Global Virtual Reality Headset Market Size, Share and Growth Report By Product Type (Standalone, Smartphone-Enabled, and PC-Connected), By Device Type (Low-End Device, Mid-Range Device, and High-End Device), By End-Use Industry (Gaming, Healthcare, Media and Entertainment, Manufacturing, Education, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sept. 2024

- Report ID: 106128

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

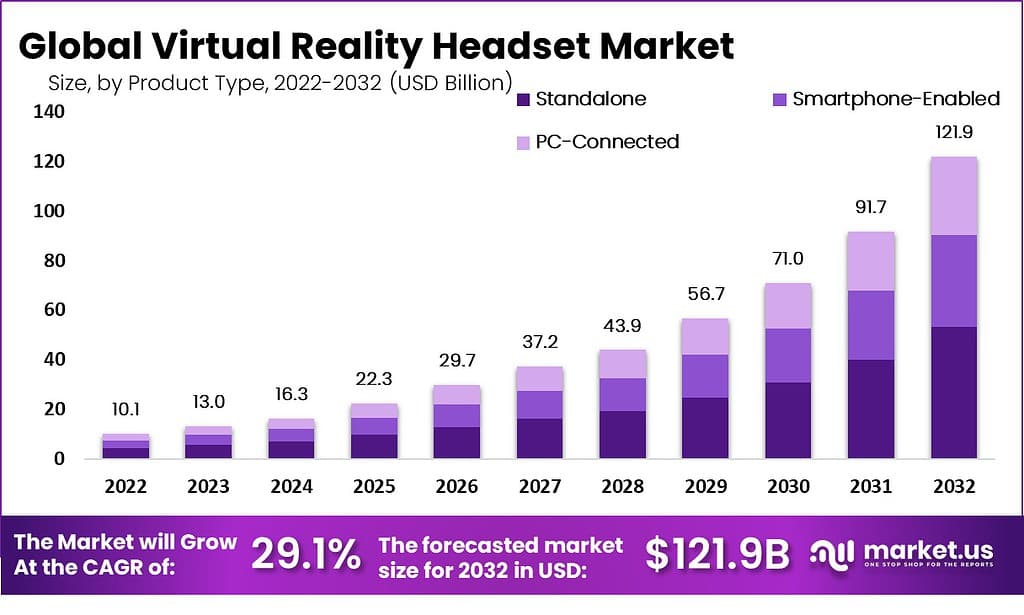

The Global Virtual Reality Headset Market size is expected to be worth around USD 121.9 Billion By 2032, from USD 13 Billion in 2023, growing at a CAGR of 29.1% during the forecast period from 2023 to 2032.

A virtual reality (VR) headset is a head-mounted device that provides virtual reality for the wearer. These devices are widely used in various applications ranging from gaming and entertainment to training and education. VR headsets typically encompass a stereoscopic head-mounted display, providing separate images for each eye, stereo sound, and sensors for head motion tracking to immerse the user in a virtual world.

The market for VR headsets has witnessed significant growth due to the increasing popularity of virtual reality applications across industries. The expansion of this market is propelled by technological advancements in display and sensor technologies, making VR more immersive and accessible. Consumer demand is driven not only by gaming but also by applications in simulation-based learning, virtual tours, and advanced training scenarios in fields such as aviation, medicine, and engineering.

The demand for VR headsets is largely driven by the gaming and entertainment sectors, where users seek more immersive experiences. However, growth is also being fueled by enterprise applications, particularly in training and simulation, which benefit from cost-effective, scalable, and safe environments that VR can provide. The educational sector is increasingly adopting VR to enhance interactive learning and engagement among students.

The VR headset market is ripe with opportunities, especially with the advent of 5G technology, which can significantly enhance the VR experience by enabling faster data speeds and reduced latency. There is also a growing interest in integrating AI with VR to create more personalized and adaptive user experiences. Additionally, as more industries recognize the benefits of VR for remote collaboration and training, the market is expected to expand into new verticals, offering substantial opportunities for growth and innovation.

