Urokinase for Injection Market By Product Type (Powder and Solution), By Application (Hospitals, Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132150

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

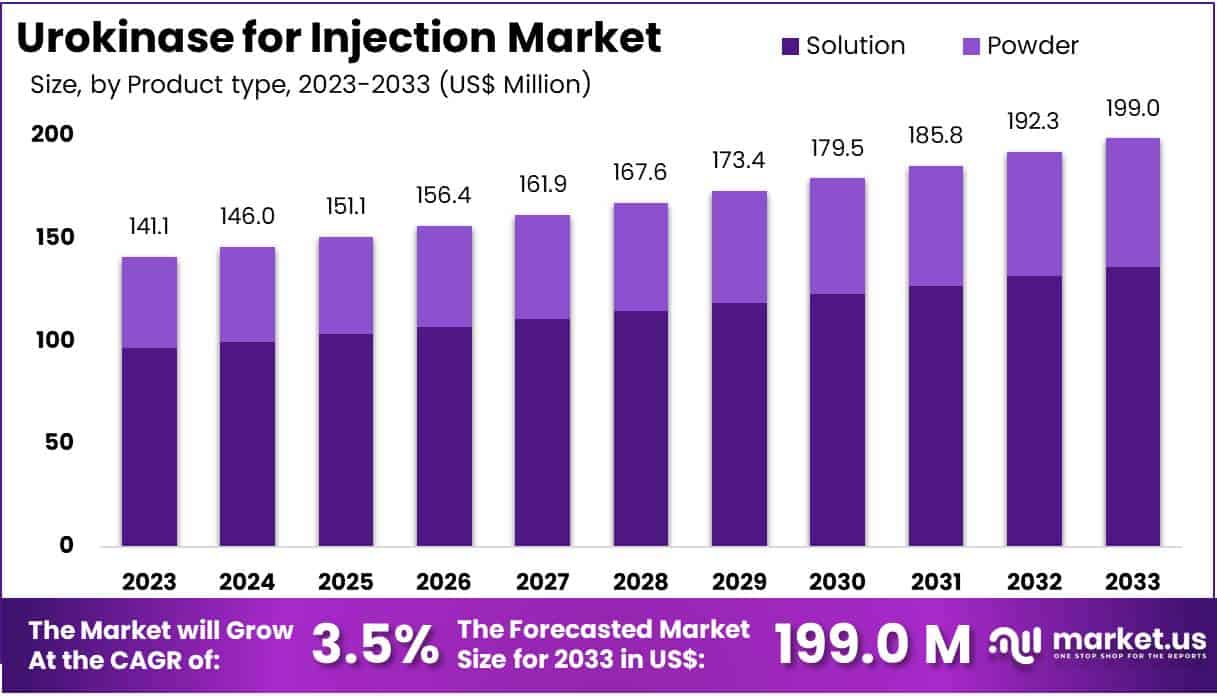

The Urokinase for Injection Market Size is expected to be worth around US$ 199.0 million by 2033 from US$ 141.1 million in 2023, growing at a CAGR of 3.5% during the forecast period 2024 to 2033.

Rising incidence of cardiovascular and thromboembolic disorders drives demand in the urokinase for injection market, as urokinase plays a critical role in dissolving blood clots in conditions such as acute ischemic stroke and myocardial infarction. In 2023, about 3 million people globally experienced acute myocardial infarction, highlighting the need for effective thrombolytic agents.

Urokinase, as a first-generation thrombolytic, remains a cost-effective option in resource-limited settings, offering a viable alternative to newer agents like alteplase. Its use in acute ischemic stroke treatment has shown efficacy in clinical studies, particularly in settings where cost constraints limit access to more expensive alternatives. Increasing research into urokinase’s therapeutic potential also fosters growth in this market.

A 2022 study indicated that urokinase-type plasminogen activator receptors (uPAR) show high expression in malignant tumors, making them a promising target for cancer therapies that spare healthy tissue, thereby supporting urokinase’s expanded application in oncology. Additionally, researchers are evaluating urokinase’s benefits for managing tuberculosis-related pleural effusions, which could further diversify its applications beyond cardiovascular health.

