Global Veterinary Vaccines Market By Product (Attenuated Live Vaccines, Inactivated, Toxoid Vaccine, and Others), By Animal( Porcine Vaccines, Poultry Vaccines, and Others), By Route of Administration, By Disease Indication, By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 20089

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

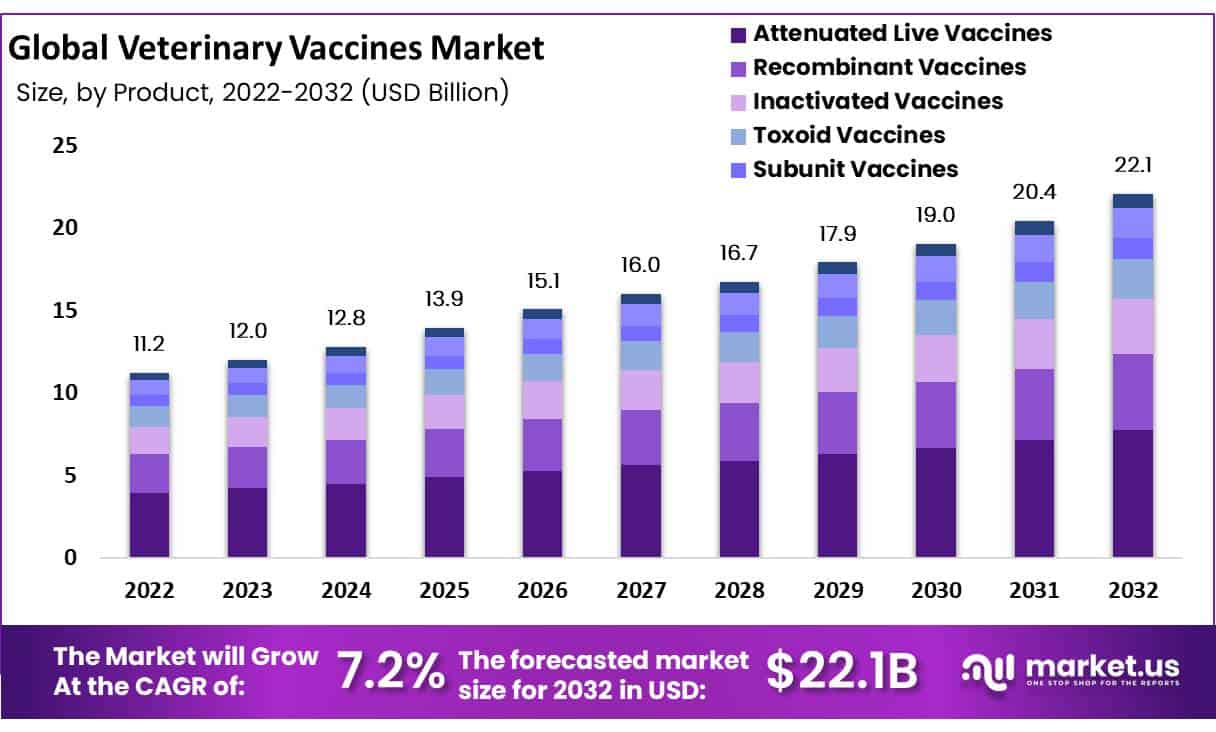

The global veterinary vaccines market size is expected to be worth around USD 22.1 Billion by 2032 from USD 11.2 Billion in 2022, growing at a CAGR of 7.2% during the forecast period from 2022 to 2032.

Veterinary vaccines contain vaccines used for treating and preventing lifetime-threatening diseases in animals. These vaccines are beneficial in decreasing animal suffering and transmission of diseases that causes microorganisms in the animal population.

This vaccine is mainly used to develop the immunity power of animals, which further protects the transmission of diseases from animals to humans. Veterinary vaccines signify bio-prepared immunizations administered to animals through oral or parenteral routes to encourage protective immune responses without causing the disease.

Besides this, veterinary vaccines are lucrative, offer long-term prevention, and are reliable, owing to which they are also used to grow livestock production worldwide.

Product Analysis

Recombinant Segment to Generate Highest Share During the Forecast Period

Based on product, the global veterinary vaccines market is segmented into attenuated live vaccines, Inactivated, toxoid, recombinant, subunit, conjugate, and DNA vaccines.

The inactivated and live attenuated vaccine segment accounted for the largest market share during the forecast period, even with their status as conventional products and related limitations. On the other hand, recombinant vaccine products are projected to grow at the largest CAGR owing to their positive features, such as efficacy, safety, potency, and purity.

