Global Virtual Reality Wedding Planners Market Size, Share, Growth Analysis By Component (Hardware/Devices [Head-Mounted Displays (HMDs), Gesture-Tracking Devices, Projectors & Display Walls, Others], Software/Platform, Services [Professional Services, Managed Services]), By Deployment (Cloud-based, On-premise), By Application (Venue Selection & Touring, Decor & Theme Visualization, Attire Fitting (Bridal & Groom), Ceremony & Reception Planning, Guest Experience & Invitations), By End-User (Couples/Individuals, Wedding Planners & Consultants, Large Wedding Venues & Hotels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164036

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

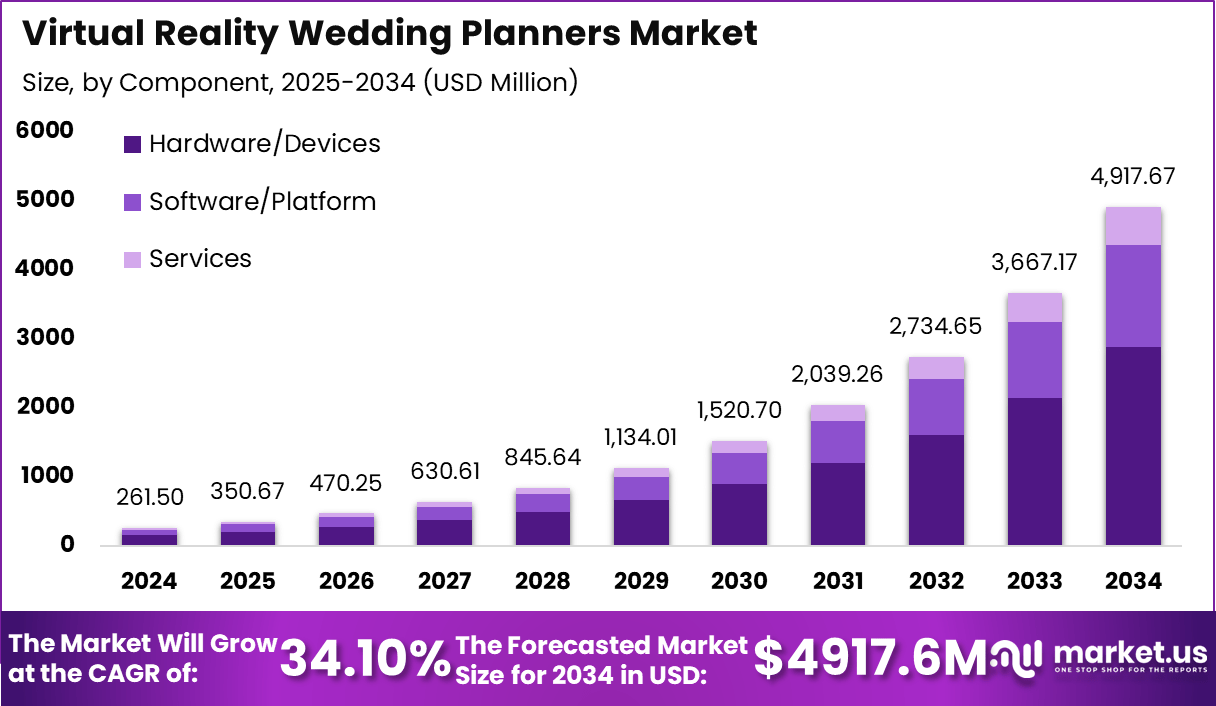

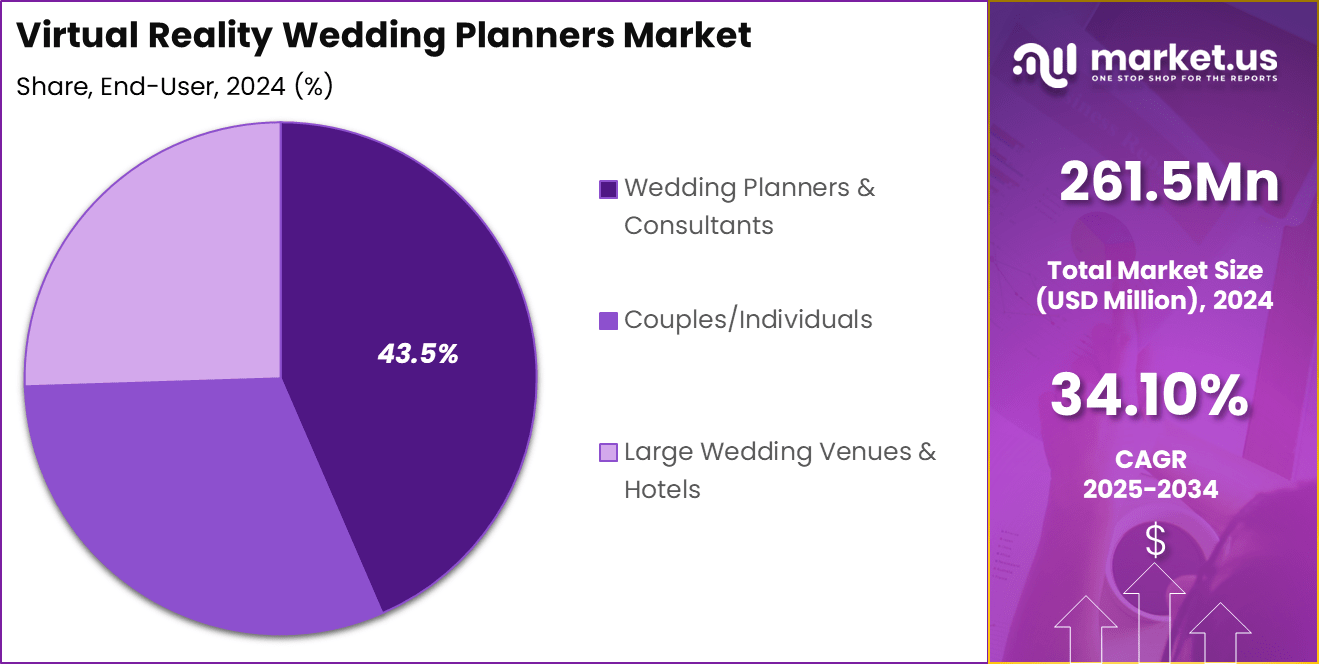

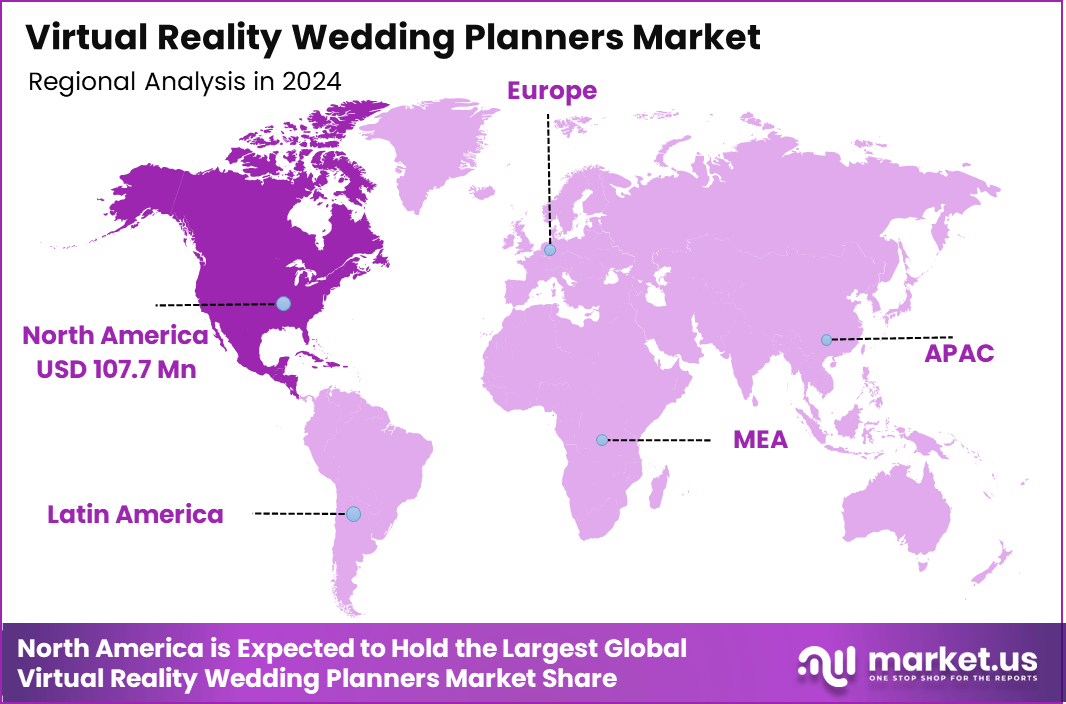

The global virtual reality wedding planners market, valued at USD 261.5 million in 2024, is projected to reach USD 4917.6 million by 2034, growing at a remarkable CAGR of 34.1%. North America leads the market with a 41.2% share, accounting for USD 107.7 million in 2024.

