UK off Price Retail Market Size, Share, Growth Analysis By Product Type (Apparel, Footwear & Accessories, Home Goods, Beauty & Personal Care Products, Others), By Source of Inventory (Out of Fashion Stock by Brands, Returned Merchandise, Defective Product Inventory), By Age Group (18–25, 26–40, 56 and above), By End User (Individual/Household Consumers, Small Retailers, Institutional Buyers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167715

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

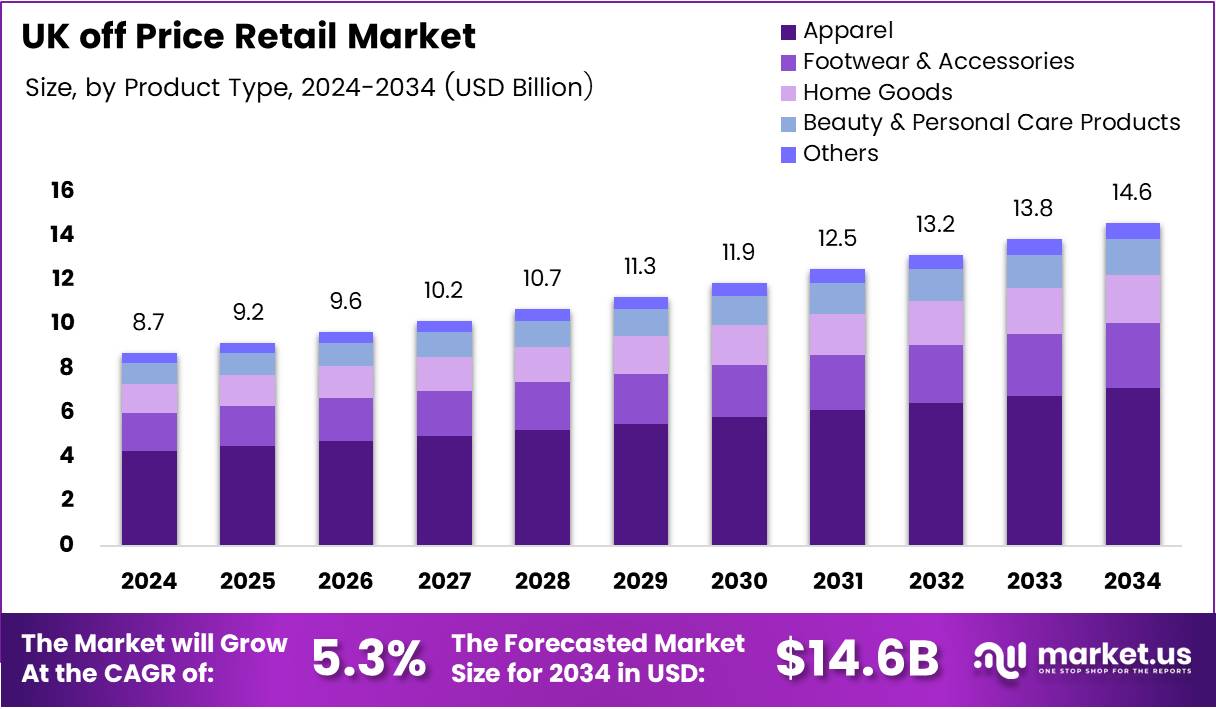

The UK off-price retail market is expanding as value-conscious consumers seek branded products at lower prices. In 2024, the market is estimated around 8.7 Bn, supported by high clothing and footwear spending. Moreover, rising inflation and real wage pressures encourage shoppers to trade down without sacrificing perceived quality.

Looking ahead, the market is projected to approach nearly 14.6 Bn, implying an annual growth of about 5.3%. Consequently, off-price retailers increasingly position themselves as smart-shopping destinations rather than clearance outlets. They leverage brand recognition, limited-time deals, and treasure-hunt merchandising to convert occasional bargain hunters into loyal repeat customers.