Some influences that have caused the recombinant segment’s development are the manufacturers’ lucrative production capability to produce a developed and higher quality. The further benefit over conventional immunization products is that the recombinant dose tolerates the immune system to focus its antibody production over the significant antigens.

Key Takeaways

- Market Growth: Veterinary vaccines market is set to reach USD 22.1 billion by 2032, with a 7.2% CAGR from 2022.

- Technological Developments: Ongoing technological advancements in veterinary vaccines, including DNA and recombinant vaccines, enhance their stability and ease of administration.

- Recombinant Vaccines: Expected to lead growth due to safety and efficacy, with manufacturers investing in higher quality production.

- Companion Animals: Dominant market segment due to rising pet ownership and animal adoption worldwide.

- Parenteral Administration: Leading route for vaccine delivery, with intramuscular, subcutaneous, and intradermal options.

- Disease Indication: Porcine reproductive and respiratory syndrome holds the largest market share due to its high prevalence.

- Distribution Channels: Veterinary clinics lead distribution, with pharmacies and drug stores also showing growth.

- Drivers: Rising awareness and advanced vaccine products propel the market, addressing zoonotic diseases.

- Regional Analysis:

- North America: Dominates the market due to the prevalence of zoonotic diseases and favorable compensation programs.

- Europe: The second-largest regional market, driven by government guidelines, pet insurance adoption, and healthcare infrastructure improvements.

Animal Analysis

Companion Animal Segment to Exhibit Major CAGR in the Upcoming Future

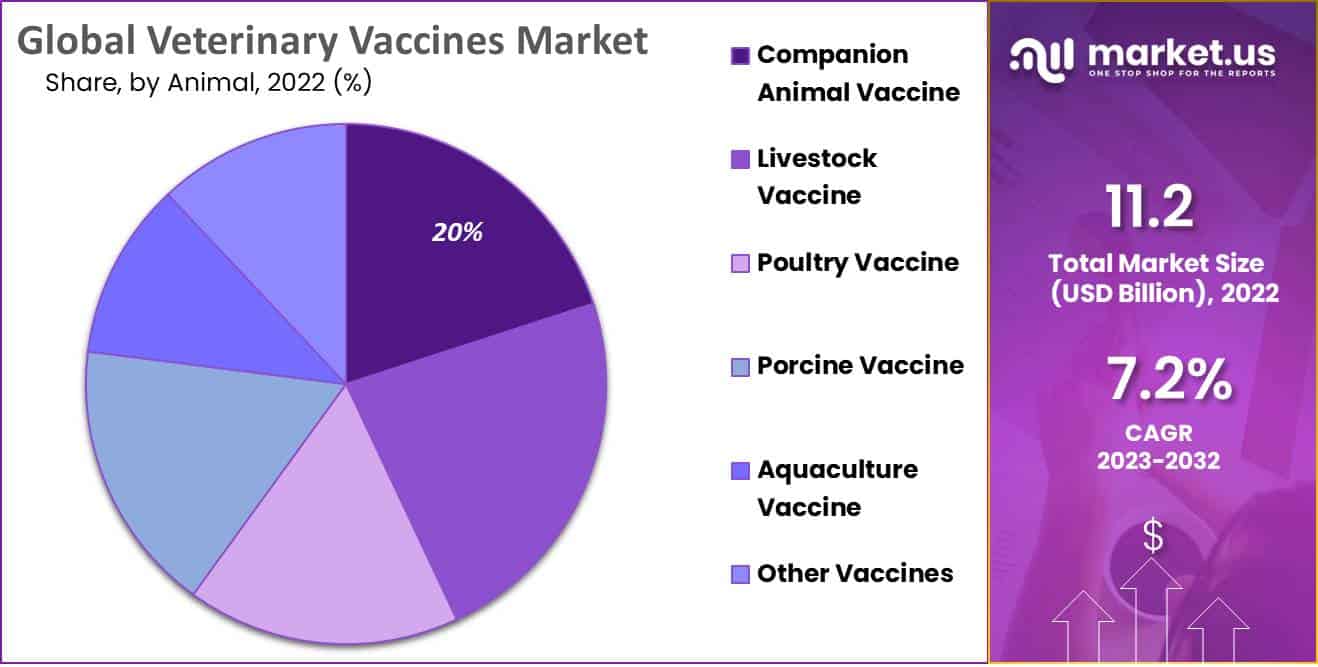

Based on the animal type, the veterinary vaccine market is divided into porcine, poultry, livestock {bovine vaccines & small recombinant vaccines} companion animal vaccines, {canine and feline vaccine} aquaculture vaccines, and other animal vaccines. Among these, the companion segment accounted largest market share.