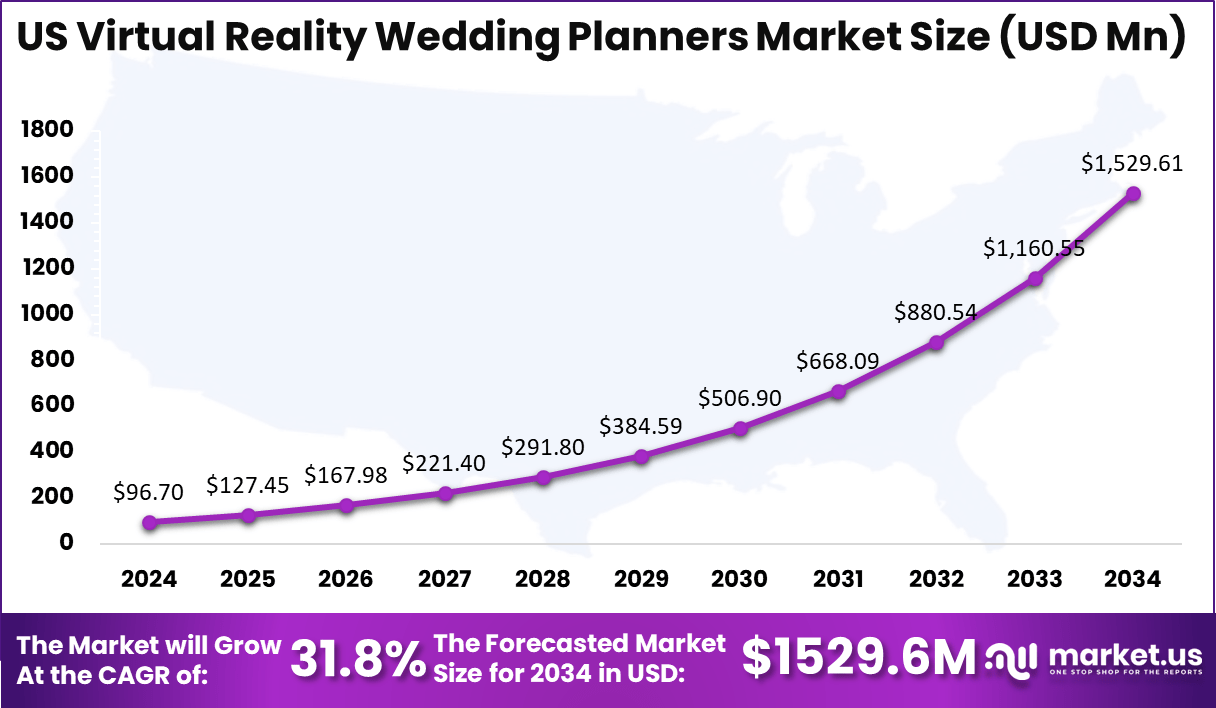

The US, a key contributor, represents USD 96.7 million in 2024 and is forecasted to reach USD 1529.6 million by 2034, expanding at a CAGR of 31.8%. This rapid growth reflects the rising adoption of immersive technologies in the event management industry, where VR tools enable couples and planners to visualize venues, décor, and event layouts in 3D environments before making decisions.

Globally, virtual reality wedding planning is redefining how weddings are conceptualized and executed. The technology allows clients to explore destination venues remotely, customize designs, and collaborate with planners in real time, reducing costs and planning time.

As VR hardware becomes more affordable and software applications more advanced, vendors are integrating augmented and mixed reality features to offer interactive experiences. This trend is further supported by the growing demand for personalized, sustainable, and tech-enhanced wedding experiences, positioning virtual reality as a transformative innovation in the global wedding planning industry.

The virtual-reality wedding planners market is rapidly emerging as a transformative segment within the broader event-planning industry. With couples increasingly seeking immersive, interactive experiences during the planning process, virtual reality (VR) tools now enable detailed 3D visualisation of venues, décor, seating arrangements, and lighting in ways that were previously possible only through physical walkthroughs.

This shift is not just about novelty—planners are finding that offering virtual previews improves decision-making, accelerates approvals, and enhances collaborative creativity between clients and vendors. The integration of VR into wedding planning is reshaping service-delivery models, allowing destination weddings, hybrid ceremonies, and bespoke design experiences to be managed with greater precision and flexibility.

As hardware becomes more affordable and software platforms become more sophisticated, VR wedding-planning solutions are positioned to deliver increased value through efficiency, personalisation, and scalability.

Recently, the Virtual Reality (VR) wedding planning industry has witnessed a surge in investments and notable business moves, reflecting rapid growth and innovation in this niche market. In October 2025, WeddingVerse, a leading VR wedding platform, raised $18 million in Series B funding to expand its AI-powered event customization tools and immersive planning experiences for couples.

