Global Vein Illuminator Market By Product Type (Infrared, Transilluminated and Ultrasound), By Application (Intravenous Access and Blood Draw), By End-User (Hospitals, Rehabilitation Facilities, Academic Institutions and Blood Donation Camps), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177550

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

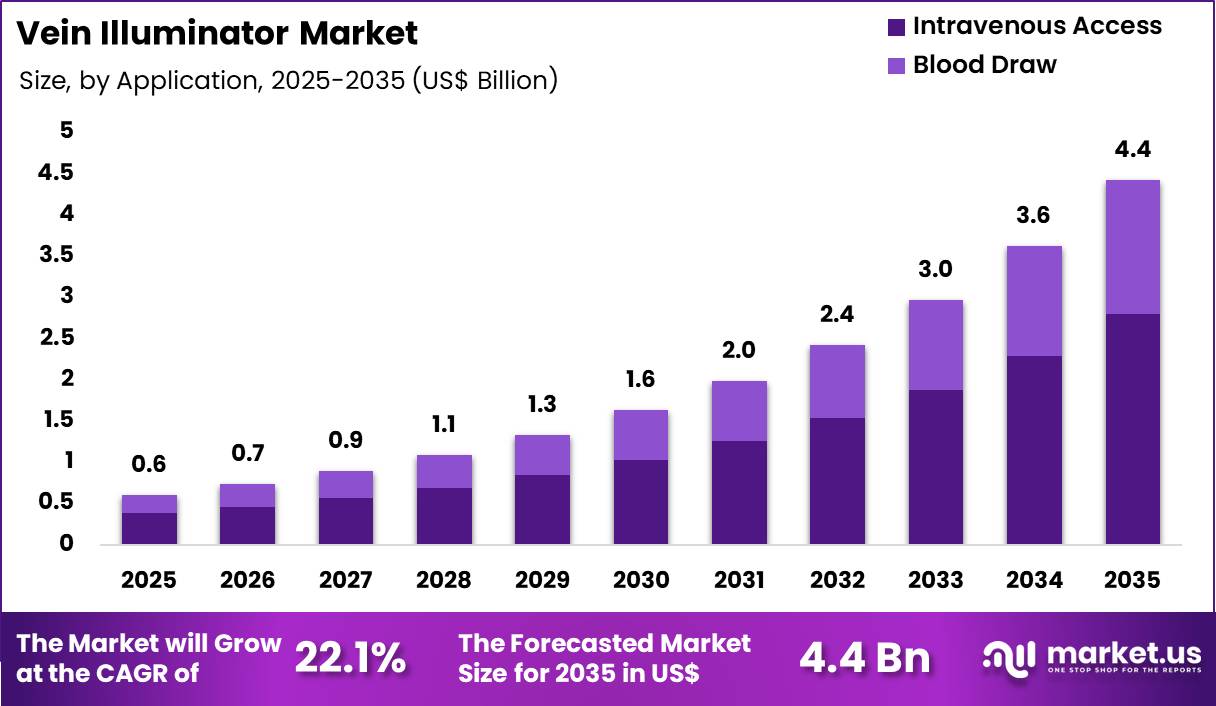

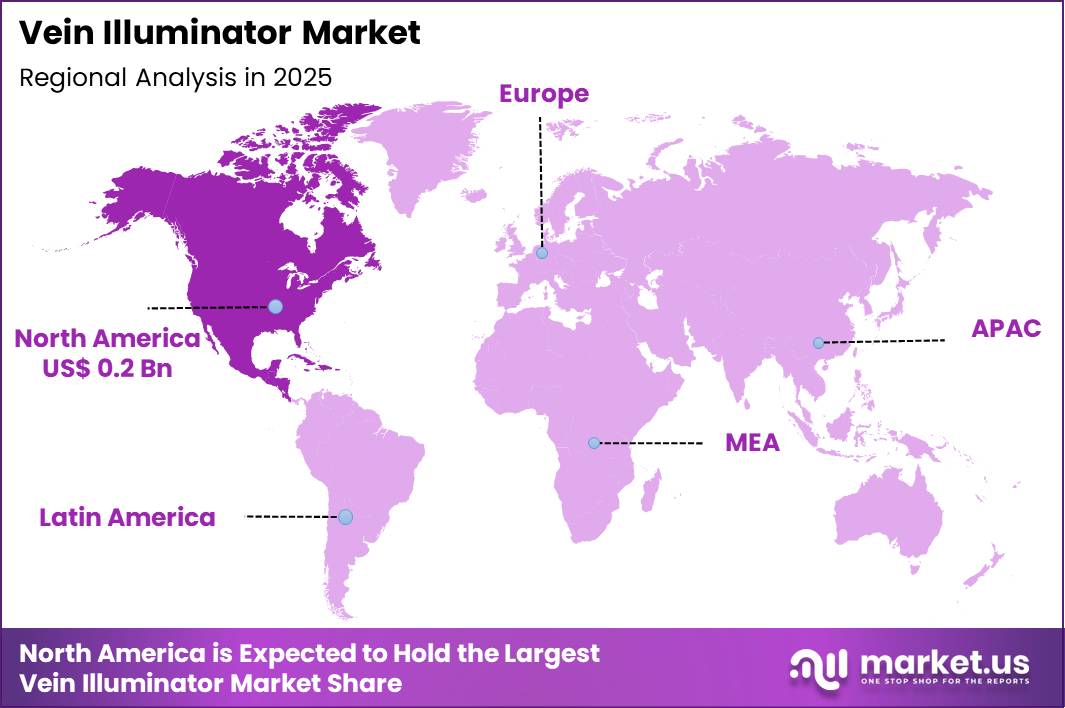

The Global Vein Illuminator Market size is expected to be worth around US$ 4.4 Billion by 2035 from US$ 0.6 Billion in 2025, growing at a CAGR of 22.1% during the forecast period 2026 to 2035. In 2025, North America led the market, achieving over 40.0% share with a revenue of US$ 0.2 Billion.

Increasing emphasis on patient safety and procedural efficiency drives the vein illuminator market as healthcare providers adopt near-infrared imaging devices to enhance venous access success rates across clinical settings. Nurses and phlebotomists increasingly utilize handheld vein illuminators during peripheral intravenous catheter insertions, visualizing subsurface veins in patients with difficult access due to obesity, dark skin tones, or dehydration.

These devices support neonatal and pediatric care by projecting vein maps onto the skin surface, facilitating safer blood draws and intravenous therapy in infants with fragile vasculature. Emergency department clinicians apply vein illuminators to expedite central line placements in critically ill patients, reducing attempts and associated complications such as arterial puncture.

