Global Trade Surveillance Systems Market Size, Share Analysis Report By Component (Solutions (Risk & Compliance, Reporting & Monitoring, Surveillance & Analytics, Case Management, Other Solutions), Services (Managed Services, Professional Services (Consulting, Deployment & Integration, Support & Maintenance))), By Deployment Mode (Cloud, On-premises), By Organization Size (Small and Medium-sized Enterprises, Large Enterprises), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150028

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

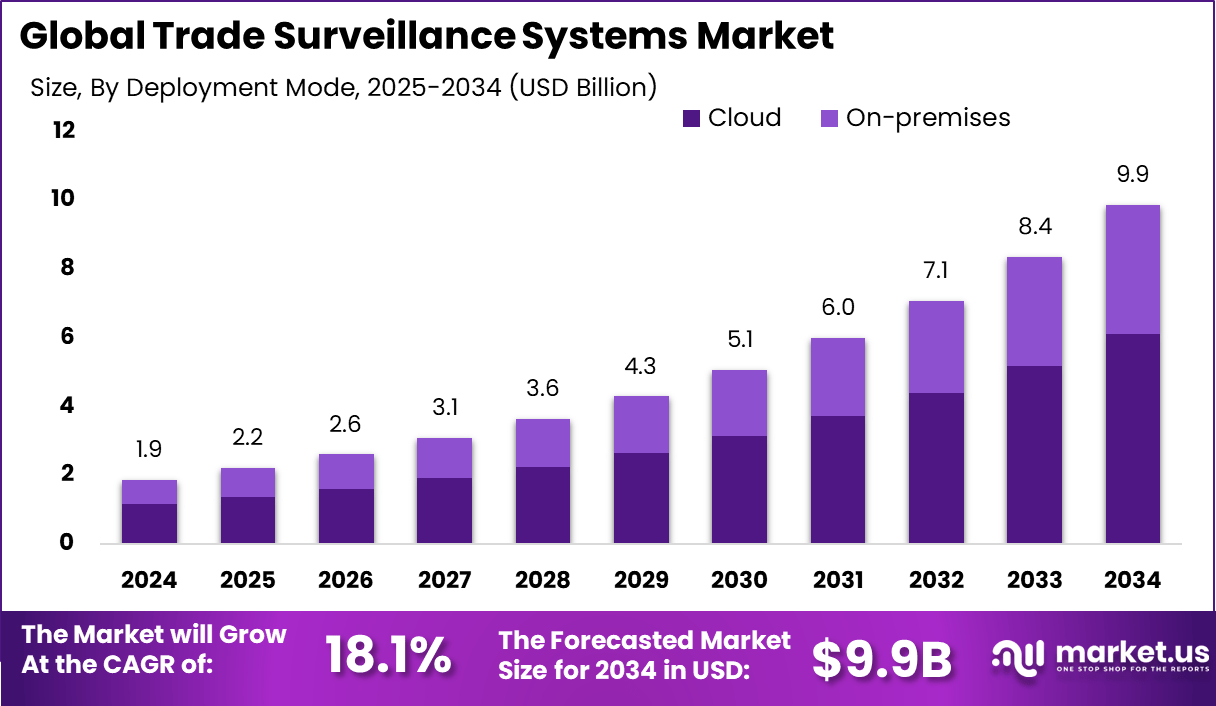

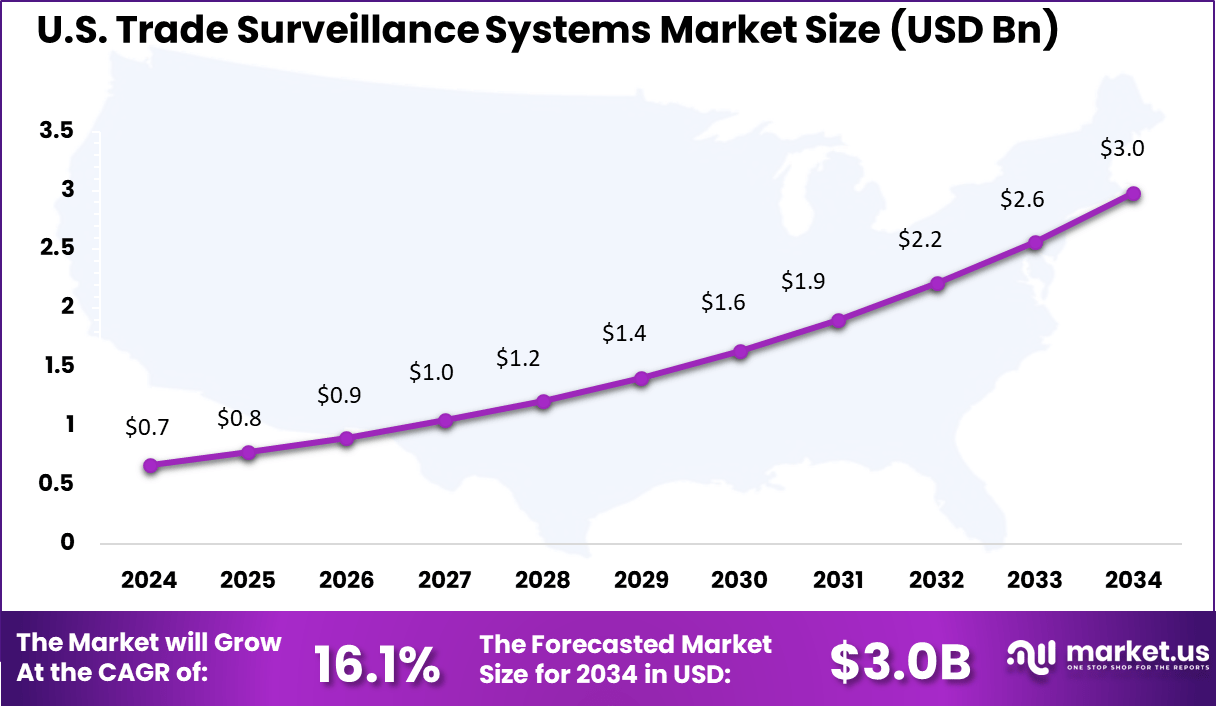

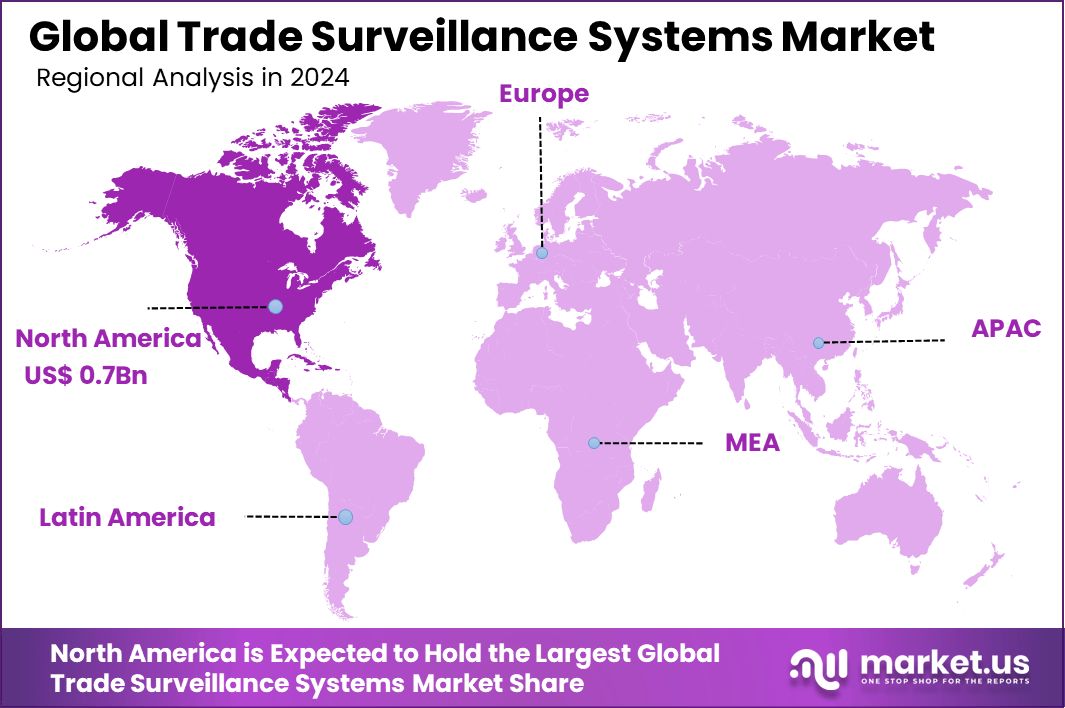

The Global Trade Surveillance Systems Market size is expected to be worth around USD 9.9 Billion By 2034, from USD 1.9 billion in 2024, growing at a CAGR of 18.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 0.7 Billion revenue. In 2024, the U.S. Trade Surveillance Systems market was valued at USD 0.67 billion, growing at a strong CAGR of 16.1%.

Trade surveillance systems are specialized software platforms designed to monitor, detect, and prevent illicit trading activities within financial markets. These systems analyze vast amounts of trading data in