Vascular Access Devices Market, By Device Type (Central Vascular Access Devices, Peripheral Vascular Access Devices, Accessories), By Application (Administration of Drugs, Administration of Fluid and Nutrition, and Other Applications), By End-User, By Region and Companies - Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2024

- Report ID: 103859

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

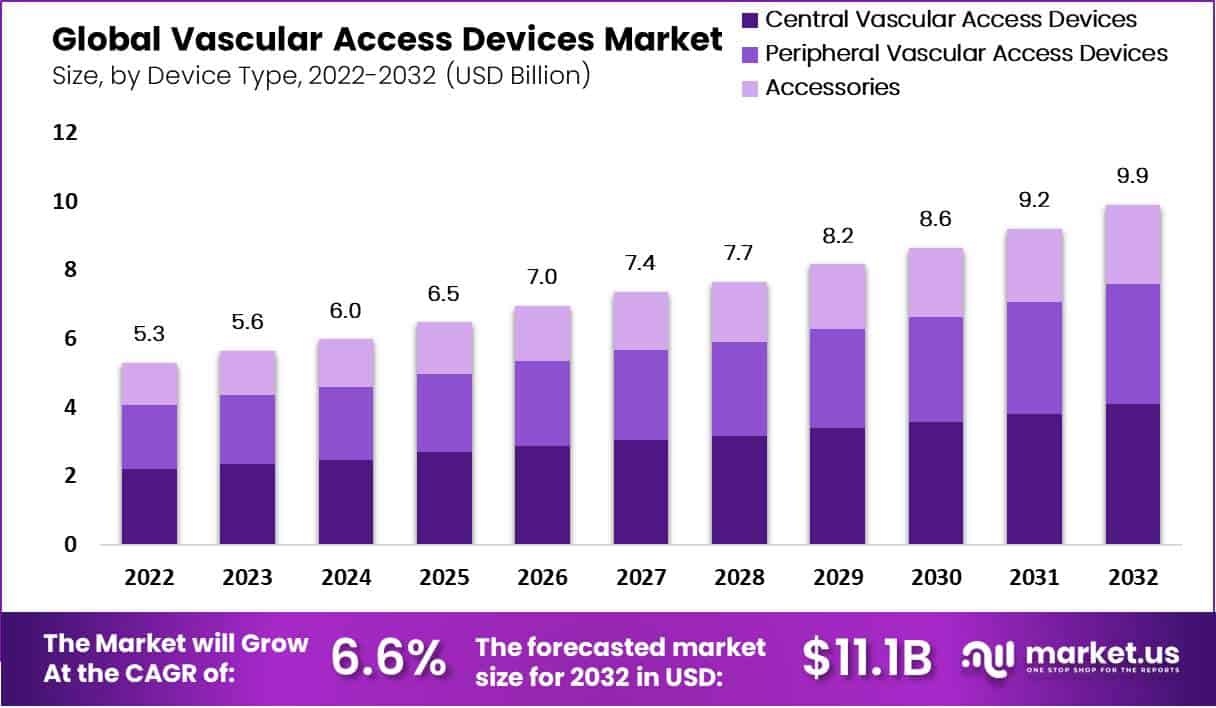

The Global Vascular Access Devices Market Size is expected to be worth around US$ 9.9 Billion by 2032, from US$ 5.3 Billion in 2022, growing at a CAGR of 6.6% during the forecast period from 2023 to 2032.

Vascular access devices are medical devices used to access the bloodstream for various diagnostic and therapeutic purposes. They are commonly used in hospitals, clinics, and other healthcare settings.

They commonly provide a route for the administration of medications, fluids, and blood products, as well as for blood sampling and monitoring directly into the bloodstream. They enable the delivery of various medications, including antibiotics, chemotherapy drugs, pain medications, and intravenous fluids. These devices facilitate the transfusion of blood and blood products, such as packed red blood cells, platelets, and plasma.

