UAE Office Supplies Market Size, Share, Growth Analysis By Product (Paper Supplies, Binding Supplies, Filing Supplies, Writing Supplies, Desk Supplies, Others), Distribution Channel (Offline, Online), By End Use (Corporate, Educational Institutes, Hotels, Hospitals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151647

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

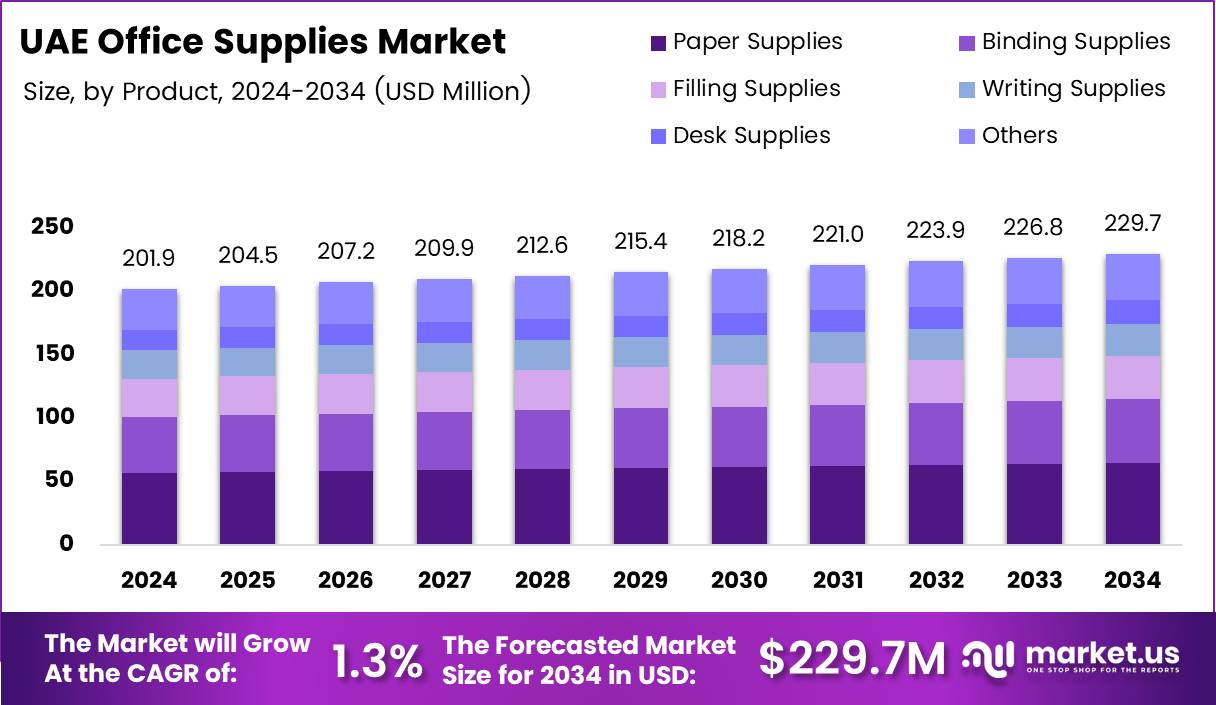

The UAE Office Supplies Market size is expected to be worth around USD 229.7 Million by 2034, from USD 201.9 Million in 2024, growing at a CAGR of 1.3% during the forecast period from 2025 to 2034.

The UAE office supplies market is evolving swiftly, driven by increased demand from corporate offices, SMEs, and government institutions. With business hubs like Dubai and Abu Dhabi expanding, the market continues to benefit from infrastructure growth and strong economic activity. Additionally, evolving work culture and hybrid working models contribute to rising demand for office essentials.

Government initiatives such as Dubai Paperless Strategy and Smart Dubai aim to reduce paper consumption, accelerating the transition toward digital office supplies. According to Shift Eco, the average office worker uses about 10,000 sheets of paper annually, and 50% of that ends up in the trash within 24 hours, highlighting the urgency for eco-friendly alternatives.

Moreover, sustainability is shaping buying patterns. According to Coohom, 65% of office supply buyers are willing to pay a premium for sustainable products, showcasing a clear market shift towards greener options. Businesses are now investing in recyclable stationery, refillable pens, and energy-efficient office equipment to align with ESG goals.

