Global Veterinary Telemetry Systems Market By Product Type (Vital Signs Monitors, Wearables, ECG/EKG Monitors, Anesthesia Machines, Accessories, and Others), By Technology (Compact/Tabletop, Floor Standing, and Portable), By Application (Respiratory, Neurology, Cardiology, and Others), By Animal (Small Animals and Large Animals), By End-user (Veterinary Hospitals/Clinics and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149988

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

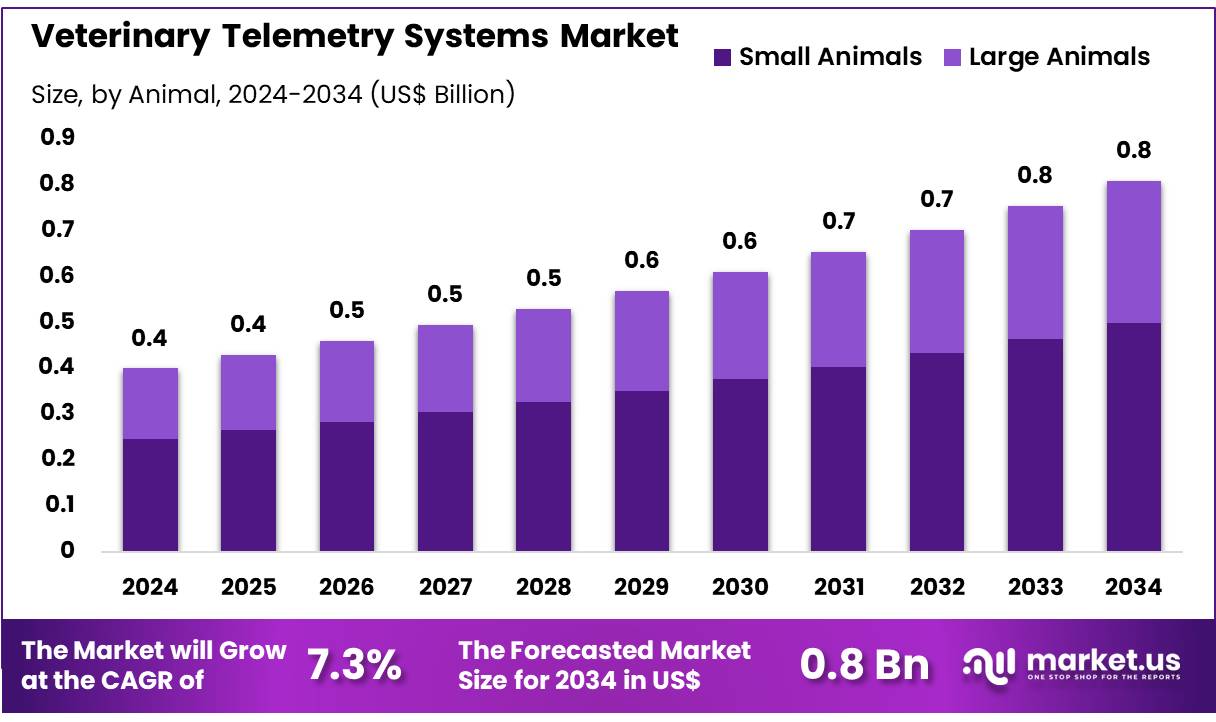

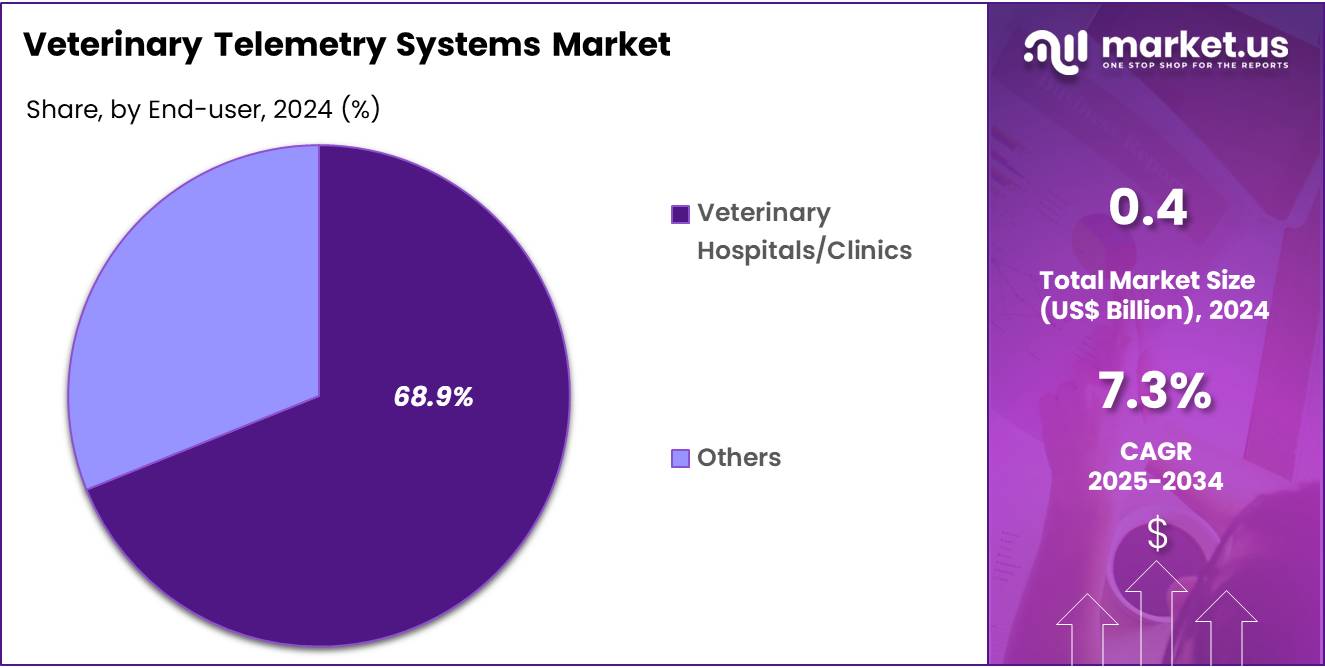

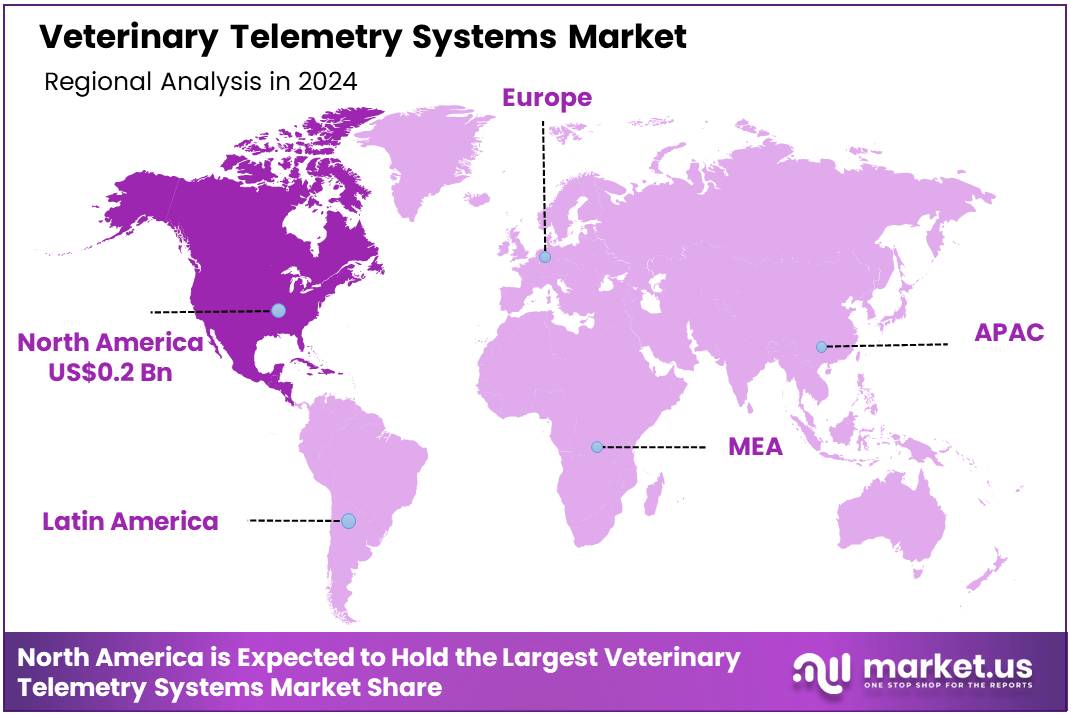

Global Veterinary Telemetry Systems Market size is expected to be worth around US$ 0.8 Billion by 2034 from US$ 0.4 Billion in 2024, growing at a CAGR of 7.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.9% share with a revenue of US$ 0.2 Billion.

Rising pet ownership and the increasing focus on animal welfare are significantly driving the veterinary telemetry systems market. These systems find crucial applications in continuous monitoring of vital signs like heart rate and temperature, which is essential during surgical procedures and for managing chronic conditions such as cardiovascular and respiratory disorders in animals.

Furthermore, telemetry plays a vital role in remote patient monitoring, especially with the growth of telemedicine, allowing veterinarians to assess animals from a distance. Recent trends reveal a growing adoption of wearable and portable telemetry devices that offer convenience for both veterinarians and pet owners. Integration of advanced technologies like AI enables real-time analysis of physiological data, facilitating early detection of health issues.