As global healthcare emphasizes early and effective treatment of thrombotic conditions, the urokinase for injection market is expected to benefit from both existing applications and innovative, targeted therapeutic strategies.

Key Takeaways

- In 2023, the market for urokinase for injection generated a revenue of US$ 141.1 million, with a CAGR of 3.5%, and is expected to reach US$ 199.0 million by the year 2033.

- The product type segment is divided into powder and solution, with solution taking the lead in 2023 with a market share of 68.5%.

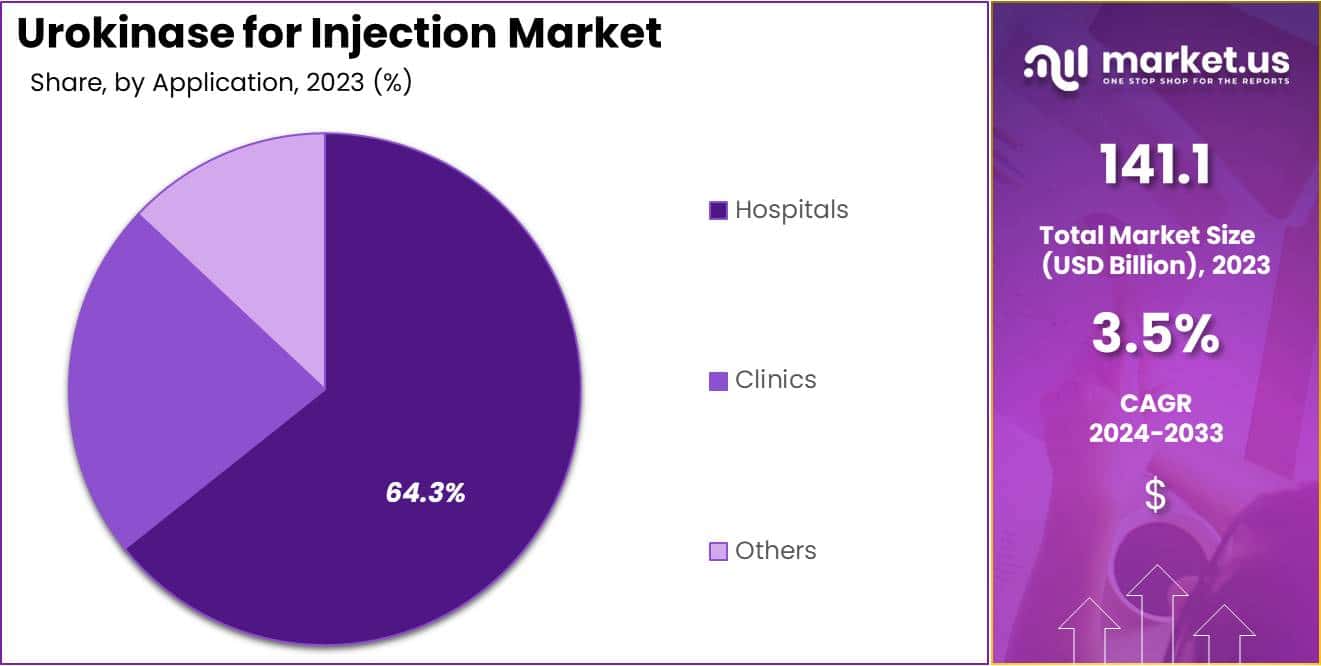

- Considering application, the market is divided into hospitals, clinics, and others. Among these, hospitals held a significant share of 64.3%.

