have also seen a steady increase in their market share. These clinics provide specialized eye care, which has become more sought after with advancements in surgical techniques and rising awareness of eye health. Though hospitals continue to lead, ophthalmology clinics are expected to experience considerable growth. Their specialized services and focused care make them an attractive option for patients requiring vitrectomy surgeries, contributing to their growing share in the market.

Ambulatory surgical centers (ASCs) are becoming a significant player in the vitrectomy devices market. These centers offer more cost-effective and efficient alternatives to hospitals. Patients benefit from shorter recovery times and lower surgical costs. Although ASCs currently hold a smaller share compared to hospitals, their appeal for outpatient surgeries is driving growth. As patients seek more affordable and convenient surgical options, ASCs are expected to continue expanding within the vitrectomy devices market.

Key Market Segments

By Product Type

- Vitrectomy surgical platforms

- Vitrectomy packs

- Access and fluidics modules

- Illumination and visualization modules

- Laser and photocoagulation systems

- Vitrectomy probes and cutters

- Micro-instruments and surgical adjuncts

- Others

By Application

- Diabetic retinopathy

- Retinal detachment

- Macular hole

- Vitreous haemorrhage

- Others

By End-User

- Hospitals

- Ophthalmology Clinics

- Ambulatory surgical centres

Drivers

Disease Burden and Aging Population Driving Vitrectomy Device Adoption

The rising burden of diabetic retinopathy and age-related macular degeneration has been expanding the surgical pool for vitrectomy devices. The growing geriatric base and increasing diabetes cases have driven procedure volumes across hospitals and specialty eye clinics. The market growth can be attributed to sustained demand for posterior-segment interventions. As these chronic conditions progress, the need for surgical management remains stable. As a result, consistent utilization of vitrectomy systems and accessories has been observed across treatment settings.

Diabetes prevalence has reached significant levels, strengthening demand for vitrectomy solutions. An estimated 589 million adults, representing 11.1% of the population, were living with diabetes in 2024–2025. By 2050, the diabetic population is projected to reach roughly 853 million. This large patient group supports a continuous caseload for ophthalmic surgeons. Increasing diagnosis and treatment of diabetic eye diseases reinforce stable long-term adoption of vitrectomy platforms.

Among diabetic individuals, the pooled global prevalence of any diabetic retinopathy is approximately 22.3%. This burden translated to about 103.1 million individuals living with diabetic retinopathy in 2020. The affected population is expected to grow to nearly 160.5 million by 2045. Advanced stages frequently result in complications such as vitreous hemorrhage and traction. These conditions require vitrectomy intervention. Therefore, the expanding diabetic retinopathy population contributes directly to procedure growth and supports continuous equipment usage.

Age-related macular degeneration continues to represent a key cause of vision impairment, reinforcing the need for vitrectomy devices. Approximately 196 million individuals were affected by AMD in 2020, with projections indicating nearly 288 million cases by 2040. Vision impairment associated with AMD impacted about 8.06 million people in 2021. These figures demonstrate substantial treatment demand for posterior-segment disease. As AMD progresses, surgical options are required. This ensures persistent demand for vitrectomy systems, instruments, and consumables across care facilities.

Restraints

Cost and Reimbursement Constraints Limiting Vitrectomy Device Adoption

High capital investment for vitrectomy platforms and procedure-related expenditure have restricted broader uptake, particularly in developing markets. Advanced systems, specialized instruments, and trained personnel increase overall treatment expense. Limited reimbursement environments compound this challenge, as hospitals face difficulty recovering costs for technologically intensive retinal procedures. As a result, adoption in price-sensitive regions remains limited, and budget-constrained providers often defer platform upgrades, slowing penetration of next-generation devices.

Procedure economics strongly influence decision-making in established markets. Day-of-surgery costs for retinal detachment repair have been reported at approximately USD 5,155 for standard pars plana vitrectomy, while complex procedures reach nearly USD 7,852 at U.S. academic centers. Several analyses indicated that Medicare reimbursement did not fully offset these expenditures, creating negative operating margins. These dynamics discourage investment in premium surgical systems and disposable instruments, particularly where institutional cost containment policies are enforced.

