Global Transparent Solar Cells Market Size, Share Analysis Report By Cell Type (Thin-Film Photovoltaics (TPV), Polymer Solar Cell, Others), By Transparency Type (Partial, Full), By Application (Building Integrated Photovoltaics (BIPV), Automobile, Consumer Electronics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153642

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

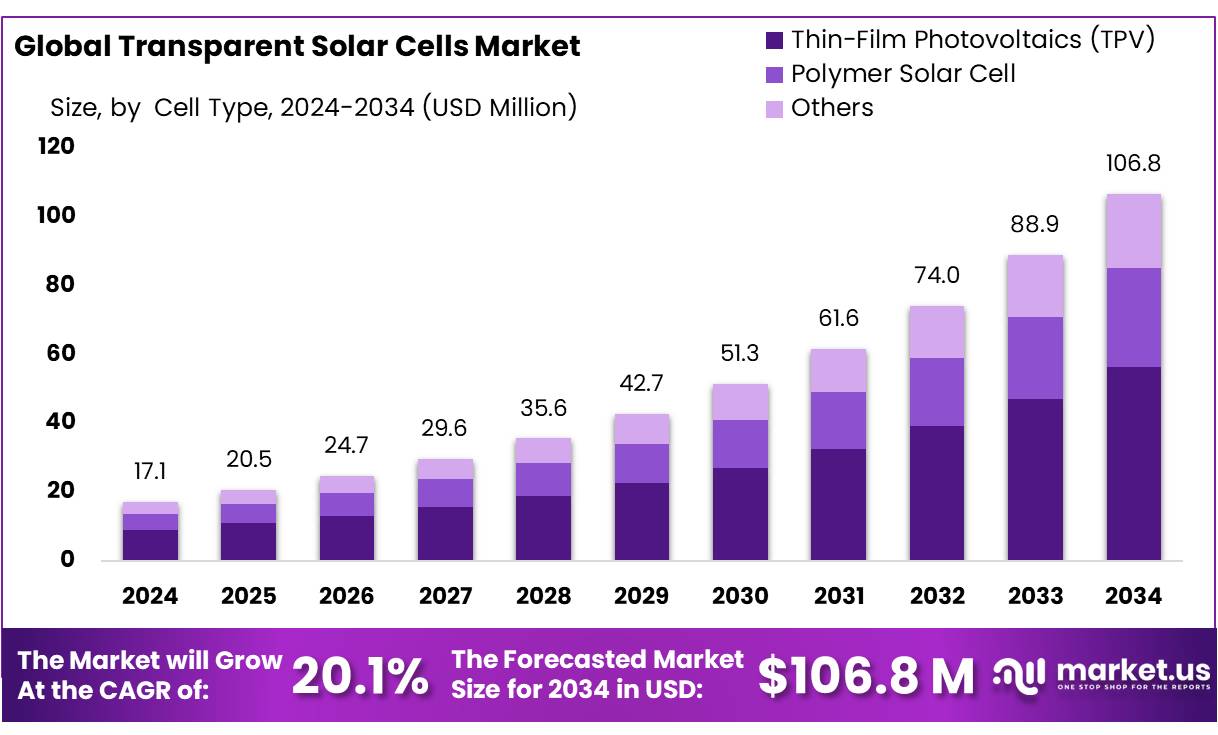

The Global Transparent Solar Cells Market size is expected to be worth around USD 106.8 Million by 2034, from USD 17.1 Million in 2024, growing at a CAGR of 20.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 44.7% share, holding USD 4.0 Billion revenue.

Transparent solar cells (TSCs), also known as transparent photovoltaic cells, capture energy from non-visible light while allowing visible light to pass through. Recent advancements, such as perovskite–organic tandem designs that achieve up to 12.3% efficiency at around 30% transparency, highlight the significant potential for integration into windows, facades, greenhouses, and electronic devices. Although commercial deployment is still in its early stages, research from institutions like the U.S. National Renewable Energy Laboratory (NREL), through cooperative R&D initiatives like the PV Fleet Initiative, is accelerating the transition from prototypes to commercial demonstration.

