Global Transportation Management System Market By Deployment mode (On-Premise and Cloud Based), By Mode of Transportation (Roadways, Railways, Waterways and Airways), By End-User (Retail and E-commerce, Manufacturing, Logistics, Government Organizations, Other End-Use), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 27722

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

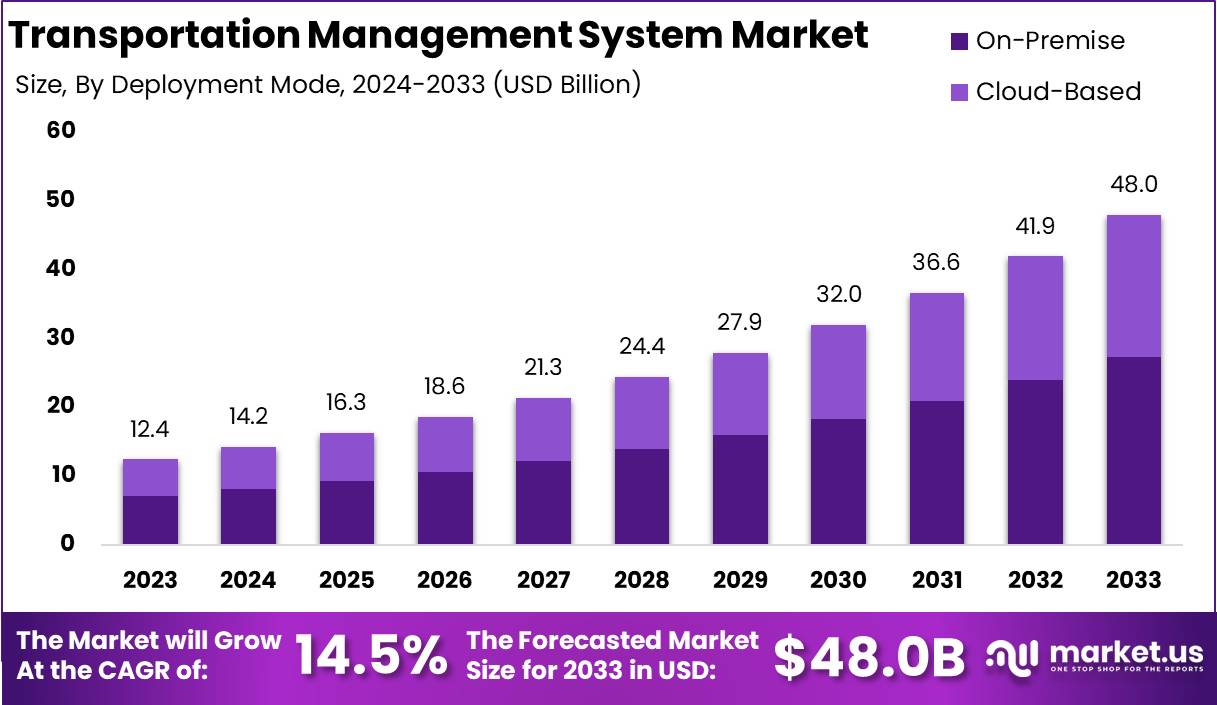

The Global Transportation Management System Market size is expected to be worth around USD 48.0 Billion by 2033, From USD 12.4 Billion by 2023, growing at a CAGR of 14.5% during the forecast period from 2024 to 2033.

A Transportation Management System (TMS) is a sophisticated software platform designed to optimize the planning, execution, and monitoring of transportation-related activities within supply chain operations. TMS solutions enable businesses to streamline freight management, route optimization, carrier selection, shipment tracking, and cost management across diverse transportation modes, such as road, rail, air, and sea.

By centralizing these processes, a TMS empowers organizations to achieve greater operational efficiency, reduce costs, enhance visibility, and improve customer service levels. It also integrates seamlessly with other supply chain technologies like Warehouse Management Systems (WMS) and Enterprise Resource Planning (ERP) solutions, creating a holistic view of logistics operations.