According to Market.us, The Extended Reality (XR) market is forecasted to experience a substantial growth trajectory, with projections indicating a surge from USD 49.6 Billion in 2023 to USD 519.5 Billion by 2032, achieving a Compound Annual Growth Rate (CAGR) of 30.8%. This growth underscores the increasing adoption and integration of XR technologies across various sectors.

In a similar vein, the Mixed Reality market is set to witness an even more dynamic expansion. Estimated to grow from USD 52.6 Billion in 2023 to USD 1,224.0 Billion by 2032, it is expected to register a remarkable CAGR of 43.2%. This indicates a broader acceptance and application of mixed reality technologies, reflecting significant advancements and increasing market penetration.

The Immersive-reality Technologies market is also on a positive trajectory, poised to increase from USD 90.8 Billion in 2023 to USD 780.4 Billion by 2033, with a steady CAGR of 24%. This growth is indicative of the expanding use cases and enhanced immersive experiences provided by these technologies.

Augmented Reality (AR) shows promise with an anticipated growth from USD 29.6 Billion in 2024 to USD 591.7 Billion by 2033, maintaining a CAGR of 39.5%. This substantial growth can be attributed to the versatile applications of AR across different industries including gaming, healthcare, and retail.

The Augmented Reality and Virtual Reality (AR and VR) market combined is expected to grow from USD 34.8 Billion in 2023 to USD 106.2 Billion by 2033, at a CAGR of 11.8%. This slower pace, compared to single technology segments, suggests a maturing market yet steady demand for integrated AR and VR solutions.

Lastly, the Mobile AR market is expected to witness a significant rise from USD 24.2 Billion in 2023 to USD 472.4 Billion by 2033, growing at a CAGR of 34.6%. This growth is driven by the increasing proliferation of smartphones equipped with AR capabilities and the rising consumer engagement with AR applications.

Consumer insights from G2 indicate that 48% of US consumers have engaged with VR at least once, with 80% describing their experiences as positive. This consumer sentiment is bolstered by the fact that more than 40% express a willingness to use VR under suitable conditions, and 37% are excited about its potential societal benefits, reflecting a robust market receptivity.

Key Takeaways

- The global Virtual Reality Headset market is projected to experience substantial growth, forecasted to expand from USD 13 Billion in 2023 to approximately USD 121.9 Billion by 2032. This growth represents a robust Compound Annual Growth Rate (CAGR) of 29.1% over the forecast period from 2023 to 2032.