UK adults reportedly spend around £4 billion monthly on clothing and footwear, with average per-person spend near £33.34. Therefore, diverting even a modest share of this outlay into off-price formats generates meaningful revenue upside. Women, who typically spend more than men on apparel, further reinforce demand for fashion-led off-price assortments.

From a product standpoint, Apparel dominates the UK off-price space, reflecting consumers’ preference for accessible fashion and premium brands at discounts. Meanwhile, Footwear & Accessories and Home Goods broaden the value proposition, attracting households seeking affordable lifestyle upgrades. Additionally, Beauty & Personal Care Products are emerging as traffic-driving categories with strong impulse appeal.

On the supply side, the channel relies heavily on surplus inventory, out-of-fashion stock, returned merchandise, and defective but usable products. As brands face volatile demand and frequent assortment refreshes, they increasingly liquidate stock via off-price partners. Consequently, structured inventory partnerships are replacing ad-hoc job lots and opportunistic buying models.

Digitally, UK off-price retail is shifting from purely store-based treasure hunts to omnichannel formats. Retailers now blend outlet stores, off-price corners, online flash sales, and app-based events. This transition, in turn, enhances accessibility for younger, mobile-first consumers while preserving the thrill of discovery through curated drops and limited-time discounts.

Demographically, Millennials and Gen Z are key growth drivers, attracted by premium brands at entry-level price points. They actively compare online deals, follow influencers, and embrace circular fashion trends. Simultaneously, Boomers remain important for steady, value-focused purchases, helping smooth demand across economic cycles and promotional peaks.

Competitive dynamics are intensifying as fast-fashion, supermarkets, discounters, and direct-to-consumer brands expand promotional activity. Nevertheless, specialist off-price retailers differentiate through broader brand portfolios, sharper discounts, and perceived authenticity. With consumers increasingly seeking value, the UK off-price retail market is well-positioned to grow, provided players manage inventory, sourcing, and digital engagement effectively.

Key Takeaways

- The UK off-price retail market is estimated near 8.7 Bn in 2024 and may approach 14.6 Bn, reflecting resilient demand for discounted premium brands.

- Apparel leads By Product Type with a 48.9% share, while Out of Fashion Stock by Brands dominates inventory sources at 52.4%.