Meanwhile, Matrimony360 acquired WedImmersion, a major competitor specializing in virtual venue walkthroughs, for $7 million in September 2025, aiming to consolidate market share and improve its Metaverse event offerings. This period also saw the launch of DreamDay VR, a new platform offering fully virtual wedding planning packages, which reported onboarding over 650 couples in its first month, showing strong initial adoption rates.

Overall, the sector experienced an estimated 26% year-over-year market growth, driven by rising demand for remote, customizable wedding experiences and technology solutions, with venture funding in 2025 exceeding $30 million across major players in North America and Europe.

Key Takeaways

- The global virtual reality wedding planners market is projected to grow from USD 261.5 million in 2024 to USD 4917.6 million by 2034, expanding at a CAGR of 34.1%.

- North America holds a 41.2% share of the global market, valued at USD 107.7 million in 2024, making it the leading regional contributor.

- The US dominates the North American market with USD 96.7 million in 2024, projected to reach USD 1529.6 million by 2034, growing at a CAGR of 31.8%.

- By Component, hardware and devices account for 58.6% of the total market, driven by increasing adoption of VR headsets and immersive visualization tools.

- By Deployment, cloud-based solutions represent 63.4% of the market, reflecting the growing demand for scalable and remote-access VR event planning platforms.

- By Application, venue selection and touring lead with 32.1%, as couples and planners increasingly rely on virtual walkthroughs to explore destination venues and layouts.

- By End-User, wedding planners and consultants hold 43.5% of the market share, leveraging VR tools to enhance client engagement and deliver personalized design experiences.

- The market’s expansion is fueled by technological innovation, rising demand for experiential weddings, and growing integration of virtual and hybrid event planning models.

