USA Baby Personal Care Products Market Size, Share, Growth Analysis By Nature (Organic/Natural, Synthetic), By Product Type (Skin Care, Hair Care, Toiletries, Others), By Age Group (0 to 6 Months, 6 to 12 Months, 12 το 24 Months, 25 Months and Above), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169363

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

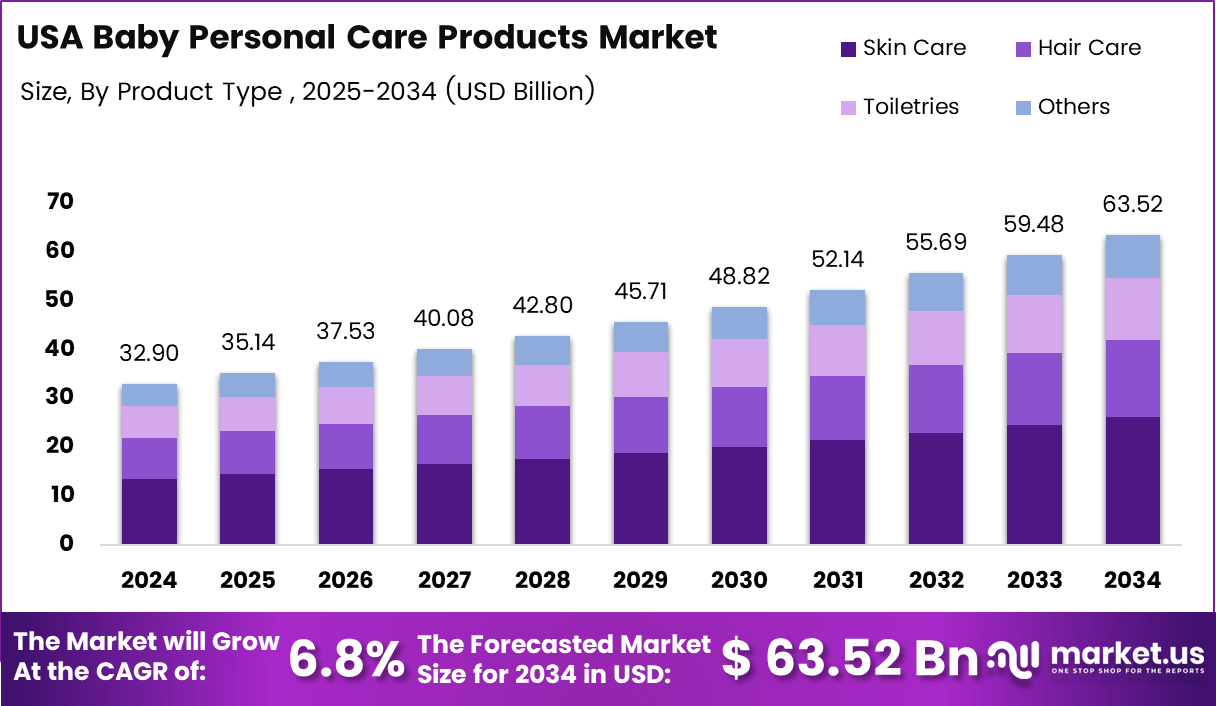

The USA Baby Personal Care Products Market size is expected to be worth around USD 63.52 billion by 2034, from USD 32.9 billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

The USA baby personal care products market reflects steady expansion as parents increasingly prioritize clean, safe, and skin-friendly solutions. Growing awareness of baby hygiene encourages manufacturers to upgrade formulations, packaging, and safety standards. Moreover, rising incomes and evolving parenting behaviors continue shaping long-term consumption patterns across essential grooming, cleansing, and skincare categories.

Additionally, expanding digital access transforms purchasing decisions as caregivers rely on trusted recommendations and ingredient transparency. Retailers benefit from omnichannel adoption that strengthens product discovery and brand loyalty. With rising focus on dermatologically tested essentials, demand for gentle lotions, wipes, washes, and protective creams accelerates across both new families and established households.

