Global Underwater Communication System Market By Component (Hardware, Software, Services), By Connectivity (Wired, Wireless), By Application (Climate monitoring, Environmental monitoring, Hydrography, Oceanography, Pollution monitoring, Others), By End-user (Marine, Military & Defence, Oil & Gas, Scientific Research & Development, Others) By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167184

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

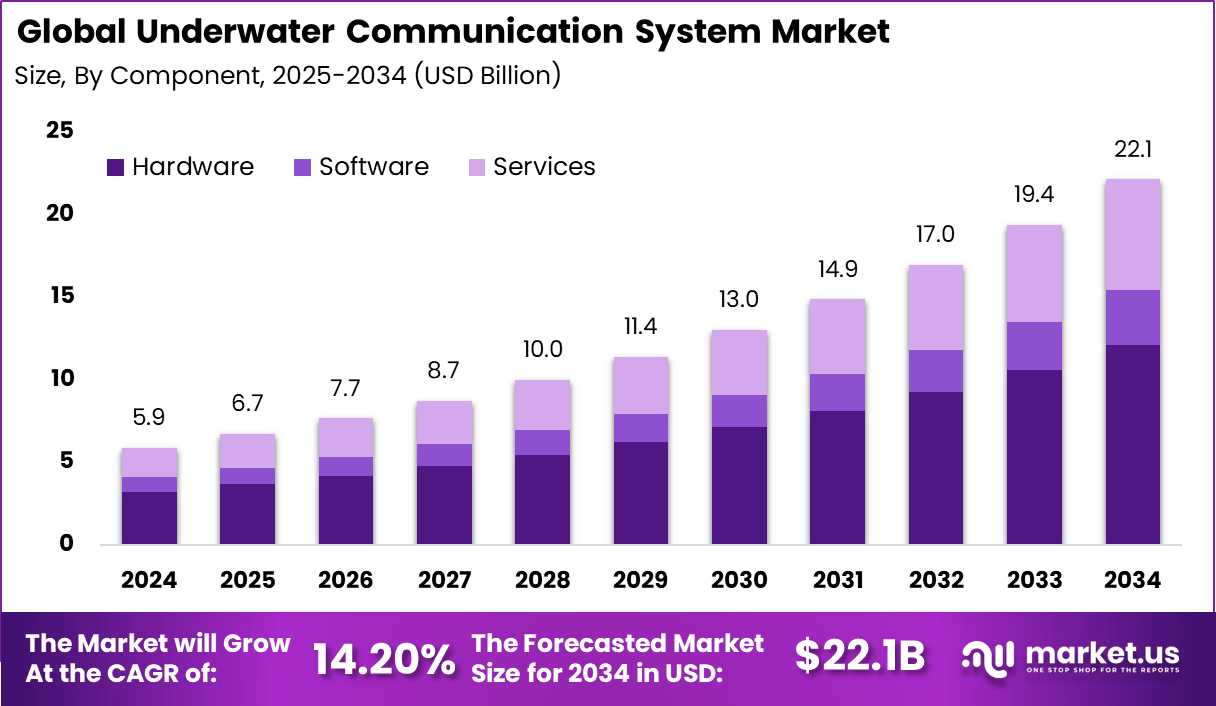

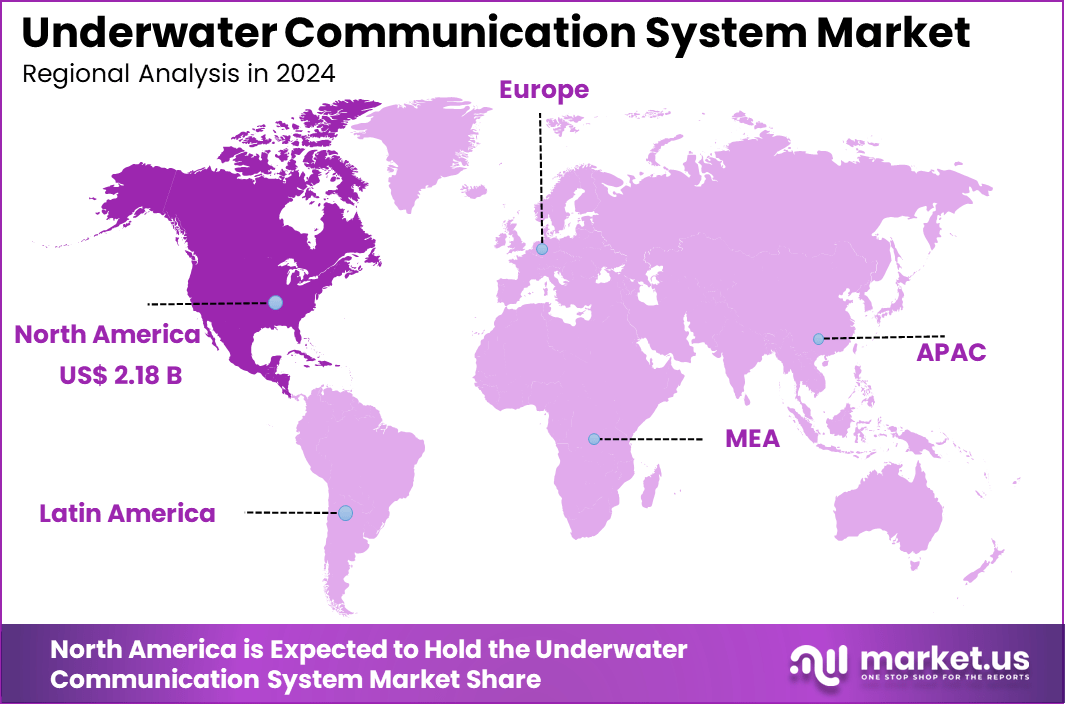

The Global Underwater Communication System Market generated USD 5.9 billion in 2024 and is predicted to register growth from USD 6.7 billion in 2025 to about USD 22.1 billion by 2034, recording a CAGR of 14.20% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 37.3% share, holding USD 2.18 Billion revenue.

The underwater communication system market has expanded as naval forces, offshore energy operators and marine research agencies demand reliable communication below the water surface. Growth reflects the increasing scale of underwater exploration, subsea infrastructure development and the need for secure data transfer in environments where traditional radio waves cannot operate effectively. The market includes acoustic, optical and electromagnetic communication technologies used in both shallow and deep water operations.

The growth of the market can be attributed to rising offshore oil and gas activities, expansion of subsea renewable energy projects and growing use of autonomous underwater vehicles. Marine security requirements, environmental monitoring and undersea defence missions also strengthen adoption. Advances in ocean research, climate monitoring and underwater robotics further contribute to market momentum.

Demand is rising across naval applications, offshore drilling platforms, subsea cable inspection, scientific expeditions and environmental observation programs. Defence agencies require underwater communication for surveillance, navigation and coordinated underwater missions. Commercial operators use these systems to monitor pipelines, rigs and underwater equipment. Oceanographers rely on communication networks for real time data transfer from sensors and research instruments.

Top Market Takeaways

- By component, hardware accounts for approximately 54.6% of the market, driven by the demand for advanced transceivers, modems, sensors, and cabling systems that enable reliable underwater data transmission.

