Global Virtual Shopping Assistant Market Size, Share Analysis Report By Component (Solutions, Services), By Technology (Natural Language Processing (NLP), Machine Learning (ML), Computer Vision, Speech Recognition, Augmented Reality (AR), Others), By Device Platform (Smartphones/Tablets, Smart Mirrors & AR Displays, Desktop/Web Platforms, Smart Speakers/Voice-Activated Devices), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Large Enterprises, Small & Medium-Sized Enterprises (SMEs)), By Application (Product Discovery & Search, Virtual Try-On, Cart & Purchase Assistance, After-Sales Support, Inventory & Price Checking, Personalized Upselling/Cross-Selling), By End-User Industry (Retail & E-Commerce, Fashion & Apparel, Beauty & Cosmetics, Consumer Electronics, Home Decor & Furniture, Grocery & Food Delivery, Others (Books, Toys, Automotive Accessories, etc.), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152597

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- US Market Size

- By Component: Solutions

- By Technology: NLP

- By Device Platform: Smartphones/Tablets

- By Deployment Mode: Cloud-Based

- By Enterprise Size: Large Enterprises

- By Application: Product Discovery & Search

- By End-User Industry: Retail & E-Commerce

- Key Market Segments

- Emerging Trend

- Driver

- Restraint

- Market Opportunity

- Challenge

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

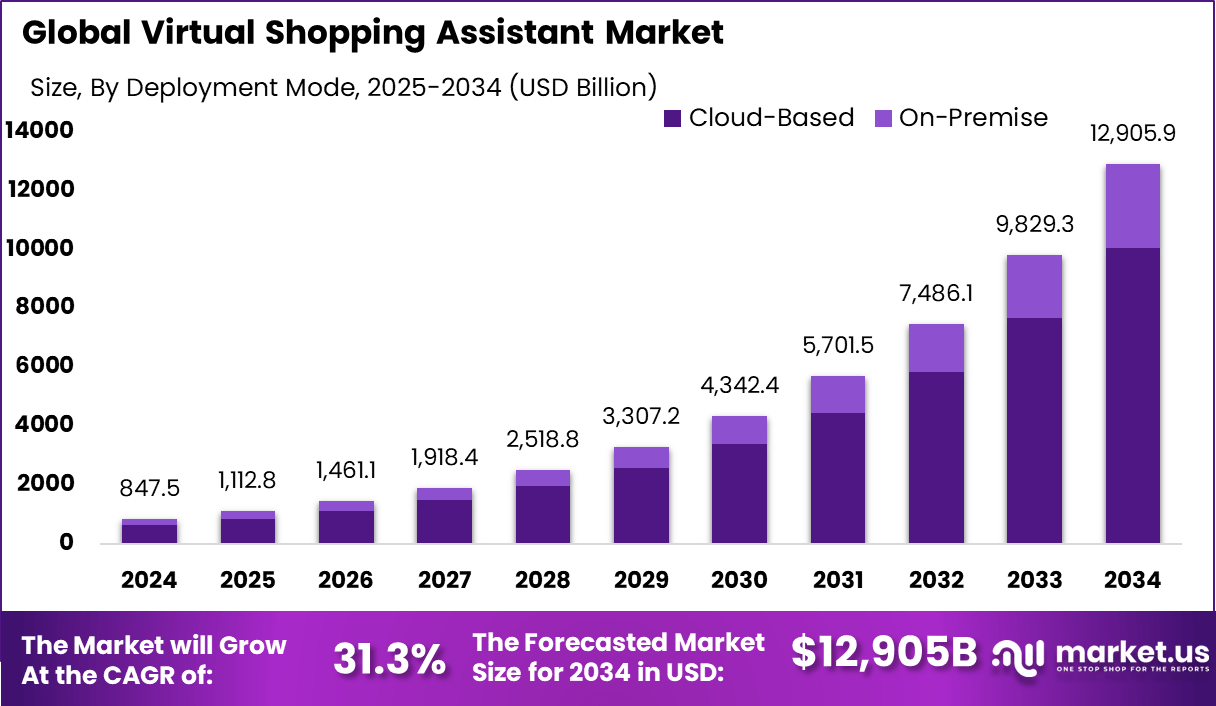

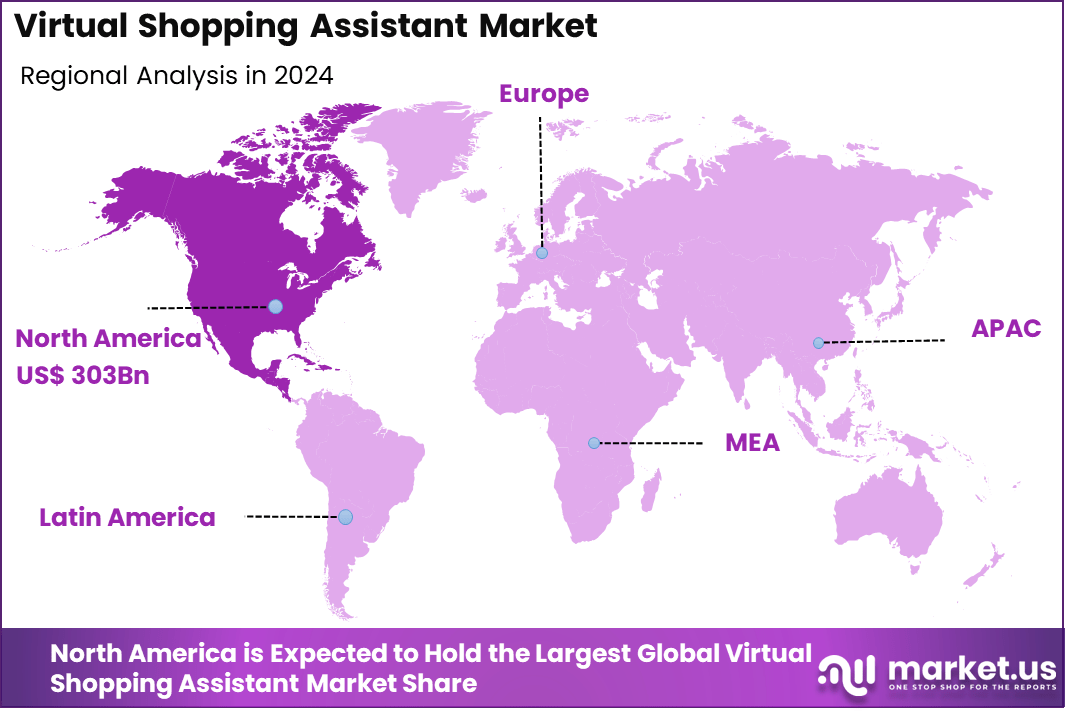

The Global Virtual Shopping Assistant Market size is expected to be worth around USD 12,905 Billion By 2034, from USD 847.5 billion in 2024, growing at a CAGR of 31.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.8% share, holding USD 303 Billion revenue.

The virtual shopping assistant market describes digital systems powered by artificial intelligence, natural language processing, computer vision, and voice technologies. These systems operate across e-commerce platforms, mobile apps, websites, smart devices, and in-store interactive interfaces. Their goal is to assist consumers through personalized product recommendations, real-time support, simplified checkout, and post-purchase engagement.

