Global Earthquake Insurance Market Size, Share Analysis Report By Type (Life Insurance, Non-Life Insurance), By Application (Personal, Commercial), By Distribution Channel (Banks, Agents, Brokers, Retailers, Others), By End-User (Individuals, Business), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147592

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

- Earthquake Insurance Market Size

- Key Takeaways

- Market Overview

- Analysts’ Viewpoint

- U.S. Market Forecast Expansion

- By Type Analysis

- By Application Analysis

- By Distribution Channel Analysis

- By End-User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Earthquake Insurance Market Size

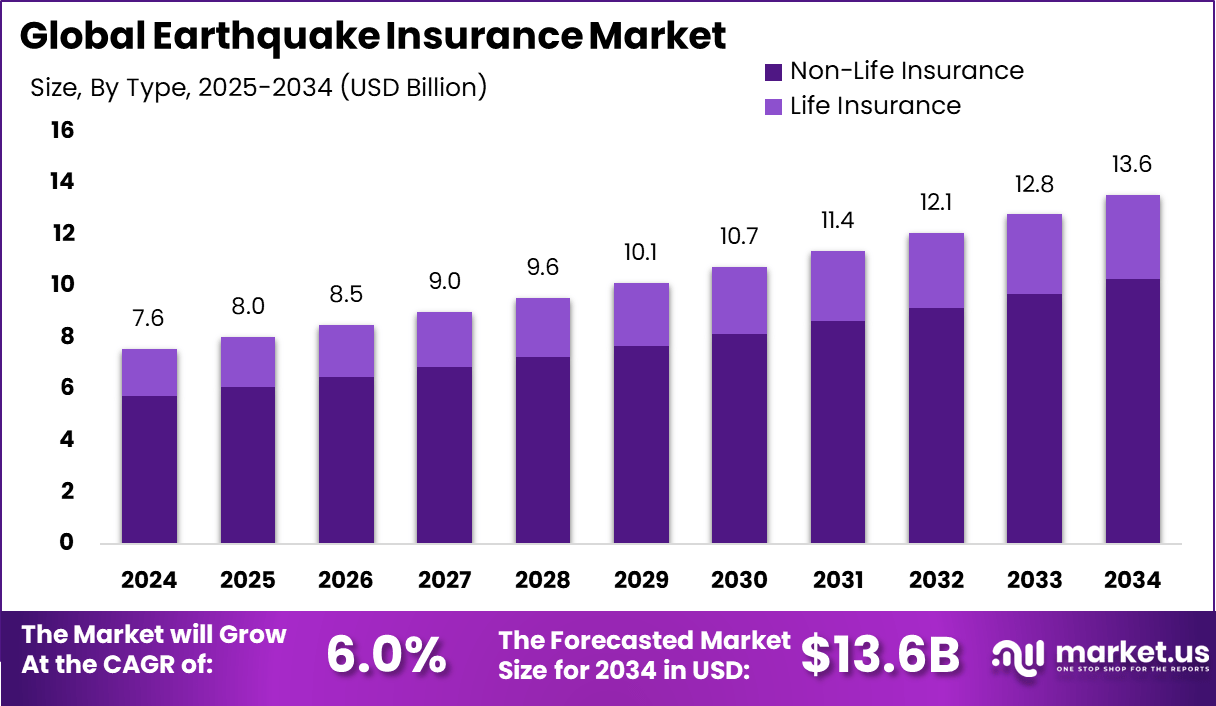

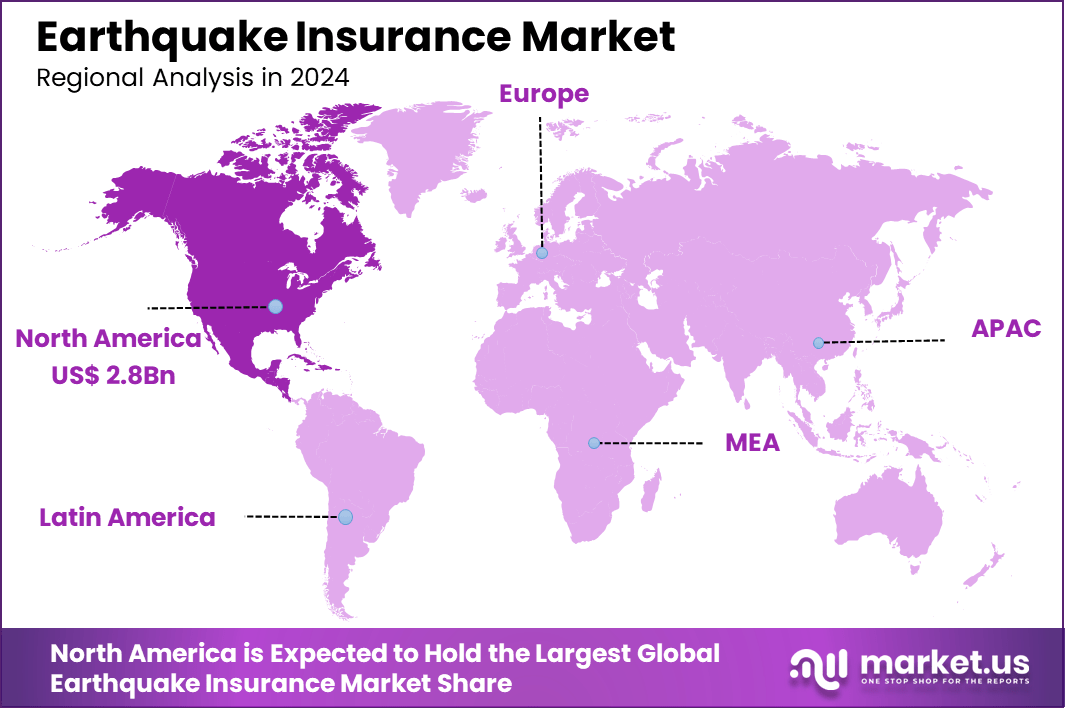

The Global Earthquake Insurance Market size is expected to be worth around USD 13.6 Billion By 2034, from USD 7.6 billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 2.8 Billion revenue.

Earthquake insurance is a specialized financial product designed to protect property owners from the economic impact of seismic events. Unlike standard homeowners’ insurance, which typically excludes earthquake-related damages, this coverage specifically addresses losses resulting from ground shaking, structural damage, and associated perils.

Policies often encompass repair costs, rebuilding expenses, and temporary living arrangements, providing a crucial safety net for individuals and businesses in earthquake-prone regions. Several factors contribute to the expansion of the earthquake insurance market. The rising frequency and severity of natural disasters, coupled with rapid urbanization and the proliferation of high-value assets, have heightened the demand for comprehensive coverage.

