Global Treatment Planning Systems And Advanced Image Processing Market Analysis By Component [Advanced Image Processing Software, Treatment Planning Software (PET/CT Deformable Software, Multi-Modality Software, Others)], By Technique (3D Image Reconstruction, Image Registration using Graphics Processor Unit, In-Room Imaging), By Application (Online Monitoring, Dose Accumulation, Tracking, Adaptive Radiotherapy, Validation of Image Registration, Other Applications), By End-User (Hospitals, Ambulatory Surgical Centers, Diagnostic and Treatment Centers, Other End-Users) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 73447

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

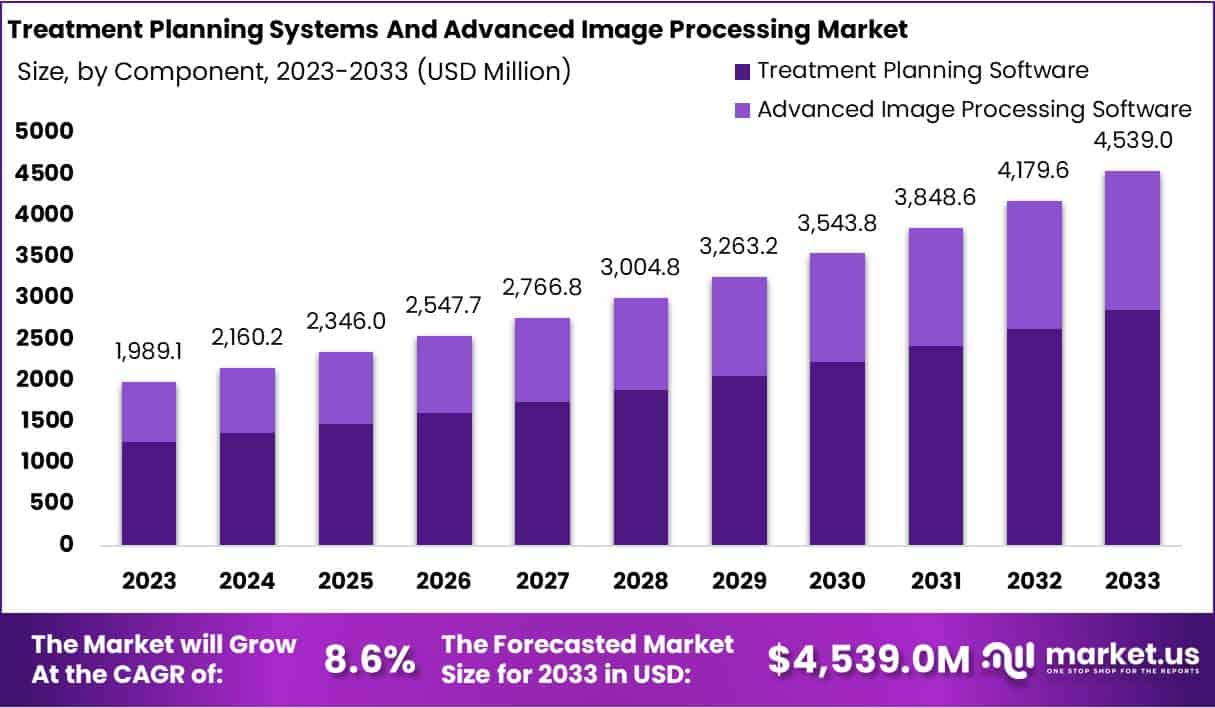

The Global Treatment Planning Systems And Advanced Image Processing Market size is expected to be worth around USD 4539 Million by 2033, from USD 1989.1 Million in 2023, growing at a CAGR of 8.6% during the forecast period from 2024 to 2033.

Treatment Planning Systems (TPS) and Advanced Image Processing stand at the forefront of enhancing medical imaging and radiation therapy, especially in the meticulous field of cancer treatment. TPS, a sophisticated suite of software, is instrumental in creating and fine-tuning radiation therapy plans. It meticulously calculates the ideal radiation dose, ensuring tumors receive effective treatment while safeguarding surrounding healthy tissues through its dose calculation algorithms and optimization tools.