Reimbursement pressure has intensified. A 2025 policy review documented inflation-adjusted declines in Medicare payments for retinal detachment repair from 2013 to 2021. This trend has raised concern among providers about long-term financial viability. Lower real reimbursement limits revenue per case, while equipment, labor, and facility expenses continue to rise. As margins narrow, facilities tend to prioritize essential technologies, delaying adoption of advanced vitrectomy platforms that require significant upfront expenditure.

Regulatory reimbursement frameworks further shape purchasing behavior. Centers for Medicare & Medicaid Services issue annual updates for Ambulatory Surgical Center and Outpatient Prospective Payment System schedules. These updates define facility payments and often trail technology cost inflation, particularly for capital-intensive ophthalmic surgical equipment. This lag constrains returns on investment for high-performance vitrectomy devices. Consequently, facilities adopt conservative procurement strategies, emphasizing cost efficiency over rapid technological advancement, which slows premium device uptake.

Opportunities

Rising Adoption of Minimally Invasive Vitrectomy Systems and Ambulatory Surgical Settings

Technological progress in minimally invasive vitrectomy systems is expected to drive strong market expansion. The introduction of 27-gauge instruments and advanced fluidics has enabled smaller incisions, reduced trauma, and faster patient recovery. These developments improve clinical precision and efficiency. The growth of compact and more efficient vitrectomy platforms positions manufacturers to benefit from rising adoption across diverse surgical environments. Demand is reinforced as surgeons increasingly prioritize precision, flexibility, and safety in ophthalmic procedures.

The shift toward smaller-gauge vitrectomy devices is creating significant growth potential. Clinical evidence from more than 1,000 surgeries has demonstrated that 27-gauge systems deliver favorable safety outcomes. Comparative studies show outcomes equal to, or better than, those achieved with larger-gauge instruments. Surgeons are now expanding clinical applications for minimally invasive systems. As confidence increases, the market is expected to experience sustained demand for advanced gauge technologies that support predictable and consistent surgical performance.

A growing preference for outpatient and ambulatory surgical centers is accelerating adoption of compact vitrectomy systems. Vitrectomy procedures are predominantly performed as outpatient treatments, which reduces hospital burden and increases patient throughput. Ambulatory settings support efficient workflow and improve cost-effectiveness, benefiting both providers and payers. Equipment offering portability, quick turnover, and simplified setup fits this environment. As the surgical model shifts, manufacturers offering high-efficiency platforms that align with ambulatory care requirements are positioned to capture expanding purchasing demand.

Strong utilization trends in ophthalmic ambulatory surgery centers are further strengthening this opportunity. Historical market analyses indicate meaningful ASC adoption among vitreoretinal surgeons and a broader ophthalmology migration toward outpatient surgery. This evolution is driving demand for advanced consoles, disposable instruments, and integrated fluidics systems suited for high-volume practices. Increased ASC preference supports recurring purchase cycles for consumables and devices. Therefore, suppliers of compact, reliable, and high-performance vitrectomy solutions can expect sustained commercial momentum as outpatient care expands.

Trends

Digitally Enhanced and Robotics-Assisted Vitrectomy Systems

A trend toward digitally integrated vitrectomy platforms has been observed, driven by the need for greater precision and improved surgical ergonomics. The adoption of augmented visualization and digital microscopy has increased. Enhanced imaging supports retinal surgeons with real-time clarity. The growth of these systems can be attributed to continued innovation in digital interfaces and operating platforms. Demand has been supported by rising surgical complexity. Adoption has been further supported by increasing attention to surgeon fatigue and intraoperative efficiency.

Heads-up and three-dimensional visualization systems are being incorporated into retinal detachment and macular procedures. Randomized and prospective studies have documented non-inferior clinical outcomes versus traditional microscopes. Reduced light exposure and improved ergonomics have been demonstrated. Lower illumination levels support retinal safety. Ease of visualization has enabled enhanced depth perception and stable posture for surgeons. These systems have moved from experimental use to routine deployment in specialized centers, signaling a structural shift in operating room technology.