Anesthesiologists employ the technology for peripheral nerve blocks and regional anesthesia, identifying target vessels to improve accuracy and minimize hematoma formation. In dialysis centers, vein illuminators assist in arteriovenous fistula assessment, guiding cannulation and monitoring maturation progress to optimize long-term vascular access.

Manufacturers pursue opportunities to integrate augmented reality overlays and wireless connectivity into vein illuminators, expanding applications in telemedicine and home health settings where remote guidance improves access for chronic illness patients. Developers advance portable, battery-powered models with adjustable brightness and depth penetration, broadening utility in mobile phlebotomy services and field emergency response.

These innovations facilitate pediatric-specific designs with gentler projection systems, addressing comfort needs in young patients requiring frequent venipuncture. Opportunities emerge in AI-enhanced devices that automatically detect optimal insertion sites, reducing operator variability in high-volume infusion centers.

Companies invest in durable, antimicrobial housing materials that support infection control protocols in intensive care and surgical environments. Recent trends emphasize compact, ergonomic form factors with extended battery life, positioning vein illuminators as essential tools for improving first-stick success and patient experience across diverse venous access procedures.

Key Takeaways

- In 2025, the market generated a revenue of US$ 0.6 Billion, with a CAGR of 22.1%, and is expected to reach US$ 4.4 Billion by the year 2035.

