Global Transformers Market By Type(Power Transformer, Distribution Transformer, Instrument Transformer, Others), By Power Rating, Small( Medium, Large, By Cooling Type(Air Cooled, Oil Cooled), By Insulation(Dry, Liquid Immersed), By Phase(Three Phase, Single Phase), By Application(Utility, Industrial, Commercial, Residential), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: April 2024

- Report ID: 13317

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The global Transformer market size is expected to be worth around USD 123 Billion by 2033, from USD 68 Billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2023 to 2033.

The transformer market refers to the global industry involved in the design, manufacturing, distribution, and sale of electrical transformers. Transformers are critical components in electrical distribution systems, responsible for changing electrical energy from one voltage to another, either increasing or decreasing voltage levels to meet the needs of power transmission and distribution networks.

This market encompasses a wide range of transformer types, including power transformers, distribution transformers, instrument transformers, and specialty transformers, each serving different applications across various sectors. Power transformers are used in transmission networks for high-voltage electricity transfer, while distribution transformers are employed in local distribution networks to provide the final voltage transformation needed for residential and commercial use. Instrument transformers are used for measurement and protective relay purposes in electrical systems.

The demand within the Transformers Market is driven by factors such as the expansion of power generation capacities, the modernization of existing electrical infrastructure, the integration of renewable energy sources, and the growing need for energy efficiency and reliability. The market is influenced by technological advancements, regulatory policies, and economic trends that shape energy consumption and production worldwide.

Key stakeholders in this market include transformer manufacturers, utility companies, industrial and commercial users, government and regulatory bodies, and research and development institutions. The Transformers Market is characterized by its focus on innovation, with continuous advancements in materials, design, and manufacturing processes aimed at improving transformer efficiency, reducing losses, and enhancing durability and environmental compatibility.

Key Takeaways

- Market Size: Expected to reach USD 123 billion by 2033, growing at a CAGR of 6.2% from USD 68 billion in 2023.

- Segment Dominance: Power transformers lead with 47.2% market share, followed by distribution and instrument transformers.

- Preferred Types: Medium power-rated transformers hold 51.3% share, with air-cooled transformers dominating at 61.2%.

- Insulation Preference: Dry insulation transformers lead at 63.2%, while three-phase transformers are preferred with 58.9% market share.

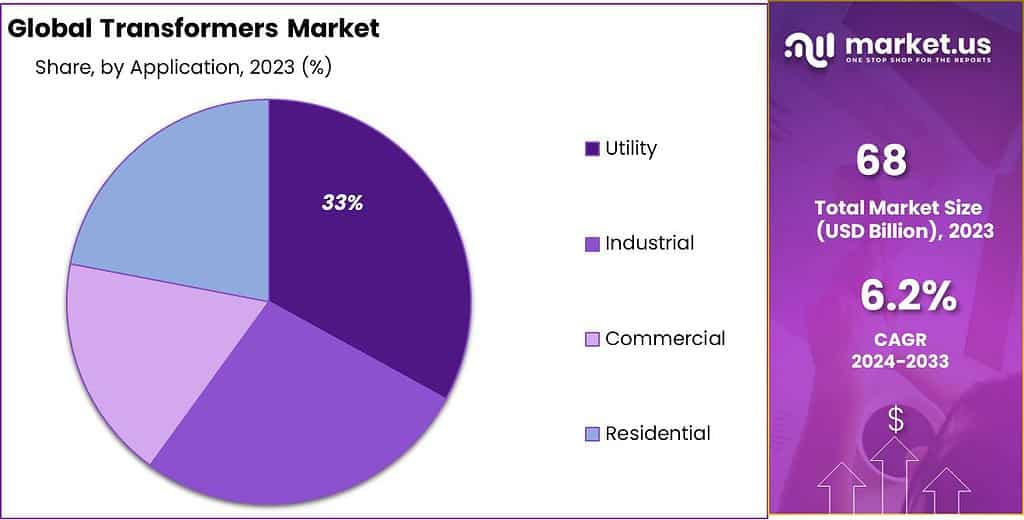

- Application Significance: Utility transformers hold 33.3% market share, followed by industrial, commercial, and residential segments.

