Global Ultra-High Purity Manganese Sulphate Market By Grade(Battery Grade, Industrial Grade, Others), By Application(Batteries, Food, Chemical, Pharmaceutical, Others), By Distribution Channel(Direct Sales, Indirect Sales), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2023

- Report ID: 68354

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

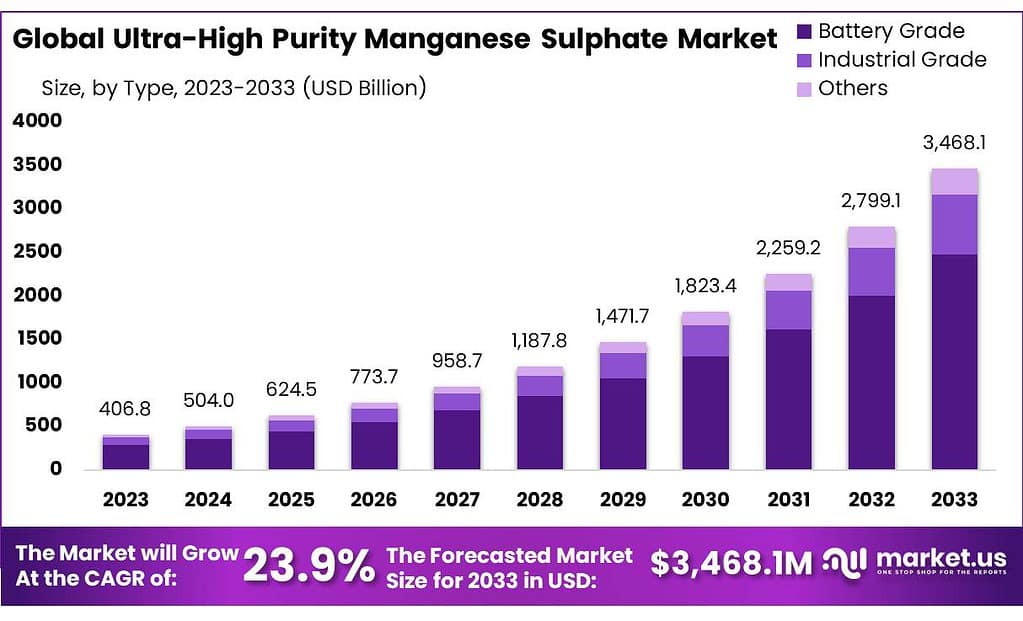

The global Ultra-High Purity Manganese Sulphate Market size is expected to be worth around USD 3468.1 Million by 2033, from USD 406.8 Million in 2023, growing at a CAGR of 23.9% during the forecast period from 2023 to 2033.

The Ultra-High Purity Manganese Sulphate Market refers to the global marketplace for manganese sulfate with exceptionally high purity levels. Manganese sulfate is a chemical compound composed of manganese, sulfur, and oxygen, commonly used in various industrial applications, including agriculture, pharmaceuticals, ceramics, and batteries.

Ultra-high purity manganese sulfate is produced through rigorous purification processes to remove impurities, resulting in a product with superior quality and performance characteristics. The market encompasses the production, distribution, and consumption of ultra-high purity manganese sulfate, along with factors influencing its demand, supply, pricing, and regulatory landscape. Industries and sectors utilizing ultra-high purity manganese sulfate include agriculture for soil amendment and micronutrient supplementation, pharmaceuticals for medicinal formulations, and battery manufacturing for energy storage applications.

Key Takeaways

- Market Growth: Ultra-High Purity Manganese Sulphate Market to hit USD 3468.1 Mn by 2033, growing at 23.9% CAGR.

