UK Music Tourism Market Size, Share, Growth Analysis By Event (Concert, Festivals, Others), By Age Group (18 to 34 Years, Below 18 Years, 34 to 54 Years, 55 Years & Above), By Booking Mode (Online Travel Agencies (OTAs), Direct Booking, Travel Agents), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153149

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

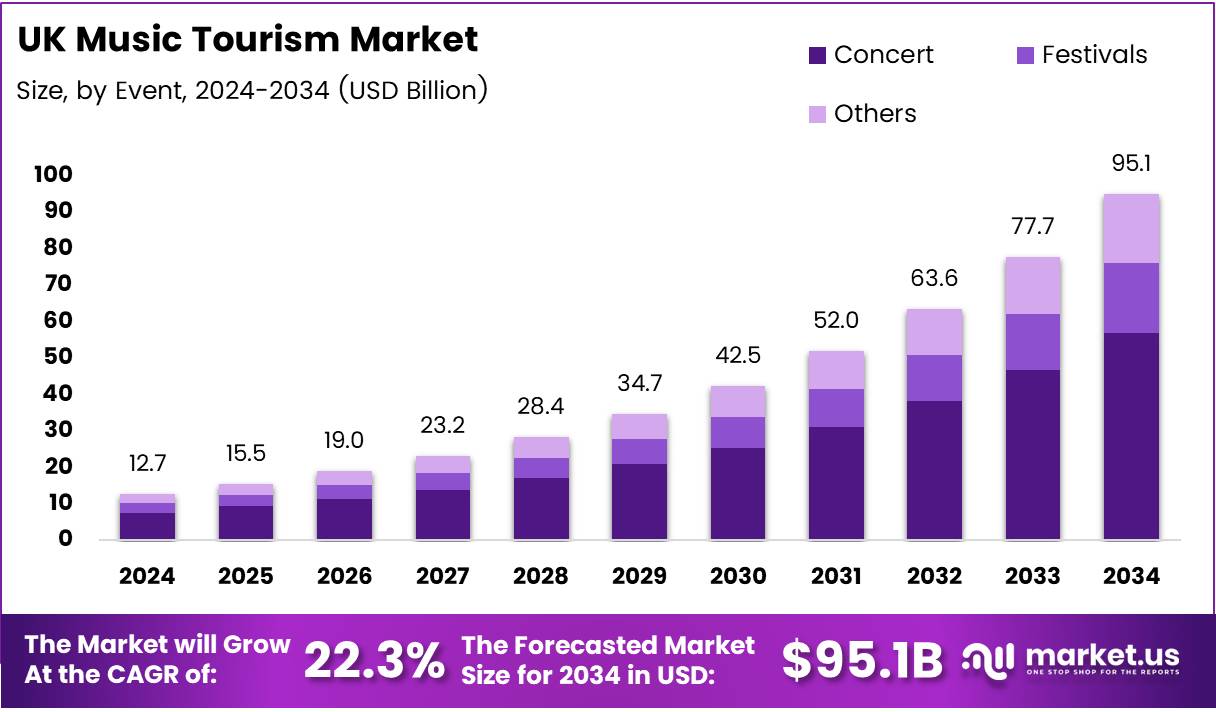

The UK Music Tourism Market size is expected to be worth around USD 95.1 Billion by 2034, from USD 12.7 Billion in 2024, growing at a CAGR of 22.3% during the forecast period from 2025 to 2034.

The UK Music Tourism Market is an essential segment of the country’s tourism industry, drawing both domestic and international visitors. This market revolves around the attraction of music-based events, festivals, and live performances. It has experienced steady growth due to the UK’s cultural legacy, which continues to allure music fans worldwide.

One key factor driving the growth of the UK Music Tourism Market is the increasing popularity of music festivals. Events like Glastonbury, Reading, and Leeds attract millions of visitors annually, boosting local economies. As these festivals continue to gain traction, there are significant opportunities for local businesses to benefit from the influx of tourists, including hotels, transport services, and retail outlets.

Additionally, government investments have played a vital role in supporting this sector’s growth. The UK government has continuously backed the creative industries through various funding programs aimed at enhancing cultural offerings. This investment encourages new music festivals and initiatives, which directly benefit the tourism sector by attracting more visitors to the country.

Moreover, favorable regulations and policies have contributed to the expansion of this market. The UK has streamlined the visa process for international performers and their teams, making it easier to host international music events. This ease of movement has facilitated greater collaboration with global artists, further elevating the UK’s position as a prime music tourism destination.