The Transportation Management System Market refers to the ecosystem of software providers, service vendors, and related stakeholders delivering solutions that support transportation and logistics optimization across industries. This market is driven by businesses aiming to enhance supply chain agility and operational efficiency while navigating complexities such as growing e-commerce demands, globalization, and rising freight costs.

The market encompasses solutions tailored for various industries, including retail, manufacturing, healthcare, and logistics service providers. It also spans diverse deployment models such as cloud-based and on-premise platforms, catering to the unique operational needs of organizations, from small enterprises to global corporations.

The growth of the Transportation Management System market is propelled by several interconnected factors. Increasing globalization and the rise of complex supply chain networks have created a pressing need for more efficient transportation management. Similarly, the expansion of e-commerce, characterized by faster delivery expectations and high order volumes, is driving businesses to invest in advanced TMS solutions to remain competitive.

The demand for Transportation Management Systems continues to escalate as businesses face mounting pressure to improve supply chain efficiency and cost-effectiveness. Organizations are increasingly prioritizing real-time visibility, route optimization, and seamless coordination between multiple stakeholders in their logistics operations.

The Transportation Management System market offers significant opportunities for growth and innovation. The integration of emerging technologies, such as the Internet of Things (IoT), blockchain, and 5G connectivity, holds immense potential to revolutionize how businesses manage transportation and logistics.

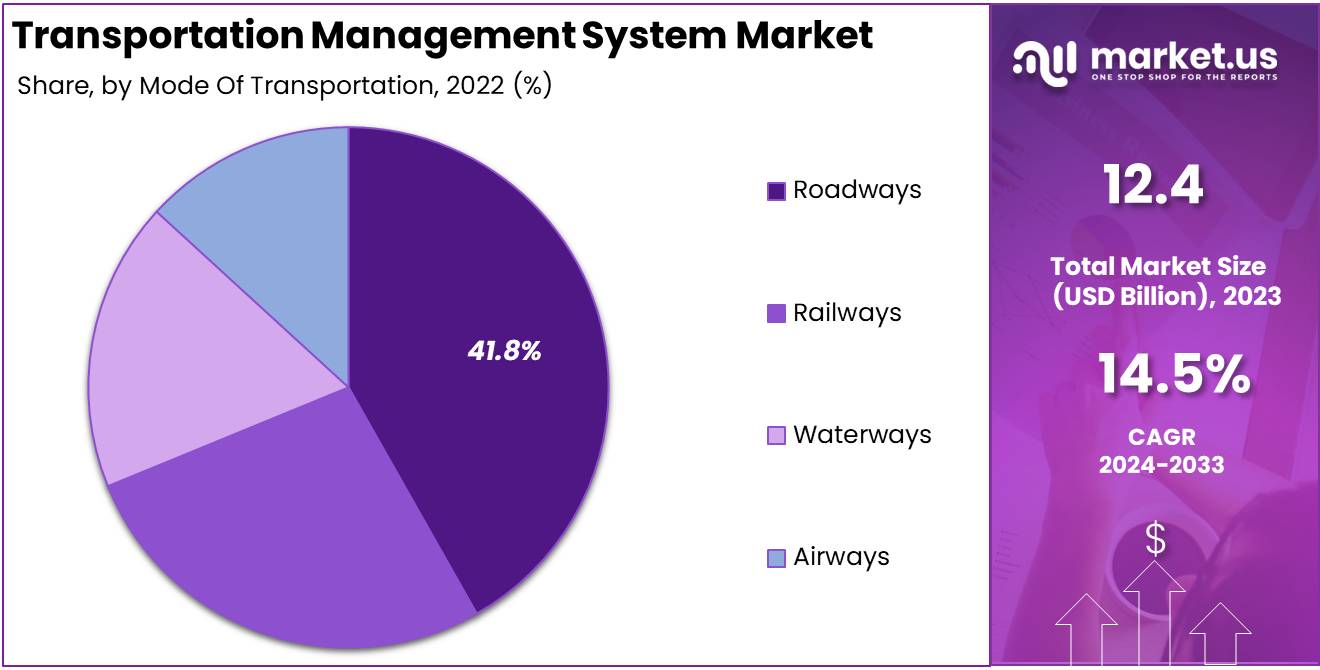

According to LLCBuddy, Transportation Management Systems (TMS) are reshaping global logistics, with roadways contributing over 40% of total TMS revenue. Maritime transportation, however, is anticipated to grow significantly as trade volumes increase. TMS solutions are expected to account for more than 65% of market revenue, largely fueled by their adoption in emerging economies.

