Global V2X Cybersecurity Market By Unit Type (On-Board Unit, Roadside Unit), By Vehicle Type (Passenger Car, Commercial Vehicles ), By Propulsion Type (ICE, Electric and Hybrid, Others), By Communication (Vehicle-To-Vehicle (V2V), Vehicle-To-Infrastructure(V2I), Vehicle-To-Grid (V2G), Vehicle-to-Pedestrian (V2P), Vehicle-to-Cloud (V2C)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121960

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

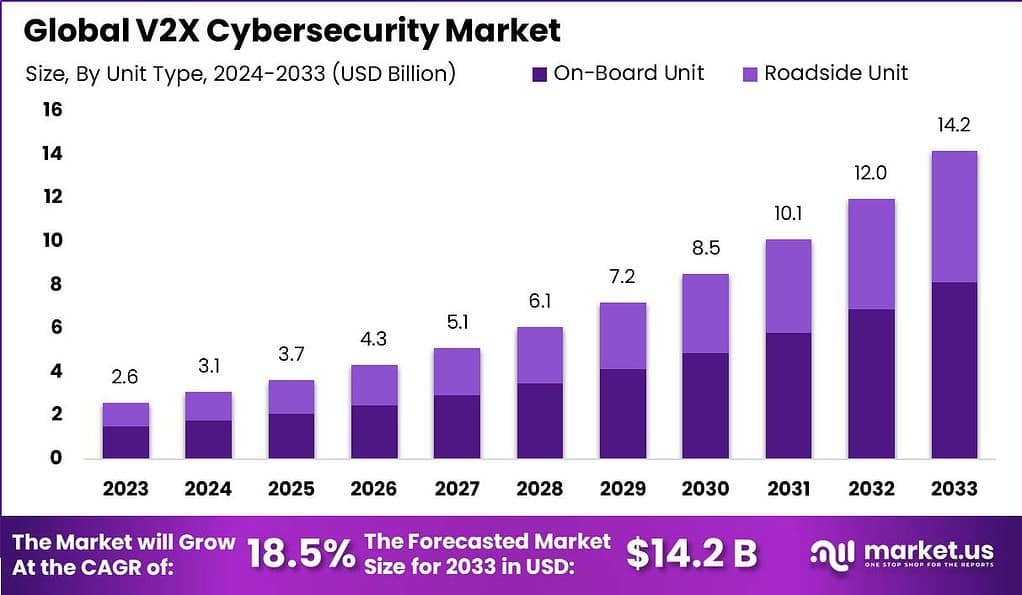

The Global V2X Cybersecurity Market size is expected to be worth around USD 14.2 Billion By 2033, from USD 2.6 Billion in 2023, growing at a CAGR of 18.5% during the forecast period from 2024 to 2033.

V2X (Vehicle-to-Everything) cybersecurity refers to the measures and systems put in place to secure the communication and data exchange between vehicles and their surroundings, including other vehicles, infrastructure, pedestrians, and the overall transportation ecosystem. With the advent of connected and autonomous vehicles, V2X technology has gained significant importance in enabling efficient and safe transportation systems.

The V2X (Vehicle-to-Everything) cybersecurity market has witnessed significant growth in recent years due to the increasing adoption of connected and autonomous vehicles. V2X technology enables vehicles to communicate with each other, infrastructure, pedestrians, and other devices, enhancing road safety, traffic management, and overall driving experience. However, with the growing connectivity and complexity of these systems, the need for robust cybersecurity solutions has become paramount.

One of the key growth factors for the V2X cybersecurity market is the rising number of cyber threats targeting connected vehicles. As vehicles become more connected and autonomous, they are exposed to various cybersecurity risks, including hacking, unauthorized access, data breaches, and remote control manipulation. These threats can pose significant safety risks and compromise the integrity of transportation systems. Consequently, automakers, government agencies, and cybersecurity companies are investing heavily in developing advanced security measures to protect V2X communication networks.

