Global Marine Communication Market Size, Share, Statistics Analysis Report By Product Type (VHF Radio, MF/HF Radio, Satellite Communication, AIS, Others), By Application (Commercial, Recreational, Military), By End-User (Shipping Industry, Offshore Oil & Gas, Naval Forces, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 139334

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. Marine Communication Market

- Product Type Analysis

- Application Analysis

- End-User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

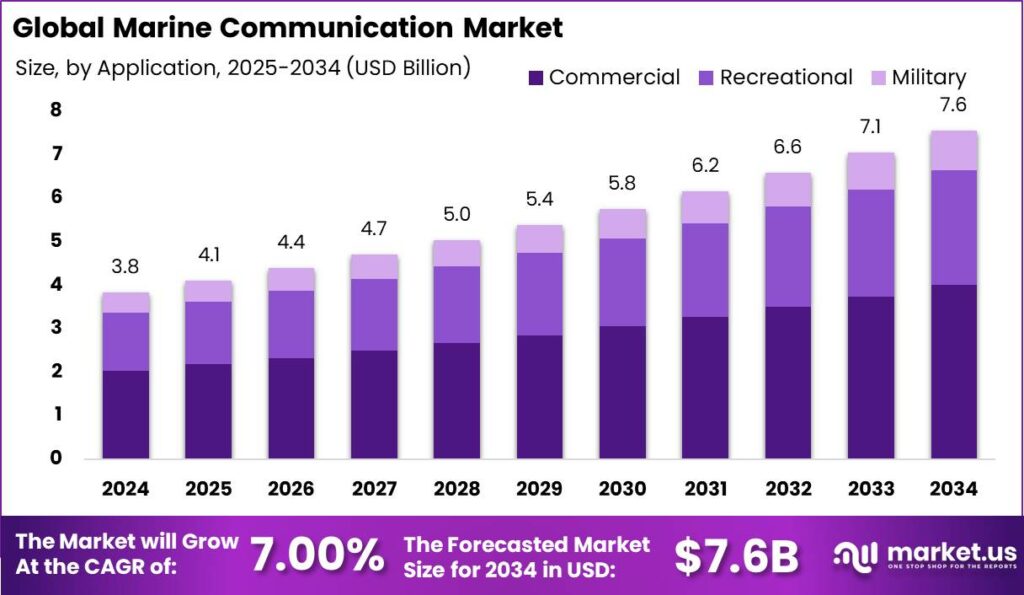

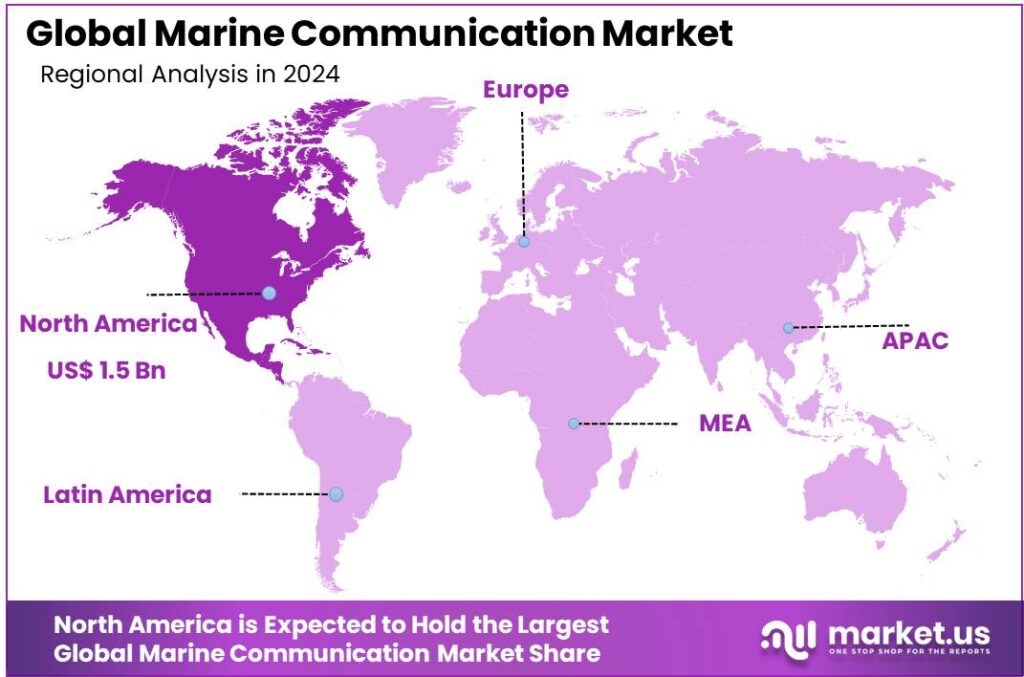

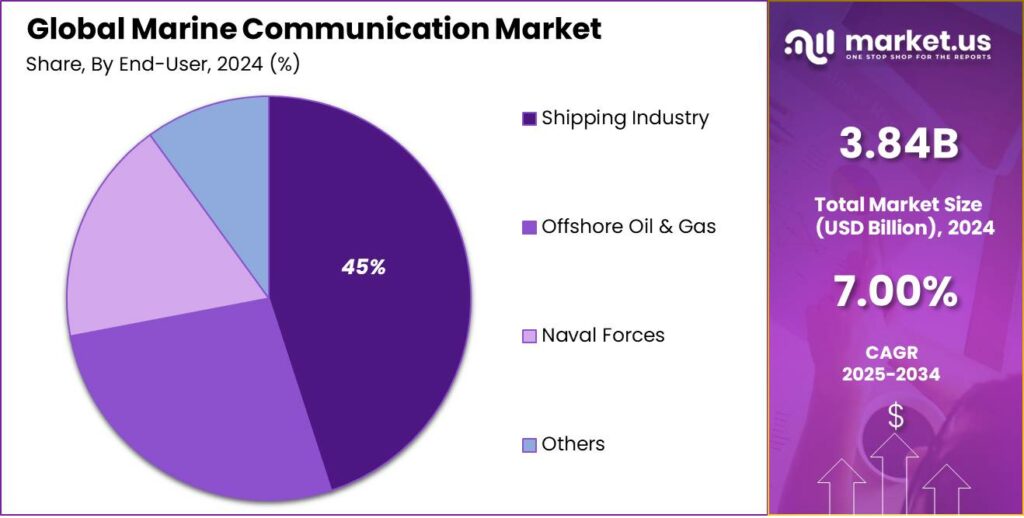

The Global Marine Communication Market size is expected to be worth around USD 7.6 Billion By 2034, from USD 3.84 Billion in 2024, growing at a CAGR of 7.00% during the forecast period from 2025 to 2034. In 2024, North America led the Marine Communication Market, securing more than 40% of the market share and generating approximately USD 1.5 billion in revenue.

Marine communication refers to the exchange of information between ships, marine stations, ports, and coastal facilities, essential for the safety, navigation, and coordination of maritime operations.It involves using various communication technologies like radios, satellite systems, and digital tools. These systems enable real-time interaction to prevent accidents, navigate waters, and maintain emergency contact during distress situations.

The marine communication market is witnessing significant growth, driven by the need for enhanced maritime safety, regulatory compliance, and operational efficiency. The adoption of advanced communication technologies like satellite systems and digital selective calling has revolutionized maritime operations, allowing for real-time tracking, emergency management, and efficient navigational information exchange.

Recent innovations in marine communication include the integration of Internet of Things (IoT) technologies and cloud-based platforms, which facilitate real-time data sharing and improved coordination between vessels and port operations. The deployment of smart devices and the utilization of high-speed broadband connections through VSAT systems are also notable, enhancing connectivity and supporting complex data applications at sea.

Additionally, cybersecurity measures are increasingly critical to protect against data breaches and ensure the reliability of maritime communication systems. There is a growing demand for sophisticated marine communication systems, particularly among commercial shipping companies, fishing fleets, and naval forces. This demand is driven by the need to enhance navigational safety, comply with international maritime safety standards, and improve operational efficiencies.

The marine communication sector presents numerous investment opportunities, particularly in developing and implementing advanced communication technologies that cater to the evolving needs of the maritime industry. Investors and stakeholders are particularly interested in companies that offer innovative solutions such as automated systems, cybersecurity enhancements, and integrated communication platforms that can provide comprehensive and secure communication capabilities for maritime operations.