Cloud-based TMS solutions dominate the market, holding over 60% of the total share due to their scalability and real-time capabilities. By 2032, manufacturing and transportation & logistics are projected to contribute over 50% of the market’s revenue. Additionally, the Asia Pacific region is poised to grow at nearly 12% annually, establishing itself as the fastest-growing market for TMS solutions globally. These developments signal a transformative shift across industries as companies increasingly rely on advanced TMS to streamline operations and drive efficiency.

Key Takeaways

- The Global Transportation Management System Market will expand from USD 12.4 billion in 2023 to USD 48.0 billion by 2033, at a CAGR of 14.5%.

- The on-premise segment led with 57.2% in 2022, driven by high demand for secure and customizable solutions.

- Roadways accounted for 41.8% of the market in 2022 as the most widely used mode of freight transport globally.

- The manufacturing sector captured 36.4% of the market in 2022 due to its dependence on streamlined logistics.

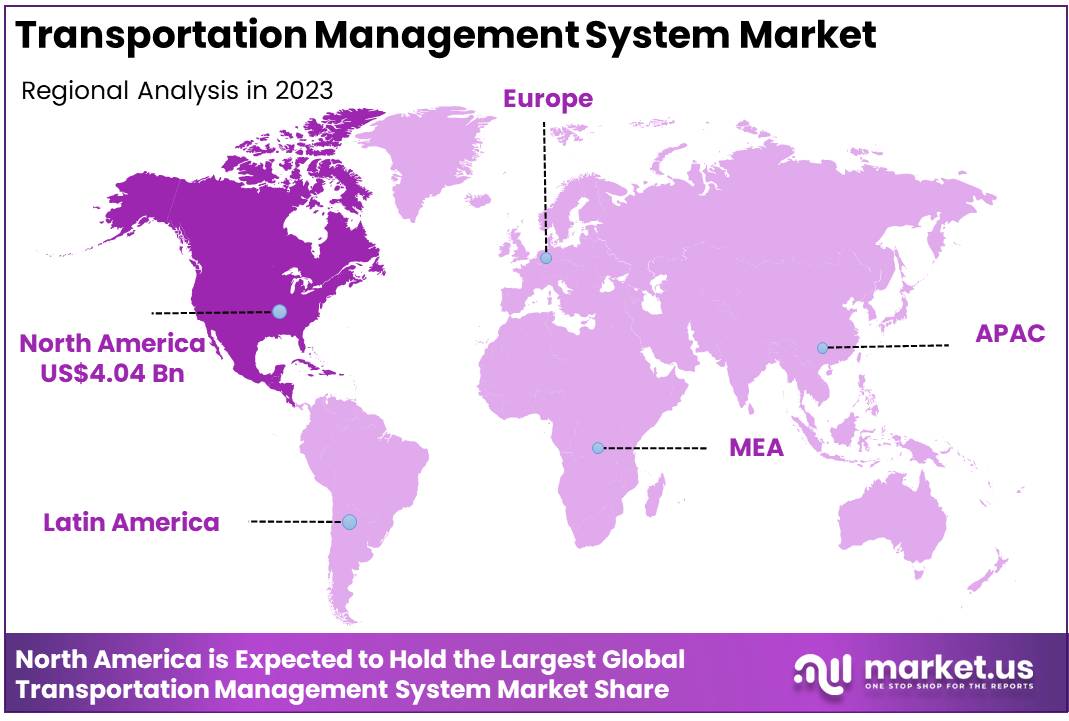

- North America dominated with a 32.6% share in 2023, driven by strong freight infrastructure and road networks.

By Deployment Mode Analysis

The On-Premise Segment Drives The Market Growth Globally.