Additionally, government initiatives promoting disaster preparedness and resilience have encouraged greater adoption of earthquake insurance policies. Demand analysis indicates a growing inclination among property owners to secure earthquake insurance, particularly in regions with high seismic activity. The increasing value of real estate assets and the potential for catastrophic losses have underscored the importance of such coverage.

According to the findings from Market.us, The global AI for Earth Monitoring market is projected to witness significant growth, reaching a value of USD 23.9 Billion by 2033, rising from USD 3.15 Billion in 2023. This expansion is expected to occur at a CAGR of 22.5%. The rapid growth can be attributed to the increasing use of artificial intelligence in analyzing environmental data, forecasting climate risks, managing natural resources, and supporting disaster response.

In 2023, North America emerged as the leading region, commanding more than 36.8% of the global market share, which accounted for approximately USD 1.15 Billion in revenue. This regional dominance was mainly due to strong investments in geospatial AI platforms, early adoption of remote sensing AI in the U.S., and supportive environmental regulations.

Key Takeaways

- The global earthquake insurance market is projected to grow steadily from USD 7.6 billion in 2024 to around USD 13.6 billion by 2034, reflecting a CAGR of 6.0% over the forecast period.

- North America led the global market in 2024, holding a 38% share with USD 2.8 billion in revenue, largely driven by risk-prone regions like California.

