Global Veterinary Supplements Market By Type (Over-the-counter (OTC) and Prescription) By Pet Type (Dogs, Cats and Other Pet Types) By Form (Pills/Tablets, Chewables, Powders and Other Forms) By Application (Skin & Coat, Hip & Joint, Digestive Health and Other Applications) By Distribution Channel (Online and Offline) by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 84164

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

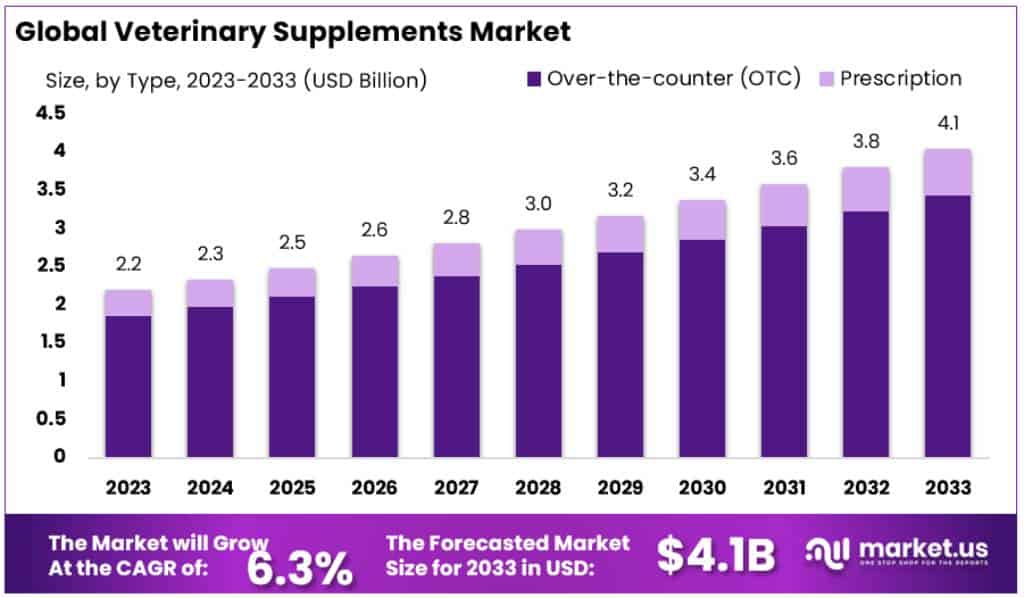

The Global Veterinary Supplements Market size is expected to be worth around USD 4.1 Billion by 2033, from USD 2.2 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

Veterinary supplements, also known as pet supplements, are concentrated ingredients added to an animal’s diet for nutritional or therapeutic benefits.

Veterinarian supplements are used to offer important nutrients to animals that they don’t receive the same from their diets or if they can’t create on their own. Pregnant and lactating pigs, for example, require more calcium to ensure the health of their piglets while in the womb and when nursing.

For livestock animals, a veterinary supplement is employed. Supplements are necessary to boost an animal’s immunity and to reduce stress levels in strenuous situations. These supplements aid in the nourishment of the immune system, the improvement of bone density, muscle growth, and the functioning of internal organs.

Key Takeaways

- The Veterinary Supplements Market is projected to grow at a CAGR of 6.3%.

- The market is expected to reach approximately USD 4.1 Billion by 2033.

- In 2023, the market was valued at USD 2.2 Billion.

- Over-the-counter (OTC) supplements held a dominant market share of more than 84.8% in 2023.

