Global UV Nail Gel Market By Product Type (UV Gel Polish, UV Gel Builder, UV Gel Top Coat, and UV Gel Base Coat), By Chemistry (Methacrylate and Acrylate), By Raw Material (Bio-Based and Petrochemical), By Type (Hard Gel and Soak-Off Gel), By Finishing (Glossy, Glitter, Matte, and Others), By Distribution Channel (Online and Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034.

- Published date: September 2025

- Report ID: 146680

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

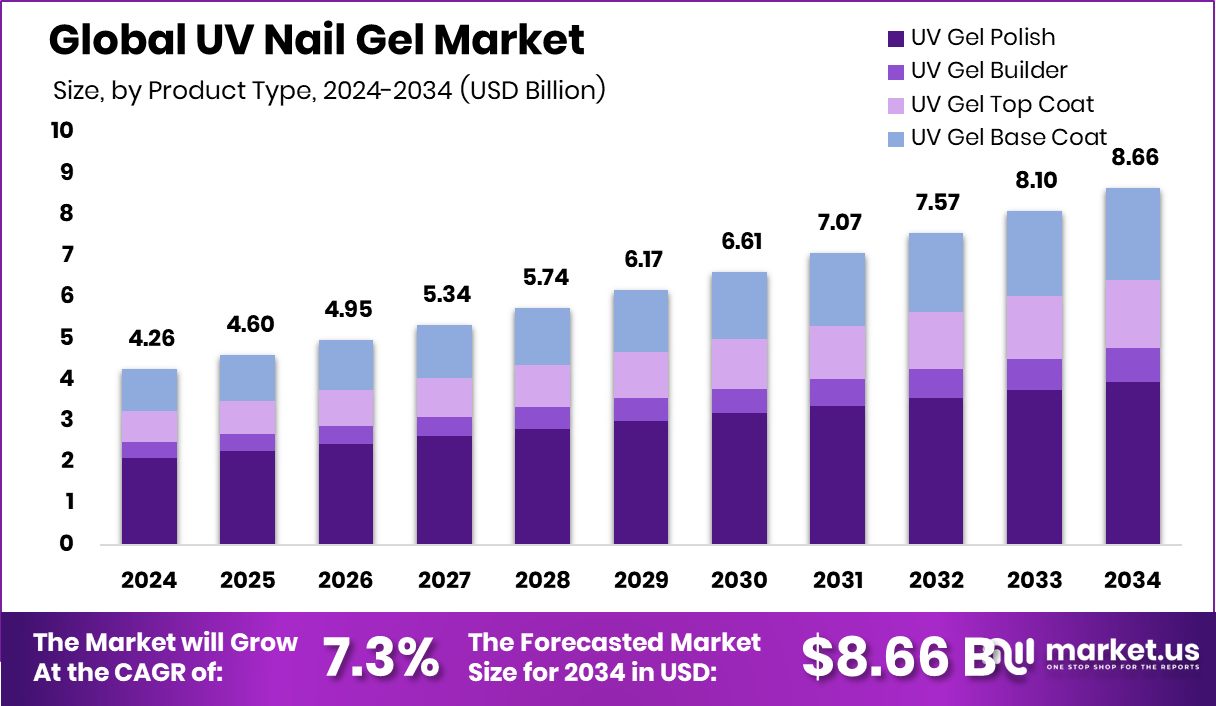

In 2024, the Global UV Nail Gel Market was valued at US$4.26 billion, and between 2025 and 2034, this market is estimated to register a CAGR of 7.3%, reaching about US$8.66 billion by 2034.

UV gel for nails is a type of artificial nail enhancement that hardens or cures when exposed to ultraviolet (UV) light. Unlike traditional nail polish, UV gel requires a curing process under a lamp to harden and bond to the natural nail. The major driver of the UV nail gel is its durability and long-lasting finish, which offers a chip-resistant and glossy manicure that can last for weeks. The at-home or DIY category in the product is gaining popularity in recent years.

As there is a shift in consumer preference towards sustainable products, many brands are aligning themselves with the trend. According to a study by the United States National Institute of Health, the intensity of UV nail lamp devices ranged from 39.0 W/m2 to 184.9 W/m2. Due to the high intensity of these lamps, the market is facing challenges regarding health and safety concerns related to repeated and regular use of UV lamps.

