Virtual Nursing Solutions Market By Component (Software/Platform, Services and Hardware), By Mode of Delivery (Cloud-based, Web-based and On-premises), By Application (Chronic Disease Management, Post-acute Care, Elderly Care, Mental Health Support, Post-Operative & Post Discharge Care and Others), By End User (Hospitals, Nursing Homes and Long-term Care Facilities, Home Healthcare, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153239

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

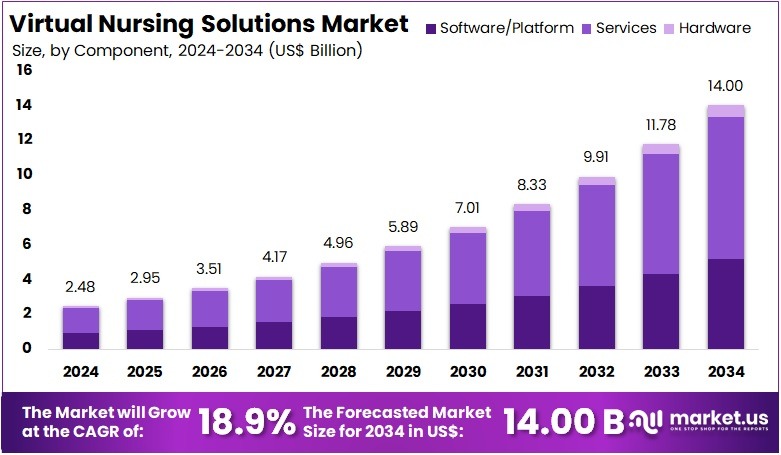

The Virtual Nursing Solutions Market Size is expected to be worth around US$ 14.00 billion by 2034 from US$ 2.48 billion in 2024, growing at a CAGR of 18.9% during the forecast period 2025 to 2034.

Virtual Nursing Solutions offer a promising strategy to tackle the changing dynamics of healthcare delivery. By utilizing technology to expand nursing care, VNS can enhance patient outcomes, improve care delivery efficiency, and provide valuable support to nurses in their crucial roles. However, thorough planning, effective implementation, and continuous evaluation are crucial to ensure the successful integration of VNS.

Virtual nursing leverages telecommunication technologies to provide remote nursing services, enhancing patient care and supporting bedside clinicians. By utilizing video consultations, remote monitoring, and AI-driven tools, virtual nurses assist with tasks such as patient education, medication reconciliation, and discharge planning. This model not only alleviates the workload of on-site nurses but also offers mentorship opportunities for less experienced staff, thereby improving overall job satisfaction and retention.

The virtual nursing market is experiencing rapid growth, driven by factors like nursing shortages, increased patient demand, and advancements in telehealth technologies. In the U.S., the market is poised for significant growth. Healthcare systems are increasingly adopting virtual nursing models to enhance care delivery, reduce operational costs, and improve patient outcomes. This trend is supported by the integration of AI, remote monitoring, and centralized virtual care platforms, which enable scalable and efficient nursing support across various care settings.

In May 2025, Rural communities in the United States encounter significant healthcare challenges, including restricted access to healthcare providers. To tackle this critical issue, VirtuAlly and Teledigm Health have formed a partnership to deliver virtual nursing services to the rural healthcare systems and critical access hospitals supported by Teledigm.

Key Takeaways

- In 2024, the market for Virtual Nursing Solutions generated a revenue of US$ 48 billion, with a CAGR of 18.9%, and is expected to reach US$ 14.00 billion by the year 2034.

- The Component segment is divided into Software/Platform, Services, and Hardware with Services taking the lead in 2024 with a market share of 58.4%.

