Global Urine Collection Devices Market By Product Type (Urine Collection Bags, Leg bags, Large bags, Urinary Catheters, Urine Specimen Cups & Containers, Accessories) By Material (PVC, Polypropylene (PP)/Polyethylene (PE), Silicone, Latex, Others) By Patient Type (Adult, Pediatric) By Application (Clinical diagnostics, Urinary drainage & incontinence management, Drug screening & toxicology, Others) By End-User (Hospitals, Diagnostic laboratories/Pathology centres, Homecare settings, Long-term care facilities, Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165187

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

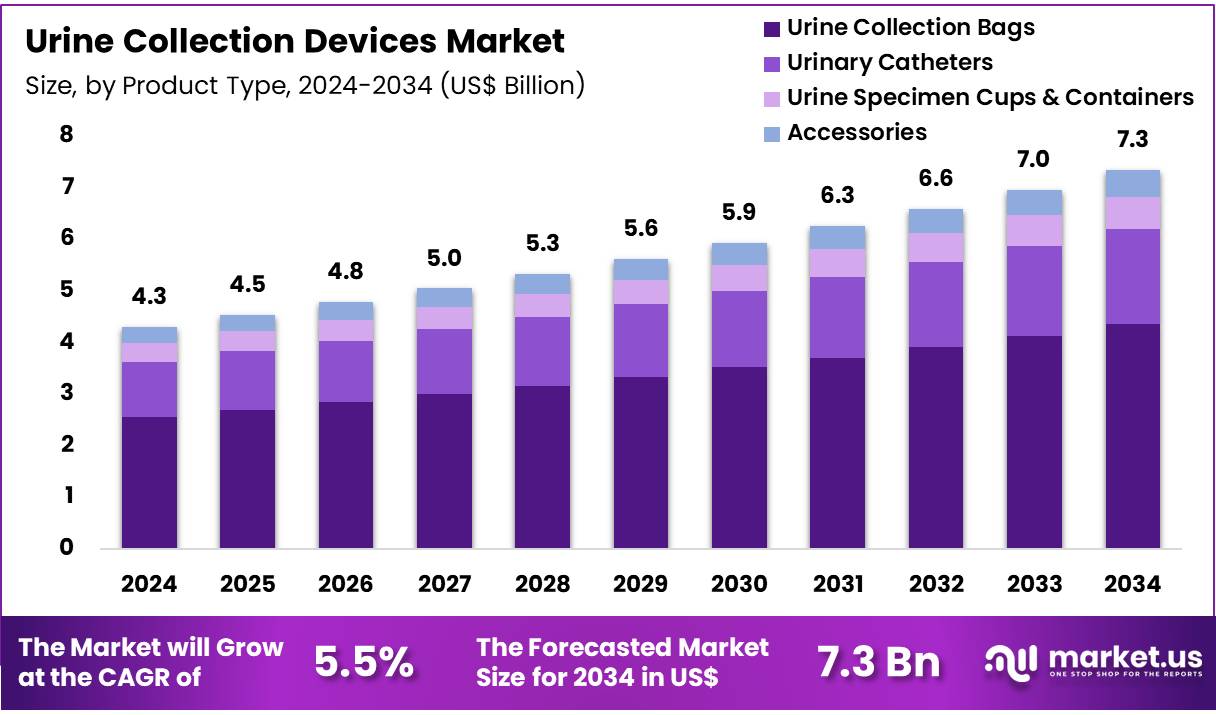

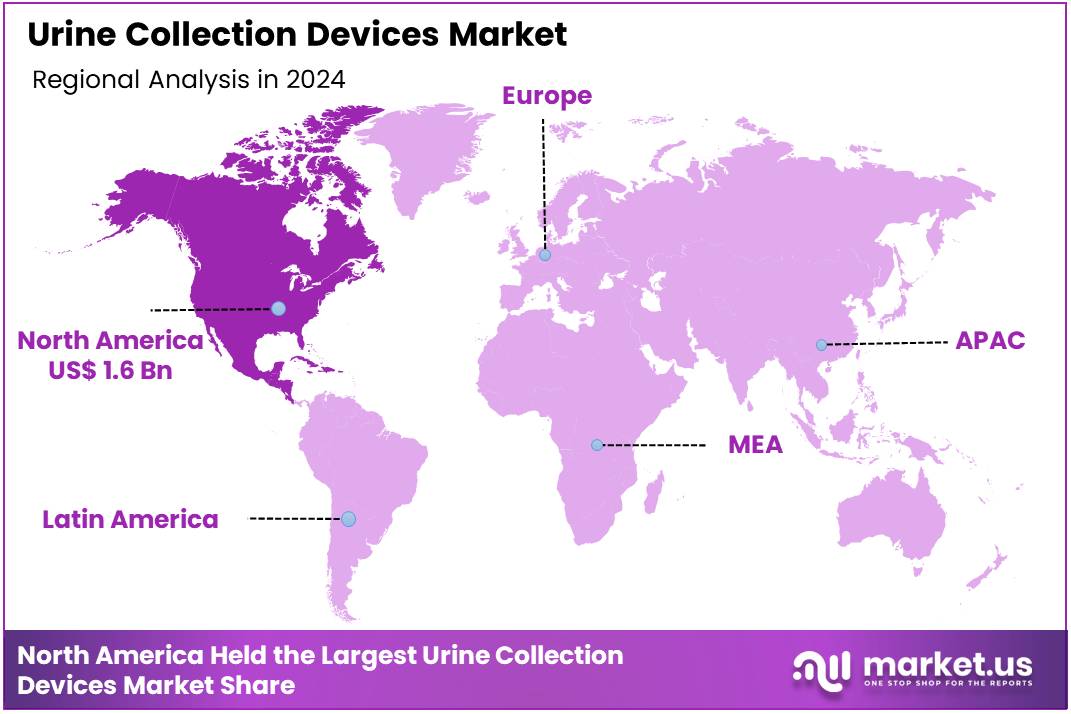

Global Urine Collection Devices Market size is expected to be worth around US$ 7.3 Billion by 2034 from US$ 4.3 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 36.5% share with a revenue of US$ 1.6 Billion.

The demand for urine collection devices has been increasing due to clear demographic and clinical pressures. The global population is ageing, and it has been estimated that by 2030 one in six people will be aged 60 years or older, while by 2050 this group will reach 2.1 billion. The growth in the older population has been associated with a higher prevalence of geriatric syndromes, including urinary incontinence, which has been identified by WHO as a major contributor to reduced quality of life. As a result, consistent demand has been observed for external catheters, absorbent alternatives, and specimen collection systems used in assessment and long-term management.

Hospital utilization continues to be a significant market driver. The U.S. CDC reports that 15–25% of hospitalized patients receive an indwelling urinary catheter, and approximately 75% of hospital-acquired urinary tract infections are catheter-associated. Infection-prevention programs have encouraged the adoption of closed drainage systems, anti-reflux valves, sampling ports, and single-use components that minimize contamination.