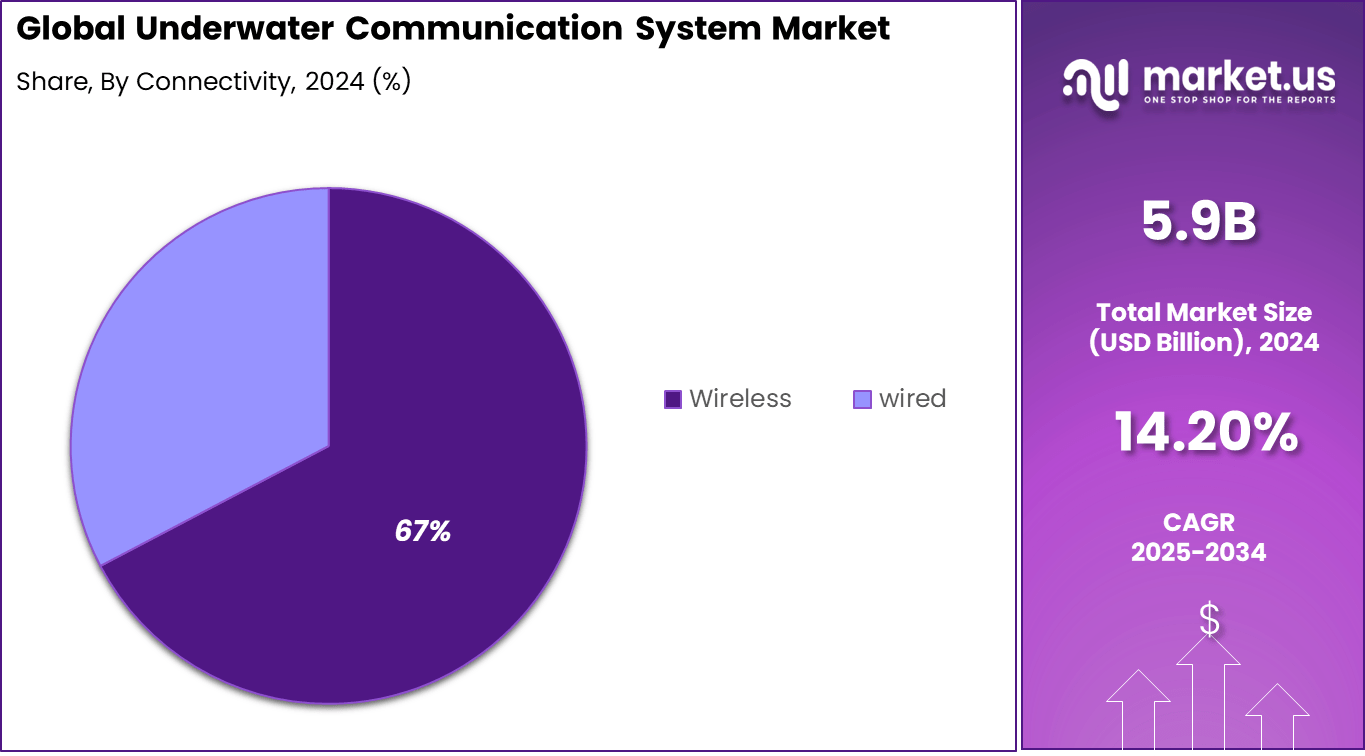

- By connectivity, wireless underwater communication leads with about 67.3% share, favored for its flexibility in environmental monitoring, marine research, and defense applications despite challenges presented by underwater acoustic and optical signal propagation.

- By application, environmental monitoring dominates with 40.7% of the market. Key use cases include climate monitoring, pollution detection, oceanography, hydrography, and sustainable management of marine resources.

- By end-user, the marine sector holds around 35.5% of the market, reflecting extensive use in offshore exploration, marine research, underwater construction, and navigation aids.

- Regionally, North America accounts for approximately 37.3% market share.

