Veterinary Pain Management Market By Product Type (NSAIDs, Opioids, Anesthetics, and Others), By Animal Type (Companion Animals and Production Animals), By Application (Osteoarthritis, Postoperative Pain, and Others), By Route of Administration (Parenteral, Oral, and Topical), By End-user (Hospitals & Clinics, Retail Outlets, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149956

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Animal Type Analysis

- Application Analysis

- Route of Administration Analysis

- End-user Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

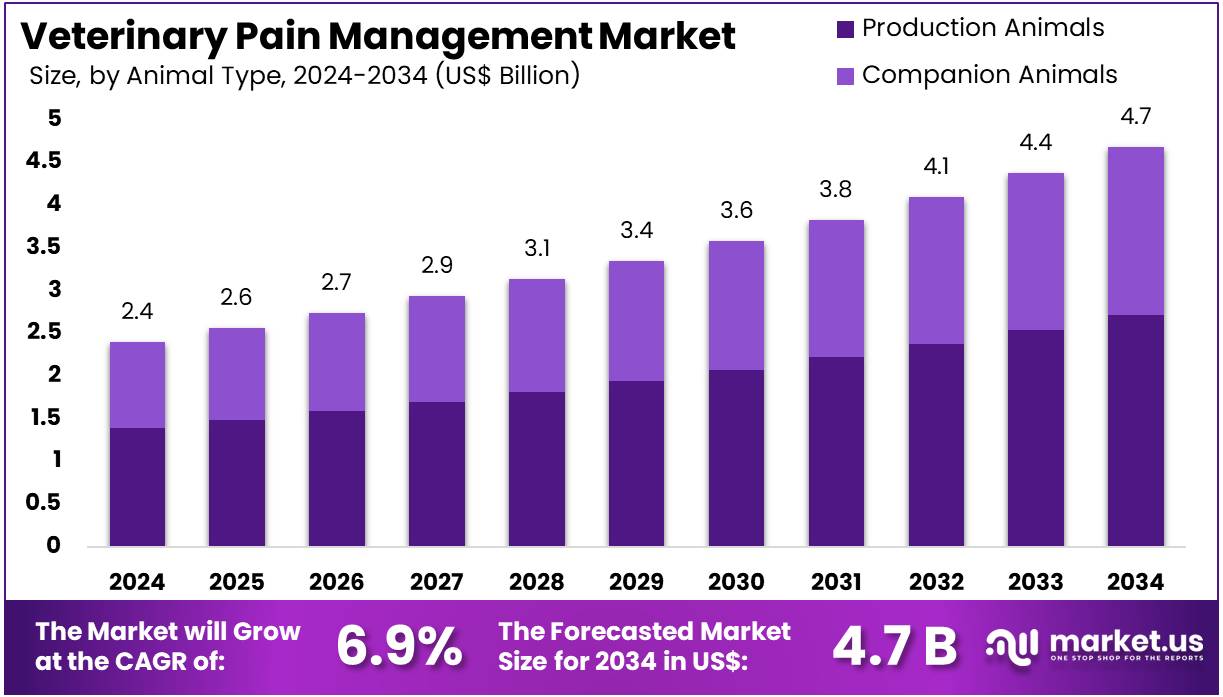

The Veterinary Pain Management Market Size is expected to be worth around US$ 4.7 billion by 2034 from US$ 2.4 billion in 2024, growing at a CAGR of 6.9% during the forecast period 2025 to 2034.

Rising awareness of animal welfare and the need for effective pain relief drives the growth of the veterinary pain management market. Veterinary pain management solutions address acute and chronic pain in companion animals, livestock, and equine species, improving recovery outcomes and overall quality of life.

Expanding veterinary services and advancements in analgesic drugs, including non-steroidal anti-inflammatory drugs (NSAIDs), opioids, and local anesthetics, offer diversified treatment options. Increasing demand for minimally invasive procedures and postoperative care further fuels the adoption of pain management therapies.

In March 2024, Zoetis reinforced its leadership in animal health by acquiring a 21-acre manufacturing facility in Melbourne, enabling enhanced production capacity and vaccine development for various species such as cattle, dogs, sheep, cats, and horses. This expansion aligns with the market’s opportunity to meet growing demands for high-quality veterinary pharmaceuticals. Trends indicate a shift toward personalized pain management protocols and integration of multimodal analgesia to optimize therapeutic efficacy.

