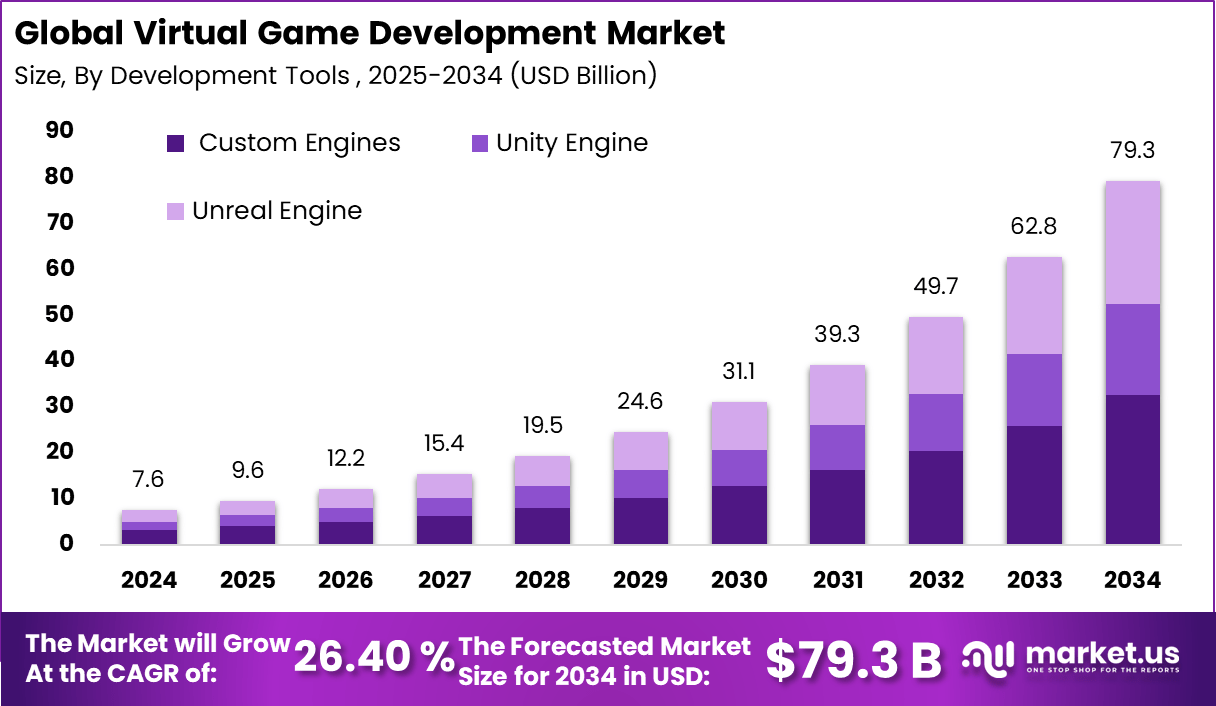

Global Virtual Game Development Market Size, Share, Industry Analysis Report By Development Tools(Custom Engines, Unity Engine, Unreal Engine), By Genres (Action, Puzzle, Role Playing, Simulation, Sports, Strategy, Others), By End-Users (Casual Gamers, Enterprise, Hardcore Gamers), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 166307