According to Market.us, The Global Intelligent Virtual Assistant Market is set for robust expansion, with the market value expected to rise from approximately USD 15.3 Billion in 2023 to nearly USD 309.9 Billion by 2033. This growth represents a strong CAGR of 35.1% over the forecast period. The increasing integration of AI-powered assistants across sectors such as banking, healthcare, retail, and enterprise services is driving this upward trajectory.

Scope and Forecast

Report Features Description Market Value (2024) USD 847.5 Bn Forecast Revenue (2034) USD 12,905.9 Bn CAGR (2025-2034) 31.3% Largest market in 2024 North America [35.8% market share] A primary driver is the growing adoption of conversational commerce and advancements in natural language processing and machine learning. These improvements allow virtual assistants to understand nuanced language and user intent, resulting in more natural and accurate interactions. Rising consumer demand for personalized shopping is driving adoption, as these tools provide tailored recommendations and faster support than traditional service methods.

Consumer demand has surged alongside increasing urbanization and rising disposable incomes. Urban shoppers, in particular, seek convenience and instant support, making virtual assistants an ideal solution for streamlined digital transactions. Consumers engaging with these assistants often report higher satisfaction and retention, indicating strong momentum in usage and loyalty across retail verticals.

Enterprises are implementing virtual shopping assistants to enhance customer satisfaction, reduce operational overheads, and increase conversion rates. These assistants are available around the clock, efficiently manage large volumes of customer inquiries, and allow human agents to focus on complex tasks. Automation of routine queries and targeted product suggestions drives both user engagement and sales outcomes.