Innovations in delivery systems, including sustained-release formulations and transdermal patches, improve compliance and convenience. Regulatory support and stricter animal welfare laws promote broader use of pain management products. Collaboration among veterinarians, pharmaceutical companies, and research institutions encourages development of safer, more effective therapies. The market benefits from increasing pet ownership and heightened spending on animal healthcare. As veterinary care evolves, pain management remains a critical component, presenting significant growth potential and opportunities for technological advancements.

Key Takeaways

- In 2024, the market for veterinary pain management generated a revenue of US$ 2.4 billion, with a CAGR of 6.9%, and is expected to reach US$ 4.7 billion by the year 2034.

- The product type segment is divided into NSAIDs, opioids, anesthetics, and others, with NSAIDs taking the lead in 2023 with a market share of 48.7%.

- Considering animal type, the market is divided into companion animals and production animals. Among these, production animals held a significant share of 57.9%.

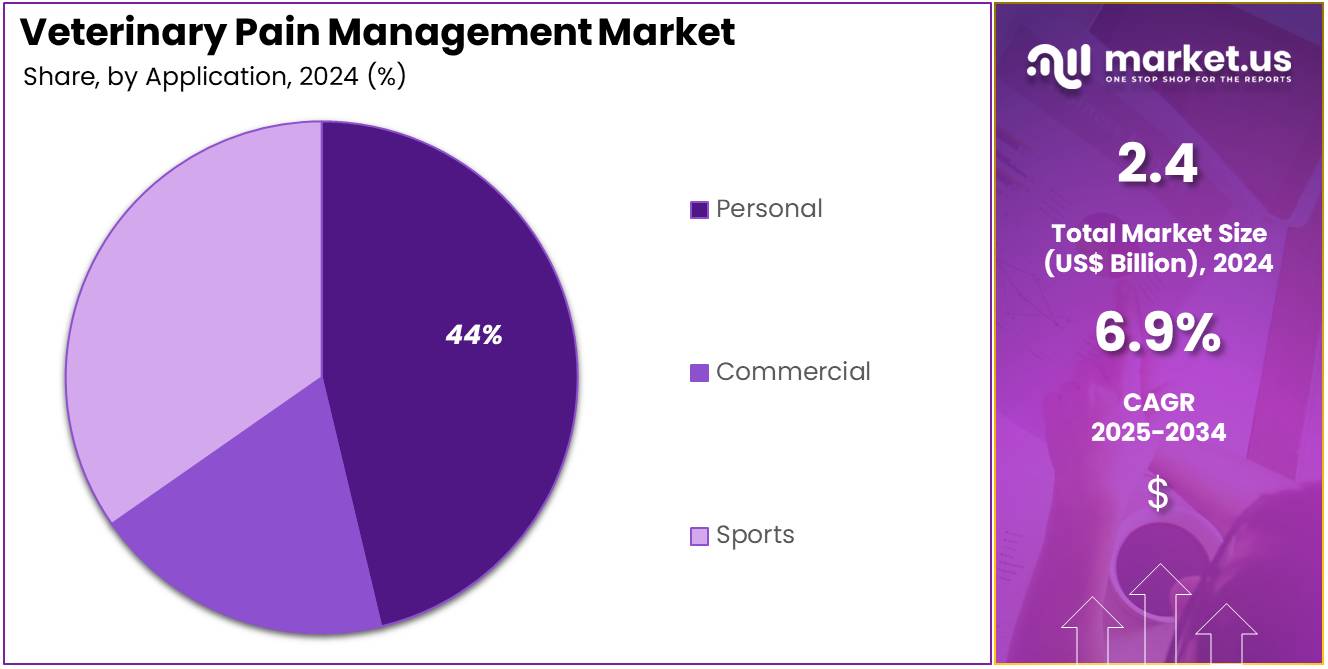

- Furthermore, concerning the application segment, the market is segregated into osteoarthritis, postoperative pain, and others. The osteoarthritis sector stands out as the dominant player, holding the largest revenue share of 51.3% in the veterinary pain management market.

- The route of administration segment is segregated into parenteral, oral, and topical, with the oral segment leading the market, holding a revenue share of 47.8%.

- Considering end-user, the market is divided into hospitals & clinics, retail outlets, and others. Among these, hospitals & clinics held a significant share of 54.6%.