In October 2024, the collaboration between Mella Pet Care and Vetster exemplified this trend by linking Mella’s monitoring devices with Vetster’s telemedicine platform to enhance remote veterinary care across the US, the UK, and Canada. This partnership aims to improve the accuracy of remote pet evaluations through continuous data from Mella’s diagnostic tools, showcasing the market’s movement towards more integrated and accessible animal health solutions.

Key Takeaways

- In 2024, the market for veterinary telemetry systems generated a revenue of US$ 0.4 billion, with a CAGR of 7.3%, and is expected to reach US$ 0.8 billion by the year 2034.

- The product type segment is divided into vital signs monitors, wearables, ECG/EKG monitors, anesthesia machines, accessories, and others, with vital signs monitors taking the lead in 2024 with a market share of 31.3%.

- Considering technology, the market is divided into compact/tabletop, floor standing, and portable. Among these, compact/tabletop held a significant share of 43.1%.

- Furthermore, concerning the application segment, the market is segregated into respiratory, neurology, cardiology, and others. The respiratory sector stands out as the dominant player, holding the largest revenue share of 36.4% in the veterinary telemetry systems market.

- The animal segment is segregated into small animals and large animals, with the small animals segment leading the market, holding a revenue share of 61.7%.

- Considering end-user, the market is divided into veterinary hospitals/clinics and others. Among these, veterinary hospitals/clinics held a significant share of 68.9%.

- North America led the market by securing a market share of 38.9% in 2024.

Product Type Analysis