Key Insight Summary

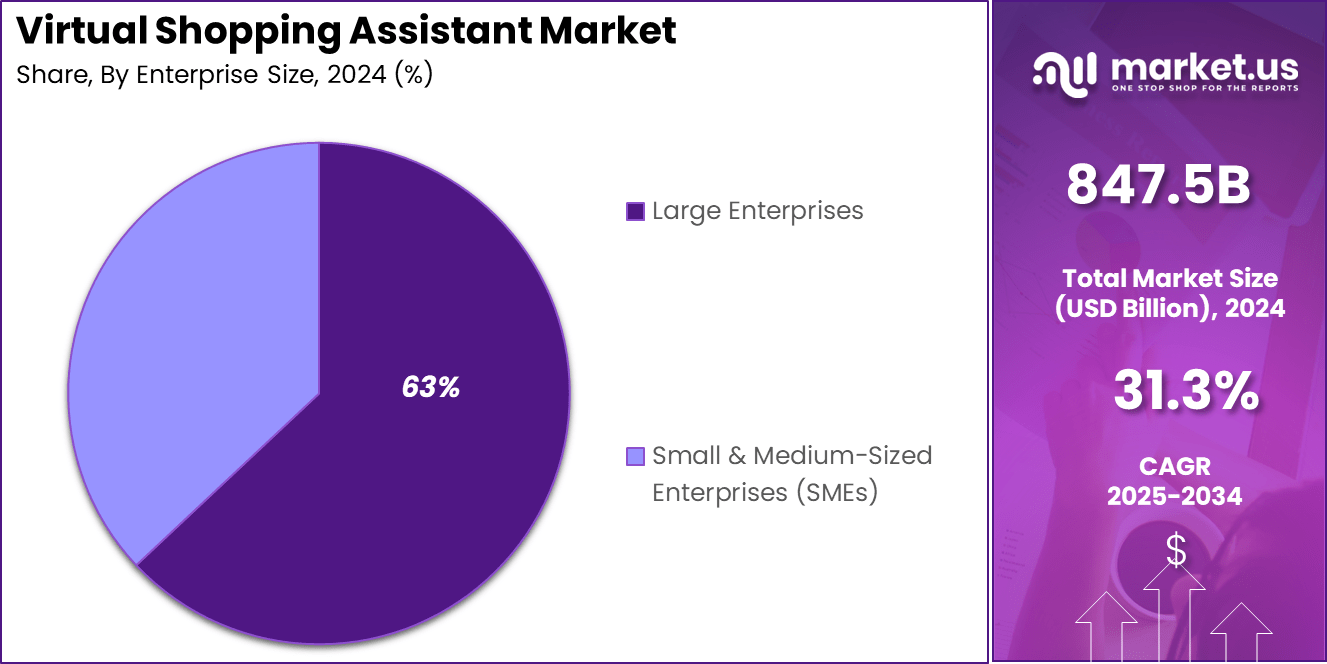

- The market is projected to grow from USD 847.5 billion in 2024 to approximately USD 12,905 billion by 2034, registering an impressive CAGR of 31.3%, driven by rising demand for personalized, AI-enabled shopping experiences.

- North America led the global market in 2024, capturing over 35.8% share and generating around USD 303 billion, supported by advanced retail digitalization and high consumer adoption of virtual assistants.