The rising burden of chronic diseases has broadened the user base. WHO data indicate that diabetes affected 830 million people by 2022, while chronic kidney disease impacts 9–13% of the global population. Increased monitoring requirements for these conditions have raised the need for routine urine testing and reliable specimen collection in both clinical and home settings.

Policy and clinical guidelines have reinforced safer urine management practices. Updated CDC guidelines on catheter-associated infection prevention and WHO policies supporting primary care and self-care have promoted early testing, home monitoring, and the procurement of safe, easy-to-use collection devices. Growth in home and community health services has further supported demand for external catheters, leg bags, night bags, and spill-resistant containers.

Overall, ageing demographics, chronic disease burdens, infection-control priorities, and expanding home-based care models are expected to sustain steady market growth for urine collection devices over the next decade.

Key Takeaways

- Market Size: Global Urine Collection Devices Market size is expected to be worth around US$ 7.3 Billion by 2034 from US$ 4.3 Billion in 2024.

- Market Growth: The market growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Product Type Analysis: Urine collection bags have been observed to dominate the product landscape, accounting for an estimated 59.3% share in 2024.

- Material Analysis: PVC has been identified as the dominant material category, accounting for an estimated 52.0% share in 2024.

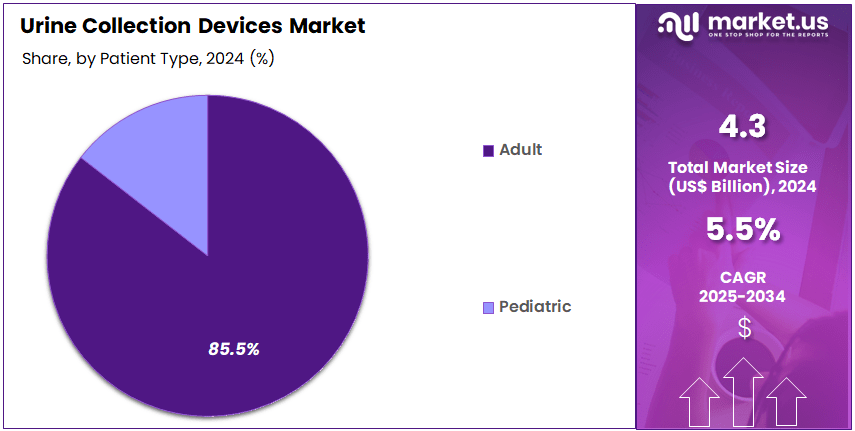

- Patient Type Analysis: By patient type Devided into adult and pediatric users. The adult segment has been reported to dominate the market, representing an estimated 85.5% share in 2024.

