Global Tributyrin Market Size, Share, And Business Benefits By Type (Purity 45%, Purity 45%-99%, Purity 99% and Above), By Form (Liquid, Powder), By Grade (Food Grade, Pharmaceutical Grade, Technical Grade), By Application (Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153913

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

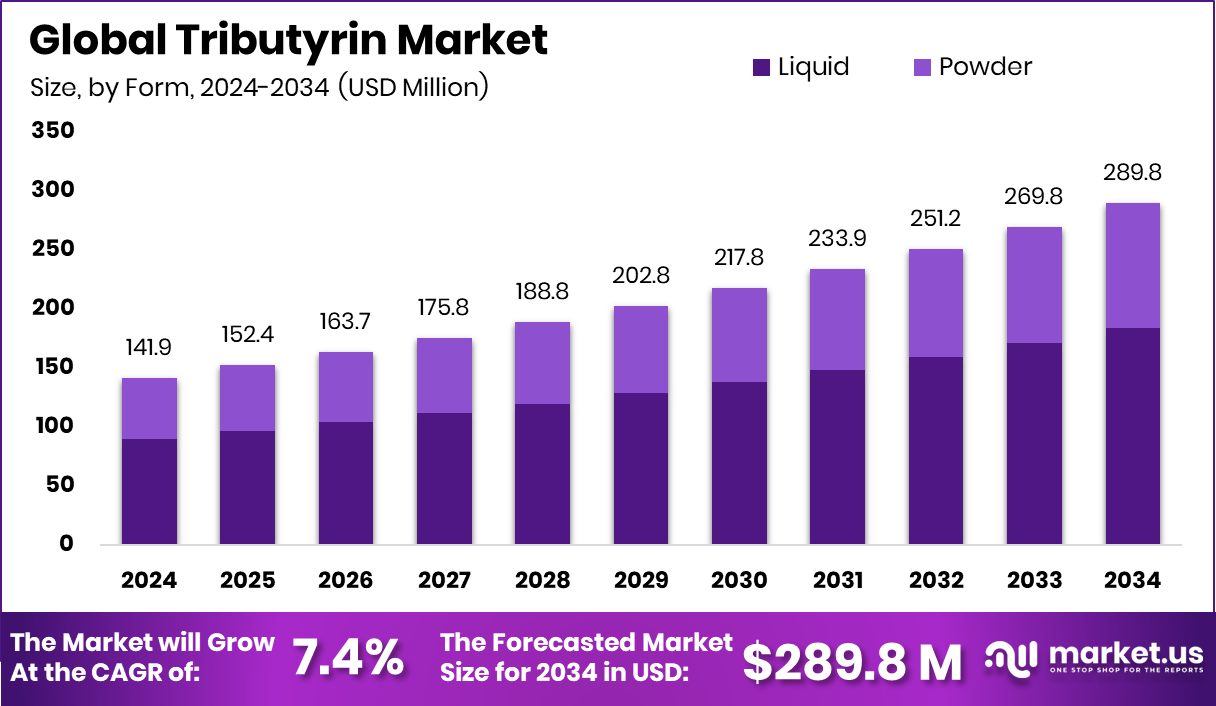

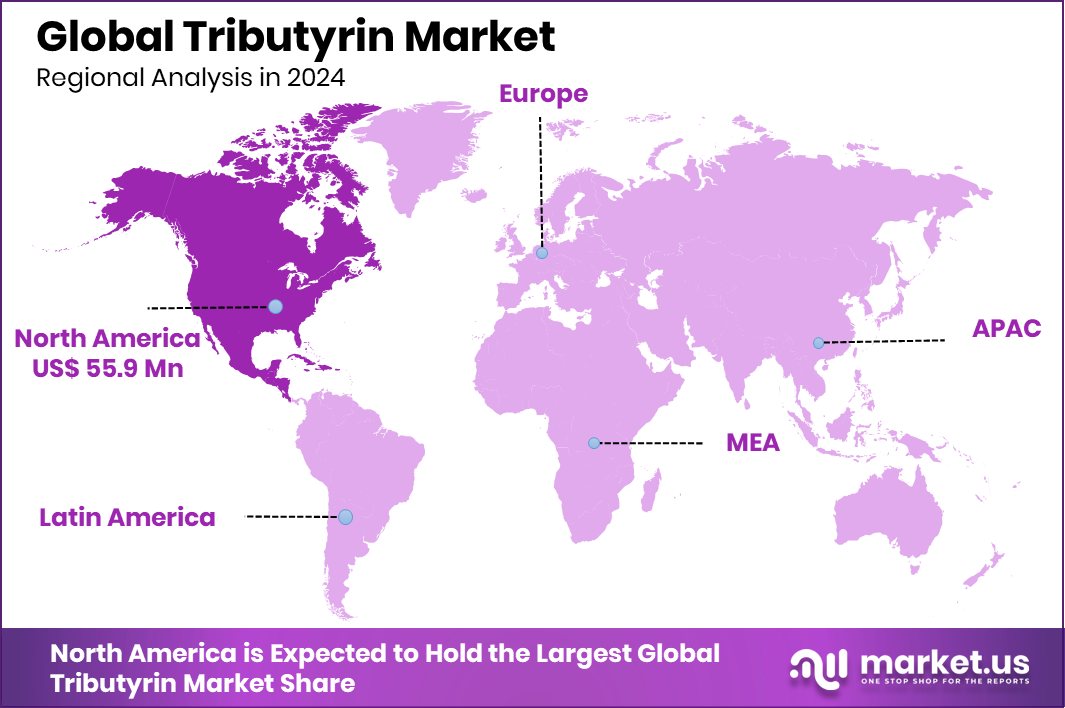

The Global Tributyrin Market is expected to be worth around USD 289.8 million by 2034, up from USD 141.9 million in 2024, and is projected to grow at a CAGR of 7.4% from 2025 to 2034. With a USD 55.9 million value, North America led with 39.4% market share.

Tributyrin is a triglyceride composed of butyric acid and glycerol. It is a colorless, oily liquid used in food, pharmaceutical, and animal feed applications. In the human body, tributyrin functions as a prodrug, releasing butyric acid, a short-chain fatty acid known for its beneficial effects on gut health. It is commonly used as a flavoring agent, a nutritional additive, and a delivery vehicle for butyrate in medical formulations due to its stability and bioavailability.

The tributyrin market refers to the commercial landscape surrounding the production, distribution, and utilization of tributyrin across various industries. This market includes applications in food and beverages, animal nutrition, and pharmaceuticals. Growing awareness of gut health, digestive wellness, and the importance of short-chain fatty acids in immunity and inflammation control is helping the market expand steadily.

The market is being driven by rising demand for natural and functional additives in both food and animal feed. Increased consumer focus on digestive health and the use of butyrate in supporting intestinal functions are key contributors. Furthermore, growing health consciousness and preference for clean-label products have opened new application areas for tributyrin.

Demand is largely supported by the need for alternative gut health solutions, especially in animal farming, where antibiotics are being phased out. Tributyrin offers a natural way to enhance nutrient absorption and maintain intestinal integrity. Its application in human nutrition and pharmaceuticals is also growing due to its role in maintaining colon health and reducing inflammation.

Key Takeaways

- The Global Tributyrin Market is expected to be worth around USD 289.8 million by 2034, up from USD 141.9 million in 2024, and is projected to grow at a CAGR of 7.4% from 2025 to 2034.

- In 2024, Purity 45%-99% led the Tributyrin market with a 57.2% share globally.

- Liquid form dominated the Tributyrin market in 2024, accounting for approximately 63.4% of the total share.

- Food Grade held a strong position in the Tributyrin market with a 59.1% share in 2024.