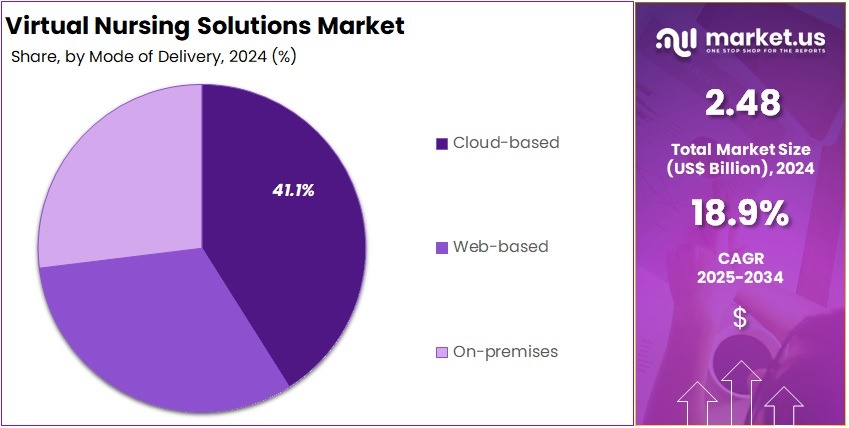

- By Mode of Delivery, the market is bifurcated into Cloud-based, Web-based, and On-premises, with Cloud-based leading the market with 41.1% of market share.

- Furthermore, concerning the Application segment, the market is segregated into Chronic Disease Management, Post-acute Care, Elderly Care, Mental Health Support, Post-Operative and Post Discharge Care, and Others. The Chronic Disease Management stands out as the dominant segment, holding the largest revenue share of 31.0% in the Virtual Nursing Solutions market.

- Considering the End User segment, the market is classified into Hospitals, Nursing Homes and Long-term Care Facilities, Home Healthcare, and Others with Hospitals showing the largest market dominance accounting for 51.3% market share in 2024.

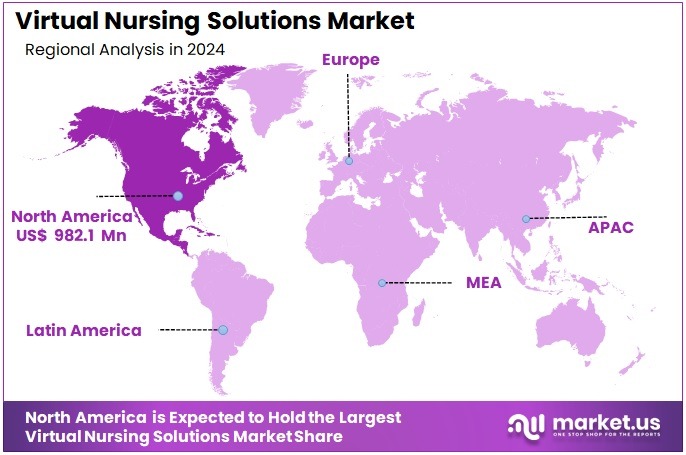

- North America led the market by securing a market share of 39.6% in 2024.

Component Analysis

The Software & Services segment leads the global virtual nursing solutions market. It holds around 58.4% of the total market share. This strong position is due to the growing need for scalable and customizable platforms. These platforms are designed to integrate with electronic health records (EHRs) and support remote diagnostics. They help healthcare providers manage care more efficiently. Virtual nursing software also enables continuous and personalized care beyond hospital walls. This improves patient outcomes and helps reduce overall healthcare costs.

Despite its benefits, virtual nursing adoption remains low in 2024. Only 10% of hospital leaders and 14% of hospital IT leaders have fully integrated virtual nursing into standard care delivery. At the same time, 30% of both groups reported not using virtual nursing at all. These findings come from the “Virtual Care Insight Survey” by AvaSure. The data shows that many healthcare facilities are still in early stages of adopting virtual nursing. Technological barriers and workflow integration challenges may be contributing to the slow progress.

However, optimism about virtual nursing is increasing. According to the same survey, 74% of hospital leaders believe virtual nursing is or will soon be a core part of inpatient care. This is a significant rise from 66% in the previous year. The upward trend reflects growing awareness of the benefits of virtual care. It also indicates a shift in healthcare delivery models. As digital tools evolve, the virtual nursing market is expected to expand further in the coming years.

Mode of Delivery Analysis

Cloud-based delivery models led the virtual nursing market with a 41.1% share. This dominance is due to their scalability, cost-effectiveness, and accessibility. Healthcare providers use these platforms to offer virtual nursing services without heavy investments in infrastructure. Cloud solutions are flexible and support remote care, which became essential during the COVID-19 pandemic. For instance, in April 2023, AvaSure launched its Virtual Nursing application and Care Model. This initiative supports six virtual nursing implementations, with many more in the planning phase, indicating strong future adoption.

