Global Transport Protein Assays Kits Market By Product Type (Kits, Reagents, and Consumables), By Application (Drug Delivery & Development, Disease Diagnosis, Phagocytosis, and Others), By End-user (Pharmaceutical Companies, Biotechnological Companies, Hospitals, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2024

- Report ID: 168744

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

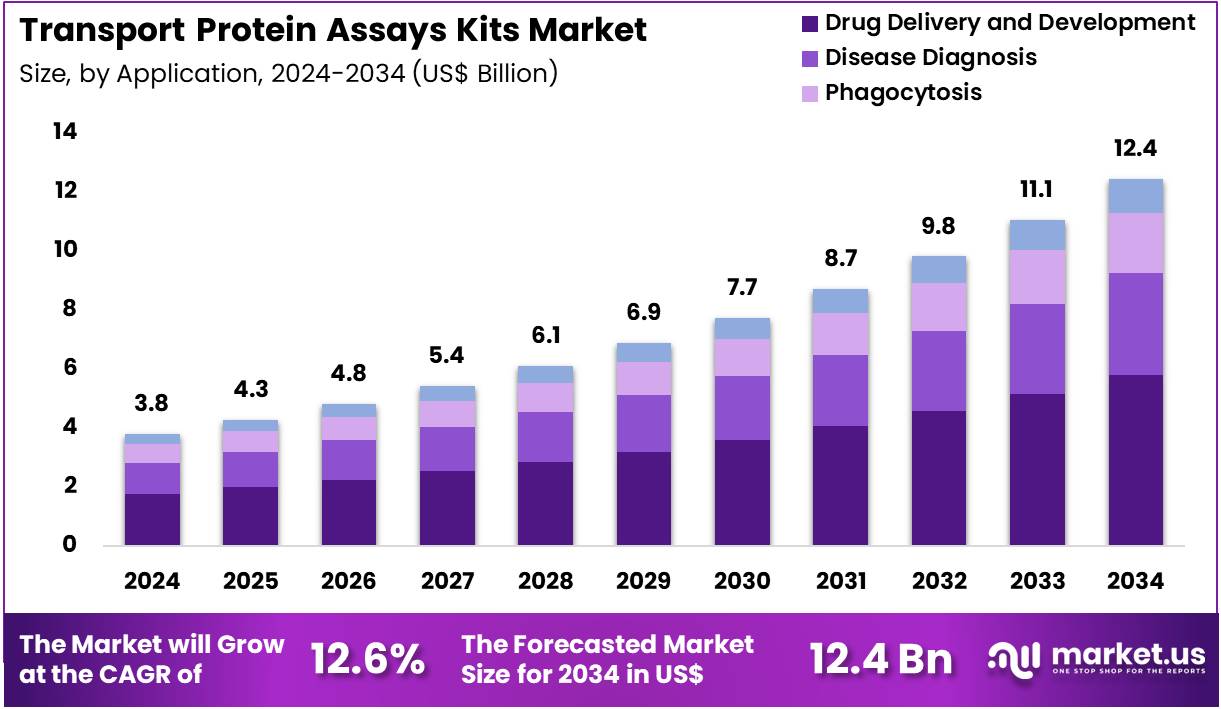

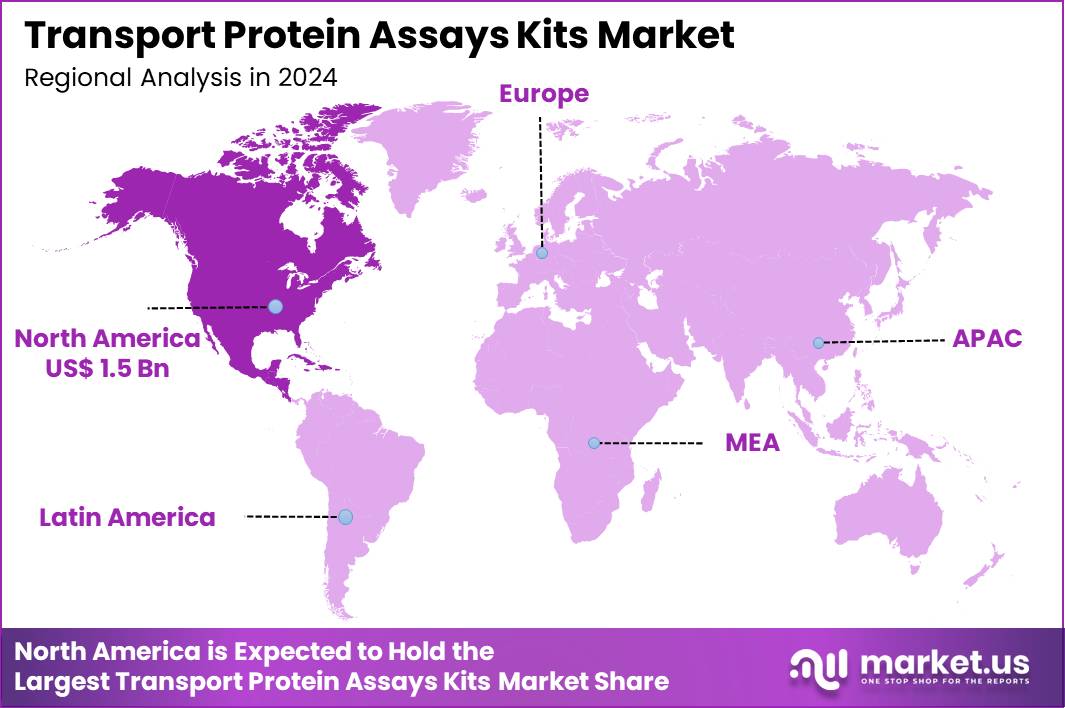

Globa Transport Protein Assays Kits Market size is expected to be worth around US$ 12.4 Billion by 2034 from US$ 3.8 Billion in 2024, growing at a CAGR of 12.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.1% share with a revenue of US$ 1.5 Billion.

Increasing demand for accurate drug-transporter interaction data propels the Transport Protein Assays Kits market, as pharmaceutical developers prioritize early assessment of absorption, distribution, and efflux liabilities to reduce late-stage attrition. Biotechnology firms engineer cell-based and membrane vesicle kits that quantify substrate uptake or inhibition across major solute carrier (SLC) and ABC transporter families.

These assays enable regulatory submission support for P-gp and BCRP interaction studies, hepatobiliary clearance prediction via OATP1B1/1B3 profiling, renal secretion evaluation through OCT2 and MATE1/2K testing, and blood-brain barrier penetration forecasting with BCRP and P-gp co-expression models.

Researchers increasingly favor mass-spectrometry-based transport assays over traditional radioactive or fluorescent methods for superior specificity and multiplexing capability in SLC transporter evaluations. This methodological shift directly heightens demand for specialized kits optimized for LC-MS endpoints and enhances quantitative precision in preclinical pharmacokinetics. Pharmaceutical sponsors seize opportunities to streamline candidate selection with robust, non-radioactive transporter data.