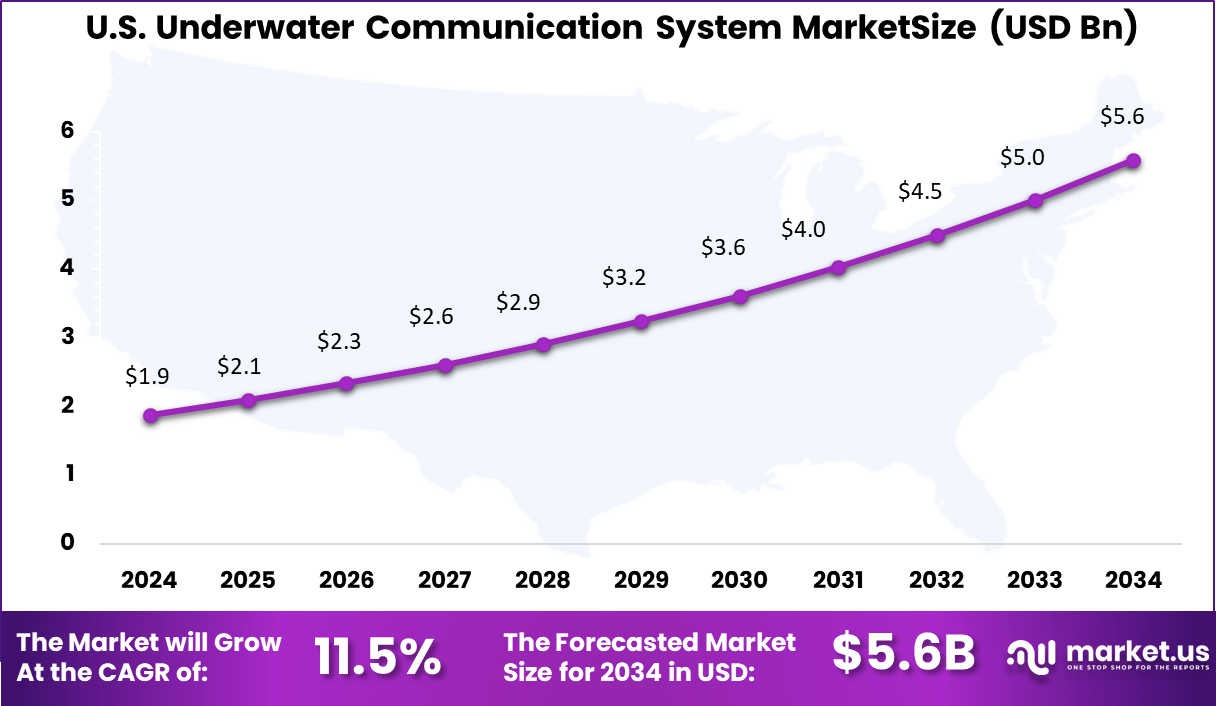

- The U.S. market is valued at roughly USD 1.88 billion in 2025.

- The market is growing at a CAGR of about 11.5%, driven by increasing investment in offshore oil and gas, marine environmental preservation efforts, advancements in underwater wireless technologies, and rising defense expenditure for underwater surveillance and security.

By Component

In 2024, the hardware segment holds a strong 54.6% share in the underwater communication system market. This segment includes essential electronic components such as transceivers, acoustic modems, sensors, cables, connectors, and circuit boards that facilitate underwater data transmission.

The hardware’s vital role lies in its ability to withstand harsh subsea environments, ensuring robust, reliable communication across varying depths and conditions. Innovations in hardware design focus on miniaturization, energy efficiency, and enhanced signal processing to improve communication fidelity and operational lifespan.

As underwater missions diversify and demand real-time, error-free data delivery, the continuous enhancement of hardware technologies becomes crucial. Deployments span marine research, offshore energy, and defense sectors, where dependable communication infrastructure underpins mission success and safety.

By Connectivity

In 2024, Wireless connectivity dominates the market with a notable 67% share. Wireless underwater communication relies primarily on acoustic signals, enabling data transfer over water where traditional RF waves falter. This wireless mode facilitates greater flexibility and mobility for submerged equipment like AUVs and sensor networks. It supports complex applications like environmental monitoring and underwater exploration by providing real-time, remote access to crucial data.

Despite challenges such as limited bandwidth and signal attenuation in underwater environments, advancements in acoustic modems and network algorithms are enhancing wireless communication reliability and range. The push for subsea IoT integration further drives wireless connectivity adoption, as it enables scalable, decentralized monitoring systems crucial for modern marine operations.