Meanwhile, Advanced Image Processing elevates the quality of medical images, crucial for precise diagnoses and monitoring treatment progress. Techniques such as image enhancement, reconstruction, and segmentation significantly improve image clarity and detail, aiding healthcare professionals in identifying and delineating critical structures. These technologies collectively empower a more personalized and precise approach to patient care, showcasing a significant leap towards optimizing treatment efficacy and patient safety. The ongoing integration of AI and machine learning promises to further revolutionize these processes, highlighting their indispensable role in advancing healthcare outcomes.

The rapid increase in cancer prevalence across the globe is fueling the demand for innovative and accurate oncology treatment practices. Evolving healthcare IT sector with supportive infrastructure, a rise in the adoption of Artificial Intelligence (AI) and Machine Learning (ML) with existing oncology processes, surging investments being made towards the improvement of oncology treatment and care segments, as well as the anticipated spike in the demand for innovative treatment solutions are all crucial elements that are slated to have a profound influence on the market growth prospects of this global industry.

The increasing prevalence of cancer, as well as the exponential spike in the number of cancer-related mortalities, both on a global and regional level, is extremely alarming. The Global Cancer Observatory estimated that in 2020, approximately 19.3 million new cancer cases were diagnosed globally, and 10 million cancer-related mortalities were recorded.

At the top of this list were breast cancer (11.7%) and lung cancer (11.4%). It is estimated that by 2040 more than 28.4 million new cancer cases would be diagnosed annually with a rise of 47% from 2020. This unfortunate increase in these aforementioned numbers is expected to boost the demand for innovative treatment practices in the field of oncology.

A rise in the prevalence is slated to increase the demand for an accurate diagnosis to subsequently support adequate treatment plans. Additionally, radiotherapy is steadily gaining popularity as a prominent and cost-effective treatment option.

Key Takeaways

- Market size projected to reach USD 4539 million by 2033, with a CAGR of 8.6% from 2024 to 2033.

- Treatment Planning Software dominates, capturing over 63% of the market in 2023.

- In-Room Imaging leads technique segment with a market share exceeding 56% in 2023.

- Validation of Image Registration claims top spot in applications, securing over 28% market share in 2023.