Cloud technology has played a key role in expanding access to virtual nursing. Providers can quickly deploy services to meet growing patient needs. These platforms reduce upfront costs and allow easier maintenance and updates. As a result, they are especially favored by small and mid-sized healthcare facilities. The ability to support care teams remotely ensures timely patient interactions and improved outcomes. This model aligns with broader trends in digital health transformation and telemedicine integration in clinical workflows.

Web-based platforms also contribute significantly to the virtual nursing landscape. These solutions run directly through web browsers, requiring no complex software installations. This feature is critical for reaching underserved populations and remote regions. Patients and caregivers benefit from easy access on various devices, including mobile phones. Web platforms also reduce technical barriers, improving adoption among older adults and low-tech users. Their simplicity, paired with strong backend support, makes them a practical option for expanding virtual nursing services at scale across diverse healthcare settings.

Application Analysis

Chronic disease management has emerged as the leading application of virtual nursing solutions, holding a 31.0% market share. This segment addresses the urgent need for continuous care beyond traditional clinical settings. Virtual nursing supports remote monitoring, medication management, and patient education. These features help improve adherence to treatment and reduce hospital readmissions. The growing prevalence of chronic conditions such as diabetes, hypertension, and heart disease is fueling demand. Healthcare providers are increasingly adopting virtual nursing to deliver proactive and cost-effective chronic disease management.

Post-acute care represents another key application of virtual nursing. It focuses on helping patients transition safely from hospital to home. Virtual nursing solutions enable remote assessments, regular follow-ups, and coordination with primary care teams. These functions ensure care continuity and enhance patient outcomes. The ability to monitor patients remotely supports early intervention and helps prevent complications. This is especially important for elderly or high-risk individuals who need sustained support after discharge. The trend is contributing to improved recovery rates and reduced readmissions.

In February 2024, care.ai partnered with Virtua Health to advance virtual care delivery. Care.ai is known as the world’s first and most advanced AI Smart Care Facility Platform. Virtua Health is a Magnet-recognized academic health system in the U.S. Their collaboration will deploy care.ai’s Virtual Care solutions at multiple facilities, starting with Virtua Our Lady of Lourdes Hospital in Camden, New Jersey. This strategic move highlights the growing adoption of AI-driven virtual nursing technologies in modern healthcare systems across the country.

End User Analysis

Hospitals are the leading end users of virtual nursing solutions, holding a dominant market share of 51.3% in 2024. These systems help hospitals extend care beyond traditional settings. They are used to manage patient flow and optimize internal resources. Virtual nursing also helps reduce nurse workload while improving patient outcomes. By enhancing operational efficiency, these solutions support hospitals in delivering high-quality care. As demand for remote and efficient care grows, hospitals are adopting virtual nursing to streamline processes and ensure consistent support.

Nursing homes and long-term care facilities also benefit from virtual nursing technologies. These tools are used to monitor residents’ health and manage chronic conditions effectively. In facilities with limited staff, virtual nursing ensures timely care and round-the-clock support. It improves safety, enhances response time, and supports proactive healthcare delivery. The technology also reduces dependence on physical interventions, enabling consistent patient engagement. Such advancements help care homes provide personalized treatment, maintain continuity, and lower the burden on healthcare personnel.

In October 2022, eVideon partnered with Lee Health, a major public health system in Florida. This strategic collaboration supports the deployment of Vibe Health Engage TVs and Insight digital whiteboards. The devices will be installed in 500 rooms, including those at Golisano Children’s Hospital. The aim is to build a fully integrated patient room hub. This digital setup is designed to boost clinical efficiency and improve patient experience. The partnership reflects a broader trend of smart room technologies in modern healthcare delivery.