They provide a direct and efficient route for delivering these components to patients. Devices such as central venous catheters and peripherally inserted central catheters are used for parenteral nutrition. They allow the delivery of essential nutrients directly into the bloodstream when a patient is unable to tolerate or absorb oral nutrition.

They also allow healthcare professionals to obtain blood samples for diagnostic testing, such as laboratory analysis, blood gas measurements, and monitoring of various blood parameters. This eliminates the need for repeated needle sticks. The rising geriatric population along with the increasing prevalence of chronic diseases like cardiovascular disease, cancer, diabetes, etc. are key factors driving the demand for vascular access devices. Also, technological advancements and new product launches are expected to contribute to the Vascular Access Devices market growth over the forecast period.

Key Takeaways

- In 2022, the global Vascular Access Devices market value was USD 5.3 billion.

- The market is expected to grow at a CAGR of 6.6%.

- By 2032, the market is anticipated to reach USD 9.9 billion.

- The central vascular access devices segment had the largest revenue share of 41.5% in 2022.

- For drug administration, vascular access devices accounted for a revenue share of 37% in 2022.

- The elderly population is projected to reach 16% by 2050 and 24% by 2100 globally.

- In 2022, about 10% of the world’s population, or 771 million individuals, were over the age of 65.

- According to GLOBOCAN 2020 projections, there will be 19.3 million new cases of cancer globally.

- The number of cancer cases in India is expected to rise to 2.08 million by 2040, a 57.5% increase from 2020.

- In the United States during 2020, there were 602,347 cancer-related deaths.

- According to the IDF Diabetes Atlas 2021, 10% of the global population, or 537 million people aged 20 to 79, had diabetes.

- By 2045, the global diabetes prevalence is expected to surpass 12%.

