US Tennis Equipment Market Size, Share, Growth Analysis By Product (Shoes, Apparel, Racquets, Ball, Strings, Bags, Accessories), By Material (Graphite Composite, Carbon Fiber, Natural Rubber, Recycled Materials), By Buyer Type (Individual Players, Institutional Buyers), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173964

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

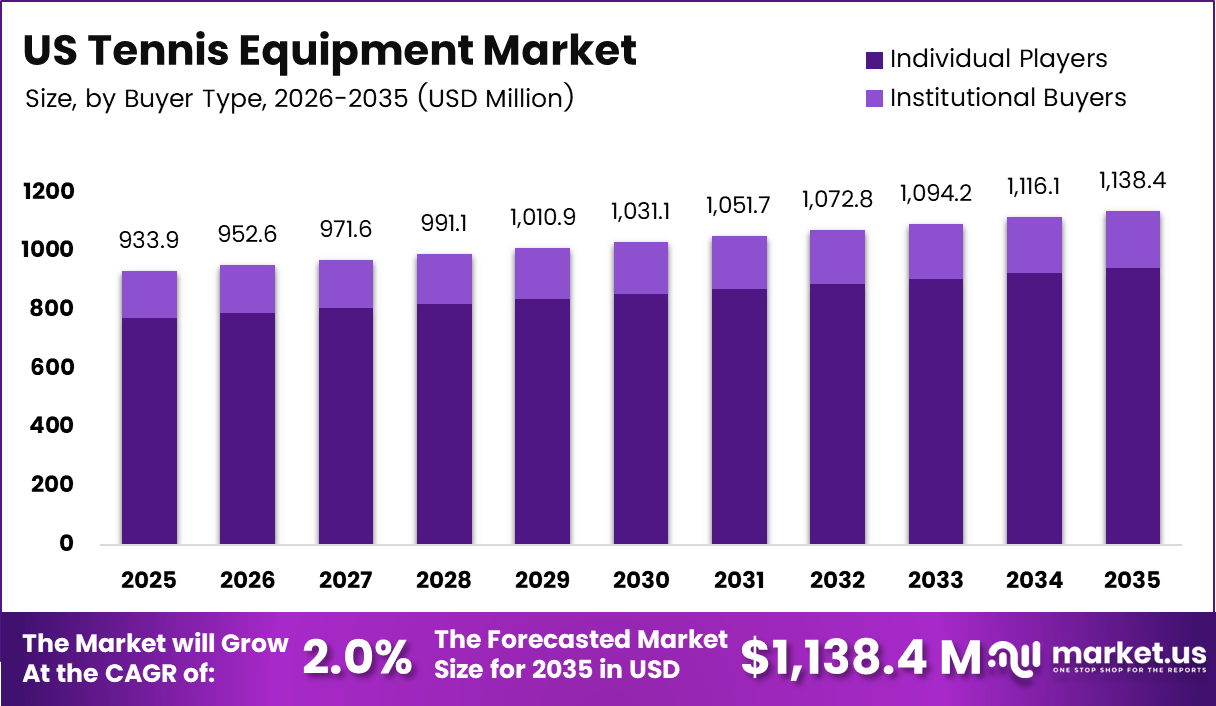

The US Tennis Equipment Market size is expected to be worth around USD 1,138 million by 2035, from USD 933.9 million in 2025, growing at a CAGR of 2% during the forecast period from 2026 to 2035.

The US Tennis Equipment Market represents the commercial ecosystem supporting tennis participation, training, and competition nationwide. It includes racquets, balls, footwear, apparel, strings, and accessories used across recreational and professional levels. Consequently, the market reflects participation trends, product innovation, and compliance with sport governing standards influencing purchase decisions.

From a growth perspective, rising health awareness and organized sports participation continue strengthening equipment demand. Moreover, school level programs, community courts, and private clubs increasingly promote tennis engagement. As a result, consistent replacement cycles for consumables and performance gear support stable market expansion across urban and suburban regions.