Additionally, the increasing regulatory focus on automotive cybersecurity is driving market growth. Governments and regulatory bodies across the globe are implementing stringent regulations and standards to ensure the security and privacy of connected vehicles. For instance, the European Union’s General Data Protection Regulation (GDPR) and the United Nations Economic Commission for Europe’s (UNECE) WP.29 regulations include provisions for cybersecurity in connected vehicles. Compliance with these regulations necessitates the adoption of robust V2X cybersecurity solutions, creating opportunities for market growth.

Despite the growth prospects, the V2X cybersecurity market also faces several challenges. One of the primary challenges is the complexity and diversity of V2X communication systems. V2X networks involve a wide range of technologies, including wireless communication protocols, vehicle sensors, cloud platforms, and backend infrastructure. Securing these complex ecosystems requires comprehensive solutions that can address multiple vulnerabilities and potential attack vectors.

Moreover, the rapid evolution of V2X technology poses challenges for both existing players and new entrants. The market demands innovative and adaptive cybersecurity solutions that can keep pace with the advancements in connected and autonomous vehicles. New entrants in the V2X cybersecurity market have an opportunity to provide novel approaches and technologies to address emerging threats. The increasing demand for expertise in areas like artificial intelligence (AI), machine learning (ML), and anomaly detection opens avenues for startups and niche players to establish themselves in the market.

Key Takeaways

- The V2X Cybersecurity Market size is expected to be worth around USD 14.2 Billion By 2033, from USD 2.6 Billion in 2023, growing at a CAGR of 18.5% during the forecast period from 2024 to 2033.

- In 2023, the On-Board Unit (OBU) segment held a dominant market position within the V2X (Vehicle-to-Everything) cybersecurity market, capturing more than a 57.4% share.

- In 2023, the Passenger Car segment held a dominant market position in the V2X (Vehicle-to-Everything) cybersecurity market, capturing more than a 66.4% share.

- In 2023, the Internal Combustion Engine (ICE) segment held a dominant position in the V2X cybersecurity market, capturing more than a 52.6% share.

- In 2023, the Vehicle-To-Vehicle (V2V) segment held a dominant market position within the V2X cybersecurity market, capturing more than a 36.4% share.

- In 2023, North America held a dominant market position in the V2X cybersecurity landscape, capturing more than a 36.8% share with revenues reaching approximately USD 0.9 billion.

Unit Type Analysis

In 2023, the On-Board Unit (OBU) segment held a dominant market position within the V2X (Vehicle-to-Everything) cybersecurity market, capturing more than a 57.4% share. This leadership can be attributed primarily to the critical role that OBUs play in facilitating direct communication between vehicles and the infrastructure surrounding them.

These units are integral to enhancing the safety features of smart transportation systems by enabling real-time data exchange about traffic conditions, road hazards, and vehicle diagnostics, which are vital for the effective functioning of autonomous and connected vehicles. The dominance of the On-Board Unit segment is further bolstered by increased investments in autonomous vehicle technology, where cybersecurity becomes paramount to protect against potential cyber threats and unauthorized data access.

Governments and automotive manufacturers worldwide are implementing stringent regulations and standards to ensure vehicle data privacy and security, thus driving the demand for advanced OBU security solutions. For instance, the deployment of OBUs equipped with secure communication protocols is essential to comply with these regulations, contributing significantly to the segment’s growth. Moreover, the technological advancements in V2X communication systems and the growing emphasis on reducing road accidents have led to the expanded use of OBUs.

These devices not only facilitate vehicle connectivity but also support advanced applications such as cooperative collision warning, electronic emergency brake lights, and intersection movement assist, which rely heavily on the robustness of cybersecurity measures. This reliance is expected to propel the market forward, with the OBU segment anticipated to maintain its lead in the coming years due to continuous innovations and enhancements in vehicle communication technologies.

Vehicle Type Analysis

In 2023, the Passenger Car segment held a dominant market position in the V2X (Vehicle-to-Everything) cybersecurity market, capturing more than a 66.4% share. This significant market share is largely due to the increasing integration of advanced driver-assistance systems (ADAS) and connected car technologies in passenger vehicles, which require robust cybersecurity solutions to protect against cyber threats and data breaches.

