US Active Sports Bras Market By Type, (Non-wired & Wired), By Color Mix, (Bold Colors (Red, blue, green), Neutral Colors (White, black, Gray), Pastel Colors: (Light pink, light blue, lavender), Patterns and Prints: (Floral, abstract, geometric)), By Level of Support, (High Impact, Low Impact, Medium Impact), By Padding (Non-padded & Padded), By Style/Design (Combination (Compression and Encapsulation) Sports Bras, Compression Sports Bras, Encapsulation Sports Bras, High-Neck Sports Bras, Racerback Sports Bras, Zip-Front Sports Bras, and Others), and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165151

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

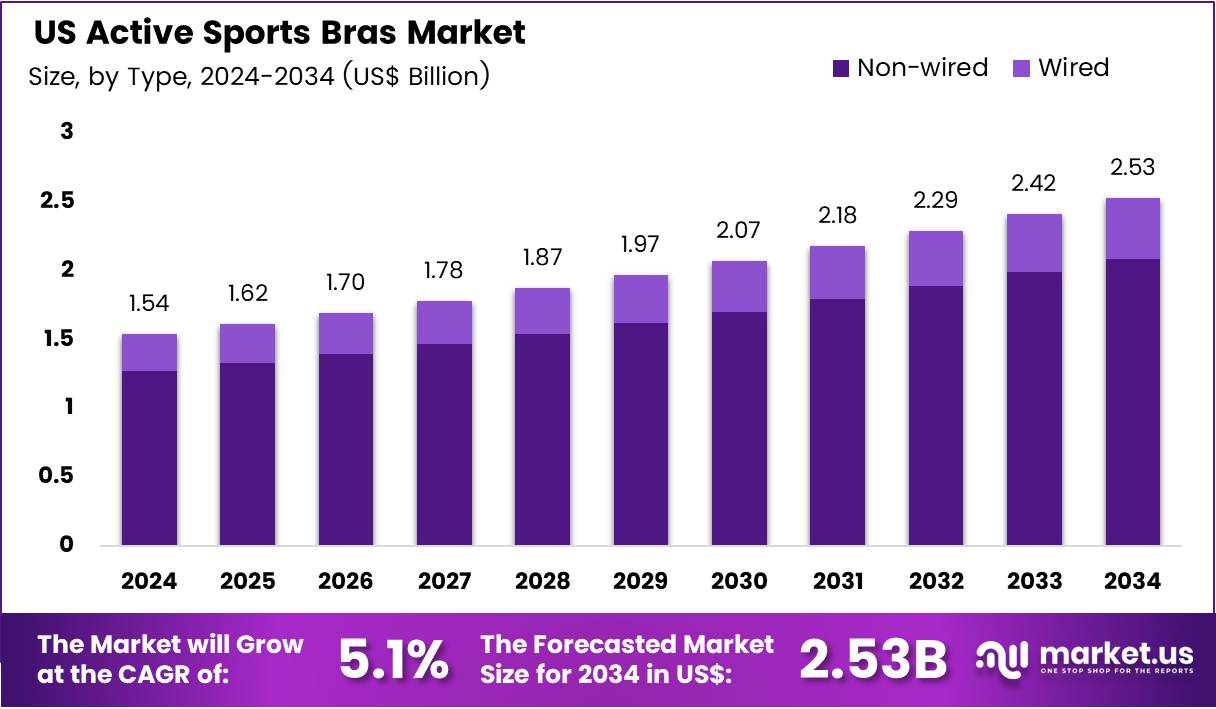

The US Active Sports Bras Market size is expected to be worth around US$ 2.53 billion by 2034 from US$ 1.54 billion in 2024, growing at a CAGR of 5.1% during the forecast period 2025 to 2034. The active sports bras market in the US is experiencing substantial growth, driven by evolving consumer preferences toward health and wellness, the influence of fashion trends, and the impact of social media.