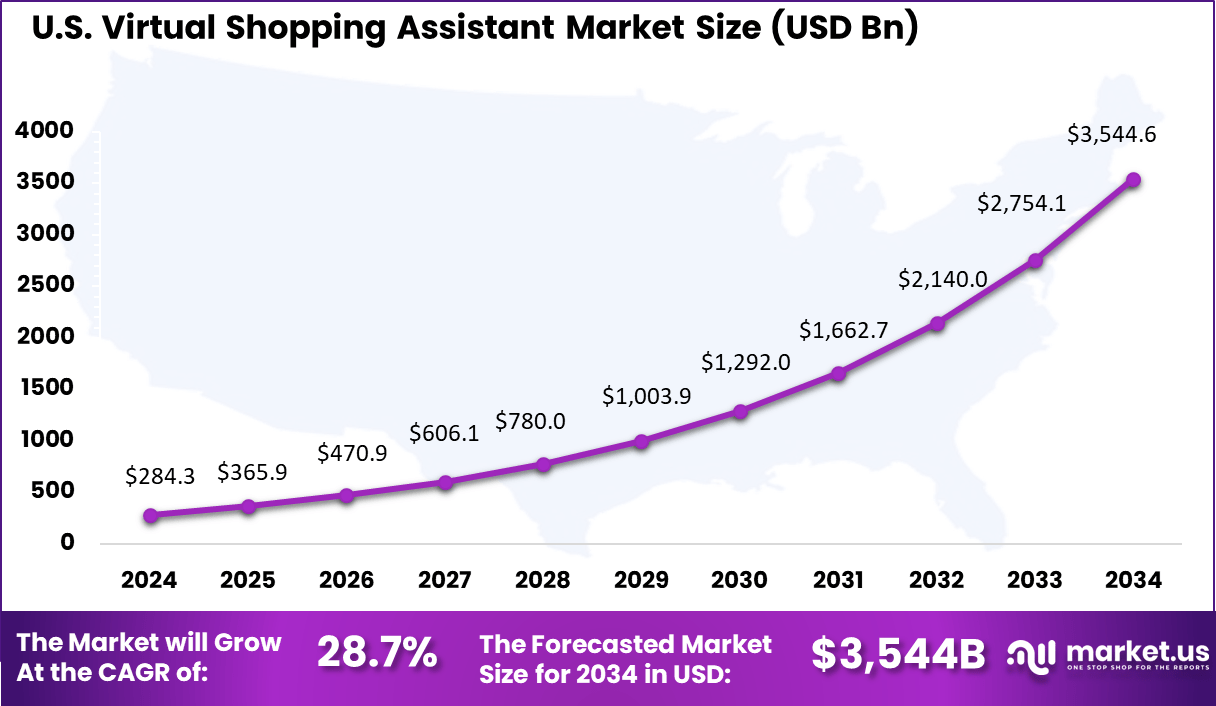

- The U.S. market alone contributed approximately USD 284.3 billion in 2024, with a projected CAGR of 28.7%, reflecting strong investments in AI and customer engagement technologies.

- By component, Solutions dominated with a 76% share, highlighting enterprise focus on full-featured virtual assistant platforms over standalone services.

- By technology, Natural Language Processing (NLP) accounted for 24% share, enabling intuitive, conversational interactions between shoppers and digital assistants.

- By device platform, Smartphones/Tablets led with 45% share, as mobile-first consumers increasingly rely on personal devices for shopping support and recommendations.

- By deployment mode, Cloud-Based solutions held a commanding 78% share, favored for scalability, flexibility, and lower upfront costs.

- By enterprise size, Large Enterprises accounted for 63% share, driven by their greater resources and need to scale personalized customer experiences.

- By application, Product Discovery & Search held 20% share, reflecting strong use of virtual assistants to enhance navigation and find relevant products quickly.

- Among end-user industries, Retail & E-Commerce dominated with 28% share, as businesses adopt AI assistants to improve conversion rates and customer satisfaction.

US Market Size

The U.S. Virtual Shopping Assistant Market was valued at USD 284.3 Billion in 2024 and is anticipated to reach approximately USD 3,544 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 28.7% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 35.8% share and generating over USD 303 billion in revenue within the Virtual Shopping Assistant market. This leadership can be attributed to the region’s early adoption of advanced retail technologies, widespread smartphone penetration, and strong e-commerce infrastructure.

Retailers across the United States and Canada have rapidly integrated AI-powered assistants into digital platforms to enhance customer service, streamline checkout experiences, and reduce cart abandonment. The presence of tech-savvy consumers, along with high awareness of personalized digital interactions, has further strengthened the region’s growth trajectory.

The market’s dominance in North America has also been reinforced by substantial investments from retail giants and tech companies into natural language processing, voice commerce, and virtual try-on technologies. The ecosystem is strongly supported by innovations in AI and machine learning coming out of leading U.S.-based technology firms.

By Component: Solutions

In 2024, the solutions segment dominated the virtual shopping assistant market by capturing the largest share of approximately 76%. This leadership is attributed to the growing demand for ready-to-deploy platforms that enable personalized and interactive shopping experiences.

Solutions have been preferred over services as they offer scalable and robust tools that integrate seamlessly with existing digital commerce channels. Businesses have increasingly opted for solutions that reduce deployment time and operational complexity while enhancing customer engagement and satisfaction.

By Technology: NLP

Natural Language Processing accounted for nearly 24% share, leading among technologies. The strong adoption of NLP stems from its capability to understand and process human language, enabling virtual assistants to converse naturally with users.

NLP-driven assistants have significantly improved response relevance and customer experience by interpreting queries in context and delivering intuitive product recommendations. The growing emphasis on conversational commerce has further accelerated the preference for NLP-based technologies in this market.