In parallel, the UAE government is promoting environmental responsibility through regulations that encourage sustainable procurement. This regulatory support creates opportunities for green office supply manufacturers and eco-certification agencies to scale in the region.

Digitization is another growth lever. The adoption of cloud-based printing, virtual meeting accessories, and digital projectors is on the rise. Companies increasingly prefer digital solutions, reducing reliance on traditional paper-based supplies and enabling new market segments to emerge.

E-commerce is transforming distribution. Online platforms like Amazon.ae and Noon.com are simplifying access to bulk stationery, office tech, and ergonomic furniture. This change is supporting SME buyers who seek cost-effective, time-saving procurement channels with transparent pricing models.

Meanwhile, local distributors and global players are entering strategic partnerships to increase market penetration. This collaboration is enhancing product variety, delivery logistics, and after-sales service—key decision points for UAE office supply customers.

As offices prioritize employee wellness, demand is rising for ergonomic chairs, sit-stand desks, and blue-light filter screens. This health-conscious trend is creating micro-niches within the UAE office supplies market with premium margins.

Key Takeaways

- The UAE Office Supplies Market is projected to reach USD 196.4 Billion by 2034, up from USD 128.9 Billion in 2024.

- The market is expected to grow at a CAGR of 4.3% from 2025 to 2034.

- Paper Supplies led the product segment in 2024 with a 34.5% market share due to consistent use in documentation and communication.

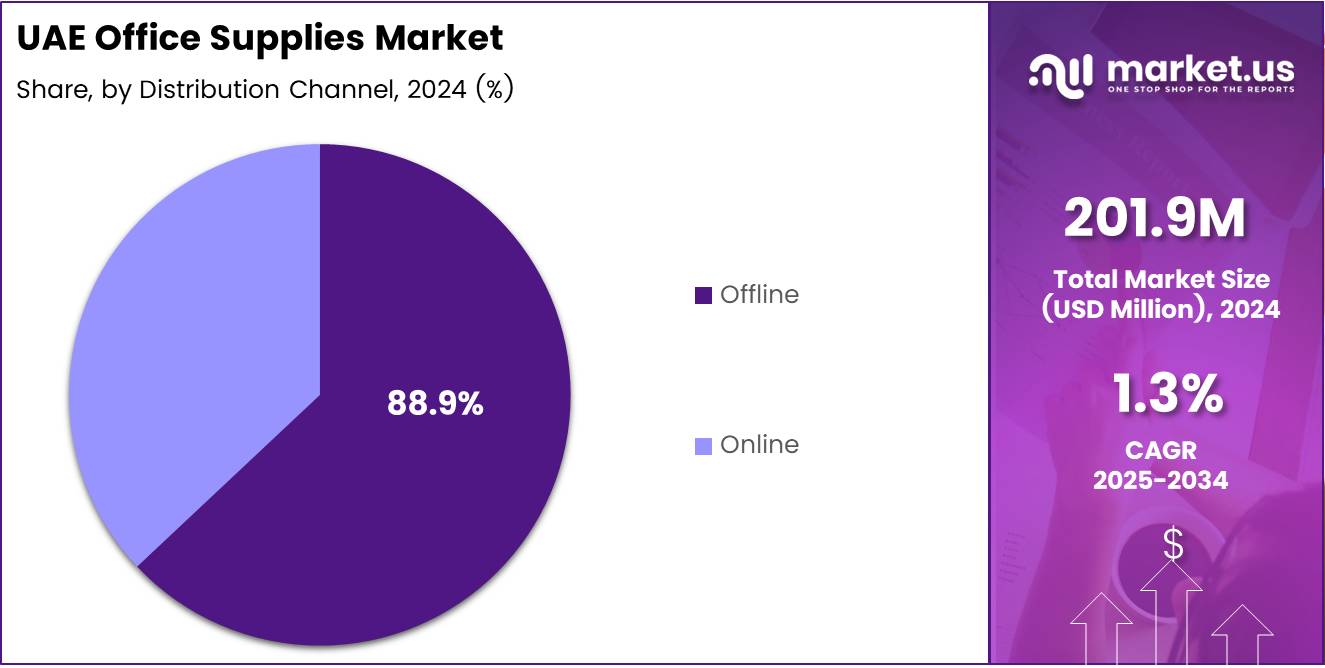

- Offline distribution dominated the market in 2024 with an 88.9% share, driven by traditional purchasing habits and bulk buying.