Key Takeaways

- The Global Marine Communication Market size is expected to reach USD 7.6 billion by 2034, growing from USD 3.84 billion in 2024, with a compound annual growth rate (CAGR) of 7.00% during the forecast period from 2025 to 2034.

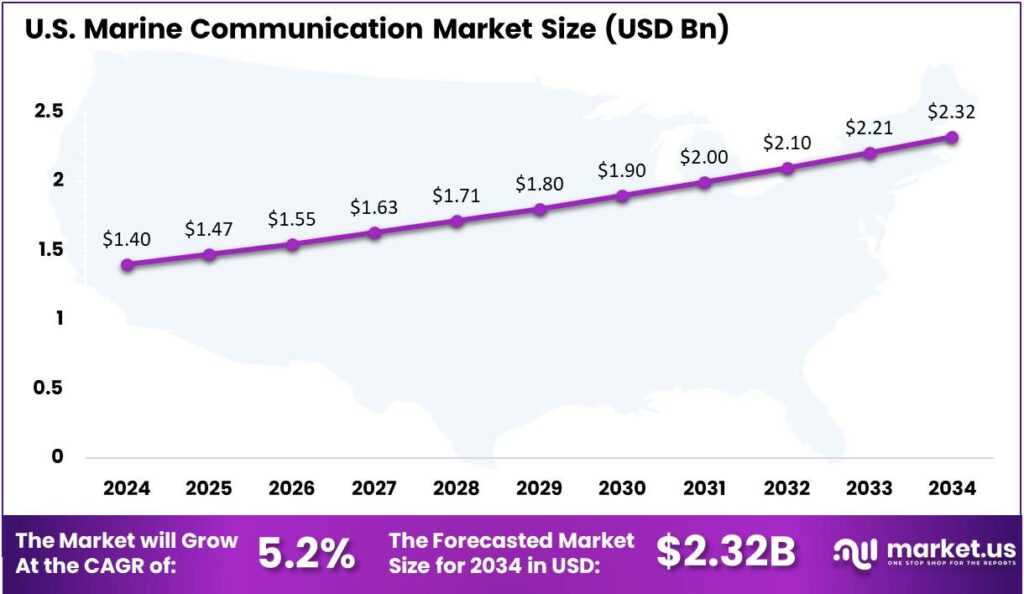

- The U.S. Marine Communication Market was valued at USD 1.4 billion in 2024, with a CAGR of 5.2%.

- In 2024, North America held a dominant market position in the Marine Communication Market, capturing over 40% of the market share, generating a revenue of approximately USD 1.5 billion.

- In 2024, the Satellite Communication segment led the market, holding more than 30% of the market share in marine communication.

- The Commercial segment dominated the market in 2024, accounting for over 53% of the marine communication market share.

- The Shipping Industry segment was the dominant player in the Marine Communication Market in 2024, holding more than 45% of the market share.

U.S. Marine Communication Market

The U.S. Marine Communication Market is projected to be valued at $1.4 billion by 2024, with expectations for steady growth over the coming years. This market is forecasted to experience (CAGR) of 5.2%, reflecting the increasing demand for advanced communication systems within the marine industry.

As technological advancements continue to improve communication infrastructure, marine operators are seeking more reliable, efficient, and secure communication solutions to ensure operational safety, navigation, and emergency response capabilities.

Several factors contribute to this market growth, including the increasing global trade and maritime activities, which necessitate more robust communication systems. Additionally, the ongoing development of technologies such as satellite communication, real-time data transmission, and integrated digital solutions are expected to drive the expansion of the market.

The growing emphasis on safety regulations and the adoption of automation in marine vessels further supports the demand for high-performance communication systems. This trend is expected to open new opportunities for both established players and emerging tech companies to meet the evolving needs of the maritime sector.

In 2024, North America held a dominant market position in the Marine Communication Market, capturing over 40% of the market share with a revenue of approximately USD 1.5 billion. This leadership can be attributed to several key factors, including the presence of a large and technologically advanced maritime infrastructure in the region.

The United States is home to a number of commercial and defense maritime vessels that rely heavily on sophisticated communication systems for navigation, safety, and operations. North America’s extensive coastline and busy ports create an ongoing need for robust communication networks, driving continued investment in marine communication technologies.