The vital signs monitors segment claimed a market share of 31.3% owing to increasing demand for real-time monitoring in animal healthcare. Clinics and hospitals prioritize devices that track heart rate, temperature, respiratory rate, and blood pressure continuously, especially during surgical procedures or intensive care. The rising incidence of chronic conditions among companion animals, such as cardiovascular disorders and respiratory illnesses, has elevated the need for reliable and precise monitoring tools. Pet owners also invest more in preventive care, which supports wider adoption.

Furthermore, technological advancements have improved the portability, accuracy, and integration of vital signs monitors with digital veterinary platforms. Remote telemetry capabilities are expected to gain traction, enabling veterinarians to access patient data from mobile devices. Growing awareness among pet owners about early diagnostics also drives segment demand.

In addition, the rising population of elderly pets contributes to the need for consistent health tracking. Regulatory support and growing investments in smart monitoring devices further enhance market penetration. Urban pet adoption and increased veterinary infrastructure are anticipated to support sustained growth in this segment.

Technology Analysis

The compact/tabletop held a significant share of 43.1% due to increasing demand for space-efficient and cost-effective telemetry solutions. Veterinary clinics with limited operational space prefer compact systems that offer high performance without occupying large physical areas. These devices integrate well into existing clinical workflows and provide quick setup and mobility benefits. Their rising affordability makes them accessible to both urban and semi-urban practices.

