Global Virtual Queuing System Market Size, Share Analysis Report By Component (Software, Hardware, Services (Installation Services, Maintenance Services, Consulting Services)), By Deployment Mode (Cloud-based, On-premises), By End-User Industry (Healthcare, Retail, Hospitality, Banks, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151036

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

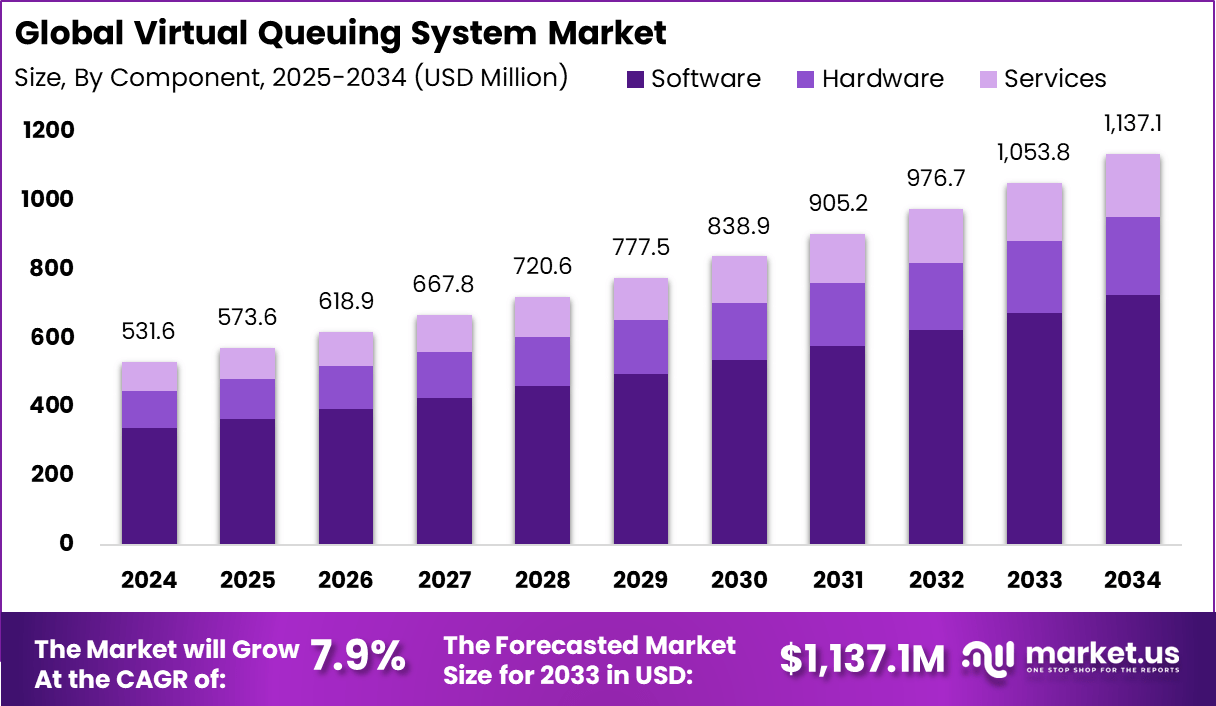

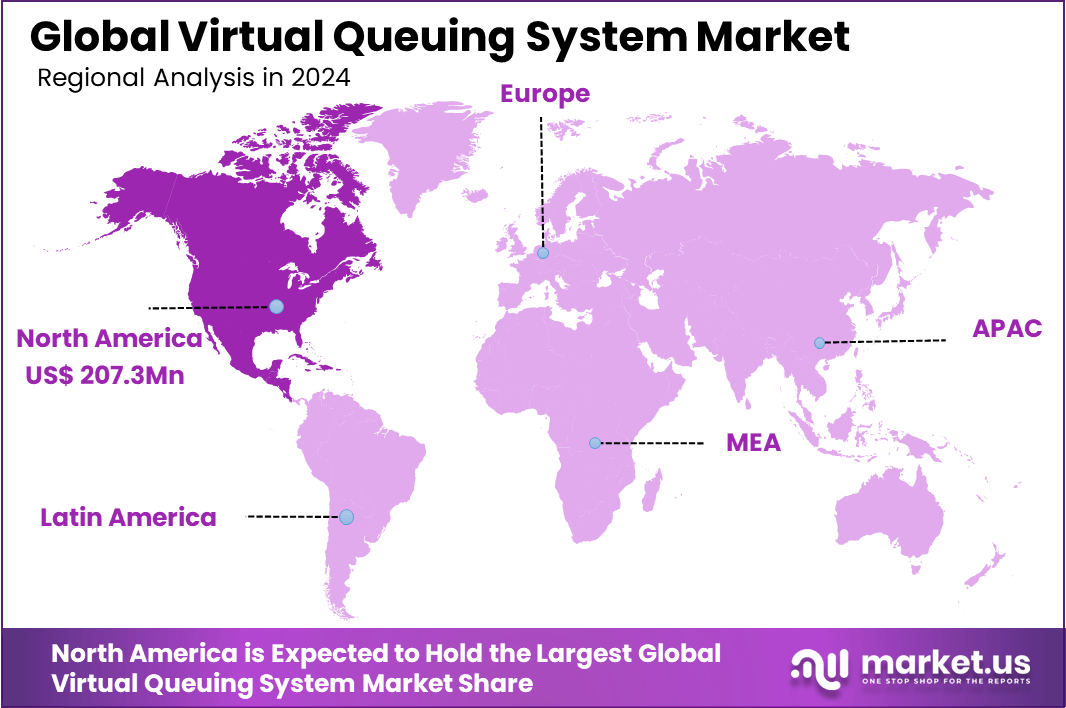

The Global Virtual Queuing System Market size is expected to be worth around USD 1,137.1 Million By 2034, from USD 531.6 Million in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39% share, holding USD 207.3 Million revenue.

The Virtual Queuing System (VQS) Market refers to the digital management of waiting lines using virtual solutions instead of traditional physical queues. These systems enable users to join a queue remotely through mobile applications, web portals, or kiosks, allowing them to wait from any location. The market has witnessed growing attention across sectors such as healthcare, retail, banking, and government services.

One of the top driving factors behind the rise of virtual queuing systems is the increasing pressure on service-based organizations to enhance customer experience and reduce perceived wait times. Businesses are adopting these systems to reduce congestion at physical locations and offer seamless, efficient service journeys. Real-time updates, personalized alerts, and queue transparency are strengthening user engagement and satisfaction.

Demand analysis reveals that the market is experiencing widespread uptake in both developed and emerging economies. In sectors such as healthcare and public administration, virtual queuing is being used to manage large volumes of walk-ins and appointments efficiently. Retail chains and banks are also implementing VQS to reduce in-store wait times and optimize service delivery.

The market is experiencing strong momentum due to increasing adoption of enabling technologies such as AI, IoT, and cloud-based platforms. These technologies are enabling real-time queue analytics, customer behavior prediction, and adaptive wait time estimation. Smart signage, contactless kiosks, and virtual assistants are being incorporated into queuing environments, providing more intuitive and self-service capabilities.

