United States Electric Car Market Size, Share, Growth Analysis By Propulsion (Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle, Fuel Cell Electric Vehicle), By Vehicle Type (Passenger Cars, Two-wheelers, Commercial Vehicles), By Battery (Lithium Ion, Sealed Lead Acid, Nickel Metal Hydride), By Range (Less than 100 km, 100 km – 200 km, 200 km – 300 km, Above 300 km), By Drivetrain (Front-wheel drive, Rear-wheel drive, All-wheel drive), By Price Range (Below USD 10,000, USD 10,000 to USD 30,000, USD 30,000 to USD 50,000, Above USD 50,000), By End Use (Personal, Commercial, Government, Private), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154649

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

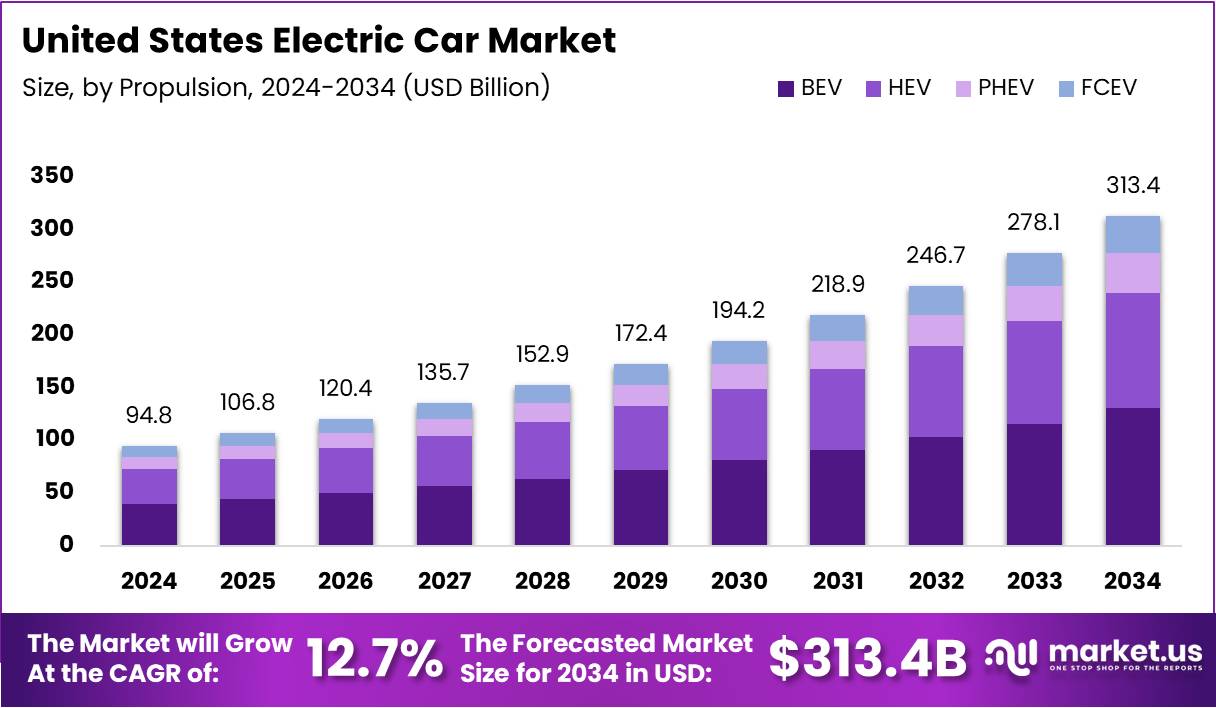

The United States Electric Car Market size is expected to be worth around USD 313.4 Billion by 2034, from USD 94.8 Billion in 2024, growing at a CAGR of 12.7% during the forecast period from 2025 to 2034.

The United States Electric Car Market continues to reshape the future of mobility by embracing sustainable transport solutions. With increasing demand for zero-emission vehicles, automakers and startups are swiftly innovating. Consumer preferences are shifting toward eco-friendly mobility, supported by rising awareness and improving charging infrastructure across states.

Additionally, market dynamics are evolving as affordability improves and EV choices expand. Companies are now offering electric sedans, SUVs, and trucks tailored to American needs. This diversification enhances mass adoption and strengthens overall EV penetration, especially in urban and suburban areas. Consequently, the transition toward electric mobility is gaining firm momentum.