This is primarily owing to the rising pet animal ownership across the world. Other factors contributing to the growth of the animal companion section is the overall development of animal adoption. A cause that several non-governmental agencies actively support.

Companion animal vaccination is one of the greatest veterinary processes assumed worldwide, especially owing to rising consciousness and concerned animal owners.

Owed to the excessive dependence of humans on livestock segment animals for several requirements, such as animal-based products and meat, improved consideration is concentrated on the standardization of livestock vaccines. This is a more determined government prohibiting antibiotics on livestock animals intended for food.

This influences procedures of animal meat to depend on well-timed immunization to protect against unnecessary veterinary drugs. This is anticipated to propel the livestock segment’s growth.

Route of Administration Analysis

Parenteral segments Lead in Terms of Revenue Generation in the Upcoming Years

Based on the route of administration, the global market can be divided into oral, parenteral, and others. Among these, the parenteral segment is anticipated to generate the highest revenue in the market throughout the forecast period.

Parenteral animal immunization is one of the major and traditional modes of vaccination and is projected to enlarge during the forecast period. Parenteral animal vaccinations contain three major routes intramuscular, subcutaneous, and intradermal.

In addition, this segment further propels market growth due to technological advances in immunization delivery devices. However, the oral segment is expected to see several R& D initiatives owing to increasing trials with new modes of vaccination delivery. This is particularly true for the mucosal vaccination, which is also an oral route of administration.

Disease Indication Analysis

Porcine Reproductive and Respiratory Syndrome held the largest share of the Market

Based on disease indication, the market is segmented into porcine reproductive, respiratory syndrome, Avian Influenza, Rabies, Coccidiosis, Swine Pneumonia, Brucellosis, Canine Parvovirus, Anaplasmosis, Distemper Disease, and Foot and Mouth Disease. Among these, porcine reproductive and respiratory segments dominated the market due to the high and increasing prevalence of the infection.

Distribution Analysis

The Veterinary Clinics Segment Accounted for the Highest Share Among Distribution Channel

Based on distribution channels, the market is classified into veterinary hospitals, veterinary clinics, pharmacies & drug stores, and others. The veterinary clinics segment dominates the market growth with the largest revenue share.

Vaccinations are often a short-duration process that is conducted at smaller institutions. The veterinary hospital segment is expected to be the second dominant share due to cases of difficulties, and these institutions are meant to provide more advanced care facilities.

The pharmacies and drug stores segment is also projected to experience growth opportunities for revenue increase purchases of veterinary vaccines online, which the institutes frequently maintain.

Key Market Segments

By Product

- Attenuated Live Vaccines

- Inactivated

- Toxoid Vaccines

- Recombinant Vaccines

- Subunit Vaccines

- Conjugate Vaccines

- DNA Vaccines

By Animal

- Porcine Vaccine

- Poultry Vaccine

- Livestock Vaccine

- Bovine Vaccines

- Small Ruminant Vaccine

- Companion Animal Vaccine

- Canine Vaccine

- Feline Vaccine

- Aquaculture Vaccines

- Other Animal Vaccine

By Route of Administration

- Oral

- Parenteral

- Others

By Disease Indication

- Porcine Reproductive and Respiratory Syndrome

- Avian Influenza

- Rabies

- Coccidiosis

- Swine Pneumonia

- Brucellosis

- Canine Parvovirus

- Anaplasmosis

- Distemper Disease

- Foot and Mouth Disease

By Distribution Channel

- Veterinary Hospitals

- Veterinary Clinics

- Pharmacies

- Drug Stores

- Others

Drivers

Rising Awareness and Invention of New Inoculation Products to Drive the Market

In terms of market dynamics, one of the primary drivers for the rapidly expanding size of the veterinary vaccines market is a rise in animal husbandry initiatives, increased animal ownership, and increased awareness of veterinary healthcare.

As a result, modern animal owners are far more aware of their animals’ vaccinations and the new veterinary vaccines available to protect their health. They have also been helped by government and non-government organizations like Bayer’s global campaign for animal health, which aims to reduce zoonotic diseases.

Increasing Demand for Advanced and Effective Immunization Products to Drive Market Growth

The introduction of animal products and subsequent technological advancements are two significant driving forces. Since their introduction to the general public, animal immunization has undergone significant R&D advancements.