The growing emphasis on healthier lifestyles and increased participation in fitness activities has led to a significant shift in consumer preferences. As the population prioritizes health and wellness, there has been a surge in demand for comfortable, functional active sports bras. This trend is further fueled by a heightened awareness of the importance of physical activity in maintaining overall well-being.

US Active Sports Bras Market, Analysis, 2020-2024 (US$ Billion)

US 2020 2021 2022 2023 2024 CAGR Revenue 191.4 230.5 253.3 262.9 272.9 5.1% Data from the Health & Fitness Association indicates that there are more than 64 million Americans holding gym memberships, with a noteworthy retention rate of around 60%. This highlights a strong interest in physical fitness, contributing to the heightened demand for active sports bras and fostering growth within the market.

Increasing engagement in sports and fitness among women has led to higher demand for supportive and comfortable sports bras designed for various activities such as running, yoga, and gym workouts.

The blending of active sports bras with everyday fashion has popularized sports bras. Due to the versatile apparel of sports bras, they can be worn not only during workouts but also as part of casual and athleisure outfits, thereby expanding their market appeal.

The advancement in fabric technology, including moisture-wicking materials, breathable fabrics, and seamless designs, enhances comfort and performance, meeting specific needs. Further expanding the growth of the active sports bra market.

Key Takeaways

- The US Active Sports Bras market was valued at USD 1.54 billion in 2024 and is anticipated to register substantial growth of USD 2.53 billion by 2034, with 5.1% CAGR.

- Based on Type, the market is bifurcated into Non-wired, and Wired with Non-wired taking the lead in 2024 with 82.3%market share.