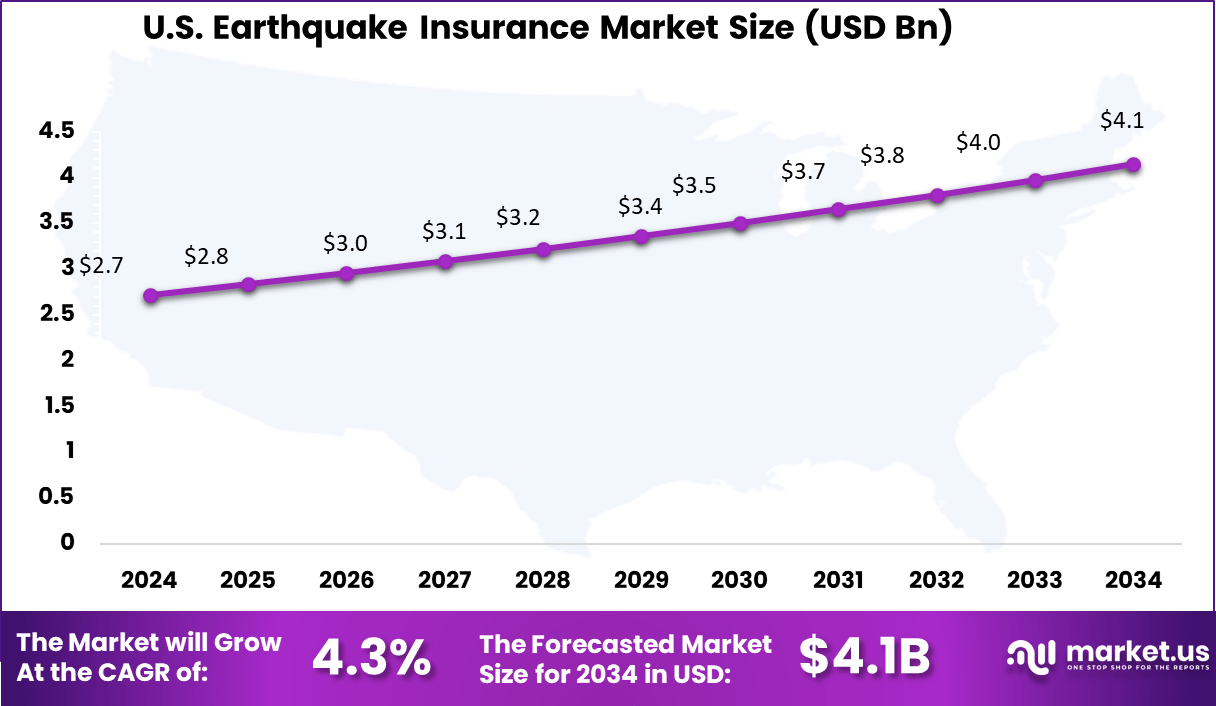

- The U.S. alone contributed nearly USD 2.7 billion in 2024 and is expected to reach USD 4.1 billion by 2034, growing at a CAGR of 4.3% – slightly below the global pace but still significant.

- The Non-Life Insurance segment dominated the global landscape in 2024, accounting for more than 76% of the total market, due to broader coverage for property and asset damage.