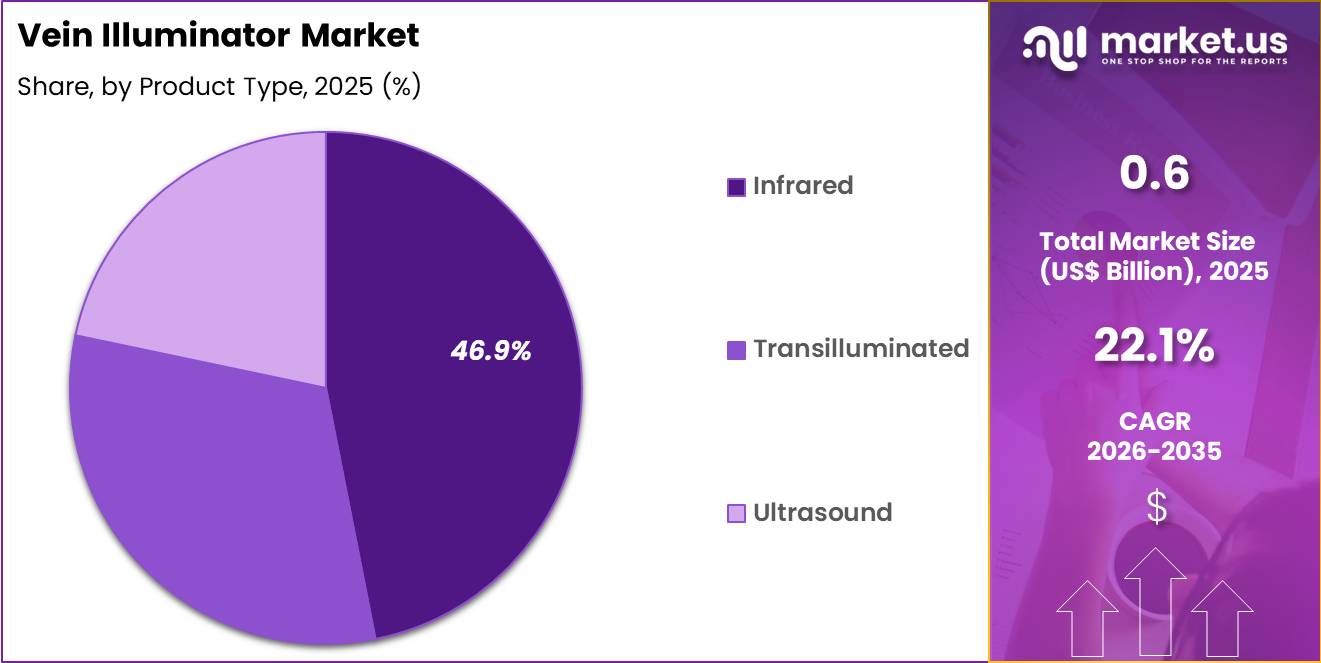

- The product type segment is divided into infrared, transilluminated and ultrasound, with infrared taking the lead with a market share of 46.9%.

- Considering application, the market is divided into intravenous access and blood draw. Among these, intravenous access held a significant share of 63.2%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, rehabilitation facilities, academic institutions and blood donation camps. The hospitals sector stands out as the dominant player, holding the largest revenue share of 54.6% in the market.

- North America led the market by securing a market share of 40.0%.

Product Type Analysis

Infrared vein illuminators contributed 46.9% of growth within product type and led the vein illuminator market due to their ability to provide fast, non-invasive visualization of superficial veins across diverse patient groups.

Clinicians prefer infrared technology because it projects real-time vein maps without skin contact, which improves patient comfort and reduces procedure anxiety. High accuracy in patients with difficult venous access, including pediatric, geriatric, and obese populations, strengthens adoption. Ease of portability and minimal training requirements further support widespread clinical use.

Growth strengthens as device manufacturers improve image contrast, depth penetration, and battery efficiency. Infrared systems integrate smoothly into routine nursing workflows for frequent venipuncture tasks. Hospitals favor these devices to reduce failed attempts and procedure time.

Infection control protocols also support touch-free visualization tools. The segment is expected to remain dominant as healthcare settings prioritize efficiency, safety, and patient experience during vascular access procedures.

Application Analysis

Intravenous access generated 63.2% of growth within application and emerged as the leading segment due to the high frequency of IV procedures in clinical care. Hospitals and outpatient facilities perform intravenous cannulation for medication delivery, fluid therapy, and diagnostic procedures multiple times daily.

Failed first-attempt insertions increase discomfort and resource utilization, which drives demand for vein visualization support. Vein illuminators improve first-stick success rates and reduce complications such as infiltration and hematoma.

Growth accelerates as healthcare systems emphasize patient-centered care and procedural efficiency. Rising admissions for chronic diseases increase IV dependency. Training programs encourage adoption of assistive technologies for vascular access. Standardization of IV safety protocols further reinforces usage. The segment is anticipated to maintain leadership as intravenous access remains a foundational component of modern medical treatment.

End-User Analysis

Hospitals accounted for 54.6% of growth within end-user and dominated the vein illuminator market due to their high procedural volume and diverse patient population. Emergency departments, intensive care units, and general wards require frequent vascular access under time-sensitive conditions. Hospitals invest in vein illumination devices to support nursing efficiency and reduce complications. Centralized procurement and standardized protocols increase consistent device utilization.

Growth continues as hospitals expand patient safety initiatives and adopt technology-assisted care models. Staff shortages increase reliance on tools that improve procedural success. Teaching hospitals further drive adoption through training and research. Referral patterns concentrate complex cases within hospital settings. The segment is projected to remain the primary growth driver as hospitals continue to anchor high-volume vascular access care.