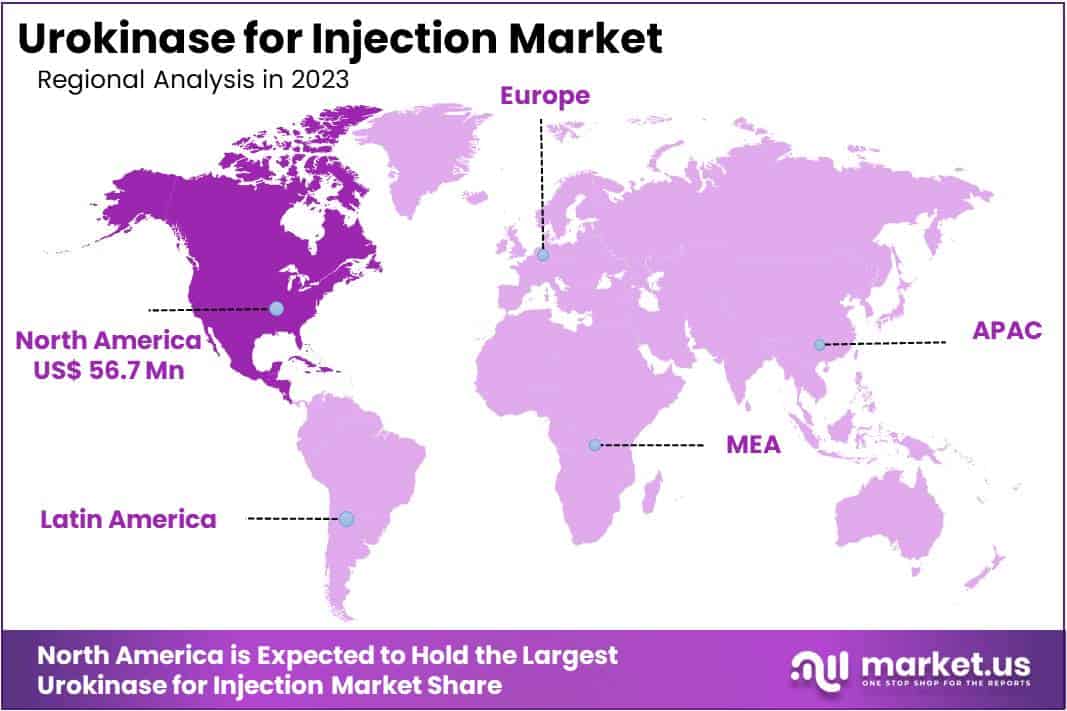

- North America led the market by securing a market share of 40.2% in 2023.

Product Type Analysis

The solution segment led in 2023, claiming a market share of 68.5% owing to its convenience and ease of administration. Healthcare providers increasingly prefer ready-to-use solutions, as they minimize preparation time and reduce the risk of dosage errors, making them suitable for urgent care situations.

Rising incidences of conditions requiring thrombolytic therapy, such as deep vein thrombosis and pulmonary embolism, drive the demand for urokinase solutions, which offer rapid efficacy in dissolving blood clots. Advancements in packaging technology ensure the stability and shelf-life of urokinase solutions, enhancing their appeal in clinical settings.

Furthermore, hospitals and emergency facilities prioritize solution forms due to their efficiency in high-stress environments, where quick response is crucial. Favorable reimbursement policies for injectable thrombolytics make urokinase solutions more accessible, especially in emerging markets. These factors contribute to the anticipated growth of the solution segment, positioning it as a preferred option in the urokinase market.

Application Analysis

The hospitals held a significant share of 64.3% due to the critical role hospitals play in emergency thrombolytic treatments. The rising prevalence of cardiovascular conditions, which require immediate intervention, increases hospital demand for urokinase for injection to manage blood clot-related complications.

Hospitals possess the infrastructure and skilled personnel necessary for administering complex treatments, which supports the adoption of urokinase in this setting. As healthcare providers increasingly adopt advanced therapies for improved patient outcomes, urokinase injections are likely to gain traction in hospitals.

Additionally, government healthcare programs that expand hospital capacities in emerging regions contribute to the growth of this segment. The increase in hospital admissions related to clotting disorders, combined with initiatives to improve patient care standards, further supports the demand for urokinase for injection in hospitals. Consequently, these factors are projected to drive sustained growth for the hospitals segment within this market.