Growing emphasis on rare genetic transporter disorders accelerates the Transport Protein Assays Kits market, as clinical laboratories adopt functional assays to confirm pathogenic variants identified through genomic sequencing. Diagnostic developers supply ready-to-use kits featuring recombinant transporter-overexpressing cell lines and validated probe substrates.

Applications encompass Hartnup disorder diagnosis via SLC6A19 neutral amino acid transport measurement, cystinuria confirmation through SLC3A1/SLC7A9 heterodimer activity, carnitine deficiency screening with OCTN2 uptake kinetics, and glucose-galactose malabsorption verification using SGLT1-mediated transport. Functional validation kits open avenues for personalized therapeutic monitoring and novel orphan drug development targeting transporter rescue. Reference laboratories increasingly integrate these assays into diagnostic algorithms for inherited metabolic diseases.

Rising integration of high-throughput screening platforms invigorates the Transport Protein Assays Kits market, as discovery teams evaluate large compound libraries against multiple transporters simultaneously to flag potential drug-drug interaction risks early. Manufacturers launch 384-well plate formats with fluorescent or luminescent readouts compatible with automated liquid handling systems.

These scalable kits support lead optimization for OAT1/OAT3 renal toxicity prediction, biliary efflux assessment via MRP2 and BSEP inhibition studies, CNS exposure modeling through P-gp and BCRP bidirectional assays, and intestinal absorption forecasting with PEPT1 peptide transporter profiling.