In 2022, the on-premise segment made up more than 57.2%. Many large distribution and manufacturing companies still prefer to use on-premise TMS due to its data safety requirements, easy access to the server, and greater control over customization. As cloud-based TMS becomes more popular, incumbents in various industries will likely choose cloud-based TMS. Over the forecast period, the cloud segment will show the highest growth rate.

The cloud-based TMS provides shippers, logistics providers, and vendors with unique planning and optimization advantages. Cloud-based TMS is becoming more popular as companies continue to increase their data volumes. This is due to its superior configuration capabilities and efficiency.

Cloud-based TMS is more cost-effective than on-premise TMS due to its lower licensing and management fees. As the information is stored on the cloud that can be easily accessible from anywhere is the significant advantage of the cloud-based TMS. The segment growth is expected to be driven by such benefits.

By Mode Of Transportation Analysis

The Roadways Segment Dominates The Market Growth Globally

In 2022, the roadways segment made up more than 41.8%. Road freight is one of the most popular modes of transport worldwide. Because it is flexible and cost-effective, it can be loaded and unloaded at any location. Due to the increased dependence of consumers on e-commerce during COVID-19, companies had to increase their delivery options for the roadway segment.

Many governments are simultaneously pursuing initiatives to improve transportation infrastructure. This is expected to increase the demand for logistics via roadways and, consequently, the growth in the roadways segment.

Over the forecast period, the fastest-growing segment will be the waterways segment. This growth can be attributed in large part to the substantial investments made by different governments in TMS for the efficient management and maintenance of waterways.

By End-User Vertical Analysis

The Manufacturing Sector Holds The Largest Market Share Globally.

In 2022, the manufacturing sector held the largest share, with over 36.4%. The necessity for outsourcing inventory and raw materials has increased as a result of the rising number of manufacturing units in emerging economies like India and Mexico.

For instance, the Make in India initiative launched by the Indian government places a significant emphasis on the growth of the domestic manufacturing sector and may even encourage indigenous manufacturing. Over the course of the forecast period, such initiatives bode well for the expansion of the manufacturing sector.

Over the forecast period, the retail and e-commerce segments are expected to experience a significant increase in sales. This growth is due to unabated growth in the retail and e-commerce industries in countries like India and China. China is responsible for almost 80% of all online sales in Asia-Pacific.

However, India is poised to become the fastest-growing e-commerce marketplace by leveraging strong investments in the e-commerce sector and deeper smartphone penetration. TMS is being used by large e-commerce firms like Alibaba Group Holding Ltd., Walmart Inc., and Amazon Inc. to maintain and strengthen their shipping operations.

Key Market Segments

By Deployment Mode

- On-Premise

- Cloud-Based

By Mode Of Transportation

- Roadways

- Railways

- Waterways

- Airways

By End-User

- Retail & E-commerce

- Manufacturing

- Logistics

- Government Organizations

- Other End-Use

Driver

Digitalization and Automation

In 2024, the global Transportation Management System (TMS) market is significantly driven by the increasing adoption of digitalization and automation technologies across logistics and supply chain operations. Companies are prioritizing efficiency in the face of growing consumer demand for faster and more reliable deliveries, particularly in industries like e-commerce, retail, and manufacturing.

Advanced TMS platforms now integrate cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) to optimize route planning, fleet management, and real-time tracking. These advancements empower businesses to reduce costs, improve delivery times, and enhance customer satisfaction. For instance, AI-powered route optimization algorithms can adapt to real-time traffic and weather conditions, cutting fuel consumption by up to 15-20%.

Moreover, automation in areas such as freight audit, payment processing, and carrier selection reduces human error and accelerates decision-making. The global logistics ecosystem is becoming increasingly complex, with rising cross-border trade, fluctuating fuel prices, and stringent environmental regulations. As such, a robust and automated TMS enables businesses to navigate these complexities effectively while ensuring scalability.

In 2024, digitalization is not just a competitive edge but a necessity, particularly for companies aiming to gain visibility and control across multi-modal transportation networks. With businesses transitioning to digital-first supply chains, the penetration of advanced TMS solutions is projected to rise. This drive toward automation and data-driven decision-making is solidifying the role of TMS in modern logistics operations, propelling market growth further.