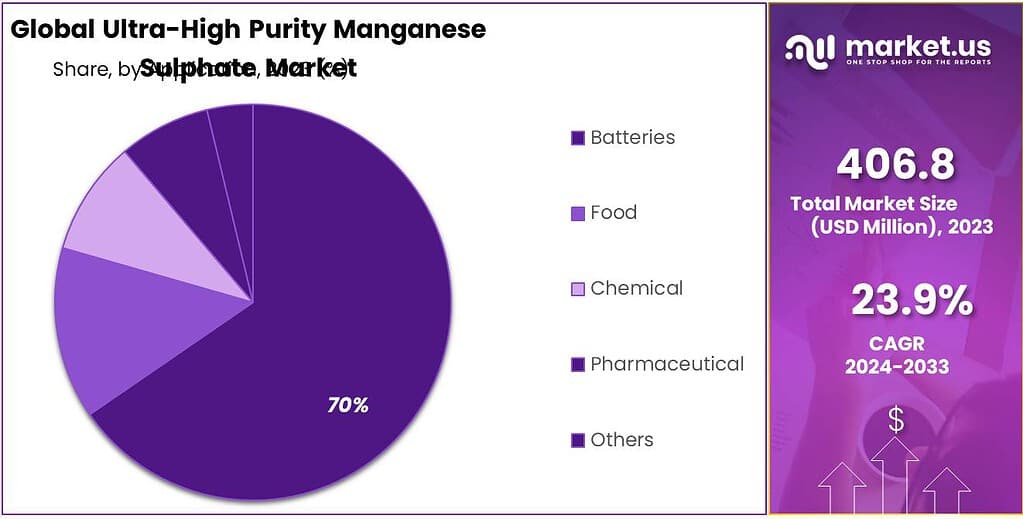

- Application Dominance: The batteries segment holds a 70.4% market share, driven by EV and consumer electronics demand.

- Distribution Channels: Indirect sales channels capture 69.3% market share, offering accessibility across industries.

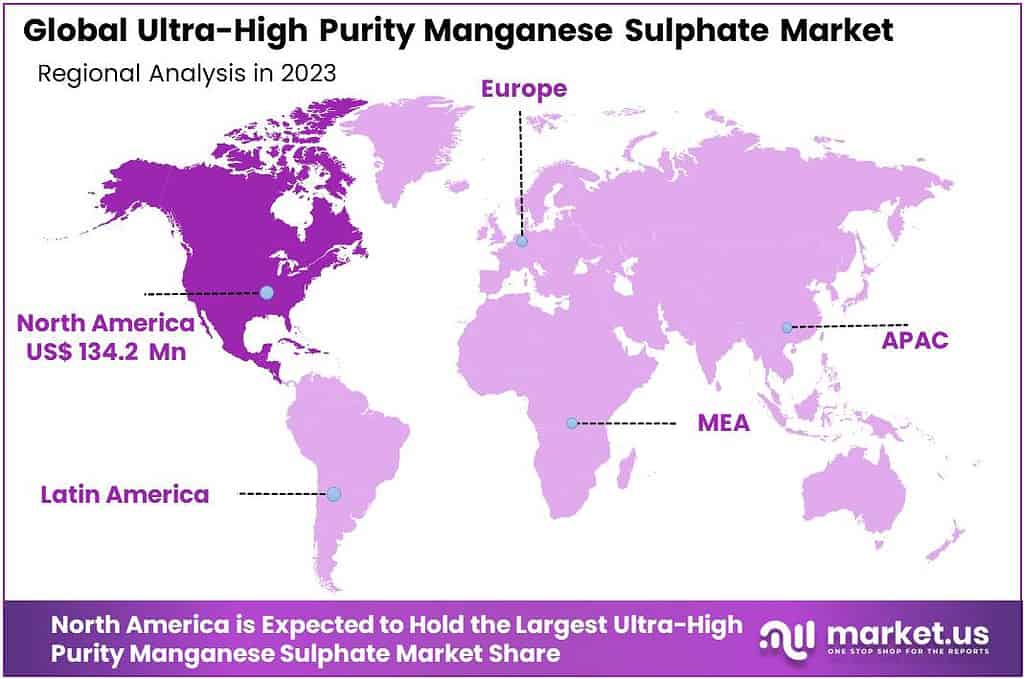

- Regional Leadership: North America leads with a 38.4% market share, propelled by US demand for high-efficiency battery components.

