UK Kitchenware Market Size, Share, Growth Analysis By Product (Tableware, Cookware, Bakeware, Others), By Application (Residential, Commercial), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153253

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

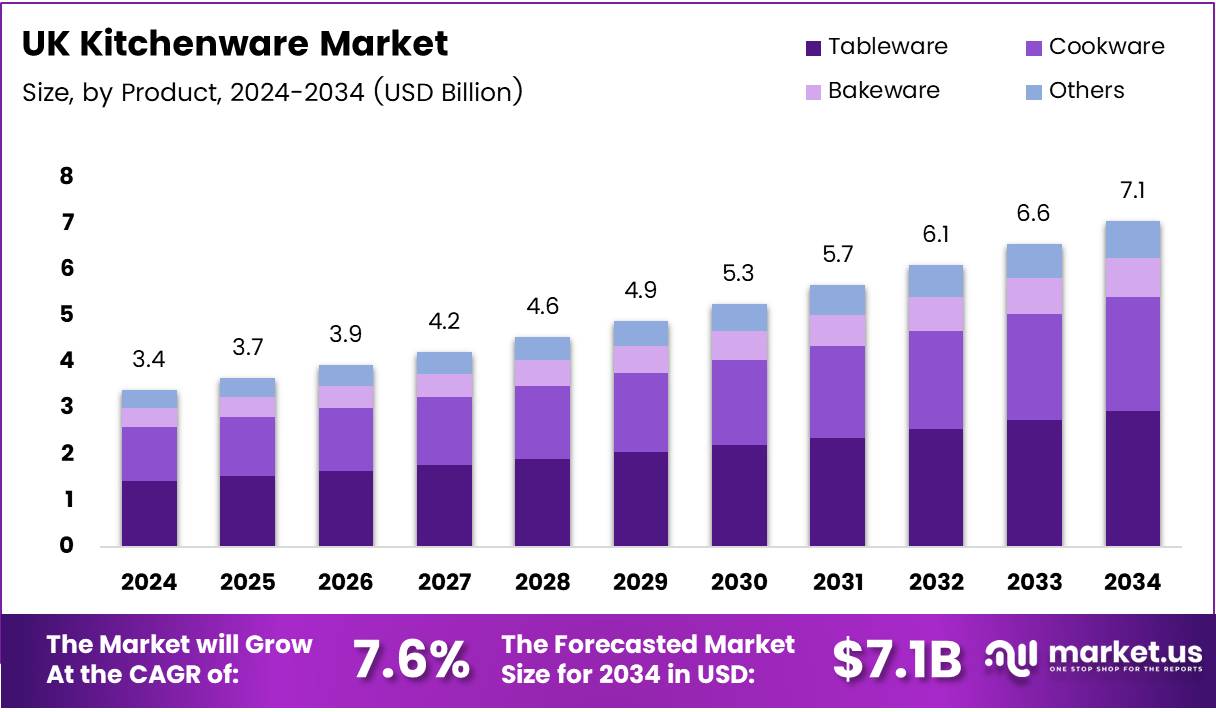

The UK Kitchenware Market size is expected to be worth around USD 7.1 Billion by 2034, from USD 3.4 Billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034.

The UK kitchenware market continues to evolve as consumer habits shift and innovation accelerates across the home and lifestyle sectors. Demand is rising for space-saving cookware, multifunctional tools, and aesthetic utility products that complement modern kitchen designs. This evolution is largely driven by younger homeowners investing in practical yet stylish kitchen essentials.

Simultaneously, the rising influence of sustainability is prompting a transition towards eco-friendly kitchen tools, including bamboo utensils and reusable food storage options. Consumers are prioritizing long-term utility and ethical sourcing, prompting retailers to diversify their offerings. With increasing climate awareness, product lifecycle transparency has also become a decisive factor in purchasing behavior.

Moreover, online channels are reshaping the competitive landscape. Consumers prefer buying kitchenware via e-commerce platforms, where bundled deals, reviews, and visuals influence purchasing decisions. This shift is encouraging direct-to-consumer (DTC) models. As a result, emerging brands are leveraging digital storytelling and social media to build trust and visibility.

On the economic front, inflationary pressures have altered consumer priorities. There’s an emphasis on functional items that promise durability and value. This shift has strengthened the position of brands offering modular or multipurpose solutions. At the same time, supermarkets are expanding private-label offerings to capture price-conscious segments of the market.

Innovation continues to be a competitive lever. Companies are rapidly integrating smart features in products such as app-connected scales or temperature sensors in utensils. As UK households adopt smart kitchen technologies, market players are investing more in R&D to meet changing user expectations and enhance ease of use.