- According to a study by the United States National Institute of Health (NIH), 85% to 90% of women worldwide use nail care products.

Key Takeaways

- The global UV nail Gel market was valued at US$4.26 billion in 2024.

- The global UV nail Gel market is projected to grow at a CAGR of 7.3% and is estimated to reach US$8.66 billion by 2034.

- On the basis of product type, UV gel polish dominated the market with a 49.2% share of the total global market in 2024.

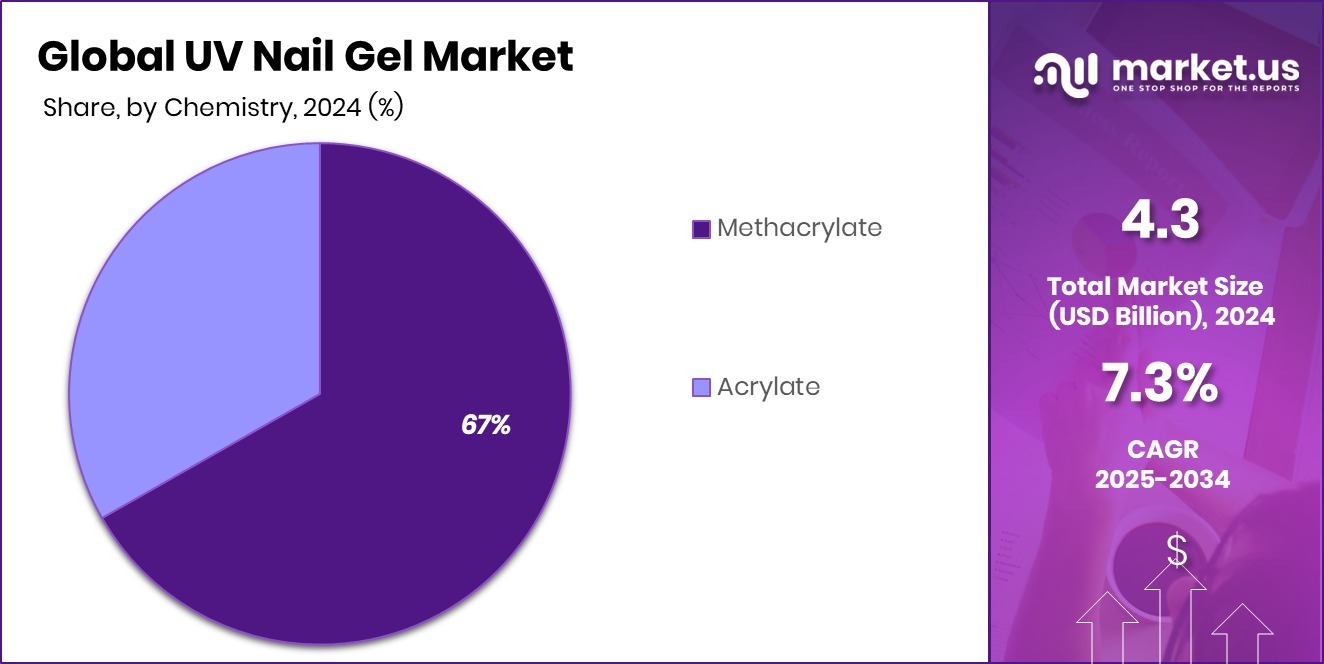

- Based on chemistry, in 2024, methacrylate led the UV nail Gel market with a substantial market share of 66.8%.

- In 2024, petrochemical-based UV nail gel led the market with a considerable market share of 88.3%.

- Soak-off UV nail gel was at the forefront of the market with a market share of 63% in 2024.

- Among the finishing, glossy UV nail Gel led the market with a market share of 48.6% in 2024.

- Offline channels remain the preferred choice among consumers, accounting for the majority market share at 76.5%.

