Veterinary Software Market Analysis By Product Type (Practice Management Software, Imaging Software), By Delivery Mode (On-premise, Cloud/Web-based), By Practice Type (Small Animals, Mixed Animals, Equine, Food-producing Animals, Other product Types), By End-use (Hospitals/Clinics, Reference Laboratories) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 29619

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

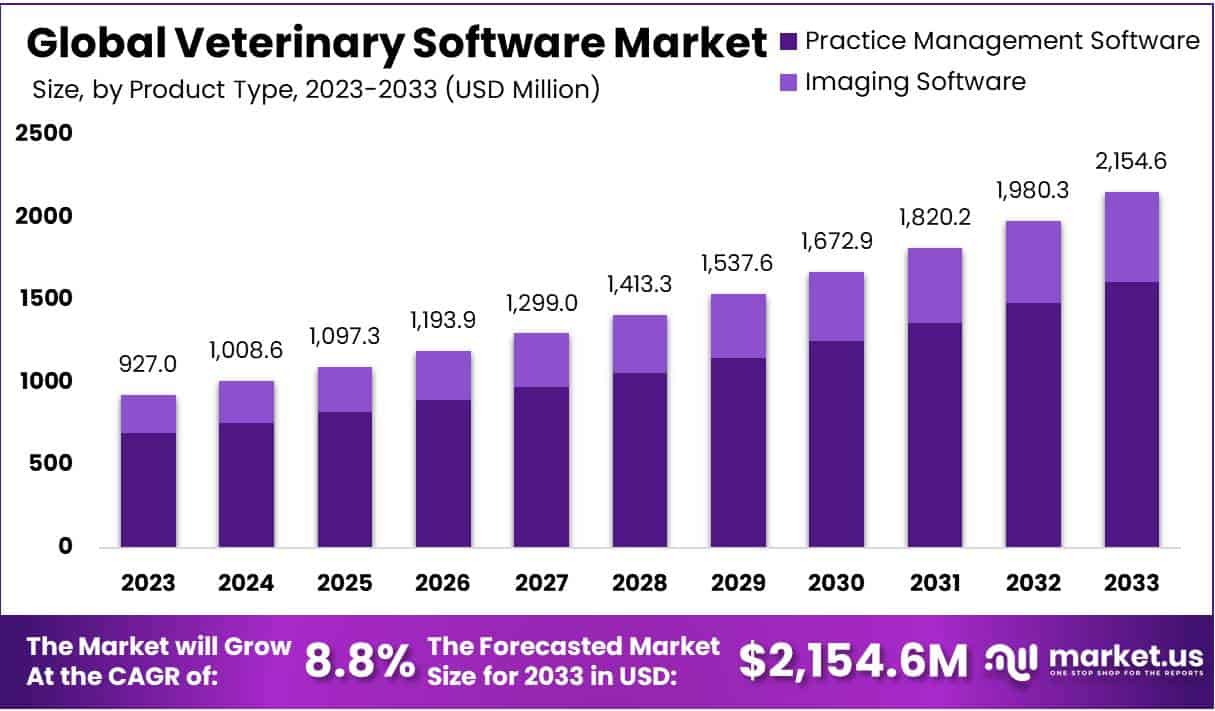

The Global Veterinary Software Market size is expected to be worth around USD 2154.6 Million by 2033, from USD 927 Million in 2023, growing at a CAGR of 8.8% during the forecast period from 2024 to 2033.

This robust expansion is indicative of the growing demand and adoption of veterinary software solutions within the industry.

Veterinary software is a specialized suite of computer applications tailored for veterinary practices. Its primary purpose is to enhance the efficiency of animal healthcare facilities by digitizing patient records, managing appointments, and handling billing and inventory.

These programs offer electronic health records, simplifying the storage of vital information such as medical history and test results. Appointment scheduling features reduce no-shows through timely reminders. Billing and invoicing modules streamline financial transactions, while inventory management ensures adequate stock levels. Communication tools foster client engagement, and integration with diagnostic equipment and labs facilitates seamless data sharing. Veterinary software ultimately optimizes practice operations, fostering improved patient care and overall organizational effectiveness.

The veterinary software market has witnessed substantial growth due to a surge in pet ownership and the heightened awareness of responsible pet care. This sector is buoyed by technological advancements, integrating cloud computing, artificial intelligence, and data analytics to enhance software capabilities. Compliance with regulatory standards and the imperative for secure electronic health records has further fueled the adoption of veterinary software.