real-time to identify patterns indicative of market abuse, such as insider trading, market manipulation, and other fraudulent behaviors. By ensuring compliance with regulatory standards, trade surveillance systems play a crucial role in maintaining market integrity and investor confidence.

The global trade surveillance systems market is experiencing significant growth, driven by increasing regulatory scrutiny and the need for advanced monitoring solutions. Key factors propelling the demand for trade surveillance systems include the proliferation of high-frequency trading, the emergence of complex financial instruments, and the increasing instances of market abuse.

Financial institutions are seeking robust solutions to monitor trading activities across various platforms and asset classes, ensuring compliance with stringent regulatory requirements. Technological advancements are playing a pivotal role in the evolution of trade surveillance systems. The integration of artificial intelligence (AI) and machine learning (ML) enables these systems to analyze trading patterns more effectively, reducing false positives and enhancing detection capabilities.

The adoption of trade surveillance systems is primarily driven by the need to comply with regulatory mandates such as the Market Abuse Regulation (MAR) in Europe and the Dodd-Frank Act in the United States. These regulations require financial entities to implement comprehensive monitoring mechanisms to detect and report suspicious trading activities. Failure to comply can result in substantial penalties and reputational damage.

Key Takeaways

- The global trade surveillance systems market is forecasted to grow significantly, reaching USD 9.9 billion by 2034, up from USD 1.9 billion in 2024, reflecting a robust CAGR of 18.1% during 2025-2034.

- In 2024, North America led the global market, accounting for over 38% of the revenue share, with regional earnings touching USD 0.7 billion.

- The U.S. market alone generated USD 0.67 billion in 2024 and is projected to expand at a healthy CAGR of 16.1%, driven by tighter financial regulations and rising demand for real-time trade monitoring.

- By component, solutions dominated with a 68% share, highlighting increased adoption of advanced analytics tools to detect suspicious trading patterns.

- On the deployment front, cloud-based models led with 62%, fueled by scalability, lower infrastructure cost, and ease of integration with existing trading systems.