By Application

In 2024, Environmental monitoring captures a significant 40.7% share of the market, indicating its strategic importance. Underwater communication systems support diverse ecological assessments including pollution tracking, marine biodiversity studies, climate change monitoring, and early detection of natural disasters like tsunamis. These systems enable scientists and environmentalists to collect live data from underwater sensors, remotely operating devices over large oceanic or freshwater areas.

The rising global awareness of climate impact and stringent environmental regulations boost demand for efficient monitoring technologies. Underwater communication facilitates data accuracy and timeliness, helping stakeholders make informed decisions that balance ecological preservation with sustainable resource use.

By End-User

In 2024, The marine industry accounts for 35.5% of end-user adoption. This sector encompasses oceanographic research, commercial shipping, aquaculture, and subsea construction, all of which rely on underwater communication for navigation, data collection, and operational control. Effective communication systems ensure safety, optimize resource management, and support real-time decision-making during complex marine operations.

Marine end-users prioritize solutions that offer high reliability and integrate easily with existing infrastructure to enhance operational efficiency. The ongoing expansion of marine industries and the shift toward automation and remote management underline the critical role of underwater communication technologies in enabling growth and innovation.

Main Reasons for Adoption

- Better naval operations: These systems make it possible for defense teams to safely and reliably communicate underwater, which is crucial for submarine missions and naval maneuvers.

- Real-time data sharing: Transferring data instantly between underwater vehicles, sensors, and surface stations is critical for control and monitoring, whether in oil rigs or scientific explorations.

- Remote and hard-to-reach areas: Underwater communication helps reach places where cables are hard to lay or maintain, making exploration and resource mapping more flexible.

- Support for autonomous technologies: The rise of remote-operated and autonomous underwater vehicles needs robust systems to relay commands and status updates deep underwater.

- Environmental monitoring: Monitoring pollution, climate change, or marine life requires continuous data transmission from underwater sensors to researchers or government agencies.

- Disaster response: These technologies play a key role in underwater rescue or disaster prediction by enabling smooth communication for divers and rescue teams.

Business Benefits

- Cost and risk reduction: Smooth data transmission eliminates the need for expensive cable installations, cuts down on infrastructure and labor costs, and reduces operational risks in challenging marine settings.

- Operational efficiency: Real-time monitoring and control of underwater equipment limit downtime, boost resource extraction, and help maintain asset health by catching issues early.

- Enhanced safety: Reliable underwater communications mean faster response to emergencies and safer working conditions for divers, offshore workers, and researchers.

- Support for innovation: Advancements such as AI-enhanced signal processing and energy-efficient, battery-free communication allow businesses to adopt cutting-edge technology for deeper, longer, and more secure underwater missions.

- Regulatory compliance: Monitoring environmental impacts helps industries meet regulations while ensuring their activities don’t harm marine ecosystems, building trust and avoiding penalties.

- Expanded opportunities: New business models emerge around deep-sea exploration, autonomous marine tech, and hybrid communication solutions for research, logistics, or defense.

Emerging Trends

Key Trend Description Hybrid Communication Technologies Integration of acoustic, optical, and radio frequency for more reliable and high-speed underwater communication. AI and Machine Learning Applications Use of AI/ML for signal processing, noise reduction, and predictive maintenance of underwater systems. Development of Smart Underwater Networks IoT-enabled interconnected underwater communication systems for real-time data monitoring and control. Expansion of Autonomous Underwater Vehicles (AUVs) Growing use of AUVs in ocean exploration and defense driving demand for advanced communication solutions. Wireless and Software-Defined Systems Shift from cable-based to wireless, software-managed communication systems for flexibility and cost efficiency. Growth Factors