In parallel, evolving player preferences create meaningful opportunities for product differentiation and premiumization. Manufacturers increasingly focus on lightweight construction, ergonomic designs, and durability improvements. Therefore, innovation aligned with player comfort, injury prevention, and performance consistency remains a key transactional driver within the US Tennis Equipment Market.

Government involvement further supports market momentum through infrastructure development and grassroots initiatives. Public investment in court renovation, youth sports funding, and community recreation facilities expands access. Additionally, regulatory oversight from sports authorities ensures standardized equipment usage, reinforcing consumer confidence and maintaining fair play across organized competitions.

Regulations and technical standards shape product specifications and quality benchmarks. Governing bodies mandate precise dimensions, materials, and performance characteristics. Consequently, compliance requirements influence manufacturing processes, testing protocols, and certification costs, while also protecting players and preserving consistency across professional and amateur tennis environments.

According to International Tennis equipment study, traditional wooden racquets historically weighed between 370–430g, while modern composite structures maintain stiffness at weights slightly above 200g. High street retailers offer racquets near 200g, whereas professional players typically prefer around 300g or heavier for enhanced control.

According to ITF Rules of Tennis, approved tennis balls must measure 2.57–2.7 inches in diameter, weigh 1.98–2.10 ounces, and bounce between 53–58 inches when dropped from 100 inches. Furthermore, manufacturer guidelines generally recommend racquet string tension within 50–60 pounds, balancing power, durability, and shot precision.

Key Takeaways

- The US Tennis Equipment Market is projected to reach USD 1,138 million by 2035, growing from USD 933.9 million in 2025 at a CAGR of 2%.

- Shoes represent the leading product segment with a dominant share of 34.8%, driven by safety, comfort, and frequent replacement demand.

- Carbon Fiber dominates the material segment, accounting for 47.4%, supported by its lightweight strength and performance advantages.

- Individual Players constitute the largest buyer group with a share of 82.9%, reflecting widespread personal equipment ownership.