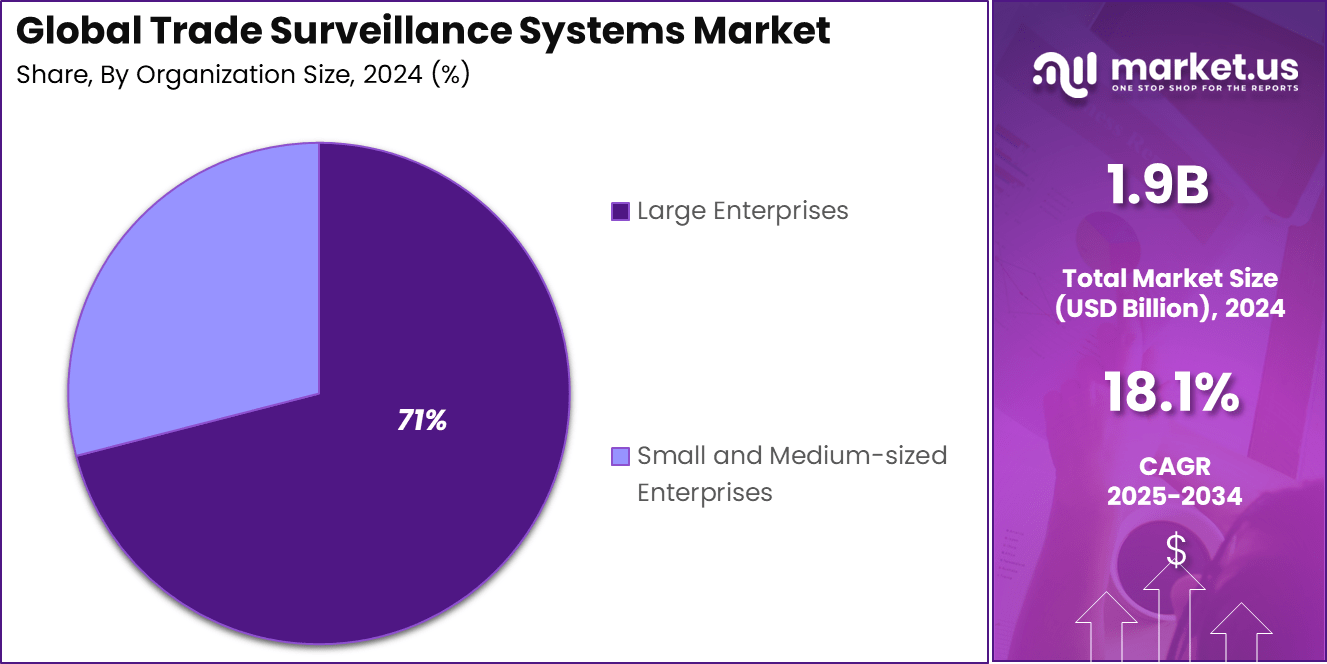

- Large enterprises remained the key adopters, contributing 71% of the market share in 2024, as regulatory compliance becomes more complex and globally enforced.

Analysts’ Viewpoint

Investment opportunities in the trade surveillance systems market are huge, particularly in regions with rapidly developing financial sectors. Asia-Pacific, for instance, is witnessing accelerated growth due to the modernization of its financial infrastructure and increased regulatory enforcement. Investors are focusing on companies that offer innovative, AI-driven surveillance solutions capable of addressing the dynamic needs of global markets.

Implementing trade surveillance systems offers numerous business benefits. These systems enhance the ability of financial institutions to detect and prevent fraudulent activities, thereby safeguarding assets and maintaining investor trust. Additionally, they streamline compliance processes, reduce operational risks, and improve overall market transparency.

The regulatory environment is becoming increasingly stringent, with authorities worldwide emphasizing the importance of proactive market monitoring. Regulatory bodies are not only enforcing compliance but also encouraging the adoption of advanced surveillance technologies to preempt market abuses. This proactive stance is compelling financial institutions to invest in sophisticated monitoring tools.

US Market Expansion

The US Trade Surveillance Systems Market is valued at approximately USD 0.7 Billion in 2024 and is predicted to increase from USD 1.4 Billion in 2029 to approximately USD 3.0 Billion by 2034, projected at a CAGR of 16.1% from 2025 to 2034.

In 2024, North America held a dominant market position in the global trade surveillance systems sector, capturing more than a 38% share, equating to approximately USD 0.7 billion in revenue. This leadership can be attributed to several key factors.

The region’s robust financial infrastructure, encompassing major exchanges and trading platforms, necessitates advanced surveillance solutions to ensure market integrity and compliance with stringent regulatory standards.

