U.S. Fishing Goods Market Size, Share, Growth Analysis By Product (Equipment, Apparel, Footwear), By Price Range (Mass, Premium), By Distribution Channel (Sporting Goods Retailer, Online, Hypermarkets & Supermarkets, Exclusive Brand Outlets, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142422

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

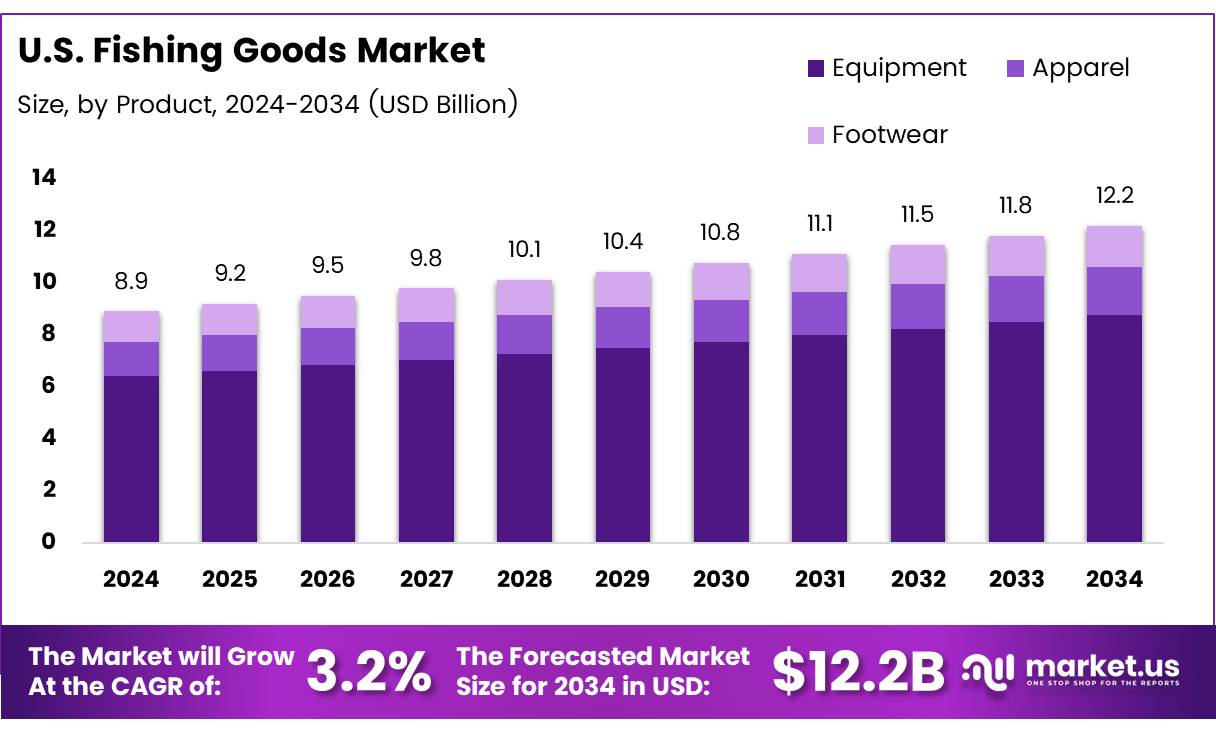

The U.S. Fishing Goods Market size is expected to be worth around USD 12.2 Billion by 2034, from USD 8.9 Billion in 2024, growing at a CAGR of 3.2% during the forecast period from 2025 to 2034.

The U.S. Fishing Goods Market encompasses a wide array of products tailored for freshwater, saltwater, and fly fishing. This market primarily includes fishing rods, reels, bait, tackle, and accessories essential for both amateur and professional anglers.

According to Survey, the number of fishing participants in the United States rose by 3.2 million from 2022 to 2023, indicating a burgeoning interest in this recreational activity. This surge in participation underscores a robust demand for fishing equipment and supplies, making the U.S. Fishing Goods Market a critical segment within the broader outdoor sporting goods industry.

The U.S. Fishing Goods Market is positioned for substantial growth, driven by an increasing number of anglers which stood at approximately 74 million in 2023, as reported by the American Sportfishing Association (ASA). This growing demographic is likely to catalyze demand for diverse fishing products, from basic gear for novices to specialized equipment for seasoned enthusiasts.

Additionally, the industry benefits significantly from the economic impact of fishing activities, which generate $16.4 billion in state and federal tax revenues annually, further highlighting its financial importance and potential for market expansion.

Government initiatives and regulations play a pivotal role in shaping the U.S. Fishing Goods Market. Regulatory measures aimed at sustainable fishing practices ensure long-term viability of fish populations, which in turn supports the fishing industry’s growth.

