Global Vehicle Recycling Market Size, Share, Growth Analysis By Type (Passenger Cars Recycling, Commercial Vehicles Recycling), By Material (Iron, Aluminium, Steel, Rubber, Copper, Glass, Plastic, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173756

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

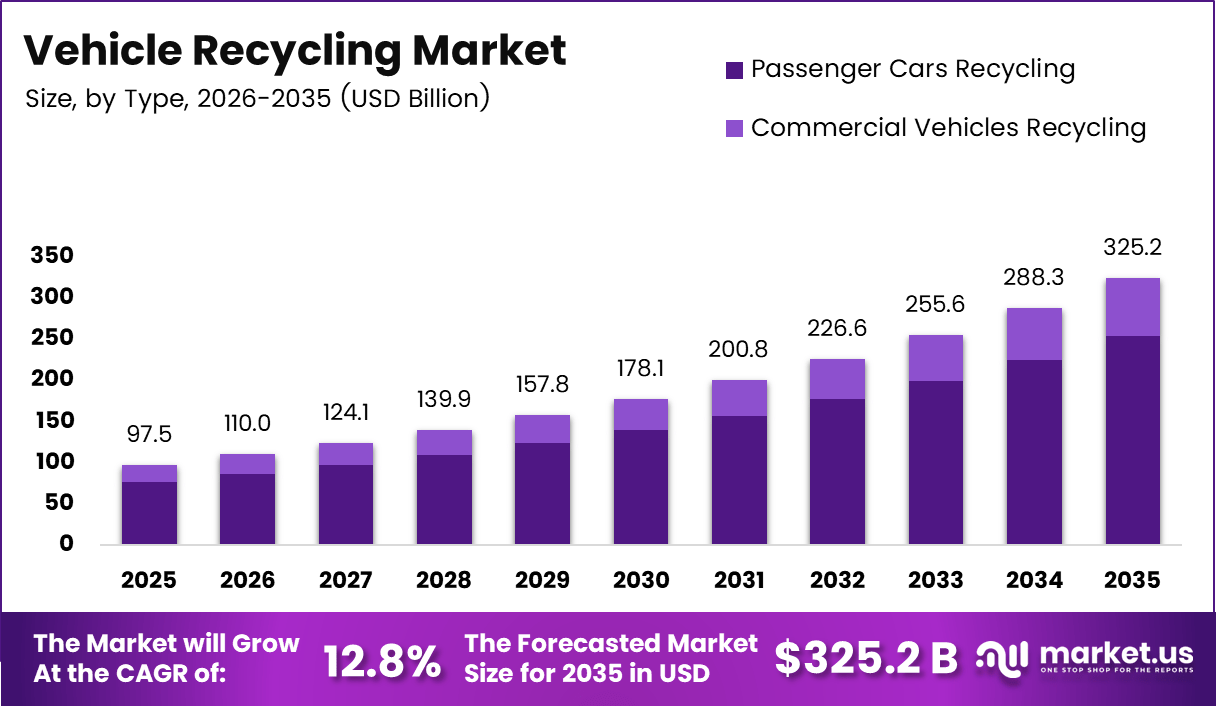

The Global Vehicle Recycling Market size is expected to be worth around USD 325.2 billion by 2035, from USD 97.5 billion in 2025, growing at a CAGR of 12.8% during the forecast period from 2026 to 2035.

The Vehicle Recycling Market represents the organized recovery, dismantling, and material reuse of end of life vehicles across global automotive ecosystems. It supports circular economy objectives by converting scrapped vehicles into secondary raw materials and reusable components. Moreover, it aligns environmental compliance with cost efficiency, resource security, and sustainable mobility supply chains.

From a growth perspective, the market benefits from rising vehicle parc maturity, accelerated scrappage initiatives, and tightening emission regulations. Consequently, governments promote formal recycling infrastructure to reduce landfill dependence. In parallel, automakers increasingly prioritize recycled inputs to stabilize raw material costs and strengthen sustainability disclosures across manufacturing operations.