Automation-compatible designs create opportunities for AI-driven structure-activity relationship modeling and virtual screening validation. Pharmaceutical companies actively expand transporter screening cascades to meet evolving regulatory expectations for comprehensive interaction profiling. This systematic approach establishes transport protein assays as critical gatekeepers in modern drug discovery pipelines.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.8 Billion, with a CAGR of 12.6%, and is expected to reach US$ 12.4 Billion by the year 2034.

- The product type segment is divided into kits, reagents, and consumables, with kits taking the lead in 2024 with a market share of 49.2%.

- Considering application, the market is divided into drug delivery & development, disease diagnosis, phagocytosis, and others. Among these, drug delivery & development held a significant share of 46.5%.

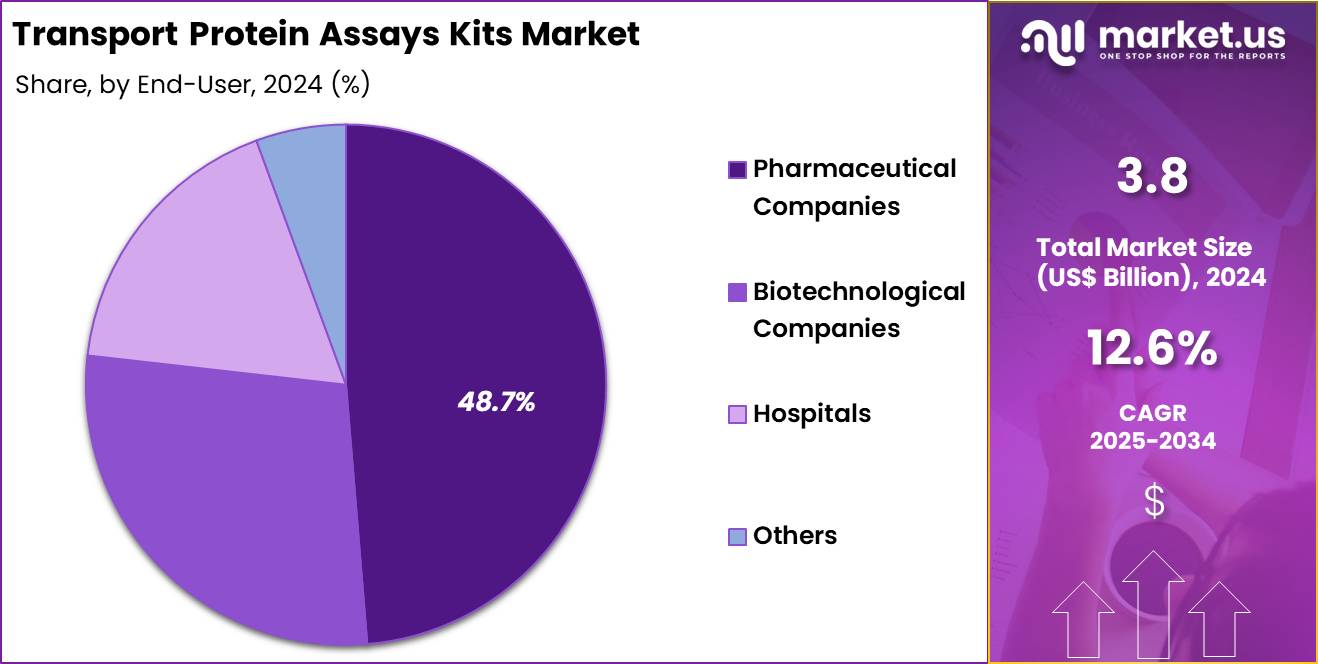

- Furthermore, concerning the end-user segment, the market is segregated into pharmaceutical companies, biotechnological companies, hospitals, and others. The pharmaceutical companies sector stands out as the dominant player, holding the largest revenue share of 48.7% in the market.

- North America led the market by securing a market share of 40.1% in 2024.

Product Type Analysis

Kits, holding 49.2%, are expected to dominate as researchers increasingly rely on standardized, ready-to-use assay formats for studying transporter activity, uptake efficiency, and efflux mechanisms. Manufacturers introduce kits optimized for ABC and SLC transporters, improving sensitivity and ease of use. Drug-development teams choose kits to generate reproducible results that support regulatory submissions.