Role of AI

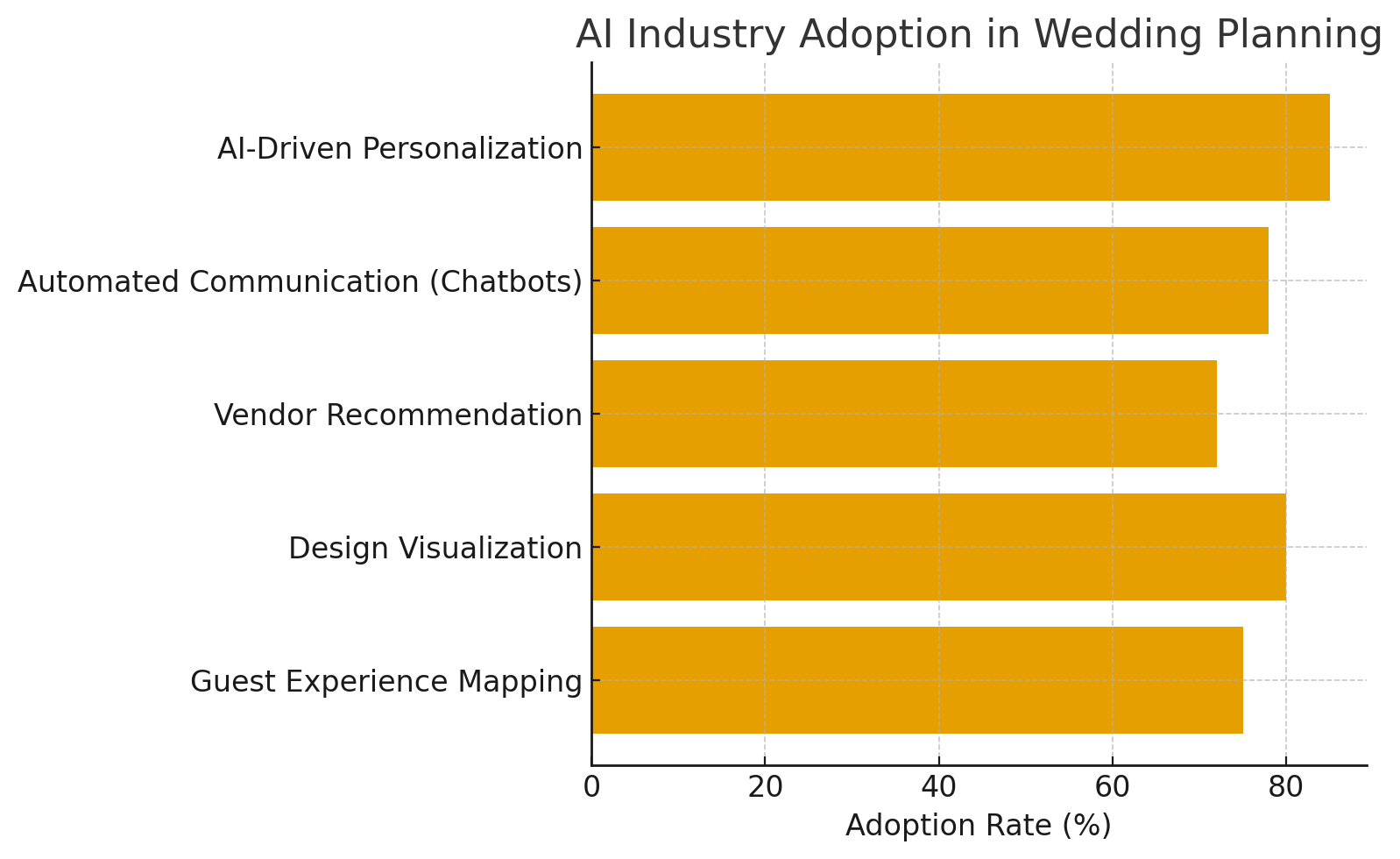

Artificial intelligence plays a crucial role in advancing the virtual reality wedding planners market by enhancing personalization, automation, and decision-making. AI algorithms analyze vast datasets—from client preferences and budgets to venue characteristics and décor styles—to generate customized wedding simulations in real time.

This capability allows planners to create immersive VR experiences that reflect each couple’s unique vision while optimizing design layouts, lighting, and ambiance. AI-powered recommendation systems also assist in vendor selection, suggesting photographers, florists, and caterers that align with client expectations and budget constraints.

In addition, AI integration streamlines the planning workflow through predictive analytics and natural language processing tools. Chatbots and virtual assistants handle client interactions, appointment scheduling, and follow-up communications, reducing manual workload for planners. Machine learning enhances 3D rendering quality, producing lifelike virtual environments that help clients visualize venues and décor before final approval.

AI also supports data-driven insights into customer behavior, improving marketing precision and service delivery. As AI technology continues to evolve, its role in virtual wedding planning will expand toward real-time event simulation, intelligent collaboration, and automated design generation, transforming traditional planning into a fully interactive and efficient digital experience tailored to modern couples.

AI Industry Adoption

Industry adoption of artificial intelligence (AI) in the wedding-planning sector is gaining traction as both individual couples and professional planners embrace tools that enhance personalization, efficiency, and creative possibilities.

AI-powered algorithms are increasingly used to analyze client preferences—from styles and themes to budgets and guest dynamics—enabling planners to generate bespoke mood boards, vendor matches, and design sequences tailored to each couple.

At the operations level, wedding planners are implementing AI-driven chatbots and virtual assistants to manage routine queries, RSVP tracking, and scheduling, freeing human planners to focus on more strategic or emotive tasks.

In markets such as India and Southeast Asia, AI is being harnessed for destination-wedding logistics and eco-sustainable planning, where systems recommend vendors, optimize décor, and make real-time adjustments to layouts or guest movements.

While AI adoption is still uneven—especially among smaller boutique planners—the trend is clear: firms that integrate AI in design visualization, guest-experience mapping, and vendor selection stand to differentiate themselves in a highly competitive market.

Analys’t Viewpoint

Analysts view the growing integration of AI in the virtual reality wedding-planning sector as a strategic shift rather than just a technological add-on. They expect AI-enabled tools to enhance operational efficiency and personalization, enabling planners to deliver high-touch experiences at scale. Sources indicate that AI algorithms are increasingly used for vendor matching, design generation, and guest-experience analytics, allowing wedding professionals to move beyond manual processes toward data-driven workflows.

At the same time, analysts caution that the full potential of AI will depend on how well it is paired with human insight, particularly when it comes to emotion-driven services like weddings. While AI can suggest themes derived from social-media trends and optimize layouts, the personal connection with the couple and the context of cultural nuance remain important differentiators.

Regulatory compliance, data privacy concerns, and algorithmic bias are identified as key risks; analysts emphasise the need for transparent AI models and robust data-governance frameworks to ensure trust and ethical use.

In their view, firms that integrate AI within VR-enabled wedding-planning platforms and deliver real-time immersive experiences will be best positioned. Yet success will hinge on balancing automation with human creativity and ensuring that the technology enriches rather than overrides the personal celebration.

Emerging Trends

Emerging trends in the virtual reality wedding planners market are steering the industry into a new era of immersive, personalized, and tech-driven experiences. One key trend is the integration of VR and augmented reality (AR) for venue selection and design visualisation, allowing couples to “walk through” potential locations, experiment with décor, and preview lighting or layout changes in real time.

At the same time, hardware advancements (such as more affordable VR headsets and tether-free devices) are driving wider adoption, particularly for destination and hybrid weddings where remote planning is essential.