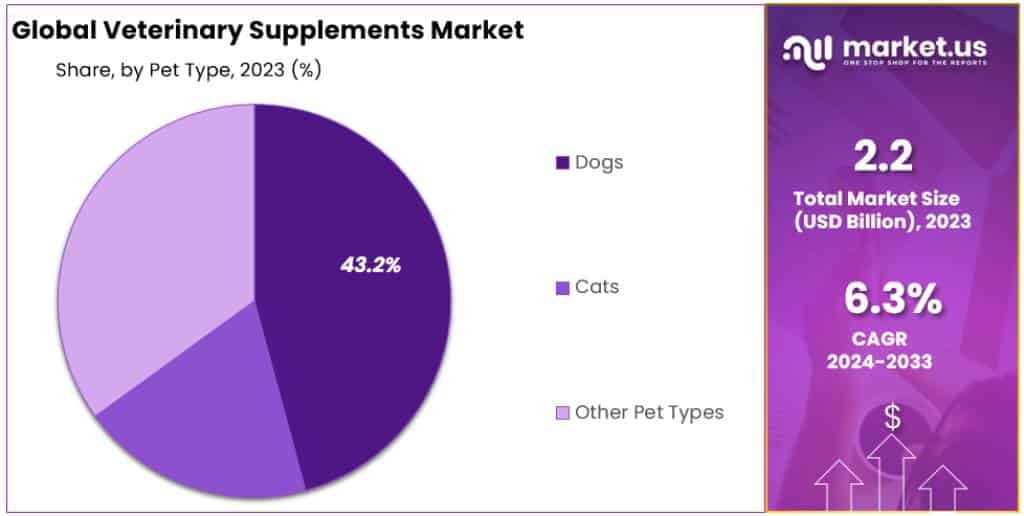

- Dog supplements captured over 43.2% of the market in 2023.

- Cat supplements are expected to grow at a CAGR of approximately 6.5% from 2023 to 2033.

- Chewable supplements held the largest market share in 2023, with over 74.3%.

- The offline distribution channel accounted for over 85.2% of the market in 2023.

- Online distribution is anticipated to grow with a projected CAGR of around 8.5% from 2023 to 2033.

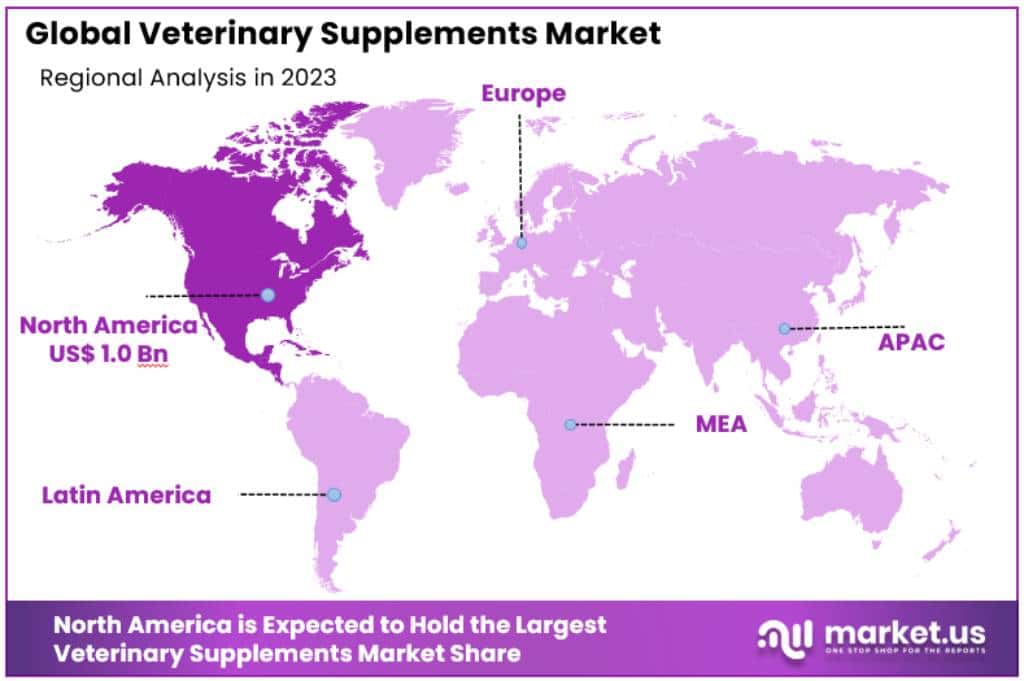

- North America leads the Veterinary Supplements Market with a 43.6% market share.