Additionally, the increasing complexity of trading activities, including the rise of algorithmic and high-frequency trading, has amplified the need for sophisticated monitoring tools capable of detecting and mitigating potential market abuses in real-time.

Component Analysis

In 2024, the Solutions segment held a dominant market position in the global trade surveillance systems market, capturing more than a 68% share. This dominance can be attributed to the increasing demand for comprehensive surveillance tools that offer real-time monitoring, advanced analytics, and automated compliance tracking.

Financial institutions are prioritizing these solutions to effectively detect and prevent market abuse, insider trading, and other fraudulent activities, ensuring adherence to stringent regulatory requirements. The prominence of the Solutions segment is further reinforced by the integration of advanced technologies such as artificial intelligence and machine learning.

These technologies enhance the capabilities of trade surveillance systems, enabling more accurate detection of complex trading patterns and anomalies. Additionally, the scalability and flexibility of these solutions allow organizations to adapt to evolving market dynamics and regulatory changes efficiently.

Deployment Mode Analysis

In 2024, the Cloud segment held a dominant position in the global trade surveillance systems market, capturing more than a 62% share. This significant market share can be attributed to the growing preference among financial institutions for scalable, cost-effective, and easily deployable surveillance solutions.

Cloud-based systems offer real-time monitoring capabilities, which are essential for detecting and preventing fraudulent activities in today’s fast-paced trading environments. The flexibility and accessibility of cloud solutions enable organizations to adapt quickly to evolving regulatory requirements and market dynamics.

The adoption of cloud-based trade surveillance systems is further driven by the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance the analytical capabilities of surveillance systems, allowing for more accurate detection of complex trading patterns and anomalies.

Organization Size Analysis

In 2024, the Large Enterprises segment held a dominant position in the global trade surveillance systems market, capturing more than a 71% share. This significant market share can be attributed to the extensive trading activities and stringent regulatory compliance requirements that large organizations face.

Operating across multiple asset classes and jurisdictions, these enterprises necessitate robust trade surveillance systems to detect market manipulation, insider trading, and other illicit activities. The need to comply with evolving global regulations, such as MiFID II, Dodd-Frank, and MAR, further accelerates the adoption of sophisticated trade monitoring systems in large organizations.

Moreover, large enterprises often have the financial resources and technical infrastructure to implement advanced surveillance solutions. These solutions, integrated with artificial intelligence and machine learning, enhance the capability to analyze vast datasets, identify complex patterns, and reduce false positives, making them indispensable in modern trading environments.

The emphasis on proactive risk management and the need for transparent trading practices have solidified the preference for integrated solutions over traditional services, positioning the Large Enterprises segment as the cornerstone of trade surveillance strategies.

Key Market Segments

By Component

- Solutions

- Risk & Compliance

- Reporting & Monitoring

- Surveillance & Analytics

- Case Management

- Other Solutions

- Services

- Managed Services

- Professional Services

- Consulting

- Deployment & Integration

- Support & Maintenance

By Deployment Mode

- Cloud

- On-premises

By Organization Size

- Small and Medium-sized Enterprises

- Large Enterprises

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

The trade surveillance landscape is rapidly evolving, driven by the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML). These technologies enhance the detection of complex trading patterns and reduce false positives, thereby improving the efficiency of compliance operations.

Financial institutions are increasingly adopting AI/ML-powered surveillance tools to analyze vast volumes of data, automate anomaly detection, and adapt to rapidly changing market conditions. This shift towards intelligent surveillance is essential for maintaining market integrity and meeting stringent regulatory requirements.

Another significant trend is the growing adoption of cloud-based trade surveillance solutions. Cloud deployments offer scalability, cost-effectiveness, and seamless integration with advanced analytics tools, making them an attractive option for financial firms. The flexibility and accessibility of cloud solutions enable organizations to adapt quickly to evolving regulatory requirements and market dynamics.

Business Benefits

Implementing robust trade surveillance systems provides significant business benefits, particularly in enhancing regulatory compliance and risk management. These systems enable financial institutions to monitor trading activities in real-time, detect potential market abuses, and ensure adherence to regulatory standards.