- The Corporate segment led end-use analysis in 2024 with a 28.3% share, fueled by structured procurement and recurring needs.

Product Analysis

Paper Supplies leads with 34.5% owing to its foundational use in office operations.

In 2024, Paper Supplies held a dominant market position in By Product Analysis segment of UAE Office Supplies Market, with a 34.5% share. The segment’s consistent demand stems from its critical role in everyday documentation, printing, and administrative communication.

Binding Supplies maintained a steady presence, catering to offices seeking durable presentation solutions. Their necessity for document organization ensured moderate yet stable demand across corporate setups.

Filing Supplies continued to support archiving and compliance activities. Businesses emphasized structured documentation, boosting the relevance of these products in a regulated environment.

Writing Supplies found traction due to their essential role in manual tasks. Despite digital shifts, pens, markers, and highlighters retained a foothold in meetings and creative processes.

Desk Supplies, including staplers and tape dispensers, served as daily utilities, supporting seamless desk operations in traditional and hybrid offices alike.

The Others category captured niche products that fulfill specific operational gaps. Though not a dominant contributor, it provided flexibility and customization within the market.

Distribution Channel Analysis

Offline dominates with 88.9% due to strong retail and bulk purchase preference.

In 2024, Offline held a dominant market position in By Distribution Channel Analysis segment of UAE Office Supplies Market, with a 88.9% share. Brick-and-mortar outlets, established supplier relationships, and bulk procurement habits among businesses largely contributed to this dominance.

Offline stores also provided a tactile experience, which many buyers still value, especially for evaluating product quality. Furthermore, traditional procurement systems used by corporate and institutional buyers favored established offline channels.

The Online segment, while smaller, continued to gain attention from tech-savvy buyers. It attracted customers seeking convenience and occasional personal or last-minute office purchases. However, logistical constraints and trust barriers kept it from surpassing offline in the short term.

End Use Analysis

Corporate leads with 28.3% thanks to structured demand and recurring purchases.

In 2024, Corporate held a dominant market position in By End Use Analysis segment of UAE Office Supplies Market, with a 28.3% share. Offices with structured procurement systems and recurring operational needs were the main contributors to this strong performance.

Educational Institutes followed as significant consumers, using supplies for administrative work, exams, and teaching materials. Their cyclical but predictable demand made them a vital segment of the market.

Hotels leveraged office supplies to manage front desk operations, guest communication, and internal coordination. Although not a large contributor, they represented a stable use-case scenario.

Hospitals used office supplies for patient record management and interdepartmental coordination, driving moderate but consistent demand.

Others included government agencies, small businesses, and freelancers—diverse entities with unique operational needs, contributing to the overall market dynamics.

Key Market Segments

By Product

- Paper Supplies

- Binding Supplies

- Filing Supplies

- Writing Supplies

- Desk Supplies

- Others

Distribution Channel

- Offline

- Online

By End Use

- Corporate

- Educational Institutes

- Hotels

- Hospitals

- Others

Drivers

Integration of Office Supply Procurement in E-Commerce Platforms Drives Market Growth

The UAE office supplies market is expanding as more companies adopt digital procurement through e-commerce. Businesses prefer the ease and speed of ordering supplies online, saving both time and operational costs.

The rapid growth of co-working spaces and shared office environments has also increased demand for flexible and diverse office supplies. These spaces require ongoing replenishment of materials and are boosting overall market activity.

Government support for startups and SMEs is another driver. Through funding and policies that encourage entrepreneurship, more small businesses are entering the market—each needing their own supply chains.

There’s also a rising demand for customized and branded office supplies. Companies are focusing on brand identity and are willing to invest in personalized stationery, packaging, and office tools, adding value to the sector.

Restraints

High Import Dependency Leading to Supply Chain Disruptions Limits Market Stability

One major challenge in the UAE office supplies market is the high dependence on imported goods. This makes the market vulnerable to global supply chain issues and delays.