High-throughput screening platforms integrate transport-protein kits to accelerate data generation across multiple compounds. Academic labs adopt multifunctional kits to simplify complex transport assays. Rising interest in intracellular transport mechanisms strengthens routine kit usage. Automation compatibility enhances workflow efficiency in large labs. Transport-inhibition studies also expand demand for validated kits. These drivers keep kits anticipated to remain the leading product type.

Application Analysis

Drug delivery and development, holding 46.5%, are anticipated to dominate application usage because transport proteins play a critical role in absorption, distribution, and cellular uptake of therapeutic molecules. Pharmaceutical companies depend on transporter assays to predict drug–drug interactions, optimize formulation design, and evaluate intracellular distribution. Growing focus on targeted therapies increases the need to study transport channels associated with tumour cells and metabolic tissues.

Preclinical studies rely on transport assays to assess compound permeability and efflux behavior. Biotech teams use these assays to design nanoparticle-based and ligand-directed delivery systems. Regulatory expectations for transporter interaction data strengthen adoption. High-throughput drug-screening programs rely on transport assays to rank candidate molecules. Increased interest in RNA, peptide, and biologic delivery expands testing frequency. These factors keep drug delivery and development projected to remain the most influential application segment.

End-User Analysis

Pharmaceutical companies, holding 48.7%, are expected to dominate due to their extensive use of transporter assays across discovery, preclinical, and clinical-development pipelines. Large drug developers require detailed transporter interaction profiles to reduce toxicity risks and improve therapeutic performance. Transport assays support modelling of absorption and tissue distribution, strengthening drug-optimization workflows.

Companies integrate high-throughput transporter platforms to accelerate screening of chemical libraries. Expansion of oncology, neurology, and metabolic drug pipelines increases the number of studies involving transporter biology. Compliance with international guidelines drives deeper evaluation of transporter-mediated drug interactions.

Partnerships with CROs further expand assay usage across outsourced programs. Adoption of advanced cell-based systems improves mechanistic insight and assay accuracy. These drivers keep pharmaceutical companies anticipated to remain the dominant end-user segment in the transport protein assays kits market.

Key Market Segments

By Product Type

- Kits

- Reagents

- Consumables

By Application

- Drug delivery & development

- Disease diagnosis

- Phagocytosis

- Others

By End-user

- Pharmaceutical companies

- Biotechnological companies

- Hospitals

- Others

Drivers

Increasing NIH Funding for Transport Protein Research is Driving the Market

The augmentation of National Institutes of Health funding for transport protein research has established a key driver for the transport protein assays kits market, as these grants support the development of assays for studying protein function in drug discovery and disease mechanisms. This financial influx enables investigators to procure advanced kits for quantifying transporter activity in cellular models, accelerating insights into pharmacokinetics.

Research institutions are leveraging these funds to validate assay kits for high-throughput screening of transporter inhibition. Regulatory agencies align with funded projects by prioritizing assays that inform safety assessments in clinical trials. Collaborative grants foster partnerships between academia and industry, enhancing kit customization for specific transporter families like ABC and SLC.

The economic model justifies the investment, as improved assays reduce failure rates in drug development pipelines. Professional societies endorse funded protocols, embedding transport protein kits in standard experimental designs. This driver stimulates innovation in fluorescent and luminescent formats, improving sensitivity for low-expression transporters.

Educational components of grants train researchers in assay optimization, promoting widespread adoption. Ultimately, the trajectory of funding ensures sustained demand for reliable, reproducible kits. In 2023, the National Institutes of Health awarded $1.92 million to study how the key protein transport mechanism XPO1 goes awry in cancer.

Restraints

Challenges in Predicting In Vivo Drug-Transporter Interactions is Restraining the Market

The persistent challenges in accurately predicting in vivo drug-transporter interactions represent a major restraint for the transport protein assays kits market, as discrepancies between in vitro results and physiological conditions limit kit reliability. These assays often overestimate transporter affinity due to artificial cellular environments, leading to misleading pharmacokinetic data. This limitation discourages pharmaceutical companies from relying solely on kit-based screening, favoring more complex animal models.

Regulatory demands for bridging studies add layers of validation, prolonging development timelines for kit enhancements. Manufacturers face difficulties in replicating tissue-specific transporter expression, constraining kit applicability across organ systems. The restraint exacerbates R&D costs, as iterative testing is required to correlate assay outputs with clinical outcomes. Laboratories in early-stage discovery phases experience workflow bottlenecks from inconsistent kit performance.