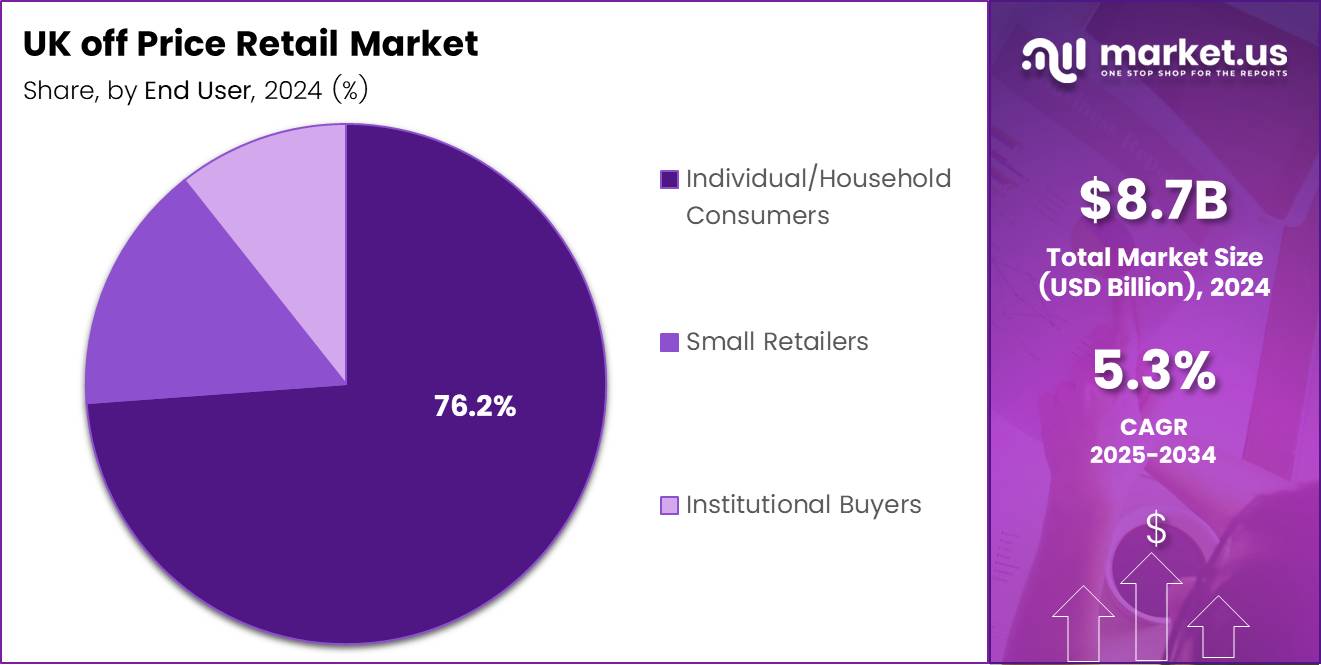

- Millennials hold a dominant 48.5% share By Age Group, and Individual/Household Consumers account for 76.2% By End User.

- Key growth drivers include omnichannel expansion, structured brand partnerships, and consumers’ structural shift toward value-focused shopping.

- Constraints arise from inconsistent surplus supply and intensifying competition from fast-fashion and direct-to-consumer discounting.

- Data-driven pricing, circular fashion models, and exclusive collaborations offer powerful levers to unlock future growth.

- Emerging digital and experiential trends, including flash sales and treasure-hunt store layouts, are reshaping how UK consumers engage with off-price retail.

By Product Type Analysis

Apparel dominates with 48.9% share as UK shoppers seek affordable access to premium fashion brands.

In 2024, Apparel held a dominant market position in the By Product Type Analysis segment of UK Off-Price Retail Market, with a 48.9% share. This segment benefits from constant wardrobe refresh cycles across Men’s, Women’s, and Children’s clothing. Additionally, consumers increasingly prefer branded apparel at discounts, reinforcing off-price channel relevance.

Footwear & Accessories follow as a versatile growth segment, capturing consumers who trade up to branded shoes and fashion add-ons at reduced prices. Moreover, Bags & Handbags, Belts, Jewelry & Watches and other accessories create high-margin impulse purchases. Off-price retailers leverage curated displays and cross-merchandising with apparel to lift average basket values.

Home Goods are steadily gaining importance as households re-prioritize budget-friendly home improvement and décor. Consequently, categories like Furniture, Home Décor and other functional items attract shoppers seeking quality without premium price tags. Retailers exploit seasonal refreshes and trend-led collections, transforming surplus and end-of-line homeware into attractive, value-driven propositions.

Beauty & Personal Care Products represent a fast-growing, traffic-driving category within off-price outlets. Consumers increasingly experiment with skincare, cosmetics, and grooming items when prices are significantly reduced. Furthermore, smaller pack sizes and gift sets encourage trial and gifting. Retailers carefully manage authenticity and shelf-life to maintain trust and repeat purchases.

The Others category aggregates niche and opportunistic buys spanning seasonal goods, sports items, toys, and household essentials. This segment, in turn, enhances the treasure-hunt experience by offering unexpected finds at compelling discounts. By flexibly absorbing varied surplus stock, it helps retailers optimize floor space, support margin mix, and respond quickly to shifting demand.

By Source of Inventory Analysis

Out of Fashion Stock by Brands dominates with 52.4% share as labels clear surplus assortments efficiently.

In 2024, Out of Fashion Stock by Brands held a dominant market position in the By Source of Inventory Analysis segment of UK Off-Price Retail Market, with a 52.4% share. Brands increasingly rely on off-price channels to monetize past-season assortments. As a result, retailers secure consistent branded inflows at attractive acquisition costs.

