US Direct Selling Market Size, Share, Growth Analysis By Product (Health & Wellness, Cosmetics and Personal Care, Household Goods & Durables, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151674

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

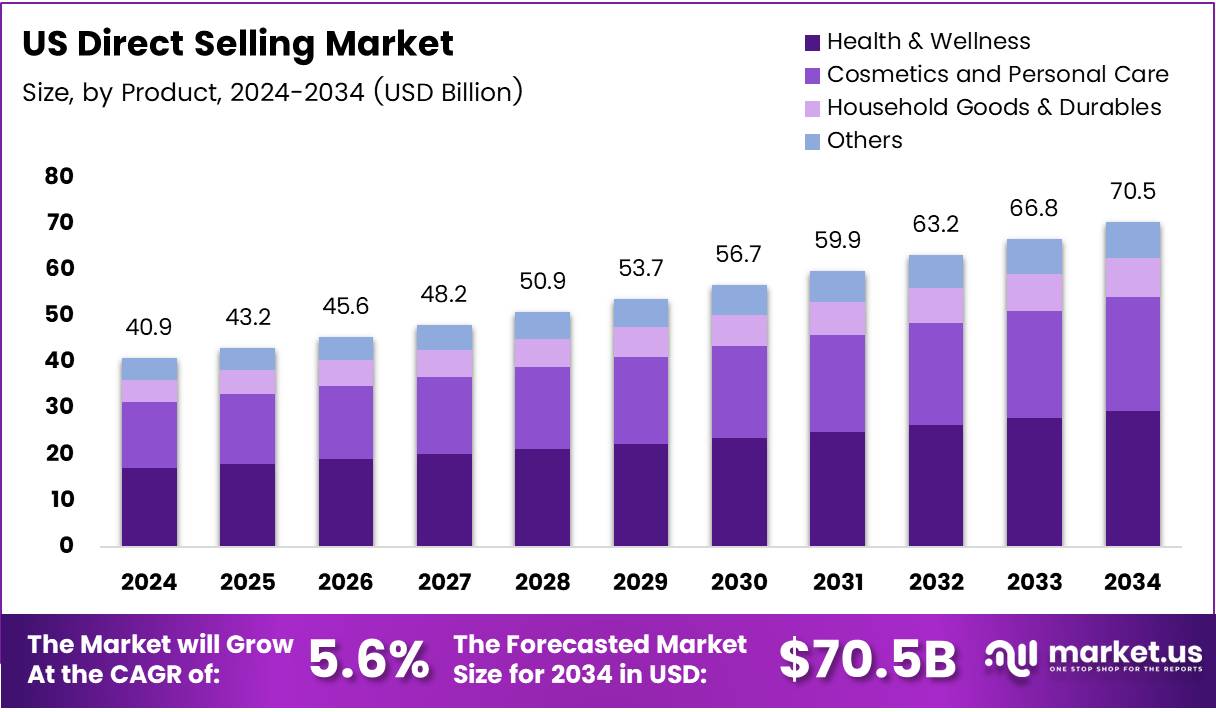

The US Direct Selling Market size is expected to be worth around USD 70.5 Billion by 2034, from USD 40.9 billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The U.S. direct selling market continues to grow, with a significant presence in retail sales. In 2023, it generated $36.7 billion in retail sales, according to the Direct Selling Association (DSA). This growth is driven by the appeal of personalized, door-to-door sales experiences, which remain integral to the U.S. economy. The industry’s resilience reflects its adaptability, especially through the expansion of online platforms.

An important trend within the market is the diversification of direct sellers. As noted by electroiq, 20% of direct selling prospects in the U.S. are African American, highlighting the growing inclusivity within the sector. This shift is crucial as it reflects a broader push towards diversity in sales models, which has the potential to open new opportunities for both sellers and customers. This evolution underscores the market’s potential for inclusivity and growth.