As consumer awareness of vehicle safety and data security continues to grow, there is a heightened demand for secure communication systems in passenger cars, driving the expansion of this segment. The leadership of the Passenger Car segment is also supported by the rapid adoption of electric vehicles (EVs), which are equipped with connected technologies for better efficiency and performance management.

These technologies, essential for the operation of EVs, create potential vulnerabilities that can be exploited by cyberattacks. Consequently, there is a pressing need for enhanced cybersecurity measures tailored to passenger vehicles, which not only protect the vehicle’s data but also ensure the safety and privacy of the passengers.

Further, governmental regulations and standards focusing on vehicle cybersecurity are becoming stricter globally, compelling automotive manufacturers to invest heavily in cybersecurity solutions. The introduction of regulations such as the WP.29 framework by the United Nations Economic Commission for Europe (UNECE) mandates that all new vehicles have systems in place to guard against cyber threats. This regulatory environment is particularly influential in the Passenger Car segment, promoting sustained investment and development in cybersecurity solutions, thereby reinforcing its market dominance.

Propulsion Type Analysis

In 2023, the Internal Combustion Engine (ICE) segment held a dominant position in the V2X cybersecurity market, capturing more than a 52.6% share. This leadership can be attributed to the widespread global fleet of ICE vehicles, which continue to outnumber electric and hybrid vehicles significantly. The longevity of ICE vehicles in emerging markets, coupled with slower adoption rates of newer electric models due to their higher initial costs and infrastructure demands, reinforces this segment’s stronghold.

The robust position of the ICE segment also stems from the regulatory pressures for enhanced security features amidst growing concerns over vehicle safety and data privacy. Governments worldwide have been instituting stringent cybersecurity regulations that necessitate advanced protection mechanisms in all vehicles, particularly in the more prevalent ICE models.

Additionally, the integration of V2X systems in ICE vehicles has been propelled by the need to improve traffic management and reduce accident rates, further driving investments into cybersecurity solutions tailored for this segment. Furthermore, while electric and hybrid vehicles are gradually incorporating more advanced cybersecurity measures due to their newer technology platforms, the ICE segment benefits from established aftermarket services and upgrades that cater to older vehicles.

This aftermarket aspect ensures continual revenue generation from existing fleets, thereby sustaining the segment’s market dominance. As the automotive industry evolves, the ICE segment’s market share is expected to remain significant, although likely to see gradual shifts as electric and hybrid technologies become more accessible and widespread.

Communication Analysis

In 2023, the Vehicle-To-Vehicle (V2V) segment held a dominant market position within the V2X cybersecurity market, capturing more than a 36.4% share. This prominence is primarily due to the critical role that V2V communication plays in enhancing road safety by allowing vehicles to directly communicate with each other. This technology enables the exchange of vital safety data, such as speed and positional information, which can significantly reduce accidents and improve traffic flow.

The leadership of the V2V segment is bolstered by supportive regulatory frameworks that promote the deployment of V2V technologies to improve automotive safety standards. For instance, various governments are increasingly mandating V2V communication capabilities in new vehicles, which necessitates robust cybersecurity measures to protect against potential cyber threats and data breaches. This regulatory push ensures sustained investment and development in V2V cybersecurity solutions, further solidifying its market share.

Moreover, the rise in autonomous and semi-autonomous vehicles has amplified the need for secure V2V communications. As vehicles become more interconnected and reliant on shared information for navigation and decision-making, the integrity and security of this data become paramount. Consequently, cybersecurity solutions specific to V2V communications are in high demand, as they are essential for the safe and efficient operation of these advanced vehicle technologies. This trend is expected to continue driving the growth of the V2V segment in the V2X cybersecurity market.