Key Takeaways

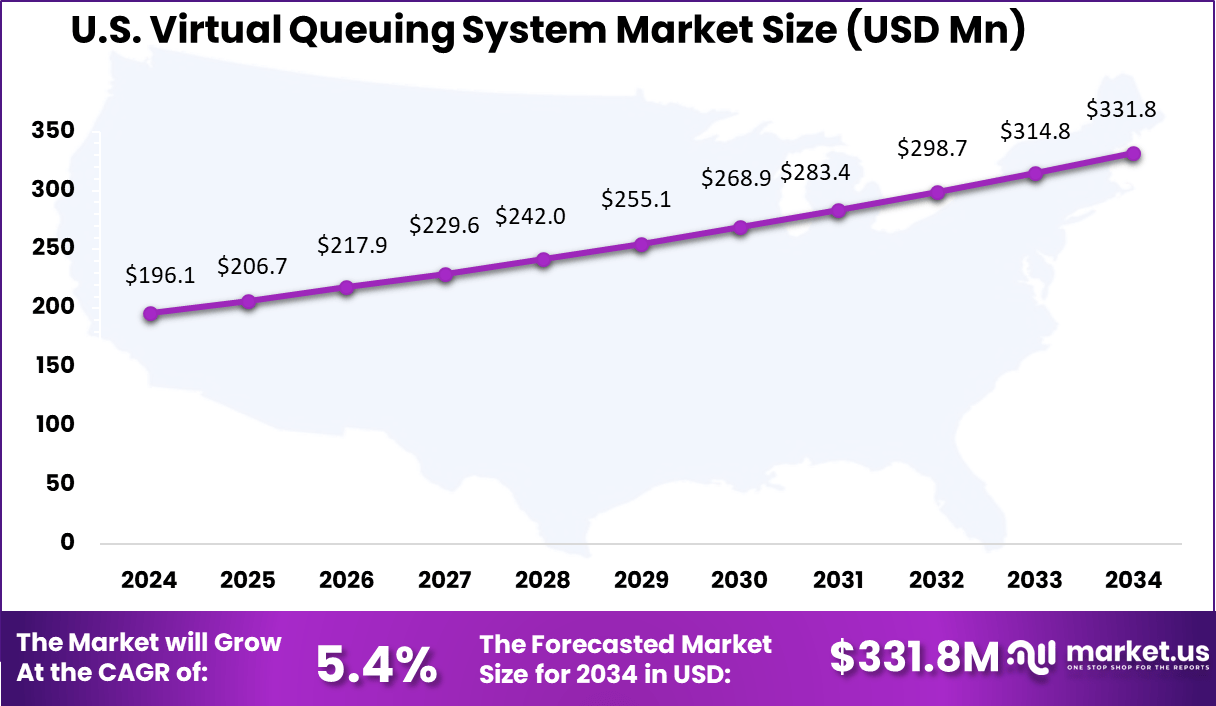

- The U.S. market alone was valued at USD 196.1 Million in 2024 and is expected to expand at a CAGR of 5.4%, reflecting widespread adoption in customer-facing sectors.

- By component, the Software segment accounted for 64% of the market, driven by rising demand for seamless digital queue management solutions.

