Global Urgent Care Center Market By Service (Trauma or Injury Treatment, Acute Illness Treatment, Physical Examinations, Immunization and Vaccination and Others) By Ownership (Hospital, Physicians, Corporation and Others) by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2023

- Report ID: 84132

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

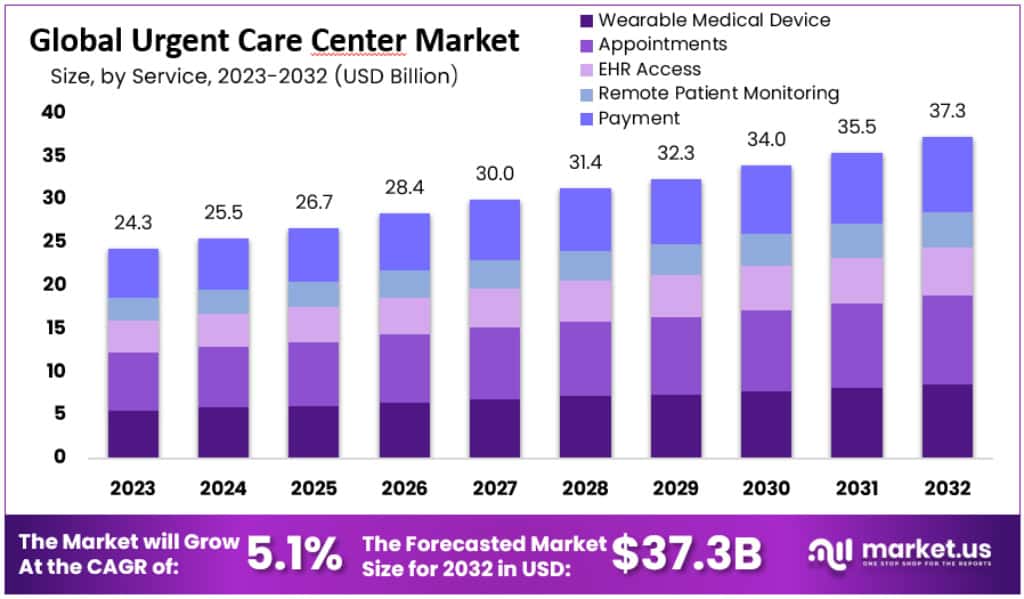

The Global Urgent Care Center Market size is expected to be worth around USD 37.3 Billion by 2032, from USD 24.3 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

An urgent care center is a medical facility that offers fast medical outpatient services, such as treatment and consultation for a variety of minor injuries and diseases. Patients can access medical treatments at urgent care centers on a walk-in basis, without taking an appointment ahead of time. Urgent care centers act as a supplement to primary and emergency care facilities.

Urgent care does not offer surgical services, including invasive procedures (those involving body organs, tendons, the deep penetration of deep fascia, ligaments, bursae, joints, muscles, or even bones), these procedures require local or general anesthesia (other than topical local anesthesia), as well as procedures, that require an entire operating room.

Key Takeaways

- The Urgent Care Center Market is expected to reach approximately USD 37.3 Billion by 2032.

- The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.1% during the forecast period from 2023 to 2033.

- In 2023, acute respiratory infection services held a dominant market share of over 27.4%.

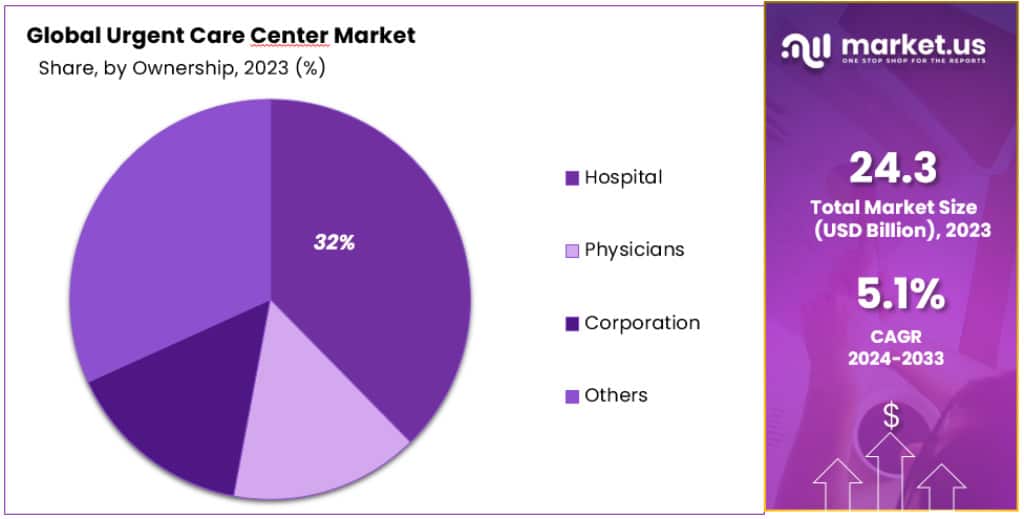

- Hospitals held a dominant market position with over 32% share in 2023.