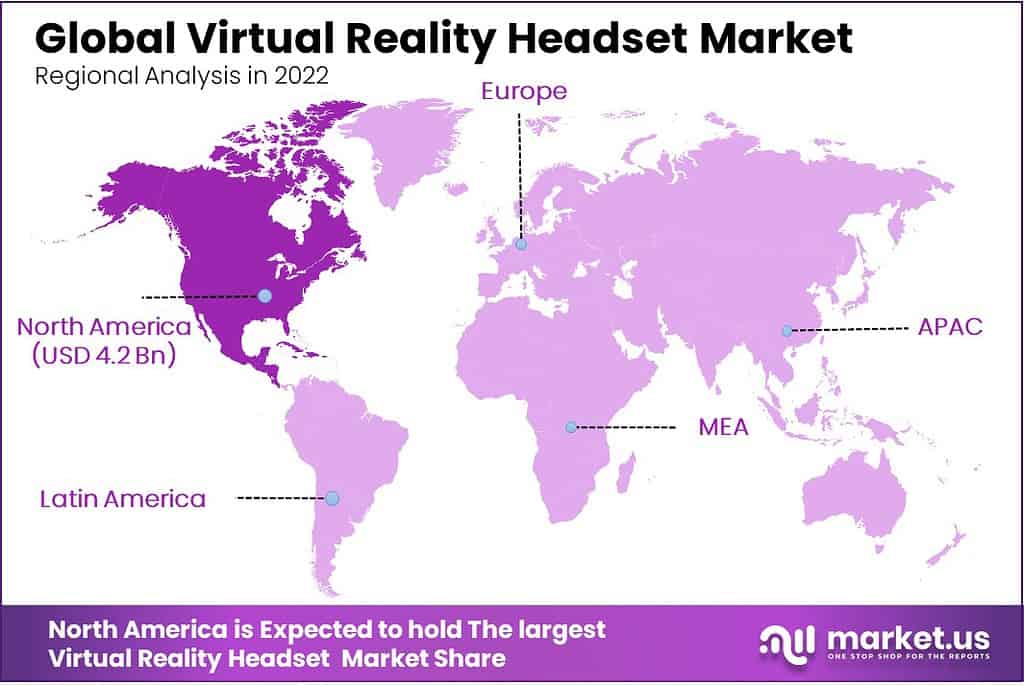

- In the geographical analysis, North America maintained a leading position in the market in 2022, accounting for a significant share of 42.3% with revenues reaching USD 4.2 billion. This dominance underscores North America’s pivotal role in the development and adoption of virtual reality technologies.

- From a product segmentation perspective, the Standalone segment exhibited a predominant market share, capturing over 43.6% in 2022. This segment’s prominence is indicative of a growing consumer preference for versatile and self-contained devices.

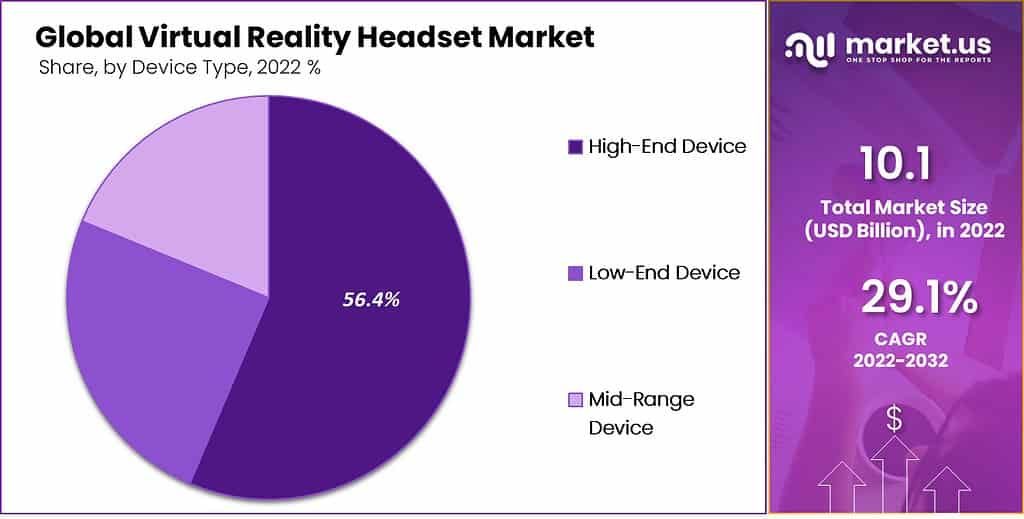

- Additionally, within the device type categorization, High-End Devices were the most prevalent in 2022, holding a dominant market share of 56.4%. This suggests a strong market inclination towards advanced features and high-quality immersive experiences.

- Furthermore, the Gaming segment emerged as the leading application area for virtual reality headsets in 2022, securing a market share of 29.4%. The segment’s dominance is reflective of the significant role gaming plays in driving VR headset sales and technological advancements.

North America Market Growth

In 2022, North America held a dominant market position in the Virtual Reality Headset market, capturing more than a 42.3% share with revenue totaling USD 4.2 billion. This substantial market share can primarily be attributed to several key factors that include advanced technological infrastructure and high consumer readiness to adopt new technologies.