Usually attenuated and inactivated pathogens have contributed significantly to protecting human and animal health through animal immunization. However, inactivated vaccines frequently only partially replicate the shortcomings of conventional animal immunization, such as the complex immunogenicity of some bacterial pathogens.

Recombinant vaccines have emerged due to these factors, and they offer several advantages, including the fact that vaccinating against the pathogen prevents exposure. The prevention of animal diseases that have the potential to spread to humans and cause epidemics, resulting in a public health crisis, is another important factor driving the widespread adoption of animal inoculation products.

Restraints

Lack of Vaccination Adoption amongst Smallholder Farmers in Developing Countries May Hamper Growth

In developing nations, millions of smallholder farmers are projected to own livestock. These smallholder farmers have a hard time getting their animals immunized because they aren’t aware of the benefits, can’t afford the inoculation products, and the supply chain is weak, making it hard for them to get their hands on them.

Smallholder farmers face additional financial strain due to the numerous diseases that kill their livestock. Governments and agencies are employing various strategies to increase accessibility, availability, and approval of animal immunization among smallholder farmers.

Trends

Technological Developments in Animal Immunization Growth are a Vital Trend

Over the past few years, there have been several technological advancements in the vaccination of animals. One of the most significant developments to date is the introduction of DNA and other vaccines based on recombinant DNA technology. In addition, cutting-edge technology has made it possible to benefit from increased stability and administration simplicity.

The nucleic acid, for instance, is a new immunization method that falls somewhere between life and kill approaches. The direct injection of messenger RNA or the cloning of DNA into a delivery plasmid are the foundations of these products. In addition, several key players are contributing to the ongoing development of product development tools to create innovative and effective veterinary vaccines.

Regional Analysis

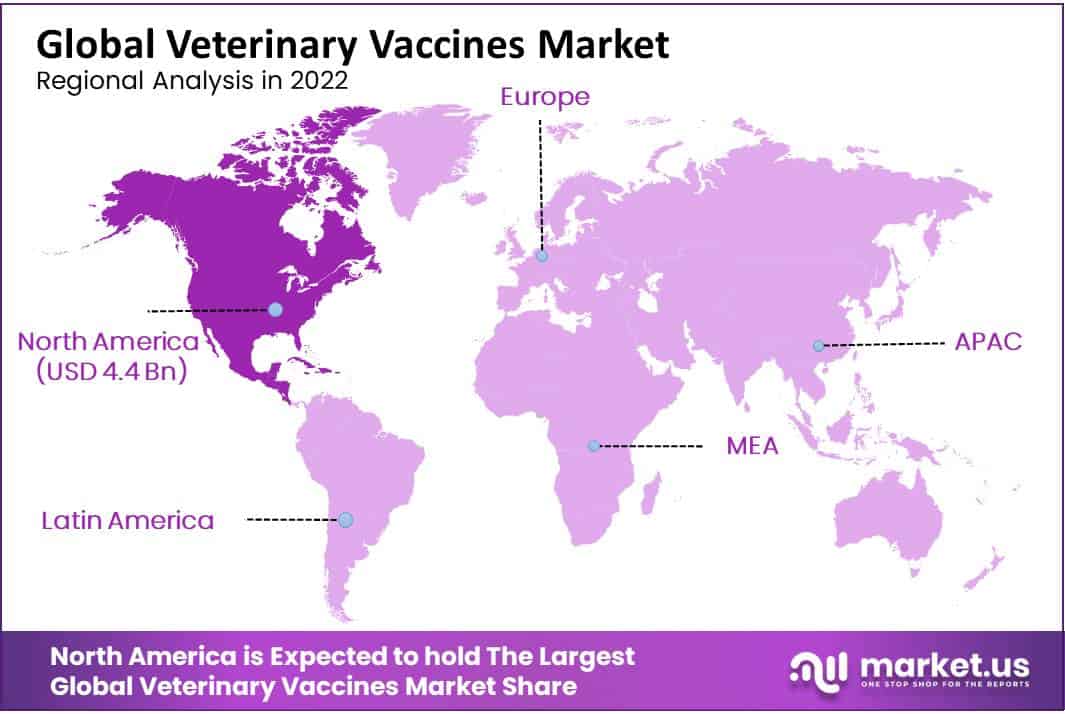

North American region accounted significant share of the global veterinary vaccines market

North America accounted for a significant veterinary vaccines market share of 40%. This growth mostly results from factors such as the rising dominance of zoonotic diseases and favorable compensation programs. Europe is the second-highest regional market due to beneficial government guidelines, such as the increased approval of pet insurance, the rising number of veterinary clinics, and enhanced healthcare infrastructure in European countries.