- Regional Leadership: Asia Pacific leads with 52.7% market share, followed by North America and Europe, each with substantial growth potential.

By Type

In 2023, Power Transformer held a dominant market position in the Transformers Market, capturing more than a 47.2% share. This segment’s leadership is attributed to the essential role power transformers play in transmitting electrical energy over long distances at high voltages, making them crucial for the efficiency and reliability of national power grids. Their ability to step up or down voltages enables the safe and effective distribution of electricity from power plants to various consumers, meeting the demands of growing industrial, commercial, and residential sectors.

Following closely, Distribution Transformer also occupies a significant portion of the market. These transformers are vital in the final voltage transformation in the power distribution process, stepping down the voltage used in the power lines to a level suitable for use by customers. Their widespread application in residential areas, commercial buildings, and industrial plants underscores their importance in ensuring the accessibility and safety of electricity.

Instrument Transformer represents another important segment, focusing on providing precise voltage and current measurements for the monitoring and control of electrical systems. They are key components in protecting and managing the efficient operation of the power distribution network, aiding in fault detection, and facilitating the effective operation of protective relays.

Each of these segments demonstrates the critical nature and diverse applications of transformers in modern electrical infrastructure, with the Power Transformer leading due to its indispensable role in energy transmission. As the electricity demand continues to rise and systems become more complex, the Transformers Market is expected to see sustained growth, driven by the need for efficient, reliable, and innovative transformer solutions.

By Power Rating

In 2023, Medium power-rated transformers held a dominant market position, capturing more than a 51.3% share. This category’s prominence is primarily due to its broad applicability across various sectors, including commercial, industrial, and utility applications. Medium transformers are versatile, capable of handling a significant range of power demands while maintaining efficiency and reliability. They are often the preferred choice for medium-scale projects, like commercial building complexes, small manufacturing units, and secondary distribution networks, where their balance between capacity and cost-efficiency meets the diverse needs of these applications.

Small power-rated transformers also play a crucial role, especially in localized applications, residential areas, and for specific industrial machinery that requires lower voltage. Although they occupy a smaller market share compared to medium transformers, their importance in ensuring safe, efficient electricity distribution to end-users cannot be understated. Their compact size and lower capacity make them suitable for applications where space is limited and the power demand is relatively low.

Large power-rated transformers are essential for high-demand applications, such as major industrial operations, large power plants, and high-voltage transmission networks. While their market share is less than that of medium transformers, their role in the power grid is critical. They are designed to handle very high voltages and large loads, making them indispensable in the backbone infrastructure of national and regional power systems.

Each of these power rating segments caters to specific needs within the electrical distribution and transmission landscape, with Medium transformers leading due to their versatility and efficiency in a wide range of applications. As the global electricity demand grows and infrastructure continues to evolve, the Transformers Market is expected to see shifts in demand across all power rating categories, reflecting changing needs and technological advancements.

By Cooling Type

In 2023, Air Cooled transformers held a dominant market position, capturing more than a 61.2% share. This category’s leading status is attributed to the widespread adoption of air-cooled or dry-type transformers across various sectors, including commercial, industrial, and residential applications. Air-cooled transformers are favored for their safety, efficiency, and ease of maintenance, especially in environments where fire risk must be minimized. They do not require a liquid cooling agent, making them a preferred choice in indoor or enclosed spaces where leakage could pose a significant hazard.

Oil Cooled transformers, while holding a smaller market share compared to air-cooled models, are indispensable in applications requiring high power capacity and superior cooling efficiency. These transformers use oil as a cooling and insulating medium, making them well-suited for heavy-duty applications such as power generation stations and large industrial complexes. Oil cooling’s effective heat dissipation properties allow these transformers to handle higher loads and operate more reliably under strenuous conditions.

Each cooling type serves distinct needs within the Transformers Market, with Air Cooled transformers leading due to their versatility, safety, and lower maintenance requirements. As technological advancements continue and environmental considerations become increasingly paramount, the demand for efficient and eco-friendly transformer solutions is expected to influence the market dynamics of both air-cooled and oil-cooled transformers.