Restraint

High Implementation Costs

Despite the rapid advancements in Transportation Management Systems, high implementation and maintenance costs remain a major restraint, particularly for small and medium-sized enterprises (SMEs). These solutions, while increasingly sophisticated, often require substantial upfront investments in infrastructure, software licensing, and employee training.

Additionally, the integration of TMS platforms with existing enterprise resource planning (ERP) systems, warehouse management systems (WMS), and other operational software can present technical challenges that incur additional costs. This financial burden deters smaller companies from adopting advanced TMS solutions, leaving them reliant on manual processes or basic software tools that lack comprehensive functionality.

Moreover, the cost barrier is compounded by limited access to affordable cloud-based TMS options in certain regions. While Software-as-a-Service (SaaS) models offer more affordable entry points compared to on-premise systems, some small businesses still perceive subscription fees and the associated data migration costs as prohibitive.

For example, SMEs in emerging markets often lack the financial resources to justify the initial investment required for system adoption. This creates a gap in market penetration, as TMS providers primarily focus on catering to large-scale enterprises with greater purchasing power.

Additionally, concerns around cybersecurity risks and data privacy associated with cloud-based TMS further discourage adoption among smaller businesses. Addressing these cost-related constraints will be critical to unlocking the full potential of the TMS market, as SMEs represent a significant share of the global logistics ecosystem. Until these barriers are mitigated, the growth of TMS solutions will likely remain uneven across different business segments.

Opportunity

Growing Adoption of Cloud-Based TMS Solutions

The increasing shift toward cloud-based Transportation Management Systems presents a major growth opportunity for the market in 2024. Cloud-based TMS solutions offer unparalleled scalability, cost-efficiency, and ease of deployment, making them highly attractive for businesses aiming to modernize their logistics operations. Unlike traditional on-premise systems, cloud-based platforms require minimal hardware investments, reducing upfront costs and enabling smaller companies to adopt these technologies.

This shift aligns with the broader digital transformation trends in industries like retail, manufacturing, and third-party logistics (3PL), where cloud-based TMS platforms enable real-time data access, collaboration, and integration across multiple stakeholders.

Additionally, cloud-based TMS platforms enhance operational agility by offering regular updates and faster implementation timelines. These systems are particularly beneficial in dynamic logistics environments where businesses need to adapt to fluctuating demand, supply chain disruptions, or new regulatory requirements.

For example, cloud-based TMS solutions can provide real-time visibility into shipment statuses and help companies reroute shipments in case of delays, thus minimizing downtime and ensuring customer satisfaction. The global logistics industry’s increasing reliance on real-time data analytics further underscores the importance of cloud platforms, as they enable businesses to gain actionable insights without investing heavily in IT infrastructure.

Moreover, the adoption of cloud-based TMS is expanding rapidly in emerging markets due to improved internet connectivity and the proliferation of subscription-based pricing models. SaaS-based TMS platforms are becoming a preferred choice for businesses looking to optimize their supply chains without incurring substantial costs.

As global supply chains grow more interconnected, cloud-based TMS solutions are expected to play a pivotal role in enabling companies to manage their operations seamlessly. The scalability and flexibility offered by these systems position them as a transformative force in the transportation management market, driving both adoption rates and overall market growth.

Trends

Rising Focus on Sustainability and Green Logistics

In 2024, sustainability has become a defining trend in the Transportation Management System market, with businesses across industries prioritizing eco-friendly logistics solutions. The growing emphasis on reducing carbon emissions, prompted by regulatory pressures and shifting consumer preferences, is pushing organizations to adopt TMS platforms that enable greener transportation practices.

Advanced TMS solutions now incorporate tools for carbon footprint tracking, fuel efficiency optimization, and route planning designed to minimize environmental impact. This shift aligns with global sustainability goals, such as achieving net-zero emissions, which many corporations have pledged to meet by 2030 or sooner.