Meanwhile, market opportunities strengthen as government initiatives encourage product safety compliance, sustainable packaging, and regulated ingredient disclosure. Regulatory guidance enhances consumer confidence and motivates companies to introduce innovative, eco-aligned offerings. Furthermore, support for family-wellness programs and maternal-child health frameworks contributes positively to category development across the United States.

Moreover, community-driven efforts reinforce market trust by highlighting values of safety, responsibility, and long-term commitment. According to Brand Survey, the category remains chosen by millions for 60+ years for comfort, dryness, and protection. Transitioning to social impact, Honest Baby Product reports 20,000 volunteer hours supporting donation drives, meal services, and cleanups.

Likewise, nonprofit partnerships amplify product accessibility nationwide. According to company disclosures, more than 30 million essential and clean-beauty baby care products have been donated to families in need. These initiatives enhance market reliability while supporting sustainable consumption trends and strengthening household confidence, creating strong pathways for future growth across the USA baby personal care products market.

Key Takeaways

- The USA Baby Personal Care Products Market is projected to grow from USD 32.9 billion in 2024 to USD 63.52 billion by 2034 at a CAGR of 6.8%.

- Organic/Natural segment leads the By Nature category with a dominant share of 62.3% in 2024.

- Skin Care is the top By Product Type segment, accounting for a notable 41.2% share in 2024.

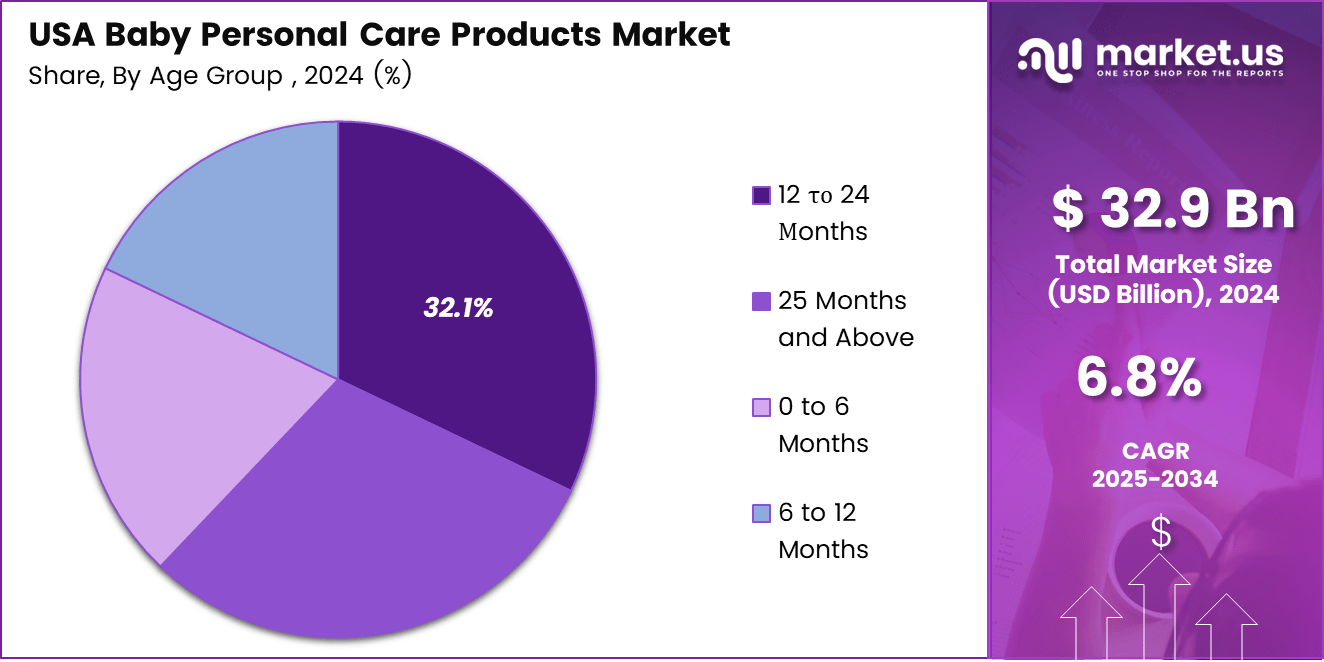

- The 12 to 24-month age group dominates consumption patterns with a 32.1% share in 2024.