Key drivers of the transparent solar cell industry include increasing government policy incentives and regulatory mandates. For instance, Japan offers substantial subsidies, while India has set local content requirements to boost domestic manufacturing.

Growing demand for building-integrated photovoltaics (BIPV), which combine aesthetic appeal with renewable energy generation, is particularly notable in urban areas with space constraints. Materials innovation is helping improve the balance between efficiency and transparency, further driving industrial growth. The International Energy Agency (IEA) emphasizes the need for government policies to diversify photovoltaic supply chains and secure energy independence.

The transparent solar cell industry’s growth is also supported by the global shift towards energy-efficient buildings, space optimization, and sustainability requirements. As per IEA data, solar PV accounted for over 60% of new renewable capacity additions globally from 2010 to 2023, with expectations to rise to 80% by 2030. Transparent solar cells are well-positioned to leverage this trend by integrating photovoltaic technology directly into architectural structures, creating an opportunity for urban markets to reduce their carbon footprint.

Government initiatives in key regions have further accelerated the development of transparent solar technology. Japan has committed USD 1.5 billion in subsidies to commercialize ultra-thin, flexible perovskite solar cells, with a target of achieving installation capacity equivalent to 20 nuclear power plants by 2040. India’s localization policies, aimed at achieving a 500 GW non-fossil fuel target by 2030, also promote the growth of transparent solar technology. Additionally, EU initiatives under REPowerEU and solar rooftop mandates, alongside IEA’s recommendations for investment de-risking and raw material diversification, are fueling the development of a global solar energy supply chain.

Key Takeaways

- The Transparent Solar Cells Market is projected to reach USD 106.8 Million by 2034, growing from USD 17.1 Million in 2024, at a CAGR of 20.1%.

- Thin-Film Photovoltaics (TPV) dominated the market, holding more than a 52.8% share of the transparent solar cells market.

- Partial transparency accounted for a dominant share of more than 83.5% in the transparent solar cells market.