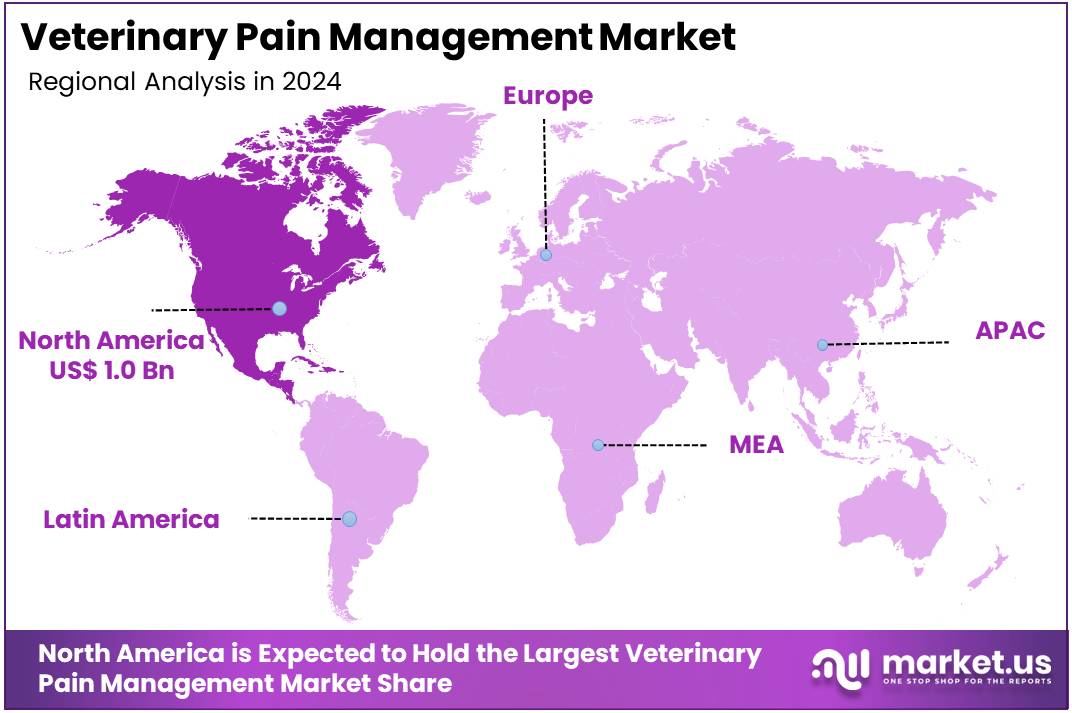

- North America led the market by securing a market share of 39.9% in 2023.

Product Type Analysis

The NSAIDs segment claimed a market share of 48.7% owing to its proven efficacy in managing inflammation and pain in animals. Owing to their favorable safety profile compared to opioids, NSAIDs remain the preferred choice for long-term pain relief. Growth in this segment is driven by the rising prevalence of chronic conditions such as arthritis in pets and livestock. Increasing adoption of multimodal pain management approaches also fuels demand.

Additionally, expanding veterinary healthcare infrastructure and higher pet ownership rates contribute to growth. Advancements in NSAID formulations improve compliance and therapeutic outcomes, further accelerating market expansion.

Animal Type Analysis

The production animals held a significant share of 57.9% due to the growing global demand for animal protein and enhanced livestock productivity. This growth is driven by increased focus on animal welfare and regulatory compliance, encouraging the use of pain management solutions. Rising incidences of injuries and diseases in production animals such as cattle, pigs, and poultry also contribute significantly.

Awareness among farmers about the economic benefits of effective pain relief supports market growth. Furthermore, veterinary service providers offering specialized treatments and advancements in drug delivery systems boost this segment.

Application Analysis

The osteoarthritis segment had a tremendous growth rate, with a revenue share of 51.3% owing to the aging pet population and increased lifespan of companion animals. This growth is driven by veterinarians prioritizing osteoarthritis management to improve animals’ quality of life and mobility. Early diagnosis through advanced diagnostics contributes to earlier treatment initiation, further boosting demand.

Availability of novel NSAIDs and adjunct therapies provides a wider range of treatment options. Moreover, pet owners’ willingness to invest in chronic pain care and increasing clinical research on osteoarthritis in animals reinforce segment growth. Growing trends of pet humanization also play a vital role.

Route of Administration Analysis

The oral segment grew at a substantial rate, generating a revenue portion of 47.8% due to the ease of administration and improved compliance among pet owners and farm managers. This segment’s growth is driven by the availability of palatable and sustained-release oral medications that enhance adherence. Oral delivery suits both acute and chronic conditions, increasing its popularity.

Rising recommendations by veterinary professionals for outpatient pain management further stimulate demand. Advancements in drug formulation improving bioavailability and reducing side effects also contribute. Expansion of retail outlets and e-commerce platforms enhances accessibility, supporting the segment’s expansion.