- Ultra-high purity manganese sulfate can have a maximum sulfate (SO4) content of less than 0.005%.

- Ultra-high purity manganese sulfate typically has a purity level of 99.99% or higher.

By Grade

In 2023, Battery Grade ultra-high purity manganese sulfate led the market with a dominant share of over 71.5%. This substantial market presence is primarily due to the growing demand for lithium-ion batteries in electric vehicles (EVs) and various electronic devices. Battery grade manganese sulfate is crucial for producing cathode materials in lithium-ion batteries, offering high performance and efficiency.

The push towards electrification and sustainable energy solutions has significantly driven the demand for EVs, subsequently increasing the need for high-quality battery components. This trend has positioned battery grade manganese sulfate as a key ingredient in the battery manufacturing industry.

On the other hand, Industrial Grade ultra-high purity manganese sulfate also holds an essential place in the market. While it captures a smaller market share compared to the battery grade, its applications across agriculture, animal feed, water treatment, and industrial chemical processes remain vital.

Industrial grade manganese sulfate is utilized for its nutritional benefits in feedstock and its role as a micronutrient in fertilizers, enhancing crop yield and quality. Furthermore, its application in water treatment and various chemical processes underlines the versatility and importance of manganese sulfate in industrial applications.

By Application

In 2023, the Batteries segment held a dominant position in the ultra-high purity manganese sulfate market, capturing more than a 70.4% share. This dominance is primarily driven by the surging demand for lithium-ion batteries in the electric vehicle (EV) sector and various portable electronic devices. Ultra-high purity manganese sulfate is a critical component in the cathode material of lithium-ion batteries, contributing to their efficiency, durability, and performance. The global push towards electrification, coupled with the rapid growth in the consumer electronics market, has significantly fueled the demand for high-quality battery components, placing the Batteries segment at the forefront of the market.

The Food segment also plays a crucial role in the ultra-high purity manganese sulfate market, albeit with a smaller share compared to Batteries. Manganese sulfate serves as an essential micronutrient in animal feed and fertilizers, enhancing nutritional value and promoting healthy growth. Its use in the food industry underscores the importance of manganese in dietary supplements and fortification processes, catering to health-conscious consumers and sectors focused on nutritional enrichment.

In the Chemical sector, ultra-high purity manganese sulfate is utilized in various chemical reactions and processes. Its role in synthesizing other chemicals and in water treatment applications highlights its versatility and utility across a broad range of industrial and environmental applications. Although this segment captures a smaller portion of the market, its contribution to industrial operations and environmental management is significant.

The Pharmaceutical segment, focusing on the use of ultra-high purity manganese sulfate in medicinal products, represents another vital market. Manganese sulfate is used in pharmaceuticals for its therapeutic properties, including in supplements and treatments requiring trace minerals. This segment’s importance is reflected in the ongoing research and development efforts to explore new medical applications of manganese sulfate.

By Distribution Channel

In 2023, Indirect Sales held a dominant position in the ultra-high purity manganese sulfate market, capturing more than a 69.3% share. This prominent market share is attributed to the effectiveness and efficiency of distribution channels such as distributors, resellers, and online marketplaces in reaching a broad customer base.

Indirect sales channels facilitate the accessibility of ultra-high purity manganese sulfate for various end-users across different industries, including batteries, food, chemical, and pharmaceutical sectors. The convenience, extensive network, and strong relationships maintained by distributors and resellers with both manufacturers and end-users significantly contribute to the popularity of indirect sales. This approach allows manufacturers to focus on their core activities, such as production and innovation, while leveraging the expertise of distribution partners to expand market reach and customer engagement.