In terms of statistics, according to UK Music, the UK music tourism sector reached a record £10 billion in spending in 2024, reflecting a 26% increase from 2023. This growth highlights the growing significance of music tourism in the broader UK economy. Additionally, data from Passport-Photo shows that music tourism in the UK generated approximately £6.6 billion in 2022, underlining the sector’s continued importance.

With these positive growth indicators, the UK Music Tourism Market is projected to continue flourishing. Both the demand for large-scale music events and the government’s support create an environment conducive to growth. Future opportunities lie in tapping into niche music genres and regional events, which can diversify the tourist experience even further.

Key Takeaways

- The UK Music Tourism Market is projected to reach USD 95.1 Billion by 2034, up from USD 12.7 Billion in 2024, growing at a CAGR of 22.3% from 2025 to 2034.

- Concerts held the top spot in the By Event Analysis segment in 2024, capturing 57.8% of the market share.

- The 18 to 34 years age group dominated the By Age Group Analysis in 2024, with a commanding 73.8% market share.

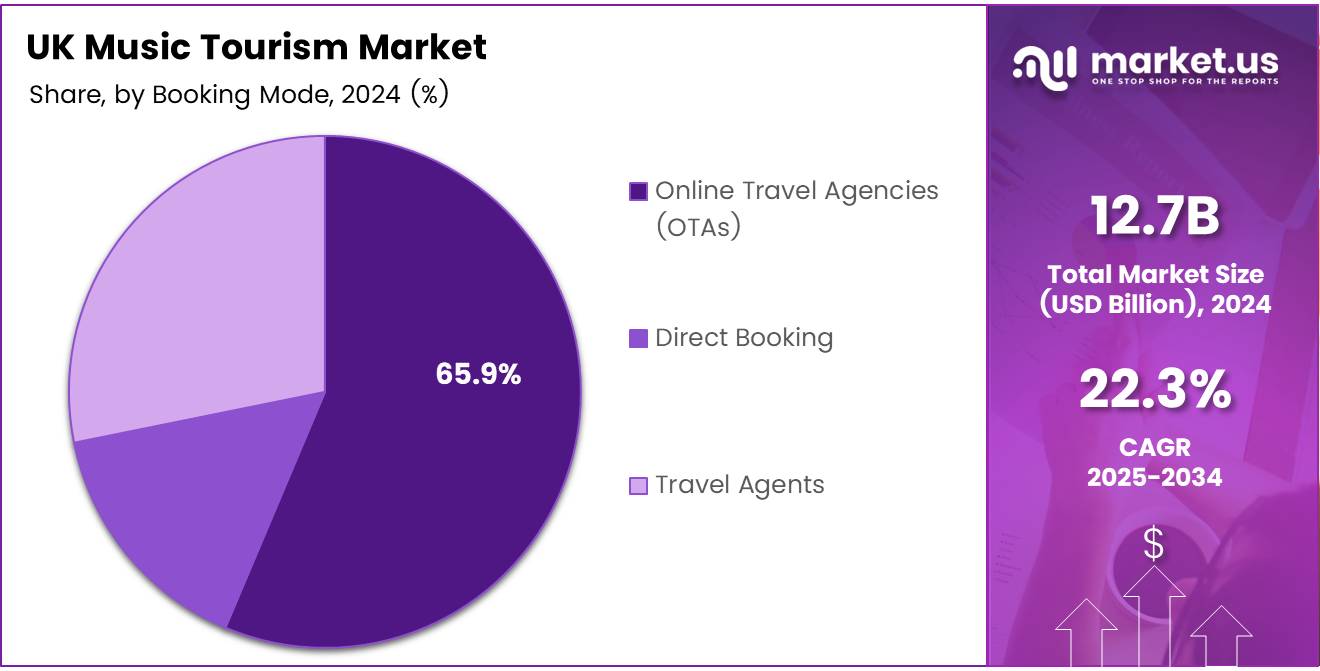

- Online Travel Agencies (OTAs) led the By Booking Mode Analysis in 2024, accounting for 65.9% of bookings.

Event Analysis

In 2024, Concert held a dominant market position in By Event Analysis segment of UK Music Tourism Market, with a 57.8% share

In 2024, concerts held a dominant market position in the UK Music Tourism market, accounting for 57.8% of the market share in the By Event Analysis segment. This dominance can be attributed to the enduring popularity of live performances, which continue to attract both domestic and international tourists. Major concert events, particularly those featuring popular artists, generate significant tourism activity, from travel to accommodation, contributing greatly to the economy.

Festivals, while also a significant segment, accounted for a smaller share of the market. The appeal of festivals, with their immersive experiences and diverse lineups, continues to grow. However, concerts remain the go-to event for many music tourists, who are drawn to the star power and unique atmospheres that these events offer.