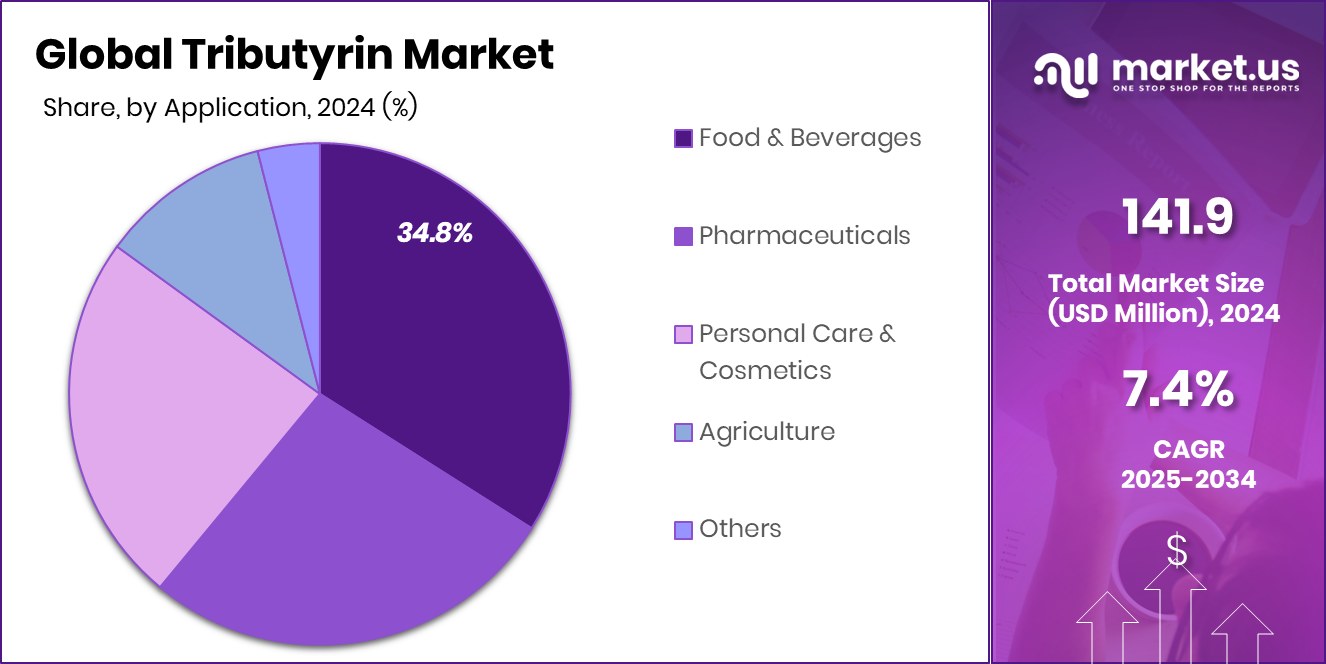

- Food and beverage applications led demand in 2024, capturing about 34.8% of the global Tributyrin market.

- In North America, tributyrin usage increased, capturing a 39.4% share, USD 55.9 million.

By Type Analysis

Purity 45%-99% leads the Tributyrin Market with 57.2% share.

In 2024, Purity 45%–99% held a dominant market position in the By Type segment of the Tributyrin Market, with a 57.2% share. This high market share can be attributed to its widespread use across food, pharmaceutical, and animal nutrition industries due to its balanced composition, cost-effectiveness, and suitability for large-scale applications. The 45%–99% purity range offers optimal functional properties while maintaining stability and ease of formulation, making it a preferred choice for manufacturers seeking efficient butyrate delivery solutions.

Its adoption has been particularly notable in applications where precise butyric acid release is required without the need for ultra-pure grades. The segment’s dominance is also supported by the availability of this purity range in both liquid and encapsulated forms, allowing flexibility across diverse end-use scenarios.

Moreover, this segment continues to benefit from ongoing product developments aimed at enhancing bioavailability and shelf life. The relatively lower cost compared to higher purity forms has made this grade more accessible to manufacturers in cost-sensitive markets, thereby broadening its footprint.

By Form Analysis

Liquid form dominates the Tributyrin Market, capturing 63.4% in 2024.

In 2024, Liquid held a dominant market position in the By Form segment of the Tributyrin Market, with a 59.1% share. This leading share is primarily driven by the ease of handling, mixing, and dosing that liquid tributyrin offers across multiple applications. In sectors such as food processing, animal feed, and pharmaceuticals, the liquid form allows for better absorption, faster action, and uniform distribution in formulations, making it highly preferred by manufacturers.

Liquid tributyrin also supports more efficient transportation and storage due to its stable viscosity and compatibility with standard equipment. Its solubility in oils and other lipid-based systems enhances its utility in formulations that require consistent and controlled release of butyric acid. Moreover, the liquid form enables direct application without complex processing, which reduces manufacturing steps and cost, especially in high-volume production environments.

The strong market demand for gut health-enhancing ingredients in both human and animal nutrition has further supported the adoption of liquid tributyrin. As a result, the segment continues to maintain its leadership position, supported by its functional versatility, user-friendly nature, and compatibility with evolving formulation trends in the health and nutrition sectors.

By Grade Analysis

Food-grade Tributyrin accounts for 59.1% of global demand.