Key Market Segments

By Unit Type

- On-Board Unit

- Roadside Unit

By Vehicle Type

- Passenger Car

- Commercial Vehicles

By Propulsion Type

- ICE

- Electric and Hybrid

- Others

By Communication

- Vehicle-To-Vehicle (V2V)

- Vehicle-To-Infrastructure(V2I)

- Vehicle-To-Grid (V2G)

- Vehicle-to-Pedestrian (V2P)

- Vehicle-to-Cloud (V2C)

Driver

Technological Advancements in Connected Vehicle Technologies

The V2X (Vehicle-to-Everything) cybersecurity market is significantly driven by technological advancements in connected vehicle technologies. Innovations in Artificial Intelligence (AI) and the implementation of 5G networks are transforming the automotive industry, enhancing vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications.

These technologies enable more efficient and safe driving experiences by improving the predictive capabilities of vehicles, which are crucial for real-time decision-making in autonomous and semi-autonomous vehicles. As the automotive industry continues to evolve towards more connected and autonomous vehicles, the demand for robust cybersecurity solutions to protect these communications systems from cyber threats is increasingly critical.

Restraint

Stringent Regulatory Requirements

The growth of the V2X cybersecurity market faces significant restraint due to the increasing complexity and stringency of regulatory requirements across different regions. New cybersecurity laws, such as those being implemented in the European Union and developed by countries like South Korea and Japan, require automotive manufacturers to adhere to rigorous standards in cybersecurity.

These regulations are designed to keep pace with the rapidly evolving technological landscape and the corresponding cyber threats but pose challenges for compliance, potentially slowing down the introduction of new connected vehicle technologies.

Opportunity

Expansion of Cellular-V2X (C-V2X) Technologies

A major opportunity in the V2X cybersecurity market is the expansion of Cellular-V2X (C-V2X) technologies, which are set to benefit greatly from the rollout of 5G networks. C-V2X technology supports high reliability and low latency communications essential for advanced automotive functions such as platooning, remote driving, and advanced predictive maintenance.

The integration of 5G is expected to further enhance these capabilities, providing a significant boost to the efficiency and safety of automotive operations. This advancement is expected to open up new growth avenues for the market, especially as governments and automotive manufacturers invest heavily in testing and deploying these technologies.

Challenge

Security of Third-Party Applications and Services

A critical challenge in the V2X cybersecurity market is ensuring the security of third-party applications and services. As vehicles become more integrated with digital technologies, they increasingly support third-party applications, which can introduce new vulnerabilities and attack vectors.

The challenge is compounded by the diversity of these applications and the complexity of ensuring that all potential backdoors and vulnerabilities are addressed. Ensuring robust cybersecurity measures that can keep pace with the rapid development of applications and the sophistication of potential cyber-attacks is a significant hurdle for the industry.

Growth Factors

- Increased Adoption of Connected Vehicles: The global rise in connected vehicle production and adoption is driving the demand for V2X cybersecurity solutions. As vehicles become more connected, the need to secure communication between vehicles and with infrastructure intensifies, creating significant growth potential for cybersecurity providers.

- Government Regulations and Standards: The implementation of stringent cybersecurity regulations and standards across different countries is compelling automotive manufacturers and stakeholders to enhance their cybersecurity measures. Regulations like the EU’s cybersecurity laws and the development of standards such as ISO/SAE 21434 are pivotal growth factors for the market.

- Technological Advancements in Communication Technologies: The development of advanced communication technologies, particularly Cellular-V2X (C-V2X) aided by 5G, is a key driver. These technologies require robust cybersecurity solutions to protect against the increasing sophistication of cyber threats.

- Rising Concerns Over Cyber Threats: As cyber threats become more sophisticated, there is a heightened awareness and concern among consumers and regulatory bodies about the security of vehicle data and communications. This awareness drives the demand for more advanced cybersecurity solutions.

- Public and Private Sector Collaboration: Collaborations between governments, automotive manufacturers, and technology providers to develop and implement V2X cybersecurity solutions are crucial for market growth. These collaborations often lead to innovation and faster adoption of security measures across the sector.