Another significant aspect of the U.S. direct selling market is its workforce. In 2023, 13 million people in the U.S. signed or renewed independent contractor sales agreements, according to DSA. This indicates a thriving community of direct sellers, further validating the model’s appeal as a flexible and rewarding employment opportunity. The market has proven resilient, even in uncertain economic conditions, attracting a diverse group of individuals looking for entrepreneurial opportunities.

Additionally, the demographic breakdown reveals that 81.8% of direct sales representatives in the U.S. are female, with 18.2% male, highlighting the dominance of women in the industry. This trend is increasingly relevant, as female entrepreneurs continue to leverage direct selling for financial independence and business growth. The shift in gender demographics aligns with broader societal trends toward empowering women in business.

Government regulations and investments continue to shape the industry. The federal government has consistently supported direct selling through regulations that protect both consumers and sellers. These regulations ensure that the industry remains transparent and secure, which builds trust among customers and suppliers alike. This creates an environment ripe for innovation and expansion, particularly as online platforms enhance connectivity between sellers and buyers.

Key Takeaways

- The US Direct Selling Market is projected to reach USD 70.5 billion by 2034, growing at a CAGR of 5.6% from 2025 to 2034.

- Health & Wellness dominates the By Product Analysis segment in 2024, driven by high demand for nutritional supplements, immunity boosters, and weight management products.

- Social media platforms like Instagram, Facebook, and TikTok are crucial for direct sellers to build trust and promote products in real time.

- Direct selling offers more personalized shopping experiences, with tailored recommendations and one-on-one support, enhancing consumer engagement.

- Strict U.S. regulations on product claims, compensation plans, and consumer protection create challenges for companies.

Product Analysis

Health & Wellness leads the pack with a dominant share in 2024.

In 2024, Health & Wellness held a dominant market position in the By Product Analysis segment of the US Direct Selling Marketshare. The strong demand for nutritional supplements, immunity boosters, and weight management products significantly contributed to this dominance. Consumers’ increasing focus on preventive health and self-care practices continued to drive consistent sales in this category.

Cosmetics and Personal Care followed as the second-largest category. Skincare, anti-aging, and natural ingredient-based products fueled this segment’s appeal. Consumers, especially millennials and Gen Z, increasingly prefer personalized and eco-friendly beauty solutions, helping maintain a steady market presence for this product group.

Household Goods & Durables secured the third position, supported by the rise in remote working lifestyles and a shift toward home improvement. Products like air purifiers, cleaning systems, and kitchen gadgets were commonly sold through direct channels, offering demonstrable utility and quality assurance.

Others comprised the smallest segment but continued to show niche growth. This includes educational products, accessories, and specialty items which attract targeted consumer interest. Despite a smaller share, this segment provides opportunities for direct sellers to innovate and capture new buyer personas.

Key Market Segments

By Product

- Health & Wellness

- Cosmetics & Personal Care

- Household Goods & Durables

Drivers

Growth of Social Media Platforms as Effective Marketing Tools Drives Market Expansion

Social media is playing a key role in the growth of the U.S. direct selling market. With platforms like Instagram, Facebook, and TikTok, sellers can easily connect with customers and promote products in real time. These channels help sellers build trust and showcase product benefits directly.

Consumers today prefer shopping experiences that feel personal. Direct sellers often tailor recommendations and provide one-on-one support, creating a shopping journey that feels more customized than traditional retail.

Additionally, the rise of e-commerce is making it easier for sellers to reach more people. Online tools allow for simple ordering and fast delivery, which supports the growth of direct sales from home or on the go.

Restraints

Stringent Regulatory Frameworks Pose Challenges for Market Participants

Strict regulations in the U.S. direct selling industry create hurdles for many companies. They must follow legal guidelines related to product claims, compensation plans, and consumer protection, which can be costly and time-consuming.

Another challenge is the industry’s heavy dependence on the recruitment model. Many companies rely on adding new sellers to generate income. This can lead to market saturation, making it harder for individual sellers to earn profits or grow their businesses sustainably.