These solutions effectively streamline administrative tasks, reduce paperwork, and boost overall operational efficiency in veterinary practices. Notably, the COVID-19 pandemic has accelerated the adoption of telemedicine and remote monitoring solutions, transforming the landscape of veterinary services. The market continues to expand globally, driven by a focus on preventive care, standardization of software solutions, and the increasing demand for comprehensive, efficient veterinary management tools.

Key Takeaways

- Market Growth: The Veterinary Software Market is set to reach USD 2,154.6 Million by 2032, with a robust 8.8% CAGR from 2023 to 2032.

- Technology Impact: Advanced tech, including AI and cloud computing, enhances software capabilities, meeting the demand for efficient veterinary solutions.

- Pandemic Acceleration: COVID-19 speeds up adoption of telemedicine in veterinary services, transforming how care is delivered to animals.

- Compliance and Security: Stringent regulations drive adoption, ensuring secure electronic health records and compliance with healthcare standards.

- Product Dominance: Practice Management Software claims a 74.8% market share, emphasizing the industry’s focus on operational efficiency.

- Diagnostic Advancements: Imaging Software, though smaller, grows significantly, reflecting the increasing importance of advanced diagnostic tools in veterinary care.

- Pet-Centric Demand: Small Animals, capturing 58% of the market, benefit from increased awareness of advanced healthcare management for pets.

- Versatile Solutions: Mixed Animals, handling both small and large animals, contribute substantially, showcasing the versatility of software solutions.

- Primary Market Segment: Hospitals/Clinics command 52.3% of the market share, indicating the pivotal role of advanced technological solutions in veterinary healthcare services.

- Regional Leadership: North America leads with a 41% market share, driven by advanced practices, technological integration, and a strong pet ownership culture.

Product Type Analysis

In 2023, Practice Management Software took the lead in the Veterinary Software Market, securing a dominant market position with a remarkable share of more than 74.8%. This segment plays a pivotal role in streamlining various administrative tasks within veterinary practices, offering user-friendly interfaces and efficient tools to manage appointments, billing, and patient records.

Imaging Software emerged as another crucial player in the market, contributing to the technological advancement of veterinary diagnostics. Although holding a smaller share compared to Practice Management Software, Imaging Software showcased substantial growth, accounting for the remaining market share. This software facilitates precise and detailed imaging for diagnostic purposes, aiding veterinarians in accurate assessments and informed decision-making.

These segments collectively drive the evolution of the Veterinary Software Market, addressing the diverse needs of veterinary professionals. The dominance of Practice Management Software highlights the industry’s emphasis on enhancing operational efficiency, while the growth of Imaging Software underscores the increasing significance of advanced diagnostic tools in veterinary care. As the market continues to evolve, these segments are expected to play complementary roles in shaping the future landscape of veterinary software solutions.

Practice Type Analysis

In 2023, the veterinary software market showcased a robust landscape, with various practice types contributing to its growth. Among these segments, the Small Animals category held a dominant market position, by capturing over 58% of the total market share.

The Small Animals segment, which primarily includes pets like dogs and cats, witnessed significant traction due to the increasing awareness among pet owners about the importance of advanced healthcare management. This heightened awareness has driven veterinary practices specializing in small animals to adopt sophisticated software solutions for streamlined operations.

Following closely, the Mixed Animals segment also played a substantial role, accounting for a noteworthy market share. This segment caters to practices that handle a combination of small and large animals. The versatility of software solutions in managing diverse patient profiles contributed to the popularity of these systems within mixed animal practices.

In contrast, the Equine segment, dedicated to the healthcare of horses, demonstrated steady growth, albeit with a relatively smaller market share. The specialized nature of equine care requires tailored software solutions, addressing the unique needs of horse veterinarians and contributing to the segment’s distinct market presence.

Food-producing Animals, encompassing livestock and farm animals, represented another significant segment. The demand for comprehensive software tools in managing the health and well-being of food-producing animals has been on the rise, driven by the increasing emphasis on food safety and quality.

Lastly, the Other Types category, comprising niche segments and emerging practice types, exhibited promising growth potential. This diverse category includes exotic animals, wildlife, and specialized veterinary services, reflecting the expanding horizons of veterinary care.