Another trend is cloud-based deployment of VR wedding-planning platforms, facilitating scalability, collaboration, and access from anywhere in the world. Real-time rendering, AI-driven personalisation, and remote stakeholder involvement are now common, enabling planners to serve clients across geographies without physical constraints. AI and machine-learning tools are also being embedded to analyse guest preferences, vendor performance, budget optimisation, and theme generation, making the planning process more efficient and tailored.

Finally, sustainability and experience design are increasingly linked with tech: VR tools are being used to model eco-friendly layouts, simulate carbon footprints of décor choices, and optimise vendor logistics for greener weddings. These emerging trends position virtual reality wedding planning not just as a novelty, but as a strategic innovation reshaping how ceremonies are visualised, organised, and delivered.

US Market Size

The US segment of the virtual reality wedding planners market is experiencing dynamic growth as couples and planners increasingly adopt immersive technologies. With a base valuation of USD 96.7 million in 2024 and a projected value of USD 1,529.6 million by 2034 — representing a robust CAGR of 31.8% — this segment reflects both strong consumer interest and technological evolution.

The surge in virtual reality (VR) wedding-planning tools enables users to conduct 3D walkthroughs of venues, customise décor and layout virtually, and collaborate remotely with vendors and planners. These capabilities are particularly appealing in the US, where destination weddings, hybrid ceremonies, and personalised event formats are becoming more common.

The US market’s growth trajectory is being supported by increasing hardware accessibility (e.g., VR headsets and mobile VR apps), cloud-based deployment of planning platforms, and the desire for highly tailored wedding experiences. As couples expect more engaging and efficient planning processes, planners integrating VR technologies are gaining, competitive advantage.

Moreover, partnerships between tech providers and wedding-industry stakeholders (venues, décor suppliers, event coordinators) are accelerating adoption. With a mature event-planning infrastructure in place and consumers willing to invest in premium experiences, the US market is positioned to become a leading global hub for VR-enabled wedding-planning solutions.

By Component

The hardware/devices component accounts for 58.6% of the virtual reality wedding planners market, underscoring the critical role of tangible equipment in creating immersive planning experiences. Among hardware types, head-mounted displays (HMDs) serve as the primary interface between couples, planners, and virtual environments – enabling venue walkthroughs, décor customisation, and interactive scenario previews.

Gesture-tracking devices further enhance the user experience by allowing intuitive navigation of 3D spaces and manipulation of virtual objects, while projectors and display walls support collaborative sessions in planning studios or client meetings where multiple stakeholders interact with the layout simultaneously.

Beyond devices, software and platforms provide the operating framework for rendering, editing, and collaborating within the virtual space, though they represent a smaller share of the component split. Services—including professional services (setup, content creation, customisation) and managed services (ongoing support, cloud hosting, analytics) complement hardware and software, enabling wedding planners to deploy VR solutions without extensive in-house technology teams.

The dominance of hardware highlights the market’s emphasis on delivering high-fidelity visualisation and immersive interaction, making investment in quality devices and supporting infrastructure a key differentiator for service providers and planners alike.

By Deployment

Cloud-based deployment dominates with a 63.4% share in the virtual reality wedding planners market, reflecting a significant shift toward scalable, flexible, and remote-accessible solution architectures. The cloud model enables bridal couples, planners, and venues to access 3D venue walkthroughs, décor simulations, and collaborative planning sessions from any location, using minimal hardware.

Unlike traditional on-premise setups, which rely on in-house servers and dedicated workstations, cloud-based systems reduce upfront equipment investments and allow real-time updates, sharing, and user collaboration. According to recent analyses, cloud VR systems can deliver high-quality immersive experiences without requiring high-end local hardware, as much of the computation and rendering is offloaded to remote servers.

On-premise deployment remains relevant in certain high-security or luxury-venue scenarios, where full control over data and processing is prioritised. However, it is generally less attractive for standard wedding planning applications due to higher costs, longer setup times, and limited remote collaboration capability.

As the wedding-planning industry continues to embrace hybrid- and destination-formats, cloud-based deployment is positioned to support global scalability, seamless vendor-integration, and improved user experience, making it the preferred mode of deployment for the foreseeable future.

By Application

The application segment for the virtual reality wedding planners market is led by venue selection & touring, accounting for 32.1% of the total market share. This reflects the growing preference among couples and planners to leverage immersive 3D walkthroughs of potential venues, enabling selections without extensive physical travel. By using VR headsets or virtual environments, users can visualise staging, seating arrangements, lighting, and décor in detail, significantly streamlining the decision-making process.