As a result, businesses need to focus more on product value and customer retention rather than just expanding sales teams.

Growth Factors

Technological Advancements in Automation and Digital Tools Fuel Growth Opportunities

New technologies are opening fresh doors in the U.S. direct selling market. Automation tools help sellers manage orders, track inventory, and connect with customers more efficiently, saving time and improving performance.

Forming partnerships with well-known brands also creates new growth paths. These collaborations allow direct selling companies to expand their product ranges and build credibility with consumers.

Health and wellness products are gaining attention too. With rising consumer interest in self-care and healthy living, sellers focusing on this segment can tap into strong and lasting demand.

Emerging Trends

Increased Use of Influencer-Driven Direct Selling Campaigns Shapes Market Trends

Influencers are becoming a powerful force in direct selling. Their ability to engage followers makes them ideal partners for promoting products and increasing visibility for brands.

Sustainability is another growing trend. More direct selling companies are offering eco-friendly products and packaging, aligning with consumers who care about environmental impact.

The shift toward subscription-based models is also notable. These plans offer convenience and help sellers build a stable customer base through regular, recurring purchases.

Key US Direct Selling Company Insights

In the 2024 US Direct Selling Market, several key players have demonstrated notable strategies and performance. Friedrich Vorwerk Group SE ADR, although traditionally focused on energy infrastructure, has shown growing interest in diversifying its portfolio. Its tentative steps into the direct selling space suggest an innovation-led approach to tap into new consumer markets.

Amway Corporation continues to maintain its dominant presence, leveraging its strong legacy and diversified product offerings. Its emphasis on wellness, coupled with digital engagement tools for distributors, has helped reinforce its leadership in a competitive landscape.

Tupperware Brands Corp has faced challenges in recent years but is actively undergoing a transformation. The company is focusing on revitalizing its brand image and restructuring its sales force, which could play a key role in regaining consumer trust and boosting sales in the direct selling channel.

Oriflame remains focused on beauty and personal care, with a well-established network of consultants. Its commitment to sustainability and product innovation supports steady growth and aligns with evolving consumer preferences in the US market.

These companies exemplify the different strategies shaping the direct selling sector—from digital transformation to portfolio diversification and sustainability. Their performances and adaptability will be critical to how the US market evolves in 2024 and beyond.

Top Key Players in the Market

- Amway Corporation

- Herbalife Ltd

- Natura &Co Holding SA

- Friedrich Vorwerk Group SE

- Nu Skin Enterprises Inc

- Tupperware Brands Corp

- Oriflame

Recent Developments

- In February 2024, Hunch Mobility merged with Direct Selling Acquisition Corp to form a new entity named Hunch Technologies. This strategic business combination aims to accelerate Hunch’s expansion in the direct selling technology space.

- In July 2024, Fluid completed the acquisition of direct selling mobile app provider NOW Tech. The deal enhances Fluid’s mobile-first capabilities and strengthens its position in the direct selling ecosystem.

- In January 2024, Kirkland & Ellis LLP advised Direct Selling Acquisition Corp (DSAQ) on its business combination with Hunch Mobility.The legal counsel played a key role in structuring and executing the transaction that led to the formation of Hunch Technologies.

Report Scope

Report Features Description Market Value (2024) USD 40.9 billion Forecast Revenue (2034) USD 70.5 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Health & Wellness, Cosmetics and Personal Care, Household Goods & Durables, Others) Competitive Landscape Friedrich Vorwerk Group SE ADR, Amway Corporation, Tupperware Brands Corp, Oriflame, Nu Skin Enterprises Inc Class A, Herbalife Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amway Corporation

- Herbalife Ltd

- Natura &Co Holding SA

- Friedrich Vorwerk Group SE

- Nu Skin Enterprises Inc

- Tupperware Brands Corp

- Oriflame