Key Market Segments

By Product Type

- Infrared

- Transilluminated

- Ultrasound

By Application

- Intravenous Access

- Blood Draw

By End-User

- Hospitals

- Rehabilitation Facilities

- Academic Institutions

- Blood Donation Camps

Drivers

Increasing number of venipuncture procedures is driving the market.

The rising volume of venipuncture procedures in healthcare settings has significantly increased the demand for vein illuminators to improve first-stick success rates and reduce patient discomfort. Enhanced clinical practices and the need for frequent blood draws in diagnostic testing contribute to this growth. Healthcare facilities are adopting vein illuminators to minimize errors in vein access, particularly in challenging cases.

The high frequency of these procedures underscores the necessity for tools that enhance visibility of peripheral veins. Vein illuminators utilize near-infrared light to project vein images on the skin, aiding in accurate needle placement. The correlation between procedural volume and complication risks further propels the adoption of these devices.

Public health organizations highlight the importance of efficient venipuncture to optimize patient care workflows. Leading companies are innovating portable models to meet this escalating clinical requirement. This driver interconnects with the expansion of outpatient services requiring reliable vein access solutions.

Blood collection via venipuncture is the most common invasive procedure for inpatients, who experience an average of 1.6 to 2.2 blood collection episodes per day, for a total of approximately 450 million in US hospitals annually.

Restraints

High cost of vein illuminator devices is restraining the market.

The substantial pricing of vein illuminator systems, including handheld and stand-mounted models, restricts their uptake in budget-constrained medical facilities. Manufacturing complexities for optical components and batteries elevate overall production expenses for these devices. Smaller clinics often delay purchases, favoring traditional palpation methods due to financial limitations.

Regulatory approvals for safety standards add to the cost burden on suppliers. In public health sectors, procurement decisions prioritize essential equipment over premium visualization tools. Providers weigh the benefits against the economic implications when selecting these illuminators for routine use. This restraint impacts scalability, especially in low-resource environments with limited funding.

Industry strategies to offer entry-level models aim to mitigate these pressures partially. Despite efficiency gains, the cost factor limits universal accessibility in diverse healthcare applications. Consequently, addressing pricing through value-based models is crucial for alleviating this market impediment.

Opportunities

Expansion into aesthetics and cosmetic procedures is creating growth opportunities.

The growing application of vein illuminators in aesthetics for precise injections presents avenues for market penetration in non-traditional healthcare segments. Governmental regulations on cosmetic safety support the integration of visualization tools in dermal filler and botox treatments. Increasing consumer demand for minimally invasive beauty procedures amplifies the need for accurate vein mapping to avoid complications.

Partnerships with aesthetics distributors facilitate compliance and entry for device manufacturers. The large volume of cosmetic interventions in urban centers magnifies potential for illuminator utilization in specialized clinics. Educational programs for aestheticians promote standardized use of these devices in practice. This opportunity enables global firms to diversify beyond hospital markets.

Key corporations are establishing collaborations to optimize supply in high-demand areas. Overall, aesthetics expansions align with efforts to enhance procedural safety in elective services. Strategic initiatives can secure notable positions in these evolving beauty landscapes.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the vein illuminator market through hospital and clinic capital budgets, outpatient volumes, and purchasing discipline. Inflation and higher interest rates raise manufacturing, logistics, and financing costs, which slows equipment refresh cycles in cost sensitive settings.

Geopolitical tensions disrupt supplies of infrared LEDs, sensors, optics, and electronic components, increasing lead times and procurement risk. Current US tariffs on imported devices and subcomponents lift landed costs for manufacturers and distributors, which compresses margins and pressures pricing decisions.

These challenges weigh on smaller providers and limit adoption in budget constrained facilities. On the positive side, trade pressure encourages local assembly, component diversification, and supply chain resilience.

Rising demand for safer intravenous access in pediatrics, oncology, and emergency care sustains clinical interest. With disciplined sourcing, ergonomic design improvements, and broader clinical awareness, the market remains positioned for steady and confident growth.

Latest Trends

Exclusive distribution partnerships for vein visualization systems is a recent trend in the market.

In 2023, strategic alliances between device makers and aesthetics leaders have advanced the commercialization of vein illuminators in specialized markets. These partnerships leverage established networks to enhance product availability for cosmetic applications. Manufacturers are focusing on tailored features to meet the needs of aesthetics practitioners during injections.

Clinical feedback drives these collaborations to improve device ergonomics for non-hospital settings. In July 2023, Merz Aesthetics entered into an exclusive distribution agreement with AccuVein. Under this partnership, Merz became the sole authorized distributor of AccuVein’s vein visualization technology within the US aesthetics market, strengthening its portfolio of noninvasive aesthetic solutions.