By Insulation

In 2023, Dry insulation transformers held a dominant market position, capturing more than a 63.2% share. This category’s prominence in the market is largely due to their safety, environmental compatibility, and ease of installation. Dry transformers, often referred to as dry-type or air-cooled transformers, are preferred in applications where safety concerns, such as the risk of fire or chemical leakage, are paramount. They are commonly used in indoor and urban settings, including commercial buildings, hospitals, and schools, where their lack of liquid coolants reduces maintenance requirements and eliminates the need for containment structures.

Liquid Immersed transformers, while occupying a smaller market share compared to dry transformers, play a critical role in the energy sector, especially in high-power and high-voltage applications. The liquid insulation and cooling medium—typically oil—allows these transformers to efficiently manage heat dissipation, enabling them to operate at higher capacities. Their use is essential in power generation plants, substations, and industrial settings where the transformer’s ability to handle large loads is crucial.

Each insulation type addresses specific operational needs and safety considerations within the Transformers Market, with Dry transformers leading due to their versatility, safety features, and suitability for a wide range of applications. As the global demand for electrical energy continues to grow and the focus on safety and environmental sustainability becomes sharper, the market for both dry and liquid-immersed transformers is expected to evolve, reflecting these broader industry trends.

By Phase

In 2023, Three Phase transformers held a dominant market position, capturing more than a 58.9% share. This preference stems from their widespread application in industrial and commercial settings, where their ability to efficiently distribute electrical power across large facilities is essential. Three-phase transformers are known for their reliability and capacity to handle high voltages and loads, making them indispensable in settings that require a constant and robust power supply, such as manufacturing plants, large commercial complexes, and utility power distribution networks.

Single-phase transformers, while holding a smaller market share, are vital in residential areas and for specific applications that require a simpler and more cost-effective solution. These transformers are typically used in situations where the power demand is lower, such as in homes, and small businesses, and in providing localized power distribution. Their straightforward design and operation make them suitable for applications where the complex power distribution of a Three-phase system is not necessary.

Each phase type caters to different needs within the Transformers Market, with Three-phase transformers leading due to their critical role in supporting industrial, commercial, and utility power systems. As energy demands continue to evolve and expand, the significance of both Three-phase and Single Phase transformers remains paramount, reflecting their essential functions in global power distribution and management.

By Application

In 2023, Utility applications of transformers held a dominant market position, capturing more than a 33.3% share. This significant market presence is largely due to the essential role transformers play in electricity generation, transmission, and distribution processes. Utility transformers are critical in stepping up or down voltages to ensure the efficient and safe delivery of electricity from power plants to end-users across vast distances. Their robust design and capacity to handle high voltages make them indispensable in maintaining the reliability and integrity of national and regional power grids.

Following utility applications, the Industrial sector also constitutes a substantial portion of the market. Transformers in industrial settings are vital for a range of operations, from manufacturing processes to heavy machinery power supply. They are designed to meet the specific power requirements of industrial facilities, ensuring safety, efficiency, and reliability in environments that often demand high power loads.

Commercial applications of transformers are similarly crucial, providing the necessary power conversion and distribution within commercial buildings, retail centers, and offices. These transformers are tailored to support the diverse electrical needs of commercial establishments, including lighting, heating, cooling, and operational equipment, contributing to their significant market share.

Residential use of transformers, while occupying a smaller segment of the market, is essential in stepping down power to the voltages suitable for household use. These transformers facilitate the final stage of electricity distribution, delivering safe and usable power to homes, highlighting their importance in the overall energy supply chain.

Each application area underscores the versatile and indispensable nature of transformers in the modern world, with Utility applications leading due to their foundational role in energy generation, transmission, and distribution systems. As the electricity demand continues to grow and evolve, the Transformers Market is expected to adapt and expand, reflecting the changing needs and advancements within each application sector.