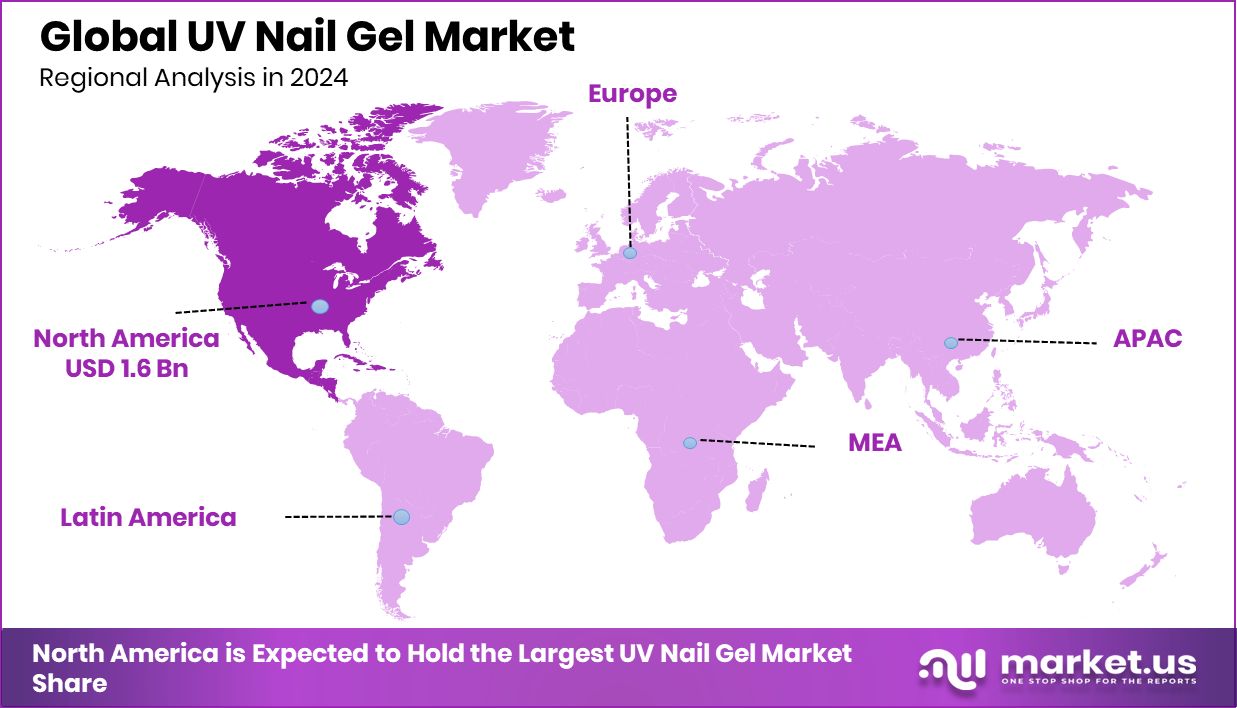

- North America was the biggest market for the UV Nail Gel in 2024, with a market share of 38.3%.

Product Type Analysis

UV Gel Polish Led the UV Nail Gel Market with a Substantial Market Share of 49.2%.

On the basis of product type, it is segmented into UV gel polish, UV gel builder, UV gel top coat, and UV gel base coat. In 2024, UV gel polish led the UV nail Gel market with a substantial 49.2% market share. This leadership is primarily driven by the widespread popularity of gel polish among consumers seeking vibrant colors, long-lasting wear, and salon-quality finishes.

UV gel polish combines ease of use with strong aesthetic appeal, offering a chip-resistant, high-gloss result that lasts up to three weeks, making it a staple in both professional salons and at-home nail kits. Nearly half of UV gel product purchases included at least one color polish, reflecting its central role in the manicure process.

Unlike builder Gel, which is typically used for nail extensions and require more technical skill, gel polish appeals to a broader audience due to its straightforward application and removal. As consumer demand centers around expressive, low-maintenance nail aesthetics, UV gel polish remains the most in-demand product type within the UV nail gel market.

Chemistry Analysis

Methacrylate dominated the UV Nail Gel Market in 2024 with a 66.8% Share of the Total Global Market.

Based on chemistry, the UV nail Gel market is divided into methacrylate and acrylate. In 2024, methacrylate dominated the UV nail Gel market, capturing approximately 66.8% of the total global market share. This dominance is primarily due to methacrylate’s superior performance characteristics, including better adhesion to the natural nail, enhanced durability, and a lower risk of premature lifting or peeling.