Early robotic assistance in vitreoretinal surgery has achieved notable milestones, including first-in-human success. Reviews have reported higher precision and controlled micro-manipulation. Operative times remain longer due to the early maturity stage of robotic platforms. Performance advantages include tremor filtration and sub-micron movement control. Current systems operate with stepwise automation and surgeon oversight. Clinical feasibility has been validated. Adoption is progressing incrementally as efficiency and workflow integration continue to improve across high-acuity ophthalmic centers.

Strategic interest has been demonstrated by key market participants. In 2022, Carl Zeiss Meditec acquired the Preceyes robotic surgical system, indicating long-term commitment to microsurgical automation. The acquisition reflects confidence in robotic assistance for retinal manipulation. This move aligns with the wider trend of major companies integrating digital optics, enhanced visualization, and robotics into ophthalmic portfolios. Such consolidation is expected to accelerate commercialization and regulatory pathways, supporting broader availability of digitally enhanced vitrectomy devices in the near term.

Regional Analysis

In 2024, North America held a dominant market position in the global vitrectomy devices market, capturing more than a 37.2% share and achieving a market value of approximately USD 647.3 million. This leadership is driven by several factors. The region has a high prevalence of retinal disorders, including diabetic retinopathy, macular holes, and retinal detachment. These conditions often require advanced surgical procedures, which in turn fuels the demand for vitrectomy devices.

The advanced healthcare infrastructure in North America further supports the widespread adoption of these devices. With state-of-the-art medical facilities and a high rate of technological adoption, healthcare providers in the region are well-equipped to use the latest vitrectomy devices. This infrastructure ensures that patients receive optimal care and outcomes from these advanced surgical tools, contributing to market growth.

In addition, North America’s strong regulatory environment plays a pivotal role in maintaining the quality and safety of medical devices. The U.S. Food and Drug Administration (FDA) sets stringent standards, which manufacturers adhere to when developing new vitrectomy devices. This regulatory framework promotes innovation and ensures that the devices used in ophthalmic surgeries are both safe and effective, enhancing the region’s market dominance.

The presence of key market players also contributes to North America’s leadership in the vitrectomy devices market. Leading ophthalmic companies in the region invest heavily in research and development. Through strategic partnerships and continuous innovation, these companies introduce cutting-edge vitrectomy technologies. Coupled with favorable reimbursement policies, these factors have created an environment that encourages the widespread use of vitrectomy devices in North America.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The vitrectomy devices market is highly competitive, driven by leading companies such as Alcon Inc., Bausch + Lomb, and Carl Zeiss Meditec AG. These key players are shaping the market with their technological innovations, strategic acquisitions, and robust product portfolios. Alcon Inc. holds a dominant position due to its advanced surgical systems, including high-speed cutters and illumination technologies. Bausch + Lomb has gained a strong foothold by offering modular surgical platforms, while Carl Zeiss Meditec AG continues to lead with its precision-focused instruments and acquisition of D.O.R.C.

Other significant players, such as NIDEK Co. Ltd. and Johnson & Johnson Vision Care Inc., are also contributing to the market’s growth. NIDEK focuses on precision surgical instruments, gaining a loyal customer base, particularly in the Asia-Pacific region. Meanwhile, Johnson & Johnson Vision Care brings its vast ophthalmic expertise to the vitrectomy market. These companies are committed to enhancing patient safety, optimizing surgical efficiency, and providing high-quality surgical solutions that cater to both established and emerging markets.

Companies like D.O.R.C. Holding B.V., Geuder AG, and Oertli Instrumente AG have solidified their positions by providing specialized surgical instruments. D.O.R.C., now part of Carl Zeiss Meditec AG, was recognized for its retinal surgical offerings. Geuder AG focuses on high-quality, precision surgical tools, while Oertli Instrumente AG provides compact, efficient vitrectomy systems. These companies are known for their innovation, reliability, and continued focus on enhancing the efficacy of retinal surgeries worldwide.