Type Analysis

In 2023, the veterinary supplements market was distinctly segmented into Over-the-counter (OTC) and Prescription types, each with its unique market dynamics and consumer preferences.

Over-the-counter (OTC) Supplements

OTC veterinary supplements held a dominant market position, capturing more than an 84.8% share. This significant market share can be attributed to the ease of availability and the wide range of products offered in this segment. OTC supplements are popular among pet owners for routine health maintenance and preventive care due to their convenience and the lack of necessity for a veterinarian’s prescription.

The segment includes a variety of supplements like vitamins, minerals, and nutritional aids that cater to general wellness, immunity boost, and specific health concerns like joint health and digestive support. The growth in this segment is bolstered by the rising trend of pet humanization, where pet owners are increasingly attentive to the health and nutritional needs of their pets.

Prescription Supplements

While smaller in market share compared to OTC supplements, prescription-based veterinary supplements are essential for addressing more specific or severe health conditions in animals. These supplements are tailored for individual health needs and are prescribed by veterinarians based on a thorough medical evaluation of the pet.

This segment includes specialized formulations for conditions such as renal support, liver health, and therapeutic dietary needs. The demand for prescription supplements is driven by the growing awareness of pet health issues and the increasing willingness of pet owners to seek professional veterinary care.

Pet Type Analysis

In 2023, the veterinary supplements market was segmented by pet type, with dogs, cats, and other pet types each representing distinct segments.

Dog Supplements

Dog supplements held a dominant market position in 2023, capturing more than a 43.2% share, slightly up from ~44% in 2022. Dogs are the most popular pets globally, and their high adoption rate significantly contributes to the segment’s dominance. The United States, for example, has 69.0 million households owning a dog, as per the National Pet Owners Survey conducted by the American Pet Products Association.

The continuous introduction of new supplements for dogs, targeting mobility, immune system support, and skin and coat health, further propels this segment’s growth. Notable is the launch of a line of dog supplements by Greenies, a brand of Mars and Affiliates, in October 2021. These supplements, free from artificial flavors, preservatives, and fillers, and formulated with high-quality ingredients, exemplify the trend towards more natural and health-focused products for dogs.

Cat Supplements

The cats’ segment, though smaller compared to dog supplements, is expected to register a compound annual growth rate (CAGR) of ~6.5% from 2023 to 2033. Cats are increasingly recognized for providing comfort and companionship, which has boosted their adoption and, subsequently, the demand for cat-specific supplements.

The therapeutic benefits of owning a cat, such as potential aid in managing conditions like insomnia and obstructive sleep apnea, have been recognized. This growing appreciation for the health benefits of cats is likely to create more opportunities for market growth in cat supplements.

Other Pet Types

While dogs and cats constitute the major segments, the market also caters to other pet types, including birds, small mammals, and exotic animals. These segments, though smaller, are essential in the overall veterinary supplements market, addressing the unique dietary and health requirements of a diverse range of pets.

Application Analysis

In 2023, the veterinary supplements market, segmented by application, highlighted significant trends in pet healthcare needs.

Hip and Joint Supplements

The hip and joint segment maintained a dominant position in the market, capturing over 48.9% share. This segment’s prominence is due to the prevalence of joint-related issues in pets, such as limping, stiffness, and anxiety. The use of ingredients like glucosamine and chondroitin, which aid in protecting joints from wear and tear and preventing arthritis, has been pivotal.

Additionally, supplements containing omega-3 fatty acids have been popular for their anti-inflammatory benefits. Given these factors, the demand for supplements addressing hip and joint issues is expected to remain strong.

Skin and Coat Supplements

The skin and coat segment is projected to grow at a CAGR of ~6% from 2022 to 2033. This growth is fueled by the increasing occurrence of skin issues in pets, such as hair loss, dry skin, and dandruff.