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

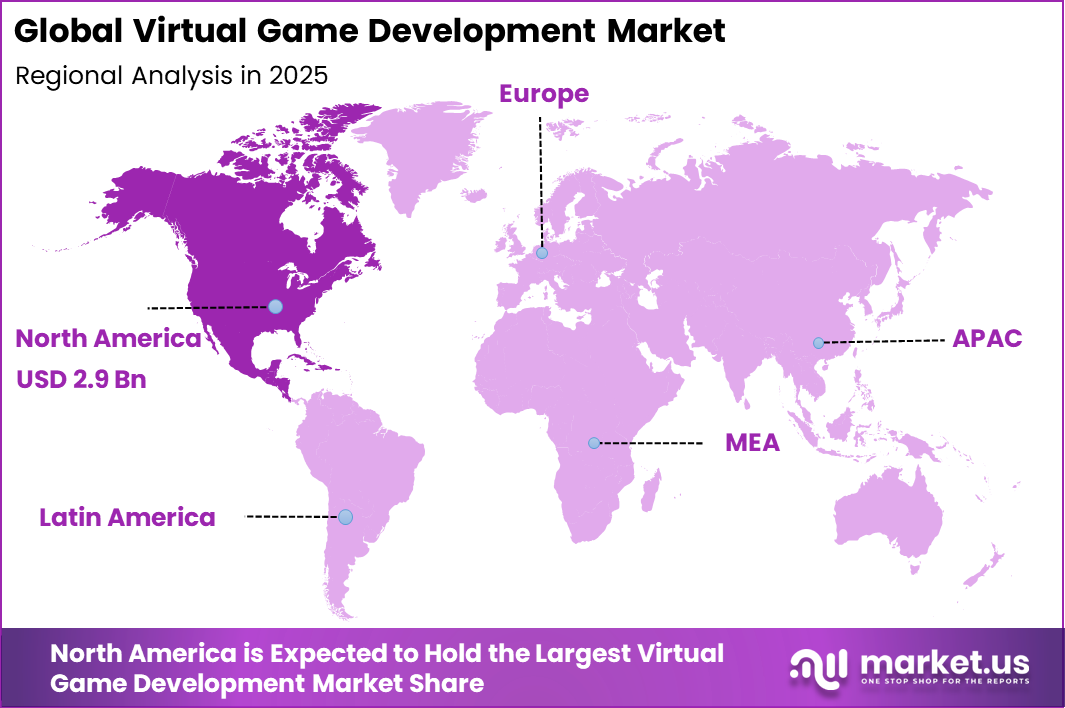

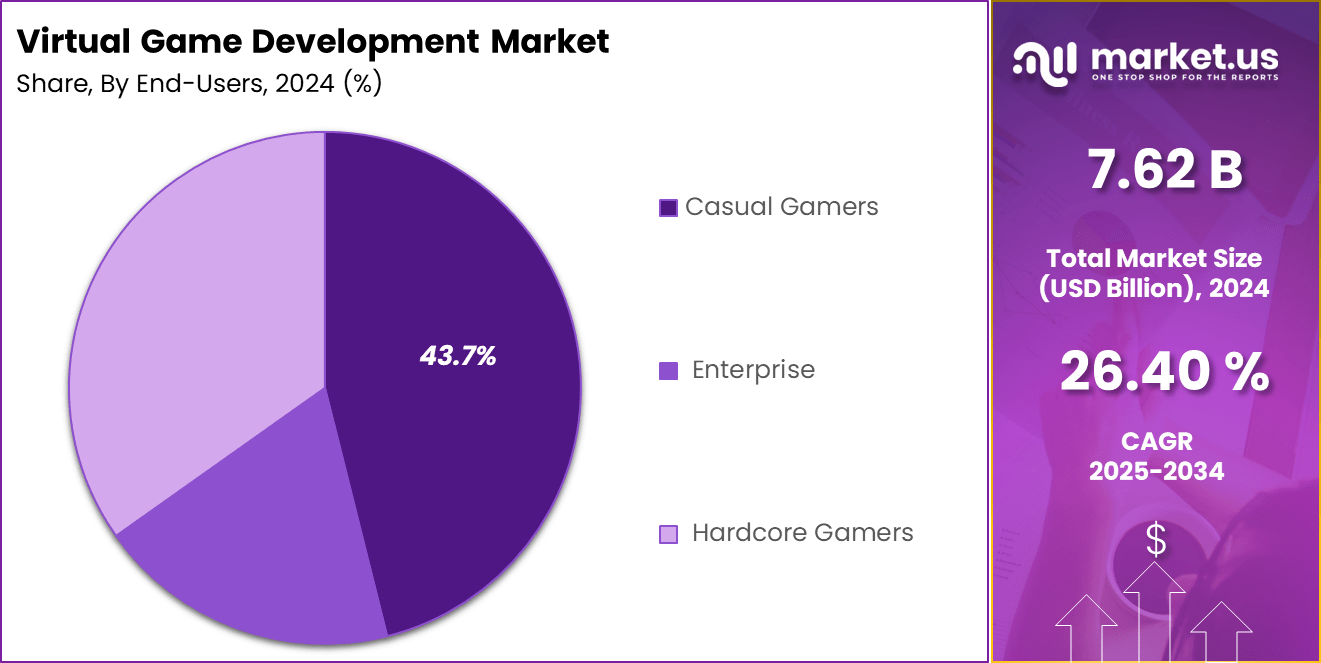

The Global Virtual Game Development Market generated USD 7.62 Billion in 2024 and is predicted to register growth to about USD 79.3 Billion by 2034, recording a CAGR of 26.40% throughout the forecast span. In 2024, North America held a dominant market position, capturing more than a 38.5% share, holding USD 2.9337 Billion revenue.