Key Market Segments

By Type

- Power Transformer

- Distribution Transformer

- Instrument Transformer

- Others

By Power Rating

- Small

- Medium

- Large

By Cooling Type

- Air Cooled

- Oil Cooled

By Insulation

- Dry

- Liquid Immersed

By Phase

- Three Phase

- Single Phase

By Application

- Utility

- Industrial

- Commercial

- Residential

Drivers

Infrastructure Expansion and Renewable Energy Integration Drive the Transformers Market

A major driver propelling the growth of the Transformers Market is the global push toward infrastructure expansion and the integration of renewable energy sources. As countries worldwide aim to enhance their electricity generation capacities and modernize existing power distribution networks, the demand for transformers, essential components in the transmission and distribution of electrical power, is experiencing a significant upsurge.

The ongoing expansion of urban and industrial infrastructures necessitates robust electrical systems capable of supporting increased power demands. Transformers play a pivotal role in these systems, facilitating the efficient transmission of electricity over long distances and ensuring reliable power supply to burgeoning urban centers, industrial parks, and commercial complexes. This infrastructure development, particularly in emerging economies, is a key factor driving the demand for both power and distribution transformers.

Simultaneously, the global shift towards sustainable energy solutions is accelerating the deployment of renewable energy sources such as wind, solar, and hydroelectric power. Transformers are integral to renewable energy systems, where they are used to step up the generated power to transmission voltages, enabling its integration into the national grid. The variability and decentralized nature of renewable energy production further underscore the need for advanced transformer solutions that can adapt to fluctuating power outputs and ensure stability within the grid.

Moreover, the modernization of aging electrical infrastructure in developed countries represents another significant driver for the Transformers Market. Upgrading old transformers with newer, more efficient models is crucial for reducing energy losses, improving system reliability, and accommodating the evolving energy landscape marked by increased renewable integration and changing consumption patterns.

The push for energy efficiency and reduced environmental impact also contributes to the market growth, with transformers being designed to minimize losses and operate more cleanly than their predecessors. Innovations in transformer technology, including the development of smart transformers capable of adjusting their performance based on real-time demands and conditions, are meeting the needs of modern, dynamic power systems.

Restraints

High Initial Investment and Maintenance Costs: A Key Restraint in the Transformers Market

One of the significant restraints facing the Transformers Market is the high initial investment and maintenance costs associated with transformer systems. Transformers, being crucial components in power transmission and distribution networks, require substantial financial outlay for manufacturing, installation, and integration into existing electrical infrastructures. This initial cost can be a major hurdle, especially for utility companies and industries operating within tight budgetary constraints or in regions where financial resources are limited.

The complexity and sophistication of modern transformers, designed to meet the growing demands for energy efficiency, reliability, and integration with renewable energy sources, further add to the cost. Advanced features such as remote monitoring, automatic load regulation, and enhanced insulation materials, while contributing to operational efficiencies and environmental compliance, also increase the price tag of these critical components.

Moreover, the long-term operation and maintenance of transformers present additional financial challenges. Although transformers generally have a long operational lifespan, they require regular maintenance to ensure optimal performance and prevent failures that could lead to costly downtimes and repairs. The need for specialized personnel to perform these maintenance tasks, along with the costs of replacement parts and potential upgrades, contributes to the overall operational expenses.

In regions prone to extreme weather conditions or where access is difficult, the costs associated with installing and maintaining transformers can be even higher. These environmental and logistical challenges necessitate the use of specially designed transformers and infrastructure enhancements, further escalating costs.

The combination of high initial investment and ongoing maintenance expenses can restrain the growth of the Transformers Market by limiting the ability of utilities and industries to upgrade existing systems or expand their electrical networks. This is particularly relevant in emerging economies, where the need for electrical infrastructure development is greatest, but financial resources may be more constrained.

Addressing this restraint requires innovative solutions to reduce the costs associated with transformers, such as the development of more cost-effective manufacturing processes, the use of alternative materials, and the implementation of technologies that enhance operational efficiency and reduce maintenance needs. Additionally, financial mechanisms such as grants, loans, and incentives can play a crucial role in alleviating the financial burden and encouraging the adoption of advanced transformer technologies.

Opportunity

Smart Grid Technology Integration: A Prime Opportunity for the Transformers Market

A significant opportunity for the Transformers Market lies in the integration with smart grid technology. As the global energy sector moves towards more intelligent, efficient, and reliable power distribution networks, the demand for advanced transformer solutions that can seamlessly integrate into these smart grids is rapidly increasing.