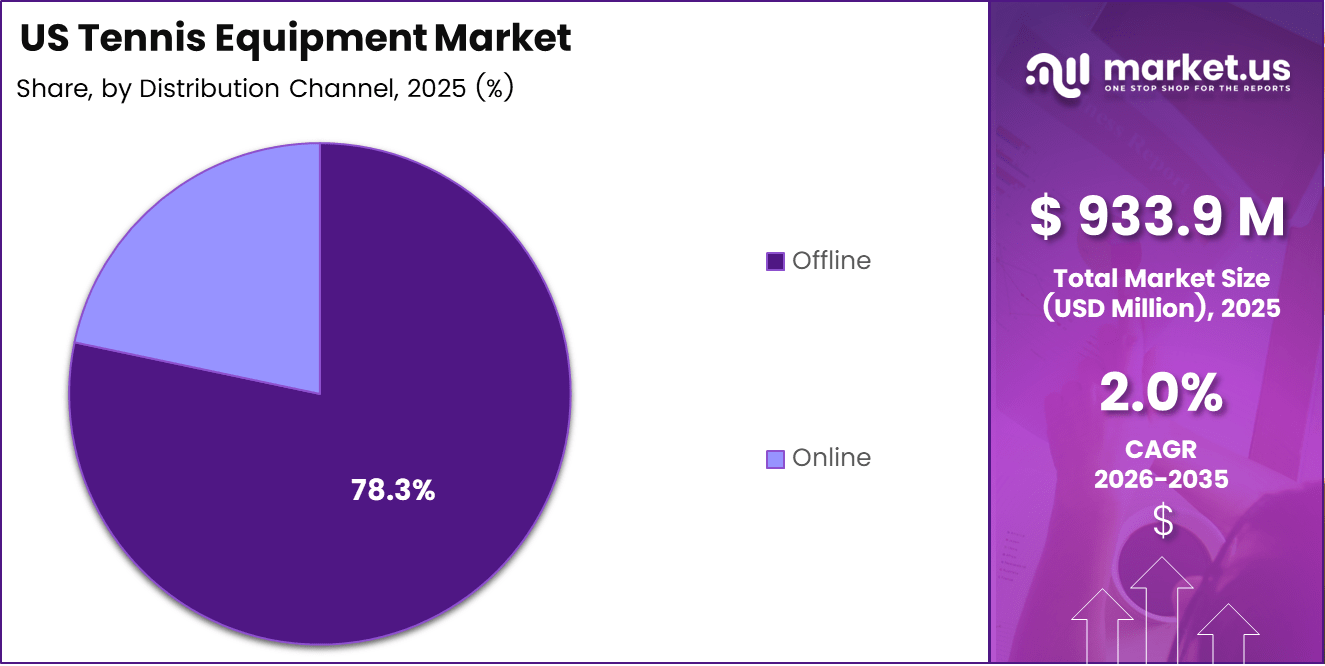

- Offline distribution channels lead the market with 78.3%, as consumers prefer physical trials and expert guidance.

- North America remains the core regional market, with the US acting as the primary contributor to overall revenue and participation levels.

By Product Analysis

Shoes dominate with 34.8% due to their essential role in player safety, comfort, and on-court performance.

In 2025, Shoes held a dominant market position in the By Product Analysis segment of the US Tennis Equipment Market, with a 34.8% share. Shoes remain critical as players prioritize injury prevention, grip, and court specific traction. Moreover, frequent wear and tear encourages repeat purchases across recreational and competitive users.

Apparel demand remains steady as players increasingly value breathable fabrics, ergonomic fits, and climate adaptability. Consequently, apparel supports both performance and lifestyle usage, benefiting from tennis inspired athleisure trends. Transitioning consumer preferences toward comfort driven sportswear sustain consistent replacement cycles.

Racquets continue driving performance oriented purchases as players seek control, power balance, and vibration reduction. Therefore, material innovation and customization options influence buying decisions. Racquets often reflect skill progression, prompting upgrades as players advance in training or competition.

Balls generate recurring demand due to limited durability and regulation driven usage standards. Similarly, Strings require frequent replacement as tension degrades over time. Bags and Accessories support storage, convenience, and personalization needs, complementing core equipment purchases and enhancing overall playing experience.

By Material Analysis

Carbon Fiber dominates with 47.4% due to its superior strength to weight ratio and performance consistency.

In 2025, Carbon Fiber held a dominant market position in the By Material Analysis segment of the US Tennis Equipment Market, with a 47.4% share. This material enables lightweight yet stiff structures, enhancing control and swing speed. Consequently, performance focused products increasingly rely on carbon fiber integration.

Graphite Composite remains widely adopted due to its balance between durability, flexibility, and cost efficiency. Moreover, manufacturers leverage composite layering to fine tune racquet responsiveness. This material supports broad adoption across beginner, intermediate, and advanced playing categories.

Natural Rubber continues supporting ball manufacturing due to its elasticity and rebound consistency. Therefore, compliance with bounce and durability standards sustains its relevance. Natural rubber also aligns with traditional manufacturing practices trusted by governing bodies.

Recycled Materials gain traction as sustainability considerations influence purchasing behavior. Subsequently, eco conscious consumers encourage brands to incorporate recycled plastics and fibers, particularly in bags, apparel, and accessories, supporting environmental responsibility without compromising functional performance.

By Buyer Type Analysis

Individual Players dominate with 82.9% driven by widespread recreational participation and personal equipment ownership.

In 2025, Individual Players held a dominant market position in the By Buyer Type Analysis segment of the US Tennis Equipment Market, with a 82.9% share. Personal ownership remains common as players prefer customized gear suited to skill level and playing style.

Institutional Buyers include schools, academies, clubs, and recreational facilities. These buyers focus on bulk purchases, durability, and compliance standards. Although smaller in share, institutional demand supports stable baseline volumes and long term replacement contracts.