End-user Analysis

The hospitals & clinics held a significant share of 54.6% due to the comprehensive pain management services these facilities provide. Growth is driven by increased specialization and the adoption of multimodal pain protocols within veterinary hospitals and clinics. Investments in veterinary infrastructure and advanced diagnostic capabilities support effective treatment delivery.

Pet owners’ preference for professional pain management contributes to rising demand. Furthermore, the increasing number of veterinary specialists and trained professionals bolsters the segment. Collaborations between hospitals and pharmaceutical companies also play a crucial role in segment expansion.

Key Market Segments

By Product Type

- NSAIDs

- Opioids

- Anesthetics

- Others

By Animal Type

- Companion Animals

- Production Animals

By Application

- Osteoarthritis

- Postoperative Pain

- Others

By Route of Administration

- Parenteral

- Oral

- Topical

By End-user

- Hospitals & Clinics

- Retail Outlets

- Others

Drivers

Growing Pet Ownership is Driving the Market

The increasing number of households owning pets is a significant driver for the veterinary pain management market. As pet ownership rises, so does the demand for veterinary services, including pain management. Pet owners are increasingly viewing their animals as family members and are more willing to invest in their health and well-being, which includes addressing their pain.

According to the American Veterinary Medical Association (AVMA), in 2024, 45.5% of US households owned dogs, and 32.1% owned cats, representing 89.7 million and 73.8 million animals, respectively. This growing population of companion animals directly correlates with a higher demand for products and therapies that alleviate pain in pets.

Restraints

High Cost of Certain Treatments is Restraining the Market

The cost of some advanced pain management treatments and medications can restrain the growth of the veterinary pain management market. While pet owners are increasingly willing to spend on their animals’ health, the expense of certain therapies, such as laser therapy or newer injectable medications, can be prohibitive for some.

As noted in a 2023 report, the average cost for laser therapy for chronic pain can range from US$ 25 to 35 per treatment, and multiple sessions are often required, making the overall cost significant. This financial constraint can lead some pet owners to opt for less expensive or over-the-counter options, or to forgo certain treatments altogether, thereby limiting the adoption of more advanced pain management solutions.

Opportunities

Increasing Awareness of Animal Well-being Creates Growth Opportunities

A growing awareness among pet owners about animal health and welfare is creating significant opportunities for the veterinary pain management market. As owners become more attuned to the signs of pain in their animals, they are more likely to seek veterinary care to address these issues. Educational initiatives and campaigns focused on animal pain awareness contribute to this trend, encouraging proactive pain management.

For instance, the American Animal Hospital Association (AAHA) provides guidelines and resources to help veterinarians and pet owners recognize and manage pain effectively. This increased vigilance and desire to improve the quality of life for pets are driving the demand for a wider range of pain management products and services.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions significantly influence the veterinary pain management market. During economic downturns, pet owners might reduce spending on non-essential veterinary services, potentially affecting the demand for certain pain management treatments. Conversely, economic growth often leads to increased disposable income, allowing pet owners to invest more in their animals’ healthcare, including advanced pain relief.

Geopolitical factors can also play a role; for instance, disruptions in global supply chains could affect the availability and cost of imported veterinary pharmaceuticals and equipment used in pain management. However, the increasing humanization of pets and the growing recognition of the importance of their well-being tend to create a relatively resilient demand for veterinary care, including pain management, even amidst economic or geopolitical uncertainties. This underlying commitment to pet health provides a degree of stability to the market.

Current US tariffs can have varied effects on the veterinary pain management market. If tariffs are imposed on imported veterinary pharmaceuticals or components used in manufacturing pain management products, this could lead to increased costs for domestic suppliers and potentially higher prices for pet owners. This might, in turn, slightly dampen the demand for certain treatments.

On the other hand, tariffs could incentivize domestic production of veterinary medicines and supplies within the US, potentially fostering growth in the local industry over the long term. While the immediate impact might be a rise in costs for some products, the strong bond between pet owners and their animals, coupled with the increasing focus on animal health, suggests that the market will likely adapt. Domestic innovation and strategic sourcing could mitigate the negative effects of tariffs, ensuring the continued availability of pain management solutions for animals.

Latest Trends

Focus on Innovative Pain Management Products is a Recent Trend

A notable recent trend in the veterinary pain management market is the focus on developing and approving innovative pain management products. Pharmaceutical companies are investing in research and development to introduce new drugs and therapies with improved efficacy and fewer side effects. For example, in January 2022, the US FDA approved Solensia (frunevetmab injection), the first monoclonal antibody treatment to control pain associated with osteoarthritis in cats.