- Application Analysis: Clinical diagnostics has been identified as the leading segment, accounting for an estimated 38.1% share in 2024.

- End-Use Analysis: Hospitals are projected to dominate the market in 2024, accounting for an estimated 50.6% share.

- Regional Analysis: In 2024, North America led the market, achieving over 36.5% share with a revenue of US$ 1.6 Billion.

Product Type Analysis

The market for urine collection devices has been categorized into urine collection bags, urinary catheters, urine specimen cups and containers, and associated accessories. Urine collection bags have been observed to dominate the product landscape, accounting for an estimated 59.3% share in 2024. Their adoption has been supported by extensive use in hospitals, long-term care facilities, and home-based patient management. The segment’s growth has been attributed to rising incidence of chronic urological disorders and the increasing number of surgical procedures requiring postoperative urine monitoring.

Urinary catheters represent another key product type, with demand influenced by the rising geriatric population and the increasing prevalence of urinary retention disorders. Urine specimen cups and containers have been widely utilized in diagnostic laboratories and healthcare facilities, supported by the growing volume of urinalysis testing. Accessories, including tubing, connectors, and drainage components, continue to play a supportive role by ensuring system efficiency and improved patient handling within clinical environments.

Material Analysis

The urine collection devices market has been segmented by material into PVC, polypropylene (PP)/polyethylene (PE), silicone, latex, and other specialized polymers. PVC has been identified as the dominant material category, accounting for an estimated 52.0% share in 2024. Its leadership has been supported by high flexibility, cost efficiency, and widespread compatibility with diverse clinical applications. The material’s durability and ease of sterilization have further contributed to its extensive use in urine collection bags and drainage systems.

PP and PE have been utilized primarily in urine specimen cups and containers due to their chemical resistance and structural stability. Silicone has been adopted for premium devices such as long-term urinary catheters, driven by its biocompatibility and reduced risk of irritation. Latex continues to be used in select catheter types, although its share remains limited due to allergy concerns. Other materials, including advanced elastomers, have been incorporated to address specialized performance requirements.

Patient Type Analysis

By patient type Devided into adult and pediatric users. The adult segment has been reported to dominate the market, representing an estimated 85.5% share in 2024. This dominance has been associated with the higher prevalence of chronic kidney disease, urinary incontinence, benign prostatic hyperplasia, and postoperative monitoring requirements within the adult population. Increased hospital admissions, growth in the geriatric demographic, and the rising incidence of lifestyle-related urological conditions have further supported the segment’s extensive use of urine collection bags, catheters, and specimen containers.

The pediatric segment accounts for a comparatively smaller share, with demand influenced mainly by neonatal care, pediatric urinary tract infections, and diagnostic testing in infants and young children. Specialized pediatric urine collection bags and noninvasive devices have been utilized to ensure safe sampling and improved comfort. Although smaller in scale, the pediatric category continues to benefit from advancements in child-friendly materials and improved clinical protocols.

Application Analysis

By application segment devided into clinical diagnostics, urinary drainage and incontinence management, drug screening and toxicology, and other emerging uses. Clinical diagnostics has been identified as the leading segment, accounting for an estimated 38.1% share in 2024. The dominance of this category has been attributed to the expanding volume of urinalysis testing and the increasing emphasis on early detection of kidney disorders, metabolic diseases, and urinary tract infections. The growing number of laboratory examinations in hospitals and diagnostic centers has further reinforced demand for specimen cups, containers, and sterile collection systems.

Urinary drainage and incontinence management represents another major application area, supported by the rising geriatric population and the high prevalence of chronic urological conditions. Drug screening and toxicology testing has been used extensively across workplace compliance, forensic settings, and rehabilitation programs. The “others” segment includes applications in research, long-term patient monitoring, and specialized clinical procedures, contributing steadily to overall market adoption.