The virtual game development market focuses on the creation of digital games designed for immersive and interactive virtual environments. These games are developed for platforms such as consoles, personal computers, mobile devices, and virtual reality systems. The market includes game design, development tools, engines, testing, and live content updates. It plays a key role in the global digital entertainment ecosystem.

Virtual game development supports genres such as action, simulation, role-playing, and multiplayer online games. Developers focus on realism, interactivity, and user engagement. The market continues to expand as digital gaming becomes a mainstream form of entertainment. Growth is supported by advances in graphics and computing power.

Demand for virtual game development is strong among entertainment companies and independent studios. Players seek engaging content with frequent updates. Multiplayer and social gaming features increase demand for complex development. This supports sustained market demand. It is also rising from non-entertainment sectors. Education, training, and simulation use virtual games for learning and skill development. Gamified environments improve engagement. This expands the application scope.

Game engines and real-time rendering technologies are widely adopted in virtual game development. These tools enable faster development and realistic visuals. Physics engines improve interaction accuracy. Technology adoption enhances game quality. Cloud-based development and testing platforms are also increasingly used. They support collaboration across teams and regions. Continuous integration improves release cycles. Technology improves efficiency and scalability.

One key reason for adoption is enhanced user engagement. Virtual games offer interactive and immersive experiences. Players remain engaged for longer periods. This improves retention. Another reason is creative flexibility for developers. Virtual environments allow limitless design possibilities. Developers experiment with new mechanics and narratives. This supports innovation.

Key Takeaways

- Custom engines lead as the most utilized development tools in the virtual game development market, accounting for 41.3%.

- Action games are the most popular genre in virtual game development, making up about 28.4% of the market.

- The largest share of virtual game engagement, at 43.7%, is attributed to Casual Gamers within the end-user segment.

- North America represents a significant 38.5% share of the virtual game development market, underscoring its role as a leading hub for game creation and consumption.