End-use Analysis

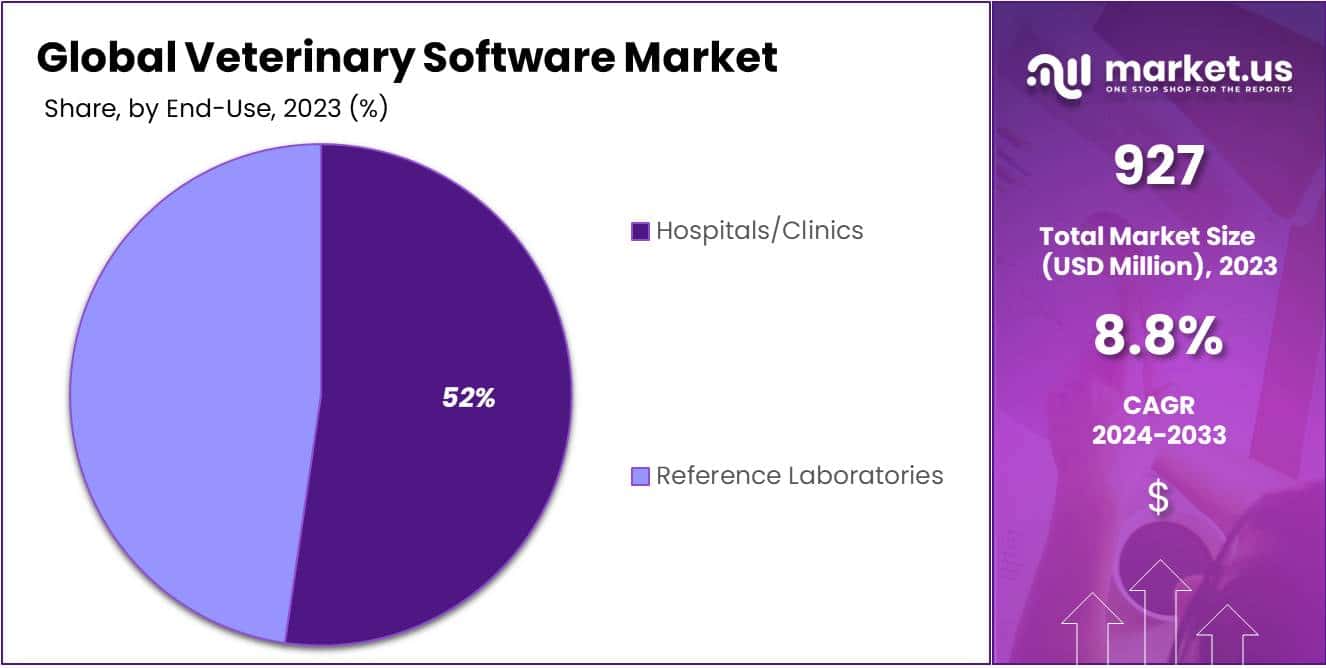

In 2023, the Veterinary Software Market showcased a noteworthy landscape, with the Hospitals/Clinics segment held a dominant market position, and commanding a substantial market share exceeding 52.3%. This dominance can be attributed to the pivotal role played by hospitals and clinics in providing comprehensive veterinary care services.

The Hospitals/Clinics segment is the heartbeat of the veterinary software market, serving as the primary point of contact for pet owners seeking medical attention for their furry companions. The robust adoption of veterinary software in these settings is driven by the pressing need for efficient patient management, streamlined workflows, and accurate record-keeping. With more than half of the market under its sway, the Hospitals/Clinics segment signifies a profound reliance on advanced technological solutions to enhance the overall quality of veterinary healthcare services.

On the other hand, Reference Laboratories, while not holding the same dominant position as Hospitals/Clinics, constitute a significant and growing segment within the veterinary software market. In 2023, these laboratories claimed a noteworthy market share, reflecting the increasing recognition of their crucial role in diagnostic testing and research.

Reference Laboratories rely on veterinary software to manage a diverse array of tasks, ranging from sample tracking and analysis to result reporting. The adoption of advanced software solutions in these laboratories is fueled by the pursuit of precision in diagnostic procedures and the imperative to contribute to the broader understanding of animal health.

Looking ahead, the Veterinary Software Market is poised for dynamic shifts, driven by ongoing technological advancements and an evolving healthcare landscape. While Hospitals/Clinics maintain their stronghold on the market, Reference Laboratories are anticipated to experience accelerated growth, underscoring the collective commitment to advancing veterinary care through innovative software solutions.