Advances in modular design allow tabletop systems to support multiple monitoring parameters within a single unit. These innovations enhance usability for both general practices and emergency care settings. As veterinary services expand in smaller and independent clinics, the preference for scalable and versatile equipment increases. Compact devices also suit mobile veterinary units, which are growing in rural and underserved regions.

Moreover, the demand for diagnostic flexibility and multi-species support adds value to these systems. The rising number of outpatient procedures reinforces the need for easy-to-deploy telemetry tools. With user-friendly interfaces and digital connectivity, compact units are projected to see continued preference over bulkier models.

Application Analysis

The respiratory segment had a tremendous growth rate, with a revenue share of 36.4% owing to a surge in respiratory illnesses among companion and farm animals. Environmental changes, allergens, and infectious agents increasingly affect the respiratory health of pets, driving demand for continuous pulmonary monitoring. Clinics prioritize respiratory telemetry to manage complex conditions such as asthma, pneumonia, and chronic obstructive pulmonary diseases in animals.

Technological advancements in respiratory monitoring now enable non-invasive and highly sensitive tracking, improving early detection. The growing use of anesthesia in veterinary surgeries also increases the need for accurate respiratory rate and oxygen saturation monitoring.

Additionally, portable respiratory monitoring solutions support care delivery in field settings and mobile clinics. Pet owners now seek advanced diagnostics for early signs of respiratory distress, further propelling this segment. Increasing awareness about zoonotic diseases has led to more stringent veterinary protocols around respiratory health. The rise in animal sports and agility training demands comprehensive health assessments, including respiratory evaluations. These combined factors are anticipated to drive strong market expansion for respiratory monitoring applications.

Animal Analysis

The small animals segment grew at a substantial rate, generating a revenue portion of 61.7% due to the rising pet adoption rates and growing expenditure on companion animal healthcare. Urbanization and changing lifestyles have increased the preference for smaller pets such as dogs, cats, and rabbits. As pet owners treat animals as family members, the demand for advanced monitoring technologies continues to grow. Small animals undergo a wide range of diagnostic and surgical procedures requiring continuous telemetry, boosting device utilization.

Moreover, the shorter life spans of these animals necessitate regular health assessments to catch early signs of illness. Telemetry systems designed for small-bodied species now offer higher accuracy and are less invasive, improving clinical outcomes. The proliferation of veterinary clinics specializing in pet wellness has expanded access to these services.

Growing awareness of breed-specific diseases also fuels demand for tailored monitoring protocols. With telehealth integration becoming common, monitoring small animals remotely has become feasible and attractive. Additionally, manufacturers increasingly develop compact, species-specific telemetry tools for small animals, enhancing segment growth.

End-user Analysis

The veterinary hospitals/clinics held a significant share of 68.9% due to the rising institutionalization of animal care services and growing infrastructure investments. These facilities handle a high volume of complex cases requiring advanced diagnostic and monitoring equipment. Hospitals increasingly adopt telemetry solutions to manage preoperative, intraoperative, and postoperative animal care efficiently.

Integration with electronic health records and cloud-based data access enhances operational precision and continuity of care. The demand for multidisciplinary diagnostics in clinics fuels investments in all-in-one telemetry platforms. As pet insurance coverage expands, clinics gain greater ability to offer premium monitoring services. Staff training and professional development in these settings further promote the adoption of sophisticated systems.

In addition, emergency and critical care units in hospitals depend on continuous telemetry to respond rapidly to patient changes. The emergence of corporate veterinary chains also contributes to increased standardization and equipment procurement. Finally, growing partnerships between device manufacturers and clinics support tailored installations and technology upgrades, strengthening segment expansion.