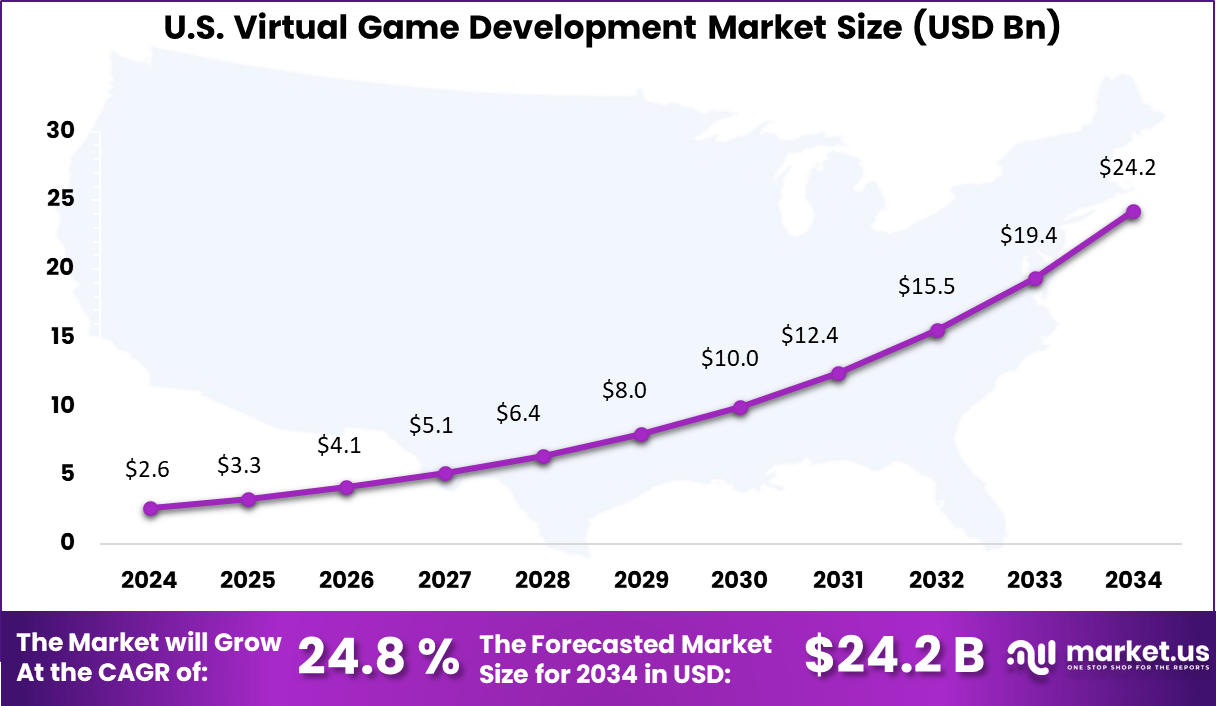

- The US market alone is valued at approximately USD 2.64 billion and is expanding rapidly with a high CAGR of 24.8%.

By Region

The United States reached USD 2.64 Billion with a CAGR of 24.8%, reflecting rapid market growth. Expansion is driven by rising demand for immersive gaming experiences. Developers continue to innovate across platforms. Virtual game development remains a high-growth segment.

North America holds 38.5%, supported by strong gaming culture and digital infrastructure. The region shows high adoption of virtual games across demographics. Developers benefit from advanced development tools and talent availability. Investment in gaming remains strong.

By Development Tools

Custom engines account for 41.3%, showing their strong role in virtual game development. Developers use custom engines to gain full control over game mechanics and performance. These engines allow tailored features that match specific game requirements. Flexibility supports creative design.

The dominance of custom engines is driven by demand for unique gameplay experiences. Studios prefer in-house tools to optimize performance and graphics. Custom engines also support advanced physics and rendering. This approach helps differentiate games in competitive markets.

By Genres

Action games represent 28.4%, making them the leading genre in virtual game development. These games require fast response, detailed environments, and dynamic gameplay. Developers invest heavily in action titles to meet player expectations. High engagement levels support this focus.

Growth in the action genre is driven by strong consumer demand. Players seek immersive and interactive experiences. Action games also perform well across platforms. This sustains ongoing development investment.

By End Users

Casual gamers account for 43.7%, highlighting their influence on game design and distribution. This group prefers accessible games with simple mechanics and short play sessions. Developers target casual users to reach wider audiences. Ease of use supports high adoption.

Adoption among casual gamers is driven by mobile and online platforms. These players engage with games during limited free time. Developers focus on user-friendly interfaces and engaging visuals. This approach supports market expansion.

Key Market Segments

By Development Tools

- Custom Engines

- Unity Engine

- Unreal Engine

By Genres

- Action

- Puzzle

- Role Playing

- Simulation

- Sports

- Strategy

- Others

By End-Users

- Casual Gamers

- Enterprise

- Hardcore Gamers

Emerging Trends

In the virtual game development market, one clear trend is the growing use of immersive technologies such as virtual reality and augmented reality to create deeper player engagement. Developers are focusing on interactive environments, spatial gameplay, and realistic motion to enhance player involvement. These technologies allow games to move beyond traditional screen based formats and deliver more engaging digital experiences.

Another important trend is the increased use of cloud based development environments for collaboration and testing. Development teams are often distributed across regions, and cloud platforms support shared asset libraries, real time collaboration, and remote testing. This approach shortens development cycles and improves coordination between design, programming, and quality teams.

Growth Factors

A key growth factor in the virtual game development market is the rising demand for high quality and visually rich gaming experiences. Players expect detailed graphics, smooth performance, and engaging storylines across devices. To meet these expectations, developers are investing in advanced engines and tools that support realistic rendering and interactive gameplay.

Another factor supporting growth is the wider availability of development tools and engines that reduce technical barriers. Independent developers and small studios can now access professional grade tools that simplify animation, physics simulation, and world building. This accessibility expands the developer base and increases the volume of innovative game content.

Driver

A major driver of the virtual game development market is the expansion of the global gaming audience across mobile, console, and PC platforms. More users are spending time on interactive entertainment, which encourages continuous creation of new virtual games. This expanding user base supports sustained development activity and content investment.

Another driver is the steady improvement in computing hardware performance. Modern processors and graphics units enable complex simulations, larger environments, and higher frame rates. These improvements allow developers to push creative boundaries while maintaining smooth gameplay experiences.