This agreement expands access to NIR technology for precise vein location in dermal procedures. Industry emphasis on distribution exclusivity aims to streamline supply chains and regulatory adherence. Regulatory endorsements in 2023 for partnership models have accelerated product rollout.

Sector synergies concentrate on training programs for enhanced user proficiency. These developments position collaborative distribution as pivotal for market evolution in 2024 and beyond.

Regional Analysis

North America is leading the Vein Illuminator Market

North America held a 40.0% share of the Vein Illuminator market in 2024, supported by rising demand for accurate vascular access across hospitals, clinics, and outpatient centers. Providers increasingly adopted visualization tools to reduce failed venipuncture attempts, especially in pediatric, geriatric, and obese patient populations.

Growth in infusion therapy, oncology treatments, and chronic disease management increased the frequency of needle based procedures, reinforcing routine use of these devices. Nursing shortages also pushed facilities to rely on technologies that improve first stick success and workflow efficiency.

Emergency departments and ambulatory centers favored portable systems to shorten procedure time and improve patient experience. Training institutions incorporated vein visualization into standard phlebotomy education.

A supporting indicator comes from the US Census Bureau, which reported in 2023 that adults aged 65 and older exceeded 55 million in the US, a demographic group that often presents difficult venous access and drives sustained clinical demand.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Vein Illuminator market in Asia Pacific is expected to expand steadily during the forecast period as healthcare systems scale diagnostic and infusion capacity. Hospitals prioritize tools that reduce complications and improve efficiency amid high patient volumes. Rising prevalence of anemia, diabetes, and cancer increases the need for repeated blood draws and IV access across both urban and rural settings.

Governments invest in modernizing public hospitals and improving nursing productivity, which supports adoption of visualization technologies. Medical tourism and day care procedures further increase demand for fast and accurate venous access.

Local manufacturers introduce affordable models tailored to regional needs. A verifiable signal of this demand appears in 2023 data from the World Health Organization, which estimated that anemia affects more than 40% of pregnant women in South East Asia, underscoring the high volume of blood testing and infusion procedures that support growth across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the vein illuminator market grow by advancing imaging clarity, ergonomics, and portability that help clinicians locate veins more reliably across pediatric, geriatric, and difficult access patients. They also deepen customer value by integrating user-friendly interfaces, rechargeable power systems, and adaptable lighting modes that support high-throughput clinical settings and home health use.

Firms expand commercial reach through partnerships with hospital groups, outpatient clinics, and large nursing networks, strengthening purchase preference and recurring demand. Geographic expansion into Europe, North America, and rapidly growing Asia Pacific complements established positions, capturing rising investments in minimally invasive care delivery and patient comfort technologies.

AccuVein Inc. exemplifies a focused technology company with a strong presence in the vein visualization segment, emphasizing robust product performance, extensive clinician training support, and global distribution that aligns with diverse care settings.

The company advances its strategic agenda through disciplined product refinement, targeted collaborations with healthcare providers, and coordinated commercialization that connects innovation with evolving clinical needs.

Top Key Players

- AccuVein

- Christie Medical Holdings

- TransLite

- Zyklus MedTech

- Near Infrared Imaging

- Vuetek Scientific

- InSono

- Sharn Anesthesia

- Promed Group

- Veinlite

Recent Developments

- In January 2025, LimFlow secured both FDA clearance and CMS reimbursement codes for its TADV System. The establishment of dedicated payment codes marks an important milestone and may create a favorable reimbursement pathway for related visualization and vascular intervention technologies.

- In December 2024, Therma Bright entered into a distribution agreement in the United States for the Venowave VW5 device. The partnership highlights growing distributor interest in vascular-access and vein-related tools within the US healthcare market.

Report Scope

Report Features Description Market Value (2025) US$ 0.6 Billion Forecast Revenue (2035) US$ 4.4 Billion CAGR (2026-2035) 22.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Infrared, Transilluminated and Ultrasound), By Application (Intravenous Access and Blood Draw), By End-User (Hospitals, Rehabilitation Facilities, Academic Institutions and Blood Donation Camps) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AccuVein, Christie Medical Holdings, TransLite, Zyklus MedTech, Near Infrared Imaging, Vuetek Scientific, InSono, Sharn Anesthesia, Promed Group, Veinlite Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AccuVein

- Christie Medical Holdings

- TransLite

- Zyklus MedTech

- Near Infrared Imaging

- Vuetek Scientific

- InSono

- Sharn Anesthesia

- Promed Group

- Veinlite