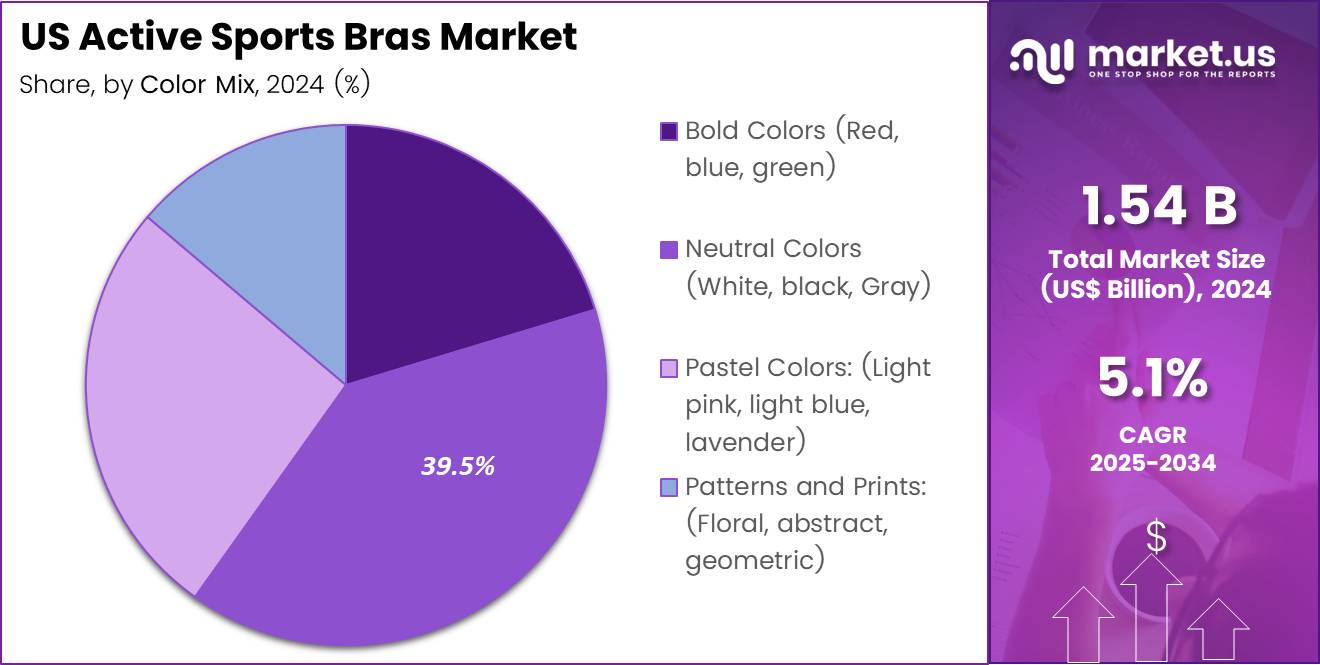

- Based on Color Mix, the market is bifurcated into Bold Colors (Red, blue, green), Neutral Colors (White, black, Gray), Pastel Colors: (Light pink, light blue, lavender), Patterns and Prints: (Floral, abstract, and geometric) with Neutral Colors taking the lead in 2024 with 39.5%market share.

- Based on Level of Support, the market is bifurcated into High Impact, Low Impact, and Medium Impact with High Impact the lead in 2024 with 44.7%market share.

- Considering Padding, the market is bifurcated into Non-padded, and Padded with Padded the lead in 2024 with 71.3%market share

- By Style/Design, the market is bifurcated into Combination (Compression and Encapsulation) Sports Bras, Compression Sports Bras, Encapsulation Sports Bras, High-Neck Sports Bras, Racerback Sports Bras, Zip-Front Sports Bras, and Others with Combination the lead in 2024 with 28.1%market share.

By Type

Non-Wired active wear sports bra represents a dominant segment of the US activewear sports bra market, accounting for 82.30% of the market share. Women adopt both non-wired and wired sports bras for varying reasons, reflecting diverse preferences and needs in activewear. Non-wired sports bras are favoured for their comfort and flexibility, providing gentle support without the constriction of the underwire.

They are often chosen for low-impact activities like yoga, Pilates, and casual wear, offering a more natural feel and freedom of movement. These bras typically feature soft, stretchy fabrics and seamless designs that minimize irritation during prolonged wear, making them suitable for everyday use.

US Active Sports Bras Market, Type, 2020-2024 (US$ Million)

Type 2020 2021 2022 2023 2024 CAGR Non-wired 846.5 1,031.7 1,147.5 1,205.6 1,267.2 5.36% Wired 191.4 230.5 253.3 262.9 272.9 4.01% Total 1,038.0 1,262.2 1,400.7 1,468.4 1,540.1 5.13% On the other hand, wired sports bras are preferred for their enhanced support. This bra is especially preferred by women who are involved in high-impact activities such as running, HIIT workouts, and team sports. The underwire helps to lift and separate the breasts, providing additional stability and minimizing bounce during vigorous movements.

Wired bras often feature moulded cups and adjustable straps for a customized fit, catering to women seeking maximum support and shape retention during intense physical activities. The rising awareness about the benefits of physical activities in women is further driving the growth of the activewear sports bra market over the projected period.

By Color Mix

Neutral Colors (White, black, Gray) accounted for a dominant segment of the US activewear sports bra market, accounting for 39.5% of the market share. Women’s preference for different colors and patterns on sports bras reflects a variety of personal and functional considerations. Bold colors, neutral tones, pastel shades, and patterns/prints each serve distinct purposes in activewear, influencing consumer choices and driving sales in the market.