Direct Sales, while holding a smaller portion of the market compared to indirect sales, remains a vital distribution channel for ultra-high purity manganese sulfate. This segment caters to end-users and industries that prefer a direct relationship with manufacturers for their supply needs.

Direct sales are characterized by transactions directly between the producer and the consumer, offering advantages such as customized solutions, detailed technical support, and the possibility of long-term contracts. For industries requiring specific purity grades of manganese sulfate or those engaged in large-scale projects, direct sales provide a level of specificity and reliability that is highly valued.

Key Market Segments

By Grade

- Battery Grade

- Industrial Grade

- Others

By Application

- Batteries

- Food

- Chemical

- Pharmaceutical

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

Driving Factors

The Surge in Demand for Electric Vehicles (EVs)

A pivotal driver propelling the ultra-high purity manganese sulfate market is the escalating demand for electric vehicles (EVs). This surge is directly linked to global efforts toward sustainable transportation solutions, aiming to reduce carbon emissions and combat climate change. Ultra-high purity manganese sulfate plays a crucial role in the manufacturing of lithium-ion batteries, which are the backbone of the EV industry, providing the necessary power density, longevity, and efficiency required for electric vehicles.

The transition towards electric mobility has gained remarkable momentum in recent years, with governments worldwide implementing policies and incentives to encourage the adoption of EVs. These measures include subsidies for electric vehicle purchases, investments in charging infrastructure, and stringent emissions regulations. Consequently, automakers are expanding their EV offerings, further boosting the demand for high-quality lithium-ion batteries and, by extension, ultra-high purity manganese sulfate.

Manganese sulfate’s role in battery production is indispensable. It is used as a precursor for the synthesis of cathode materials, which are critical for the battery’s performance. The high purity level of manganese sulfate ensures the production of batteries with higher energy densities, faster charging capabilities, and longer lifecycles. This quality is essential to meet the increasing consumer expectations for EV performance and reliability.

Moreover, the growing consumer electronics market contributes to the demand for ultra-high purity manganese sulfate. Devices such as smartphones, laptops, and tablets rely on lithium-ion batteries for their compact size, light weight, and ability to hold a charge over an extended period. The continuous innovation in consumer electronics, aiming for longer battery life and faster charging, parallels the requirements in the EV sector, further driving the demand for high-quality manganese sulfate.

In addition to the direct impact on the battery industry, the demand for ultra-high purity manganese sulfate is also buoyed by the broader shift towards renewable energy sources. Energy storage solutions, crucial for managing the intermittency of renewable energy, increasingly rely on lithium-ion batteries. This trend underscores the integral role of manganese sulfate in supporting the transition to a more sustainable and electrified future.

Restraining Factors

Stringent Environmental Regulations and Health Concerns

A significant restraining factor for the ultra-high purity manganese sulfate market is the stringent environmental regulations and health concerns associated with manganese mining and sulfate production. The extraction and processing of manganese, essential for producing manganese sulfate, involve several environmental and health risks, including water pollution, soil degradation, and air quality issues. These concerns have led to the implementation of strict regulations governing the mining and chemical industries, aiming to minimize environmental impact and protect worker health.

The production of ultra-high purity manganese sulfate requires meticulous processing to achieve the high levels of purity needed for applications in lithium-ion batteries and other high-tech industries. This process often involves the use of chemicals and solvents that can be hazardous if not managed properly, posing risks to both the environment and human health. Regulatory bodies across the globe have placed tight controls on the discharge of industrial waste, the emission of volatile organic compounds (VOCs), and the exposure of workers to potentially harmful substances. These regulations necessitate significant investment in waste management, emission control technologies, and worker safety measures, increasing the operational costs for manufacturers of ultra-high purity manganese sulfate.