- Hypermarkets/Supermarkets hold the highest distribution share at 44.7% in 2024 across the USA market.

- North America remains the largest regional contributor with strong market strength reflected in its 46.3% leadership.

By Nature Analysis

Organic/Natural dominates with 62.3% due to rising preference for gentle and safe formulations.

In 2024, Organic/Natural held a dominant market position in the By Nature segment of the USA Baby Personal Care Products Market, with a 62.3% share. Parents increasingly choose plant-based options to reduce exposure to harsh chemicals. This segment grows as caregivers prioritize dermatologically safe, eco-friendly, and hypoallergenic baby essentials.

Synthetic held a steady market presence in the By Nature segment. This category continues evolving as brands redesign formulations to meet safety expectations. Synthetic options remain relevant because they provide stable performance, longer shelf life, and affordability, supporting a wide population seeking functional personal care solutions for babies across diverse needs. By Product Type Analysis

Skin Care dominates with 41.2% due to increasing demand for moisturizers, lotions, and protective creams.

In 2024, Skin Care held a dominant market position in the By Product Type segment of the USA Baby Personal Care Products Market, with a 41.2% share. Parents prioritize skin hydration and barrier protection, driving demand for creams, balms, and safe formulations. This segment expands alongside rising awareness of infant dermatological wellness.

Hair Care sustained notable demand in the By Product Type segment. Parents prefer mild shampoos and scalp-friendly cleansers that help maintain hygiene without irritation. The segment grows as brands introduce tear-free, pH-balanced, and hypoallergenic solutions designed for delicate baby hair, supporting daily grooming routines across households.

Toiletries maintained a stable role in the By Product Type segment. This includes essential everyday items contributing to hygiene and comfort. The segment benefits from increased product innovation, improved packaging formats, and convenient bundles that support parents seeking reliable and easy-to-use personal care products for infants.

Others contributed meaningfully to the By product type segment. This category includes supportive daily-care items that enhance baby comfort. The segment gradually evolves as brands diversify offerings to address specific needs, encouraging parents to adopt complementary solutions beyond core personal care essentials across varied age groups.

By Age Group Analysis

12 to 24 Months dominate with 32.1% due to increasing product usage as mobility and daily routines expand.

In 2024, 0 to 6 Months remained an essential segment in the By Age Group category of the USA Baby Personal Care Products Market. This group requires gentle, fragrance-free products supporting newborn skin. Parents rely on safe cleansing and moisturizing routines, driving consistent adoption across hospitals, households, and caregiver environments.

6 to 12 Months continued to experience growing engagement in the By Age Group segment. As infants begin exploration, the need for hygiene, bathing, and skincare frequency increases. Brands introduce age-appropriate formulations designed to protect sensitive skin while supporting healthy development and daily grooming practices.

12 to 24 Months held a dominant market position in the By Age Group segment of the USA Baby Personal Care Products Market, with a 32.1% share. Rising physical activity and outdoor exposure increase product usage. Parents adopt more diverse care routines as toddlers require stronger hygiene and specialized skincare support.25 Months and Above contributed steadily to the By Age Group segment. Children in this range transition toward independent routines, increasing demand for mild, safe, and easy-to-use personal care solutions. This segment expands as parents seek continuity in gentle product choices even beyond infancy.

By Distribution Channel Analysis

Hypermarkets/Supermarkets dominate with 44.7% due to wide accessibility and strong product assortment.

In 2024, Hypermarkets/Supermarkets held a dominant market position in the USA baby personal care products market by distribution channel, with a 44.7% share. Parents prefer these outlets for convenience, variety, and immediate product availability. Strong retail presence encourages repeat purchases and supports brand visibility across regions.

Specialty Stores maintained a solid role in the By Distribution Channel segment. These outlets attract parents seeking curated, premium, and natural offerings tailored for infant care. Enhanced in-store guidance and brand-specific experiences strengthen consumer trust, helping specialty channels sustain relevance in evolving purchasing behaviors.