In 2024, Food Grade held a dominant market position in the By Grade segment of the Tributyrin Market, with a 49.2% share. This significant share reflects the rising demand for safe, high-quality additives in food applications where tributyrin is used as a flavor enhancer and nutritional supplement.

Food-grade tributyrin meets stringent regulatory and safety standards, making it suitable for direct human consumption. Its recognized role in promoting gut health, supporting digestive functions, and contributing to overall well-being has led to increased use in functional foods and health-oriented dietary products.

Manufacturers prefer food-grade tributyrin due to its reliable quality, purity, and compliance with international food safety regulations. The growing awareness among consumers regarding digestive health and the benefits of short-chain fatty acids has further accelerated its inclusion in health supplements and fortified foods. Additionally, the shift toward clean-label and natural food ingredients continues to drive the adoption of food-grade tributyrin, particularly in developed markets.

The segment’s leading position is supported by its application versatility and increasing consumer focus on preventive health and wellness, reinforcing its importance across the food industry. As these trends persist, food-grade tributyrin is expected to remain the preferred choice for manufacturers prioritizing safety, quality, and consumer trust.

By Application Analysis

Food and beverage applications hold 34.8% of the tributyrin market.

In 2024, Food and Beverages held a dominant market position in the By Application segment of the Tributyrin Market, with a 34.8% share. This dominance is largely driven by the increasing incorporation of tributyrin as a functional ingredient aimed at enhancing digestive health and nutritional value in food products. Its role as a source of butyric acid, known for supporting intestinal health, makes it a valuable addition in various food formulations, particularly in functional foods and health-oriented beverages.

The demand for food and beverage products with added health benefits has grown consistently, and tributyrin fits well within this trend due to its bioactive properties. Manufacturers favor its use for its ability to improve gut flora balance and aid nutrient absorption, which aligns with the consumer shift toward preventive health solutions through diet.

Furthermore, its compatibility with existing food processing methods and stability in formulations adds to its appeal in this segment. The rising global focus on wellness and clean-label ingredients has further supported the demand for tributyrin in food and beverage applications.

Key Market Segments

By Type

- Purity 45%

- Purity 45%-99%

- Purity 99% and Above

By Form

- Liquid

- Powder

By Grade

- Food Grade

- Pharmaceutical Grade

- Technical Grade

By Application

- Food and Beverages

- Pharmaceuticals

- Personal Care and Cosmetics

- Agriculture

- Others

Driving Factors

Rising Demand for Gut Health Supporting Ingredients

One of the main driving factors for the tributyrin market is the growing demand for gut health-promoting ingredients in both human and animal nutrition. Tributyrin, as a stable source of butyric acid, plays a crucial role in supporting intestinal integrity, reducing inflammation, and improving digestion. With increasing consumer awareness around digestive health and the connection between the gut and overall well-being, products that support the microbiome are gaining popularity.

In animal feed, the need to replace antibiotics with natural solutions is also boosting the use of tributyrin. This shift toward preventive health and natural additives continues to strengthen market growth, especially in food, dietary supplements, and functional feed applications where gut health is a key priority.

Restraining Factors

High Production Cost Limits Widespread Market Adoption

One major restraining factor for the tributyrin market is its high production cost, which affects its overall affordability and limits its broader use, especially in cost-sensitive regions. The process of manufacturing tributyrin with consistent quality and stability requires advanced technology and stringent quality control, making it more expensive than alternative additives.

This cost barrier is a challenge for small and medium-sized manufacturers, particularly in emerging markets where pricing plays a critical role in purchasing decisions. In animal nutrition, cheaper substitutes are often preferred, reducing tributyrin’s competitive edge. As a result, despite its health benefits and functionality, the high cost of production and formulation remains a key factor that can slow down its market expansion.

Growth Opportunity

Expanding Use in the Human Nutritional Supplements Sector

A key growth opportunity for the tributyrin market lies in its expanding use in human nutritional supplements. With increasing global focus on preventive health and wellness, consumers are actively seeking products that support gut health, immunity, and digestion. Tributyrin, as a stable and effective source of butyric acid, offers proven benefits for colon health, inflammation control, and nutrient absorption. This makes it a strong candidate for inclusion in dietary supplements targeting gastrointestinal health.

Additionally, rising interest in the gut-brain connection and the role of short-chain fatty acids in mental wellness could further support its application in next-generation supplement products. As health-conscious consumers grow worldwide, the demand for innovative, gut-supporting supplements using tributyrin is expected to rise significantly.