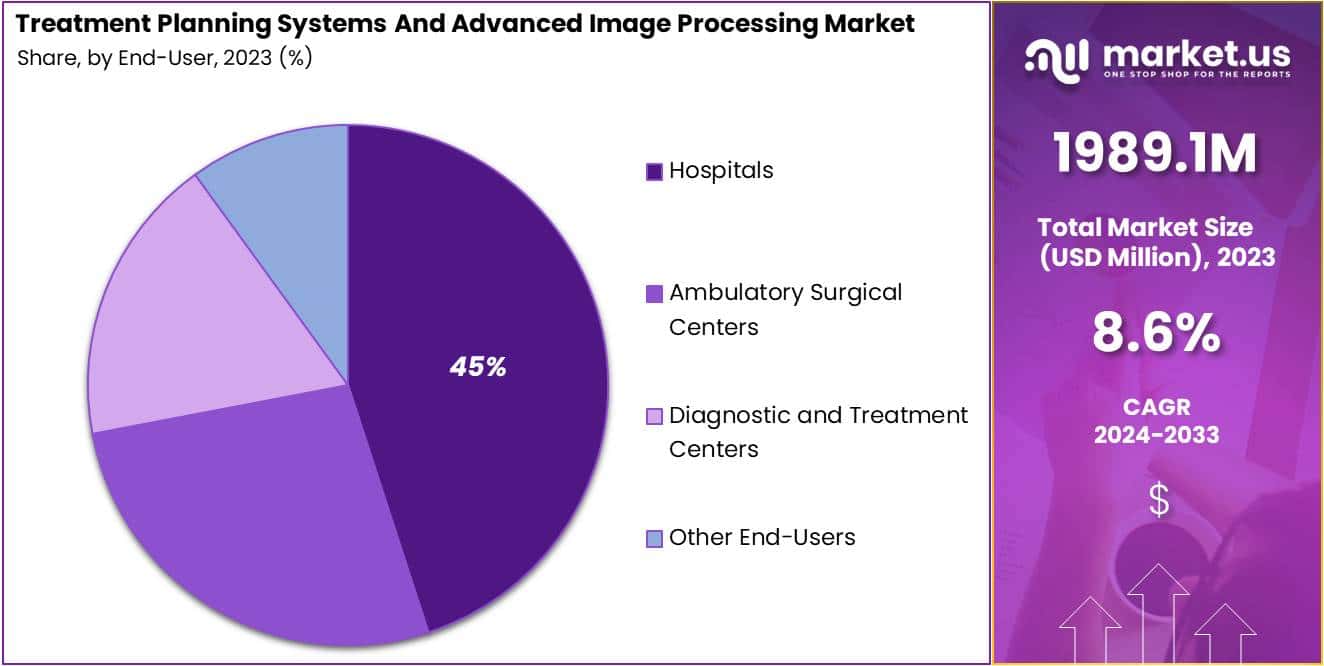

- Hospitals lead end-user segment with over 45% market share in 2023.

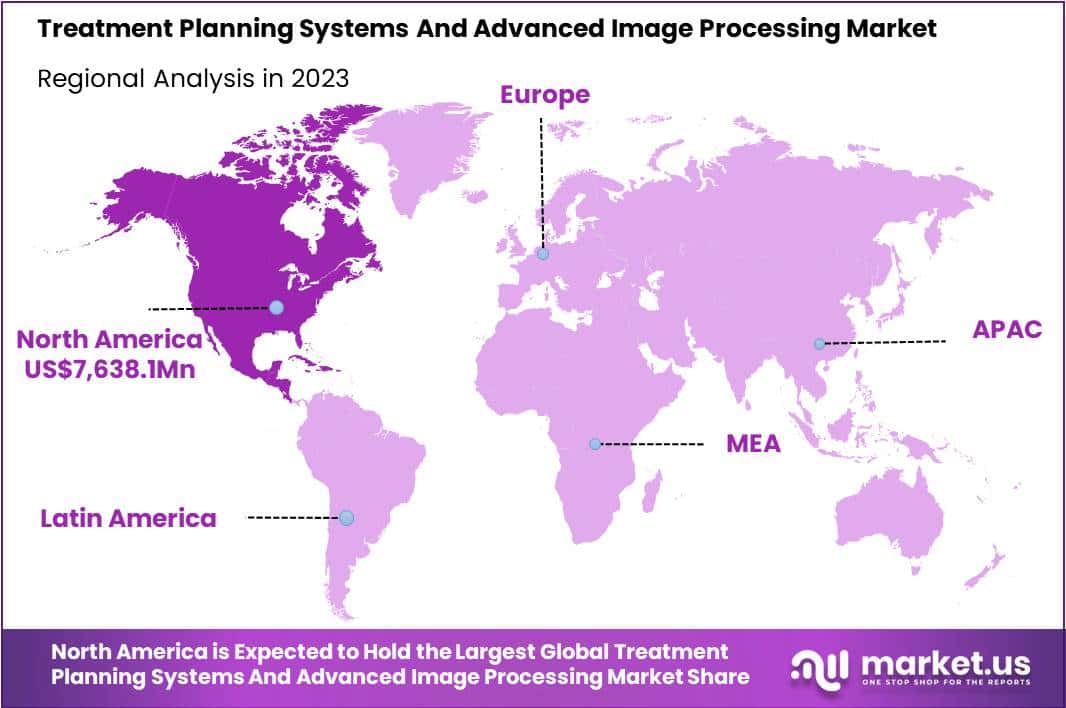

- North America led in 2023 with a 38.4% market share and USD 7638.1 million value, driven by advanced infrastructure and innovation.

Component Analysis

In 2023, the Treatment Planning Software segment held a dominant market position in the Component segment of the Treatment Planning Systems and Advanced Image Processing Market, capturing more than a 63% share. This robust performance can be attributed to the increasing demand for advanced treatment planning solutions across various medical applications, including oncology, neurology, and cardiology. Treatment planning software plays a pivotal role in enhancing treatment precision and efficacy by facilitating accurate dose calculations, optimizing treatment workflows, and integrating with advanced imaging modalities such as PET/CT deformable software and multi-modality software.