The region’s robust economic landscape, coupled with a strong presence of leading VR headset manufacturers and tech companies, further bolsters market growth. Companies such as Oculus, HTC, and others have their research and development centers in this region, continuously innovating and driving forward the capabilities and adoption of VR technology.

Furthermore, North America benefits from a well-established gaming community and a burgeoning enterprise sector that increasingly utilizes VR for training, simulations, and customer service applications. The integration of VR in various sectors such as education, healthcare, and real estate also contributes significantly to the growth of the market.

Government initiatives aimed at enhancing technological prowess in digital realities have provided a conducive environment for the market’s expansion. For instance, educational grants for VR-based learning initiatives have spurred further adoption in academic settings, reinforcing the market’s growth trajectory.

The cultural inclination towards early adoption of technology in North American countries, especially the United States and Canada, facilitates rapid consumer acceptance. As VR technology becomes more accessible and affordable, the consumer base is expected to broaden, encompassing not only gamers and tech enthusiasts but also casual users seeking immersive experiences.

Projections for the market indicate a continued upward trend, underpinned by innovations in VR content development and hardware enhancement that promise to enrich user engagement and expand practical applications across industries.

By Product Type Analysis

In 2022, the Standalone segment held a dominant market position within the virtual reality headset market, capturing more than a 43.6% share. This leadership can be attributed to several key factors that favor the standalone design over other types of VR headsets.

Standalone VR headsets offer a complete, all-in-one solution, integrating all necessary components – display, processor, and sensors – directly into the headset. This independence from external devices makes them particularly appealing for users seeking simplicity and portability.

The appeal of standalone VR headsets extends beyond convenience to include greater accessibility. Without the need for additional hardware such as a PC or a smartphone, standalone headsets reduce the entry barrier for consumers new to VR.

This has enabled a broader demographic to explore virtual reality, expanding the consumer base and, in turn, driving segment growth. Furthermore, advances in battery technology and processor efficiency have enhanced the performance and usability of these devices, bolstering their market appeal.

Technological advancements have also played a crucial role in the dominance of the standalone segment. Innovations in display resolution, field of view, and tracking accuracy have significantly improved the user experience, making standalone headsets competitive with their PC-connected counterparts in terms of immersive experience.

By Device Type Analysis

In 2022, the High-End Device segment held a dominant market position within the virtual reality headset market, capturing more than a 56.4% share. This segment’s leadership is primarily driven by the increasing demand for superior quality graphics, precision tracking, and more immersive experiences, which are pivotal in sectors such as advanced gaming, professional training, and simulation.

High-end VR headsets deliver exceptional performance with state-of-the-art display technology, higher refresh rates, and expanded fields of view, which are crucial for creating a truly immersive virtual environment. These devices often include advanced features such as eye-tracking, hand-tracking, and spatial audio, enhancing the overall user experience.

The demand for high-quality immersion has led to significant adoption in industries where VR is used for training purposes, such as in medical education and flight simulation, where the precision and quality of the simulation can directly impact the effectiveness of the training.

Moreover, the gaming industry, a primary consumer of VR technology, continuously demands higher levels of realism and immersion, which only high-end devices can provide. As the gaming market grows, so does the subset of gamers who are willing to invest in premium equipment to enhance their gaming experience. This trend is supported by VR game developers who increasingly focus on creating more complex and richly detailed environments that require more powerful hardware to run effectively.

By End-Use Industry Analysis

In 2022, the Gaming segment held a dominant market position within the virtual reality headset market, capturing more than a 29.4% share. This prominence is largely due to the deep integration of VR technology in the gaming industry, which seeks to deliver highly immersive and interactive experiences to a growing audience of tech-savvy gamers.

The gaming industry’s continual push for innovative and engaging experiences has made it a prime driver for VR headset adoption. Virtual reality offers gamers the unique opportunity to immerse themselves completely in a virtual world, enhancing the realism and emotional intensity of the gaming experience.