Supplements in this category often contain omega-3 and omega-6 fatty acids, coconut oil, zinc, vitamins, and antioxidants, providing essential nourishment to pets’ skin and helping relieve dryness. The rising concern among pet owners regarding the overall wellbeing of their pets is driving the demand for these products.

Digestive Health Supplements

Digestive health supplements are another significant segment of the market. These products focus on enhancing gut health and aiding in digestion. Probiotics, prebiotics, digestive enzymes, and fiber are commonly found in these supplements. They are particularly beneficial for pets with sensitive stomachs, gastrointestinal disorders, or those recovering from illness. The growing understanding of the importance of gut health in overall wellness is driving interest in this segment.

Other Applications

The ‘Other Applications’ segment encompasses a variety of specialized supplements catering to different health needs such as immune system support, weight management, and cardiac health. This segment includes products tailored for specific conditions or life stages of pets, reflecting the diverse and evolving needs in pet healthcare.

Form Analysis

In 2023, the veterinary supplements market was segmented into various forms, including Pills/Tablets, Chewables, Powders, and Other Forms. Each of these segments caters to different preferences and needs in the animal healthcare sector.

Chewables

Chewables held a dominant market position in 2023, capturing more than a 74.3% share. This segment’s popularity is largely due to the ease of administration and palatability, especially for companion animals like dogs and cats. Chewable supplements are often flavored and designed to appeal to animals, making them an attractive choice for pet owners.

These supplements typically address a range of health needs, including joint health, dental care, and general wellness. The widespread acceptance of chewables is also a reflection of the trend towards making pet care more convenient and enjoyable for both pets and their owners.

Pills/Tablets

Pills and tablets form an important part of the veterinary supplements market. Although they have a smaller market share compared to chewables, they are crucial for precise dosing and specific health conditions. These forms are typically used for more targeted health interventions and are often preferred for their stability and long shelf life. Veterinarians often prescribe pills and tablets for chronic conditions or specific dietary needs.

Powders

Powder supplements in the veterinary market cater to a niche but essential segment. Powders are versatile and can be easily mixed with regular pet food. This form is particularly useful for animals that are averse to pills or chewables. Powders are often used for supplements that require larger dosages or for more comprehensive nutritional needs.

Other Forms

The ‘Other Forms’ segment includes a variety of innovative and specialized delivery methods such as liquids, gels, and injectables. These forms are particularly useful for specific therapeutic needs and for animals with unique dietary restrictions or health conditions.

Distribution Channels Analysis

In 2023, the veterinary supplements market was segmented by distribution channels into Online and Offline, each offering distinct consumer experiences and benefits.

Offline Distribution Channel

Offline held a dominant market position in 2023, capturing more than an 85.2% share. This channel includes supermarkets/hypermarkets, convenience stores, and local shops. The high market share can be attributed to the convenience and trust associated with in-store purchases. Many pet owners and livestock farm operators prefer the tactile experience of purchasing in brick-and-mortar stores, where they can physically inspect products and receive immediate assistance.

Additionally, the offline channel has been bolstered by the availability of a diverse range of supplements, from multivitamins to specialized skin and coat care products. For example, in July 2020, the French supermarket chain Carrefour, in collaboration with Invivo Retail’s pet care brand Noa, launched a concept pet store in Paris offering a wide selection of supplements.

Online Distribution Channel

Though the online distribution channel accounted for a smaller portion of the market, it is anticipated to register a significant compound annual growth rate. The rise of e-commerce and online channels has been catalyzed by the COVID-19 pandemic, leading to a shift in consumer buying behaviors.

The convenience of online shopping, coupled with the expansive range of products available and the appeal of customer loyalty programs like “Subscribe and Save”, are major drivers for this segment’s growth.

Key players like Chewy, Petco Animal Supplies, Inc., BestVetCare.com, and Amazon have become trusted online suppliers, offering a wide array of products for various domesticated animals including dogs, cats, fish, and birds.