Furthermore, the rising prevalence of chronic diseases and the growing adoption of image-guided radiation therapy (IGRT) are driving the demand for sophisticated treatment planning solutions globally. These software systems enable healthcare providers to tailor treatment strategies to individual patient characteristics, thereby improving patient outcomes and reducing treatment-related complications.

Moreover, technological advancements in treatment planning software, such as the integration of artificial intelligence (AI) algorithms and machine learning techniques, are further bolstering market growth. These advancements empower clinicians with predictive modeling capabilities, personalized treatment recommendations, and automated treatment plan optimization, thereby streamlining clinical workflows and enhancing treatment precision.

Looking ahead, the Treatment Planning Software segment is poised for continued growth, fueled by ongoing innovations in software functionalities, increasing investments in healthcare infrastructure, and a growing emphasis on personalized medicine approaches. Additionally, collaborations between software developers and healthcare institutions to co-create tailored solutions are expected to drive market expansion, catering to the evolving needs of healthcare providers and patients alike.

Technique Analysis

In 2023, the Technique segment of the Treatment Planning Systems and Advanced Image Processing market saw the In-Room Imaging category emerging as a frontrunner, capturing a substantial market share of over 56.2%. This dominance can be attributed to several pivotal factors.

Firstly, the escalating adoption of cutting-edge imaging technologies within the healthcare sector has fueled the demand for in-room imaging solutions. These systems offer real-time imaging capabilities, empowering healthcare practitioners to make informed decisions during medical procedures.

Additionally, advancements in imaging technology, particularly in radiology and oncology, have further propelled the growth of the In-Room Imaging segment. These advancements encompass improved image resolution, refined image reconstruction techniques, and the integration of artificial intelligence algorithms for image analysis.

Moreover, substantial investments from healthcare facilities and medical institutions to upgrade their imaging infrastructure have bolstered the segment’s expansion. This investment drive stems from the increasing focus on patient-centric care and the necessity for accurate diagnostic imaging for enhanced treatment outcomes.

Looking ahead, the In-Room Imaging segment is poised for sustained growth, fueled by ongoing technological innovations and the rising demand for advanced imaging solutions across diverse medical specialties. Furthermore, the segment stands to benefit from the escalating prevalence of chronic diseases and the growing adoption of minimally invasive procedures, which necessitate high-quality imaging guidance.

Application Analysis

In 2023, the Validation of Image Registration segment emerged as a frontrunner in the Application Segment of the Treatment Planning Systems and Advanced Image Processing Market, securing over a 28.4% share. This segment’s leading position highlights its pivotal role in ensuring the accuracy and reliability of image registration within treatment planning systems.

Essentially, validation processes are crucial for confirming the alignment of diverse medical images from various modalities, ensuring precise target delineation and treatment delivery in radiation therapy settings. The prominence of this segment underscores the industry’s commitment to upholding stringent quality assurance standards for patient safety and treatment efficacy.

Moreover, the Validation of Image Registration segment’s dominance reflects the increasing demand for sophisticated treatment planning systems equipped with robust validation functionalities, particularly in oncology centers and radiology clinics globally. As technology continues to advance, with ongoing enhancements in validation algorithms and treatment planning workflows, this segment is poised for sustained growth.

Additionally, amidst the evolving healthcare landscape and the rise of precision medicine, accurate image registration remains paramount for tailoring personalized therapy strategies to individual patient needs, further driving the demand for innovative solutions in this segment.

End-User Analysis

In 2023, the Hospitals segment emerged as the frontrunner in the End-User segment of the Treatment Planning Systems and Advanced Image Processing Market, capturing over 45% of the market share. This dominance is attributed to several key factors.