Key Market Segments

By Product Type

- Powder

- Solution

By Application

- Hospitals

- Clinics

- Others

Drivers

Rise in Cardiovascular Diseases

A notable driver in the urokinase for injection market is the rising prevalence of cardiovascular diseases (CVDs), which increasingly require anticoagulant or thrombolytic therapy. Globally, the burden of CVDs, such as pulmonary embolism, has seen a consistent rise, with an estimated 10 million cases annually. This prevalence fuels the demand for clot-busting agents like urokinase, which are instrumental in treating life-threatening blockages.

The rise in sedentary lifestyles, obesity, and associated conditions such as hypertension further contribute to the increasing incidence of these disorders, amplifying the need for effective therapeutic agents. The market is therefore expected to see steady growth as healthcare providers adopt urokinase to manage and prevent serious cardiovascular incidents in high-risk patients.

Restraints

High Costs and Regulatory Challenges

High treatment costs and regulatory hurdles act as significant restraints on the urokinase for injection market. As a complex biologic product, urokinase faces stringent safety, efficacy, and quality regulations, especially in the U.S. and EU. These requirements drive up development and compliance costs, limiting market accessibility in regions with less robust healthcare funding.

The high production costs, coupled with regulatory expenses, restrict smaller companies from entering the market, which reduces competition and keeps prices elevated. Furthermore, the need for rigorous clinical trials and continuous quality checks impedes the market’s growth potential, as these factors delay new product releases and limit accessibility for lower-income populations.

Opportunities

Increased R&D and Government Approvals

Opportunities in the urokinase market are reinforced by growing investments in research and development and favorable regulatory shifts. For example, advancements in urokinase-based therapies have focused on enhancing safety profiles and reducing side effects. Partnerships and R&D funding in the sector aim to develop optimized delivery methods for urokinase, addressing previous challenges such as systemic bleeding risks.

Additionally, increased government approvals and global healthcare expenditure on anticoagulant therapies make room for innovative products that expand urokinase’s clinical applications. These innovations, particularly in countries with growing healthcare budgets, are anticipated to drive market growth by making urokinase-based therapies more accessible and effective

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors considerably shape the urokinase for injection market, affecting supply, pricing, and access to this critical thrombolytic drug. Rising healthcare costs globally challenge providers, as higher expenses for importing and maintaining drug inventories directly impact affordability for patients.

Additionally, the lingering effects of COVID-19 disrupted global supply chains, causing delays and increasing costs in the production and distribution of urokinase for injection, impacting patient access to timely treatment. However, as the prevalence of cardiovascular and thrombotic disorders rises, particularly in aging populations, demand for urokinase for injection has surged, necessitating a steady supply and supporting market growth.

Geopolitical tensions further influence this market, as trade barriers can complicate the cross-border movement of essential medical supplies, including active pharmaceutical ingredients (APIs) required for urokinase production. On a positive note, increased healthcare expenditure and collaborative agreements among major pharmaceutical companies aim to stabilize the urokinase supply chain and drive innovations to enhance treatment efficacy, positioning the market for sustainable growth amid these challenges.

Trends

Product Innovation and Partnerships

The urokinase for injection market has also seen a recent trend toward innovation through strategic partnerships and product launches. For instance, companies like Microbix Biosystem and Syner Medica have reintroduced and expanded access to urokinase-based drugs in North American and European markets. These launches are geared towards meeting the high demand for thrombolytic agents in emergency medicine and routine clinical procedures.

Additionally, partnerships and collaborative R&D efforts are paving the way for next-generation urokinase formulations that aim to improve safety and efficacy. This trend reflects the market’s adaptation to a growing need for minimally invasive thrombolytic therapies, aligning with a broader industry shift toward patient-centered and precision medicine

Regional Analysis

North America is leading the Urokinase for Injection Market

North America dominated the market with the highest revenue share of 40.2% owing to an increased incidence of thrombolytic disorders and a rising demand for effective clot-dissolving agents in healthcare. Cardiovascular diseases and pulmonary embolism cases continue to impact morbidity rates, with the CDC reporting that venous thromboembolism (VTE) affects approximately 900,000 Americans annually, highlighting the need for thrombolytic therapies like urokinase.