Key Factor Description Increasing Offshore Oil and Gas Exploration Growing offshore operations require reliable systems for communication, navigation, and safety. Rising Defense and Naval Investments Enhanced underwater communication for anti-submarine warfare, surveillance, and reconnaissance fuels growth. Expanding Marine Research Activities Scientific research and environmental monitoring increase demand for efficient underwater data transmission. Regulatory Support and Standardization Government policies promoting underwater technology development and safer communication infrastructures. Technological Advances and Innovation Continuous improvements in sensor technology, signal processing, and energy efficiency supporting market expansion. Key Market Segments

By Component

- Hardware

- Software

- Services

By Connectivity

- Wired

- Wireless

By Application

- Climate Monitoring

- Environmental Monitoring

- Hydrography

- Oceanography

- Pollution Monitoring

- Others

By End-User

- Marine

- Military & Defence

- Oil & Gas

- Scientific Research & Development

- Others

Regional Analysis

In 2024, North America held a commanding 37.3% share of the global underwater communication system market, driven by the region’s advanced maritime infrastructure and intensive offshore activities. The increasing demand for reliable underwater communication in subsea exploration, defense, and marine research sectors fuels the market’s expansion.

Technological advancements in acoustic and optical communication systems enhance data transmission capabilities, enabling efficient underwater operations. The region benefits from a strong base of innovative companies and significant investments in research and development, supporting next-generation communication technologies that improve connectivity in challenging underwater environments.

The U.S. stands as the largest market within North America, valued at approximately USD 1.88 billion in 2024 and growing robustly at a CAGR of 11.5%. The U.S. growth is underpinned by substantial government and private sector funding focused on naval modernization, offshore oil and gas exploration, and scientific marine initiatives.

The demand for enhanced, real-time underwater data transmission and sensor network integration pushes adoption of sophisticated communication systems. Additionally, advancements in hybrid acoustic-optical technologies and autonomous underwater vehicles (AUVs) drive increased system deployment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Offshore Energy and Defense Activities

The underwater communication system market is propelled by the increasing offshore energy exploration and production activities, along with escalating defense and surveillance operations. These sectors demand reliable and robust underwater communication technologies to enable real-time data exchange between underwater vehicles, sensors, and surface stations.

The rise of offshore oil, gas, and renewable energy projects further amplifies the need for advanced communication systems to monitor and control subsea operations efficiently. Moreover, the growing use of autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) in scientific research and environmental monitoring also boosts market growth.

Restraint

Signal Reduction and Environmental Challenges

A significant restraint in the underwater communication system market is the inherent signal reduce and interference caused by the underwater environment. Acoustic waves primarily used for communication suffer from limited bandwidth, latency, and multipath fading due to water salinity, pressure, and temperature variations. These factors degrade signal strength and data transmission quality over long distances.

Environmental noises from marine life and human activities also interfere with communication, posing challenges in maintaining reliable links. These limitations restrict real-time high-data-rate transfers and impede system performance, curtailing broader application in certain deep-sea missions.

Opportunity

Integration of AI and Hybrid Communication Technologies

The market presents vast opportunities through the integration of artificial intelligence and hybrid communication technologies combining acoustic, optical, and radio-frequency systems. AI enhances signal processing, adaptive modulation, interference management, and predictive maintenance, significantly improving underwater communication quality and reliability.

Hybrid communication solutions can leverage the strengths of different transmission methods to overcome individual limitations. This facilitates applications demanding high bandwidth and low latency such as underwater video transmission and seamless control of unmanned underwater systems. Increasing investments in smart underwater networks and IoT further expand these prospects.

Challenge

High Costs and Complex System Integration

The underwater communication system market faces critical challenges in managing the high costs associated with deploying and maintaining state-of-the-art communication infrastructure. Specialized acoustic modems, autonomous platforms, and hybrid systems require expensive components and skilled operators.