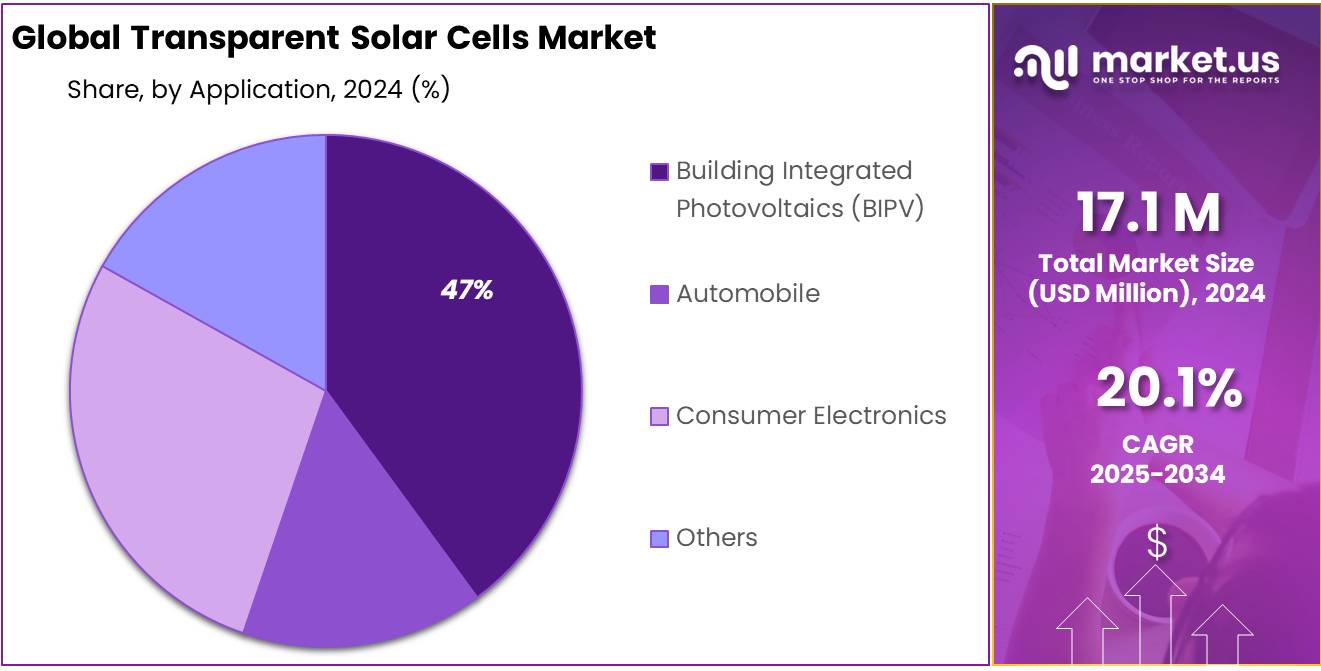

- Building Integrated Photovoltaics (BIPV) captured over 47.3% of the transparent solar cells market.

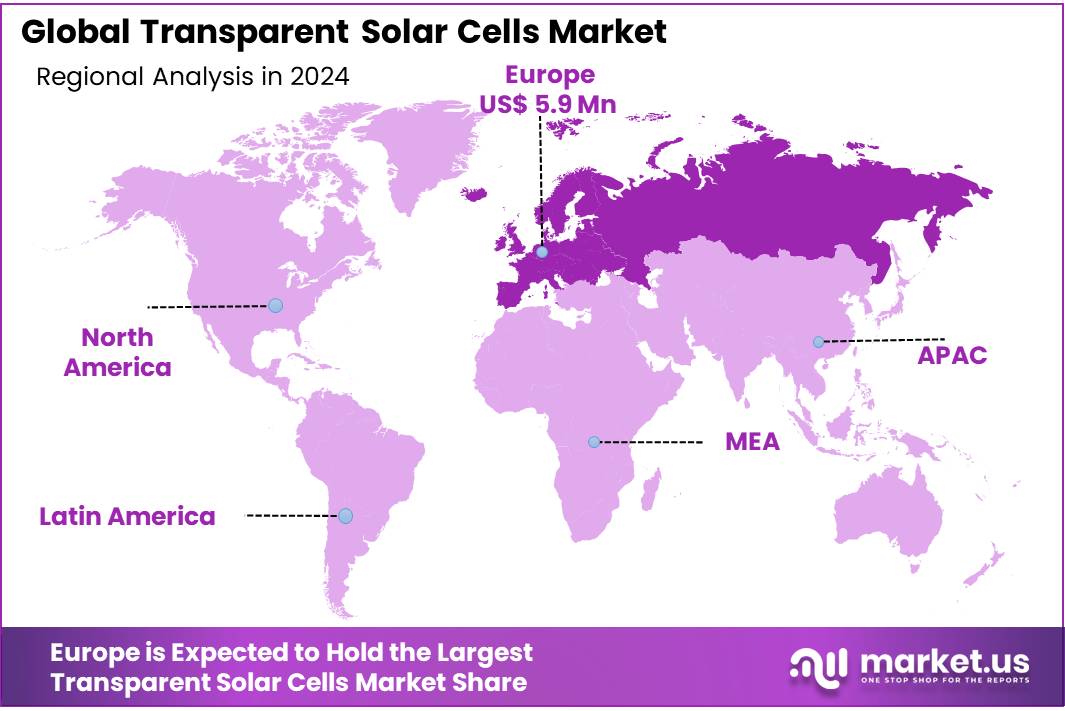

- Europe led the transparent solar cells market, with a 34.80% share, valued at USD 5.9 million.

By Cell Type Analysis

Thin-Film Photovoltaics (TPV) Dominates Transparent Solar Cells Market with 52.8% Share in 2024

In 2024, Thin-Film Photovoltaics (TPV) held a dominant market position, capturing more than a 52.8% share of the transparent solar cells market. This segment’s leading position can be attributed to several factors, including the technology’s ability to deliver a balance between transparency and energy efficiency. TPV’s thin-film architecture, which allows for the deposition of photovoltaic materials on flexible substrates, has made it a preferred choice for integration into building materials such as windows and facades.