Government policies are also shaping the market. Recent incentives supporting energy-efficient appliances have indirectly fueled demand for products like induction-ready cookware. Moreover, UK recycling regulations are pushing manufacturers toward recyclable or biodegradable packaging, affecting procurement strategies and pricing models across distribution channels.

According to Financial Times, air fryer purchases in the UK surged by 30% between 2021 and 2022, enough to warrant inclusion in the ONS inflation basket. This trend reflects a consumer tilt towards healthier, energy-efficient cooking appliances, further influencing complementary product categories such as non-stick cookware and oil sprayers.

According to PwC, nearly 40% of UK consumers engaged with on-demand grocery or subscription services in the past year. This shift signals clear potential for DTC kitchenware sales integrated with food delivery models. As convenience becomes a lifestyle choice, synergistic offerings are expected to gain traction across the UK kitchenware ecosystem.

Key Takeaways

- The UK Kitchenware Market size is projected to reach USD 7.1 Billion by 2034, growing at a CAGR of 7.6% from 2025 to 2034.

- Tableware dominated the By Product Analysis segment with a 53.9% share in 2024, driven by home dining trends and premium dining preferences.

- Residential led the By Application Analysis segment with a 65.7% share in 2024, fueled by the rising popularity of cooking at home and healthier lifestyles.

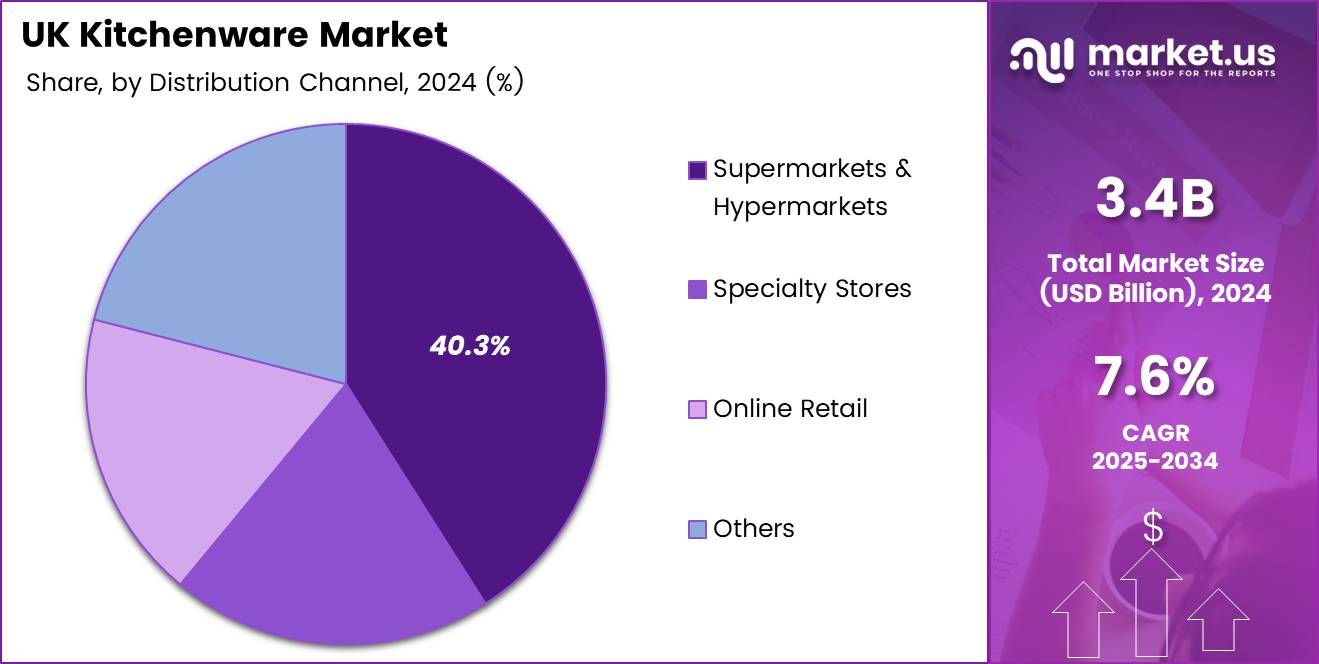

- Supermarkets & Hypermarkets held a 40.3% share in the By Distribution Channel Analysis segment in 2024, benefiting from extensive shelf space and loyalty programs.

Product Analysis

Tableware dominates with 53.9% due to high usage across UK households and hospitality settings.

In 2024, Tableware held a dominant market position in the By Product Analysis segment of the UK Kitchenware Market, with a 53.9% share. The rising frequency of home dining and increased consumer preference for premium dining aesthetics have made tableware a staple in UK households.