Firstly, hospitals boast the necessary infrastructure to seamlessly integrate and utilize sophisticated medical technologies. Additionally, their role as comprehensive healthcare centers allows for the application of these advanced systems across various medical specialties, ensuring comprehensive patient care. Furthermore, hospitals prioritize regulatory compliance and accreditation standards, aligning with the requirements for implementing such technologies. While hospitals currently maintain their leading position, the market dynamics are poised for change.

Ambulatory Surgical Centers, Diagnostic and Treatment Centers, and other healthcare facilities are increasingly recognizing the benefits of these technologies, driving adoption beyond traditional hospital settings. Factors such as the growing emphasis on outpatient care and advancements in minimally invasive procedures are expected to fuel further demand across diverse end-user segments in the Treatment Planning Systems and Advanced Image Processing Market.

Key Market Segments

Component

- Advanced Image Processing Software

- Treatment Planning Software

- PET/CT Deformable Software

- Multi-Modality Software

- Others

Technique

- 3D Image Reconstruction

- Image Registration using Graphics Processor Unit

- In-Room Imaging

Application

- Online Monitoring

- Dose Accumulation

- Tracking

- Adaptive Radiotherapy

- Validation of Image Registration

- Other Applications

End-User

- Hospitals

- Ambulatory Surgical Centers

- Diagnostic and Treatment Centers

- Other End-Users

Drivers

Increasing Prevalence of Chronic Diseases

The escalation in the prevalence of chronic diseases globally serves as a pivotal driver for the expansion of the Treatment Planning Systems and Advanced Image Processing Market. According to the World Health Organization, chronic diseases such as cancer, cardiovascular diseases, and neurological disorders are on the rise, with noncommunicable diseases (NCDs) accounting for over 70% of global deaths annually. This surge necessitates the adoption of sophisticated diagnostic and treatment planning tools to manage these conditions effectively.

The integration of advanced image processing and treatment planning systems is critical in addressing the complexity of personalized treatment regimens. Furthermore, the incorporation of Artificial Intelligence (AI) and machine learning technologies into these systems is enhancing their precision and efficiency, thereby bolstering the demand. The market’s growth is underpinned by the imperative to deliver accurate diagnosis and tailored treatment approaches, reflecting the urgent need to combat the growing burden of chronic illnesses.

Restraints

High Cost of Advanced Imaging Equipment

The high cost associated with advanced imaging equipment and treatment planning systems emerges as a significant restraint in the market, particularly impacting its expansion in developing regions. The acquisition and maintenance of state-of-the-art imaging technologies necessitate substantial financial investment, often running into millions of dollars.

For instance, the installation of a single unit of advanced Magnetic Resonance Imaging (MRI) equipment can cost healthcare providers upwards of $1 million, not accounting for additional expenses in maintenance and staff training. The World Health Organization has highlighted the disparity in access to such technologies, noting that less than 10% of low-income countries have access to these advanced diagnostic tools, compared to over 80% in high-income areas. This financial barrier not only limits the adoption of cutting-edge imaging and treatment planning systems but also accentuates the operational challenges, requiring a cadre of highly skilled professionals for operation and interpretation, further escalating the total cost of ownership and potentially impeding market growth in these critical sectors.

Opportunities

Integration of Artificial Intelligence (AI)

The integration of Artificial Intelligence (AI) and machine learning within treatment planning systems and advanced image processing is poised to revolutionize the healthcare industry, presenting unparalleled opportunities for market expansion and enhancement of clinical outcomes.

According to recent findings from the World Health Organization, the application of AI in health technologies is forecasted to increase global health expenditure efficiency by 10-15% over the next decade, underscoring the substantial economic and clinical value AI brings to healthcare. Specifically, AI’s capability to significantly improve the efficiency and accuracy of disease diagnosis, prognosis predictions, and the personalization of patient care plans stands at the forefront of this technological evolution. With AI-driven systems, healthcare providers can achieve a higher degree of precision in treatment planning, thereby reducing operational costs and improving patient outcomes.

As AI technologies continue to advance, their application in treatment planning systems is anticipated to broaden, opening new avenues for growth and innovation in the market. This expansion is supported by a growing body of research and investment in AI, indicating a promising trajectory for the integration of AI in enhancing healthcare delivery and treatment planning methodologies.