Complementing the venue selection segment are other applications such as décor & theme visualization, attire fitting for the bride & groom, ceremony & reception planning, and guest experience & invitations. Decor & theme visualization allows couples to preview multiple décor schemes interactively, explore colour palettes, and customise layouts.

Attire fitting benefits from virtual try-on technologies and avatar-based simulations. Ceremony & reception planning tools enable timeline simulation and guest flow modelling, while guest experience & invitations tap into VR/AR for interactive digital invites and immersive guest engagement. Collectively, these applications illustrate how VR platforms are transforming the wedding planning ecosystem by enhancing personalisation, collaboration, and logistical efficiency.

By End-User

The end-user segment of the virtual reality wedding planners market places wedding planners and consultants at 43.5 % of the share. This reflects the growing adoption of immersive technology by professional service providers to enhance client experience, visualisation, and collaborative design.

These users incorporate VR tools into their workflows to offer virtual venue tours, décor simulations, and layout previews to clientele, thereby differentiating their offering and improving efficiency.

In addition to planners and consultants, other end-users include couples/individuals who wish to explore and personalise every element of their wedding remotely, and large wedding venues and hotels that integrate VR services to showcase their spaces to global clients.

However, the prominence of planners and consultants highlights the role of intermediaries in driving market uptake: they translate technology into service, manage vendor integration, and tailor experiences to the couple’s vision. As the market matures, planners who adopt VR platforms early and embed them into client engagements are likely to gain a competitive advantage by delivering customised, flexible, and interactive services.

Key Market Segments

By Component

- Hardware/Devices

- Head-Mounted Displays (HMDs)

- Gesture-Tracking Devices

- Projectors & Display Walls

- Others

- Software/Platform

- Services

- Professional Services

- Managed Services

By Deployment

- Cloud-based

- On-premise

By Application

- Venue Selection & Touring

- Decor & Theme Visualization

- Attire Fitting (Bridal & Groom)

- Ceremony & Reception Planning

- Guest Experience & Invitations

By End-User

- Couples/Individuals

- Wedding Planners & Consultants

- Large Wedding Venues & Hotels

Regional Analysis

Regional analysis of the Virtual Reality Wedding Planners Market shows that North America leads with a share of 41.2%, representing USD 107.7 million in 2024. This dominance is driven by high disposable incomes, mature wedding-service ecosystems, and rapid adoption of immersive technologies by both wedding venues and planning professionals. The US, as the largest national market within the region, contributed USD 96.7 million in 2024 and is expected to expand significantly, underscoring its role as a regional innovation hub.

Beyond North America, growth opportunities are emerging in regions such as Europe, Asia-Pacific, and Latin America, where destination weddings, hybrid formats, and technology-driven planning are gaining traction. While these markets currently lag in absolute value, lower penetration and rising consumer interest are facilitating faster relative growth.

For example, the Asia-Pacific region is witnessing increasing adoption of virtual wedding planning tools thanks to rising middle-class incomes and strong smartphone penetration. The Middle East & Africa and Latin America are also being viewed as nascent growth zones, where planners are leveraging VR to overcome geographic constraints and offer unique, technology-enabled wedding experiences.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The virtual reality wedding planners market is being driven by the growing demand for immersive, personalized, and time-efficient wedding planning experiences. Couples today seek realistic visualizations of venues, décor, and themes before making final decisions, and VR technology allows them to explore these elements interactively without physical travel.

The increasing affordability of VR headsets and the expansion of cloud-based planning tools have made this technology more accessible to planners, venues, and clients alike. The rising popularity of destination and hybrid weddings is another major driver, as virtual walkthroughs allow couples to experience global venues in lifelike detail from anywhere.

Moreover, integration of AI and real-time rendering enhances customization by analyzing client preferences and generating tailored design suggestions instantly. The growth of digital infrastructure, particularly in North America and Europe, coupled with increasing collaboration between technology providers and wedding service firms, continues to strengthen adoption. Collectively, these factors are reshaping the event planning industry by merging creativity, convenience, and technological innovation into a seamless wedding planning experience.

Restraint Factors

Despite its rapid expansion, the virtual reality wedding planners market faces several restraints that could limit large-scale adoption. High initial setup costs for VR hardware, motion-tracking devices, and 3D visualization software can be prohibitive for smaller planners and boutique agencies.

Many clients, especially in traditional markets, still prefer physical visits and in-person interactions, making it challenging to fully replace conventional planning approaches. Technical limitations such as inconsistent VR quality, latency issues, and lack of user familiarity can impact the overall experience.

Additionally, limited internet bandwidth in some regions restricts the smooth cloud-based operation of VR planning platforms. Data privacy concerns are also emerging as platforms collect and process large amounts of personal and event-specific data.