The TPV market is driven by the growing demand for energy-efficient solutions in architecture and construction, with increasing emphasis on building-integrated photovoltaics (BIPV). As urbanization continues to rise, the need for sustainable energy solutions that do not compromise the aesthetics of buildings has pushed the adoption of TPV technology. Moreover, TPVs are lightweight, cost-effective, and relatively easier to scale up for mass production, contributing to their dominance in the market.

By Transparency Type Analysis

Partial Transparency Dominates the Transparent Solar Cells Market with 83.5% Share in 2024

In 2024, Partial transparency held a dominant market position, capturing more than an 83.5% share of the transparent solar cells market. This segment’s market lead is largely driven by the versatility and effectiveness of partial transparency in integrating solar cells into architectural structures. Partial transparency allows for a balance between light transmission and energy generation, making it ideal for applications in windows, facades, and other building materials where visibility and energy harvesting are both important.

The adoption of partial transparency in transparent solar cells is expected to increase in 2025 as the technology continues to improve, offering better energy efficiency without compromising the aesthetic appeal of building designs. The demand for partial transparency is primarily driven by the growing trend of building-integrated photovoltaics (BIPV), where transparency is key for creating visually appealing, energy-efficient buildings. With continuous advancements in material technologies, partial transparency solutions are becoming increasingly cost-effective and practical for large-scale deployment.

By Application Analysis

Building Integrated Photovoltaics (BIPV) Leads Transparent Solar Cells Market with 47.3% Share in 2024

In 2024, Building Integrated Photovoltaics (BIPV) held a dominant market position, capturing more than a 47.3% share of the transparent solar cells market. This strong position is driven by the growing demand for sustainable and aesthetically integrated energy solutions in architecture. BIPV technologies are particularly popular in the construction of energy-efficient buildings, as they allow solar cells to be embedded into building materials such as windows, facades, and rooftops, generating power while maintaining the visual appeal of the structure.

The increasing focus on energy-efficient buildings, especially in urban areas, is a key factor behind BIPV’s dominance in the market. In 2025, BIPV’s market share is expected to remain strong, fueled by rising adoption across both residential and commercial sectors. Governments and industry leaders are prioritizing green building standards and energy-efficient infrastructure, further boosting the adoption of BIPV solutions.

Key Market Segments

By Cell Type

- Thin-Film Photovoltaics (TPV)

- Polymer Solar Cell

- Others

By Transparency Type

- Partial

- Full

By Application

- Building Integrated Photovoltaics (BIPV)

- Automobile

- Consumer Electronics

- Others

Emerging Trends

Advancements in Transparent Solar Cell Efficiency

A significant trend in the transparent solar cell (TSC) industry is the continuous improvement in efficiency, particularly through the development of perovskite-based technologies. Recent research has demonstrated that semitransparent perovskite solar cells can achieve open-circuit voltages (Voc) exceeding 1.7 V, with power conversion efficiencies (PCE) reaching up to 8.2%. These advancements are pivotal for integrating TSCs into building-integrated photovoltaics (BIPV), enabling energy generation without compromising aesthetics.

In India, the government is actively promoting the use of domestically produced solar photovoltaic (PV) modules in clean energy projects. Starting June 2026, all clean energy projects will be required to use PV modules made from locally produced cells, aiming to reduce reliance on imports and boost domestic manufacturing capabilities. This initiative supports India’s ambitious target of achieving 500 GW of non-fossil fuel capacity by 2030, up from the current 156 GW. The government is also providing incentives and support to companies investing in solar cell manufacturing, fostering innovation and growth in the sector.

These developments underscore the dynamic nature of the TSC industry, where technological advancements and supportive government policies converge to drive the adoption of transparent solar technologies in various applications. As efficiency improves and costs decrease, TSCs are poised to play a significant role in the future of renewable energy, offering sustainable solutions for urban environments and beyond.

Drivers

Government Initiatives Driving Transparent Solar Cell Adoption

Governments worldwide are playing a pivotal role in accelerating the adoption of transparent solar cells (TSCs), recognizing their potential to revolutionize energy generation in urban settings. Through strategic investments and policy frameworks, nations are fostering innovation and creating conducive environments for the commercialization of TSC technologies.