Trends

Telemedicine and Remote Treatment Planning

The global treatment planning systems and advanced image processing market is undergoing a remarkable shift, with the adoption of telemedicine and remote treatment planning gaining unprecedented momentum, especially in the wake of the COVID-19 pandemic. This period has seen a substantial pivot towards telehealth platforms by healthcare providers, a move that significantly underscores the value of cloud-based treatment planning systems. These systems are pivotal in enabling remote access and analysis of medical images, thereby ensuring timely and efficacious patient care.

A pivotal study by McKinsey & Company highlights that the adoption of telehealth has experienced a 38-fold increase from the pre-pandemic baseline, underscoring a profound shift towards digital healthcare solutions. This surge in telemedicine utilization is concurrently catalyzing the demand for sophisticated image processing and treatment planning systems. The market is expected to witness robust growth as healthcare entities globally continue to embrace and expand their remote care capabilities. This evolution not only promises to elevate patient care standards but also to redefine healthcare delivery models in the evolving post-pandemic landscape.

Regional Analysis

In 2023, North America held a dominant market position in the Treatment Planning Systems and Advanced Image Processing market, capturing more than a 38.4% share and boasting a market value of USD 7638.1 million for the year. This robust performance can be attributed to several factors, including the region’s advanced healthcare infrastructure, substantial investment in research and development activities, and the presence of key market players driving innovation and adoption of advanced technologies.

The United States, in particular, emerged as a frontrunner in the region, accounting for a significant portion of the market share. Factors such as increasing prevalence of chronic diseases, rising demand for personalized treatment options, and favorable reimbursement policies have fueled the adoption of treatment planning systems and advanced image processing solutions across various healthcare facilities in the country.

Furthermore, the growing emphasis on precision medicine and the integration of artificial intelligence (AI) and machine learning (ML) algorithms into treatment planning processes have contributed to the expansion of the market in North America. These technologies enable healthcare providers to analyze vast amounts of medical data efficiently, optimize treatment strategies, and improve patient outcomes.

In addition to the United States, Canada also played a pivotal role in driving market growth in North America. The country’s strong focus on healthcare innovation, coupled with initiatives aimed at enhancing patient care and safety, has created a conducive environment for the adoption of advanced treatment planning systems and image processing solutions.

Looking ahead, North America is poised to maintain its leading position in the Treatment Planning Systems and Advanced Image Processing market, supported by ongoing technological advancements, strategic collaborations between industry players and healthcare institutions, and increasing investments in healthcare IT infrastructure. However, it is essential for market stakeholders to remain vigilant of regulatory changes, evolving healthcare policies, and competitive dynamics to sustain growth and capitalize on emerging opportunities in the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the rapidly evolving market of treatment planning systems and advanced image processing, several key players are at the forefront, driving innovation and shaping the future of healthcare technology. Elekta AB, a leader in precision radiation therapy, is highly regarded for its advanced solutions that enable targeted cancer treatment with minimal side effects, reflecting its strong commitment to research and development.

Koninklijke Philips NV leverages its vast healthcare technology expertise to deliver superior image quality in patient care, integrating AI and machine learning to enhance treatment planning accuracy. MIM Software specializes in versatile and user-friendly software solutions, focusing on improving treatment planning and patient management in medical imaging and radiation therapy.

RaySearch Laboratories, known for its cutting-edge RayStation treatment planning system, emphasizes flexibility across various treatment modalities, underscoring its dedication to innovation through research partnerships. Additionally, other key players contribute to the industry’s dynamism with their unique technological solutions and strategic collaborations, highlighting the competitive and innovative nature of this specialized healthcare sector.

Market Key Players

- Elekta AB

- Koninklijke Philips NV

- MIM Software

- RaySearch Laboratories

- Brainlab

- Varian Medical Systems

- Accuray Incorporated

- ViewRay Inc.

- DOSIsoft SA

- Prowess Inc

Recent Developments

- In January 2024, ViewRay Inc. achieved a milestone with the FDA 510(k) clearance for its MRIdian Linac system, accompanied by the latest iteration of its treatment planning software. This clearance paves the way for the incorporation of real-time tumor tracking capabilities within radiotherapy procedures, signifying a leap forward in the delivery of personalized and adaptive radiotherapy solutions.