Key Market Segments

By Product Type

- Vital Signs Monitors

- Wearables

- ECG/EKG Monitors

- Anesthesia Machines

- Accessories

- Others

By Technology

- Compact/ tabletop

- Floor Standing

- Portable

By Application

- Respiratory

- Neurology

- Cardiology

- Others

By Animal

- Small Animals

- Large Animals

By End-user

- Veterinary Hospitals/Clinics

- Others

Drivers

Increasing Focus on Continuous Animal Monitoring is Driving the Market

The growing emphasis on the continuous and detailed monitoring of animal physiology is a significant driver for the veterinary telemetry systems market. This approach provides a more nuanced understanding of an animal’s health and responses over time. The increasing dog population in the US, as reported by the AVMA in October 2024, reaching 89.7 million, signifies a larger pet base requiring advanced care.

Supporting this, Zomedica’s August 2024 introduction of advanced audio features to its VETGuardian remote monitoring system demonstrates the technological advancements enabling more comprehensive continuous monitoring for both equine and companion animals, aiding in early distress detection. This drive for enhanced and remote monitoring solutions is steadily fueling market demand.

Restraints

High Initial Investment Costs are Restraining the Market

A notable factor that can limit the broader adoption of these advanced monitoring tools is the significant initial financial investment required to purchase and implement veterinary telemetry systems. These systems often involve specialized sensors, robust data transmission hardware, and sophisticated software for analysis, which can represent a substantial upfront cost.

While the long-term benefits of enhanced data collection and potentially improved patient outcomes are acknowledged, this immediate financial barrier can be a challenge, particularly for smaller veterinary clinics or academic research labs operating with constrained budgets. The partnership between Mella Pet Care and Vetster in October 2024, integrating monitoring devices with telemedicine, aims to improve accessibility of monitoring but the initial device cost remains a factor for adoption.

Opportunities

Advancements in Sensor and Wireless Technologies are Creating Growth Opportunities

The continuous progress in sensor technology and wireless communication is generating substantial opportunities for expansion within the veterinary telemetry systems market. The development of smaller, more accurate, and more biocompatible sensors allows for the monitoring of a wider range of physiological indicators with greater precision and less invasiveness.

The collaboration between GE HealthCare and Sound Technologies, as reported in January 2023, to expand the distribution of the Vscan Air handheld ultrasound device, illustrates how portable and wireless diagnostic tools are becoming more accessible, enhancing remote monitoring capabilities for a wider range of animals. These technological advancements are making telemetry more versatile and user-friendly.

Impact of Macroeconomic / Geopolitical Factors

Prevailing macroeconomic conditions can exert a notable influence on the capital expenditure budgets of veterinary hospitals and research institutions, which consequently affects their capacity to invest in advanced technologies such as veterinary telemetry systems. During periods of economic downturn, there might be a tendency towards more conservative spending on new equipment and technological upgrades.

Furthermore, geopolitical factors, including international trade policies and the landscape of global research collaborations, can also play a significant role by potentially affecting the stability of the supply chain for essential components and the overall economic environment for research funding initiatives. Nevertheless, the escalating emphasis on animal welfare standards and the growing demand for high-quality, continuous physiological data within both veterinary medicine and animal research often provide a certain degree of resilience to the growth and evolution of this market.

The imposition of current US tariffs has the potential to create a dual impact on the veterinary telemetry systems market. If tariffs are levied on the importation of critical components such as sensors, other electronic parts, or even fully assembled telemetry units, this could lead to an increase in costs for end-users based in the US, potentially making these advanced monitoring tools more expensive and less immediately accessible.

Conversely, these same tariffs might create an incentive for the expansion of domestic manufacturing capabilities for veterinary telemetry technology within the United States, which could, in turn, foster local innovation and potentially create new economic opportunities within the country. While the possibility of increased costs due to tariffs could present a short-term challenge to market growth, the underlying fundamental drivers supporting the adoption of advanced animal monitoring solutions are likely to ensure the continued evolution and expansion of the veterinary telemetry systems market over the longer term.

Latest Trends

Integration with Cloud-Based Platforms is a Recent Trend

A key recent trend observed in the veterinary telemetry systems market is the increasing integration of these systems with cloud-based platforms for efficient data management, storage, and collaborative analysis. This integration facilitates remote access to real-time physiological data, enabling better collaboration among veterinary teams and researchers.