Other events, though important, hold a more limited share in comparison. These events cater to niche audiences, providing unique musical experiences. However, their impact on the market is overshadowed by the more mainstream appeal of concerts and festivals.

Age Group Analysis

In 2024, 18 to 34 Years held a dominant market position in By Age Group Analysis segment of UK Music Tourism Market, with a 73.8% share

In 2024, the 18 to 34 years age group held a dominant market position in the By Age Group Analysis segment of the UK Music Tourism Market, accounting for 73.8% of the total market share. This group is highly engaged in music tourism, frequently attending concerts and festivals. Their active participation in live music events, both locally and internationally, plays a major role in driving the growth of the sector.

The below 18 years segment, while growing, still represents a smaller share of the market. This demographic is typically less engaged in independent travel for music events, often attending local performances or family-oriented festivals.

The 34 to 54 years group holds a moderate share of the market. This age group, while not as dominant as the 18 to 34 years segment, contributes to a significant portion of the audience. They tend to attend more niche, curated events or established festivals.

Finally, the 55 years and above group accounts for a smaller segment of the market. This demographic typically attends more relaxed, low-key events, and their participation is more concentrated in established music tourism destinations.

Booking Mode Analysis

In 2024, Online Travel Agencies (OTAs) held a dominant market position in By Booking Mode Analysis segment of UK Music Tourism Market, with a 65.9% share

In 2024, Online Travel Agencies (OTAs) led the By Booking Mode Analysis segment of the UK Music Tourism Market, with a dominant share of 65.9%. This trend reflects the growing reliance on digital platforms for event and travel bookings. OTAs offer convenience, flexibility, and comprehensive packages, allowing music tourists to easily book tickets, accommodations, and other travel essentials in one place. The convenience and accessibility of OTAs make them the preferred choice for many.

Direct booking, while still a viable option for some, holds a smaller share of the market. Many music tourists prefer the direct interaction and potential for exclusive deals when booking directly with venues or event organizers. However, this segment has seen a relative decline as OTAs continue to dominate.

Travel agents represent the smallest segment in this analysis. While some tourists continue to rely on travel agents for personalized services and bespoke travel packages, this method of booking is becoming less common as more people turn to digital platforms for convenience and price comparison.

Key Market Segments

By Event

- Concert

- Festivals

- Others

By Age Group

- 18 to 34 Years

- Below 18 Years

- 34 to 54 Years

- 55 Years & Above

By Booking Mode

- Online Travel Agencies (OTAs)

- Direct Booking

- Travel Agents

Drivers

Strong Cultural Heritage and Music Events Drive UK Music Tourism Market Growth

The UK’s rich cultural heritage and iconic music history play a big role in attracting tourists from all over the world. Cities like London, Liverpool, and Manchester are known for producing legendary artists like The Beatles, David Bowie, and Adele. This deep-rooted music legacy draws fans who want to visit famous venues, museums, and hometowns of these stars.

Social media and music streaming platforms have also boosted music tourism in the UK. Tourists often discover UK-based artists online and are inspired to attend their live performances or visit locations featured in music videos. Platforms like TikTok and Spotify help fans stay connected to British music trends, influencing travel decisions.

The UK government supports the arts and cultural tourism through funding and initiatives that promote music events. Programs that celebrate British music help local communities and give tourists more reasons to visit. This support ensures festivals and concerts continue to grow and remain accessible.

International music festivals like Glastonbury and Reading & Leeds have gained global popularity, attracting thousands of international visitors each year. These events not only showcase top global acts but also highlight British culture, offering a full music tourism experience.

Restraints

High Travel and Accommodation Costs for International Tourists Restrain UK Music Tourism Market

Travel and hotel costs in the UK are often high, especially in major cities where music events take place. For international tourists, this can make attending concerts and festivals expensive, limiting the market’s full potential.

Political uncertainty, especially after Brexit, has created new challenges for both visitors and event organizers. Visa rules, travel restrictions, and regulatory changes have impacted the ease of travel for European tourists, who previously made up a large part of the audience.

An economic downturn can affect music tourism by reducing people’s extra spending money. When individuals have less disposable income, they are less likely to spend on travel, entertainment, and event tickets, which directly affects attendance rates.

Some areas in the UK lack the proper infrastructure to support large-scale music events. Limited public transport, parking, and accommodation in rural or less-developed locations make it difficult to host or attend major concerts and festivals, reducing accessibility for potential tourists.

Growth Factors

Expanding the Role of Digital Music Platforms in Promotion Presents Growth Opportunities

Digital music platforms are opening new opportunities for promoting UK music tourism. Artists and event organizers use streaming services and social media to advertise concerts and festivals globally. This makes it easier for fans from other countries to discover events and plan visits.