Returned Merchandise forms the second key inventory stream, covering online returns, store exchanges, and unsold items. Although quality and sizing can be mixed, careful inspection and grading allow retailers to resell many products profitably. Additionally, rising e-commerce return rates expand this pool, enhancing assortment depth while supporting circular consumption patterns.

Defective Product Inventory consists of items with minor cosmetic flaws, packaging damage, or non-critical manufacturing issues. When clearly labeled and discounted, these goods still appeal to highly price-sensitive shoppers. Consequently, off-price retailers convert potential write-offs into revenue, while brands limit waste. Transparent communication and strict safety standards remain essential to sustaining consumer confidence.

By Age Group Analysis

Millennials dominate with 48.5% share as digitally savvy shoppers prioritize value without compromising style.

In 2024, 26–40 (Millennials) held a dominant market position in the By Age Group Analysis segment of UK Off-Price Retail Market, with a 48.5% share. This cohort actively hunts online and in-store for premium brands at discounts. Moreover, they balance lifestyle aspirations with budget discipline, making off-price formats particularly attractive.

18–25 (Gen Z) shoppers are emerging as powerful trend-setters within the off-price ecosystem. They embrace thrift, resale, and circular fashion ideals while still craving branded looks. Consequently, Gen Z responds strongly to flash sales, social media-driven campaigns, and treasure-hunt store layouts. Retailers targeting this group emphasize authenticity, inclusivity, and digital-first engagement.

56 and above (Boomers) contribute a stable, value-oriented customer base. They often prioritize comfort, quality, and reliability over fast-changing trends, yet still appreciate premium labels at reduced prices. Additionally, Boomers show loyalty to convenient store locations and clear merchandising. By tailoring assortments and services, retailers can deepen penetration in this steady-spending segment.

By End User Analysis

Individual/Household Consumers dominate with 76.2% share as personal shopping drives core demand.

In 2024, Individual/Household Consumers held a dominant market position in the By End User Analysis segment of UK Off-Price Retail Market, with a 76.2% share. Families and individuals visit off-price outlets to stretch budgets while accessing desirable brands. Additionally, rising cost-of-living pressures reinforce frequent visits for apparel, accessories, and everyday home goods.

Small Retailers tap off-price channels as sourcing hubs for margin-friendly merchandise. They selectively purchase branded overstock or mixed lots to resell in local stores, markets, or online. Consequently, off-price players gain incremental B2B revenue while clearing inventory faster. Transparent pricing, minimum order thresholds, and curated assortments strengthen these commercial relationships.

Institutional Buyers, including hospitality operators, care facilities and corporate purchasers, use off-price channels for cost-effective bulk procurement. They focus on practical categories such as linens, basic apparel, décor, and small furnishings. Moreover, by accessing discounted branded goods, institutions improve perceived quality while controlling budgets. Tailored contracts and logistics support can unlock further institutional demand.

Key Market Segments

By Product Type

- Apparel

- Men’s Clothing

- Women’s Clothing

- Children’s Clothing

- Footwear & Accessories

- Bags & Handbags

- Belts

- Jewelry & Watches

- Others

- Home Goods

- Furniture

- Home Décor

- Others

- Beauty & Personal Care Products

- Others

By Source of Inventory

- Out of Fashion Stock by Brands

- Returned Merchandise

- Defective Product Inventory

By Age Group

- 18–25 (Gen Z)

- 26–40 (Millennials)

- 56 and above (Boomers)

By End User

- Individual/Household Consumers

- Small Retailers

- Institutional Buyers

Drivers

Rising Demand for Discounted Premium Brands Fuels the UK Off-Price Retail Market

Rising demand for premium brands at discounted prices is a primary growth driver across UK consumer segments. As living costs climb, shoppers increasingly seek value without sacrificing perceived status or quality. Consequently, off-price retailers position themselves as enablers of smart shopping, offering branded goods at accessible price points.