In Japan, the government has committed a substantial USD 1.5 billion to advance the development and commercialization of ultra-thin, flexible perovskite solar cells. This initiative aims to position Japan as a leader in next-generation solar technology, challenging existing global supply chains and enhancing energy security. The government’s support includes subsidies for domestic manufacturers and research institutions, facilitating the scaling up of production and addressing technical challenges associated with TSCs.

Similarly, India is making significant strides in promoting solar energy through its Pradhan Mantri Surya Ghar Muft Bijli Yojana. Launched in 2024, this scheme aims to provide rooftop solar installations to 1 crore households, offering up to 300 units of free electricity per month. The initiative is backed by an investment exceeding ₹75,000 crore, with subsidies covering up to ₹78,000 per household. As of March 2025, over 3 GW of rooftop solar capacity has been installed under this program, with an additional 27 GW targeted by 2027.

These government-led initiatives underscore a global commitment to integrating transparent solar technologies into everyday infrastructure. By providing financial incentives, streamlining regulatory processes, and supporting research and development, governments are not only fostering innovation but also paving the way for a sustainable and energy-efficient future.

Restraints

High Manufacturing Costs

One of the significant challenges facing the widespread adoption of transparent solar cells (TSCs) is their high manufacturing costs. Currently, semi-transparent solar cells are priced between $300 and $400 per square meter, while fully transparent panels can cost between $500 and $600 per square meter. This pricing is substantially higher than traditional opaque solar panels, which are more cost-effective and widely used.

The elevated costs of TSCs are primarily attributed to the complex fabrication processes and the use of specialized materials. For instance, the production of high-efficiency, transparent thin films often involves sophisticated techniques and expensive organic materials. Manufacturing defect-free, highly efficient, and transparent thin films requires advanced equipment and precise methods, leading to increased production expenses.

These higher costs pose a barrier to the widespread adoption of TSCs, especially in price-sensitive markets and applications where traditional solar panels are more economically viable. While TSCs offer unique advantages, such as integration into architectural elements without compromising aesthetics, their current cost structure limits their competitiveness compared to conventional solar technologies. Therefore, addressing the cost challenge is crucial for accelerating the commercialization and adoption of transparent solar cells.

Opportunity

Government Incentives Fueling Transparent Solar Cell Growth

Transparent solar cells (TSCs) are gaining momentum as governments worldwide recognize their potential to revolutionize energy generation in urban environments. These cells, which allow visible light to pass through while capturing energy from non-visible light spectra, offer a unique solution for integrating renewable energy into buildings without compromising aesthetics. Government initiatives are playing a pivotal role in accelerating the development and adoption of TSCs.

In the United States, the Department of Energy (DOE) has allocated substantial funds to support solar energy technologies. Through the Infrastructure Investment and Jobs Act, the DOE is investing $62 billion specifically for clean energy infrastructure, including building-integrated photovoltaic technologies like TSCs. Additionally, the Inflation Reduction Act provides significant tax incentives for solar technology adoption, encouraging developers to integrate bifacial solar cells into commercial buildings, residential windows, and electric vehicles.

Similarly, in Japan, the government is investing $1.5 billion in the commercialization of ultra-thin, flexible perovskite solar cells. These cells are significantly thinner than traditional solar panels and can be deployed on buildings, stadiums, and other structures, making them ideal for Japan’s geographical constraints. The Japanese government aims to generate energy equivalent to 20 nuclear power plants by 2040, targeting up to 50% renewable energy in its electricity mix.

In India, the government has mandated the use of locally-made solar photovoltaic (PV) modules in clean energy projects from June 2026. This initiative aims to reduce reliance on Chinese imports and boost domestic manufacturing. India plans to increase its non-fossil fuel capacity to 500 GW by 2030, up from the current 156 GW. The government is also providing subsidies and incentives to companies investing in solar cell manufacturing, fostering a conducive environment for the growth of TSCs.