Additionally, an aging population in North America has led to a higher prevalence of clot-related conditions, as older adults are at increased risk for disorders requiring anticoagulant treatments. Advances in diagnostic technologies have also facilitated the early detection of clot-related issues, further fueling market growth.

Increased awareness among healthcare providers regarding the benefits of urokinase in managing acute clots has expanded its adoption in clinical settings. These factors, along with regulatory support for new treatment options, have collectively bolstered the urokinase for injection market in North America in 2023.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to a rising prevalence of thrombolytic disorders and enhanced healthcare accessibility. The aging population in countries like Japan, where 28.9% of the population was aged 65 or older in 2022, is expected to contribute to a higher incidence of cardiovascular and clot-related conditions requiring efficient thrombolytic solutions.

Additionally, increased awareness about the health risks associated with untreated thrombosis has prompted hospitals and clinics to adopt advanced clot-dissolving therapies across the region. Expanding healthcare infrastructure in emerging markets, particularly in Southeast Asia, is anticipated to boost access to urokinase for injection, supporting market growth.

Government initiatives promoting modern healthcare practices, combined with efforts to develop local manufacturing for essential medications, are likely to make thrombolytic treatments more affordable and accessible. These factors position the Asia Pacific urokinase for injection market for robust growth as demand for effective thrombolytic therapies continues to rise.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the urokinase for injection market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the urokinase for injection market implement various strategies to drive growth and strengthen their competitive edge.

They focus on research and development to enhance product efficacy and safety, addressing critical needs in thrombolytic therapy. Collaborations with hospitals and healthcare providers facilitate broader access and streamline the adoption of their solutions in clinical settings. Expanding distribution networks in emerging markets allows companies to capture demand in regions with growing healthcare investments.

Additionally, they prioritize educational initiatives aimed at physicians, raising awareness about the benefits and applications of urokinase in managing blood clots effectively.

Top Key Players in the Urokinase for Injection Market

- Wanhua Biochem

- TAJ Pharmaceuticals Limited

- Syner Medica LTD

- Microbix Biosystems Inc

- Jiangxi Haoran Bio-Pharma Co., Ltd

- Jiangsu Aidea Pharmaceutical Co Ltd

- ImaRx Therapeutics, Inc

- Cadila Healthcare Limited

Recent Developments

- In July 2023: Microbix Biosystems Inc. and Cadila Healthcare Ltd. (Zydus Cadila) signed a collaborative agreement to reintroduce Kinlytic (urokinase) in North America, addressing the need for thrombolytic agents to treat blood clots and embolisms, enhancing access to urokinase for injection in healthcare settings.

- In 2022: Wanhua Biochem expanded its urokinase product line to include advanced formulations for injection, aiming to meet both domestic and international demand. This expansion supports the urokinase for injection market by increasing product availability amid the global rise in thrombotic conditions and embolisms.

Report Scope

Report Features Description Market Value (2023) US$ 141.1 million Forecast Revenue (2033) US$ 199.0 million CAGR (2024-2033) 3.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Powder and Solution), By Application (Hospitals, Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Wilex AG, TAJ Pharmaceuticals Limited, Syner Medica LTD, Microbix Biosystems Inc, Jiangxi Haoran Bio-Pharma Co., Ltd, Jiangsu Aidea Pharmaceutical Co Ltd, ImaRx Therapeutics, Inc, and Cadila Healthcare Limited. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Urokinase for Injection MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Urokinase for Injection MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Wanhua Biochem

- TAJ Pharmaceuticals Limited

- Syner Medica LTD

- Microbix Biosystems Inc

- Jiangxi Haoran Bio-Pharma Co., Ltd

- Jiangsu Aidea Pharmaceutical Co Ltd

- ImaRx Therapeutics, Inc

- Cadila Healthcare Limited