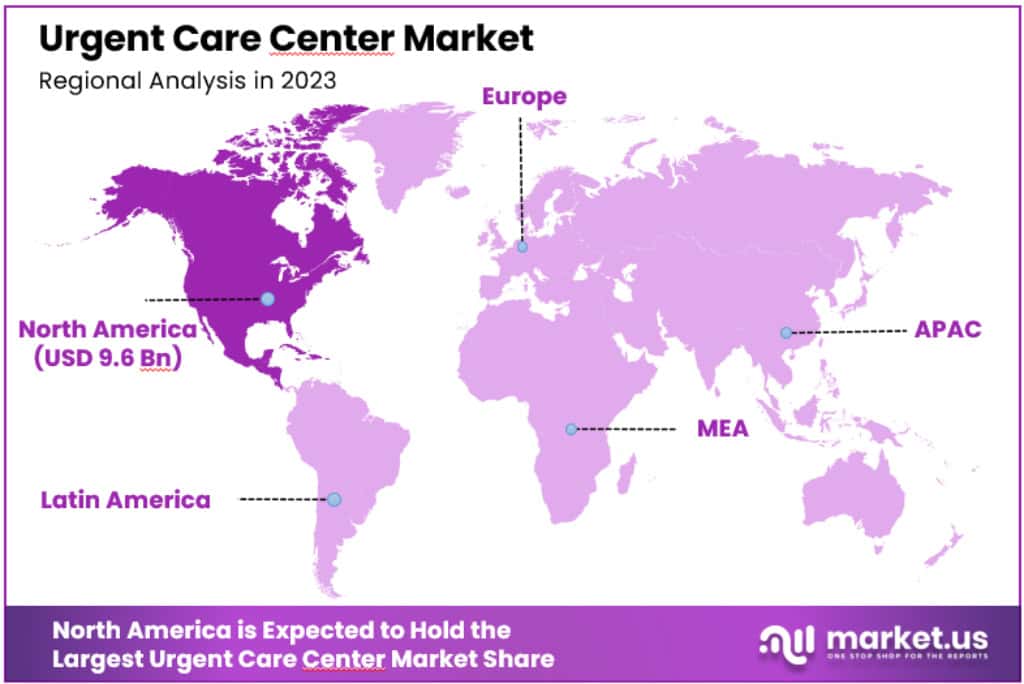

- In North America, the market had a commanding 39.7% share in 2023, with the U.S. showing robust growth.

Service Analysis

In 2023, the urgent care center market observed a notable trend in its service segments. Acute respiratory infection held a dominant market position, capturing more than a 27.4% share. This prominence can be attributed to the increasing prevalence of respiratory diseases and the convenience offered by urgent care centers for immediate care.

Trauma or injury treatment services also showed significant market presence. These services are integral in urgent care centers due to the rising incidents of minor accidents and injuries requiring prompt attention. The efficiency and speed of these centers in treating such cases contribute to their market appeal.

Physical examinations segment has seen steady growth in the urgent care center market. These routine checks are essential for preventive healthcare and are increasingly sought after in urgent care settings for their accessibility and shorter wait times compared to traditional healthcare facilities.

Immunization and vaccination services, in the context of a global focus on preventive healthcare, have witnessed an upward trajectory in urgent care centers. The ease of access to these services, along with growing public health campaigns, drives this segment’s growth.

Other services in the urgent care center market, including lab services and monitoring of chronic conditions, play a crucial role. These services provide a comprehensive care approach, enhancing the appeal of urgent care centers for patients seeking one-stop solutions for their healthcare needs.

Ownership Analysis

In 2023, the urgent care center market, segmented by ownership, revealed distinct trends. Hospitals held a dominant market position, capturing more than a 32% share. This dominance is primarily due to hospitals expanding their services to offer more accessible and cost-effective care through urgent care centers.