Opportunities continue to expand as electrification reshapes automotive material composition and recycling complexity. Therefore, vehicle recycling increasingly integrates advanced dismantling, depollution, and material separation technologies. Furthermore, recyclers pursue value chain upgrades into alloy processing, remanufacturing, and precision components to capture higher margins beyond scrap recovery.

Government investment and regulation remain foundational to market expansion worldwide. For instance, extended producer responsibility frameworks mandate safe vehicle disposal and traceable recycling systems. Meanwhile, public funding supports modernization of shredding, sorting, and battery recycling facilities. As a result, compliance driven demand strengthens organized recyclers while discouraging informal processing practices.

From a performance standpoint, the market demonstrates strong material recovery efficiency across vehicle categories. According to survey, an overall recycling rate of 80-95% of a vehicle’s weight is achieved through reuse and energy recovery. This efficiency positions vehicle recycling as a mature sustainability solution.

Material specific recovery further strengthens the market outlook. According to study, nearly 90% of Stainless steel and iron, representing around 65% of a vehicle’s weight, is recycled into new products. nearly 90% aluminum recovery rates, supporting lightweight automotive manufacturing.

According to study, Battery and volume statistics reinforce long term scalability 98-99% of car batteries are recyclable, enabling recovery of lithium, cobalt, and nickel essential for electric mobility. Moreover, the International Organization of Motor Vehicle Manufacturers estimates over 27 million vehicles are recycled globally each year, ensuring steady feedstock availability.

Key Takeaways

- The Global Vehicle Recycling Market is projected to grow from USD 97.5 billion in 2025 to USD 325.2 billion by 2035, registering a CAGR of 12.8% during 2026–2035.

- Passenger Cars Recycling emerged as the leading segment in 2025, accounting for a dominant share of 78.2% due to high end of life vehicle volumes.

- Commercial Vehicles Recycling contributes steady value through higher material yield per vehicle, supporting long term fleet retirement and compliance driven recycling programs.