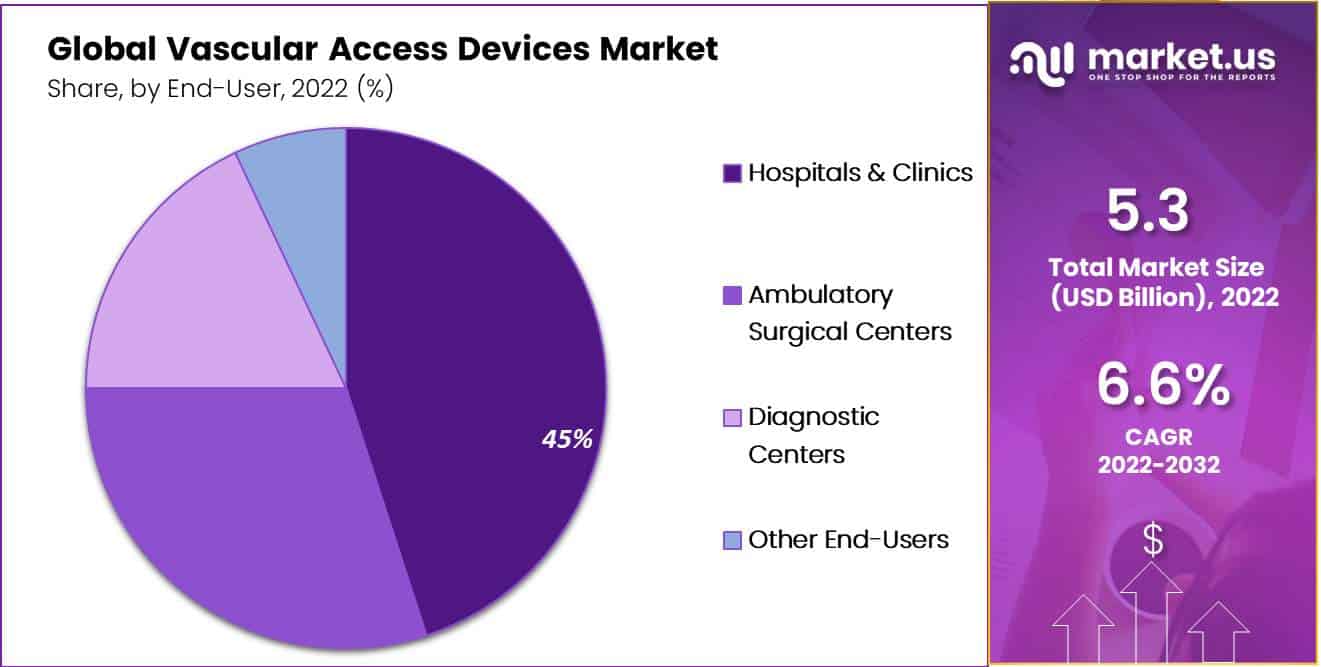

- Hospitals & clinics are expected to dominate the Vascular Access

- Devices market with a revenue share of 45% during the forecast period.

- Due to the COVID-19 pandemic, outpatient clinics and ambulatory care centers reported a 96.5% decrease in clinical volume.

- Ambulatory surgical centers are expected to witness a high growth rate during the projection period due to the rise in the incidence of chronic diseases.

Device Type Analysis

Central Vascular Access Devices are Experiencing the Highest Demand

The central vascular access devices segment dominated the Vascular Access Devices market in 2022 with the largest revenue share of 41.5%. These devices include peripherally inserted central catheters, percutaneous non-tunneled catheters, and other central vascular access devices. These devices are used to provide fluids, nutrients, and medications over an extended period of time.

These devices can be left in for a short while or for many years. The delivery point of the majority is located far from the skin insertion site in a central vein and is threaded under the skin. It is shielded from slight jolts and tugs, and the danger of infection is reduced as a result. These devices are used to a high extent in chemotherapy. The rising prevalence of cancer is a major factor driving the segment’s growth.

Also, the peripheral vascular access devices segment is expected to witness growth at a high rate during the projection period. These devices include peripheral catheters, midline catheters, and other peripheral vascular access devices. The increasing prevalence of peripheral vascular diseases like peripheral artery disease (PAD) is a key factor driving the growth of the segment, as these devices are mostly used in the treatment of these diseases.

Application Analysis

Administration of Drugs Application Dominates The Vascular Access Devices Market

The administration of drugs segment leads the application segment by accounting for a revenue share of 37% in 2022. Large-scale utilization of vascular access devices for drug administration for chronic disease treatment is a key factor driving the growth of the segment. Moreover, the high availability of various vascular access devices for the administration of drugs is expected to contribute to segment growth during the projection period.

Furthermore, the administration of the fluid and nutrition segment is likely to witness high growth over the forecast period. To manage fluids, administer drugs, and provide nourishment to critically sick patients as well as individuals with specialized needs, such as cytotoxic treatments, parenteral nutrition, inadequate vascular access, and long-term pharmaceutical infusions, central vascular access devices are used.

Thus, the crucial role played by central vascular access devices in the administration of fluid and nutrition is a key factor driving the segment’s growth.

End-User Analysis

Hospitals & clinics are major end-users

Hospitals & clinics are expected to dominate the Vascular Access Devices market with a revenue share of 45% throughout the forecast period. The rising demand for vascular access devices in hospitals due to the increasing prevalence of chronic diseases like cancer, cardiovascular diseases, diabetes, and other diseases is a key factor driving the segment’s growth during the estimated time period.

Moreover, ambulatory surgical centers are expected to witness growth at a high rate during the projection period. The rise in the number of surgical procedures performed in several countries due to the rise in the incidence of chronic diseases, along with increasing demand for minimally invasive surgical procedures, are key factors stimulating the growth of the segment.

Market Segments

Device Type

- Central Vascular Access Devices

- Peripherally Inserted Central Catheters

- Percutaneous Non-tunneled Catheters

- Other Central Vascular Access Devices

- Peripheral Vascular Access Devices

- Peripheral Catheter

- Midline Catheter

- Other Peripheral Vascular Access Devices

- Accessories

Application

- Administration of Drugs

- Administration of Fluid and Nutrition

- Diagnostics and Testing

- Other Applications

End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

- Other End-Users

Drivers

Rising Geriatric Population

The entire world is facing a crucial challenge in the form of an increasingly elderly population. The Visual Capitalist estimates that 771 million individuals, or about 10% of the world’s population, will be over the age of 65 in 2022. The elderly population has been expanding, and it is predicted that it will reach 16% in 2050 and 24% in 2100.