Furthermore, in January 2025, the FDA approved Journavx (suzetrigine), a novel non-opioid analgesic for acute pain in adult humans, indicating a broader trend toward new approaches in pain management that could eventually translate to veterinary medicine. These approvals highlight the ongoing efforts to provide veterinarians with more options for managing pain in animals.

Regional Analysis

North America is leading the Veterinary Pain Management Market

North America dominated the market with the highest revenue share of 39.9% owing to increasing pet ownership and a greater awareness among pet owners regarding animal welfare and pain. The American Veterinary Medical Association (AVMA) emphasizes the importance of recognizing and treating pain in animals.

Furthermore, advancements in veterinary medicine have led to a wider availability of pain management options for pets, including pharmaceuticals, nutraceuticals, and other therapies. The development of drugs specifically for animal use, approved by the FDA’s Center for Veterinary Medicine (CVM), also contributes to the market’s expansion. A growing number of pet owners are willing to invest in treatments that improve their animals’ quality of life, including pain relief.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is projected to witness the fastest growth rate in the veterinary pain management market. This can be attributed to the rising pet population across countries such as China, India, and Southeast Asia. As more people adopt companion animals, the demand for veterinary healthcare, especially pain management solutions, continues to rise. Growing urbanization and higher disposable incomes are also encouraging pet owners to invest in better animal care. Veterinary clinics are expanding in both urban and semi-urban regions, further supporting market growth.

Although detailed region-wide statistics from government sources remain limited, the overall trend is clear. The veterinary healthcare infrastructure in Asia Pacific is developing rapidly. Greater awareness about animal well-being and increasing access to advanced treatments are helping drive demand. Countries such as Japan and Australia are also seeing an upsurge in veterinary service adoption. As the focus on pet health intensifies, the region is expected to remain a key driver of global market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the veterinary pain management market drive growth through strategic investments in research and development, expanding product portfolios, and enhancing global market presence. They focus on developing innovative pain relief solutions, including non-steroidal anti-inflammatory drugs (NSAIDs), opioids, and biologics, to address various pain conditions in animals.

Companies also emphasize the adoption of advanced technologies, such as laser therapy and electromagnetic field devices, to provide non-invasive treatment options. Strategic partnerships and acquisitions enable these companies to broaden their service offerings and access new markets. Additionally, they invest in educational initiatives to raise awareness about pain management in animals among veterinary professionals and pet owners.

Zoetis Inc., a leading player in this domain, offers a comprehensive range of products and services for veterinary pain management. Established in 1952 and headquartered in Parsippany, New Jersey, Zoetis is the world’s largest producer of medicine and vaccinations for pets and livestock. The company provides a variety of pain relief solutions, including NSAIDs and biologics, to treat conditions such as osteoarthritis and postoperative pain in animals. Zoetis operates in approximately 45 countries and sells its products in more than 100 countries, with operations outside the United States accounting for 50% of total revenue.

Top Key Players in the Veterinary Pain Management Market

- Zoetis

- Vetoquinol

- Norbrook

- Elanco

- Chanelle Pharma

- Ceva Animal Health

- Boehringer Ingelheim

- Merck & Co.

Recent Developments

- In September 2024, Boehringer Ingelheim completed the acquisition of Saiba Animal Health AG, a company focused on developing novel treatments for chronic diseases in dogs. This move enhances Boehringer Ingelheim’s portfolio in animal health, strengthening its position in innovative veterinary therapeutics.

- In July 2024, Merck Animal Health acquired the aqua division of Elanco Animal Health Incorporated. This acquisition expands Merck’s presence in aquatic animal health, allowing it to offer a broader range of products and solutions in this growing segment.

Report Scope

Report Features Description Market Value (2024) US$ 2.4 billion Forecast Revenue (2034) US$ 4.7 billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (NSAIDs, Opioids, Anesthetics, and Others), By Animal Type (Companion Animals and Production Animals), By Application (Osteoarthritis, Postoperative Pain, and Others), By Route of Administration (Parenteral, Oral, and Topical), By End-user (Hospitals & Clinics, Retail Outlets, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zoetis, Vetoquinol, Norbrook, Elanco, Chanelle Pharma, Ceva Animal Health, Boehringer Ingelheim, and Merck & Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Veterinary Pain Management MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Veterinary Pain Management MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zoetis

- Vetoquinol

- Norbrook

- Elanco

- Chanelle Pharma

- Ceva Animal Health

- Boehringer Ingelheim

- Merck & Co.