Key Market Segments

By Type

- Over-the-counter (OTC)

- Prescription

By Pet Type

- Dogs

- Cats

- Other Pet Types

By Form

- Pills/Tablets

- Chewables

- Powders

- Other Forms

By Application

- Skin & Coat

- Hip & Joint

- Digestive Health

- Other Applications

By Distribution Channel

- Online

- Offline

Drivers

- Increasing Pet Ownership and Health Awareness: The surge in pet ownership, particularly in the U.S., is a significant driver. With over 98 million dogs in 68% of U.S. households, pet culture has massively boosted demand for veterinary supplements. Since 1988, pet ownership in the U.S. has risen by 56%. The growing awareness of pet health and wellness, including the need for specialized diets for conditions like obesity and diabetes in pets, further drives this demand.

- Rise in Livestock Numbers: Globally, the livestock population has increased over the past decade, driven by the rising demand for animal products. This has led to an increase in the use of dietary supplements to ensure animal health and productivity.

- Premiumization of Pet Care: The trend towards premiumization in pet healthcare, including dietary supplements, is a key growth driver. This is evident from the pet industry expenditure in the U.S., which reached USD ~124 billion in 2021, up 19.1% from the previous year.

Restraints

- Economic Factors: Economic uncertainties and high inflation rates can impact market growth by affecting consumer spending power.

- Regulatory Challenges: Stringent regulations regarding pet supplements can pose challenges to market expansion.

Opportunities

- E-Commerce Growth: The online segment is witnessing significant growth, with a projected CAGR of ~8.5% from 2023 to 2033. The COVID-19 pandemic has accelerated this trend, with brands like Happy Go Healthy launching products online.

- Innovation and Product Development: The demand for innovative products like CBD supplements and condition-specific formulations offers substantial opportunities for manufacturers.

Challenges

- Market Fragmentation: The intense competition and fragmentation in the market, especially with the rise of online sales, pose a challenge to existing and new players.

- Supply Chain Disruptions: Global events and economic uncertainties can disrupt supply chains, affecting product availability and pricing.

Trends

- Pet Humanization: The trend of pet humanization, where pets are treated as family members, is influencing purchasing decisions. This is reflected in the increasing expenditure on pet dietary supplements and the preference for premium products.

- Rise in Specific Health Supplements: There is a growing demand for supplements that target specific health issues like joint health, liver health, and immune system support. For instance, a study in the Irish Veterinary Journal highlighted that 22% of horse caregivers commonly use joint health supplements.

Regional Analysis

North America’s Dominance

In 2023, North America is leading the Veterinary Supplements Market, holding a substantial 43.6% share with a market value of USD 1 billion. This dominance is primarily due to the large pet population in the United States, which accounts for a significant portion of the market. The U.S., in particular, has a culture of multiple pet ownership, with a strong emphasis on pet health. This trend, coupled with the presence of key players and substantial R&D investments, contributes to the region’s market growth.

Initiatives like the North American Pet Health Insurance Association aim to enhance awareness and address challenges in the pet healthcare industry, further boosting the market.

Asia Pacific’s Rising Market

The Asia Pacific region is expected to register the highest CAGR, nearly ~14%, during the forecast period. Countries like India and China are driving this growth due to increased pet adoption and improved living standards.

The growing pet population and heightened health concerns for pets are key drivers. Additionally, advancements in healthcare infrastructure are expected to bolster the market. In China, the trend of pet ownership has been influenced by Western culture, leading to a rise in the pet population, while India’s growing acceptance of dogs as pets among younger generations is contributing to market growth.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The Veterinary Supplements Market is characterized by a mix of well-established corporations and innovative startups, leading to a consolidated yet competitive landscape. Major companies in this market are actively engaging in strategic mergers, acquisitions, and partnerships, contributing to market consolidation. Nearly 45% of the market is dominated by these key players, which intensifies competition, especially for new entrants.