Asia–Pacific is projected to witness the largest growth in the market. Due to growing disposable incomes across the region, there is more awareness regarding protective animal healthcare.

Along with this, the increasing expenditure on animal health & veterinary services and the substantial cattle population are anticipated to drive market growth in the Asia-Pacific region. On the other hand, the Middle East & Africa, and Latin regions are anticipated to witness stable growth rates throughout the forecast period. Owing to rising pet adoption across the areas.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Eli Lilly and Company, Intervet Inc., and Elanco, Inc. to Support their position by Establishing a Strong Global Presence.

The market players are involved in regional expansions, strategic collaborations, and new product launches to tolerate the completion. Established organizations and large enterprises are investing in the achievements of the market players to gain a competitive edge.

Focused on inorganic approaches such as Elanco’s achievement of Bayer’s Animal Health Division is more expected to associate the leading revenue share. Major prominent players in the market include Merck & Co, Inc., Zoetis, Inc., Vetoqional S. A, ADM Animal Nutrition, Evonik Industries AG,

Market Key Players

- Elanco Animal Health Incorporated

- Boehringer Ingelheim International GmbH

- HIPRA

- Merck& Co, Inc.

- Virbac

- Vetoqional S. A

- ADM Animal Nutrition

- Evonik Industries AG

- Zoetis Inc.

- MSD Animal Health

- Hester Biosciences Limited

- Ceva Logistics

- Neogen Corporation Limited

- Biogenesis Bago S A

- Kindered Biosciences, Inc.

- Bayer AG

- Indian Immunologicals Ltd

- Eli Lilly and Company

- Phibro Animal Health Corporation

- Other Key Players

Recent Development

- November 2020- HIPRA declared the virtual launch of GUMBOHATCH’s innovative generation Infectious Bursal Disease complex immunization product for boiler chickens.

- September 2020- Hester Biosciences Limited declared the Brucella vaccine’s development, confirming lifetime immunity in calf- hood. However, the company signed with the Indian Veterinary Research Institute and the Indian Council of Agriculture to obtain the indigenously established technology for emerging the Brucella Abortus s19 Delta Per dose.

- February 2020 – Zoetis received the U. S FDA authorization for Simparica, a one-time- once-a-month chewable flea and tick intranasal inoculation product that prevents beef and dairy cattle from typical pneumonia affecting viral pathogens.

Report Scope

Report Features Description Market Value (2022) US$ 11.2 Bn Forecast Revenue (2032) US$ 22.1Bn CAGR (2023-2032) 7.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product – Attenuated Live Vaccines, Inactivated, Toxoid Vaccines, Recombinant Vaccines, Subunit Vaccines, and DNA Vaccines; By Animal- Porcine Vaccines, Poultry Vaccines, Livestock Vaccines{ Bovine and Small Ruminant Vaccines} Companion Animal Vaccine {Canine and Feline Vaccines} Aquaculture Vaccines, and other Animal Vaccines; By Route of Administration- Oral, Parenteral, and Others; By Disease Indication- Porcine Reproductive and Respiratory Syndrome, Avian influenza, Rabies, Coccidiosis, Swine Pneumonia, Brucellosis, Canine Paravirus, Anaplasmosis, Distemper Disease, and Foot and Mouth Disease; By Distribution Channel- Veterinary Hospitals, Veterinary Clinics, Pharmacies& Drug Stores, and Others Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Elanco Animal Health Incorporated, Merck& Co, Inc., Virbac, Vetoquional S.A, ADM Animal Health, Zoetis Inc., MSD Animal Health, Hester Biosciences Limited, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Elanco Animal Health Incorporated

- Boehringer Ingelheim International GmbH

- HIPRA

- Merck& Co, Inc.

- Virbac

- Vetoqional S. A

- ADM Animal Nutrition

- Evonik Industries AG

- Zoetis Inc.

- MSD Animal Health

- Hester Biosciences Limited

- Ceva Logistics

- Neogen Corporation Limited

- Biogenesis Bago S A

- Kindered Biosciences, Inc.

- Bayer AG

- Indian Immunologicals Ltd

- Eli Lilly and Company

- Phibro Animal Health Corporation

- Other Key Players