This makes initial capital expenditures and operational costs significant barriers, particularly for smaller organizations. Additionally, integrating underwater communication systems with surface networks and legacy systems is complex, often demanding custom engineering solutions. Ensuring compatibility, data security, and system scalability in harsh marine environments further complicates implementation.

Competitive Analysis

Kongsberg Maritime, L3Harris Technologies, Thales, and Saab lead the underwater communication system market with advanced acoustic, optical, and electromagnetic communication technologies. Their systems support naval operations, subsea monitoring, autonomous underwater vehicles, and offshore energy projects. These companies focus on long-range reliability, secure data transfer, and robust performance in challenging marine environments.

Teledyne Marine, Ultra, Sonardyne, Undersea Systems International, and Sea & Land Technologies strengthen the competitive landscape through specialized underwater modems, navigation systems, and real-time subsea communication platforms. Their solutions enhance data exchange for oceanographic research, environmental monitoring, and offshore infrastructure inspection.

EvoLogics, HYDROMEA, and other emerging participants expand the market with innovative wireless acoustic technologies, compact modems, and energy-efficient communication devices. Their systems support short-range and medium-range underwater data transfer for commercial, research, and industrial applications. These companies emphasize modular design, low power consumption, and easy deployment.

Top Key Players in the Market

- Kongsberg Maritime

- L3Harris Technologies, Inc.

- Thales

- Saab AB

- Teledyne Marine Technologies Incorporated.

- Ultra

- Sonardyne

- Underwater Wireless Modem & Communication Devices

- Undersea Systems International, Inc.

- Sea and Land Technologies Pte Ltd.

- EvoLogics GmbH

- HYDROMEA

- Others

Future Outlook

The future outlook for the underwater communication system market is promising, driven by increasing adoption in defense, offshore energy, and environmental monitoring sectors. Advances in acoustic, optical, and RF communication technologies will improve data rates and network reliability. Growing use of autonomous underwater vehicles and sensor networks will further fuel demand. Emphasis on subsea infrastructure security and environmental regulation will support long-term market growth.

Opportunities in Future Description Autonomous Underwater Vehicles Increasing deployment for subsea exploration, inspection, and maintenance tasks. Offshore Renewable Energy Growing need for reliable communication in offshore wind farms and subsea energy infrastructure. Defense and Security Rising demand for secure, low-detectability communication in naval operations and underwater surveillance. Environmental Monitoring Expansion of real-time underwater data collection for marine ecosystem and pollution tracking. Recent Developments

- November, 2025, Kongsberg reported a 20% revenue increase in Q2 2025 compared to the previous year. Growth was driven by defense contracts, including unmanned turret production for the U.S. Marines.

- May, 2025, Teledyne Marine participated in SeaSEC Challenge 2025, showcasing integrated subsea acoustics, sonar, and autonomous vehicle communications for maritime security.

Report Scope

Report Features Description Market Value (2024) USD 5.9 Bn Forecast Revenue (2034) USD 22.1 Bn CAGR(2025-2034) 14.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Connectivity (Wired, Wireless), By Application (Climate monitoring, Environmental monitoring, Hydrography, Oceanography, Pollution monitoring, Others), By End-user (Marine, Military & Defence, Oil & Gas, Scientific Research & Development, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kongsberg Maritime, L3Harris Technologies, Inc., Thales, Saab AB, Teledyne Marine Technologies Incorporated, Ultra, Sonardyne, Underwater Wireless Modem & Communication Devices, Undersea Systems International, Inc., Sea and Land Technologies Pte Ltd., EvoLogics GmbH, HYDROMEA, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Underwater Communication System MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Underwater Communication System MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kongsberg Maritime

- L3Harris Technologies, Inc.

- Thales

- Saab AB

- Teledyne Marine Technologies Incorporated.

- Ultra

- Sonardyne

- Underwater Wireless Modem & Communication Devices

- Undersea Systems International, Inc.

- Sea and Land Technologies Pte Ltd.

- EvoLogics GmbH

- HYDROMEA

- Others