Emerging Trends

- Integration of AI and Machine Learning: Artificial intelligence (AI) and machine learning are increasingly being integrated into cybersecurity solutions to predict, detect, and respond to threats more effectively. These technologies enable real-time monitoring and adaptive responses to security threats in vehicle communications.

- Blockchain for Enhanced Security: Blockchain technology is being explored for its potential to offer decentralized security solutions for V2X communications. Its application could significantly enhance data integrity and privacy by preventing unauthorized data manipulation and access.

- Adoption of Edge Computing: Edge computing is emerging as a trend in the V2X cybersecurity space, facilitating faster processing and response times by handling data locally at the edge of the network. This is particularly beneficial for real-time automotive applications requiring immediate data processing and action.

- Focus on Firmware Security: As the software within vehicles becomes more complex, there is a growing focus on securing the firmware against attacks. Firmware security is crucial for preventing malicious attacks that could take control of vehicle systems or steal sensitive data.

- Development of Standardized Cybersecurity Practices: There is a trend towards the development and implementation of standardized cybersecurity practices and frameworks across the automotive industry. This standardization helps ensure a unified approach to securing V2X communications, improving overall industry resilience.

Regional Analysis

In 2023, North America held a dominant market position in the V2X cybersecurity landscape, capturing more than a 36.8% share with revenues reaching approximately USD 0.9 billion. This region leads primarily due to the high concentration of technological innovations and the presence of major automotive and cybersecurity firms.

North America has been at the forefront of adopting advanced vehicular communication technologies, spurred by the integration of 5G networks and the Internet of Things (IoT), which enhance vehicle connectivity and demand robust cybersecurity solutions. The regulatory environment in North America also significantly contributes to the region’s leadership in the market. Stringent regulations and standards set by governmental bodies necessitate advanced security features in automotive technology, driving the adoption of sophisticated V2X cybersecurity solutions.

Moreover, collaborations between public and private sectors in research and development activities have fostered a conducive environment for the growth of the V2X cybersecurity market. Initiatives such as dedicated investment in smart transportation infrastructure and incentives for developing secure automotive technologies further solidify North America’s leading position in the global market.

Europe follows closely, driven by similar technological advancements and a robust regulatory framework. The region’s emphasis on data protection and privacy, guided by regulations such as the General Data Protection Regulation (GDPR), compels automotive manufacturers to adopt advanced cybersecurity measures. Europe’s strategic collaborations across the automotive sector, coupled with government funding in cybersecurity initiatives, also play a crucial role in advancing the region’s market share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The V2X cybersecurity market is supported by a robust framework of key players, each contributing significantly to the technological advancements and adoption of secure vehicular communication systems. Aptiv, Continental AG, and DENSO CORPORATION are notable for their comprehensive solutions that enhance vehicle connectivity and safety. ETAS (ESCRYPT) specializes in embedded security for automotive systems, providing crucial protections against cyber threats. Green Hills Software and HARMAN International stand out for their secure software platforms that support critical in-vehicle systems.

ID Quantique introduces quantum-safe cryptography, offering an additional layer of security against sophisticated cyber-attacks, while Infineon Technologies AG leads with its hardware-based security solutions that safeguard vehicle-to-everything communications. Lear Corporation and NXP Semiconductors further enrich the market with their advanced electronic components that facilitate secure and reliable vehicle communications.

Moreover, AUTOCRYPT Co. Ltd. and Autotalks bring specialized expertise in encryption and chipset solutions, respectively, which are vital for the integrity and privacy of V2X communications. Together, these key players are pivotal in driving forward the innovations and adoption of cybersecurity measures necessary for the safe deployment of connected vehicles across the globe. Their contributions not only ensure compliance with stringent security standards but also foster consumer trust in emerging vehicular technologies.

Top Key Players in the Market

- Aptiv

- Continental AG

- ETAS (ESCRYPT)

- Green Hills Software

- HARMAN International

- ID Quantique

- Infineon Technologies AG

- Lear Corporation

- NXP Semiconductors

- AUTOCRYPT Co.Ltd.