Methacrylate compounds, such as hydroxyethyl methacrylate and ethyl methacrylate, are widely used in professional-grade and at-home UV gel systems because they provide a strong yet flexible finish that resists chipping and cracking for up to three weeks. Additionally, methacrylate polymers offer better control during the curing process, minimizing issues like heat spikes and uneven hardening.

While acrylates are still used in certain formulations, particularly for their lower viscosity and cost-effectiveness, they are more prone to causing skin sensitivity and allergic reactions, which has led many brands to shift toward methacrylate-dominant blends.

Raw Material Analysis

Among the Raw Materials, Petrochemical-based UV Nail Gel dominated the Market with an 88.3% Share in 2024.

Based on raw materials, the UV nail Gel market is divided into bio-based and petrochemical. In 2024, petrochemical-based UV nail Gel dominated the global market, accounting for approximately 88.3% of the total share, significantly outperforming bio-based alternatives. This dominance is largely attributed to the established performance, availability, and cost-efficiency of petrochemical-derived ingredients such as methacrylates and acrylates.

Despite growing environmental awareness, the transition to bio-based UV gel formulations has remained slow due to higher production costs, limited raw material sources, and inconsistent performance outcomes.

While bio-based alternatives are emerging, especially among niche eco-conscious consumers, the scale, stability, and performance of petrochemical-based UV Gel ensured their position in the market.

Type Analysis

In 2024, Soak-Off UV Nail Gel Led the Market with a 63% Share of the Total Global Market.

On the basis of type, the UV nail Gel market is divided into hard gel and soak-off gel. In 2024, soak-off UV nail gel led the global market with approximately 63% share, owing to its convenience, ease of removal, and growing popularity among both professionals and DIY users.

Unlike traditional hard Gel, soak-off Gel can be removed without filing or drilling, using acetone-based solutions that gently lift the gel from the nail surface. This feature significantly reduces the risk of nail damage, making soak-off Gel a preferred choice for clients prioritizing nail health.

The product’s versatility also contributes to its dominance; it offers the same high-gloss finish, chip resistance, and long wear as other UV gel types, while being more user-friendly for at-home applications.

Finishing Analysis

The Global UV Nail Gel Market was Dominated by Glossy Gel in 2024.

Based on the finish, the UV nail Gel market is divided into glossy, glitter, matte, and others. In 2024, the global UV nail gel market was dominated by glossy Gel, outperforming glitter and matte finishes with a market share of 48.6%. Glossy Gel remains the most popular choice due to its high-shine finish and classic appeal.

Their smooth, polished look enhances both bold and neutral colors, making them a go-to option for everyday wear and professional settings. Nail technicians favor glossy Gel for their ease of application and ability to hide minor imperfections in the nail surface.

Furthermore, glossy finishes are more durable and resistant to visible wear, maintaining their shine for up to three weeks. In contrast, matte Gel, while trendy, tends to show scratches more easily, and glitter Gel is often reserved for festive or seasonal looks, limiting their appeal for daily use.

Distribution Channel Analysis

Offline Channels Dominated the UV Nail Gel Market with Around 76.5% of the Total Market Share.

The UV nail Gel market is segmented into online and offline channels based on their distribution channels. Offline distribution channels dominated the UV nail Gel market, driven by consumer preference for in-person product evaluation, immediate availability, and professional guidance.

Beauty supply stores, salons, and specialty cosmetic retailers continue to serve as the primary points of purchase for both individual consumers and professionals. Moreover, many licensed nail technicians and salon owners prefer to buy supplies directly from physical distributors or trade shows, where they can explore new products and receive hands-on demonstrations.

Additionally, the trust factor associated with seeing and trying the product before purchase continues to attract first-time buyers. Offline channels also play a critical role in brand visibility, allowing newer or smaller brands to gain exposure through shelf presence.

Key Market Segments

By Product Type

- UV Gel Polish

- UV Gel Builder

- UV Gel Top Coat

- UV Gel Base Coat

By Chemistry

- Methacrylate

- Acrylate

By Raw Material

- Bio-Based

- Petrochemical

By Type

- Hard Gel

- Soak-Off Gel

By Finishing

- Glossy

- Glitter

- Matte

- Others

By Distribution Channel

- Online

- Offline

Drivers

Demand for Longer Lasting and Chip-Resistant Manicures Drives the UV Nail Gel Market.