Key Market Segments

Product Type

- Practice Management Software

- Imaging Software

Delivery Mode

- On-premise

- Cloud/Web-based

Practice Type

- Small Animals

- Mixed Animals

- Equine

- Food-producing Animals

- Other product Types

End-use

- Hospitals/Clinics

- Reference Laboratories

Drivers

Rising Demand for Efficient Practice Management

Veterinary software facilitates streamlined practice management, including appointment scheduling, billing, and medical record management. The increasing demand for efficient administrative processes in veterinary clinics is a key driver.

Technological Advancements in Healthcare for Animals

Advances in veterinary technology, such as digital imaging and diagnostic tools, are driving the adoption of sophisticated software solutions. These tools enhance the accuracy and efficiency of veterinary diagnoses and treatments.

Growing Pet Adoption Rates

The rising trend of pet ownership has increased the demand for veterinary services. As more households adopt pets, there is a corresponding surge in the need for software solutions that can handle the growing volume of patient data and appointments.

Regulatory Compliance and Paperless Operations

Stringent regulatory requirements for record-keeping in the veterinary sector are pushing clinics to adopt digital solutions. Veterinary software ensures compliance with regulations while also enabling paperless operations, reducing the risk of errors and improving overall efficiency.

Restraints

High Initial Implementation Costs

The upfront costs associated with implementing veterinary software, including training staff and integrating the system into existing workflows, can be a significant barrier for smaller clinics with limited budgets.

Resistance to Technological Adoption

Some veterinary professionals may be resistant to adopting new technologies, particularly older practitioners who are accustomed to traditional paper-based record-keeping. Overcoming this resistance poses a challenge to the widespread adoption of veterinary software.

Data Security Concerns

With the increasing reliance on digital platforms, there is a growing concern about the security of patient data. Veterinary clinics may be hesitant to transition to software solutions due to worries about data breaches and unauthorized access.

Lack of Standardization in Veterinary Practices

The lack of standardized practices across the veterinary industry makes it challenging for software developers to create one-size-fits-all solutions. The diversity in veterinary procedures and practices can hinder the seamless integration of software.

Opportunities

Telemedicine and Remote Consultations

The integration of telemedicine features within veterinary software presents a significant growth opportunity. Remote consultations and follow-ups can enhance accessibility to veterinary care, especially in underserved rural areas.

Expansion of AI and Machine Learning Applications

The integration of artificial intelligence (AI) and machine learning (ML) into veterinary software has the potential to transform the way we approach diagnostics and treatment planning for animals. This presents a significant opportunity to create software capable of analyzing medical images, forecasting diseases, and recommending personalized treatment strategies.

Globalization of Veterinary Services

As veterinary services expand globally, there is an opportunity for software developers to create solutions that can cater to international standards and regulatory requirements. This is particularly relevant as more veterinary clinics engage in cross-border collaborations.

Integration with Wearable Technologies

The integration of veterinary software with wearable devices for animals presents an avenue for growth. Remote monitoring through wearables can provide real-time health data, enabling veterinarians to make more informed decisions about patient care.

Trends

Cloud-Based Solutions and Mobile Apps

The trend towards cloud-based veterinary software solutions and mobile applications is on the rise. These platforms offer flexibility, scalability, and accessibility, allowing veterinary professionals to manage their practices from anywhere.

Focus on User Experience and Interface Design

Veterinary software developers are placing increased emphasis on user experience and interface design. Intuitive interfaces and user-friendly experiences are becoming key differentiators in the market.

Interoperability and Integration with Other Systems

There is a trend towards developing veterinary software that can seamlessly integrate with other healthcare systems, laboratories, and pharmacies. Interoperability ensures a more cohesive and collaborative approach to animal healthcare.

Evolving Data Analytics and Reporting Capabilities

The inclusion of advanced data analytics and reporting features in veterinary software is a notable trend. This allows practitioners to derive insights from patient data, optimize clinic workflows, and make data-driven decisions for better patient outcomes.

Regional Analysis

In 2023, North America emerged as a formidable leader in the Veterinary Software Market, securing a dominant market position with a commanding share of more than 41%. The region demonstrated its robust presence by achieving a remarkable market value of USD 378.1 million for the year. This substantial market share can be attributed to several key factors that delineate North America’s prominence in the veterinary software landscape.

The technological landscape and digital infrastructure in North America have played a pivotal role in propelling the adoption of veterinary software solutions. With advanced veterinary practices and a high degree of technological integration in animal healthcare facilities, the region has been quick to embrace innovative software solutions designed to enhance operational efficiency, streamline workflow, and improve overall patient care.