This has not only attracted hardcore gamers but has also piqued the interest of casual players, thereby expanding the market base. High-profile game releases specifically designed for VR platforms further stimulate demand, reinforcing the segment’s growth.

Additionally, the rise in esports and competitive gaming where VR adds a novel dimension to the competition, attracts sponsorships, and increases viewer engagement has further propelled the demand in this segment. The immersive nature of VR gaming creates new opportunities for content creators and broadcasters in the esports arena, making it an increasingly lucrative market.

Key Market Segments

Product Type

- Standalone

- Smartphone-Enabled

- PC-Connected

Device Type

- Low-End Device

- Mid-Range Device

- High-End Device

End-Use Industry

- Gaming

- Healthcare

- Media and Entertainment

- Manufacturing

- Education

- Other End-Use Industries

Driver

Technological Integration and Gaming Industry Expansion

One of the primary drivers for the virtual reality (VR) headset market is the integration of VR with advanced technologies such as artificial intelligence (AI) and machine learning (ML), enhancing the sophistication of virtual environments.

The significant investments in and transformative impact of VR technologies across diverse sectors like gaming, healthcare, and education enhance user engagement and operational efficiencies, propelling market growth. The expanding gaming industry, specifically, serves as a major catalyst. High-profile VR game releases have substantially boosted headset sales, with the immersive experiences offered by these games attracting both existing gamers and new users.

Restraint

Technical Challenges and User Experience Consistency

A major restraint in the VR headset market is the technical challenge associated with integrating VR with other cutting-edge technologies like 5G, AI, and the Internet of Things (IoT). Issues such as latency and bandwidth can significantly hinder the seamless experience required for effective VR applications.

Additionally, the variation in headset quality affects the consistency of user experiences across different devices. Ensuring a high-quality, uniform experience remains a hurdle, given the substantial costs associated with producing engaging, high-quality VR content, and the technical difficulties in standardizing this experience across various headsets.

Opportunity

Expansion into New Applications and Consumer Accessibility

There is a notable opportunity in the broader application of VR technology beyond traditional sectors. As VR headsets become more user-friendly and accessible, industries such as real estate and tourism are beginning to explore how VR can enhance customer experiences.

Additionally, ongoing improvements in hardware, such as better haptic feedback and spatial audio, are making VR headsets more engaging and realistic, thus opening new applications in sectors that require detailed environmental simulations. These advancements are setting the stage for VR to revolutionize how professionals work and interact, not just how they play or learn.

Challenge

Quality Control and Production Costs

A significant challenge facing the VR market is the high cost and effort required to create quality VR content, which is crucial for user retention and satisfaction. The inconsistency in headset performance complicates content standardization across different platforms. Moreover, the current field of view (FOV) in many VR headsets is narrower than the natural human range, which can diminish the immersive experience.

Expanding FOV without compromising other aspects like weight and comfort remains a technical challenge for manufacturers. These factors necessitate ongoing research and development to balance user expectations with feasible and economically viable technological solutions.

Key Player Analysis

The Virtual Reality Headset market is highly competitive, with several key players dominating the landscape through strategic acquisitions, product launches, and partnerships. Among these, Google LLC, Microsoft Corporation, and HTC Corporation stand out as top contenders.

Google LLC has consistently expanded its foothold in the VR market through innovative product developments and strategic partnerships. The launch of Google Daydream View was a significant milestone, enhancing mobile VR with better user interfaces and more immersive content. Google’s ongoing research into improving VR experiences through advanced technologies like augmented reality (AR) integration positions it as a forward-thinking leader in this space.

Microsoft Corporation leverages its extensive technological ecosystem to advance in the VR arena, primarily through the integration of its mixed reality platform, Windows Mixed Reality. The acquisition of AltspaceVR and the launch of innovative products like the HoloLens 2 have enabled Microsoft to blend both virtual and augmented realities, offering unique experiences that extend from gaming to collaborative and professional environments. Microsoft’s approach to VR emphasizes not only entertainment but also practical applications in design, training, and education.