End-user Analysis

The end-user landscape for urine collection devices is defined by healthcare institutions and community-based care settings where diagnostic accuracy and patient management requirements remain high. Hospitals are projected to dominate the market in 2024, accounting for an estimated 50.6% share. This dominance can be attributed to the high volume of inpatient and outpatient procedures, increased utilization of catheterization, and the requirement for standardized urine sampling protocols in acute and surgical departments. Demand is further supported by the strong emphasis on infection control and continuous patient monitoring within hospital environments.

Diagnostic laboratories and pathology centers represent a significant secondary segment, driven by routine urine testing for metabolic, infectious, and renal disorders. Steady adoption is also observed in homecare settings due to rising preference for self-care and chronic disease management. Long-term care facilities contribute through the growing elderly population with higher urinary complications, while the “Others” category reflects specialized clinics and ambulatory centers with consistent but moderate demand growth.

Key Market Segments

By Product Type

- Urine Collection Bags

- Leg bags

- Large bags

- Urinary Catheters

- Urine Specimen Cups & Containers

- Accessories

By Material

- PVC

- Polypropylene (PP)/Polyethylene (PE)

- Silicone

- Latex

- Others

By Patient Type

- Adult

- Pediatric

By Application

- Clinical diagnostics

- Urinary drainage & incontinence management

- Drug screening & toxicology

- Others

By End-User

- Hospitals

- Diagnostic laboratories/Pathology centres

- Homecare settings

- Long-term care facilities

- Others

Driver

The prevalence of urinary disorders is increasing worldwide, driving sustained demand for urine collection devices. According to the World Health Organization, ageing populations face higher rates of urinary incontinence and chronic kidney disease, both of which require routine urine monitoring. The U.S. Centers for Disease Control and Prevention has also reported significant incidence of urinary tract infections, which remain among the most common bacterial infections requiring diagnostic urine sampling.

Peer-reviewed studies published through platforms such as the National Institutes of Health have noted rising utilisation of urinalysis for renal, metabolic and infectious disease assessment. These structural health burdens have increased the use of standardized, sterile urine collection systems across hospitals, diagnostic laboratories and long-term care facilities.

Trend

A notable trend is the rapid shift toward home-based and decentralized urine testing supported by global healthcare policies. The U.S. Department of Health and Human Services has promoted telehealth expansion, which has increased patient-managed sample collection in home settings. The National Institute on Aging highlights a growing preference for home-based management of chronic urinary and kidney conditions among elderly individuals.

Furthermore, infection-control guidance from the CDC emphasizes minimization of catheter-associated risks, encouraging adoption of improved external and non-invasive urine collection solutions. These regulatory and behavioural shifts are contributing to greater demand for user-friendly, safe and hygienic collection devices adaptable to both clinical and home environments.

Restraint

A key restraint arises from operational and regulatory burdens. Medical device approval processes overseen by agencies such as the U.S. Food and Drug Administration require extensive safety, sterility, and biocompatibility assessments, which lengthen development timelines and create market entry constraints. Cost pressure is another limiting factor, particularly in public healthcare systems where procurement budgets are tightly managed.

The World Bank and OECD have documented cost-containment measures in healthcare spending across many countries, which can reduce the adoption of advanced urine collection products when basic alternatives are considered sufficient. These structural limitations create slower adoption cycles in certain regions.

Opportunity

Significant opportunity is emerging from increased use of urine in non-invasive diagnostics and biomarker research. The National Institutes of Health recognizes urine as a promising medium for genomic, proteomic and metabolomic analysis, enabling early detection of kidney disease, prostate disorders and metabolic syndromes.

Government-funded research initiatives, including those under the NIH and European public health agencies, continue to expand the clinical utility of urine-based testing. This scientific progress supports demand for advanced, contamination-resistant collection devices capable of preserving biomolecular integrity. Additionally, the global policy shift toward value-based care promotes early diagnosis and home-based monitoring, creating further growth potential for specialized urine collection systems.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 36.5% share and holding a market value of US$ 1.6 billion for the year. This leadership was supported by strong healthcare infrastructure and high adoption of advanced diagnostic practices. The region’s demand for accurate and reliable urine collection systems has been reinforced by steady growth in chronic disease incidence and the increasing use of laboratory testing in routine clinical care.

North America’s dominance can be attributed to the widespread availability of technologically improved urine collection products. Hospitals, diagnostic laboratories, and home-based care settings in the region have shown consistent preferences for standardized and contamination-resistant devices. The presence of structured reimbursement systems has also encouraged higher utilization rates across clinical workflows.