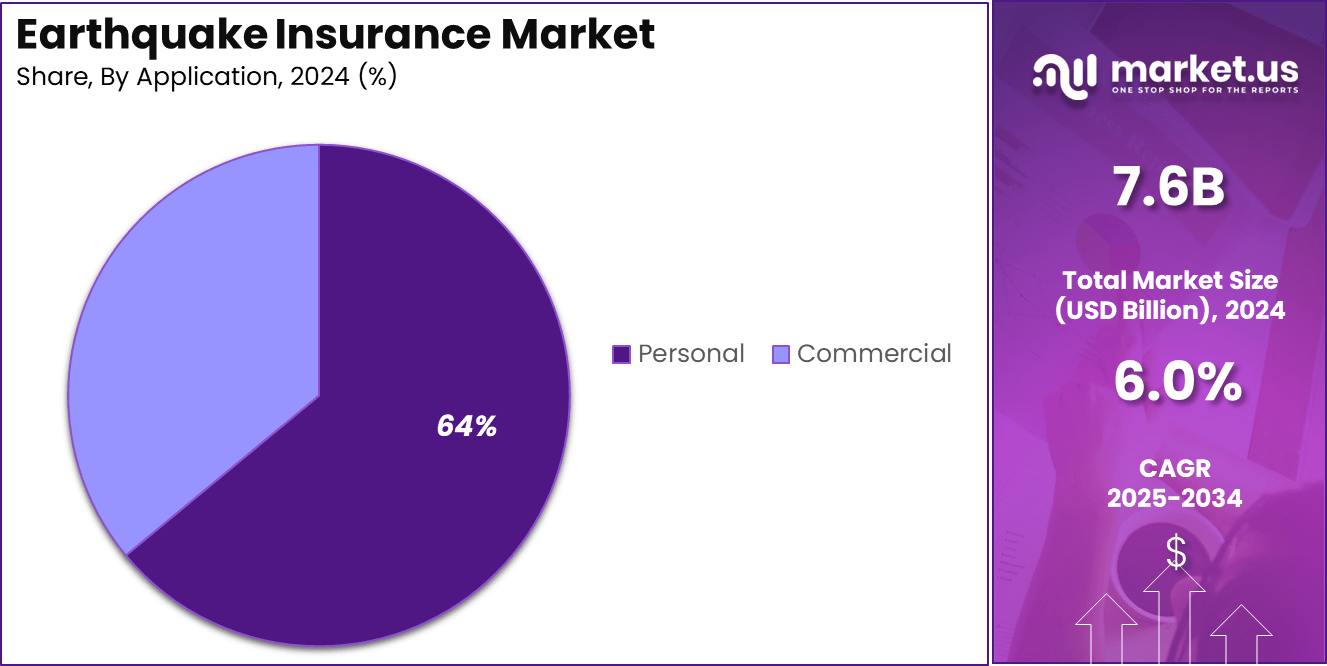

- On the basis of coverage type, Personal policies took the lead in 2024, with over 64% market share, highlighting rising awareness among homeowners in seismic zones.

- In terms of distribution, Agents were the key sales channel, capturing over 30% share in 2024, driven by consumer trust and personalized advisory during risk evaluation.

- Individual policyholders formed the bulk of the insured population, representing over 66% of the market in 2024, indicating a growing focus on household-level protection against seismic losses.

Market Overview

A primary driver of increased demand is the heightened awareness of the financial devastation that earthquakes can cause. High-profile seismic events have illuminated the limitations of traditional insurance policies, prompting individuals and businesses to seek specialized coverage. This shift in perception underscores the critical role of earthquake insurance in comprehensive risk management strategies.

Current market trends reveal a shift towards innovative insurance solutions, such as parametric policies that offer predetermined payouts based on seismic event parameters. The integration of technology, including real-time data analytics and advanced modeling, has enhanced the precision of risk assessments, enabling insurers to develop more responsive and customer-centric products.

The adoption of cutting-edge technologies, such as Internet of Things (IoT) devices and artificial intelligence (AI), is transforming the earthquake insurance landscape. These tools facilitate real-time monitoring of structural integrity and environmental conditions, allowing for proactive risk mitigation and more accurate underwriting. The implementation of such technologies is driven by the need for improved risk assessment, faster claims processing, and enhanced customer engagement.

For businesses, earthquake insurance provides a safeguard against operational disruptions and financial losses resulting from seismic events. By securing appropriate coverage, companies can ensure continuity of operations, protect assets, and maintain stakeholder confidence. This proactive approach to risk management is particularly vital for enterprises operating in high-risk zones or with critical infrastructure.

Analysts’ Viewpoint

Investors are increasingly recognizing the potential of the earthquake insurance market, particularly in emerging economies where urban development is accelerating. The growing emphasis on disaster resilience and the expansion of infrastructure projects present lucrative opportunities for investment in insurance products and related technologies.

Technological advancements are reshaping the earthquake insurance industry, enabling more accurate risk modeling and efficient claims processing. The utilization of big data analytics, machine learning algorithms, and geospatial technologies enhances the ability of insurers to assess vulnerabilities and tailor policies accordingly. These innovations contribute to more resilient insurance frameworks and improved customer satisfaction.

The regulatory environment plays a pivotal role in shaping the earthquake insurance market. Governments and regulatory bodies are increasingly implementing policies that mandate or incentivize the adoption of earthquake insurance, particularly in regions with high seismic risk. Such measures aim to enhance societal resilience, reduce economic losses, and ensure the availability of financial resources for recovery efforts.

U.S. Market Forecast Expansion

The US Earthquake Insurance Market is valued at approximately USD 2.7 Billion in 2024 and is predicted to increase from USD 2.8 Billion in 2025 to approximately USD 4.1 Billion by 2034, projected at a CAGR of 4.3% from 2025 to 2034.