High-income nations like Japan (30%), Italy (24%), and Finland (23%), for example, are some of the regions having high elderly share rates today. One in four people in Europe, North America, and Asia will likely be older than 65 in just three decades.

More than one-third of the population in a number of Asian and island nations with slow population growth—including South Korea and Jamaica at 44%—is anticipated to be over 65 by 2100. As the geriatric population is prone to developing different chronic disorders like cancer, respiratory disorders, diabetes, cardiovascular diseases, etc., this is likely to drive the demand for vascular access devices during the forecast period.

Increasing Prevalence of Chronic Disorders

Many individuals in several countries around the globe suffer due to some or other chronic disease. According to the 2020 projections from the Global Cancer Observatory (GLOBOCAN), there will be 19.3 million new cases of cancer around the world.

China and the United States were first and second, respectively, on the list, while India was at number three. According to GLOBOCAN, the number of cancer cases in India will rise to 2.08 million, or a 57.5% increase, from 2020 to 2040. According to the United States Cancer Statistics (USCS), there were 602,347 cancer-related deaths and 1,603,844 new cancer cases reported in the United States during the year 2020.

Additionally, it predicted that the condition’s prevalence would rise by 134% in Africa, 68% in South-East Asia, and 13% in Europe. Thus, the increasing prevalence of chronic diseases is likely to fuel the demand for vascular access devices during the projection period.

Rise in Chemotherapy Procedures

Due to the high prevalence of cancer, the number of chemotherapy procedures performed is increasing at a high rate. A large or major portion of stage I and stage II colon cancer patients in the US were treated with colectomy (84%), while those with stage III disease typically received adjuvant chemotherapy (66%), according to the American Cancer Society’s 2019–2021 Cancer Treatment & Survivorship Facts & Figures report.

About half of the stage I rectal cancer patients were treated with radiation and/or chemotherapy in addition to having a proctectomy (surgical removal of the rectum) or a proctocolectomy (removal of the rectum plus all or part of the colon). Stage II and stage III rectal tumors were treated with chemotherapy and radiation before surgery (neoadjuvant) as opposed to stage I and stage II colon cancers. Thus, an increase in the number of chemotherapy procedures performed is anticipated to boost the demand for vascular access devices.

Restraints

Risks and Side-Effects Associated With The Use of Vascular Access Devices

Some individuals may develop allergic reactions to the materials used in these devices, such as catheters or adhesive dressings. These allergic responses can cause local skin irritation, itching, or even systemic reactions in rare cases. These devices can promote the formation of blood clots (thrombosis) in the blood vessels.

Clots can obstruct the device or dislodge, potentially leading to complications such as deep vein thrombosis (DVT), pulmonary embolism, or catheter-associated thrombosis. Thrombosis can necessitate device removal and may require anticoagulant therapy. Thus, risks and side effects associated with the use of vascular access devices may limit the Vascular Access Devices market growth during the projected time period.

Stringent Regulations

Regulatory authorities often classify vascular access devices into different risk categories based on the potential harm they may pose to patients. Higher-risk devices, such as long-term implantable catheters, may be subject to more rigorous regulatory requirements, including clinical data demonstrating safety and efficacy.

As a result, significantly stringent regulations involved in the approval of vascular access devices are expected to have a negative impact on the growth of the Vascular Access Devices market over the forecasted time period.

Opportunities

Initiatives Spreading Awareness Regarding the Cost of Catheter-Related Issues

The need for solutions that can reduce problem rates is growing, which supports the Vascular Access Devices market as a result of rising awareness of the costs associated with catheter-related difficulties in healthcare facilities. The poor use and maintenance of vascular access devices may contribute significantly to the issues, according to a number of recent clinical studies.