US Active Sports Bras Market, Color Mix, 2020-2024 (US$ Million)

Color Mix 2020 2021 2022 2023 2024 CAGR Bold Colors (Red, Blue, Green) 205.6 251.6 281.0 296.6 313.0 5.79% Neutral Colors (White, Black, Gray) 412.9 501.4 555.6 581.6 609.0 4.97% Pastel Colors (Light Pink, Light Blue, Lavender) 270.5 329.8 367.0 385.8 405.8 5.41% Patterns and Prints (Floral, Abstract, Geometric) 149.0 179.4 197.1 204.4 212.3 3.99% Total 1,038.0 1,262.2 1,400.7 1,468.4 1,540.1 5.13% Bold colors such as vibrant blues, reds, and greens are often chosen for their energetic and eye-catching appeal. They can boost motivation during workouts and convey a sense of confidence and empowerment. Women gravitate towards bold colors to express their personality or make a fashion statement while engaging in physical activities. The increasing number of women engaging in gym workouts and fitness activities has significantly boosted the sale of bold-colored sports bras and supported the expansion of the sports bra market.

Neutral colors such as black, white, and gray are favoured for their versatility and ability to seamlessly blend with existing wardrobe choices. These colors are often preferred for their classic and understated appearance, suitable for both workouts and casual wear. Neutral sports bras are also less likely to show sweat or dirt, contributing to their practical appeal.

By Level of Support

High Impact accounted for a dominant Share in the US activewear sports bra market, accounting for 44.70% of the market share. High-impact sports bras are preferred for activities such as running, aerobics, and team sports where breasts undergo significant movement. These bras feature firm support, often with underwire, padded cups, and adjustable straps to minimize bounce and provide maximum stability during vigorous movements. Women choose high-impact bras to reduce discomfort and potential tissue damage associated with repetitive motion.

US Active Sports Bras Market, Level of Support, 2020-2024 (US$ Million)

Level of Support 2020 2021 2022 2023 2024 CAGR High Impact 457.6 558.3 621.6 653.9 688.0 5.47% Low Impact 175.4 213.4 236.9 248.5 260.7 5.18% Medium Impact 405.0 490.5 542.2 566.1 591.4 4.70% Total 1,038.0 1,262.2 1,400.7 1,468.4 1,540.1 5.13% Low-impact sports bras, on the other hand, offer lighter support suitable for activities like yoga, Pilates, and walking. They typically feature soft, stretchy fabrics and minimal compression, providing gentle support without restricting movement. Women opt for low-impact bras for their comfort and flexibility, ideal for activities where breast movement is minimal.

Furthermore, medium-impact sports bras strike a balance between high and low-impact styles, offering moderate support for activities such as cycling, hiking, and dance classes. They provide enhanced comfort and stability compared to low-impact bras, incorporating features like wider straps and compression panels to minimize bounce while allowing for freedom of movement.

By Padding

Padded accounted for a dominant segment of the US activewear sports bra market, accounting for 71.3% of the market share. The rising popularity of padded sports bras lies in their ability to offer enhanced support, coverage, and shape. This is particularly appealing to women who seek extra modesty during workouts, whether in the gym or during outdoor activities. The padding not only helps in reducing visibility but also provides additional structural support necessary for high-impact sports.

US Active Sports Bras Market, Padding, 2020-2024 (US$ Million)

Padding 2020 2021 2022 2023 2024 CAGR Non-padded 302.3 366.3 404.9 422.9 441.8 4.72% Padded 735.6 896.0 995.8 1,045.5 1,098.3 5.29% Total 1,038.0 1,262.2 1,400.7 1,468.4 1,540.1 5.13% The increasing participation of women in fitness and sports activities is driving the sale of padded activewear sports bras. As more women engage in active lifestyles, there is a higher demand for specialized activewear that not only performs well but also meets aesthetic and comfort preferences. Brands have responded by innovating with advanced materials, designs that offer both functionality and style and inclusive sizing options to cater to a diverse range of body types.

In April 2023, Nike launched Alate bra, it is a light support, padded bra. The aim behind the campaign of this product is to get more women involved in sports regardless of their athletic ability.

By Style/Design

Combination (Compression and Encapsulation) Sports Bras accounted for a dominant segment of the US activewear sports bra market, accounting for 28.1% of the market share. Compression sports bras provide uniform support and minimize movement by flattening the breasts, making them suitable for low to medium-impact activities like yoga and Pilates.