Another important aspect driving North America’s dominance is its strong focus on innovation and technological advancements. The region’s leading marine communication providers are investing heavily in the development of next-generation systems, such as integrated digital solutions, high-speed satellite communication, and IoT-based platforms.

Product Type Analysis

In 2024, the Satellite Communication segment held a dominant market position, capturing more than a 30% share of the marine communication market. This dominance is primarily driven by the increasing reliance on satellite networks for long-range communication, especially in remote oceanic regions where traditional communication infrastructure is unavailable.

Satellite communication systems provide global coverage, enabling ships to remain connected even in the most isolated areas, thereby ensuring safety, operational efficiency, and regulatory compliance. With the rise in demand for real-time data and seamless communication in the maritime industry, satellite communication has emerged as the preferred choice for vessels navigating vast and remote waterways.

The VHF Radio segment remains one of the most widely used communication systems, especially for short-range communication, typically within coastal areas or in close proximity to port facilities. Although VHF radios are essential for day-to-day operations, their limited range makes them less effective for long-distance communication compared to satellite systems.

Application Analysis

In 2024, the commercial segment held a dominant market position, capturing more than 53% of the marine communication market share. This can be attributed to the pivotal role that commercial shipping plays in global trade, where continuous and reliable communication is crucial for day-to-day operations.

Commercial vessels, such as cargo ships, tankers, and container ships, rely on constant connectivity for navigation, safety, cargo management, and regulatory compliance. As the backbone of global supply chains, the commercial sector’s need for advanced communication systems is crucial for ensuring operational efficiency and safety.

The increasing complexity of global shipping routes and the growth in international trade volumes have significantly boosted the demand for high-quality communication systems in this segment. These systems ensure smooth communication between vessels, ports, and headquarters, facilitating the seamless management of logistics and supply chains.

Furthermore, the commercial sector is heavily influenced by strict international maritime safety regulations, such as SOLAS (Safety of Life at Sea), which mandates the installation of reliable communication systems. This regulatory push has made commercial shipping companies more inclined to adopt cutting-edge technologies that enhance both safety and operational performance.

End-User Analysis

In 2024, the Shipping Industry segment dominated the Marine Communication Market, capturing over 45% of the market share. The shipping industry’s dominance is largely driven by the critical need for efficient, reliable, and secure communication systems for the operation of commercial vessels.

With global trade continuing to expand, maritime shipping remains the backbone of international logistics, creating a substantial demand for advanced communication technologies. These systems are essential for safe navigation, cargo tracking, and ensuring compliance with regulatory standards, which has positioned the shipping sector as the largest end-user in the market.

Communication is crucial in the shipping industry for both operations and safety. In emergencies, clear and timely communication can save lives. Satellite communications and real-time data analytics are now standard, allowing for continuous vessel monitoring, improved efficiency, and better fleet management.

The rise of automation in shipping, including autonomous ships and smart solutions, has increased the need for advanced communication systems. These vessels require reliable connectivity for continuous data transmission, remote monitoring, and real-time communication to ensure safe and efficient operations.

Key Market Segments

By Product Type

- VHF Radio

- MF/HF Radio

- Satellite Communication

- AIS

- Others

By Application

- Commercial

- Recreational

- Military

By End-User

- Shipping Industry

- Offshore Oil & Gas

- Naval Forces

- Others

Driver

Growing Demand for Maritime Trade and Transportation

The increasing global demand for maritime trade and transportation is a significant driver for the marine communication market. According to various sources, approximately 80% of global trade is carried out via sea, making maritime communication systems indispensable for coordinating these vast operations. Effective communication between ships, shore stations, and port authorities ensures the smooth movement of goods across seas, particularly in an era of globalization.

With a rise in international trade, especially with the expansion of the e-commerce sector, the need for efficient, reliable, and secure communication systems becomes even more crucial. As economies continue to grow, there is an increasing requirement for advanced communication technologies, such as satellite communication, to maintain contact over vast, remote maritime regions.