Regional Insights

Europe Leads the Transparent Solar Cells Market with 34.80% Share, Reaching USD 5.9 Million in 2024

In 2024, Europe held a dominant market position in the transparent solar cells sector, capturing 34.80% of the global market share, valued at USD 5.9 million. This leading position can be attributed to the region’s strong commitment to sustainability, stringent environmental regulations, and extensive adoption of renewable energy technologies. Europe has long been a frontrunner in the adoption of solar energy, with countries like Germany, France, and the Netherlands taking proactive steps to integrate clean energy solutions into various sectors, including building-integrated photovoltaics (BIPV).

The European Union’s ambitious renewable energy targets, aiming to achieve a 40% share of renewable energy in its overall energy mix by 2030, further supports the growth of the transparent solar cells market. The region’s favorable regulatory environment, including green building initiatives and incentives for sustainable construction practices, has encouraged widespread investment in innovative solar technologies. As part of the European Green Deal, the EU is focusing on energy-efficient buildings, which drives demand for transparent solar cells in architectural and construction applications.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

InQs, a South Korea-based technology company, is developing quantum dot-based transparent solar cells with high transparency and efficiency. The firm’s technology allows natural light to pass through while converting non-visible parts of the spectrum into electricity. Targeting building glass, automotive windows, and mobile electronics, InQs focuses on miniaturized, smart-integrated PV solutions. The company continues to invest in R&D partnerships to enhance cell efficiency and explore commercialization opportunities within Asia’s fast-growing smart building and electronics markets.

Energy Advance is engaged in the development of transparent photovoltaic modules, primarily for integration into windows and facades. The company emphasizes environmentally friendly designs with a focus on balancing solar conversion efficiency and visibility. By targeting architectural and urban infrastructure markets, Energy Advance supports energy-positive buildings. Their product line includes semi-transparent PV materials tailored for commercial and residential properties. Their commitment to sustainability aligns with growing demand for aesthetic, clean energy solutions in smart cities and green buildings.

Brite Solar focuses on developing transparent solar glass for greenhouse and building applications. Based in Greece, the company specializes in advanced nanomaterials and coatings that allow visible light to pass through while generating electricity from UV and IR light. Brite’s core strength lies in its greenhouse-integrated photovoltaics, offering high transparency and significant energy savings for agricultural and commercial sectors. The company continues to expand its production capabilities and pilot projects across Europe and the Middle East.

Top Key Players Outlook

- Brite Solar

- Energy Advance

- Heliatek

- InQs

- Onyx Solar Group LLC

- Polysolar

- Sharp Corporation

- SolarScape Enterprises Ltd

- Ubiquitous Energy, Inc.

Recent Industry Developments

In 2024, Brite-Solar, a Greece-based nanomaterials company, commissioned a 150 MWp semi-transparent agrivoltaic panel manufacturing line in Patras—Europe’s first dedicated facility for agri-PV glass products.

In 2024, Onyx Solar Group LLC continued to expand its role as a leader in transparent solar cell applications within the building-integrated photovoltaics (BIPV) sector. Founded in 2009 in Ávila, Spain, Onyx Solar has delivered photovoltaic glass solutions for over 400 projects across more than 50 countries, including flagship structures such as the Dubai Frame and the Miami Heat Stadium.

Report Scope

Report Features Description Market Value (2024) USD 17.1 Mn Forecast Revenue (2034) USD 106.8 Mn CAGR (2025-2034) 20.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Cell Type (Thin-Film Photovoltaics (TPV), Polymer Solar Cell, Others), By Transparency Type (Partial, Full), By Application (Building Integrated Photovoltaics (BIPV), Automobile, Consumer Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Brite Solar, Energy Advance, Heliatek, InQs, Onyx Solar Group LLC, Polysolar, Sharp Corporation, SolarScape Enterprises Ltd, Ubiquitous Energy, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Transparent Solar Cells MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Transparent Solar Cells MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Brite Solar

- Energy Advance

- Heliatek

- InQs

- Onyx Solar Group LLC

- Polysolar

- Sharp Corporation

- SolarScape Enterprises Ltd

- Ubiquitous Energy, Inc.