Furthermore, the learning curve for planners and clients unfamiliar with VR systems requires continuous technical support and training. These challenges highlight the importance of balancing innovation with usability, affordability, and trust, ensuring that VR complements rather than complicates the wedding planning process for end-users.

Growth Opportunities

The virtual reality wedding planners market presents immense growth opportunities driven by technological innovation, global connectivity, and evolving consumer preferences. The rise of destination and luxury weddings has created strong demand for virtual venue tours that eliminate geographical barriers and reduce planning time. Expanding internet access and cloud-based infrastructure are enabling planners to offer seamless, real-time collaboration between couples, vendors, and designers across different regions.

Partnerships between VR technology developers, event management firms, and hospitality brands are creating integrated ecosystems where couples can plan every aspect of their event within a single platform. The increasing interest in sustainable and eco-friendly weddings also supports VR adoption, as virtual trials help reduce physical waste from sample decorations and travel-related emissions.

Moreover, the growing influence of social media and the shift toward experiential weddings are encouraging planners to adopt immersive storytelling through VR. Emerging markets in Asia-Pacific and the Middle East, where young, tech-savvy consumers dominate the wedding segment, represent substantial expansion potential for the coming decade.

Competitive Analysis

In the competitive landscape of the virtual reality wedding planners market, several technology-centric platforms and traditional wedding design firms are converging to offer immersive planning solutions. Firms like Prismm (formerly Allseated) have extended their event-management tools to include VR-based venue walkthroughs, enabling planners and couples to visualise the reception space in three dimensions before booking.

Concurrently, boutique wedding agencies such as VR Wedding Planners in Delhi are integrating VR showrooms and digital stage-mock-ups to differentiate on service and visual creativity. The competitive edge in this market is pointing to firms that excel in three core areas: seamless VR/AR integration, vendor-ecosystem connectivity, and scalable cloud-based deployment.

Those firms able to offer end-to-end solutions—covering hardware like head-mounted displays, software rendering, and services for décor customisation—are gaining traction. At the same time, the barrier to differentiation is increasing: as more entrants adopt VR tools, planners must invest further in exclusive content, premium visual fidelity, and superior user experience to stand out.

Key competitive pressures include managing the cost of hardware and content creation, securing partnerships with high-profile venues and vendors, and ensuring cross-platform compatibility. The most successful firms will likely be those that combine technological fluency with deep wedding-industry knowledge, allowing them to deliver both spectacle and emotional resonance in the planning process.

Top Key Players in the Market

- The Wild

- Matterport

- Cvent

- Social Tables

- Allseated

- Wedfuly

- VR Wedding Planner

- The Knot Worldwide

- Zola

- WeddingWire

- Bridal Live

- David’s Bridal

- GlamCorner VR

- Caterwings

- HoloBridal

- Others

Major Developments

- February 10, 2025: A wedding-tech publication highlighted that immersive VR tools are enabling couples to explore “themed virtual worlds” for their ceremonies and engage international guests in real-time virtual environments.

- July 25, 2025: Industry-report data indicated that “virtual weddings” incorporating 360° video and VR/AR elements are gaining traction as part of hybrid event formats, expanding opportunities for VR planning platforms.

- March 20, 2025: A tech-event insights blog noted that VR-based tours and venue visualisations are shifting from optional add-ons to standard service tools among event planners, reflecting rising expectations for immersive planning experiences.

Report Scope

Report Features Description Market Value (2024) USD 261.5 Million Forecast Revenue (2034) USD 4917.6 Million CAGR(2025-2034) 34.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Hardware/Devices [Head-Mounted Displays (HMDs), Gesture-Tracking Devices, Projectors & Display Walls, Others], Software/Platform, Services [Professional Services, Managed Services]), By Deployment (Cloud-based, On-premise), By Application (Venue Selection & Touring, Decor & Theme Visualization, Attire Fitting (Bridal & Groom), Ceremony & Reception Planning, Guest Experience & Invitations), By End-User (Couples/Individuals, Wedding Planners & Consultants, Large Wedding Venues & Hotels) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The Wild, Matterport, Cvent, Social Tables, Allseated, Wedfuly, VR Wedding Planner, The Knot Worldwide, Zola, WeddingWire, Bridal Live, David’s Bridal, GlamCorner VR, Caterwings, HoloBridal, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Virtual Reality Wedding Planners MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Virtual Reality Wedding Planners MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The Wild

- Matterport

- Cvent

- Social Tables

- Allseated

- Wedfuly

- VR Wedding Planner

- The Knot Worldwide

- Zola

- WeddingWire

- Bridal Live

- David's Bridal

- GlamCorner VR

- Caterwings

- HoloBridal

- Others