US Active Sports Bras Market, Style/Design, 2020-2024 (US$ Million)

Style/Design 2020 2021 2022 2023 2024 CAGR Combination (Compression and Encapsulation) Sports Bras 288.7 351.9 391.5 411.5 432.6 5.38% Compression Sports Bras 254.6 309.3 342.9 359.1 376.2 5.02% Encapsulation Sports Bras 200.6 243.5 269.6 282.1 295.2 4.90% High-Neck Sports Bras 93.8 114.4 127.2 133.6 140.5 5.36% Racerback Sports Bras 125.0 152.2 169.0 177.4 186.2 5.23% Zip-Front Sports Bras 39.8 48.2 53.4 55.8 58.4 4.85% Others 35.4 42.8 47.1 49.0 51.1 4.35% Total 1,038.0 1,262.2 1,400.7 1,468.4 1,540.1 5.13% Encapsulation sports bras, on the other hand, offer individual support for each breast with separate cups and often include features like underwire and adjustable straps. This design lifts and shapes the breasts, making them ideal for high-impact activities such as running, aerobics, and team sports. Sports bras that combine compression and encapsulation techniques aim to provide the benefits of both styles.

They offer enhanced support, stability, and comfort during activities of varying intensity, appealing to women seeking versatile performance from their activewear. The increasing health consciousness among women has propelled the demand for various styles/designs in activewear sports bras.

Key Market Segments

By Type

- By Type

- Non-wired

- Wired

By Color Mix

- Bold Colors (Red, blue, green)

- Neutral Colors (White, black, Gray)

- Pastel Colors: (Light pink, light blue, lavender)

- Patterns and Prints: (Floral, abstract, geometric)

By Level of Support

- High Impact

- Low Impact

- Medium Impact

By Padding

- Non-padded

- Padded

By Style/Design

- Combination (Compression and Encapsulation) Sports Bras

- Compression Sports Bras

- Encapsulation Sports Bras

- High-Neck Sports Bras

- Racerback Sports Bras

- Zip-Front Sports Bras

Drivers

Growth in women’s sports participation

The increasing participation of women in sports, fitness and athleisure activities is a major driver of demand for active sports bras. As more women engage in running, gym workouts, yoga, Pilates and other forms of exercise, the need for technical support garments – specifically sports bras that minimize breast movement and enhance comfort – is expected to rise.

In the US context, the rise in female gym membership, fitness boutique usage and running event participation supports this. The increased awareness of breast health, comfort and the functional differences between a regular bra and a sports bra also contributes.

From a market-research vantage point, companies in the US active wear space can expect that continued gains in female athlete numbers, plus a broader shift towards everyday active lifestyles (not just formal sport), will underpin incremental demand for higher-support, better-performing sports bras.

Restraints

Price sensitivity among consumers

Even as demand grows, one key restraint is consumer price sensitivity, especially for higher-end, performance-oriented sports bras. Some research flags that premium sports bras, incorporating advanced fabric technologies or specialist design features, may cost significantly more than standard bras, which may limit their adoption among cost-conscious buyers.

In the US, where multiple channels (mass retail, direct to consumer, premium specialty) co-exist, the presence of lower-priced alternatives can slow the pace at which premium players expand. For active sports bras brands targeting high-impact support, marketing and product differentiation must therefore justify the higher price point.

From a market-research perspective, it means that segmentation by price tier and channel becomes critical: tracking the mid-price bracket growth may show faster uptake than the premium tier. The balancing act for US brands is offering performance features while keeping pricing accessible enough to overcome the price-sensitive consumer base.

Growth Factors

Innovation in product and material technologies

A key opportunity in the US active sports bras market lies in innovation – both in materials (e.g., moisture-wicking textiles, recycled/sustainable fabrics) and in product design (e.g., adjustable support, inclusive sizing, multi-impact styles). Research highlights that “growing product launches” are expected to offer lucrative opportunities.