Moreover, opportunities are growing due to rapid advancements in battery technologies. Declining battery prices, extended driving range, and faster charging options are improving consumer satisfaction. At the same time, software-driven EVs are offering features like autonomous driving and real-time diagnostics, further enhancing product value and appeal.

In parallel, federal and state governments continue to provide crucial support through grants and tax credits. The Inflation Reduction Act, along with Clean Vehicle Credits, motivates both manufacturers and buyers. State-wise zero-emission mandates and carbon reduction goals are also pushing EV manufacturers to expand local production capabilities.

Furthermore, the electrification of commercial fleets opens new doors for revenue. Delivery and ride-hailing companies are increasingly switching to EVs to cut operational costs and reduce emissions. This shift is prompting partnerships between automakers, energy firms, and infrastructure providers to accelerate deployment in commercial segments.

In addition, regulatory reforms are setting clear roadmaps for EV adoption. Stricter emission rules and fuel economy standards are compelling automakers to prioritize EV development. These policies are encouraging domestic manufacturing, reducing reliance on imports, and creating employment in clean mobility sectors.

According to a recent survey, U.S. EV sales surged from just 17,763 in 2011 to 1,456,484 vehicles in 2023, reflecting a CAGR of ~53%. This significant rise highlights how far the market has progressed in just over a decade. Also, used EV sales rose 62.6% in 2024 vs 2023, according to the same source, driven largely by uncertainty around federal rebates.

Altogether, the U.S. electric car market stands at a transformational stage, powered by policy incentives, rising consumer confidence, and strategic investments. As a result, the landscape is maturing rapidly, creating a fertile environment for long-term growth and innovation in the clean mobility space.

Key Takeaways

- United States Electric Car Market projected to reach USD 313.4 Billion by 2034, growing at a CAGR of 12.7% from USD 94.8 Billion in 2024.

- BEV (Battery Electric Vehicles) leads propulsion with a 71.6% share in 2024 due to zero emissions and strong government support.