Moreover, government investments in wildlife and natural resource conservation can enhance fishing environments, potentially attracting more participants. These efforts not only preserve the ecological balance but also boost the market by creating favorable conditions for fishing activities, thereby attracting new enthusiasts and sustaining the interest of existing anglers.

The global production of fish also influences the U.S. market, with a recorded output of 186.6 million metric tons in 2023, marking a slight increase from the previous year, as per Sinay’s data. This increment reflects a steady supply of fish, crucial for the bait and tackle segment of the market.

The interplay between global fish production and local market demands underscores the interconnectedness of the U.S. Fishing Goods Market with global seafood industries, affecting everything from bait pricing to the availability of specific types of fishing gear. This global perspective is essential for market stakeholders aiming to forecast trends and align their strategies accordingly.

Key Takeaways

- The U.S. fishing goods market is projected to grow from USD 8.9 billion in 2024 to USD 12.2 billion by 2034, at a CAGR of 3.2%.

- Equipment is the dominant category within the Product Analysis segment, holding a 93.1% market share in 2024.

- Mass leads the premium category in the Price Range Analysis segment, with a 65.7% market share in 2024.

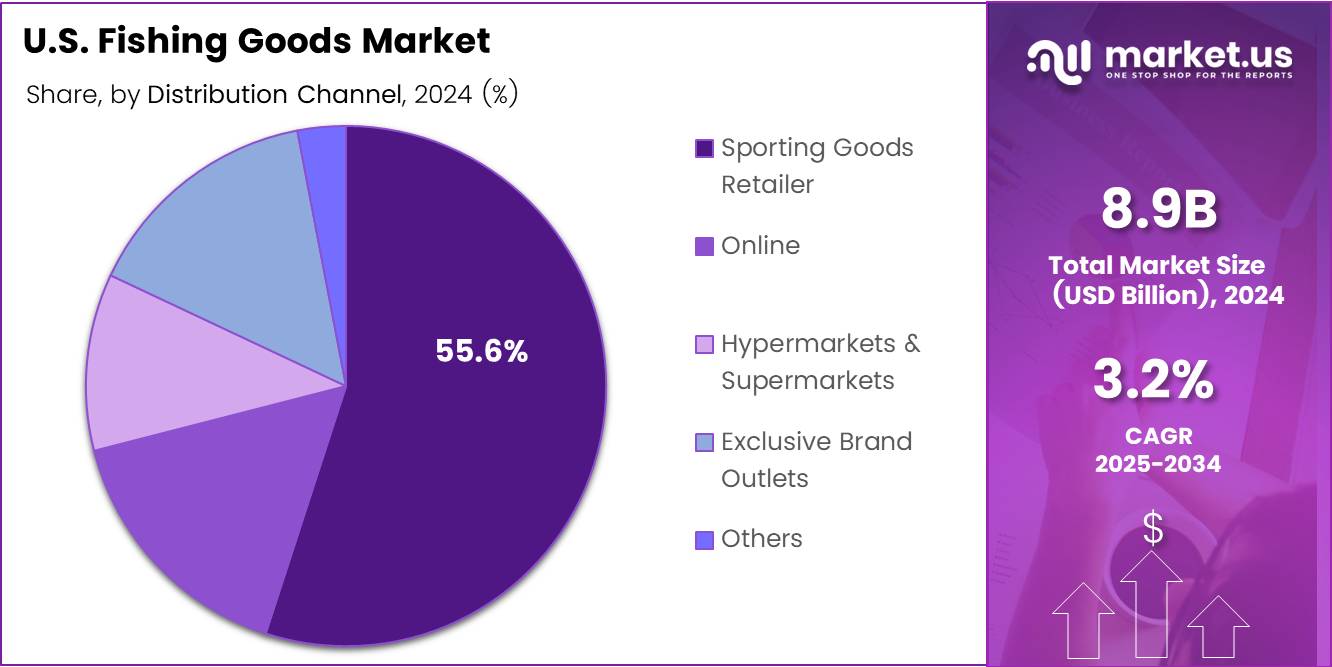

- Sporting Goods Retailers dominate the Distribution Channel Analysis segment with a 55.6% market share in 2024.

Product Analysis

Equipment Leads U.S. Fishing Goods Market with Overwhelming 93.1% Share

In 2024, the U.S. fishing goods market saw a significant concentration in the By Product Analysis segment, with Equipment emerging as the predominant category, capturing a 93.1% market share. This segment encompasses a wide range of products essential for the fishing aficionado, including rods, reels and components, lures, flies, and artificial baits, lines and leaders, creels, strings, and other related accessories.

The dominance of Equipment can be attributed to its fundamental role in the fishing experience, catering to both amateur and professional anglers seeking quality and performance in their fishing gear.