By Distribution Channel Analysis

Offline dominates with 78.3% as consumers prefer physical evaluation and expert guidance before purchase.

In 2025, Offline held a dominant market position in the By Distribution Channel Analysis segment of the US Tennis Equipment Market, with a 78.3% share. Specialty sports stores allow product trials, fitting services, and professional recommendations, enhancing buyer confidence.

Online channels continue expanding through convenience, wider selection, and competitive pricing. Gradually, digital platforms support repeat purchases of consumables and accessories. Improved logistics and return policies further strengthen online adoption, particularly among experienced players.

Top Key Players in the Market

By Product

- Shoes

- Apparel

- Racquets

- Ball

- Strings

- Bags

- Accessories

By Material

- Graphite Composite

- Carbon Fiber

- Natural Rubber

- Recycled Materials

By Buyer Type

- Individual Players

- Institutional Buyers

By Distribution Channel

- Offline

- Online

Drivers

Rising Participation in Recreational and Competitive Tennis Drives Market Growth

Rising participation in recreational and competitive tennis across urban and suburban regions continues to support steady demand for tennis equipment in the US. Community courts, local clubs, and fitness focused housing developments increasingly promote tennis as a social and wellness activity. This wider access encourages first time players to invest in basic gear and regular players to upgrade equipment over time.

Increased consumer spending on premium performance oriented racquets, footwear, and apparel also acts as a strong growth driver. Players show higher awareness of comfort, injury prevention, and performance benefits linked to advanced materials and ergonomic designs. As a result, consumers increasingly prefer branded products positioned around durability and playability.

Professional tennis tournaments and athlete endorsements strongly influence buying behavior. Major US based tournaments create seasonal demand spikes, while endorsements shape preferences toward specific racquet models, shoes, and apparel styles. Amateur players often follow professional trends to replicate playing styles.

The expansion of tennis programs in schools, colleges, and private sports academies further strengthens long term demand. Structured coaching programs increase equipment standardization and recurring purchases, supporting consistent market growth.

Restraints

High Replacement Cost of Advanced Tennis Equipment Limits Market Expansion

High replacement costs of advanced tennis equipment remain a key restraint in the US market. Premium racquets, specialized footwear, and performance apparel often come with higher price tags. This limits frequent upgrades, especially among recreational and budget conscious players who extend usage cycles.

Advanced materials and technology based features increase product prices and reduce affordability. Players may delay replacements until equipment performance significantly declines. This behavior slows repeat purchase rates and affects volume growth in higher priced segments.

Competition from alternative fitness and racquet sports also reduces overall tennis engagement. Sports such as pickleball, badminton, and general fitness activities compete for time and spending. These alternatives often require lower equipment investment, making them attractive to casual players.

Younger consumers also show diversified sports interests, which spreads discretionary spending across multiple activities. This reduces consistent commitment to tennis equipment purchases and creates pressure on long term demand stability.

Growth Factors

Growing Adoption of Smart Racquets Creates New Growth Opportunities

Growing adoption of smart and sensor integrated tennis racquets presents strong future opportunities. Performance tracking features help players analyze swing speed, impact points, and consistency. This technology driven feedback appeals to both competitive amateurs and training focused recreational players.

Expansion of direct to consumer sales channels by manufacturers further improves market reach. Online platforms allow brands to control pricing, launch limited editions, and offer better product education. This improves customer engagement and increases conversion rates.

Demand for customized and personalized tennis gear continues to rise among amateur players. Custom grip sizes, string tension options, and personalized apparel designs enhance player comfort and brand loyalty. Personalization also supports premium pricing strategies.

Sustainable and eco friendly materials create additional growth potential. Environmentally conscious consumers increasingly prefer recycled fabrics, bio based grips, and durable materials, encouraging innovation and differentiation.

Emerging Trends

Shift Toward Lightweight Racquet Technologies Shapes Market Trends

A strong shift toward lightweight and vibration dampening racquet technologies defines current market trends. Players prefer racquets that reduce arm strain while maintaining control and power. This trend supports ongoing material innovation and product upgrades.