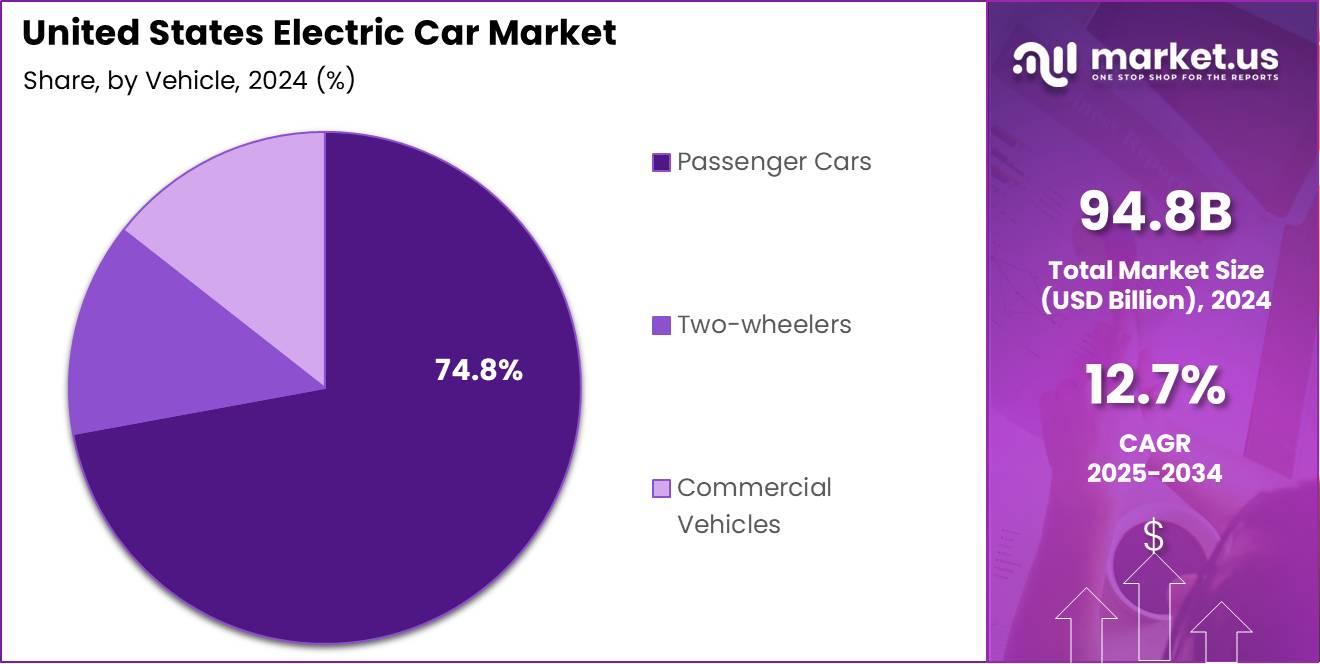

- Passenger Cars dominate vehicle type with a 74.8% market share in 2024, fueled by rising personal EV adoption.

- Lithium Ion batteries hold the highest market preference in 2024 for their high energy density and long lifecycle.

- North America leads regional performance with a 42.8% share, valued at USD 23.5 Billion in the United States market.

By Propulsion Analysis

BEV leads with 71.6% share as U.S. consumers shift toward fully electric solutions.

In 2024, BEV held a dominant market position in By Propulsion Analysis segment of United States Electric Car Market, with a 71.6% share. Battery electric vehicles have gained massive traction owing to their zero-emission nature, lower running costs, and government incentives promoting clean mobility.

HEVs are also witnessing steady adoption. Hybrid Electric Vehicles combine internal combustion with electric power, making them suitable for consumers not yet ready for a full transition. Their market share reflects a moderate preference in transition phases.

PHEVs cater to those seeking flexibility. These Plug-in Hybrid Electric Vehicles offer electric driving with an ICE backup, appealing to urban and suburban users. Their market uptake remains niche but relevant.

FCEVs, although promising in terms of range and refueling time, face infrastructure limitations. Their market share is significantly smaller due to limited hydrogen refueling stations.

By Vehicle Analysis

Passenger Cars lead with 74.8% share due to rising individual EV ownership.

In 2024, Passenger Cars held a dominant market position in By Vehicle Analysis segment of United States Electric Car Market, with a 74.8% share. The high adoption is driven by expanding EV lineups, cost competitiveness, and growing consumer environmental awareness.

Two-wheelers are gaining attention in urban regions. Electric scooters and bikes offer low-cost, short-distance travel options. While still a smaller segment, it plays a key role in last-mile mobility.

Commercial Vehicles are gradually entering the electric shift. Though adoption remains slower due to cost and load requirements, businesses are exploring electrification for fleet sustainability goals.

By Battery Analysis

Lithium Ion dominates with highest market preference due to its performance edge.

In 2024, Lithium Ion held a dominant market position in By Battery Analysis segment of United States Electric Car Market. Their dominance is credited to high energy density, lightweight design, and long lifecycle, making them ideal for EV performance demands.

Sealed Lead Acid batteries, though more affordable, are less common in modern electric cars due to weight and lower efficiency. Their use is mainly restricted to older or lower-cost models.

Nickel Metal Hydride (NiMH) batteries offer durability and stability, often used in hybrid vehicles. While not mainstream in pure EVs, they provide a viable solution in specific propulsion combinations.

Key Market Segments

By Propulsion

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

By Vehicle

- Passenger Cars

- Sedan

- SUV

- Hatchback

- Others

- Two-wheelers

- Motorcycles

- E-bikes

- Commercial Vehicles

- Light

- Medium

- Heavy

By Battery

- Lithium Ion

- Sealed Lead Acid

- Nickel Metal Hydride (NiMH)

By Range

- Less than 100 km

- 100 km – 200 km

- 200 km to 300 km

- Above 300 km

By Drivetrain

- Front-wheel drive

- Rear-wheel drive

- All-wheel drive

By Price Range

- Below USD 10,000

- USD 10,000 to USD 30,000

- USD 30,000 to USD 50,000

- Above USD 50,000

By End Use

- Personal

- Commercial

- Government

- Private

Drivers

Rising Investments by Traditional Automakers in EV Lineups Drive Market Expansion

The United States electric car market is witnessing significant growth, largely due to increasing investments from traditional automakers in electric vehicle (EV) development. Companies like Ford, General Motors, and Stellantis are investing billions of dollars to expand their EV portfolios. These efforts aim to meet growing consumer demand and comply with stricter emission regulations. Such investments are helping make EVs more accessible and competitive in terms of price and performance.