Policy recommendations for standardized in vivo correlation metrics remain underdeveloped, hindering guideline adoption. These issues collectively temper market confidence, slowing innovation in next-generation kits. Mitigation through hybrid models combining kits with computational simulations is emerging but requires further evidence.

Opportunities

Acquisitions in Proteomics Technologies is Creating Growth Opportunities

Strategic acquisitions in proteomics technologies are generating considerable growth opportunities for the transport protein assays kits market, as these deals integrate advanced platforms for transporter profiling in drug metabolism studies. Such consolidations enable kit developers to access proprietary reagents, enhancing assay specificity for membrane-bound transporters.

Opportunities arise in bundling kits with mass spectrometry tools, offering comprehensive solutions for ADME investigations. Regulatory approvals for acquired technologies expedite market entry, linking kits to accelerated drug development pathways. Partnerships post-acquisition facilitate cross-validation, supporting global tenders for research consortia. This landscape diversifies revenue through expanded portfolios, including kits for rare transporter variants.

Economic synergies from scale reduce production costs, improving competitiveness in academic markets. Emerging applications in personalized pharmacogenomics broaden utility, tailoring kits to genetic polymorphisms. These developments position the market for collaborations with biotech startups, fostering custom assay designs. Sustained integration will drive adoption in preclinical screening pipelines. In 2024, Thermo Fisher Scientific acquired Olink, a provider of next-generation proteomics solutions, for $3.1 billion to advance protein biomarker discovery including transport proteins.

Impact of Macroeconomic / Geopolitical Factors

Economic turbulence and rising operational expenses strain biotech firms’ investments in transport protein assays kits, leading developers to postpone expansions in volatile markets. Thriving precision drug discovery efforts and demographic-driven research funding, however, motivate companies to accelerate kit deployments for membrane protein studies, bolstering innovation in high-growth segments.

Geopolitical conflicts in Asia and Europe fracture critical reagent supply lines from affected regions, prolonging delivery schedules and amplifying procurement fees for global manufacturers. These conflicts, nonetheless, push industry leaders toward diversified partnerships in stable areas, enhancing chain redundancy and speeding up localized production.

Current U.S. tariffs, imposing 10% to over 100% levies on Chinese-sourced diagnostic kits under expanded 2025 measures, escalate costs for American importers and disrupt competitive pricing in research tenders. Suppliers respond strategically by relocating assembly to USMCA nations and pursuing exemption filings, which secures supply stability and trims long-term overheads.

In sum, these elements compel tighter controls yet unlock avenues for operational resilience. The transport protein assays kits market advances with firm resolve, converting such trials into catalysts for more agile, cost-effective solutions that drive breakthroughs in cellular transport research.

Latest Trends

Expansion of UK Biobank Pharma Proteomics Project is a Recent Trend

The scaling of large-scale proteomics projects has crystallized as a defining trend in the transport protein assays kits market during 2024, emphasizing high-throughput analysis of transporter expression in population cohorts. This initiative utilizes assay kits to profile thousands of proteins across vast sample sets, revealing transporter roles in disease susceptibility. The trend prioritizes compatibility with automated liquid handlers, enabling efficient processing of biobank specimens.

Developers are adapting kits for plasma and tissue matrices, aligning with project-specific throughput demands. Regulatory oversight ensures data quality, validating kits for longitudinal studies. This evolution intersects with AI for pattern recognition in transporter dysregulation. Competitive responses include reagent optimizations for minimal sample volumes, supporting retrospective analyses.

Broader implications encompass therapeutic target identification, adapting kits for functional validation. The trend fosters international data-sharing consortia, harmonizing assay protocols globally. Ethical frameworks address privacy in proteomic datasets from diverse populations. Thermo Fisher Scientific’s Olink technology supports the UK Biobank Pharma Proteomics Project, analyzing more than 5,400 proteins from 600,000 samples to discover biomarkers including transport proteins.

Regional Analysis

North America is leading the Transport Protein Assays Kits Market

North America accounted for 40.1% of the overall market in 2024, and the region experienced strong growth as pharmaceutical and biotechnology companies expanded transporter-protein research to support drug-discovery and safety-assessment programs. Laboratories increased use of efflux and uptake transporter assay kits to evaluate drug–drug interactions and optimize candidate selection.