In 2024, North America held a dominant position in the global earthquake insurance market, capturing over 38% of the market share, with revenue exceeding USD 39.8 billion. This leadership is attributed to several factors, including high seismic risk in regions such as California, a well-established insurance infrastructure, and heightened public awareness of earthquake-related risks.

The presence of major insurance providers like State Farm, Allstate, and Liberty Mutual, coupled with regulatory frameworks that encourage or mandate earthquake coverage, has significantly contributed to the market’s growth in this region.

By Type Analysis

In 2024, the Non-Life Insurance segment held a dominant position in the global earthquake insurance market, capturing over 76% of the total market share. This significant lead is attributed to the segment’s comprehensive coverage of tangible assets, including residential and commercial properties, vehicles, and business operations, which are directly vulnerable to earthquake-induced damages.

The increasing frequency and severity of seismic events have heightened the demand for such protective measures, prompting both individuals and enterprises to prioritize non-life insurance policies that offer financial safeguards against potential losses.

The dominance of the Non-Life Insurance segment is further reinforced by the proactive measures taken by insurers to address the evolving risks associated with earthquakes. Advancements in risk assessment technologies, such as seismic hazard mapping and structural vulnerability analyses, have enabled insurers to offer more tailored and accurate coverage options.

Additionally, regulatory frameworks in various regions have mandated or incentivized the inclusion of earthquake coverage in standard property insurance policies, thereby expanding the reach and adoption of non-life insurance solutions. These combined factors underscore the segment’s pivotal role in mitigating the financial impacts of earthquakes and its continued prominence in the insurance market landscape.

By Application Analysis

In 2024, the Personal segment held a dominant position in the global earthquake insurance market, capturing over 64% of the total market share. This significant lead is attributed to the heightened awareness among homeowners and renters about the financial risks associated with earthquake damages.

The increasing frequency of seismic events, coupled with the realization that standard homeowners’ insurance policies often exclude earthquake coverage, has prompted individuals to seek specialized insurance solutions. Additionally, government initiatives and educational campaigns have played a pivotal role in informing the public about the importance of earthquake insurance, further driving the adoption in the personal segment.

The dominance of the Personal segment is further reinforced by the affordability and accessibility of earthquake insurance products tailored for individual needs. Insurers have developed flexible policies with varying coverage levels and deductibles, making it easier for individuals to find suitable options within their budgets.

Moreover, the integration of advanced technologies in risk assessment and claims processing has enhanced the efficiency and appeal of these insurance products. These combined factors have solidified the Personal segment’s leading position in the global earthquake insurance market.

By Distribution Channel Analysis

In 2024, the Agents segment held a dominant position in the global earthquake insurance market, capturing over 30% of the total market share. This prominence is attributed to the personalized services and trust that agents offer to clients, especially when dealing with complex insurance products like earthquake coverage.

Agents provide tailored advice, helping individuals and businesses understand the nuances of policies, coverage limits, and exclusions, which is particularly valuable in regions prone to seismic activity. The dominance of the Agents segment is further reinforced by their extensive networks and deep understanding of local markets. They often have longstanding relationships with clients, enabling them to recommend appropriate coverage based on specific needs and risk profiles.

Additionally, agents play a crucial role in educating clients about the importance of earthquake insurance, especially in areas where such coverage is not mandatory but highly recommended. Their ability to demystify policy details and provide ongoing support has solidified their position as the preferred distribution channel for earthquake insurance products.

By End-User Analysis

In 2024, the Individuals segment held a dominant position in the global earthquake insurance market, capturing over 66% of the total market share. This significant lead is attributed to the heightened awareness among homeowners and renters about the financial risks associated with earthquake damages.

The increasing frequency of seismic events, coupled with the realization that standard homeowners’ insurance policies often exclude earthquake coverage, has prompted individuals to seek specialized insurance solutions. Additionally, government initiatives and educational campaigns have played a pivotal role in informing the public about the importance of earthquake insurance, further driving the adoption in the personal segment.

The dominance of the Individuals segment is further reinforced by the affordability and accessibility of earthquake insurance products tailored for individual needs. Insurers have developed flexible policies with varying coverage levels and deductibles, making it easier for individuals to find suitable options within their budgets.

Moreover, the integration of advanced technologies in risk assessment and claims processing has enhanced the efficiency and appeal of these insurance products. These combined factors have solidified the Individuals segment’s leading position in the global earthquake insurance market.