Another key driver is the expansion of domestic battery manufacturing facilities. The U.S. government and private companies are working together to build more battery production plants across the country. This local manufacturing reduces reliance on imports, lowers production costs, and helps ensure a steady supply of batteries one of the most expensive parts of an EV.

In addition, several U.S. states are implementing Zero-Emission Vehicle (ZEV) programs to promote clean transportation. These programs require automakers to sell a certain percentage of zero-emission vehicles within their states. As a result, automakers are motivated to increase their EV offerings, which directly supports market growth.

Lastly, the integration of renewable energy sources like solar and wind with EV charging infrastructure is helping reduce the carbon footprint of electric cars. Clean energy-powered charging stations make EVs more sustainable and appeal to eco-conscious consumers. This green synergy strengthens public trust and drives adoption of electric vehicles across the country.

Restraints

Limited Availability of Raw Materials for EV Components Restricts Market Expansion

One major challenge in the U.S. electric car market is the limited availability of essential raw materials such as lithium, cobalt, and nickel. These materials are crucial for producing EV batteries. However, domestic mining and refining capacities remain insufficient, leading to supply shortages and increased production costs. This affects automakers’ ability to scale EV production efficiently.

Regional disparities in charging infrastructure also act as a restraint. While states like California and New York have a dense network of EV charging stations, many rural and less-developed areas still lack proper infrastructure. This uneven access discourages potential buyers in underserved regions, limiting nationwide adoption.

The market also heavily depends on government incentives to keep electric vehicles affordable. Tax credits and rebates significantly reduce upfront purchase costs. However, changes or reductions in these policies could lead to a sudden drop in demand, especially among price-sensitive consumers. This reliance on subsidies makes the market vulnerable to policy shifts.

Lastly, high insurance premiums for electric vehicles present another concern. Insurers often charge more for EVs due to higher repair costs and the expensive nature of battery replacement. This increases the total cost of ownership for consumers, making EVs less appealing compared to traditional internal combustion engine (ICE) vehicles.

These restraints collectively slow the momentum of the U.S. electric car market, despite growing consumer interest and government support for clean mobility solutions.

Growth Factors

Electrification of Commercial Vehicle Fleets and Delivery Services Unlocks New Market Avenues

The development of Vehicle-to-Grid (V2G) technology is opening exciting growth opportunities in the U.S. electric car market. This technology allows EVs to not only draw power from the grid but also send excess energy back during peak hours. As utility companies explore energy balancing strategies, V2G integration could support grid stability while offering cost-saving incentives to EV owners and fleet operators.

The shift toward electrifying commercial vehicle fleets is also accelerating demand. Delivery companies, logistics providers, and ride-sharing platforms are investing in electric vans and trucks to meet sustainability targets and reduce operating costs. With growing pressure to cut emissions in urban areas, the U.S. is expected to see a sharp rise in electric fleet conversions over the next few years.

Collaboration between utilities and EV manufacturers is strengthening. Joint efforts to improve charging infrastructure, offer time-of-use pricing, and launch smart charging systems are making EV adoption easier and more appealing to consumers. These partnerships are also essential in optimizing the electric grid for future load demands caused by rising EV usage.

Lastly, the expansion of subscription-based EV ownership models is changing how people access vehicles. Monthly subscription plans covering insurance, maintenance, and charging make EVs more affordable and flexible for a wider range of consumers. This model attracts tech-savvy users and urban dwellers who prefer short-term commitments over traditional ownership. It is poised to broaden the customer base for electric vehicles significantly.

Emerging Trends

Surge in EV Sales Through Online Retail Platforms is Transforming Market Trends

In recent years, online platforms have become a popular way to buy electric vehicles (EVs) in the United States. This trend is gaining strength as more consumers prefer the convenience of browsing, comparing, and even customizing EVs online. Major automakers and new EV startups are now offering direct-to-consumer sales models, removing traditional dealership barriers and streamlining the purchase experience.