For instance, TMS platforms equipped with predictive analytics can analyze historical data and forecast fuel consumption, allowing businesses to choose energy-efficient transportation modes. Similarly, features like multi-modal transportation planning help optimize freight movement by combining trucks, rail, and ships to reduce reliance on high-emission road transport.

As environmental regulations become stricter, particularly in regions like the European Union and North America, the adoption of such features has become a critical compliance requirement. Furthermore, sustainability-driven TMS adoption is also fueled by the long-term cost savings associated with energy efficiency.

Companies implementing green logistics practices through TMS solutions often experience reduced fuel costs and lower maintenance expenses, creating a win-win situation for both profitability and environmental stewardship.

The integration of electric vehicles (EVs) and alternative fuel technologies into TMS ecosystems further highlights the industry’s commitment to sustainability. With stakeholders across the supply chain now demanding transparency and accountability in environmental impact, sustainability-oriented TMS solutions are emerging as a key differentiator in the market.

This trend not only reflects the growing consumer demand for eco-friendly practices but also represents a transformative shift in how companies view and manage their transportation networks.

Regional Analysis

North America Leads the Transportation Management System Market with the Largest Market Share of 32.6% in 2023

The global transportation management system (TMS) market demonstrates significant regional variations in growth dynamics, driven by factors such as regional industrialization, adoption of digital technologies, and logistics infrastructure development. North America dominates the TMS market, accounting for a substantial 32.6% market share in 2023, valued at USD 4.04 billion.

This leadership is primarily attributed to the region’s well-established logistics networks, high adoption of cloud-based TMS solutions, and the increasing demand for optimized supply chain operations among enterprises. The presence of advanced transportation infrastructure and the region’s push for sustainability and cost-efficiency in logistics operations further solidify its dominant position.

Europe represents another key market, driven by the growing focus on regulatory compliance, particularly in cross-border transportation. The implementation of government regulations emphasizing carbon emission reductions and efficient freight management has fueled the adoption of TMS platforms.

Countries such as Germany, France, and the UK are at the forefront, with advanced manufacturing and retail sectors contributing to sustained demand. Additionally, investments in IoT-enabled logistics and smart transport systems are propelling growth across the region.

Asia Pacific is emerging as a high-growth region, owing to rapid industrialization, increasing e-commerce penetration, and the expansion of manufacturing hubs in countries like China, India, and Japan. The region’s transportation and logistics sectors are witnessing a digital transformation as enterprises adopt advanced TMS solutions to address complex supply chain challenges.

Favorable government initiatives promoting infrastructure development and investments in smart city projects further bolster the market’s growth in this region. The demand for cost-effective and scalable solutions among small- and medium-sized enterprises (SMEs) has also contributed to the adoption of TMS platforms across Asia Pacific.

The Middle East & Africa market is experiencing steady growth, driven by infrastructure development and growing trade activities across key regional economies. Governments in countries like the UAE and Saudi Arabia are heavily investing in transportation and logistics projects as part of broader economic diversification strategies. This is complemented by increasing demand for TMS solutions to enhance operational efficiency and meet the growing complexity of cross-border transportation.

Latin America is also witnessing growing adoption of transportation management systems, albeit at a moderate pace compared to other regions. The market is driven by the rise of trade agreements, improving road infrastructure, and the modernization of supply chains in countries such as Brazil, Mexico, and Argentina. Furthermore, the increased focus on regional trade integration is creating opportunities for logistics players to optimize operations through TMS adoption.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In order to improve their products and launch new products in this highly competitive transportation management system market, key players are spending heavily on research and development. MercuryGate International, Inc., for instance, enhanced its TMS system by adding smart transportation features such as embedded analytics and artificial intelligence to it.

The product provides real-time insight into local and global supply chain requirements. Companies are also pursuing different strategies to remain competitive. These include mergers and acquisitions, strategic partnerships, contracts, and agreements.