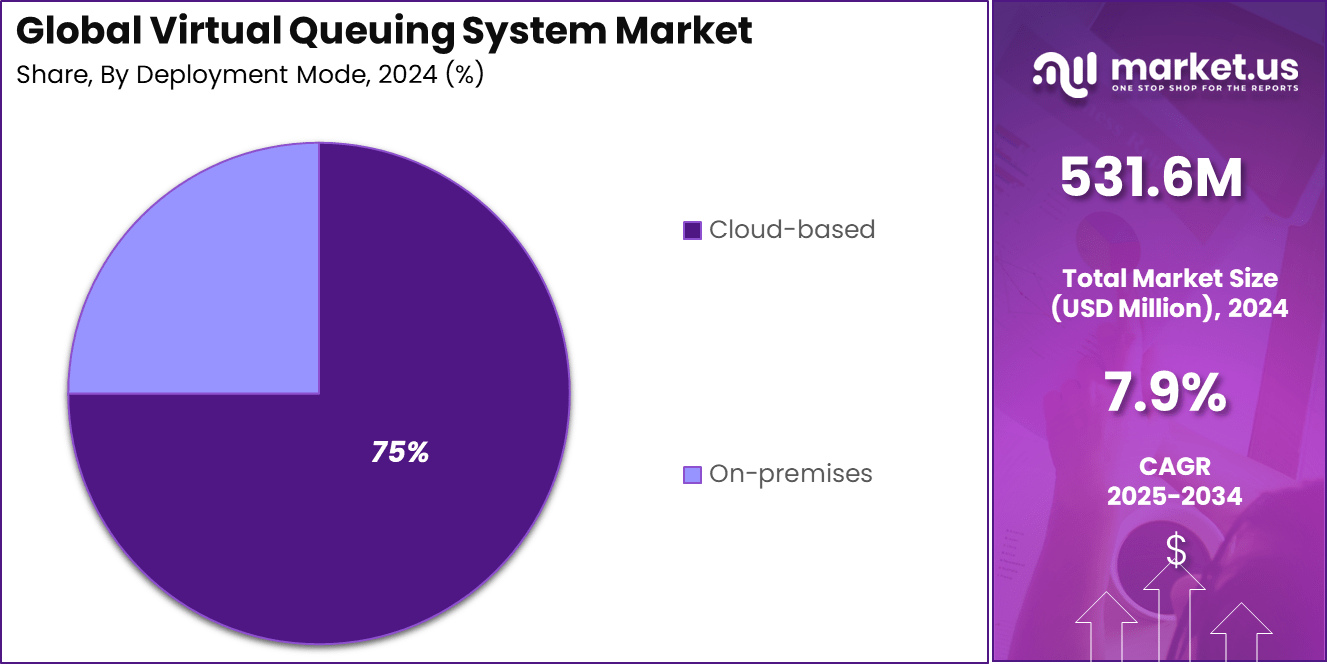

- Cloud-based deployment dominated in 2024 with a 75% share, enabled by its scalability, flexibility, and remote access capabilities.

- Among end-user industries, Healthcare emerged as the top segment, holding 32% market share, as hospitals and clinics increasingly adopted virtual queuing to reduce wait times and improve patient flow.

Analysts’ Viewpoint

There are multiple investment opportunities in this space, particularly in vertical-specific solutions for healthcare, retail, and transport hubs. Investors are increasingly targeting platforms that offer integration capabilities with CRM systems, appointment schedulers, and payment gateways. Demand is also rising for customizable queue workflows suited for enterprises and public institutions, offering scalability across multiple locations and regions.

The business benefits of VQS adoption are well recognized. These include reduced physical congestion, improved service throughput, enhanced brand loyalty, and streamlined staff coordination. Real-time queue visibility improves accountability and responsiveness, while automated feedback mechanisms support continuous service refinement. Organizations using these systems are also better positioned to comply with accessibility and health-related regulations.

The regulatory environment is gradually evolving, especially in sectors dealing with personal data and healthcare services. Compliance with data privacy laws such as GDPR and HIPAA is essential, as virtual queuing systems handle user identifiers and scheduling information. Additionally, public sector adoption is being encouraged through digital transformation mandates and smart city initiatives.

US Market Expansion

The US Virtual Queuing System Market is valued at approximately USD 196.1 Million in 2024 and is predicted to increase from USD 255.1 Million in 2029 to ~USD 331.8 Million by 2034, projected at a CAGR of 5.4% from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 39% share, with total revenue reaching approximately USD 207.3 million. This leadership can be attributed to the widespread adoption of digital customer experience tools across sectors such as healthcare, banking, retail, and government services.

The region’s well-established IT infrastructure and high penetration of smartphones have significantly supported the implementation of virtual queuing technologies. Additionally, the strong push from enterprises to reduce physical wait times and manage foot traffic post-pandemic has played a vital role in driving market expansion.

Component Analysis

In 2024, the Software segment held a dominant market position in the Virtual Queuing System industry, capturing more than a 64% share of the total market. This supremacy can be attributed to several key factors. Software solutions offer unmatched flexibility and scalability, accommodating rapid deployments across multiple locations without requiring heavy investment in physical infrastructure.