Key Market Segments

By Component

- Software/Platform

- Services

- Hardware

By Mode of Delivery

- Cloud-based

- Web-based

- On-premises

By Application

- Chronic Disease Management

- Post-acute Care

- Elderly Care

- Mental Health Support

- Post-Operative and Post Discharge Care

- Others (Emergency Support and Crises Management, and among Others)

By End User

- Hospitals

- Nursing Homes and Long-term Care Facilities

- Home Healthcare

- Others (Educational Institutes, and among Others)

Drivers

Shortage of medical nurses

The global shortage of medical nurses is a key driver behind the rising demand for virtual nursing solutions. Developed countries are facing an increasing need for healthcare services. This is due to aging populations, more chronic disease cases, and public health emergencies like pandemics. However, the supply of qualified nurses is not keeping up with this demand. This shortage puts pressure on hospitals and clinics. Virtual nursing offers a practical solution by helping nurses deliver care remotely. It supports healthcare systems in maintaining care quality despite staffing limitations.

Virtual nursing uses telehealth tools to improve patient care delivery. Nurses can monitor patient health, conduct remote consultations, and manage treatment plans from a distance. These technologies help extend the reach of existing staff. As a result, facilities can treat more patients without exhausting their workforce. It also enhances operational efficiency by reducing the need for in-person visits. By doing so, it allows better time management for both patients and healthcare providers. This model helps in maintaining care continuity across various settings.

In addition, virtual nursing plays a role in reducing nurse burnout. The flexibility of remote work offers a better work-life balance. This is especially important when staff numbers are low. The trend is expected to continue, as shortages persist across the healthcare sector. A 2022 study in Health Affairs showed that over 100,000 registered nurses left the workforce between 2020 and 2021. Most of these nurses were under 35 and worked in hospitals. This highlights the urgency of adopting sustainable nursing solutions.

Restraints

High technology infrastructure costs

A major restraint on the widespread adoption of virtual nursing solutions is the high technology infrastructure costs. The deployment of telehealth platforms, remote monitoring devices, and secure communication networks requires significant initial investments, both in terms of software and hardware. Healthcare organizations need to purchase and integrate state-of-the-art tools, upgrade their IT infrastructure, and ensure continuous data security measures to protect patient information.

Moreover, the ongoing costs of system maintenance, staff training, and troubleshooting add further financial strain. For smaller healthcare facilities or organizations in developing regions with limited budgets, these costs can be prohibitive. The necessity to comply with strict regulatory standards, such as HIPAA in the United States, also requires added investments in secure, compliant systems. While these technologies can ultimately save money by reducing hospital readmissions and improving patient outcomes, the high upfront investment required may deter some organizations from implementing virtual nursing solutions.

Cost Component Description Estimated Cost Range (US$) Virtual Nurse Software Development or purchase of the virtual nurse application $8,000 – $25,000+ System Integration Integration with EHR, databases, and hospital systems $5,000 – $50,000+ Telehealth Platform Monthly cost or custom platform development $24 – $300/user/month (SaaS) or $50,000 – $500,000 (custom) Hardware & Infrastructure Devices, sensors, monitors, VR headsets (if required) $2,000 – $20,000+ Staff Training Training nurses, IT staff, and administrators $5,000 – $100,000 (depending on scale) Annual Maintenance & Support Software updates, tech support, license renewals $2,000 – $10,000/year Compliance & Security HIPAA/privacy protections and cybersecurity measures $5,000 – $25,000+ Opportunities

Increasing technological advancement virtual health

Increasing technological advancements in virtual health represent a significant opportunity for the expansion of virtual nursing solutions. Over the past decade, telehealth technologies have evolved rapidly, making it easier for healthcare providers to offer remote care with a higher degree of accuracy and efficiency. Innovations like artificial intelligence (AI), machine learning, and predictive analytics are transforming how virtual nurses interact with patients.

AI-driven platforms can now analyze vast amounts of patient data in real time, identifying early warning signs of health issues and providing actionable insights for healthcare providers. This allows virtual nurses to intervene proactively and offer personalized care. Additionally, advancements in wearable devices and remote monitoring technologies allow nurses to track patients’ vital signs continuously, ensuring timely interventions.