These leading firms are continually striving to expand their market presence through various strategic initiatives. For example, Beaphar, a significant player in the market, introduced a new line of natural calming products for pets in September 2020. This launch highlights the trend of incorporating natural ingredients in pet products.

The acquisition of FoodScience Corporation by Wind Point Partners in March 2021 is a notable example of market consolidation. FoodScience specializes in nutritional research and pet supplements, and this acquisition is indicative of the growing interest in the pet supplements sector.

Key Market Players

- Boehringer Ingelheim

- Mars Incorporated

- Nestlé

- The J.M. Smucker Company

- Hill’s Pet Nutrition Inc.

- General Mills Inc.

- Schell & Kampeter Inc.

- Spectrum Brands Inc.

- Virbac

- Garmon Corp

- P. S. Health Care

- Nutri-Vet

- FOODSCIENCE

- Ark Naturals

- NOW Foods

- Zoetis

- Bayer AG

- Pet Honesty

- Nutramax Laboratories

- Zesty Paws

- Other Key Players

Recent Developments

- November 2023: Nestlé Purina PetCare announces the launch of a new line of personalized veterinary supplements tailored to an individual pet’s breed, age, and health needs.

- November 2023: Mars Petcare acquires a leading manufacturer of joint health supplements for dogs, expanding its portfolio in this growing segment.

- October 2023: The FDA approves a new veterinary supplement for the treatment of cognitive decline in senior dogs.

- October 2023: A study published in the Journal of Animal Science finds that a combination of probiotics and prebiotics can improve gut health and immune function in cats.

- September 2023: Virbac partners with a leading animal nutrition research organization to develop new veterinary supplements for pets with specific health conditions, such as kidney disease and diabetes.

- September 2023: Zoetis invests in a startup company developing novel delivery technologies for veterinary supplements, aiming to improve absorption and efficacy.

- August 2023: Bayer launches a new line of veterinary supplements made with organic ingredients, targeting the growing demand for natural pet products.

- August 2023: Hill’s Pet Nutrition expands its line of dental care supplements with a new product designed to reduce plaque and tartar buildup in cats.

- July 2023: Nutramax Laboratories acquires a small company specializing in herbal remedies for pets, adding to its portfolio of natural veterinary supplements.

- July 2023: PetAg announces the launch of a new line of functional snacks formulated with probiotics, vitamins, and minerals to promote overall pet health.

Report Scope

Report Features Description Market Value (2023) USD 2.2 Billion Forecast Revenue (2033) USD 4.1 Billion CAGR (2023-2032) 6.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Over-the-counter (OTC) and Prescription) By Pet Type (Dogs, Cats and Other Pet Types) By Form (Pills/Tablets, Chewables, Powders and Other Forms) By Application (Skin & Coat, Hip & Joint, Digestive Health and Other Applications) By Distribution Channel (Online and Offline) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nestlé, The J.M. Smucker Company, Hill’s Pet Nutrition Inc., General Mills Inc., Schell & Kampeter Inc., Spectrum Brands Inc., Virbac, Garmon Corp, P. S. Health Care, Nutri-Vet, FOODSCIENCE, Ark Naturals, NOW Foods, Zoetis, Bayer AG, Pet Honesty, Nutramax Laboratories, and Zesty Paws, among others key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Veterinary Supplements MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Veterinary Supplements MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Boehringer Ingelheim

- Mars Incorporated

- Nestlé

- The J.M. Smucker Company

- Hill’s Pet Nutrition Inc.

- General Mills Inc.

- Schell & Kampeter Inc.

- Spectrum Brands Inc.

- Virbac

- Garmon Corp

- P. S. Health Care

- Nutri-Vet

- FOODSCIENCE

- Ark Naturals

- NOW Foods

- Zoetis

- Bayer AG

- Pet Honesty

- Nutramax Laboratories

- Zesty Paws

- Other Key Players