For example, Infor Inc. partnered in February 2022 with DB Schenker to provide a supply-chain solution. Infor Nexus technology is available to all customers of DB Schenker as part of the partnership. Infor Nexus technology is used by DB Schenker’s Logistics Service Providers (LSP) business to provide a complete supply chain solution that simplifies cost, factory, and transportation management. It also facilitates supplier collaboration and automates shipping. This helps to reduce inventory, reduce costs, and increase supply chain resilience.

Market Key Players

- 3GTMS

- BluJay Solutions Ltd.

- H. Robinson Worldwide, Inc.

- Cerasis, Inc.

- Inet-logistics GmbH

- Infor Inc.

- International Business Machines Corp.

- JDA Software Group, Inc.

- Manhattan Associates

- MercuryGate International, Inc.

- Oracle Corp.

- SAP SE

- The Descartes Systems Group Inc.

- Trimble Transportation Enterprise Solutions, Inc.

- Other key Players

Recent Developments

- In 2023, Manhattan Associates Inc. (NASDAQ: MANH) was recognized as a Leader in the Magic Quadrant for Transportation Management Systems for the fifth year in a row. The company’s Manhattan Active® Transportation Management solution addresses growing demands for unified, transparent transportation solutions. Integrated with Manhattan Active Warehouse Management, it creates a single supply chain execution platform, offering businesses a complete view of their distribution networks. This recognition highlights Manhattan’s leadership in advancing supply chain technology.

- In January 2023, Descartes Systems Group (TSX: DSG) (Nasdaq: DSGX) acquired Supply Vision, a U.S.-based provider of shipment management solutions for North American Logistics Service Providers (LSPs). Supply Vision’s modular applications support shipment lifecycle processes, from quoting to final delivery. The integration of Supply Vision with Descartes MacroPoint™ enhances real-time shipment visibility for LSPs and their customers, driving operational efficiency.

- In 2024, Körber and KKR announced the acquisition of MercuryGate International Inc., a leading provider of transportation management systems (TMS). This acquisition strengthens Körber Supply Chain Software’s portfolio with MercuryGate’s multimodal optimization capabilities and rapid implementation expertise. The deal positions Körber and KKR to deliver a more comprehensive and scalable supply chain execution platform.

- In July 2024, C.H. Robinson launched an advanced load-matching platform powered by artificial intelligence and data science. This enhanced tool within Navisphere® Carrier provides carriers with hyper-customized load recommendations in real time, based on their search history and truck postings. The platform’s automated alerts reach carriers through their preferred communication channels, ensuring faster and more efficient operations.

- In 2023, Blue Yonder received the Powered by Snowflake Industry Solution Development Partner of the Year award at the Snowflake Summit. The award highlights Blue Yonder’s integration of Snowflake’s data capabilities into its Luminate® Platform, enabling scalable, end-to-end supply chain management solutions. The partnership allows customers to unify data across internal and external sources, driving innovation in supply chain execution.

Report Scope

Report Features Description Market Value (2022) USD 12.4 Bn Forecast Revenue (2032) USD 48.0 Bn CAGR (2023-2032) 14.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments. Segments Covered By Deployment mode: On-Premise and Cloud-Based; By Mode of Transportation: Roadways, Railways, Waterways, and Airways; By End-Use Vertical: Retail & E-commerce, Manufacturing, Logistics, Government Organizations, and Other End-Use Verticals. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3GTMS, BluJay Solutions Ltd., C.H. Robinson Worldwide, Inc., Cerasis, Inc., inet-logistics GmbH, Infor Inc., International Business Machines Corp., JDA Software Group, Inc., Manhattan Associates, MercuryGate International, Inc., Oracle Corp., SAP SE, The Descartes Systems Group Inc., Trimble Transportation Enterprise Solutions, Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Transportation Management System MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Transportation Management System MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 3GTMS

- BluJay Solutions Ltd.

- H. Robinson Worldwide, Inc.

- Cerasis, Inc.

- Inet-logistics GmbH

- Infor Inc.

- International Business Machines Corp.

- JDA Software Group, Inc.

- Manhattan Associates

- MercuryGate International, Inc.

- Oracle Corp.

- SAP SE

- The Descartes Systems Group Inc.

- Trimble Transportation Enterprise Solutions, Inc.

- Other key Players