Apparel and footwear, while vital for comfort and functionality during fishing activities, held smaller portions of the market. These categories offer specialized items designed to enhance the angler’s experience through improved protection and mobility, reflecting a more targeted consumer base.

The overwhelming preference for Equipment underscores its indispensable nature in the sport of fishing, where the effectiveness of tools directly influences success and enjoyment levels. As market trends evolve, the focus remains keen on innovations within Equipment, ensuring it meets the growing demands for technology integration and sustainability in fishing practices.

Price Range Analysis

Mass Dominates U.S. Fishing Goods Market with 65.7% in Premium Segment

In 2024, Mass achieved a commanding lead in the U.S. Fishing Goods Market within the By Price Range Analysis segment, securing a 65.7% market share in the premium category. This substantial market dominance is attributed to Mass’s strategic focus on high-quality, durable products that appeal to serious anglers seeking superior performance and reliability.

The premium segment’s growth is driven by increasing consumer willingness to invest in high-end fishing gear, influenced by rising disposable incomes and a growing trend towards professional and recreational fishing activities.

Mass’s leadership in this segment underscores its effective branding and targeted marketing strategies, which resonate with consumers looking for top-tier fishing tools. The company’s ability to consistently deliver innovative products that meet the rigorous demands of fishing enthusiasts has helped it maintain a competitive edge.

As a result, Mass not only retains a loyal customer base but also attracts new customers looking for products that promise longevity and exceptional functionality. This segment’s performance is a clear indicator of shifting consumer preferences towards quality and durability in the fishing goods industry.

Distribution Channel Analysis

Sporting Goods Retailers Lead U.S. Fishing Goods Sales Through Dominant Distribution Channel

In 2024, Sporting Goods Retailers held a dominant market position in the By Distribution Channel Analysis segment of the U.S. Fishing Goods Market, commanding a significant 55.6% market share. This prominent placement underscores the critical role that brick-and-mortar retail stores play in catering to the specific needs and preferences of fishing enthusiasts.

These retailers not only offer a wide variety of fishing equipment and supplies but also provide the advantage of immediate product access and in-person customer service, which are highly valued in the sporting goods industry.

The online segment also demonstrated considerable growth, reflecting an ongoing shift toward digital platforms. However, it still trails significantly behind traditional retail stores, suggesting that while convenience is appreciated, the tactile buying experience offered at physical locations remains paramount among consumers.

Hypermarkets and supermarkets, although they stock a diverse range of goods, captured a smaller portion of the market due to their broader focus, which dilutes the specialized attention that dedicated sporting goods retailers provide.

Exclusive brand outlets and other miscellaneous channels, though vital for specific demographics, collectively hold a minor share, further emphasizing the stronghold that Sporting Goods Retailers maintain within the U.S. fishing goods market.

Key Market Segments

By Product

- Equipment

- Rods, Reels and Components

- Lures, Flies, and Artificial Baits

- Lines and Leaders

- Creels, Strings

- Others

- Apparel

- Footwear

By Price Range

- Mass

- Premium

By Distribution Channel

- Sporting Goods Retailer

- Online

- Hypermarkets & Supermarkets

- Exclusive Brand Outlets

- Others

Drivers

Leisure Fishing Popularity Spurs Market Growth

The U.S. fishing goods market is seeing a boost, mainly driven by an increased interest in leisure fishing. More people are getting into fishing as a fun and engaging way to connect with nature. This surge is pushing up sales of fishing gear and equipment as beginners and seasoned anglers alike look to upgrade their kits.

Additionally, the rising number of sport fishing tournaments is making anglers invest in better gear to compete effectively. There’s also a growing trend towards using eco-friendly fishing products as more anglers become aware of their environmental impact. These factors are all coming together to energize the fishing goods market across the country.

Restraints

Stricter Environmental Rules Slow Down U.S. Fishing Goods Sales

Stricter environmental rules are tightening up on fishing across the U.S. This includes limits on how much fish can be caught and efforts to protect certain areas and fish types. These rules make it tough for people to fish as much as they used to, which means they buy fewer fishing goods like rods, reels, and bait.

Fishing also has its busy seasons and slow times throughout the year, making sales go up and down, which can shake up the market’s steadiness. Companies selling fishing gear need to figure out how to deal with these ups and downs and the new rules to keep their sales from dropping too much.

Growth Factors

E-Commerce Expansion Fuels Growth in the U.S. Fishing Goods Market

The U.S. fishing goods market stands to significantly benefit from the expansion of e-commerce, presenting a robust growth opportunity by enabling businesses to reach a wider audience and boost sales through online platforms.

As digital shopping continues to dominate consumer behavior, fishing gear manufacturers and retailers can leverage this trend to streamline distribution, enhance customer engagement, and offer a broader range of products more efficiently.