Emerging companies like Blink Medical, Topcon Corporation, and MedOne Surgical are also gaining traction. Blink Medical is gaining attention by offering cost-effective solutions to meet growing demand in the retinal care sector. Topcon Corporation continues to innovate with diagnostic and surgical systems integrated with advanced imaging technology. MedOne Surgical is known for its specialized surgical instruments, further strengthening its position in the vitrectomy devices market. These emerging players are focused on affordability and accessibility without compromising quality.

Market Key Players

- Alcon Inc.

- Bausch + Lomb Incorporated

- Carl Zeiss Meditec AG

- NIDEK Co. Ltd.

- Johnson & Johnson Vision Care Inc.

- D.O.R.C. Holding B.V.

- Geuder AG

- Oertli Instrumente AG

- BVI

- Blink Medical

- Topcon Corporation

- HOYA Medical Singapore Pte. Ltd

- MedOne Surgical

- Oculus Surgical

Recent Developments

- In September 2022: Bausch + Lomb entered into an exclusive global distribution agreement with Alfa Instruments s.r.l., an Italian ophthalmic medical device company. Under this agreement, Bausch + Lomb assumed responsibility for the worldwide distribution and commercialization of Alfa Instruments’ line of surgical intraocular dyes, branded as Vitreocare. This portfolio includes products such as Vitreo Lutein for vitreous staining and Double Lutein Blue for internal limiting membrane and epiretinal membrane staining. These dyes are CE marked and have been proven safe and effective in the European Union. The distribution commenced in the first half of 2023, excluding Italy, where Alfa Instruments is based.

- In July 2024: Alcon completed the acquisition of BELKIN Vision for an upfront consideration of $81 million, with potential additional payments of up to $385 million contingent upon sales-based milestones. This acquisition includes BELKIN Vision’s Direct Selective Laser Trabeculoplasty (DSLT) technology, which is designed to simplify glaucoma treatment by automating the delivery of laser energy to the eye’s trabecular meshwork. The technology eliminates the need for a gonio lens or manual aiming, offering a non-contact, patient-friendly approach to glaucoma therapy.

- In August 2025: At the EURETINA 2025 conference, Zeiss introduced the TDC VELOCE™ high-speed cutter, designed for the EVA NEXUS™ phacovitrectomy system. This cutter features enhanced performance with a cut speed of up to 20,000 cuts per minute, improved aspiration flow for 25G/27G, and an ergonomic design for better maneuverability. It aims to provide constant intraoperative pressure stability (SMART IOP™) during posterior surgery, setting new standards in IOP stability during vitreous shaving.

Report Scope

Report Features Description Market Value (2024) US$ 1.74 Billion Forecast Revenue (2034) US$ 3.12 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Vitrectomy surgical platforms, Vitrectomy packs, Access and fluidics modules, Illumination and visualization modules, Laser and photocoagulation systems, Vitrectomy probes and cutters, Micro-instruments and surgical adjuncts, Others), By Application (Diabetic retinopathy, Retinal detachment, Macular hole, Vitreous haemorrhage, Others), By End-User (Hospitals, Ophthalmology Clinics, Ambulatory surgical centres) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Alcon Inc., Bausch + Lomb Incorporated, Carl Zeiss Meditec AG, NIDEK Co. Ltd., Johnson & Johnson Vision Care Inc., D.O.R.C. Holding B.V., Geuder AG, Oertli Instrumente AG, BVI, Blink Medical, Topcon Corporation, HOYA Medical Singapore Pte. Ltd, MedOne Surgical, Oculus Surgical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alcon Inc.

- Bausch + Lomb Incorporated

- Carl Zeiss Meditec AG

- NIDEK Co. Ltd.

- Johnson & Johnson Vision Care Inc.

- D.O.R.C. Holding B.V.

- Geuder AG

- Oertli Instrumente AG

- BVI

- Blink Medical

- Topcon Corporation

- HOYA Medical Singapore Pte. Ltd

- MedOne Surgical

- Oculus Surgical