Smart grids utilize digital communication technology to monitor and manage the transport of electricity from all generation sources to meet the varying electricity demands of end-users. The incorporation of transformers that are compatible with smart grid technology is crucial for optimizing energy distribution, enhancing grid reliability, and facilitating the widespread use of renewable energy sources.

Transformers designed for smart grids, often referred to as smart transformers, go beyond traditional functions. They actively regulate voltage and maintain power quality, ensuring efficient electricity distribution even under fluctuating load conditions. Moreover, these transformers are equipped with communication capabilities that allow for remote monitoring and control, enabling utility providers to respond promptly to changes in energy demand or potential system issues. This feature is particularly important for integrating intermittent renewable energy sources, like wind and solar, into the grid, as it helps maintain stability despite the variable nature of renewable power generation.

The transition to smart grids presents a lucrative opportunity for manufacturers in the Transformers Market. There is a growing need for transformers that can handle the complexities of modern electrical networks—those that support bidirectional energy flows, allow for enhanced consumer participation in energy management, and contribute to the overall resilience of power systems against disruptions. The development and deployment of smart transformers are key to realizing the full potential of smart grid technology, offering market players the chance to lead in a segment poised for significant growth.

Moreover, the push towards energy efficiency and sustainability globally drives investments in smart grid technology, further amplifying the opportunity for growth in the smart transformer segment. Governments and regulatory bodies around the world are implementing policies and incentives to encourage the adoption of smart grids, which, in turn, increases the demand for compatible transformers.

Trends

Eco-Friendly and Energy-Efficient Transformers: A Rising Trend in the Market

A major trend shaping the Transformers Market is the growing emphasis on eco-friendly and energy-efficient transformers. As environmental sustainability becomes a paramount concern globally, there’s an increasing demand for transformers that not only meet the current energy needs but do so in a way that minimizes environmental impact. This trend is driven by stringent regulatory standards aimed at reducing greenhouse gas emissions, along with a broader societal shift towards greener and more sustainable energy solutions.

Energy-efficient transformers are designed to reduce electrical losses during the process of voltage transformation. These losses, often manifested as heat, represent wasted energy and contribute to higher operational costs and increased carbon footprint. By improving efficiency, transformers can significantly cut down on energy consumption and, consequently, the overall environmental impact of power distribution networks. Advances in materials science, particularly in the development of low-loss magnetic materials and improved insulation technologies, have been pivotal in developing these high-efficiency transformers.

Moreover, the push for eco-friendly transformers goes beyond just improving energy efficiency. It also encompasses the use of environmentally safe materials and manufacturing processes. Traditional transformers, especially those that are oil-immersed, have faced criticism for their potential environmental hazards, including the risk of oil leaks and the use of polychlorinated biphenyls (PCBs) in older models. The industry’s response has been to develop transformers that use biodegradable insulating liquids and are constructed from recyclable materials, significantly reducing their environmental footprint.

The adoption of eco-friendly and energy-efficient transformers is further facilitated by digitalization and smart technology integration. Smart transformers, equipped with sensors and connectivity, can optimize their operation in real-time based on the current demand and grid conditions. This not only enhances efficiency but also extends the transformers’ lifespan by preventing overloads and facilitating predictive maintenance.

Regional Analysis

As of 2023, the Asia Pacific region has emerged as the leading market for transformers, capturing a dominant 52.7% market share. This significant growth is largely driven by the expanding power infrastructure and the rapid integration of renewable energy sources within key countries including China, India, Korea, Thailand, Malaysia, and Vietnam. The demand in this region is further buoyed by increasing industrialization, urbanization, and the rising energy needs of a growing population, coupled with significant investments in upgrading and expanding electrical grids to ensure reliable power distribution.

North America, with its advanced power infrastructure and a strong focus on renewable energy, continues to be a significant market for transformers. The region’s commitment to modernizing its power distribution systems, alongside initiatives to incorporate smart grid technologies, drives the demand for advanced transformer solutions. Additionally, the push towards energy efficiency and reducing carbon emissions in the United States and Canada aligns with the market’s move towards more innovative and environmentally friendly transformer technologies.