Latest Trends

Rising Use of Tributyrin in Animal Feed

One of the latest trends in the tributyrin market is its increasing use in animal nutrition, especially in poultry and swine feed. Tributyrin is gaining attention as a natural feed additive that supports gut health, improves digestion, and enhances growth performance in livestock. It is preferred over traditional antibiotics due to growing restrictions on antibiotic use in animal farming.

Farmers are now looking for safe and sustainable alternatives, and tributyrin fits well in this shift. Its ability to boost immunity and reduce harmful bacteria in the gut is encouraging more adoption in feed formulations. This trend is expected to grow further as the global demand for meat and livestock health continues to rise across developing and developed regions.

Regional Analysis

North America accounted for 39.4% market share, reaching USD 55.9 million in 2024.

In 2024, North America held a dominant position in the global tributyrin market, capturing a significant 39.4% share and reaching a market value of USD 55.9 million. This leading share highlights the region’s strong demand for tributyrin, particularly in animal feed applications where it is used to promote gut health and improve livestock performance. The regulatory push toward antibiotic-free animal nutrition has further accelerated the adoption of tributyrin across the United States and Canada.

Other regions such as Europe, Asia Pacific, the Middle East & Africa, and Latin America also contribute to the market; however, their market shares remain below North America’s 39.4% lead. These regions are witnessing growing awareness and gradual integration of tributyrin, particularly in sectors such as food processing and nutraceuticals.

While Asia Pacific is emerging with a rising demand due to expanding livestock sectors, and Europe is focused on clean-label food ingredients, their overall market presence remained relatively modest compared to North America in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Evonik has remained a prominent player due to its advanced expertise in specialty chemicals and nutritional solutions. Its tributyrin products are widely utilized in animal nutrition, especially swine and poultry, as the demand for gut health-promoting feed additives rises.

VTR Bio-Tech Co., Ltd. strengthened its presence in the tributyrin segment by focusing on biotechnological advancements and fermentation-based production. The company is known for offering cost-effective and stable tributyrin products suitable for various applications, including feed and food formulations.

Hubei Horwath Biotechnology Co., Ltd. has established itself through technical capabilities and scale, particularly in the Chinese market. It has focused on expanding production capacity to meet increasing regional demand, particularly in the livestock sector where tributyrin use is growing rapidly.

Perstorp, with its long-standing reputation in the chemical industry, has emphasized innovation in feed additives. The company has leveraged its chemical synthesis expertise to produce high-purity tributyrin solutions that align with evolving regulatory norms and clean-label trends.

Top Key Players in the Market

- Evonik

- VTR Bio-Tech Co., Ltd.

- Hubei Horwath Biotechnology Co., Ltd.

- Perstorp

- Singao Co., LTD

- Vetagro S.p.A.

- Zhejiang Esigma Biotechnology Co., Ltd.

Recent Developments

- In June 2025, VTR Bio‑Tech organized two technical conferences in Indonesia and Vietnam, focused on enzyme innovations and animal nutrition. One key highlight was the presentation of tributyrin‑based organic acids aimed at supporting poultry growth and gut health. These sessions underscored the company’s emphasis on applying tributyrin in feed solutions to improve digestion and overall poultry performance.

- In May 2025, Evonik organized a live webinar titled “Unlocking the Benefits of Tributyrin in Animal Feed: Improving Health and Performance with SpeoCare® T60”. This session introduced SpeoCare® T60, Evonik’s new tributyrin-based feed additive designed to release butyric acid in a controlled way, supporting better gut health and growth in animals.

Report Scope

Report Features Description Market Value (2024) USD 141.9 Million Forecast Revenue (2034) USD 289.8 Million CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Purity 45%, Purity 45%-99%, Purity 99% and Above), By Form (Liquid, Powder), By Grade (Food Grade, Pharmaceutical Grade, Technical Grade), By Application (Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Evonik, VTR Bio-Tech Co., Ltd., Hubei Horwath Biotechnology Co., Ltd., Perstorp, Singao Co., LTD, Vetagro S.p.A., Zhejiang Esigma Biotechnology Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Evonik

- VTR Bio-Tech Co., Ltd.

- Hubei Horwath Biotechnology Co., Ltd.

- Perstorp

- Singao Co., LTD

- Vetagro S.p.A.

- Zhejiang Esigma Biotechnology Co., Ltd.