The integration of these technologies into virtual nursing platforms is also improving the accuracy of diagnoses and enhancing patient outcomes. As technology continues to advance, the capabilities of virtual nursing solutions will expand, making them more effective and widely adopted. For instance, in March 2025, Emory University Hospital Midtown is the first Emory Healthcare hospital to deploy and test both new telehealth equipment and artificial intelligence (AI)-driven technology to assist nurses in caring for patients and preventing falls. Using a combination of new hardware, software, telehealth and AI, Emory is collaborating with Illinois-based VirtuSense Technologies to assist nurses with daily tasks and monitoring, so they can focus more on active patient care.

Impact of Macroeconomic / Geopolitical Factors

Economic conditions, such as inflation and healthcare budget constraints, can impact the affordability and scalability of virtual nursing technologies. For instance, hospitals facing financial pressures may delay investments in virtual care infrastructure.

However, during economic downturns, the demand for cost-effective solutions like virtual nursing increases as healthcare providers seek to reduce operational expenses. A notable example is the U.S. Military Health System’s virtual care program during the COVID-19 pandemic, which demonstrated a 12% reduction in patient length of stay and saved approximately US$2,047 per patient, highlighting the economic benefits of virtual nursing.

Geopolitical events, such as trade tensions and regulatory changes, can disrupt the supply chains of essential components for virtual nursing systems, including hardware and software. For example, export restrictions during the COVID-19 pandemic led to shortages of medical equipment, affecting the deployment of virtual nursing solutions. Additionally, differing healthcare regulations across countries can create barriers to the international expansion of virtual nursing services.

Latest Trends

Increasing development of remote patient monitoring products

The rising development of Remote Patient Monitoring (RPM) technologies is a major factor driving growth in virtual nursing solutions. These tools enable healthcare providers, including virtual nurses, to monitor patients’ vital signs in real time. There is no need for physical visits, which reduces the burden on hospitals. RPM devices such as smartwatches, biosensors, and glucose monitors are becoming more advanced and affordable. This affordability is helping expand access to care. As a result, RPM is now an essential part of modern telehealth and virtual care models.

Virtual nurses are using RPM tools to track chronic conditions like diabetes, heart disease, and hypertension. These devices provide continuous health data. This allows early detection of complications. Real-time monitoring also supports personalized care by delivering timely insights. Healthcare professionals can respond faster and more accurately. This leads to fewer emergencies and better long-term outcomes. Virtual nursing teams are becoming a vital part of chronic care management. This trend is expected to grow further as remote care becomes a standard in healthcare delivery.

In October 2022, GE Healthcare and AMC Health formed a key partnership in this space. Their collaboration aims to extend care beyond hospital walls. By combining GE’s acute care monitoring with AMC Health’s RPM expertise, they plan to enhance post-discharge support. AMC’s platform is FDA Class II 510(k)-cleared and powered by analytics. This integrated approach is designed to improve non-acute patient outcomes. It also demonstrates how major players are investing in virtual nursing through RPM-driven care solutions.

Regional Analysis

North America is leading the Virtual Nursing Solutions Market

The virtual nursing solutions market in North America is experiencing significant growth, driven by the increasing demand for efficient healthcare services, the need to address nursing shortages, and advancements in technology. These solutions offer a way to enhance patient care by leveraging remote monitoring, telehealth consultations, and smart technologies to extend nursing services beyond traditional settings. Virtual nursing services are projected to grow at a robust rate, helping healthcare providers manage patient care more effectively while reducing operational costs.

The growing adoption of telemedicine and remote patient monitoring tools is contributing to this growth, with healthcare systems looking for ways to improve patient outcomes while managing the strain on healthcare professionals. These solutions are especially valuable in managing chronic conditions, providing post-acute care, and supporting elderly patients. As technology continues to advance, virtual nursing is expected to play an increasingly central role in modern healthcare delivery across North America.