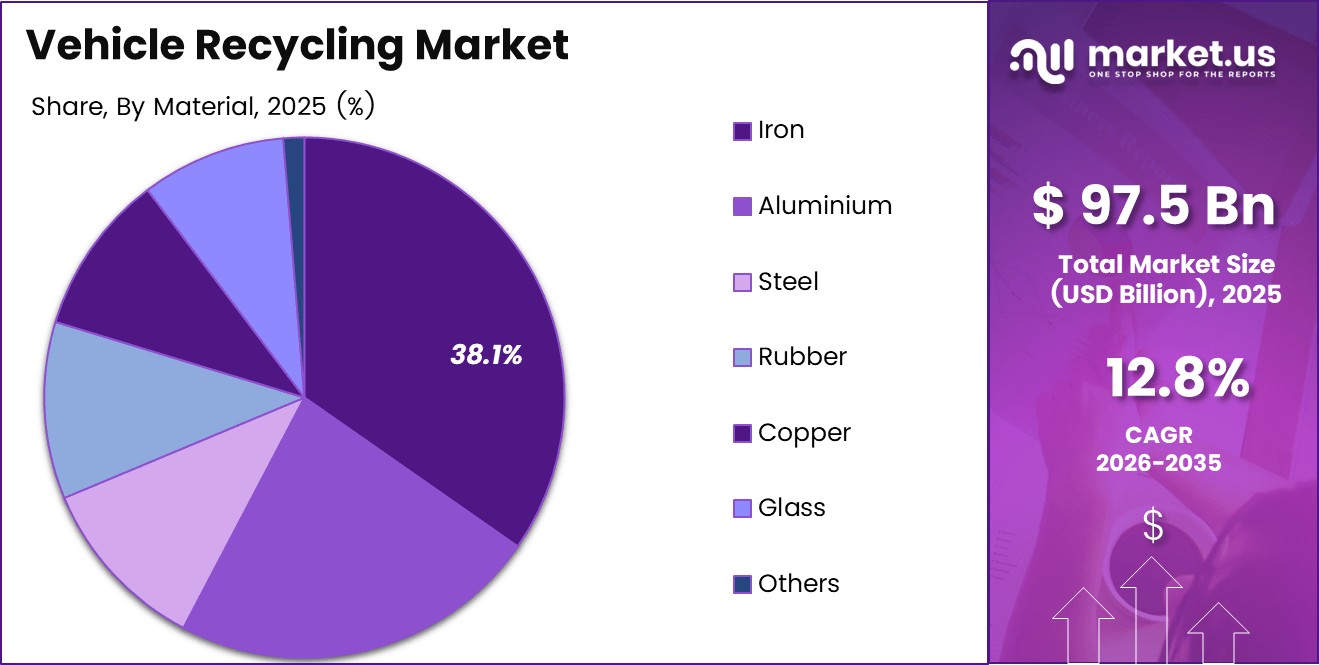

- Iron dominated the By Material segment with a market share of 38.1% in 2025, driven by efficient recovery processes and strong downstream demand.

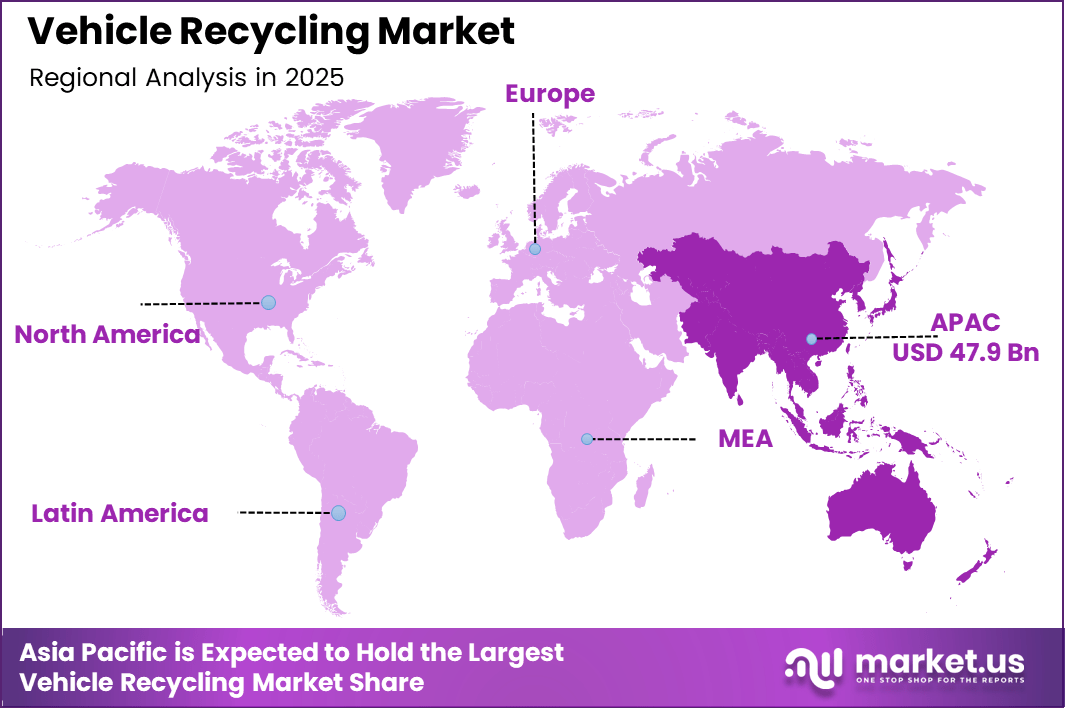

- Asia Pacific led the global market with a regional share of 49.2%, generating revenue of USD 47.9 billion in 2025.

- North America and Europe continue to benefit from mature recycling infrastructure and stringent end of life vehicle regulations supporting high recovery efficiency.

- Advanced recycling technologies and value chain integration are strengthening material recovery across metals, plastics, and batteries at scale.

- Rising government investments and circular economy mandates are accelerating formal vehicle recycling adoption across both developed and emerging regions.