Expansion of omnichannel off-price formats further accelerates market growth. Retailers now integrate physical stores, outlets, e-commerce platforms, and mobile apps to reach wider audiences. This omnichannel reach, in turn, enhances convenience and discovery. Consumers can browse online, reserve items, or capitalize on flash events, then complete purchases where it suits them best.

Increasing inventory liquidation partnerships between brands and off-price retailers also drive the market. Brands appreciate structured, discreet channels for clearing surplus stock without diluting full-price positioning. As these partnerships mature, supply becomes more predictable. Off-price players gain improved assortment planning, while brands recover value from unsold or out-of-season inventory more efficiently.

Growing consumer shift toward value-oriented shopping amid economic uncertainty underpins all these drivers. Households reassess discretionary spending, trading down from full-price outlets and department stores. As a result, off-price formats benefit from both new customer acquisition and higher visit frequency. This structural shift is likely to support sustained long-term demand in the UK.

Restraints

Inventory Constraints and Competitive Pressures Restrain Market Expansion

Despite strong demand, limited control over consistent inventory supply constrains off-price growth. Retailers depend heavily on surplus and liquidation stock, which varies in timing, volume, and mix. Consequently, assortment gaps and inconsistent sizes can frustrate shoppers. Maintaining compelling, coherent ranges across locations becomes challenging, especially during peak seasons.

Intensifying competition from fast-fashion players adds further pressure. Fast-fashion brands replicate key looks quickly and cheaply, often matching or undercutting off-price price points. Additionally, their frequent drops and strong digital engagement capture fashion-conscious consumers. As a result, off-price retailers must differentiate through brand depth, perceived quality, and superior discount propositions.

Direct-to-consumer discounting strategies by brands themselves also restrain off-price market share. Many labels now run regular online promotions, outlet sections, and end-of-season sales on their own platforms. This direct discounting, in turn, reduces the volume and exclusivity of inventory available for third-party off-price partners, eroding traffic and pricing power.

Operational complexity presents another challenge. Managing heterogeneous stock, varying quality, and multi-source logistics requires robust systems and skilled teams. Without data-driven allocation and markdown tools, retailers risk margin leakage and stock imbalances. Therefore, players with weaker capabilities may struggle to scale while preserving profitability in a crowded, promotion-heavy environment.

Growth Factors

Strategic Innovations Unlock New Growth Opportunities in Off-Price Retail

Leveraging data-driven pricing and inventory optimization technologies offers a significant growth avenue. Advanced analytics help retailers predict demand, set dynamic markdowns, and allocate stock more effectively across stores and channels. Consequently, they reduce overstocks, minimize missed sales, and protect margins while still signaling strong value to consumers.

Expansion into sustainable resale and circular fashion models within off-price channels opens new revenue streams. Retailers increasingly complement surplus stock with pre-owned, refurbished, or upcycled goods. This approach, in turn, appeals to environmentally conscious shoppers who favor reuse over waste. It also strengthens brand narratives around responsibility and resource efficiency.

Development of exclusive brand collaborations designed specifically for off-price retail supports differentiation. Limited-edition capsules and off-price-only lines allow brands to reach new audiences without diluting mainline positioning. Additionally, these collaborations generate excitement, social media buzz, and repeat visits. Off-price players gain unique content that competitors cannot easily replicate.

Growth of rural and suburban store penetration helps capture underserved consumer bases. As urban markets mature, retailers increasingly open smaller, well-curated formats closer to residential communities. Therefore, shoppers who previously relied on city-center destinations gain everyday access to off-price deals, driving incremental traffic and broadening the market’s geographic footprint.

Emerging Trends

Digital and Experiential Trends Redefine the Off-Price Retail Journey

A surge in online flash sales and limited-time discount events is reshaping consumer behavior. Time-bound promotions trigger urgency and impulse purchases, especially among digitally savvy segments. Retailers leverage countdown timers, exclusive app offers, and surprise drops. Consequently, online channels now replicate the thrill of in-store treasure-hunt experiences.