Key Market Segments

By Type

- Life Insurance

- Non-Life Insurance

By Application

- Personal

- Commercial

By Distribution Channel

- Banks

- Agents

- Brokers

- Retailers

- Others

By End-User

- Individuals

- Business

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Frequency of Natural Disasters

The global increase in natural disasters, particularly earthquakes, has significantly influenced the growth of the earthquake insurance market. In 2024, insured losses from natural disasters reached $145 billion, marking a nearly 6% rise from the previous year. Notably, the Los Angeles wildfires alone accounted for $40 billion of these losses.

This surge in natural disasters has heightened awareness among individuals and businesses about the importance of earthquake insurance. The unpredictability and potential devastation of such events have underscored the need for financial protection, leading to increased demand for insurance coverage.

Restraint

High Premiums and Deductibles

Despite the growing awareness and demand, the high cost of earthquake insurance remains a significant barrier. Premiums and deductibles are often prohibitively expensive, especially in high-risk areas. For instance, deductibles can range from 2% to 20% of the total insured property value.

These substantial costs deter many homeowners and businesses from purchasing earthquake insurance. The financial burden is particularly challenging for those in lower-income brackets or regions with limited access to affordable insurance options.

Moreover, the high premiums are often a result of the challenges insurers face in accurately assessing and pricing earthquake risk. The inherent unpredictability of seismic events and the long return periods between major earthquakes make it difficult for insurers to balance premium affordability with long-term solvency.

Opportunity

Technological Advancements in Risk Assessment

Advancements in technology present a significant opportunity for the earthquake insurance market. The integration of data analytics, machine learning, and predictive modeling can enhance risk assessment accuracy, enabling insurers to offer more tailored and affordable policies.

For example, the use of Internet of Things (IoT) devices and real-time data collection can provide insurers with detailed insights into building structures and potential vulnerabilities. This information allows for more precise underwriting and pricing, potentially reducing premiums for policyholders.

Additionally, technological innovations can improve claims processing efficiency. Automated systems and digital platforms streamline the claims process, enhancing customer satisfaction and reducing administrative costs for insurers.

Challenge

Limited Public Awareness and Education

A significant challenge facing the earthquake insurance market is the limited public awareness and understanding of earthquake risks and insurance options. Many individuals are unaware that standard homeowners’ insurance policies do not cover earthquake damage, leading to a false sense of security.

This lack of awareness is compounded by insufficient education on the importance of earthquake insurance and the potential financial consequences of being uninsured. As a result, even in high-risk areas, the uptake of earthquake insurance remains low.

To address this challenge, concerted efforts are needed to educate the public about earthquake risks and the benefits of insurance coverage. Collaborations between insurers, government agencies, and community organizations can facilitate outreach programs and informational campaigns.

Growth Factors

The increasing frequency and severity of natural disasters, particularly earthquakes, have heightened awareness about the importance of earthquake insurance. In 2024, economic losses from disaster events reached USD 318 billion, with 57% being uninsured, highlighting a substantial protection gap. This gap underscores the growing demand for earthquake insurance as individuals and businesses seek financial protection against such unpredictable events.

Government initiatives and regulations have also played a pivotal role in promoting earthquake insurance. For instance, in countries like Japan and New Zealand, government-backed schemes provide earthquake coverage, encouraging higher adoption rates among citizens . These programs not only offer financial security but also foster a culture of preparedness.

Rapid urbanization and the expansion of infrastructure in earthquake-prone regions have further propelled the market. As cities grow and buildings age, the potential risk and associated costs of earthquake damage increase, prompting property owners to invest in insurance coverage. Technological advancements in risk assessment and modeling have enabled insurers to better evaluate seismic risks, leading to more accurate pricing and tailored insurance products.

Emerging Trends

The earthquake insurance sector is witnessing several emerging trends that are reshaping the market landscape. One notable trend is the adoption of parametric insurance models. Unlike traditional indemnity insurance, parametric policies offer predefined payouts based on the occurrence of specific seismic parameters, such as magnitude or ground acceleration.

Another significant trend is the integration of advanced technologies, including artificial intelligence and machine learning, in risk assessment and underwriting processes. These technologies enable insurers to analyze vast datasets, predict potential earthquake impacts more accurately, and develop customized insurance solutions.