By Type Analysis

Passenger Cars Recycling dominates with 78.2% due to the high volume of end of life passenger vehicles and structured dismantling networks.

In 2025, Passenger Cars Recycling held a dominant market position in the By Main Segment Analysis segment of Vehicle Recycling Market, with a 78.2% share. This dominance is supported by higher ownership rates, shorter replacement cycles, and formal scrappage policies. As a result, recyclers achieve consistent material inflow and operational scale.

Commercial Vehicles Recycling represents the remaining market share and focuses on trucks, buses, and fleet vehicles. Although volumes are lower, these vehicles deliver higher material yield per unit. Consequently, recyclers target commercial vehicles for steel intensive recovery and long term fleet retirement programs driven by emission compliance.

By Material Analysis

Iron dominates with 38.1% driven by its high presence in vehicle structures and efficient recovery economics.

In 2025, Iron held a dominant market position in the By Main Segment Analysis segment of Vehicle Recycling Market, with a 38.1% share. Iron recovery benefits from established shredding and magnetic separation processes. Therefore, recyclers achieve high recovery efficiency and steady demand from construction and manufacturing industries.

Aluminum recycling continues to expand due to lightweight vehicle design trends. Consequently, recyclers increasingly invest in alloy segregation and clean recovery methods. Aluminium offers higher value per ton, supporting margin expansion despite lower volume compared to ferrous materials.

Steel recycling remains a core material stream supported by mature global recycling infrastructure. As vehicle bodies rely heavily on steel components, recyclers maintain stable output streams. Moreover, steel recycling supports energy savings compared to primary steel production.

Rubber recycling focuses on tires, seals, and interior components. Therefore, recovered rubber supports applications such as road construction and industrial flooring. However, processing complexity limits its recovery share relative to metals.

Copper recovery targets Automotive wiring harnesses, motors, and electronic systems. Consequently, recyclers prioritize copper due to its high conductivity value and strong demand from electrical industries.

Glass recycling includes windshields and windows, although laminated structures complicate recovery. As a result, glass contributes lower value but supports waste diversion targets.

Plastic recycling addresses interior trims and exterior panels. Increasing polymer diversity creates sorting challenges, yet recyclers gradually adopt advanced separation technologies to improve yields.

Other materials include fluids, composites, and specialty components. These materials require controlled handling and specialized processing, supporting regulatory compliance rather than revenue generation.

Key Market Segments

By Type

- Passenger Cars Recycling

- Commercial Vehicles Recycling

By Material

- Iron

- Aluminium

- Steel

- Rubber

- Copper

- Glass

- Plastic

- Others

Drivers

Rising End of Life Vehicle Volumes Drive Vehicle Recycling Market Growth

Rising end of life vehicle volumes strongly support the growth of the Vehicle Recycling Market across regions. Aging vehicle fleets in developed and emerging economies increase scrappage activity. As vehicles reach the end of their usable life, recyclers receive steady material inflows. This trend improves capacity utilization and supports long term planning.

Increasing regulatory mandates further accelerate market development by enforcing structured vehicle depollution and dismantling practices. Governments require safe handling of fluids, batteries, and hazardous components. As a result, formal recycling operations gain preference over informal dismantling. Compliance requirements also improve material recovery efficiency across recycling facilities.

Growing demand for secondary raw materials strengthens the economic foundation of vehicle recycling. Industries increasingly source recycled steel, aluminium, and copper to reduce dependence on primary mining. Consequently, recyclers benefit from stable off take agreements. This demand alignment supports predictable revenue generation and investment confidence.

Cost advantages associated with recycled automotive metals further drive market adoption. Compared to primary metal production, recycling requires lower energy input. During periods of energy price volatility, recycled metals offer pricing stability. Therefore, manufacturers favor recycled inputs, reinforcing demand across the vehicle recycling value chain.