Restraint

A notable restraint in the market is the increasing complexity of game development workflows. Virtual games often require coordination between multiple technical components such as graphics, networking, artificial intelligence, and audio systems. Managing these elements can extend development timelines and raise production costs.

Another restraint relates to the challenges of skill availability and training. Developing immersive and technically advanced games requires specialised expertise. Smaller teams may face difficulties in acquiring or retaining skilled professionals, which can slow development progress.

Opportunity

A strong opportunity exists in cross platform game development that allows players to interact across different devices. Games that support shared progress and multiplayer interaction across platforms can reach wider audiences. This approach improves user retention and creates long term engagement opportunities.

Another opportunity lies in supporting user generated content within virtual games. Tools that allow players to create levels, characters, or custom assets can extend the life of a game. Community driven content also strengthens player loyalty and reduces reliance on constant new releases.

Challenge

One major challenge for the virtual game development market is balancing creative ambition with performance optimisation. High quality visuals and complex mechanics must function smoothly across a wide range of devices. Achieving this balance requires careful testing and technical planning.

Another challenge involves ensuring security and fair play in online and connected games. Multiplayer environments must be protected against cheating, data breaches, and service disruptions. Maintaining secure systems while delivering smooth online experiences remains a continuous challenge for developers.

Key Players Analysis

Tencent, Sony Interactive Entertainment, Microsoft, Nintendo, and NetEase lead the virtual game development market through strong publishing capabilities, advanced game engines, and large developer ecosystems. These companies invest heavily in immersive gameplay, online infrastructure, and cross platform experiences. Their studios focus on high quality graphics, live services, and player engagement.

Activision Blizzard, Epic Games, Electronic Arts, Take Two Interactive, and Ubisoft strengthen the market with globally recognized franchises and scalable development platforms. Their tools and studios support multiplayer environments, real time updates, and monetization models such as in game purchases. These providers emphasize content innovation, engine optimization, and community driven development.

Other participants contribute to market growth by supporting indie developers, regional studios, and emerging virtual game formats. Their offerings focus on creativity, faster development cycles, and niche audience engagement. These players help diversify game content and platforms. Increasing use of cloud gaming, AR, and VR technologies continues to drive steady expansion of the virtual game development market.

Top Key Players in the Market

- Tencent Holdings Limited

- Sony Interactive Entertainment Inc.

- Microsoft Corporation

- Nintendo Co., Ltd.

- NetEase, Inc.

- Activision Blizzard, Inc.

- Epic Games, Inc.

- Electronic Arts Inc.

- Take-Two Interactive Software, Inc.

- Ubisoft Entertainment S.A.

- Others

Recent Developments

- In August, 2025 – Tencent Games made its largest gamescom presence with world premieres of PUBG Mobile’s ghost-themed gameplay and VISVISE AI tools (GoSkinning, MotionBlink) for automated 3D animation, enabling developers to cut rigging time while preserving fidelity.

- In July, 2025 – Microsoft launched Meta Quest 3S Xbox Edition with pre-paired controller and Game Pass Ultimate integration for cloud VR gaming (Forza, GTA 5, Oblivion Remastered), blending Xbox ecosystem with Meta hardware for console-free access.

Report Scope

Report Features Description Market Value (2024) USD 7.62 Bn Forecast Revenue (2034) USD 79.3 Bn CAGR(2025-2034) 26.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Development Tools (Custom Engines, Unity Engine, Unreal Engine), By Genres (Action, Puzzle, Role Playing, Simulation, Sports, Strategy, Others), By End-Users (Casual Gamers, Enterprise, Hardcore Gamers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tencent Holdings Limited, Sony Interactive Entertainment Inc., Microsoft Corporation, Nintendo Co. Ltd., NetEase Inc., Activision Blizzard Inc., Epic Games Inc., Electronic Arts Inc., Take-Two Interactive Software Inc., Ubisoft Entertainment S.A., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Virtual Game Development MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Virtual Game Development MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tencent Holdings Limited

- Sony Interactive Entertainment Inc.

- Microsoft Corporation

- Nintendo Co., Ltd.

- NetEase, Inc.

- Activision Blizzard, Inc.

- Epic Games, Inc.

- Electronic Arts Inc.

- Take-Two Interactive Software, Inc.

- Ubisoft Entertainment S.A.

- Others