Moreover, the public’s growing awareness and concern over environmental issues have led to increased scrutiny of industrial practices, particularly those involving mineral extraction and chemical production. Companies face not only regulatory pressures but also the challenge of maintaining their reputation among consumers who are increasingly valuing sustainability and ethical practices. This scenario forces manufacturers to adopt greener, more sustainable production methods, which may involve additional costs and technological challenges.

Growth Opportunity

Expansion into Energy Storage Solutions

A major growth opportunity for the ultra-high purity manganese sulfate market lies in its expansion into the energy storage solutions sector. As the world increasingly shifts towards renewable energy sources to combat climate change, the demand for efficient and scalable energy storage systems has surged. Ultra-high purity manganese sulfate, a critical component in the production of lithium-ion batteries, plays a pivotal role in this transition, offering substantial opportunities for market growth.

Energy storage systems are essential for addressing the intermittent nature of renewable energy sources, such as solar and wind power. These systems allow for the storage of excess energy generated during peak production times for use during periods of low generation. Lithium-ion batteries, favored for their high energy density, long life cycle, and reliability, are at the forefront of this technology. The use of ultra-high purity manganese sulfate in the manufacture of these batteries enhances their performance and efficiency, making it a key material in the development of advanced energy storage solutions.

The global push for a sustainable energy future has led to significant investments in renewable energy infrastructure and, by extension, in energy storage technologies. Governments and private sectors are actively seeking to increase the share of renewables in the energy mix, further driving the demand for reliable and efficient storage solutions. This trend presents a lucrative avenue for the ultra-high purity manganese sulfate market, as its products are integral to the manufacturing of lithium-ion batteries.

Furthermore, the ongoing advancements in battery technology, aimed at increasing energy storage capacity, reducing charging times, and extending battery life, underscore the importance of high-quality materials like ultra-high purity manganese sulfate. As battery manufacturers strive to meet these evolving demands, the need for ultra-high purity manganese sulfate is expected to grow, offering ample opportunities for producers to expand their market presence.

Additionally, the increasing adoption of electric vehicles (EVs), which rely on lithium-ion batteries for power, contributes to the demand for energy storage solutions. The EV market’s rapid growth, supported by governmental policies and consumer interest in sustainable transportation, further amplifies the need for ultra-high purity manganese sulfate, linking its market growth directly to the expansion of the EV sector.

Latest Trends

Integration of Circular Economy Practices

A significant and emerging trend within the ultra-high purity manganese sulfate market is the integration of circular economy practices. This approach emphasizes the reuse, recycling, and sustainable management of resources, aiming to minimize waste and environmental impact while maximizing product lifecycle value. This trend is not only reshaping production and supply chain processes but also aligning with global sustainability goals and consumer expectations for environmentally responsible products.

In the context of ultra-high purity manganese sulfate, particularly crucial for the battery industry, the circular economy model presents a transformative opportunity. The rapid growth of the electric vehicle (EV) market and the increasing reliance on lithium-ion batteries have highlighted the need for sustainable resource management. Manganese, a key component in these batteries, is under increasing demand, raising concerns about resource depletion and environmental degradation associated with mining activities.

The adoption of circular economy practices in the ultra-high purity manganese sulfate market involves developing more efficient recycling processes for battery materials. By recovering manganese from spent batteries and reintroducing it into the production cycle, manufacturers can reduce reliance on mined resources, decrease production costs, and lessen environmental impact. This not only addresses the sustainability concerns but also ensures a more stable and secure supply chain amid fluctuating raw material availability and prices.

Furthermore, advancements in recycling technologies are enabling the recovery of manganese at higher purities, making it feasible to meet the stringent quality requirements of the battery industry and other high-tech applications. This trend is supported by regulatory incentives and industry collaborations aimed at establishing a more sustainable and resilient battery ecosystem.