- In October 2023, Elekta AB expanded its portfolio through the acquisition of MONY, a firm specializing in cloud-based treatment planning for proton therapy, at a purchase price of €225 million. This strategic move is aimed at bolstering Elekta’s foothold in the realm of advanced radiotherapy technologies.

- In August 2023, A separate development, Koninklijke Philips NV introduced the IntelliSpace Discovery 7.0 platform. This platform marks a significant advancement in the fields of image processing and visualization tools tailored for the optimization of radiotherapy planning and execution. It is designed to enhance workflow efficiency and support clinical decision-making processes.

- In March 2023, RaySearch Laboratories embarking on a strategic alliance with Siemens Health, focusing on the integration of RaySearch’s RayStation treatment planning system with Siemens’ advanced digital imaging solutions. This partnership is poised to streamline operational workflows and elevate the precision of treatment planning.

Report Scope

Report Features Description Market Value (2023) USD 1989.1 Mn Forecast Revenue (2033) USD 4539 Mn CAGR (2024-2033) 8.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component [Advanced Image Processing Software, Treatment Planning Software (PET/CT Deformable Software, Multi-Modality Software, Others)], By Technique (3D Image Reconstruction, Image Registration using Graphics Processor Unit, In-Room Imaging), By Application (Online Monitoring, Dose Accumulation, Tracking, Adaptive Radiotherapy, Validation of Image Registration, Other Applications), By End-User (Hospitals, Ambulatory Surgical Centers, Diagnostic and Treatment Centers, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Elekta AB, Koninklijke Philips NV, MIM Software, RaySearch Laboratories, Brainlab, Varian Medical Systems, Accuray Incorporated, ViewRay Inc., DOSIsoft SA, Prowess Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Treatment Planning Systems And Advanced Image Processing market in 2023?The Treatment Planning Systems And Advanced Image Processing market size is USD 1989.1 million in 2023.

What is the projected CAGR at which the Treatment Planning Systems And Advanced Image Processing market is expected to grow at?The Treatment Planning Systems And Advanced Image Processing market is expected to grow at a CAGR of 8.6% (2024-2033).

List the segments encompassed in this report on the Treatment Planning Systems And Advanced Image Processing market?Market.US has segmented the Treatment Planning Systems And Advanced Image Processing market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Component the market has been segmented into Advanced Image Processing Software, Treatment Planning Software (PET/CT Deformable Software, Multi-Modality Software, Others). By Technique the market has been segmented into 3D Image Reconstruction, Image Registration using Graphics Processor Unit, In-Room Imaging. By Application the market has been segmented into Online Monitoring, Dose Accumulation, Tracking, Adaptive Radiotherapy, Validation of Image Registration, Other Applications. By End-User the market has been segmented into Hospitals, Ambulatory Surgical Centers, Diagnostic and Treatment Centers, Other End-Users.

List the key industry players of the Treatment Planning Systems And Advanced Image Processing market?Elekta AB, Koninklijke Philips NV, MIM Software, RaySearch Laboratories, Brainlab, Varian Medical Systems, Accuray Incorporated, ViewRay Inc., DOSIsoft SA, Prowess Inc

Which region is more appealing for vendors employed in the Treatment Planning Systems And Advanced Image Processing market?North America is expected to account for the highest revenue share of 38.4% and boasting an impressive market value of USD 7638.1 million. Therefore, the Treatment Planning Systems And Advanced Image Processing industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Treatment Planning Systems And Advanced Image Processing?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Treatment Planning Systems And Advanced Image Processing Market.

Treatment Planning Systems And Advanced Image Processing MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Treatment Planning Systems And Advanced Image Processing MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Elekta AB

- Koninklijke Philips NV

- MIM Software

- RaySearch Laboratories

- Brainlab

- Varian Medical Systems

- Accuray Incorporated

- ViewRay Inc.

- DOSIsoft SA

- Prowess Inc