Moreover, the integration of cloud-based platforms, AI-driven analytics, real-time monitoring, and CRM connectivity has elevated software offerings to the forefront of innovation, enabling organizations to optimize queue flows, predict wait times, and enhance customer satisfaction.

Software also leads due to its ability to support omnichannel interaction – mobile apps, web portals, kiosks, and SMS – all from a unified platform. Such versatility meets modern consumer expectations for contactless and remote queuing, which have become critical in post-pandemic service environments.

Additionally, software solutions facilitate quick updates, new feature rollouts, and analytics dashboards without on-site hardware changes, reducing maintenance overhead and extending system lifespan. This continuous improvement cycle reinforces software’s leading position in the competitive landscape.

Deployment Mode Analysis

In 2024, the Cloud-based deployment segment held a dominant market position in the Virtual Queuing System market, capturing more than a 75% share. This leadership position can be attributed primarily to its inherent agility and cost-efficiency. Cloud architectures enable organizations to deploy solutions quickly without the necessity for onsite infrastructure.

They also support subscription-based pricing, which significantly reduces upfront capital expenditure and enables scalability aligned with demand. Furthermore, the cloud-based model offers continuous improvements through automatic updates, enhanced security patches, and advanced analytics that aggregate data across locations in real time.

This allows businesses to monitor queue performance dynamically, adjust resource allocation, and derive meaningful operational insights – capabilities that are difficult to replicate with on-premises installations. The cloud’s remote management features empower IT teams to oversee multiple sites centrally, thereby improving operational efficiency and reducing total cost of ownership.

End-User Industry Analysis

In 2024, the Healthcare segment held a dominant market position in the Virtual Queuing System market, capturing more than a 32% share. This prominence can be attributed to the heightened emphasis on improving patient flow, reducing wait times, and enhancing overall care efficiency.

Virtual queuing tools enable healthcare providers to orchestrate appointments, manage check-ins, and deliver real-time updates, which collectively support smoother operations and greater patient satisfaction. Moreover, the impact of the post-pandemic environment has accelerated the adoption of contactless and remote queuing solutions, a necessity for maintaining social distancing and reducing crowd densities within hospitals and clinics.

Healthcare institutions benefit particularly from integration capabilities offered by virtual queuing platforms. These systems can seamlessly connect with electronic medical records (EMR), telehealth portals, and analytics dashboards. As a result, hospitals can allocate resources more effectively – identifying peak times, adjusting staffing levels, and predicting patient load – all of which contribute to improved service quality and operational outcomes

Key Market Segments

By Component

- Software

- Hardware

- Services

- Installation Services

- Maintenance Services

- Consulting Services

By Deployment Mode

- Cloud-based

- On-premises

By End-User Industry

- Healthcare

- Retail

- Hospitality

- Banks

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

AI-Enabled Analytics in Virtual Queuing

In recent years, the integration of artificial intelligence and real-time analytics into virtual queuing systems has become increasingly prominent. A substantial portion of businesses – approaching 72% AI adoption in queue management – are leveraging predictive wait-time modeling and dynamic resource allocation to anticipate demand peaks, reduce congestion, and elevate service quality.

This shift reflects a broader industry movement toward data-driven operational control, where insights gleaned from queue behavior directly inform staffing levels and service delivery, ultimately improving customer satisfaction and operational efficiency.

Driver

Rising Demand for Enhanced Customer Experience

The primary growth driver in this market is the increasing emphasis on improving customer satisfaction across diverse sectors. Organizations are investing in virtual queuing solutions to streamline service flow, reduce in-person waiting, and empower patrons to choose service times – all factors shown to significantly elevate the customer experience.

Moreover, regulations promoting contactless and remote check-in – such as guidance issued by the U.S. Department of Health and Human Services – have further encouraged the adoption of such systems in hospitals and clinics, reinforcing their strategic value.

Restraint

High Initial Setup Costs

The implementation of sophisticated queue management systems continues to face a notable restraint in the form of high upfront investment. Costs associated with hardware installation, software licensing, and system integration can be substantial, particularly for multi-site or public-sector deployments.