HTC Corporation remains a prominent player due to its strong focus on hardware and extensive VR content library. The launch of the HTC Vive series set a high standard for immersive experiences in the VR market. HTC continues to innovate with upgrades like the Vive Pro and Vive Cosmos, and its strategic partnerships aimed at expanding VR into new consumer and enterprise applications, including health and wellness, public sector training, and educational programs.

Top Virtual Reality Headset Market Players

- Google LLC

- Microsoft Corporation

- HTC Corporation

- HP Inc.

- Sony

- Meta Platforms Inc.

- Samsung

- Xiaomi

- Lenovo

- LG Electronics Inc.

- Other Key Players

Recent Developments

- In February 2024, Sony announced its plans to test PC compatibility for its PlayStation VR2, allowing users to access more VR games via PC. This move is expected to broaden its user base by integrating with more platforms

- In January 2023, Facebook Technologies, LLC, operating under the Oculus brand, strengthened its presence in the virtual reality (VR) market by extending its partnership with both the NBA and WNBA. This collaboration further cemented Oculus as the official partner for virtual reality headsets across these professional basketball leagues.

- Google and Samsung teamed up with Qualcomm in 2024 to develop a new VR headset powered by Qualcomm’s Snapdragon XR2+ Gen 2 chip. This partnership is expected to bring a competitive edge against Apple and Meta. Both companies aim to leverage this collaboration to create best-in-class immersive experiences, especially with new XR (Extended Reality) features.

Report Scope

Report Features Description Market Value (2023) USD 13 Bn Forecast Revenue (2032) USD 121.9 Bn CAGR (2023-2032) 29.1% Base Year for Estimation 2022 Historic Period 2019-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type – Standalone, Smartphone-Enabled, and PC-Connected; By Device Type – Low-End Device, Mid-Range Device, and High-End Device; By End-Use Industry – Gaming, Healthcare, Media and entertainment, Manufacturing, Education, Other End-Use Industries. Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Google LLC, Microsoft Corporation, HTC Corporation, HP Inc., Sony, Meta Platforms Inc., Samsung, Xiaomi, Lenovo, LG Electronics Inc., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Virtual Reality (VR) headset?A VR headset is a wearable device that immerses users in a computer-generated virtual environment. It typically consists of a head-mounted display, sensors, and sometimes hand controllers for interaction.

How big is the virtual reality headset market?The valuation of Global Virtual Reality Headset Market is expected to surpass USD 121.9 billion by the year 2032 from USD 10.1 Billion in 2022, expanding steadily at the highest CAGR of 29.1%.

What are the different types of VR headsets available in the market?VR headsets can be categorized into three main types: PC-based, standalone, and mobile-based VR headsets.

Are mobile-based VR headsets still popular?Mobile-based VR headsets, which use smartphones as screens, have become less popular due to the rise of standalone headsets with better performance and tracking capabilities.

What are the pros and cons of VR headsets?The pros of VR headsets include:

- Immersive experience

- Ability to learn new skills

- Potential for therapy

- Improved communication and collaboration

- New entertainment possibilities

- Motion sickness

- Eye strain

- Limited availability of content

- Privacy concerns

- Cost

What is the future scope of VR?The future of VR headsets is very promising. It is expected to be used in a wide variety of industries, including gaming, healthcare, education, training, and retail. The technology is constantly improving, and the cost of VR headsets is decreasing. As a result, VR is expected to become more mainstream in the years to come.

Virtual Reality Headset MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample

Virtual Reality Headset MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Google LLC

- Microsoft Corporation

- HTC Corporation

- HP Inc.

- Sony

- Meta Platforms Inc.

- Samsung

- Xiaomi

- Lenovo

- LG Electronics Inc.

- Other Key Players