By offering online or in-person training programs, manufacturers may help consumers distinguish their products from those of their rivals and create brand loyalty. Some examples of such effective programs include the clinical training programs from BD and the Teleflex Academy program from Teleflex Medical. Such key initiatives are expected to fuel market growth during the estimated time period.

Latest Trends

Increasing Demand for Vascular Access Devices In Paediatric Patients

For a number of reasons, the demand for vascular access devices is rising in pediatric patients. For instance, several pediatric hospitals and clinics use central venous access devices (CVADs) as a standard tool for a variety of therapies, such as lifelong parenteral feeding for gut enteropathies and the delivery of antibiotics for persistent osteomyelitis, according to the study “Paediatric central venous access devices: practice, performance, and costs” published in the pediatric Research in February 2022.

Thus, increasing the use of vascular access devices in pediatric patients can be considered a positive trend and is likely to boost the Vascular Access Devices market growth in the upcoming time period.

Regional Analysis

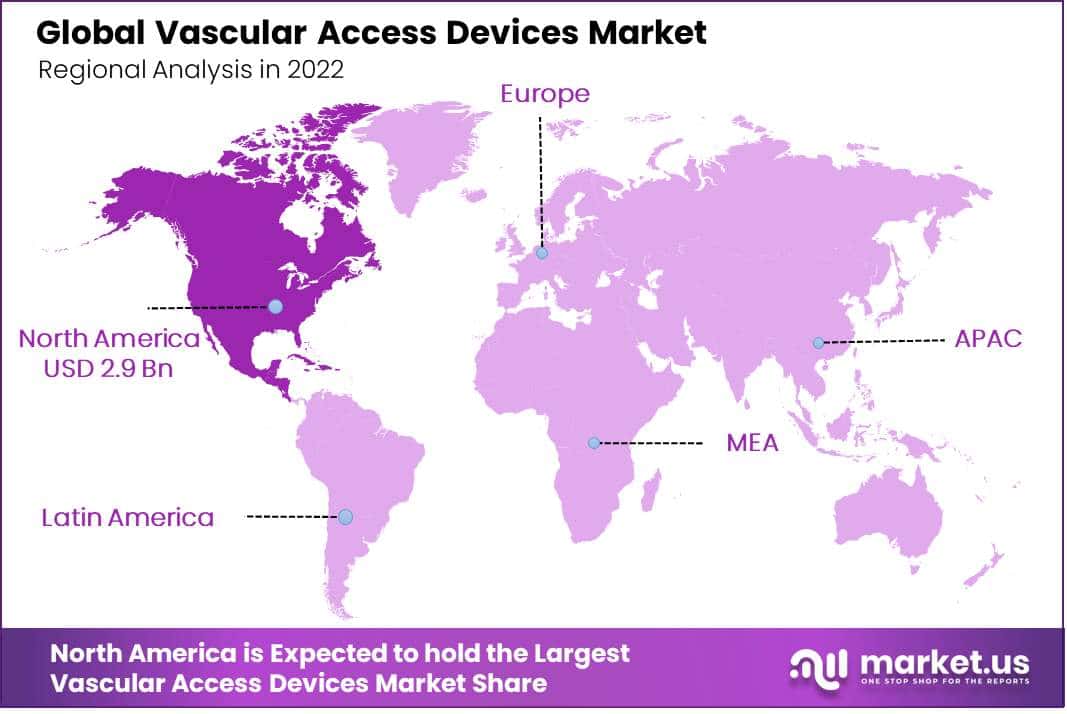

North America Leads the Market By Holding Major Revenue Share In Account

The North American region is anticipated to witness the highest growth, with a revenue share of 55% during the projected time period. The Vascular Access Devices market growth in the region is fuelled by key factors such as the rising geriatric population, increasing prevalence of chronic diseases like cancer, diabetes, etc., technological advancements, and favorable government regulations.