By Device Platform: Smartphones/Tablets

The smartphones and tablets platform dominated the market with about 45% share in 2024. This is primarily because of the widespread penetration of mobile devices as the preferred medium for online shopping.

Consumers increasingly rely on handheld devices for on-the-go product discovery, price comparisons, and instant support. The convenience of mobile commerce, combined with advancements in mobile-friendly virtual assistants, has made smartphones and tablets the leading platform.

By Deployment Mode: Cloud-Based

Cloud-based deployment emerged as the leading mode, holding approximately 78% share in 2024. Businesses have gravitated towards cloud-based solutions for their flexibility, scalability, and lower upfront costs.

These platforms allow retailers to manage virtual assistants with minimal IT infrastructure while ensuring fast updates and accessibility across regions. The growing trend of software-as-a-service (SaaS) has further reinforced the dominance of cloud-based deployments in the market.

By Enterprise Size: Large Enterprises

Large enterprises accounted for nearly 63% of the market in 2024. The higher adoption rate among large businesses is attributed to their significant investment capacity and focus on customer experience transformation.

These organizations are increasingly leveraging virtual shopping assistants to manage large volumes of customer interactions, optimize sales processes, and drive higher retention. Their need for advanced analytics and customization has also contributed to the segment’s leadership.

By Application: Product Discovery & Search

Product discovery and search led the application segment, capturing around 20% share. This dominance is driven by consumers’ growing expectations for intuitive and fast product navigation during online shopping. Virtual assistants designed to enhance product discovery help reduce drop-off rates and improve conversion by guiding shoppers directly to desired items. This application has been particularly valuable for retailers with extensive catalogs and diverse inventories.

By End-User Industry: Retail & E-Commerce

The retail and e-commerce industry emerged as the leading end-user, holding approximately 28% of the market share. The strong presence of virtual shopping assistants in this sector is driven by the urgent need to personalize digital shopping journeys and remain competitive. Retailers have been early adopters, integrating virtual assistants to offer 24/7 support, streamline purchasing decisions, and differentiate their online presence in an increasingly crowded marketplace.

Key Market Segments

By Component

- Solutions

- AI Chatbots

- Voice Assistants

- Visual Search Assistants

- Personalized Recommendation Engines

- Augmented Reality (AR)-Based Assistants

- Services

- Deployment & Integration

- Consulting & Strategy

- Support & Maintenance

By Technology

- Natural Language Processing (NLP)

- Machine Learning (ML)

- Computer Vision

- Speech Recognition

- Augmented Reality (AR)

- Others

By Device Platform

- Smartphones/Tablets

- Smart Mirrors & AR Displays

- Desktop/Web Platforms

- Smart Speakers/Voice-Activated Devices

By Deployment Mode

- Cloud-Based

- On-Premise

By Enterprise Size

- Large Enterprises

- Small & Medium-Sized Enterprises (SMEs)

By Application

- Product Discovery & Search

- Virtual Try-On

- Cart & Purchase Assistance

- After-Sales Support

- Inventory & Price Checking

- Personalized Upselling/Cross-Selling

By End-User Industry

- Retail & E-Commerce

- Fashion & Apparel

- Beauty & Cosmetics

- Consumer Electronics

- Home Décor & Furniture

- Grocery & Food Delivery

- Others (Books, Toys, Automotive Accessories, etc.)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Agentic AI for Autonomous Shopping Support

Virtual shopping assistants are evolving into intelligent agents capable of handling more complex tasks without needing continuous user commands. These assistants can now suggest full shopping carts, complete purchases, compare reviews, and even reorder frequently purchased items. The ability to act independently using buyer preferences and behavioral data marks a significant shift in how online shopping is being personalized.

This trend is being driven by growing interest in agentic AI, especially among tech-forward consumers under 45. These users are comfortable allowing AI tools to make decisions that align with their habits and preferences. As a result, shopping assistants are becoming trusted companions for online buyers, making decisions on their behalf and offering curated product recommendations before the user even asks.

Driver

Rising Demand for Personalized and Efficient Shopping

Consumers are actively seeking more personalized and faster shopping experiences. Virtual shopping assistants meet this demand by leveraging AI algorithms that analyze past behavior, preferences, and trends to recommend relevant products and services. The convenience of skipping product searches and directly receiving tailored suggestions has made these tools highly attractive in digital retail.

Additionally, time-constrained users, particularly in urban settings, appreciate that these assistants can operate across apps, platforms, and channels. From browsing to checkout, the assistant ensures a smooth experience, often syncing with loyalty programs and promotional alerts. This level of convenience helps retailers increase conversions and retain customers with minimal friction.