The market is also experiencing a shift towards greater public-private partnerships. Governments and insurers are collaborating to increase awareness about earthquake risks and promote insurance adoption. Educational campaigns and incentives are being implemented to encourage individuals and businesses to secure adequate coverage.

Business Benefits

For businesses, securing earthquake insurance offers several critical benefits that safeguard operations and financial stability. Primarily, it provides coverage for physical damages to buildings, equipment, and inventory resulting from seismic events. This protection ensures that businesses can repair or replace essential assets without bearing the full financial burden.

Moreover, earthquake insurance often includes business interruption coverage. In the event of operational downtime due to earthquake damage, this coverage compensates for lost income, helping businesses maintain cash flow and meet ongoing expenses. Such financial support is vital for small and medium-sized enterprises that may lack substantial reserves.

Having earthquake insurance also enhances a company’s credibility and reliability in the eyes of stakeholders, including investors, clients, and partners. It demonstrates a commitment to risk management and long-term sustainability. Furthermore, in regions where earthquake insurance is mandated or incentivized by authorities, compliance ensures legal adherence and potential access to additional support or resources.

Key Player Analysis

The earthquake insurance market has witnessed significant developments in recent years, with key players undertaking strategic initiatives to enhance their market positions. This analysis focuses on three prominent companies: Palomar Holdings, GeoVera Insurance Group, and State Farm, highlighting their recent acquisitions, product launches, and mergers.

Palomar Holdings has actively pursued expansion strategies to diversify its offerings and strengthen its market presence. In January 2025, the company completed the acquisition of First Indemnity of America Insurance Co., marking its entry into the surety market. This move is expected to broaden Palomar’s specialty insurance portfolio and enhance its long-term value proposition .

GeoVera Insurance Group has undergone significant organizational changes to optimize its operations. In April 2024, the company announced the sale of its insurance carriers and managing general agent (MGA) businesses, leading to the formation of GeoVera Nova Holdings, Inc. This restructuring aims to streamline GeoVera’s focus on residential earthquake risk underwriting .

State Farm, a well-established player in the insurance industry, continues to maintain a strong presence in the earthquake insurance market. While specific recent acquisitions or product launches have not been prominently reported, State Farm’s consistent performance and customer-centric approach contribute to its sustained market position. The company’s extensive network and comprehensive coverage options ensure its relevance in providing earthquake insurance solutions.

Top Key Players in the Market

- AIG

- Zurich Insurance Group

- Munich Re

- Swiss Re Group

- Berkshire Hathaway

- Allianz SE

- Lloyd’s of London

- Tokio Marine

- AXA

- Liberty Mutual Insurance

- Chubb

- State Farm

- Others

Recent Developments

- In the first quarter of 2025, AIG reported strong growth in its global commercial insurance segment, with net premiums written reaching $3.2 billion, marking an 8% year-over-year increase. Additionally, AIG enhanced its aggregate catastrophe reinsurance protection by lowering the deductible in North America, aiming to improve capital efficiency and reduce volatility in underwriting results.

- In March 2025, Munich Re announced its acquisition of the remaining 71% stake in Next Insurance, a U.S.-based digital insurer, for $2.6 billion. This move aims to strengthen Munich Re’s presence in the U.S. market and expand its digital offerings.

- In January 2025, Swiss Re sought $150 million in retrocessional protection for North American earthquake and named storm risks through a catastrophe bond issued by Matterhorn Re Ltd. This initiative is part of Swiss Re’s strategy to manage its exposure to natural catastrophes.

Report Scope

Report Features Description Market Value (2024) USD 7.6 Bn Forecast Revenue (2034) USD 13.6 Bn CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Life Insurance, Non-Life Insurance), By Application (Personal, Commercial), By Distribution Channel (Banks, Agents, Brokers, Retailers, Others), By End-User (Individuals, Business) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AIG, Zurich Insurance Group, Munich Re, Swiss Re Group, Berkshire Hathaway, Allianz SE, Lloyd’s of London, Tokio Marine, AXA, Liberty Mutual Insurance, Chubb, State Farm, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Earthquake Insurance MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Earthquake Insurance MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AIG

- Zurich Insurance Group

- Munich Re

- Swiss Re Group

- Berkshire Hathaway

- Allianz SE

- Lloyd’s of London

- Tokio Marine

- AXA

- Liberty Mutual Insurance

- Chubb

- State Farm

- Others