Physician-owned urgent care centers also marked a significant presence. These centers benefit from the personalized care and medical expertise that physicians directly bring. Their share reflects a growing preference among patients for healthcare provided by familiar and trusted medical professionals.

Corporate-owned urgent care centers are another key segment. These entities leverage their financial resources and management expertise to offer efficient services. Their growth can be attributed to strategic expansions and partnerships, aimed at widening patient access to urgent care services.

The “Others” category in the urgent care center market, which includes non-profit organizations and government-owned centers, plays a vital role. Although smaller in market share, these centers are crucial in providing care in underserved areas or to specific population groups.

Key Market Segments

Service

- Trauma or Injury Treatment

- Acute Illness Treatment

- Physical Examinations

- Immunization and Vaccination

- Others

Ownership

- Hospital

- Physicians

- Corporation

- Others

Drivers

- Rising Geriatric Population and Chronic Diseases: The global increase in elderly populations and chronic conditions, such as heart and circulatory diseases, is a primary driver. For instance, about 550 million people worldwide live with heart diseases, influencing market growth.

- Efficiency and Affordability: Urgent care centers offer quicker and more affordable care than traditional emergency and primary care centers. This convenience attracts a larger patient base.

- Increasing Investments and Strategic Development: There’s a growing trend of investments in urgent care centers, with hospitals and healthcare providers strategically entering this market. This expansion is driven by the need to provide accessible care and retain patients within healthcare networks.

Restraints

- Shortage of Skilled Professionals: A significant challenge is the lack of adequately trained healthcare professionals, which could limit market growth.

Opportunities

- Expansion into Outpatient Specialties: There’s an opportunity for growth by establishing specialized outpatient clinics (e.g., for orthopedics or cardiology) to cater to diverse patient needs.

- Adoption of Telehealth and Digital Solutions: Integrating telemedicine and digital health tools offers a significant growth avenue, helping clinics expand their reach and improve patient engagement.

- Focus on Wellness and Preventative Care: Emphasizing preventive healthcare and wellness initiatives presents an opportunity for urgent care centers to position themselves as key players in health management.

- Patient-Centered Care Approaches: Implementing patient-centered strategies, like digital communication platforms, can enhance patient experience and clinic sustainability.

Challenges

- Regulatory Hurdles in Chronic Disease Treatment: Strict regulations in chronic disease treatments pose challenges, potentially hampering the adoption of innovative therapies and affecting market growth.

Market Trends

- Hospital-Owned Centers Growing Fast: Hospital-owned urgent care centers are expanding rapidly, due to their ability to provide coordinated care and their ease of market entry. The segment is benefiting from an increasing focus on patient care and favorable reimbursement environments.

- Telehealth Driving Demand: The adoption of telehealth in the U.S. has significantly impacted the market, offering cost-effective treatment and enhancing revenue per provider.

- Increased UCCs in the U.S.: There’s been a notable increase in UCCs in the U.S., with 9,279 centers reported in 2019. This rise is attributed to the demand for rapid and affordable healthcare services.

- Lower Treatment Costs at UCCs: The cost-effectiveness of UCCs, compared to primary care providers (PCPs), is a major factor in their popularity. Treatment costs at UCCs range from USD 80 to USD 440, much lower than PCPs.

Regional Analysis

North America

In 2023, North America leads the urgent care center market with a commanding 39.7% share, equating to USD 9.6 billion. This dominance is fueled by advanced healthcare technology, a significant elderly population, and a high incidence of chronic diseases. The U.S. market, in particular, shows robust growth due to factors like technological advancements in telemedicine and a high frequency of sports injuries and accidents. For example, in 2020, bicycling injuries accounted for approximately 426,000 cases. The U.S. market size was valued at USD 56.7 billion in 2022 and is projected to grow at a CAGR of 10.99% from 2023 to 2030.

Europe

Europe’s urgent care center market is growing steadily, backed by strong government healthcare initiatives. The region’s share in 2023 stands at ~30%, indicating sustained growth driven by an aging population and advancements in healthcare infrastructure.

Asia Pacific

The Asia Pacific region is witnessing rapid market growth, propelled by increasing healthcare awareness and rising disposable incomes. Countries like China and India are key contributors to this growth. China’s market is growing at a CAGR of ~5.9%, and India’s at ~5.6%, both driven by an aging population, a surge in chronic diseases, and the integration of telehealth and digital healthcare solutions.

United States

The U.S. market, with a ~29.1% share, is expanding due to the preference for convenient and cost-effective healthcare. The aging population and chronic diseases keep outpatient services in high demand, with regulatory changes and competitive healthcare landscapes influencing the market.