The American Cancer Society predicts that 79,000 new cases of kidney cancer will likely be detected in the country in 2022, with 50,290 cases affecting men and 28,710 cases affecting women. Among the top 10 malignancies in both women and men in the world is kidney cancer. The lifetime risk of kidney cancer in men is 2.02%, and for women is 1.03%.

Additionally, end-stage renal disease (ESRD) patients who require dialysis frequently receive this treatment via a catheter in an outpatient setting, minimizing the need for ESRD patients to stay in the hospital for non-emergency interventional operations. Thus, the rising prevalence of cancer is anticipated to boost Vascular Access Devices market growth in the region throughout the forecast period.

Moreover, the Asia-Pacific region is likely to grow at a high rate during the estimated time period. The growth of the market in the region is stimulated by, a rise in the prevalence of lifestyle-related diseases, along with the rising geriatric population. Moreover, an increase in healthcare spending, along with rising R&D expenditure among Asian nations, is expected to drive the expansion of the market throughout the region during the projection period.

Key Regions

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global Vascular Access Devices market can be considered highly competitive, and key market players are emphasizing improving their presence in the market. The market is expected to grow at a high rate over the forecast period due to the high demand for vascular access devices in the treatment of chronic disorders like cancer.

Additionally, key partnerships and collaborations, investments in technology, the launch of new products are likely to contribute to the market growth in the upcoming years.

Market Key Players

- Braun Melsungen AG

- Becton, Dickinson, and Company

- Cook Medical

- Teleflex Medical

- NIPRO Medical Corporation

- Baxter International Inc.

- Medtronic

- Fresenius Medical Care

- Siemens Healthineers

- Terumo Corporation

- AngioDynamics

- Other Key Players

Recent Developments

- In September 2024: Becton, Dickinson and Company completed the acquisition of the Critical Care product group from Edwards Lifesciences for $4.2 billion in cash. This acquisition is aimed at expanding BD’s smart connected care solutions and positioning the company as a leader in advanced monitoring technology. The acquired unit includes AI-enabled clinical decision tools and is expected to significantly contribute to BD’s revenue growth and margin expansion.

- In March 2023: B. Braun Melsungen AG collaborated with Infraredx to accelerate the FDA investigational device exemption (IDE) clinical trial for the B. Braun SeQuent Please ReX. This drug-coated PTCA balloon catheter, designed for treating coronary in-stent restenosis, leverages the clinical and financial resources of both companies to facilitate its introduction in the U.S. market. The collaboration aims to meet a significant unmet clinical need by providing advanced coronary intervention solutions.

Report Scope

Report Features Description Market Value (2022) USD 5.3 Bn Forecast Revenue (2032) USD 11.1 Bn CAGR (2023-2032) 6.6% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Device Type- Central Vascular Access Devices{Peripherally Inserted Central Catheters, Percutaneous Non-tunneled Catheters, and Other Central Vascular Access Devices}, Peripheral Vascular Access Devices{ Peripheral Catheter, Midline Catheter, and Other Peripheral Vascular Access Devices}, Accessories, By Application- Administration of Drugs, Administration of Fluid and Nutrition, Diagnostics and Testing, and Other Applications, By End-User- Hospitals & Clinics, Ambulatory Surgical Centers, Diagnostic Centers, and Other End-Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape B. Braun Melsungen AG, Becton, Dickinson and Company, Cook Medical, Teleflex Medical, NIPRO Medical Corporation, Baxter International Inc., Medtronic, Fresenius Medical Care, Siemens Healthineers, Terumo Corporation, AngioDynamics, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vascular Access Devices MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Vascular Access Devices MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Braun Melsungen AG

- Becton, Dickinson, and Company

- Cook Medical

- Teleflex Medical

- NIPRO Medical Corporation

- Baxter International Inc.

- Medtronic

- Fresenius Medical Care

- Siemens Healthineers

- Terumo Corporation

- AngioDynamics

- Other Key Players