Restraint

High Implementation and Maintenance Costs

A major restraint in the marine communication market is the high cost of implementing and maintaining advanced communication systems. While the technology for marine communication has significantly evolved, the initial setup costs, including the purchase of hardware, installation, and integration with existing systems, can be a barrier for smaller companies and regional shipping operators.

Additionally, ongoing maintenance, upgrades, and training for personnel to operate the systems require considerable investment. For instance, satellite communication systems, although offering broad coverage, are associated with high subscription fees and operational costs. Smaller vessels or older fleets may find it difficult to justify the investment needed to maintain cutting-edge communication infrastructure, especially in regions with low maritime traffic.

Opportunity

Adoption of Satellite Communication for Remote Locations

A significant opportunity within the marine communication market lies in the widespread adoption of satellite communication systems, especially for remote locations and deep-sea voyages. With global trade expanding and ships venturing into more remote regions, the need for reliable communication tools is increasing.

Satellite communication provides a solution by offering near-global coverage, even in areas where traditional communication systems, like VHF radios, fall short. This technology improves communication between ships and shore stations, enhancing navigation, weather updates, and emergency response. The rise of low Earth orbit (LEO) satellite networks, like Starlink, has made satellite communication more affordable and accessible for all maritime operators.

Challenge

Integration with Existing Systems and Regulations

One of the key challenges facing the marine communication market is the integration of new communication technologies with existing systems. The maritime industry has long relied on legacy communication systems such as VHF radio, which is limited by range and functionality. Transitioning to more advanced systems, like satellite communication and digital platforms, can be complex, especially for older vessels.

The process often requires extensive retrofitting, which can be expensive and time-consuming. Additionally, the global nature of maritime operations means that communication systems must adhere to a variety of international regulations, such as those set by the International Maritime Organization (IMO). Ensuring that new systems comply with these regulations while integrating with existing infrastructure can present a logistical and technical challenge.

Emerging Trends

One of the most significant emerging trends is the integration of satellite communication systems. Traditionally, maritime communication relied on radio frequency-based methods, but satellite technology is now allowing ships to maintain better connectivity, even in the most remote areas of the world.

Another trend that is gaining momentum is the use of 5G technology. Although 5G is still being rolled out on land, it is expected to have a transformative impact on marine communications, offering faster data speeds and lower latency.

Furthermore, with the rise of the Internet of Things (IoT), vessels are increasingly equipped with sensors that can monitor everything from engine performance to fuel consumption, transmitting this data back to central systems for analysis and optimization.

Additionally, Artificial Intelligence (AI) and machine learning are starting to play a larger role in marine communication. These technologies can analyze vast amounts of data from ship sensors and satellite systems, providing actionable insights that can improve decision-making, reduce risks, and optimize operations.

Business Benefits

Adopting advanced marine communication technologies offers several key business benefits. Reliable satellite communication at sea allows companies to monitor vessels in real-time, reducing risks like safety hazards and logistical errors, which can lead to costly financial consequences.

One of the standout advantages of modern marine communication is improved operational efficiency. With the integration of IoT, AI, and data analytics, shipping companies can remotely monitor the performance of their fleet, identify maintenance needs before they become major issues, and even optimize fuel consumption.

Furthermore, the adoption of innovative communication technologies also strengthens a company’s competitive edge. With faster communication and smarter decision-making, businesses can improve their response time to market changes, regulatory requirements, and customer demands.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In this market, several key players provide innovative solutions, focusing on satellite communication systems, connectivity, and safety for vessels operating across global waters.

Cobham SATCOM is a leading provider in the marine communication sector, specializing in satellite communication equipment for maritime and offshore industries. The company offers a wide range of products, including satellite terminals and systems for voice and data transmission.

Inmarsat plc is one of the most well-known names in satellite communications, providing global mobile satellite communication services for the maritime industry. The company is recognized for its comprehensive offerings, including satellite broadband services, voice communication, and tracking solutions.

Iridium Communications Inc. is a top player in the marine communication market, offering a unique satellite network with global coverage. Unlike other companies, Iridium’s constellation of low Earth orbit satellites ensures reliable communication in even the most challenging environments.

Top Key Players in the Market

- Cobham SATCOM

- Inmarsat plc

- Iridium Communications Inc.

- Thuraya Telecommunications Company

- KVH Industries, Inc.