Such financial barriers may slow adoption among small and medium-sized enterprises or encourage longer payback periods, especially when digital infrastructure investments must be distributed over extended timeframes or limited budgets.

Opportunity

Expansion in Emerging Markets

Emerging economies, especially in the Asia-Pacific and Latin America regions, represent significant growth opportunities for virtual queue systems. With increased digital transformation initiatives and investments in public infrastructure, markets in these areas are expected to outpace global growth averages.

As awareness and digital literacy improve – particularly in government services, transit systems, and healthcare – vendors can tap into underserved markets by offering localized, cost-effective, cloud-based solutions tailored to regional requirements.

Challenge

Data Security and Integration Complexity

Security risks and system interoperability remain primary challenges for wide-scale implementation. Virtual queue platforms often must integrate with existing IT systems – such as EMR, CRM, and payment gateways – across various environments, complicating deployment and increasing vulnerabilities.

Moreover, concerns around data privacy and cyber threats can delay digital adoption, driving enterprises to invest heavily in security protocols or compliance certifications before full-scale rollouts can be justified.

Key Player Analysis

ACF Technologies enhanced its virtual queuing capabilities in February 2024 by integrating the popular messaging platform WhatsApp into its appointment scheduling and virtual queue tools. This update enables customers to receive virtual tickets, get real-time status updates, book or amend appointments via chat, and even choose between in-person or video service – all aimed at minimizing no-shows and streamlining service flow in Latin America, North America, and Europe.

JRNI merged with Swiss appointment provider Calenso and events specialist Event Farm in March 2025. This consolidation broadens JRNI’s capabilities, combining appointments, events, and queue management into a unified platform. In March 2025, JRNI also refined its calendar-sync engine (v8.10–8.11) to enhance queuing precision.

QLess continues to provide virtual check‑in via mobile apps. The system notifies users when their turn approaches, and it has been adopted in public institutions such as colleges. Notably, QLess entered Chapter 11 bankruptcy protection in June 2024, restructuring amidst financial challenges

Top Key Players Covered

- Wavetec

- Qmatic

- JRNI

- Tensator Group

- QLess

- AURIONPRO

- Qminder

- Skiplino

- ACF Technologies

- VirtuaQ

- Qtrac

- CXM Solutions

- 2meters

- MyQSafe

- Nexa Group

- Queue-Fair

- Other Key Players

Recent Developments

- In April 2025, Tensator formed a strategic partnership with MODI Vision to deploy facial recognition technology at airports and other high‑traffic venues, aiming to optimize passenger flow during boarding and arrivals.

- Wavetec introduced a new hybrid queue management system in March 2024 that integrates mobile notifications and virtual queuing features, enabling customers to join queues both online and in‑person with seamless notifications. The company also announced integration with AI‑ChatGPT for enhanced customer experience on its digital platforms.

Report Scope

Report Features Description Market Value (2024) USD 531.6 Mn Forecast Revenue (2034) USD 1,137.1 Mn CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Hardware, Services (Installation Services, Maintenance Services, Consulting Services)), By Deployment Mode (Cloud-based, On-premises), By End-User Industry (Healthcare, Retail, Hospitality, Banks, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Wavetec, Qmatic, JRNI, Tensator Group, QLess, AURIONPRO, Qminder, Skiplino, ACF Technologies, VirtuaQ, Qtrac, CXM Solutions, 2meters, MyQSafe, Nexa Group, Queue-Fair, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Virtual Queuing System MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Virtual Queuing System MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Wavetec

- Qmatic

- JRNI

- Tensator Group

- QLess

- AURIONPRO

- Qminder

- Skiplino

- ACF Technologies

- VirtuaQ

- Qtrac

- CXM Solutions

- 2meters

- MyQSafe

- Nexa Group

- Queue-Fair

- Other Key Players