- DENSO CORPORATION

- Autotalks

Recent Developments

- In May 2024, Infineon and ETAS integrated the ESCRYPT CycurHSM 3.x Automotive Security Software Stack into the AURIX™ TC4x Cybersecurity Real-time Module (CSRM). This collaboration aims to enhance security levels, performance, and functionality for software-defined vehicles, addressing the growing need for high-performance hardware and robust cybersecurity solutions.

- Aptiv has been at the forefront of enabling the transition to software-defined vehicles with their smart vehicle architecture and cybersecurity solutions. In March 2024, Aptiv published insights on achieving design and manufacturing efficiencies, highlighting their commitment to advancing vehicle connectivity and security.

- DENSO CORPORATION, a major player in the automotive sector, has been actively enhancing its cybersecurity capabilities to support the growing V2X market. In 2023, DENSO announced advancements in their cybersecurity measures for connected vehicles, ensuring robust protection against emerging cyber threats.

- HARMAN International has made significant strides in the V2X cybersecurity domain. In 2023, HARMAN launched new cybersecurity solutions tailored for connected vehicles, enhancing data protection and communication security in automotive application

Report Scope

Report Features Description Market Value (2023) USD 2.6 Bn Forecast Revenue (2033) USD 14.2 Bn CAGR (2024-2033) 18.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Unit Type (On-Board Unit, Roadside Unit), By Vehicle Type (Passenger Car, Commercial Vehicles ), By Propulsion Type (ICE, Electric and Hybrid, Others), By Communication (Vehicle-To-Vehicle (V2V), Vehicle-To-Infrastructure(V2I), Vehicle-To-Grid (V2G), Vehicle-to-Pedestrian (V2P), Vehicle-to-Cloud (V2C)) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Aptiv, Continental AG, ETAS (ESCRYPT), Green Hills Software, HARMAN International, ID Quantique, Infineon Technologies AG, Lear Corporation, NXP Semiconductors, AUTOCRYPT Co., Ltd., DENSO CORPORATION, Autotalks. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is V2X?V2X (Vehicle-to-Everything) refers to the communication systems in which vehicles communicate with various entities, including other vehicles (V2V), infrastructure (V2I), pedestrians (V2P), networks (V2N), and devices (V2D).

How big is V2X Cybersecurity Market?The Global V2X Cybersecurity Market size is expected to be worth around USD 14.2 Billion By 2033, from USD 2.6 Billion in 2023, growing at a CAGR of 18.5% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the V2X Cybersecurity Market?The key factors driving the growth of the V2X Cybersecurity Market include the rising adoption of connected and autonomous vehicles, increasing government regulations for vehicle safety, the growing threat of cyberattacks on vehicular networks, and advancements in communication technologies.

What are the current trends and advancements in V2X Cybersecurity Market?Current trends and advancements in the V2X Cybersecurity Market include the development of advanced encryption and authentication protocols, integration of artificial intelligence for threat detection, deployment of blockchain technology for secure data exchanges, and increased collaboration between automotive and cybersecurity companies.

What are the major challenges and opportunities in the V2X Cybersecurity Market?Major challenges in the V2X Cybersecurity Market involve managing the complexity of securing vast vehicle-to-everything networks, ensuring interoperability among various communication standards, and maintaining consumer trust. However, opportunities lie in the expanding market for connected vehicles, increased investment in cybersecurity solutions, and the potential for innovation in securing vehicular communication systems.

Who are the leading players in the V2X Cybersecurity Market?Aptiv, Continental AG, ETAS (ESCRYPT), Green Hills Software, HARMAN International, ID Quantique, Infineon Technologies AG, Lear Corporation, NXP Semiconductors, AUTOCRYPT Co., Ltd., DENSO CORPORATION, Autotalks.

-

-

- Aptiv

- Continental AG

- ETAS (ESCRYPT)

- Green Hills Software

- HARMAN International

- ID Quantique

- Infineon Technologies AG

- Lear Corporation

- NXP Semiconductors

- AUTOCRYPT Co.Ltd.

- DENSO CORPORATION

- Autotalks