Others contributed consistently to the By Distribution Channel segment. This category includes online platforms and alternative retail formats that continue gaining traction. Convenience, subscription models, and home delivery options drive adoption, especially among busy parents prioritizing ease, reliability, and flexible purchase planning for baby personal care products.

Key Market Segments

By Nature

- Organic/Natural

- Synthetic

By Product Type

- Skin Care

- Hair Care

- Toiletries

- Others

By Age Group

- 0 to 6 Months

- 6 to 12 Months

- 12 το 24 Months

- 25 Months and Above

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Others

Drivers

Rising Consumer Preference for Dermatologist-Tested and Pediatric-Approved Baby Formulations Drives Market Growth

Parents in the USA increasingly prefer dermatologist-tested and pediatric-approved baby formulations, encouraging brands to improve product safety. This trend strengthens trust and supports consistent usage across newborn and infant categories. As safety standards rise, companies introduce gentler and clinically validated options that improve market acceptance.

Multifunctional baby personal care products offering hydration, cleansing, and skin-barrier support also shape growth. Parents value simple routines, and multi-benefit solutions help reduce the number of products used daily. This shift supports time-saving grooming habits while expanding opportunities for brands introducing advanced, science-backed formulations.

Millennial parenting trends further influence the market, with strong demand for ingredient transparency and safe, toxin-free options. Parents now research labels before purchasing, increasing accountability among manufacturers. This behavioral shift pushes companies to adopt cleaner formulations and improve communication about product safety and sourcing.

Premium baby grooming and hygiene routines also expand across urban households. Higher spending capacity and lifestyle upgrades encourage the adoption of enhanced personal care essentials. Parents invest more in high-quality skincare products, hair care, and toiletries designed to offer added comfort and protection, boosting premium product penetration.

Restraints

Limited Product Accessibility in Rural and Underserved Retail Environments Restrains Market Expansion

Limited product access in rural and underserved retail areas continues to restrict market growth. Many households rely on general stores with limited assortments, reducing exposure to specialized baby care categories. This gap constrains brand reach and slows the adoption of dermatologist-tested and premium products.

Supply chain volatility also affects the availability of natural and plant-based raw materials. Weather fluctuations, global sourcing barriers, and higher transportation costs disrupt production cycles. These challenges affect product consistency and create delays, limiting the ability of manufacturers to maintain stable supply levels.

Rising scrutiny over preservatives and chemical additives increases reformulation expenses. Companies must redesign formulations to meet stricter safety expectations, raising production and testing costs. These efforts often extend launch timelines and pressure profit margins, especially for smaller brands facing regulatory and compliance complexity.

Growth Factors

Development of Microbiome-Friendly Baby Skincare Drives New Growth Opportunities

Microbiome-friendly baby skincare creates strong growth opportunities as research highlights the role of beneficial bacteria in infant skin health. Brands develop formulations that support protective microbial balance, attracting parents seeking science-backed and gentle skincare innovations. This emerging space improves long-term product differentiation.

Subscription-based baby care bundles also expand as convenience-focused parents prefer auto-replenishment services. These models reduce shopping frequency and ensure an uninterrupted supply of essential baby products. Companies benefit from predictable revenue streams and deeper customer loyalty through curated monthly packs.

Growing adoption of baby-specific sun care and outdoor protection products also opens new opportunities. Parents now emphasize UV protection and skin safety during outdoor routines. This trend expands demand for gentle sunscreens, balms, and repellents specifically designed for infants and toddlers.

AI-guided personalized baby care recommendations offer another promising area. Tools analyzing skin conditions and usage patterns help parents choose optimal products. This digital shift allows brands to deliver tailored experiences, increasing engagement and long-term customer retention.

Emerging Trends

Surge in TikTok and Instagram Parenting Communities Shapes Market Trends

Parenting communities on TikTok and Instagram strongly influence baby care product visibility. Viral recommendations and real-life demonstrations drive rapid brand discovery. Parents increasingly rely on social validation, accelerating trends around dermatologist-tested, gentle, and transparent baby formulation choices.