- Furuno Electric Co., Ltd.

- Garmin Ltd.

- Raytheon Technologies Corporation

- Northrop Grumman Corporation

- Harris Corporation

- Teledyne Technologies Incorporated

- Jotron AS

- Icom Inc.

- Japan Radio Co., Ltd.

- Viasat Inc.

- Kongsberg Gruppen ASA

- Saab AB

- Leonardo S.p.A.

- FLIR Systems, Inc.

- Comtech Telecommunications Corp.

- Other Key Players

Top Opportunities Awaiting for Players

- Growing Demand for Satcom Systems: Satellite communication (Satcom) systems have become essential for enhancing connectivity on vessels, particularly in remote areas where traditional communication infrastructure is limited or non-existent. Market players can capitalize on this by offering more advanced, cost-effective Satcom solutions, catering to a variety of vessels, from small fishing boats to large container ships.

- Adoption of IoT and Smart Technologies: The integration of the Internet of Things (IoT) and smart devices into the marine sector presents a significant opportunity for communication providers.Marine communication companies can focus on providing integrated communication systems that support IoT devices, enabling fleet operators to optimize operations and enhance safety measures.

- Focus on Safety and Regulatory Compliance: With international maritime organizations emphasizing safety protocols and communication standards, the demand for communication systems that ensure compliance is expected to increase. There is an opportunity for communication players to develop solutions that not only meet regulatory standards but also enhance the overall safety of marine operations, ensuring businesses stay ahead of compliance requirements.

- Enhanced Cybersecurity Solutions: Players who provide secure, encrypted communication services that protect both operational data and sensitive information from cyber threats will be in high demand.By focusing on building secure, resilient communication systems, marine communication providers can offer peace of mind to vessel owners, operators, and regulatory bodies, ensuring safe and uninterrupted services.

- Sustainability and Green Initiatives: Environmental concerns are driving the demand for sustainable marine communication systems that support eco-friendly practices, like optimizing fuel usage and reducing emissions through real-time monitoring.The opportunity lies in offering communication solutions that not only facilitate operational efficiency but also help companies meet their sustainability targets, aligning with the global push toward greener practices.

Recent Developments

- In July 2024, Inmarsat will launch the NexusWave service in September. This service will combine its Global Xpress (GX) Ka-band network with LEO services through a capacity agreement with OneWeb. Inmarsat is also showcasing its new Elera L-band technology.

- In May 2023, Viasat Inc. completed its acquisition of Inmarsat, strengthening its position in global satellite connectivity. The merger focuses on expanding innovation and meeting growing demands for reliable maritime communication solutions.

Report Scope

Report Features Description Market Value (2024) USD 3.84 Bn Forecast Revenue (2034) USD 7.6 Bn CAGR (2025-2034) 7.00% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (VHF Radio, MF/HF Radio, Satellite Communication, AIS, Others), By Application (Commercial, Recreational, Military), By End-User (Shipping Industry, Offshore Oil & Gas, Naval Forces, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cobham SATCOM, Inmarsat plc, Iridium Communications Inc., Thuraya Telecommunications Company, KVH Industries, Inc., Furuno Electric Co., Ltd., Garmin Ltd., Raytheon Technologies Corporation, Northrop Grumman Corporation, Harris Corporation, Teledyne Technologies Incorporated, Jotron AS, Icom Inc., Japan Radio Co., Ltd., Viasat Inc., Kongsberg Gruppen ASA, Saab AB, Leonardo S.p.A., FLIR Systems, Inc., Comtech Telecommunications Corp., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Marine Communication MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Marine Communication MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cobham SATCOM

- Inmarsat plc

- Iridium Communications Inc.

- Thuraya Telecommunications Company

- KVH Industries, Inc.

- Furuno Electric Co., Ltd.

- Garmin Ltd.

- Raytheon Technologies Corporation

- Northrop Grumman Corporation

- Harris Corporation

- Teledyne Technologies Incorporated

- Jotron AS

- Icom Inc.

- Japan Radio Co., Ltd.

- Viasat Inc.

- Kongsberg Gruppen ASA

- Saab AB

- Leonardo S.p.A.

- FLIR Systems, Inc.

- Comtech Telecommunications Corp.

- Other Key Players