Pickleball inspired hybrid equipment influences tennis gear design. Elements such as compact frames and comfort focused grips gradually appear in tennis products, attracting crossover players and expanding the consumer base.

Use of data analytics and mobile apps alongside tennis equipment continues to increase. Players combine smart devices with training apps to monitor progress and set performance goals. This digital integration strengthens long term engagement.

Growth of online coaching and virtual training drives at home equipment purchases. Players invest in practice nets, rebounders, and smart accessories to support remote learning, supporting consistent demand beyond traditional court play.Key US Tennis Equipment Company Insights

Ame & Lulu continues to carve a distinct niche within the US Tennis Equipment Market by blending performance with lifestyle appeal, resonating strongly with fashion-forward players who value both function and aesthetic. The brand’s innovative racket bags and apparel lines have helped broaden its footprint beyond traditional gear, making it a preferred choice among amateur and recreational players. Analysts view Ame & Lulu’s strategic collaborations and targeted marketing as key drivers for sustained growth in 2025, particularly in coastal and metropolitan regions where lifestyle-centric sports products are in high demand.

Völkl Tennis remains a respected name in premium tennis rackets, underpinned by its German engineering heritage that emphasizes precision and control. Its 2025 product lineup is expected to build on advances in material science, offering enhanced feel and power balance that appeal to experienced and competitive players. From an analyst perspective, Völkl’s focused portfolio and strong dealer relationships position it to maintain steady market share, though broader consumer recognition still lags behind larger global competitors. Continued investment in player endorsements and technology storytelling could further elevate its presence.

Geau Sport has steadily expanded its influence through a value-oriented approach, delivering quality equipment at accessible price points that attract entry-level and intermediate players. The company’s emphasis on durability and user-friendly design has fostered customer loyalty in community clubs and schools. Market observers note that Geau Sport’s channel diversification and responsiveness to grassroots demand will be instrumental in driving volume growth throughout 2025, particularly as participation rates in tennis rise across diverse demographic segments.

Tecnifibre is widely recognized for its cutting-edge strings and rackets that cater to performance enthusiasts and professional athletes alike. Its R&D investments in string technology have set it apart, appealing to players seeking superior feel and spin potential. Analysts believe Tecnifibre’s commitment to innovation, coupled with a growing coaching and academy network presence, will strengthen its competitive edge and support broader market penetration in the US during 2025.

Key Market Segments

- Ame & Lulu

- Völkl Tennis

- Geau Sport

- Tecnifibre

- Dunlop Sports

- HEAD Sport

- Solinco

- Babolat

- Amer Sports Inc

- ASICS Corp

Recent Developments

- In February 2024, an investor consortium led by Orlando Capital V successfully completed the takeover of the insolvent Tennis-Point Group, following the signing of the purchase agreement in early January, with participation from founder and CEO Christian Miele and other entrepreneurs. through a combination of asset and share deals, the consortium acquired all assets of Tennis-Point GmbH, shares in its European sales companies, and the full scope of its US business operations, marking Orlando Capital V’s second platform acquisition in 2024.

Report Scope

Report Features Description Market Value (2025) USD 933.9 million Forecast Revenue (2035) USD 1,138 million CAGR (2026-2035) 2.0% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Shoes, Apparel, Racquets, Ball, Strings, Bags, Accessories), By Material (Graphite Composite, Carbon Fiber, Natural Rubber, Recycled Materials), By Buyer Type (Individual Players, Institutional Buyers), By Distribution Channel (Offline, Online) Competitive Landscape Ame & Lulu, Völkl Tennis, Geau Sport, Tecnifibre, Dunlop Sports, HEAD Sport, Solinco, Babolat, Amer Sports Inc, ASICS Corp Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ame & Lulu

- Völkl Tennis

- Geau Sport

- Tecnifibre

- Dunlop Sports

- HEAD Sport

- Solinco

- Babolat

- Amer Sports Inc

- ASICS Corp