Waterless and concentrated baby care formats gain traction as sustainability becomes important for modern households. These products reduce packaging waste and support eco-conscious parenting. Lightweight and travel-friendly formats also appeal to busy families, encouraging wider adoption across urban markets.

Hypoallergenic and fragrance-free product lines continue rising in popularity, especially for sensitive-skin infants. Parents prefer irritation-free options that minimize allergic reactions. This growing awareness encourages brands to expand gentle and minimal-ingredient formulations, reinforcing trust in safety-focused baby care ranges.

Key USA Baby Personal Care Products Market Company Insights

The USA Baby Personal Care Products Market in 2024 reflects a competitive landscape shaped by innovation, trust-building, and shifts toward cleaner, dermatologist-approved formulations.

Johnson & Johnson is expected to maintain strong traction due to its long-standing consumer trust and continued focus on sensitive-skin baby products. Its efforts toward ingredient transparency and updated hypoallergenic formulations further strengthen its market relevance.

Procter & Gamble continues to gain visibility through diversified baby hygiene portfolios and consistent product upgrades. Its emphasis on premium care, moisture-lock technologies, and sustainable packaging supports adoption among modern urban parents seeking multifunctional solutions.

Unilever demonstrates steady progress by enhancing its baby personal care offerings with plant-based, pH-balanced formulations tailored for daily care. Its brand positioning around gentle cleansing and ethical sourcing aligns with rising clean-label expectations.Kimberly-Clark Corporation remains a dominant hygiene-focused participant through innovations in baby wipes and grooming essentials. Its distribution strength across mass retail and online platforms enables higher household penetration, particularly for fragrance-free and dermatologist-tested products.

Beiersdorf AG focuses on skin-science-driven baby moisturization and barrier-repair products suitable for sensitive skin.Burt’s Bees benefits from strong demand for natural baby balms, washes, and lotions made from botanical ingredients. Marks & Spencer continues to serve niche premium shoppers through gentle, allergen-free baby skincare lines. Pigeon expands its presence through mild cleansers and grooming accessories tailored to newborn care. Danone S.A. influences adjacent baby wellness categories that complement personal care routines. Farlin Infant Products Corp. builds relevance through safe, daily-use baby accessories paired with gentle cleansing products, reinforcing consumer trust across early growth stages.

Top Key Players in the Market

- Johnson & Johnson

- Procter & Gamble

- Unilever

- Kimberly-Clark Corporation

- Beiersdorf AG

- Burt’s Bees

- Marks & Spencer

- Pigeon

- Danone S.A.

- Farlin Infant Products Corp.

Recent Developments

- In Oct 2025, Teletrac Navman, a Vontier company and leading connected mobility platform, was named “Vehicle Telematics Solution of the Year” at the 6th annual AutoTech Breakthrough Awards.The recognition highlights Teletrac Navman’s leadership in automotive and transportation technology, honoring innovation across global telematics solutions.

- In Dec 2025, shares of Blue Cloud Softech Solutions rose by 3% to ₹25.20 following the announcement of a strategic MoU with ConnectM Technology Solutions.The collaboration focuses on jointly developing a semiconductor based EdgeAI System on Chip (SoC) for advanced automotive cybersecurity applications.

Report Scope

Report Features Description Market Value (2024) USD 32.9 Billion Forecast Revenue (2034) USD 63.52Billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic/Natural, Synthetic), By Product Type (Skin Care, Hair Care, Toiletries, Others), By Age Group (0 to 6 Months, 6 to 12 Months, 12 το 24 Months, 25 Months and Above), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Others) Competitive Landscape Johnson & Johnson, Procter & Gamble, Unilever, Kimberly-Clark Corporation, Beiersdorf AG, Burt’s Bees, Marks & Spencer, Pigeon, Danone S.A., Farlin Infant Products Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  USA Baby Personal Care Products MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

USA Baby Personal Care Products MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Johnson & Johnson

- Procter & Gamble

- Unilever

- Kimberly-Clark Corporation

- Beiersdorf AG

- Burt's Bees

- Marks & Spencer

- Pigeon

- Danone S.A.

- Farlin Infant Products Corp.