For example, brands might launch sports bras designed for high-impact activity (running, HIIT) with reinforced encapsulation, or create eco-friendly lines using recycled polyester or organic cotton targeting sustainability-conscious consumers. In the US, this opens up avenues for niche positioning (e.g., plus-size performance sports bras, maternity active support, tech-integrated bras).

From a market-research firm’s view, mapping these innovation pipelines and consumer adoption rates in the US can highlight which product advances are gaining traction, and thus where growth pockets lie – e.g., the move from gym wear to everyday athleisure support bras.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert a meaningful influence on the US active sports bras market, affecting both demand-side behavior and supply-chain dynamics. On the demand side, consumer confidence and disposable income levels are key: during periods of economic expansion, spending on discretionary apparel such as high-quality performance sports bras tends to rise, whereas an economic slowdown can lead to tightening of budgets and postponed purchases. For example, companies such as Lululemon have noted that a challenging macro environment in the US is contributing to more cautious consumer spending on activewear.

On the supply side, trade tensions in the US, tariffs, and rising cost of raw materials (such as nylon and elastane used in performance bras) impose increased cost burdens on manufacturers and can compress margins or result in higher retail prices. Geopolitical disruptions—such as restrictions on textile exports or transportation bottlenecks—also affect lead-times and inventory risk.

The US sports bras market is therefore expected to reflect a heightened sensitivity to macroeconomic oscillations, meaning that growth trajectories may slow in periods of inflation, rising interest rates, or weaker GDP growth. At the same time, brands that can manage supply-chain risks, leverage near-shoring, and maintain compelling value propositions are positioned to mitigate downside.

On the geopolitical front, shifts in trade policy (for example US-China relations) may force manufacturers to diversify sourcing, with longer-term implications for cost structures and competitive positioning in the active sports bras category. In sum, macroeconomic and geopolitical factors are projected to moderate growth pace and shape strategic decisions across production, pricing and channel approaches in the US market.

Emerging Trends

Athleisure and crossover usage of sports bras

A prominent trend in the active sports bras market in the US is the adoption of sports bras beyond exercise settings – driven by the broader athleisure trend, where activewear becomes part of everyday fashion and not just gym gear. The concept of athleisure is defined as wearing athletic-inspired clothing in non-exercise contexts.

For sports bras this means women are buying styles that look good under casual clothes, or standalone crop-tops, and use them for errands, casual outings or work-from-home. This broadens the addressable use-case of sports bras and expands the market.

For US market research, the implication is that brands that design sports bras with fashion appeal, versatile styling (not just functional), and strong branding may capture a larger share of consumers. Tracking how many sports bras are bought for non-exercise usage and how brands market them via lifestyle channels (influencers, social media) is key to understanding this trend’s impact.

Key US Active Sports Bras Company Insights

Key players in the Bearings market include Nike, Inc., Under Armour, Inc., Lululemon Athletica Inc., Adidas AG, Hanesbrands Inc., New Balance, Inc., Brooks Sports, Inc., Champion, Fabletics LLC, Wacoal Holdings Corp., Shock Absorber, ThirdLove, and Other key players.

Nike, Inc is a global leader in athletic apparel, Nike leverages its strong brand, wide retail reach and continuous innovation (e.g., sustainable fabrics in sports bras) to capture demand in the US active sports-bra market. Lululemon focuses on premium active-lifestyle apparel, offering sports bras that blend technical performance with elevated fashion appeal, targeting US consumers who seek both support and style.

Under Armour, Inc.: Under Armour emphasises performance-driven sports bras with high-impact support, sweat-wicking textiles and athlete-informed design, catering to active US women across both gym and field.

Top Key Players in the Market

- Nike, Inc.

- Under Armour, Inc.

- Lululemon Athletica Inc.

- Adidas AG

- Hanesbrands Inc.

- New Balance, Inc.

- Brooks Sports, Inc.