Growth accelerated as regulatory agencies emphasized transporter data for IND submissions, prompting wider adoption of standardized assay platforms. Academic institutes strengthened membrane-protein research linked to neurological and metabolic disorders, boosting demand for high-sensitivity reagents.

The U.S. FDA reported 55 novel drug approvals in 2023 (FDA – “New Drug Therapy Approvals 2023”), and this elevated development activity increased requirements for transporter-interaction studies. Research organizations upgraded automated systems to enhance throughput, while CROs expanded assay service capacity. These synchronized advancements supported substantial regional market expansion in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to record steady growth during the forecast period as research centers expand small-molecule screening, transporter-mechanism studies, and ADME profiling across rapidly developing pharmaceutical hubs. Universities strengthen cell-based transporter research to understand drug absorption and distribution patterns in chronic-disease models.

Regional biotech firms increase investment in early-stage discovery, driving demand for validated membrane-transport assay kits. Hospitals expand translational research partnerships to evaluate drug-response variability linked to transporter expression. Government innovation programs increase funding for molecular-biology infrastructure, accelerating adoption across academic and industrial laboratories.

The Japan Pharmaceuticals and Medical Devices Agency (PMDA) approved 52 new drugs in 2023 (PMDA – “Review Reports and Approvals 2023”), indicating sustained therapeutic-development activity that depends on transporter-protein evaluation. Manufacturers enhance distribution across India, China, and South Korea, improving access to specialized assay reagents. These developments collectively position Asia Pacific for strong forward-looking growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the transport-protein assay kits sector pursue growth by expanding assay menus to target a broad array of carrier and channel proteins, thus attracting research labs working on pharmacokinetics, metabolic disorders and drug-transporter studies. They upgrade their assay platforms to deliver high sensitivity and reproducibility, while optimizing reagent formulations to streamline workflows and reduce assay time for high-throughput screening.

They increase global penetration by establishing distribution partnerships in emerging markets and tailoring kits to meet local regulatory and laboratory requirements. They reinforce credibility by collaborating with academic institutions and contract research organisations to validate assay performance and publish peer-reviewed data. They accelerate innovation cycles by acquiring or licensing niche biotechnology firms with complementary assay technologies, allowing rapid integration of novel targets.

One of the leading companies in this space, Thermo Fisher Scientific, leverages its extensive life-sciences portfolio, global supply chain and robust R&D infrastructure to deliver comprehensive transport-protein assay solutions and support growth through consistent quality, broad accessibility and strong brand trust.

Top Key Players

- Thermo Fisher Scientific Inc.

- Merck KGaA

- PerkinElmer Inc.

- Abcam plc

- Bio-Rad Laboratories, Inc.

- BioVision Inc.

- Novus Biologicals Inc.

- Solvo Biotechnology

Recent Developments

- In August 2024, Thermo Fisher Scientific introduced the TransporterSelect™ Ultra assay kit line. These kits use multiplex fluorometric detection within a microfluidic setup to help laboratories speed up transporter-protein screening and improve workflow efficiency.

- In January 2024, Bio-Vision, Inc. formed a partnership with Solvo Biotechnology to jointly create high-throughput transport-protein assay kits. The collaboration is focused on developing tools that support rapid, early-stage drug-discovery studies.

Report Scope

Report Features Description Market Value (2024) US$ 3.8 Billion Forecast Revenue (2034) US$ 12.4 Billion CAGR (2025-2034) 12.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Kits, Reagents, and Consumables), By Application (Drug Delivery & Development, Disease Diagnosis, Phagocytosis, and Others), By End-user (Pharmaceutical Companies, Biotechnological Companies, Hospitals, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Merck KGaA, PerkinElmer Inc., Abcam plc, Bio-Rad Laboratories, Inc., BioVision Inc., Novus Biologicals Inc., Solvo Biotechnology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Transport Protein Assays Kits MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Transport Protein Assays Kits MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- Merck KGaA

- PerkinElmer Inc.

- Abcam plc

- Bio-Rad Laboratories, Inc.

- BioVision Inc.

- Novus Biologicals Inc.

- Solvo Biotechnology