Restraint

Data Privacy and Security Concerns

One major restraint limiting the adoption of virtual shopping assistants is growing consumer concern around data privacy. These tools require access to personal data, including purchase history, browsing patterns, and sometimes financial details. Without clear control over data usage and storage, consumers may hesitate to fully engage with these platforms.

The security risk increases further when assistants operate across third-party platforms such as social media, messaging apps, and e-commerce sites. Any weak link in the ecosystem could lead to unauthorized access or data breaches. Retailers and technology providers must therefore invest heavily in data encryption, user consent mechanisms, and transparent privacy policies.

Market Opportunity

Integration with Price Tracking and Deal Discovery

An exciting opportunity lies in integrating virtual shopping assistants with dynamic pricing engines and real-time deal discovery tools. These assistants can scan thousands of listings across multiple marketplaces to locate the best prices, alert users when prices drop, and even apply coupons at checkout. This function saves time and money for users while increasing the likelihood of purchases.

Retailers can further enhance the user experience by syncing assistants with flash sale notifications, restock alerts, or bundled offers. The assistant can then act as a real-time savings advisor, helping users make smarter decisions during major sale events or limited-time campaigns. This adds value to the shopping experience and builds customer loyalty.

Challenge

Balancing Automation with Human Trust

As virtual assistants become more autonomous, retailers must be cautious about how much control is delegated to AI. Users may feel uncomfortable letting a digital agent complete purchases without manual confirmation, especially for high-value or sensitive products. Trust is a major factor, and users want clarity on how recommendations are generated and how decisions are made.

There is also a branding challenge. If most user interaction happens through a third-party assistant, retailers risk losing direct customer engagement. The assistant becomes the new interface, potentially reducing brand visibility and weakening personalized brand communication. Businesses must find new ways to maintain relationships with customers while still leveraging the benefits of automation.

Key Player Analysis

Amazon, Google, and Meta lead the virtual shopping assistant market by using AI and natural language tools to improve personalization and customer interaction. Their solutions offer product recommendations, automate support, and enable voice and visual search to enhance digital shopping journeys. These players focus on innovation to meet evolving consumer needs.

Microsoft, Alibaba, and Salesforce drive adoption with cloud-based AI platforms designed for omnichannel retail. They integrate chatbots, analytics, and automation to boost efficiency and loyalty. Their scalable solutions cater to businesses of all sizes while improving customer engagement.

IBM, Zendesk, Vue.ai, and Shopify offer specialized tools for retailers, focusing on support automation, visual merchandising, and easy store integration. Others innovate in real-time personalization and multilingual features. Together, they make virtual assistants essential to modern e-commerce strategies.

Top Key Players Covered

- Amazon

- Meta

- Microsoft

- Alibaba

- Salesforce

- IBM

- Zendesk

- Vue.ai

- Shopify

- Others

Recent Developments

- August 2024: Amazon launched Rufus, a generative AI-powered shopping assistant in India. Within less than a year, over 10 million users have tried Rufus, leveraging its conversational abilities for product guidance and personalized recommendations.

- 2024: Meta accelerated AI integration across its virtual shopping platforms. Notable features include AI-powered product discovery, virtual try-on via augmented reality, and personalized recommendations. Meta also introduced automated product tagging in user content, turning organic posts into shoppable moments.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Technology (Natural Language Processing (NLP), Machine Learning (ML), Computer Vision, Speech Recognition, Augmented Reality (AR), Others), By Device Platform (Smartphones/Tablets, Smart Mirrors & AR Displays, Desktop/Web Platforms, Smart Speakers/Voice-Activated Devices), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Large Enterprises, Small & Medium-Sized Enterprises (SMEs)), By Application (Product Discovery & Search, Virtual Try-On, Cart & Purchase Assistance, After-Sales Support, Inventory & Price Checking, Personalized Upselling/Cross-Selling), By End-User Industry (Retail & E-Commerce, Fashion & Apparel, Beauty & Cosmetics, Consumer Electronics, Home Decor & Furniture, Grocery & Food Delivery, Others (Books, Toys, Automotive Accessories, etc.) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon, Google, Meta, Microsoft, Alibaba, Salesforce, IBM, Zendesk, Vue.ai, Shopify, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Virtual Shopping Assistant MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Virtual Shopping Assistant MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon

- Meta

- Microsoft

- Alibaba

- Salesforce

- IBM

- Zendesk

- Vue.ai

- Shopify

- Others