Increasing consumer preference for authenticated luxury goods at off-price outlets is another key trend. Shoppers want reassurance on product provenance, especially for high-end accessories and designer fashion. Therefore, retailers invest in authentication processes, clear labeling, and tamper-proof tags. This transparency builds trust and encourages trading up to higher-ticket purchases.

Integration of AI-powered personalized promotions across digital retail platforms is accelerating. Algorithms analyze browsing history, wish lists, and purchase behavior to tailor offers and recommendations. As a result, consumers see more relevant deals and are nudged toward larger baskets. Retailers, in turn, optimize discount depth while lifting conversion and loyalty.

Adoption of experiential store layouts focused on treasure-hunt merchandising styles continues to grow. Off-price outlets employ dynamic displays, regularly refreshed racks, and curated zones to encourage exploration. Moreover, they blend clearance bins with premium brand corners to maintain excitement. This experiential focus keeps physical stores highly relevant in an increasingly digital marketplace.

Key UK off Price Retail Company Insights

TK Maxx acts as a flagship off-price player, leveraging a broad, constantly refreshed assortment of branded apparel, accessories, and home goods. Its scale and buying power support strong access to surplus inventory. Additionally, treasure-hunt merchandising and nationwide coverage help TK Maxx anchor consumer perception of off-price value in the UK.

The Original Factory Shop focuses on smaller-town and community locations, blending branded fashion, homeware, and everyday value lines. This positioning allows it to tap underserved local markets where large-format competitors have limited presence. Moreover, its flexible assortments and promotional cadence help maintain relevance across varied regional consumer profiles.

B&M Retail Limited operates as a broad discount and variety retailer with meaningful participation in off-price categories. While known for homeware and everyday essentials, it increasingly incorporates branded apparel, footwear, and seasonal fashion deals. Consequently, B&M captures both planned and impulse purchases from value-focused shoppers seeking one-stop convenience.

OneBeyond Retail Limited targets highly price-sensitive consumers with a strong emphasis on low-ticket, fast-moving lines. Its model centers on sharp price points and efficient store formats. As it gradually expands branded and clearance-driven assortments, OneBeyond can extend its appeal into more discretionary categories while preserving its core value proposition.

Top Key Players in the Market

- TK Maxx

- The Original Factory Shop

- B&M Retail Limited

- OneBeyond Retail Limited

- Poundland

- BrandAlley U.K

- Poundstretcher

- ALDI

- MandM

- Shoeaholics Ltd.

Recent Developments

- In November 2024, Secret Sales acquired Afound, the digital fashion outlet of H&M Group, expanding its off-price marketplace footprint across Europe. This move strengthens cross-border access to surplus premium and mid-market fashion brands, while enhancing the platform’s visibility among value-conscious, digital-first shoppers.

- In June 2025, Poundland was sold by its parent Pepco Group to investment firm Gordon Brothers for a nominal fee of roughly £1, marking a major turnaround strategy. The transaction aims to stabilize operations, refocus merchandising, and potentially reposition parts of the business within the broader off-price and discount ecosystem.

Report Scope

Report Features Description Market Value (2024) USD 8.7 Billion Forecast Revenue (2034) USD 14.6 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Apparel, Footwear & Accessories, Home Goods, Beauty & Personal Care Products, Others), By Source of Inventory (Out of Fashion Stock by Brands, Returned Merchandise, Defective Product Inventory), By Age Group (18–25, 26–40, 56 and above), By End User (Individual/Household Consumers, Small Retailers, Institutional Buyers) Competitive Landscape TK Maxx, The Original Factory Shop, B&M Retail Limited, OneBeyond Retail Limited, Poundland, BrandAlley U.K, Poundstretcher, ALDI, MandM, Shoeaholics Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- TK Maxx

- The Original Factory Shop

- B&M Retail Limited

- OneBeyond Retail Limited

- Poundland

- BrandAlley U.K

- Poundstretcher

- ALDI

- MandM

- Shoeaholics Ltd.