Germany

Germany holds a ~6.1% market share, with growth driven by an aging population, chronic diseases, and advancements in telehealth and digital healthcare technologies. Despite regulatory and budgetary constraints, the market is expected to grow, adapting to healthcare needs and innovations.

China

China’s market is poised for growth with a CAGR of ~6.5%. The demand for outpatient treatments is high due to the aging population, increasing healthcare awareness, and rising chronic diseases. The growth of telemedicine and digital health technology, especially in rural areas, supports this expansion.

India

India’s market, growing at a CAGR of ~5.8%, is buoyed by a growing population, increased healthcare awareness, and a rise in chronic diseases. The developing healthcare infrastructure and the adoption of telehealth are key growth drivers, despite existing healthcare inequities and regulatory challenges.

United Kingdom

In the United Kingdom, the market is growing at a CAGR of ~4.5%. The demand for outpatient services is driven by an aging population, chronic diseases, and a focus on prompt healthcare access. The National Health Service (NHS) is working to enhance outpatient services, with telehealth and digital health solutions gaining traction.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The urgent care center market is bustling with a variety of key players, each contributing uniquely to the industry. Among these, Concentra, Inc. shines as a major player, holding a significant portion of the market. Alongside, companies like MedExpress, American Family Care, NextCare Urgent Care, and FastMed Urgent Care are notable for their substantial market presence.

Adding to this dynamic mix are CityMD Urgent Care, CareNow Urgent Care, and GoHealth Urgent Care. These entities play vital roles in shaping the market’s landscape. HCA Healthcare UK and Columbia Asia Hospitals also stand out, providing diverse urgent care options.

International SOS and St. Joseph’s Health Care London mark their presence too, among many other key contributors. This wide array of participants fosters a competitive environment, sparking innovation and ensuring that patients receive a broad spectrum of urgent care services. The market’s diversity is its strength, allowing for a range of services that cater to various patient needs and preferences.

Key Market Players

- Concentra, Inc.

- MedExpress

- American Family Care

- NextCare Urgent Care

- FastMed Urgent Care

- CityMD Urgent Care

- CareNow Urgent Care

- GoHealth Urgent Care

- HCA Healthcare UK

- Columbia Asia Hospitals

- International SOS

- St. Joseph’s Health Care London

- Other Key Players

Recent Developments

- In October 2023, CVS Health made a significant move by announcing its intention to acquire Urgent Care Now for $1.9 billion. This strategic acquisition aims to broaden CVS Health’s network of urgent care centers to over 1,000 locations, marking a major expansion in their healthcare services.

- In September 2023, UnitedHealth Group introduced Optum UrgiCare, their new brand in the urgent care sector. Optum UrgiCare is set to offer various services, including the convenience of same-day appointments, extended operating hours, and the integration of telemedicine services.

- In August 2023, saw the Urgent Care Association of America (UCAOA) reveal a noteworthy study. The study highlighted that urgent care centers contributed to an impressive saving of approximately $23 billion for the US healthcare system in 2022.

- In July 2023, brought an important announcement from the Centers for Medicare and Medicaid Services (CMS). CMS declared its decision to start reimbursing urgent care centers at rates equivalent to hospitals for certain services, a move that aligns urgent care reimbursement policies more closely with hospital-based care.

- In June 2023, witnessed the Urgent Care Association of America (UCAOA) report a 10% increase in the number of visits to urgent care centers in 2022. This growth indicates a rising reliance on and the growing importance of urgent care centers in the healthcare landscape.

Report Scope

Report Features Description Market Value (2023) USD 24.3 Billion Forecast Revenue (2032) USD 37.3 Billion CAGR (2023-2032) 5.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Trauma or Injury Treatment, Acute Illness Treatment, Physical Examinations, Immunization and Vaccination and Others) By Ownership (Hospital, Physicians, Corporation and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Concentra, Inc, MedExpress, American Family Care, NextCare Urgent Care, FastMed Urgent Care, CityMD Urgent Care, CareNow Urgent Care, GoHealth Urgent Care, HCA Healthcare UK, Columbia Asia Hospitals, International SOS, St. Joseph’s Health Care London And Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Concentra, Inc.

- MedExpress

- American Family Care

- NextCare Urgent Care

- FastMed Urgent Care

- CityMD Urgent Care

- CareNow Urgent Care

- GoHealth Urgent Care

- HCA Healthcare UK

- Columbia Asia Hospitals

- International SOS

- St. Joseph's Health Care London

- Other Key Players