Restraints

High Capital Investment Requirements Limit Vehicle Recycling Market Expansion

High capital requirements present a significant restraint for the Vehicle Recycling Market. Advanced shredding, sorting, and depollution systems demand substantial upfront investment. Smaller operators often struggle to finance modern equipment. As a result, market consolidation increases while new entrants face higher entry barriers.

Limited standardization in dismantling processes further restricts operational efficiency. Vehicle designs vary widely by region and manufacturer, complicating recycling workflows. Without unified dismantling guidelines, recovery efficiency differs significantly. This inconsistency increases processing time and limits scalability for organized recyclers.

Informal recycling dominance in certain regions also restrains market development. Unregulated dismantling activities often bypass environmental and safety standards. Consequently, formal recyclers face unfair cost competition. This imbalance discourages investment in compliant infrastructure and slows the transition toward organized recycling ecosystems.

Together, capital intensity and operational fragmentation reduce short term profitability. These challenges require supportive policy frameworks and financial incentives to ensure sustainable market growth.

Growth Factors

Integration of Electric Vehicle Battery Recycling Creates New Growth Opportunities

Expansion of aluminium and specialty alloy recovery presents strong growth opportunities for the Vehicle Recycling Market. Lightweight vehicle manufacturing increases aluminium content per vehicle. Recyclers investing in alloy segregation improve material quality. Consequently, recovered metals achieve higher acceptance across automotive and industrial applications.

Integration of electric vehicle battery recycling unlocks additional revenue streams. As electric vehicle adoption rises, battery end of life volumes increase steadily. Recycling lithium, cobalt, and nickel supports energy transition goals. Therefore, traditional vehicle recyclers expand into battery processing ecosystems.

Adoption of digital yard management and traceability systems enhances compliance and efficiency. Digital platforms improve inventory control, material tracking, and reporting accuracy. As regulations tighten, traceable recycling operations gain competitive advantage. This digital shift supports operational transparency and cost optimization.

Strategic forward integration into value added automotive component manufacturing further strengthens opportunity potential. Using recycled inputs for component production increases margins. This approach moves recyclers higher in the automotive value chain.

Emerging Trends

Shift Toward Circular Economy Models Shapes Vehicle Recycling Market Trends

The shift toward circular economy models strongly influences Vehicle Recycling Market trends. Extended producer responsibility frameworks require manufacturers to manage vehicle end of life. Consequently, recycling becomes a core component of automotive sustainability strategies. This trend strengthens long term demand for compliant recycling partners.

Increasing use of automation and AI based sorting technologies improves dismantling efficiency. Automated systems enhance material purity and reduce manual labor dependency. As technology adoption rises, recyclers achieve higher recovery yields and operational consistency.

Growing focus on recovering rare earth elements and critical materials shapes modern recycling priorities. Advanced vehicles contain complex electronics and specialized components. Recovering these materials reduces supply risk and supports strategic resource security objectives.

Rising partnerships between automakers and recyclers further define market direction. Collaborative agreements secure sustainable material supply chains. These partnerships align recycling capacity with future vehicle production requirements.

Regional Analysis

Asia Pacific Dominates the Vehicle Recycling Market with a Market Share of 49.2%, Valued at USD 47.9 Billion

Asia Pacific leads the Vehicle Recycling Market due to high vehicle parc growth, accelerated urbanization, and expanding scrappage programs. In 2025, the region accounted for a dominant share of 49.2%, with a market value of USD 47.9 billion. Strong demand for recycled metals and government backed circular economy initiatives continue to strengthen regional recycling capacity.

North America Vehicle Recycling Market Trends

North America maintains a mature vehicle recycling ecosystem supported by strict environmental regulations and well established dismantling infrastructure. The region benefits from high recovery efficiency, strong demand for secondary raw materials, and increasing focus on electric vehicle battery recycling within formal recycling networks.

Europe Vehicle Recycling Market Trends

Europe’s vehicle recycling market is driven by stringent end of life vehicle directives and extended producer responsibility frameworks. Advanced depollution standards and high recycling targets encourage investment in modern processing facilities. As a result, Europe emphasizes material traceability and sustainable automotive supply chains.