Cookware followed, driven by a rising interest in healthy home-cooked meals. Consumer preference for induction-compatible and non-stick pots and pans continues to boost cookware demand across all income brackets.

Bakeware is gaining popularity among UK consumers due to the growing influence of cooking shows and social media baking trends. The lockdown period accelerated this trend, encouraging more people to invest in quality bakeware essentials.

The Others segment includes niche and seasonal kitchen tools that serve specific needs. While smaller in size, this category sees periodic spikes during festive seasons or as new food trends emerge, contributing to overall product diversity in the market.

Application Analysis

Residential segment leads with 65.7% as home cooking remains a central part of UK lifestyle.

In 2024, Residential held a dominant market position in the By Application Analysis segment of the UK Kitchenware Market, with a 65.7% share. The growing trend of cooking at home, driven by inflation and a focus on healthier lifestyles, has substantially contributed to this lead.

Households are continuously upgrading kitchenware to align with modern cooking styles, including the use of energy-efficient cookware and easy-to-clean utensils. Additionally, social trends such as family dinners and weekend baking further reinforce the dominance of this segment.

The Commercial segment, comprising restaurants, cafes, and catering businesses, shows steady growth. Post-pandemic recovery in hospitality and increased footfall in dining establishments have revived demand for durable and stylish kitchenware.

Distribution Channel Analysis

Supermarkets & Hypermarkets lead with 40.3% as they provide wide assortment and physical product experience.

In 2024, Supermarkets & Hypermarkets held a dominant market position in the By Distribution Channel Analysis segment of the UK Kitchenware Market, with a 40.3% share. Their broad shelf space, promotional pricing, and customer loyalty programs attract a diverse shopper base.

Specialty Stores maintain strong appeal among consumers seeking curated collections and expert advice. These outlets often offer premium and designer kitchenware, making them popular among high-income households.

Online Retail is gaining traction rapidly, supported by rising internet penetration, convenience, and access to global brands. The availability of customer reviews and comparison tools adds to its popularity, especially among younger buyers.

The Others segment includes departmental stores and local vendors. Although smaller in scale, they retain a loyal customer base in niche markets and rural locations, contributing to localized demand in the UK.

Key Market Segments

By Product

- Tableware

- Cookware

- Bakeware

- Others

By Application

- Residential

- Commercial

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online Retail

- Others

Drivers

Integration of Smart Kitchen Technologies and Growing Preferences Fuel the UK Kitchenware Market

The integration of smart kitchen technologies into cookware is driving the UK kitchenware market. Smart appliances such as app-controlled cookers, smart ovens, and connected kitchen tools are gaining popularity. These innovations cater to the growing demand for convenience and energy efficiency, making meal preparation easier and more efficient.

Millennials are increasingly preferring home-cooked meals over dining out. This demographic, which values both health and sustainability, is investing in kitchen tools that help recreate restaurant-quality meals at home. The trend is contributing significantly to the demand for advanced cookware and gadgets designed for a wide range of cooking styles.

The UK is also seeing an expansion of high-end retail and department store chains, which offer a broader range of premium kitchenware products. These retail spaces provide a platform for both traditional and innovative kitchenware brands to showcase their products, thereby influencing consumer preferences and buying behaviors.

The surge in DIY culinary content on social media has also played a crucial role in driving the demand for kitchenware. With platforms like YouTube, Instagram, and TikTok, users are encouraged to try new recipes and culinary techniques, increasing the demand for tools that enhance their cooking experience.

Restraints

Challenges Hindering the Growth of the UK Kitchenware Market

The rising popularity of minimalist lifestyles is one of the key factors restricting the UK kitchenware market. More individuals are embracing simple living and downsizing, which reduces the demand for excess kitchen products. Consumers are opting for fewer, multi-functional items rather than investing in multiple specialized tools.

Market saturation, particularly in urban areas, is another challenge. In major cities, the kitchenware market is becoming increasingly competitive, with limited room for growth. High levels of competition make it difficult for new entrants to differentiate themselves and gain market share, especially when customers are already loyal to established brands.

Moreover, mid-tier kitchenware brands face difficulties with product differentiation. While premium and low-cost brands offer clear advantages, mid-tier products often struggle to stand out in terms of quality or unique features. This lack of differentiation among mid-tier brands makes it harder for these companies to capture the attention of consumers, leading to slower sales growth.

Growth Factors

Exploring Growth Opportunities in the UK Kitchenware Market

One of the promising growth opportunities in the UK kitchenware market lies in the development of modular and multi-functional kitchen tools. As consumers prioritize practicality and convenience, products that offer several uses in one design are highly appealing. Items such as stackable cookware, convertible kitchen tools, and space-saving designs are becoming increasingly popular.