Another noticeable trend is the increasing use of over-the-air (OTA) software updates in EVs. These updates allow manufacturers to remotely enhance vehicle performance, fix software bugs, and introduce new features without the need for service center visits. This capability improves vehicle longevity and provides a smarter, more connected ownership experience, which is becoming a key selling point.

The U.S. EV market is also witnessing the rise of new automotive brands and startups that focus only on electric mobility. Companies like Rivian, Lucid Motors, and Fisker are reshaping the competitive landscape by offering unique designs, sustainable practices, and advanced technologies that appeal to environmentally conscious consumers.

Additionally, the integration of bi-directional charging systems in home energy setups is gaining attention. This feature allows EV owners to use their car battery to power home appliances or feed energy back to the grid. As energy resilience and cost savings become more important, this technology is expected to drive further interest in EV adoption.

Key United States Electric Car Company Insights

In the 2024 United States Electric Car Market, leading players are actively shaping the industry landscape through innovation, strategic expansion, and product differentiation.

Lucid Motors is gaining momentum in the premium EV segment with its emphasis on luxury performance and long-range technology. The brand’s focus on high-end sedans like the Lucid Air positions it as a strong competitor in the upscale electric vehicle category.

Nissan continues to leverage its early-mover advantage through the Leaf, one of the first mass-market electric cars. In 2024, Nissan’s efforts to expand its EV lineup and integrate advanced safety and battery technologies have helped sustain its relevance in the evolving market.

Mercedes-Benz is pushing forward with its EQ series, signaling a long-term commitment to electric mobility. Its strong brand equity, combined with luxury-focused EVs like the EQS and EQE, allows it to attract a premium customer base seeking both innovation and comfort.

Chevrolet, a division of General Motors, maintains its market presence through the Bolt series and the rollout of newer models built on GM’s Ultium platform. Its strategy focuses on affordability and widespread accessibility, aiming to reach a broader segment of EV buyers.

Other major brands like Ford, Volkswagen, Rivian, BMW, Tesla, and Hyundai continue to influence market dynamics; however, the above players are especially notable for their targeted approaches and diversified offerings that align with consumer trends in 2024. Their ongoing advancements in EV technology, range capabilities, and sustainability initiatives are helping shape the competitive edge in the U.S. Market.

Top Key Players in the Market

- Lucid Motors

- Nissan

- Mercedes-Benz

- Chevrolet

- Ford

- Volkswagen

- Rivian

- BMW

- Tesla

- Hyundai

Recent Developments

- In June 2025, Motive acquired InceptEV to strengthen its capabilities in supporting commercial fleet operators with data-driven tools that accelerate electric vehicle (EV) adoption. This move enhances Motive’s transition support services by integrating InceptEV’s predictive analytics for EV performance and cost-efficiency.

- In July 2025, Parker-Hannifin expanded its electric vehicle portfolio through the $1 billion acquisition of Curtis Instruments, a global provider of EV motor controllers and instrumentation. The acquisition is set to boost Parker-Hannifin’s position in the growing electrification segment across mobile and industrial applications.

Report Scope

Report Features Description Market Value (2024) USD 94.8 Billion Forecast Revenue (2034) USD 313.4 Billion CAGR (2025-2034) 12.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion (Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle, Fuel Cell Electric Vehicle), By Vehicle Type (Passenger Cars, Two-wheelers, Commercial Vehicles), By Battery (Lithium Ion, Sealed Lead Acid, Nickel Metal Hydride), By Range (Less than 100 km, 100 km – 200 km, 200 km – 300 km, Above 300 km), By Drivetrain (Front-wheel drive, Rear-wheel drive, All-wheel drive), By Price Range (Below USD 10,000, USD 10,000 to USD 30,000, USD 30,000 to USD 50,000, Above USD 50,000), By End Use (Personal, Commercial, Government, Private) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Lucid Motors, Nissan, Mercedes-Benz, Chevrolet, Ford, Volkswagen, Rivian, BMW, Tesla, Hyundai Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  United States Electric Car MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

United States Electric Car MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lucid Motors

- Nissan

- Mercedes-Benz

- Chevrolet

- Ford

- Volkswagen

- Rivian

- BMW

- Tesla

- Hyundai