Furthermore, the heightened awareness and emphasis on animal welfare in North America have driven the demand for sophisticated veterinary management tools. The region’s pet ownership culture, characterized by a strong bond between owners and their animals, has fueled the need for comprehensive and specialized software solutions catering to the diverse needs of veterinary professionals.

The regulatory environment in North America has also been conducive to the growth of the veterinary software market. Stringent regulations regarding data management, patient records, and healthcare standards have incentivized veterinary practices to invest in state-of-the-art software solutions that ensure compliance and enhance the quality of care delivered to animal patients.

In addition to these factors, the presence of key market players and strategic collaborations within the region has further consolidated North America’s market dominance. Established software providers and emerging startups alike have found a receptive market in the region, capitalizing on the demand for innovative solutions that address the evolving challenges faced by veterinary professionals.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Veterinary Software Market, several key players play pivotal roles in shaping the industry. IDEXX Laboratories Inc. stands out as a prominent contributor, known for its innovative solutions that enhance veterinary diagnostics and practice management. The company’s commitment to cutting-edge technology positions it as a frontrunner in the market.

Hippo Manager Software Inc. brings its expertise to the forefront with user-friendly software designed specifically for veterinary practices. Their focus on simplicity and efficiency resonates well with practitioners, contributing to the overall growth of the veterinary software sector. Antech Diagnostics Inc., a subsidiary of Mars Inc., holds a significant market presence, leveraging its extensive network and resources. With a strong emphasis on diagnostics, Antech plays a vital role in advancing veterinary medicine, offering a comprehensive suite of services.

In addition to these major players, there are other key contributors shaping the Veterinary Software Market. These players, although diverse in their offerings, collectively contribute to the growth and evolution of the industry. Their presence adds depth to the market, fostering healthy competition and encouraging continuous innovation.

Market Key Players

- IDEXX Laboratories Inc.

- Hippo Manager Software Inc.

- Antech Diagnostics Inc. (Mars Inc.)

- Esaote SpA

- Henry Schein Inc.

- Patterson Companies Inc.

- ClienTrax

- Digitail Inc

- Vetspire LLC (Thrive Pet Healthcare)

- DaySmart Software

- VitusVet

- Nordhealth AS

Recent Developments

- In February 2024: DaySmart Software acquired Time To Pet, a pet care management software based in Austin. This acquisition adds capabilities for pet sitting and dog walking to DaySmart’s existing suite of services, enhancing their offerings in veterinary practice management. Although the transaction amount remains undisclosed, this move positions DaySmart to expand into new pet care markets.

- January 2024: ClienTrax released a new feature for their veterinary practice management software, enhancing their cloud services with enhanced whiteboard functionality. This update aims to improve operational efficiency within veterinary clinics by allowing better management of daily tasks and patient records. The introduction of this feature emphasizes their ongoing commitment to providing comprehensive solutions for veterinary practices.

- January 2023: Digitail successfully raised $11 million in a Series A funding round. This investment was led by Atomico and supported by Gradient Ventures, byFounders, and Partech. This funding is intended to accelerate the development of Digitail’s cloud-based veterinary software and expand its market presence.

Report Scope

Report Features Description Market Value (2023) USD 927 Mn Forecast Revenue (2033) USD 2,154.6 Mn CAGR (2024-2033) 8.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Practice Management Software, Imaging Software), By Delivery Mode (On-premise, Cloud/Web-based), By Practice Type (Small Animals, Mixed Animals, Equine, Food-producing Animals, Other product Types), By End-use (Hospitals/Clinics, Reference Laboratories) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IDEXX Laboratories Inc., Hippo Manager Software Inc., Antech Diagnostics Inc. (Mars Inc.), Esaote SpA, Henry Schein Inc., Patterson Companies Inc., ClienTrax, Digitail Inc, Vetspire LLC (Thrive Pet Healthcare), DaySmart Software, VitusVet, Nordhealth AS and other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IDEXX Laboratories Inc.

- Hippo Manager Software Inc.

- Antech Diagnostics Inc. (Mars Inc.)

- Esaote SpA

- Henry Schein Inc.

- Patterson Companies Inc.

- ClienTrax

- Digitail Inc

- Vetspire LLC (Thrive Pet Healthcare)

- DaySmart Software

- VitusVet

- Nordhealth AS