The enhanced audio capabilities of Zomedica’s VETGuardian, launched in August 2024, likely integrate with software platforms for remote data access and analysis. This move towards cloud-based solutions enhances data accessibility, improves data security, and enables the application of more advanced analytical tools to the continuous stream of physiological information.

Regional Analysis

North America is leading the Veterinary Telemetry Systems Market

North America dominated the market with the highest revenue share of 38.9% owing to the increasing emphasis on comprehensive animal care. The American Veterinary Medical Association (AVMA) underscores the role of technology in advancing veterinary practices. A 2023 AVMA survey highlighted a growing interest among veterinary professionals in adopting remote patient monitoring technologies to enhance the quality of care and improve the efficiency of their workflows.

The FDA’s Center for Veterinary Medicine (CVM) plays a crucial role by regulating veterinary devices, which includes ensuring the safety and effectiveness of telemetry systems utilized for animal health monitoring within the US. This regulatory oversight helps to build confidence in the reliability and benefits of these advanced monitoring solutions within the veterinary community.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing focus on animal health and the rising adoption of technological solutions within the veterinary sector across the region. The Asia-Pacific Veterinary Federation has observed a growing trend towards the integration of advanced technologies in animal healthcare practices.

Furthermore, the increasing mobile internet penetration across Asia Pacific, with the Telecom Regulatory Authority of India reporting that wireless internet subscribers in India reached 927.86 million in September 2024, up from 777.60 million in March 2020, creates a more accessible environment for the adoption of remote monitoring technologies for animals. This expanding digital infrastructure facilitates the use and growth of veterinary telemetry systems in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market focus on product innovation, strategic partnerships, and global expansion to drive growth. They invest heavily in R&D to introduce advanced, AI-enabled monitoring solutions and enhance connectivity features. Companies also strengthen their presence through mergers, acquisitions, and collaborations with veterinary clinics and research institutions.

Zoetis, a leading animal health company headquartered in the U.S., offers diagnostic and monitoring solutions backed by decades of expertise, a broad product portfolio, and a strong global distribution network. The firm continues to expand its reach through targeted innovation and service integration across companion and livestock animal segments.

Top Key Players

- Zomedica Corp

- SunTech

- Smiths Medical

- Nonin

- Medtronic

- Masimo

- BIONET

- Aiforia Technologies Plc

Recent Developments

- In August 2024, Zomedica Corp. upgraded its VETGuardian Zero-touch remote vital signs monitoring system by incorporating live audio monitoring and recording functionalities. These enhancements are designed to enable veterinarians to detect subtle shifts in animal behavior, thereby contributing to an elevated quality of veterinary care.

- In April 2024, Aiforia Technologies Plc. established a partnership with a leading global veterinary company in the US. This agreement focuses on the implementation of AI-driven image analysis for animal samples, with the expectation of enhancing diagnostic accuracy and facilitating improved clinical results.

- In January 2024, SunTech introduced the Vet40, a multi-functional surgical vital signs monitor specifically for companion animals. This device provides non-invasive monitoring of parameters such as SpO2, ECG, blood pressure, and temperature, with optional capabilities for ETCO2 and respiratory rate tracking. Featuring data storage, a touchscreen interface, and connectivity options, the Vet40 is intended to ensure accurate monitoring during both examinations and surgical procedures.

Report Scope

Report Features Description Market Value (2024) US$ 0.4 Billion Forecast Revenue (2034) US$ 0.8 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Vital Signs Monitors, Wearables, ECG/EKG Monitors, Anesthesia Machines, Accessories, and Others), By Technology (Compact/Tabletop, Floor Standing, and Portable), By Application (Respiratory, Neurology, Cardiology, and Others), By Animal (Small Animals and Large Animals), By End-user (Veterinary Hospitals/Clinics and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zomedica Corp, SunTech, Smiths Medical, Nonin, Medtronic, Masimo, BIONET, and Aiforia Technologies Plc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Veterinary Telemetry Systems MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Veterinary Telemetry Systems MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zomedica Corp

- SunTech

- Smiths Medical

- Nonin

- Medtronic

- Masimo

- BIONET

- Aiforia Technologies Plc