The shift towards circular economy practices is also driven by consumer awareness and demand for sustainable products. Manufacturers and brands that demonstrate commitment to circular principles can enhance their market competitiveness and brand reputation. This consumer-driven demand encourages further innovation and investment in circular solutions across the ultra-high purity manganese sulfate value chain.

Regional Analysis

As of 2023, North America is at the forefront of the ultra-high purity manganese sulfate market, accounting for a substantial 38.4% of the global share. The United States is particularly pivotal in this leadership, spurred by the escalating demand for high-efficiency battery components. This surge is attributed to the expanding electric vehicle (EV) sector and the increasing need for high-performance electronics, underlining the urgency for advanced material solutions like ultra-high purity manganese sulfate.

The region’s agricultural and technological communities are increasingly cognizant of the need for sustainable and efficient materials in battery production. This awareness is catalyzing investments in ultra-high purity manganese sulfate, recognized for its critical role in enhancing battery life, efficiency, and overall performance. The market’s readiness to adopt such innovative solutions is buoyed by the understanding of their benefits, including superior battery quality, cost-effectiveness, and a lower environmental footprint.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The ultra-high purity manganese sulfate market is characterized by its dynamic and competitive landscape, with several key players driving innovation, supply chain optimization, and market expansion. These companies play crucial roles in developing high-quality materials essential for high-tech applications, especially in the rapidly growing electric vehicle (EV) and energy storage sectors. Here’s an analysis of the key players in the ultra-high purity manganese sulfate market

Market Key Players

- P Inc (ERACHEM Comilog)

- Euro Manganese Inc

- Manganese X Energy Corp

- PT Stern

- Keras Resources PLC

- Element 25 Ltd

- Mesa Minerals Limited

- Pure Minerals Ltd

- Guangxi Yuanchen Manganese Industry

- Changsha Haolin Chemicals Co., Ltd

- Fujian Liancheng Manganese Co.,Ltd

- Hunan Yueyang Sanxiang Chemical

- ISKY Chemicals Co. Ltd

- Yantai Cash Industrial Co., Ltd

- Ningxia Tianyuan Manganese Industry Group Co., Ltd

- GEM Co., Ltd

Report Scope

Report Features Description Market Value (2023) US$ 406.8 Mn Forecast Revenue (2033) US$ 3468.1 Mn CAGR (2024-2033) 23.9% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade(Battery Grade, Industrial Grade, Others), By Application(Batteries, Food, Chemical, Pharmaceutical, Others), By Distribution Channel(Direct Sales, Indirect Sales) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape P Inc (ERACHEM Comilog), Euro Manganese Inc, Manganese X Energy Corp, PT Stern, Keras Resources PLC, Element 25 Ltd, Mesa Minerals Limited, Pure Minerals Ltd, Guangxi Yuanchen Manganese Industry, Changsha Haolin Chemicals Co., Ltd, Fujian Liancheng Manganese Co.,Ltd, Hunan Yueyang Sanxiang Chemical, ISKY Chemicals Co. Ltd, Yantai Cash Industrial Co., Ltd, Ningxia Tianyuan Manganese Industry Group Co., Ltd, GEM Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ultra-High Purity Manganese Sulphate MarketPublished date: April 2023add_shopping_cartBuy Now get_appDownload Sample

Ultra-High Purity Manganese Sulphate MarketPublished date: April 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- P Inc (ERACHEM Comilog)

- Euro Manganese Inc

- Manganese X Energy Corp

- PT Stern

- Keras Resources PLC

- Element 25 Ltd

- Mesa Minerals Limited

- Pure Minerals Ltd

- Guangxi Yuanchen Manganese Industry

- Changsha Haolin Chemicals Co., Ltd

- Fujian Liancheng Manganese Co.,Ltd

- Hunan Yueyang Sanxiang Chemical

- ISKY Chemicals Co. Ltd

- Yantai Cash Industrial Co., Ltd

- Ningxia Tianyuan Manganese Industry Group Co., Ltd

- GEM Co., Ltd