The growth of the market has been supported by rising awareness of infection control. Facilities are placing greater focus on closed urine collection systems, sterile containers, and leak-proof specimen transport solutions. The increasing geriatric population, which shows higher susceptibility to urological disorders, has further contributed to the sustained demand.

Product innovation in the region has continued to reflect a shift toward patient-centric designs. Higher accuracy in sample collection and improved ease of handling have played a significant role in adoption across both professional and home-care environments. These factors have reinforced North America’s position as the leading regional contributor to global market revenues.

Regulatory frameworks have provided clear quality benchmarks that supported consistent device performance. This environment has encouraged steady uptake of compliant products and has strengthened buyer confidence. As a result, market expansion in North America has remained stable, with gradual improvements in testing volumes and diagnostic efficiency.

Overall, North America’s established healthcare ecosystem, strong diagnostic culture, and consistent emphasis on safety and accuracy have supported its leading share in the urine collection devices market. The region is expected to maintain a favorable growth outlook as clinical testing needs continue to rise.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape is characterized by a diversified group of manufacturers and suppliers operating across diagnostic consumables and home-care medical devices. The market presence is strengthened through broad product portfolios, continuous design improvements, and strong distribution networks. Growth strategies have been supported by investments in automated urine handling systems, sterile collection solutions, and pediatric-specific devices.

Partnerships with hospitals and diagnostic laboratories have enhanced product adoption, while expansions into emerging markets have increased global penetration. Emphasis has been placed on regulatory compliance, consistent quality standards, and cost-effective production, which collectively support sustained competitiveness across clinical and non-clinical settings.

Market Key Players

- Becton Dickinson and Company

- Teleflex Incorporated

- AdvaCare Pharma

- Coloplast Corp.

- Convatec Group plc

- Cardinal Health Inc.

- McKesson Medical Surgical, Inc.

- Amsino International, Inc.

- Medline Industries, Inc.

- Thermo Fisher Scientific

- ANGIPLAST

- Ardo Medical

- Aspen Surgical

- POLYMED

- F. Hoffmann-La Roche Ltd

- Bard Medical

Recent Developments

- Teleflex Incorporated (May 2025): Teleflex presented new clinical data at the 2025 AUA meeting for its urology product line; while not purely a urine-collection bag launch, it underscores continuing innovation in bladder/urinary devices.

- Amsino International, Inc. (April 2025): Amsino announced upgraded AMSure® Foley Catheter Trays incorporating dual antiseptic skin prep and Bedal’s FlexGRIP securement system. Although focusing on catheters, the firm’s urinary collection / drainage bag business is referenced in market reports.

- Convatec Group plc (16 May 2024): Convatec scaled up its European rollout of the “GentleCath Air™ for Women” compact intermittent catheter, strengthening its continence care offering which overlaps with urine-collection/urinary drainage products

- Convatec Group plc (16 May 2024): Convatec scaled up its European rollout of the “GentleCath Air™ for Women” compact intermittent catheter, strengthening its continence care offering which overlaps with urine-collection/urinary drainage products

Report Scope

Report Features Description Market Value (2024) US$ 4.3 Billion Forecast Revenue (2034) US$ 7.3 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Urine Collection Bags, Leg bags, Large bags, Urinary Catheters, Urine Specimen Cups & Containers, Accessories) By Material (PVC, Polypropylene (PP)/Polyethylene (PE), Silicone, Latex, Others) By Patient Type (Adult, Pediatric) By Application (Clinical diagnostics, Urinary drainage & incontinence management, Drug screening & toxicology, Others) By End-User (Hospitals, Diagnostic laboratories/Pathology centres, Homecare settings, Long-term care facilities, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Becton Dickinson and Company, Teleflex Incorporated, AdvaCare Pharma, Coloplast Corp., Convatec Group plc, Cardinal Health Inc., McKesson Medical Surgical, Inc., Amsino International, Inc., Medline Industries, Inc., Thermo Fisher Scientific, ANGIPLAST, Ardo Medical, Aspen Surgical , POLYMED, F. Hoffmann-La Roche Ltd, Bard Medical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Urine Collection Devices MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Urine Collection Devices MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Becton Dickinson and Company

- Teleflex Incorporated

- AdvaCare Pharma

- Coloplast Corp.

- Convatec Group plc

- Cardinal Health Inc.

- McKesson Medical Surgical, Inc.

- Amsino International, Inc.

- Medline Industries, Inc.

- Thermo Fisher Scientific

- ANGIPLAST

- Ardo Medical

- Aspen Surgical

- POLYMED

- F. Hoffmann-La Roche Ltd

- Bard Medical