Volatility in raw material prices also affects product costs. Fluctuations in the cost of paper, plastic, and metal impact profit margins for local suppliers and retailers.

Another concern is the shift toward digital and paperless operations. Many businesses are reducing their need for traditional supplies like paper and pens, which slows market growth.

Lastly, there is a limited presence of high-quality local manufacturers. This restricts innovation and increases reliance on international brands, limiting market competitiveness.

Growth Factors

Rising Demand for Eco-Friendly and Sustainable Office Products Creates New Growth Avenues

UAE businesses are increasingly focusing on sustainability. This trend is driving demand for eco-friendly office supplies like recycled paper, biodegradable pens, and reusable items.

Technological innovation also presents growth opportunities. Smart office tools, such as digital whiteboards and wireless printers, are becoming more popular and expanding the market scope.

As remote work becomes more permanent, companies are investing in remote work supply kits. These include home office essentials that cater to employees working offsite.

Strategic partnerships with schools, universities, and corporations can also fuel growth. Such alliances can ensure consistent demand and open long-term business channels for suppliers.

Emerging Trends

Adoption of Subscription-Based Office Supply Services Shapes Market Trends

Subscription-based models are gaining popularity in the UAE office supplies market. Businesses now prefer regular, automated deliveries instead of bulk one-time purchases, improving supply consistency.

The rise of on-demand and same-day delivery services is reshaping customer expectations. Quick delivery options have become essential, especially for fast-paced businesses and coworking hubs.

Health-focused and ergonomic office furniture is also trending. With rising awareness of employee wellness, there’s more demand for adjustable chairs, standing desks, and posture-friendly accessories.

Technology is playing a key role, particularly AI and IoT in inventory management. Smart systems help companies track usage, forecast needs, and reduce waste—boosting efficiency in supply operations.

Key UAE Office Supplies Company Insights

In 2024, the UAE Office Supplies Market continues to see a dynamic shift as key global players solidify their foothold amid digital integration and evolving workspaces. Companies like 3M have remained highly relevant due to their diversified offerings in adhesives, stationery, and ergonomic products, which align well with the hybrid work culture gaining momentum in the UAE. Their innovation-centric approach and strong distribution networks give them a distinct competitive edge.

Faber-Castell, with its reputation for premium quality and eco-conscious manufacturing, continues to gain traction among educational institutions and professionals in creative industries. The brand’s blend of heritage and sustainability resonates well with the UAE’s growing interest in green procurement policies.

KOKUYO Co., Ltd., a Japanese firm known for its minimalist design and highly functional office products, is increasingly appealing to UAE’s corporate segment that prioritizes aesthetics and efficiency. Their product innovation and seamless integration with digital tools make them a strong player in the premium office supplies segment.

BIC maintains steady performance in the market due to its affordability and wide product accessibility across mass retail channels. Their consistent quality in everyday office essentials like pens and stationery appeals to both corporate buyers and SMEs across the UAE.

Together, these companies reflect the diverse demands of the UAE’s office supplies sector, where premiumization, sustainability, and reliability are shaping purchasing decisions in both government and private sectors. Strategic positioning and local partnerships will be key for continued success in this competitive landscape.

Top Key Players in the Market

- 3M

- Faber-Castell

- KOKUYO Co., Ltd.

- BIC

- Pentel

- ACCO Brands

- BYD Company

Recent Developments

- In date Jan 2025, according to Khaleej Times, the new office supply is projected to significantly rise.

It is expected to double in 2025 compared to 2024, increasing by 1.66 million square feet.

Report Scope

Report Features Description Market Value (2024) USD 201.9 Million Forecast Revenue (2034) USD 229.7 Million CAGR (2025-2034) 1.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Paper Supplies, Binding Supplies, Filing Supplies, Writing Supplies, Desk Supplies, Others), Distribution Channel (Offline, Online), By End Use (Corporate, Educational Institutes, Hotels, Hospitals, Others) Competitive Landscape BYD Company, 3M, Faber-Castell, KOKUYO Co., Ltd., BIC, Pentel, ACCO Brands Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M

- Faber-Castell

- KOKUYO Co., Ltd.

- BIC

- Pentel

- ACCO Brands

- BYD Company