The growing demand for longer-lasting and chip-resistant manicures is a key factor driving the UV nail Gel market, especially among consumers seeking durability and low maintenance. Traditional nail polishes often chip within 3–5 days, whereas UV gel manicures can last up to three weeks without noticeable wear, making them highly attractive to busy professionals, students, and individuals with active lifestyles.

This trend is further supported by a rise in do-it-yourself (DIY) nail kits, with UV gel starter kits becoming increasingly popular among home users who want salon-like finishes. Social media influencers and beauty bloggers frequently showcase gel nails as part of their beauty routines, normalizing the use of UV Gel for everyday wear. Furthermore, the rise in events, weddings, and photo-centric social culture has encouraged people to invest in manicures that last longer and maintain a polished look over time.

Restraints

Health And Safety Concerns Related To UV Exposure Might Pose a Challenge to the Market.

Health and safety concerns related to UV exposure present a significant challenge to the UV nail gel market, particularly as awareness grows around the potential risks associated with repeated use of UV lamps. UV lamps used in curing gel nails emit UVA radiation, which penetrates deep into the skin and has been linked to premature aging and, in rare cases, increased skin cancer risk.

A study published in 2023 found that UV-nail dryers can cause DNA damage and mutations in human skin cells, raising public concern. Although the exposure levels during a typical gel manicure are low, dermatologists and health experts have recommended protective measures, such as applying broad-spectrum sunscreen to hands or using UV-protective gloves during treatments. These precautions are becoming more common, especially among health-conscious consumers.

Some brands have begun promoting LED-curing Gel, which use a different light spectrum and cure faster, potentially reducing exposure time. However, confusion between UV and LED systems often leads to mistrust or hesitancy among consumers. These health-related concerns may influence purchasing decisions and push the industry to further innovate in safety and transparency.

Opportunity

Growth of the At-Home Segment Creates Opportunities in the UV Nail Gel Market.

The growth of the at-home segment has opened new opportunities in the UV nail gel market, driven by increasing consumer interest in self-care, convenience, and cost savings. With the rise of DIY beauty routines, many individuals have invested in at-home UV gel kits, including portable UV lamps, gel polish sets, and nail care tools.

Influencers on platforms have accelerated this trend by posting tutorials that demystify the process, encouraging beginners to try gel applications themselves. Popular brands such as Beetles, Modelones, and Gellen have expanded their product ranges to meet this demand, offering beginner-friendly kits and non-toxic formulas designed for home use.

Moreover, improvements in product formulations, such as odorless Gel, peel-off bases, and LED-compatible Gel, have made at-home manicures safer and more accessible. This growing segment provides significant opportunities for brands to innovate, educate, and build loyalty among DIY beauty enthusiasts.

Trends

Shift Towards Sustainability.

The shift towards sustainability is an ongoing trend in the UV nail gel market, as consumers become increasingly aware of the environmental and health impacts of beauty products. Traditional UV nail Gel often contain harsh chemicals such as toluene, formaldehyde, and dibutyl phthalate (DBP), which have raised concerns about toxicity and long-term exposure risks. Brands are reformulating their products to be 3-free, 5-free, or 10-free, indicating the absence of several harmful ingredients.

In 2024, 74% of consumers consider organic ingredients important in personal care products. Additionally, sustainable packaging, such as recyclable glass bottles and minimal plastic use, is gaining popularity, with companies like Madam Glam and Bio Seaweed Gel leading the way in offering vegan, cruelty-free, and non-toxic gel polish lines. The use of LED lamps, which consume less energy and cure nails faster than traditional UV lamps, also aligns with this eco-conscious shift.

As nail salons and at-home users alike begin to prioritize safety and sustainability, demand is rising for cleaner formulations and ethical practices, making sustainability a core element of product innovation in the UV nail gel market.

Geopolitical Impact Analysis

Geopolitical Tensions Disrupt the Supply Chains, leading to Increased Prices of Supplements and Raw Materials.

Geopolitical tensions significantly impact the UV nail gel market by disrupting supply chains, increasing production costs, and affecting international trade policies. Several UV nail gel products rely on raw materials like photo initiators and acrylates, which are primarily sourced from countries such as China and South Korea. Political disputes or trade restrictions, such as the U.S.-China tariff conflicts, lead to delays, shortages, and price hikes in these critical inputs.