Middle East and Africa Vehicle Recycling Market Trends

The Middle East and Africa region shows gradual growth supported by improving waste management policies and rising vehicle ownership. Although informal recycling remains prevalent, governments increasingly promote structured recycling systems. Infrastructure development and regulatory alignment are expected to enhance long term market potential.

Latin America Vehicle Recycling Market Trends

Latin America’s vehicle recycling market expands steadily due to aging vehicle fleets and growing awareness of environmental compliance. Countries across the region focus on formalizing dismantling operations and improving material recovery efficiency. Public initiatives supporting scrap vehicle retirement contribute to market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Vehicle Recycling Company Insights

ASM Auto Recycling Ltd. continues to play a critical role in the global Vehicle Recycling Market by focusing on compliant dismantling and high recovery efficiency. In 2025, the company benefits from structured end of life vehicle programs and rising demand for secondary raw materials. Its operations align closely with regulatory driven recycling models and circular economy objectives.

Copart Inc. strengthens its market position through large scale vehicle remarketing and recycling integration. The company leverages digital auction platforms to efficiently channel salvage vehicles into reuse and recycling streams. In 2025, its data driven approach improves asset recovery value while supporting sustainable vehicle lifecycle management across multiple regions.

Eco-bat Technologies remains a key contributor by specializing in battery recycling and advanced material recovery. As electric vehicle adoption increases, Eco-bat’s focus on recovering critical metals such as lead and lithium becomes increasingly strategic. In 2025, its capabilities support energy transition goals and secure recycled material supply chains.

INDRA holds a strong position in vehicle depollution and dismantling system technologies. The company supports recyclers by providing automated solutions that improve safety, compliance, and material separation efficiency. In 2025, INDRA’s technology driven model aligns with tightening environmental regulations and the global shift toward standardized recycling processes.

Top Key Players in the Market

- ASM Auto Recycling Ltd.

- Copart Inc.

- Eco-bat Technologies

- INDRA

- Keiaisha Co. Ltd.

- Hensel Recycling Group

- LKQ Corporation

- Schnitzer Steel Industries, Inc.

- Scholz Recycling GmbH

- Sims Metal Management Limited

Recent Developments

- In Sep 2025, NRL Recycling Limited acquired Tycod Autotech Pvt Ltd through an all-cash transaction valued at INR 240 million, marking a strategic forward integration from scrap recycling into aluminium alloy production and precision automotive components manufacturing. Post-acquisition, NRL invested an additional Rs 10 crore to modernise Tycod’s facilities with High Pressure Die Casting (HPDC), VMC, and CNC machinery to enhance value-added manufacturing capabilities.

- In Oct 2025, Crush Software Solutions LLC announced the acquisition of S3 Software Solutions LLC, the developer of Crush, a leading yard management system used by more than 200 self-service auto recycling yards across the U.S. and Canada. Following the deal, S3 will operate under Crush Software Solutions LLC, with Ryan Paterson appointed as chief executive officer and founder Dimitri Gerontis continuing as chief operating officer.

Report Scope

Report Features Description Market Value (2025) USD 97.5 billion Forecast Revenue (2035) USD 325.2 billion CAGR (2026-2035) 12.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Passenger Cars Recycling, Commercial Vehicles Recycling), By Material (Iron, Aluminium, Steel, Rubber, Copper, Glass, Plastic, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ASM Auto Recycling Ltd., Copart Inc., Eco-bat Technologies, INDRA, Keiaisha Co. Ltd., Hensel Recycling Group, LKQ Corporation, Schnitzer Steel Industries, Inc., Scholz Recycling GmbH, Sims Metal Management Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ASM Auto Recycling Ltd.

- Copart Inc.

- Eco-bat Technologies

- INDRA

- Keiaisha Co. Ltd.

- Hensel Recycling Group

- LKQ Corporation

- Schnitzer Steel Industries, Inc.

- Scholz Recycling GmbH

- Sims Metal Management Limited