- Champion

- Fabletics LLC

- Wacoal Holdings Corp.

- Shock Absorber

- ThirdLove

- Other key players

Key Opinion Leaders

Name & Title Company / Country Expert Insight President & CEO Elliott Hill Nike “At Nike, Inc., we view the US active sports-bras market as evolving toward performance plus lifestyle fusion; consumers seek adaptive fit, sustainability and high-impact comfort. Growth will centre on hybrid wear and inclusive sizing.” CEO Bjørn Gulden Adidas AG “At Adidas AG, we see strong US growth tied to women’s fitness participation. Success depends on modular support, sustainability, and blending performance with lifestyle appeal across fragmented retail channels.” Chief Marketing Officer Carly Gomez Fabletics LLC “At Fabletics LLC, we anticipate digital-driven growth in stylish, inclusive and affordable sports bras. Personalisation and fit-tech will define US market success as consumers expect comfort with fashion versatility.” Recent Developments

- In March 2025, Lululemon Athletica Inc. announced the launch of its new Go Further Bra, designed to empower women athletes with advanced support and adaptive comfort during endurance activities. Unveiled as part of the brand’s performance innovation initiative, the Go Further Bra integrates lightweight construction, seamless fit technology, and breathable materials inspired by the needs of ultramarathon participants. The launch reinforces Lululemon’s commitment to developing products that extend both comfort and confidence in motion.

- In September 2025, Athleta, a division of Gap Inc., in partnership with designer Kristin Juszczyk and Susan G. Komen, announced the debut of the Train Free Sports Bra as part of its Breast Cancer Awareness Month campaign. The limited-edition bra carries the message “Check These Out,” symbolizing women’s strength and self-care, with a portion of proceeds benefiting breast cancer research.

- In July 2025, Victoria’s Secret & Co. unveiled a major expansion to its activewear line with the introduction of the Powerful Bra, part of the Body by Victoria collection. Engineered with new lift technology and moisture-adaptive fabric, the design provides enhanced support for active lifestyles while maintaining the brand’s signature aesthetic. The launch underscores Victoria’s Secret’s continued evolution into functional yet feminine performance apparel.

- In September 2025, Knix, the leading intimate apparel and activewear brand, announced the release of its Better Than Ever campaign featuring Nicole Scherzinger, showcasing the brand’s newest Active collection. The launch introduces the CloudCut fabric technology for ultra-light comfort and durability, expanding Knix’s commitment to inclusive, performance-driven design for women of all sizes and lifestyles.

Report Scope

Report Features Description Market Value (2024) USD 1.54 Billion Forecast Revenue (2034) USD 2.53 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type, (Non-wired & Wired), By Color Mix, (Bold Colors (Red, blue, green), Neutral Colors (White, black, Gray), Pastel Colors: (Light pink, light blue, lavender), Patterns and Prints: (Floral, abstract, geometric)), By Level of Support, (High Impact, Low Impact, Medium Impact), By Padding (Non-padded & Padded), By Style/Design (Combination (Compression and Encapsulation) Sports Bras, Compression Sports Bras, Encapsulation Sports Bras, High-Neck Sports Bras, Racerback Sports Bras, Zip-Front Sports Bras, and Others), Competitive Landscape Nike, Inc., Under Armour, Inc., Lululemon Athletica Inc., Adidas AG, Hanesbrands Inc., New Balance, Inc., Brooks Sports, Inc., Champion, Fabletics LLC, Wacoal Holdings Corp., Shock Absorber, ThirdLove, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  US Active Sports Bras MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

US Active Sports Bras MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nike, Inc.

- Under Armour, Inc.

- Lululemon Athletica Inc.

- Adidas AG

- Hanesbrands Inc.

- New Balance, Inc.

- Brooks Sports, Inc.

- Champion

- Fabletics LLC

- Wacoal Holdings Corp.

- Shock Absorber

- ThirdLove

- Other key players