For instance, during periods of heightened U.S.-China tensions, several beauty brands reported shipping delays and increased customs scrutiny, forcing some manufacturers to shift production to other countries, which often results in increased lead times and higher costs.

Additionally, sanctions or export restrictions imposed by Western countries on nations like Russia or affected regions in Eastern Europe can limit access to specialty chemicals used in UV gel formulas. Global transportation disruptions caused by conflicts, such as the Russia-Ukraine war or instability in the South China Sea, have also led to increased freight costs and longer delivery times.

Regional Analysis

North America Held the Largest Share of the Global UV Nail Gel Market.

North America was the dominating region of the Global UV Nail Gel Market, holding about 38.3%, valued at approximately US$1.6 billion. The dominance of the region is attributed to a combination of high consumer awareness, strong demand for professional beauty services, and widespread adoption of nail care trends.

According to the United States Department of Toxic Substances Control, over 100 million US women use nail products regularly, with UV gel manicures becoming a preferred option for their long-lasting and chip-resistant qualities. Additionally, the region has a dense network of nail salons and licensed technicians, with more than 400,000 nail technicians in the U.S., a large portion of whom offer UV gel services.

Consumer preference for premium and long-lasting nail treatments, along with innovations in non-toxic and quick-curing UV gel formulas, further fuel market dominance. Moreover, the presence of leading cosmetic brands headquartered in North America has enabled faster product innovation and accessibility, solidifying the region’s leading position in the UV nail Gel market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Wella Company (O.P.I.), Keystone Industries, MOe Beauty Group, CND, Chemence, MissGel, MT Chemical, Vendeeni, Gelco Labs, SMC Manufacturing, and P&D are the key players in the global UV Nail Gel market. As the UV Nail Gel market is very competitive, many players try to gain a competitive edge by engaging in strategic activities, such as product development, mergers, partnerships, and investments

Top Key Players in the Market

- Wella Company (O.P.I)

- Keystone Industries

- MOe Beauty Group GmbH & Co. KG

- CNC International BV

- CND

- SK UV Gele GmbH

- Chemence (Chemence Cosmetics)

- MissGel

- MT Chemical

- Guangzhou RONIKI Beauty Supplies Co., Ltd.

- ICE NOVA

- VENDEENI

- Gelco Labs Inc.

- SMC Manufacturing

- Guangdong Baizhilin New Material Technology Co., Ltd.

- P&D

- Other Key Players

Recent Developments

- In July 2025, OPI launched its first at-home gel polish system, GELement, which comes in 30 shades, and the collection includes a no-wipe top coat and easy-to-use LED lamp.

- In September 2024, CND announced the launch of five shades of its innovative PLEXIGEL Colour Builder line, which are designed to be universally flattering, complement a diverse range of skin tones, and appeal to a broad spectrum of clientele.

Report Scope

Report Features Description Market Value (2024) USD 4.26 Billion Forecast Revenue (2034) USD 8.66 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (UV Gel Polish, UV Gel Builder, UV Gel Top Coat, UV Gel Base Coat), By Chemistry (Methacrylate, Acrylate), By Type (Hard Gel, Soak-Off Gel), By Finishing (Glossy, Glitter, Matte, Others), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Wella Company (O.P.I), Keystone Industries, MOe Beauty Group GmbH & Co. KG, CNC International BV, CND, SK UV Gele GmbH, Chemence (Chemence Cosmetics), MissGel, MT Chemical, Guangzhou RONIKI Beauty Supplies Co., Ltd., ICE NOVA, VENDEENI, Gelco Labs Inc., SMC Manufacturing, Guangdong Baizhilin New Material Technology Co., Ltd., P&D, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Wella Company (O.P.I)

- Keystone Industries

- MOe Beauty Group GmbH & Co. KG

- CNC International BV

- CND

- SK UV Gele GmbH

- Chemence (Chemence Cosmetics)

- MissGel

- MT Chemical

- Guangzhou RONIKI Beauty Supplies Co., Ltd.

- ICE NOVA

- VENDEENI

- Gelco Labs Inc.

- SMC Manufacturing

- Guangdong Baizhilin New Material Technology Co., Ltd.

- P&D

- Other Key Players