Europe also exhibits substantial growth potential in the Transformers Market. This growth is stimulated by the region’s efforts to transition towards sustainable energy, necessitating the upgrade of existing power infrastructure to accommodate renewable energy sources efficiently. The stringent EU regulations on energy efficiency and environmental protection further propel the demand for advanced transformers that can meet these regulatory standards while ensuring effective power distribution across the continent.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the dynamic Transformers Market, several key players stand out for their significant contributions and market presence. ABB Ltd. emerges as a leader with its extensive portfolio of power and distribution transformers, catering to various sectors such as utilities, renewable energy, and industry. Siemens AG also commands a considerable share, known for its high-quality products and advanced technological solutions that span energy transmission, infrastructure, and manufacturing.

General Electric Company (GE) holds a prominent position, leveraging its expertise in transformer design, manufacturing, and distribution to offer innovative solutions emphasizing efficiency, reliability, and sustainability. Schneider Electric SE rounds out the list with its diverse range of transformers tailored for residential, commercial, and industrial applications. These key players play pivotal roles in shaping the transformers market landscape, driving innovation, and meeting the evolving needs of industries worldwide.

Market Key Players

- ABB Ltd.

- Siemens

- Aktiengesellschaft

- Toshiba Corporation

- Hitachi Ltd.

- Fuji Electric Co. Ltd.

- Mitsubishi Electric Corporation

- Hyosung Corporation

- General Electric Company

- CG Power and Industrial

- SGB-SMIT Holding

- Efacec Power Solutions

- S.G.P.S.

- SA

- JiangSu HuaPeng Transformer

Recent Development

In 2023 ABB Ltd. remained at the forefront of providing efficient and reliable transformer solutions to meet the evolving needs of its diverse customer base.

In 2023 Siemens, the company showcased resilience and innovation, adapting to market dynamics while upholding its commitment to delivering efficient and reliable transformer products. Serving a wide range of industries including energy transmission, infrastructure, and manufacturing, Siemens continues to meet the diverse needs of its customers worldwide.

Report Scope

Report Features Description Market Value (2023) USD 68 Mn Forecast Revenue (2033) USD 123 Mn CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Power Transformer, Distribution Transformer, Instrument Transformer, Others), By Power Rating, Small( Medium, Large, By Cooling Type(Air Cooled, Oil Cooled), By Insulation(Dry, Liquid Immersed), By Phase(Three Phase, Single Phase), By Application(Utility, Industrial, Commercial, Residential) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape ABB Ltd., Siemens, Aktiengesellschaft, Toshiba Corporation, Hitachi Ltd., Fuji Electric Co. Ltd., Mitsubishi Electric Corporation, Hyosung Corporation, General Electric Company, CG Power and Industrial, SGB-SMIT Holding, Efacec Power Solutions, S.G.P.S., SA, JiangSu HuaPeng Transformer Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Transformer market?Transformer market size is expected to be worth around USD 123 Billion by 2033, from USD 68 Billion in 2023

What CAGR is projected for the Transformers Market?The Transformers Market is expected to grow at 6.2% CAGR (2023-2033).Name the major industry players in the Transformers Market?ABB Ltd., Siemens, Aktiengesellschaft, Toshiba Corporation, Hitachi Ltd., Fuji Electric Co. Ltd., Mitsubishi Electric Corporation, Hyosung Corporation, General Electric Company, CG Power and Industrial, SGB-SMIT Holding, Efacec Power Solutions, S.G.P.S., SA, JiangSu HuaPeng Transformer

-

-

- ABB Ltd.

- Siemens

- Aktiengesellschaft

- Toshiba Corporation

- Hitachi Ltd.

- Fuji Electric Co. Ltd.

- Mitsubishi Electric Corporation

- Hyosung Corporation

- General Electric Company

- CG Power and Industrial

- SGB-SMIT Holding

- Efacec Power Solutions

- S.G.P.S.

- SA

- JiangSu HuaPeng Transformer