Collaborating with other tourism sectors like food, art, and history offers a more complete experience for music tourists. For example, combining a music festival with local food tours or cultural exhibitions can attract a broader group of visitors and extend their stay.

There’s strong potential in targeting emerging markets, such as Southeast Asia and Latin America, where British music has growing fan bases. Promoting UK music festivals and events to these audiences could increase international visitor numbers and boost tourism revenue.

Developing smaller, niche music events can also attract tourists who are interested in specific genres or local music scenes. These events offer a more personal and unique experience and can be held in lesser-known regions, helping to spread tourism benefits more widely.

Emerging Trends

Integration of Virtual and Hybrid Concerts Shapes Trends in UK Music Tourism

Virtual and hybrid concerts are becoming more popular, especially after the pandemic. These formats allow fans to experience UK music events from anywhere in the world and often inspire them to visit in person later, supporting both online engagement and real-world tourism.

There’s a growing trend towards sustainable and eco-friendly music events. Tourists are increasingly interested in attending festivals that focus on reducing waste, using renewable energy, and promoting green travel. This aligns with broader environmental awareness among travelers.

Local and indie music scenes in the UK are gaining more attention, offering tourists authentic and unique experiences. Visiting smaller venues or local music hubs gives fans a deeper connection to UK music culture and supports independent artists.

Music tourism packages that include tickets, travel, and accommodation are becoming more common. These bundled experiences make it easier for tourists to plan trips and enjoy multiple attractions, making the UK more appealing as a music tourism destination.

Key UK Music Tourism Company Insights

In 2024, the UK music tourism market continues to thrive, driven by the strategic influence of key industry players. Ticketmaster plays a critical role as a global ticketing platform, simplifying access to music events across the UK. Its user-friendly interface and large-scale reach help stimulate domestic and international tourism for major concerts and festivals.

Glastonbury Festival, a hallmark of British music culture, remains a significant draw for global tourists. Its consistent ability to sell out rapidly and attract high-profile performers ensures its position as a pillar in the music tourism economy.

Live Nation (Music) UK Ltd has maintained its dominance through a diversified portfolio of live events and artist management. The company’s strategic partnerships and extensive concert schedule across UK cities support year-round music-driven travel.

AEG Presents has continued to expand its presence with major tours and venue management. Its investment in immersive live experiences appeals to a global audience, reinforcing the UK’s reputation as a live music destination.

Each of these players contributes uniquely to the vitality of the UK music tourism sector, shaping not only the experiences of concert-goers but also influencing travel patterns, regional economies, and the broader cultural landscape. Their ongoing innovation, infrastructure, and global branding efforts are instrumental in maintaining the UK’s competitive edge in the global music tourism arena.

Top Key Players in the Market

- Ticketmaster

- Glastonbury Festival

- Live Nation (Music) UK Ltd

- AEG Presents

- Festival Republic

- SJM Concerts

- Anschutz Entertainment Group, Inc.

- DF Concerts & Events

- Kilimanjaro Live Ltd.

- Royal Albert Hall

Recent Developments

- In July 2025, the UK Government announced up to £30 million in funding as part of the Creative Industries Sector Plan. This investment aims to fuel innovation and international growth within the high-growth UK music industry.

- In December 2024, country star Riley Green revealed 2025 UK & Ireland dates for his ‘Damn Country Music Tour’. The tour marks his debut full-scale UK headline run, bringing American country flair to British and Irish audiences.

- In December 2024, Ticketmaster made a donation of £60,000 to support grassroots music venues across the UK. The funding is intended to help sustain smaller venues crucial to the development of emerging artists.

Report Scope

Report Features Description Market Value (2024) USD 12.7 Billion Forecast Revenue (2034) USD 95.1 Billion CAGR (2025-2034) 22.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Event (Concert, Festivals, Others), By Age Group (18 to 34 Years, Below 18 Years, 34 to 54 Years, 55 Years & Above), By Booking Mode (Online Travel Agencies (OTAs), Direct Booking, Travel Agents) Competitive Landscape Ticketmaster, Glastonbury Festival, Live Nation (Music) UK Ltd, AEG Presents, Festival Republic, SJM Concerts, Anschutz Entertainment Group, Inc., DF Concerts & Events, Kilimanjaro Live Ltd., Royal Albert Hall Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ticketmaster

- Glastonbury Festival

- Live Nation (Music) UK Ltd

- AEG Presents

- Festival Republic

- SJM Concerts

- Anschutz Entertainment Group, Inc.

- DF Concerts & Events

- Kilimanjaro Live Ltd.

- Royal Albert Hall