In March 2025, Emory University Hospital Midtown became the first hospital within the Emory Healthcare network to deploy and test a combination of telehealth equipment and artificial intelligence (AI)-driven technology. This technology, in collaboration with VirtuSense Technologies, aims to support nurses by assisting with daily tasks and patient monitoring, enabling them to devote more time to active patient care. The integration of hardware, software, telehealth, and AI is designed to enhance the hospital’s ability to monitor patients effectively, with a particular focus on fall prevention.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Virtual Nursing Solutions market is witnessing growing adoption across healthcare systems. Key players include Solaborate Inc., Andor Health, Artisight, care.ai, AvaSure, Teladoc Health, MyndYou, Rhinogram, Laudio, Hicuity Health, LookDeep, Caregility, VitalChat, Collette Health, VirtuAlly, and others. These companies are offering advanced digital tools to support remote nursing care. Their solutions are helping reduce clinician burden, enhance patient monitoring, and streamline care delivery processes. The focus remains on improving patient safety, optimizing staffing efficiency, and enabling continuous virtual support in hospitals and other care settings.

Solaborate’s HelloCare platform delivers a full-scale virtual care experience. It integrates software, hardware, and AI to provide support across hospital, home, and primary care environments. The platform includes features like virtual patient observation (eSitter), remote patient monitoring (RPM), and telehealth consultations. It also supports remote examination kits, alert systems, workflow automation, and telemedicine carts. HelloCare’s integrated approach allows for efficient clinical communication and improved care coordination. This positions Solaborate as a key innovator in virtual nursing infrastructure.

Andor Health’s ThinkAndor platform enhances nursing workflows using AI-powered automation. It helps automate more than 40% of nursing tasks, such as admission and discharge processes. This allows nurses to focus on direct patient care. Artisight, with its Smart Hospital Platform, also supports virtual nursing. It enables seamless communication between clinicians, patients, and care teams. These platforms ensure efficient workflow management and help healthcare providers deliver timely, coordinated, and effective care in hybrid or fully virtual care models.

Top Key Players in the Virtual Nursing Solutions Market

- Solaborate Inc.

- Andor Health

- Artisight

- ai

- Teladoc Health, Inc.

- MyndYou

- Rhinogram

- Laudio

- Hicuity Health

- LookDeep

- Caregility

- VitalChat, Inc.

- Collette Health.

- VirtuAlly

- Other Prominent Players

Recent Developments

- In January 2025, Vanderbilt Health announced virtual nursing to improve patient care. The hospital’s model focuses on overcoming the biggest implementation challenges first, allowing virtual nursing to expand into clinical care. This approach has become a key factor in enhancing regulatory reporting, improving unit discharge efficiency, and boosting patient satisfaction.

- In September 2024, AvaSure, a leader in acute virtual care, has partnered with Oracle Cloud Infrastructure (OCI) to create a virtual concierge solution aimed at enhancing patient care and optimizing clinical workflows in hospitals and healthcare systems. This innovative virtual concierge will combine AvaSure’s Intelligent Virtual Care Platform with Oracle’s AI tools, such as OCI Compute, and NVIDIA’s advanced computing infrastructure. The solution will utilize NVIDIA H200 Tensor Core GPUs and NVIDIA NIM microservices, all part of the NVIDIA AI Enterprise software platform.

- In August 2023, Jefferson Health announced to introduce a Virtual Nurse Program, a new care model that utilizes technology to improve patient care within the hospital while offering support to nurses at the bedside.

Report Scope

Report Features Description Market Value (2024) US$ 2.48 billion Forecast Revenue (2034) US$ 14.00 billion CAGR (2025-2034) 18.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software/Platform, Services and Hardware), By Mode of Delivery (Cloud-based, Web-based and On-premises), By Application (Chronic Disease Management, Post-acute Care, Elderly Care, Mental Health Support, Post-Operative & Post Discharge Care and Others), By End User (Hospitals, Nursing Homes and Long-term Care Facilities, Home Healthcare, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Solaborate Inc., Andor Health, Artisight, care.ai, AvaSure., Teladoc Health, Inc., MyndYou, Rhinogram, Laudio, Hicuity Health, LookDeep, Caregility, VitalChat, Inc., Collette Health., VirtuAlly and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Virtual Nursing Solutions MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Virtual Nursing Solutions MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Solaborate Inc.

- Andor Health

- Artisight

- ai

- Teladoc Health, Inc.

- MyndYou

- Rhinogram

- Laudio

- Hicuity Health

- LookDeep

- Caregility

- VitalChat, Inc.

- Collette Health.

- VirtuAlly

- Other Prominent Players