Additionally, tapping into youth engagement programs can rejuvenate interest among younger demographics, securing a sustainable customer base for the future. Furthermore, exploring international markets could open new avenues for revenue, particularly in regions where fishing as a leisure activity is on the rise.

By exporting high-quality U.S. made fishing equipment abroad, companies can capitalize on global market trends and position themselves strategically in competitive international arenas. Together, these strategies encapsulate a forward-thinking approach to scaling the U.S. fishing goods sector amidst evolving consumer preferences and global market dynamics.

Emerging Trends

Fly Fishing Craze Spurs Innovations in the U.S. Fishing Goods Market

The U.S. fishing goods market is witnessing a surge in popularity for fly fishing, viewed not only as a sport but also as a form of relaxation, which is significantly driving the demand for specialized gear and accessories.

This trend is complemented by the increasing adoption of mobile applications designed to enhance the fishing experience, providing enthusiasts with valuable information on the best fishing spots, optimal weather conditions, and behavior patterns of fish.

Additionally, there is a growing demand for sustainable and eco-friendly products as consumers become more environmentally conscious, influencing both product development and marketing strategies within the industry.

Moreover, celebrity and social media influencer endorsements are playing a crucial role in boosting brand visibility and appealing to younger demographics. These endorsements help brands tap into larger audiences and foster a trendy image for fishing activities. Collectively, these factors are shaping the current trends in the market, ensuring continuous growth and innovation in the realm of fishing goods.

Key Players Analysis

Pure Fishing, Inc. remains a dominant force with its diverse portfolio of brands and products. As a comprehensive provider of fishing gear, Pure Fishing’s continuous investment in technology and global expansion strategies are likely to bolster its market share, appealing to a wide range of consumers from amateurs to professional anglers.

St. Croix Rods continues to carve a niche with its high-quality, American-made fishing rods. The company’s dedication to craftsmanship and customer loyalty through superior product performance positions it well for growth, particularly among enthusiasts seeking premium products.

Lew’s Fishing is gaining traction through its focus on innovation and value. The introduction of new, technologically advanced fishing reels and rods, combined with aggressive marketing strategies, is likely to enhance its visibility and market penetration.

Shimano North America Fishing, Inc. leverages its global brand reputation and engineering prowess to offer cutting-edge fishing equipment. Shimano’s emphasis on durability and performance, coupled with sustainability practices, aligns well with evolving consumer preferences towards eco-friendly products.

Eagle Claw Fishing Tackle Co. stands out for its commitment to manufacturing affordability and accessibility, making it a popular choice among casual anglers. Its focus on eco-friendly hooks and the adoption of lead-free materials could drive its appeal in a market increasingly conscious of environmental impact.

Daiwa Corporation continues to impress with its technological innovations, particularly in fishing reels. Its focus on ergonomic design and energy efficiency could attract a broader customer base, focusing on quality and sustainability.

Top Key Players in the Market

- Pure Fishing, Inc.

- St. Croix Rods

- Lew’s Fishing

- Shimano North America Fishing, Inc.

- Eagle Claw Fishing Tackle Co.

- Daiwa Corporation

- Rapala USA

- Johnson Outdoors Inc.

- Zebco

- Plano Synergy Holdings, Inc.

Recent Developments

- In Feb 2025, Norolan secured €600,000 in funding aimed at innovating and transforming the fishing industry through advanced technologies and sustainable practices.

- In Nov 2024, GSM Outdoors expanded its outdoor sports empire by acquiring Northland Fishing Tackle, a key player known for its innovative fishing products and accessories.

- In Jan 2025, L Catterton invested in Megabass, acquiring a significant stake in the high-end fishing gear manufacturer, enhancing its portfolio in the sports and leisure market.

Report Scope

Report Features Description Market Value (2024) USD 8.9 Billion Forecast Revenue (2034) USD 12.2 Billion CAGR (2025-2034) 3.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Equipment, Apparel, Footwear), By Price Range (Mass, Premium), By Distribution Channel (Sporting Goods Retailer, Online, Hypermarkets & Supermarkets, Exclusive Brand Outlets, Others) Competitive Landscape Pure Fishing, Inc., St. Croix Rods, Lew’s Fishing, Shimano North America Fishing, Inc., Eagle Claw Fishing Tackle Co., Daiwa Corporation, Rapala USA, Johnson Outdoors Inc., Zebco, Plano Synergy Holdings, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  U.S. Fishing Goods MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

U.S. Fishing Goods MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pure Fishing, Inc.

- St. Croix Rods

- Lew's Fishing

- Shimano North America Fishing, Inc.

- Eagle Claw Fishing Tackle Co.

- Daiwa Corporation

- Rapala USA

- Johnson Outdoors Inc.

- Zebco

- Plano Synergy Holdings, Inc.