The demand from student and rental accommodation segments is also rising. These consumers often have limited space and need compact and versatile kitchen tools. Kitchenware products that cater to small living spaces and provide ease of use for those who may not be seasoned chefs are seeing growth.

Another significant opportunity is the expansion of eco-friendly and zero-waste product lines. Consumers are becoming more conscious of the environmental impact of their purchases and are actively seeking sustainable kitchenware options. Brands that prioritize eco-friendly materials and manufacturing processes are tapping into this growing market trend.

Collaborations with celebrity chefs and influencers for exclusive kitchenware collections are also gaining momentum. These partnerships bring attention to new products, creating a sense of exclusivity and tapping into the influence of well-known personalities in the culinary world.

Emerging Trends

Key Trends Shaping the UK Kitchenware Market

There is a noticeable shift toward aesthetic and designer kitchenware, as consumers view kitchen products as a part of their home décor. Stylish and visually appealing items, such as color-coordinated cookware or aesthetically designed utensils, are becoming highly sought after. This trend is particularly prominent among younger consumers who value design as much as functionality.

The rise of Direct-to-Consumer (DTC) kitchenware brands is also a major trend in the UK market. With the growth of e-commerce, more brands are bypassing traditional retail channels to reach customers directly through online platforms. This shift enables brands to create a more personalized shopping experience and maintain better control over customer relationships.

Space-saving and stackable products are in increasing demand. With many consumers living in smaller spaces, kitchenware that is easy to store and does not take up much space is becoming essential. Products like stackable containers, collapsible kitchen tools, and compact cookware are gaining popularity.

Additionally, subscription-based kitchenware services are trending. These services offer customers the convenience of receiving regular deliveries of essential kitchen products, from utensils to gourmet ingredients, all tailored to their needs. This model is appealing to busy consumers who value both convenience and variety in their kitchen products.

Key UK Kitchenware Company Insights

In 2024, Meyer International Holdings Limited is anticipated to maintain a strong presence in the UK Kitchenware Market due to its extensive portfolio of high-quality cookware brands. The company’s innovative product designs and emphasis on consumer satisfaction will continue to drive its growth and market share.

Hamilton Beach Brands Holding Company is expected to leverage its reputation for producing reliable and affordable kitchen appliances. The brand’s strategic focus on expanding its product offerings and increasing market penetration will position it as a key player in the competitive UK kitchenware market.

Joseph Joseph Ltd., known for its functional and stylish kitchen products, will continue to thrive in the UK market by meeting the growing demand for contemporary and space-saving designs. The brand’s consistent innovation and consumer-centric approach have solidified its reputation among modern households.

The Vollrath Company, LLC remains a leader in producing high-performance commercial kitchenware. Its strong position in the B2B sector, along with a focus on quality and durability, positions the brand as a trusted name in the UK kitchenware market, particularly within the foodservice industry.

These companies’ combined emphasis on innovation, quality, and meeting changing consumer demands will be critical factors driving their continued success in 2024 and beyond.

Top Key Players in the Market

- Meyer International Holdings Limited

- Hamilton Beach Brands Holding Company

- Joseph Joseph Ltd.

- The Vollrath Company, LLC

- OXO International, Ltd.

- Tramontina

- Newell Brands

- Lifetime Brands

- Cuisinart

- Groupe SEB

Recent Developments

- In December 2024, Duni Group announced plans to acquire UK-based tabletop company Poppies, strengthening its position in the UK market and expanding its product offerings in the tableware sector.

- In December 2024, Swedish Duni Group eyes growth in the UK tableware market with the acquisition of Poppies, aiming to enhance its market share and diversify its product range.

- In September 2024, Made In Cookware launched in the United Kingdom, bringing its premium cookware line to British consumers and expanding its international presence.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Billion Forecast Revenue (2034) USD 7.1 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Tableware, Cookware, Bakeware, Others), By Application (Residential, Commercial), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online Retail, Others) Competitive Landscape Meyer International Holdings Limited, Hamilton Beach Brands Holding Company, Joseph Joseph Ltd., The Vollrath Company, LLC, OXO International, Ltd., Tramontina, Newell Brands, Lifetime Brands, Cuisinart, Groupe SEB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Meyer International Holdings Limited

- Hamilton Beach Brands Holding Company

- Joseph Joseph Ltd.

- The Vollrath Company, LLC

- OXO International, Ltd.

- Tramontina

- Newell Brands

- Lifetime Brands

- Cuisinart

- Groupe SEB