By proactively identifying and addressing compliance issues, organizations can mitigate the risk of regulatory penalties and reputational damage. Furthermore, advanced surveillance tools support comprehensive audit trails and reporting capabilities, facilitating transparent and efficient regulatory audits.

Beyond compliance, trade surveillance systems contribute to operational efficiency and cost savings. By automating the detection of suspicious activities and reducing false positives, these systems allow compliance teams to focus on genuine risks, thereby optimizing resource allocation.

Additionally, the integration of AI and ML technologies enhances the accuracy and speed of surveillance processes, enabling quicker decision-making and response times. This operational agility not only improves the effectiveness of compliance programs but also supports the overall strategic objectives of financial institutions.

Driver

Regulatory Compliance and Market Integrity

The increasing emphasis on regulatory compliance and the imperative to uphold market integrity are significant drivers for the adoption of trade surveillance systems. Financial institutions are under mounting pressure to detect and prevent market abuses such as insider trading and spoofing.

This is evident in the proactive measures taken by regulatory bodies; for instance, Germany’s financial regulator, BaFin, has integrated artificial intelligence into its surveillance systems to enhance the detection of market abuse, thereby increasing the likelihood of identifying and penalizing offenders .

The necessity for robust surveillance mechanisms is further underscored by the evolving complexity of financial markets. As trading activities become more sophisticated, the potential for illicit practices escalates, necessitating advanced surveillance solutions.

The implementation of comprehensive trade surveillance systems enables institutions to monitor trading activities effectively, ensuring adherence to regulatory standards and fostering a transparent trading environment.

Restraint

High Implementation and Operational Costs

Despite the clear benefits, the high costs associated with implementing and maintaining trade surveillance systems pose a significant restraint. The financial burden includes expenses related to technology acquisition, system integration, ongoing maintenance, and the recruitment of specialized personnel.

Moreover, the rapid evolution of trading strategies and financial instruments necessitates continual updates and enhancements to surveillance systems, further escalating operational costs. The integration of surveillance solutions with existing legacy systems can also present technical challenges, leading to additional expenditures and potential inefficiencies.

Opportunity

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into trade surveillance systems presents a significant opportunity for enhancing their effectiveness. AI and ML technologies enable the analysis of vast datasets to identify complex patterns and anomalies indicative of market abuse.

This capability allows for more accurate detection of suspicious activities and reduces the incidence of false positives, thereby improving the efficiency of compliance operations. The adoption of AI and ML also facilitates real-time monitoring of trading activities, enabling institutions to respond swiftly to potential threats.

As financial markets continue to evolve, the ability to adapt surveillance mechanisms dynamically through AI and ML integration becomes increasingly valuable. This technological advancement not only enhances compliance capabilities but also positions institutions to proactively mitigate risks associated with market manipulation.

Challenge

Data Privacy and Security Concerns

The implementation of trade surveillance systems raises significant concerns regarding data privacy and security. These systems often require access to sensitive information, including personal and transactional data, which must be handled in compliance with stringent data protection regulations.

Ensuring the confidentiality and integrity of this data is paramount, as breaches can lead to legal repercussions and damage to institutional reputations. Furthermore, the collection and analysis of unstructured data from various communication channels introduce additional complexities in maintaining data privacy.

Balancing the need for comprehensive surveillance with the obligation to protect individual privacy rights presents an ongoing challenge. Institutions must navigate these concerns carefully, implementing robust data governance frameworks to ensure compliance with privacy laws while effectively monitoring for market abuses

Key Player Analysis

In 2024, Software AG divested its webMethods and StreamSets platforms to IBM, marking a strategic shift in its operations. This transition allowed Software AG to concentrate on its core competencies in enterprise integration and data analytics.

The acquisition by IBM was finalized on July 1, 2024, and included the migration of support systems to IBM’s infrastructure. This move is expected to enhance IBM’s capabilities in data integration and cloud services, while Software AG refocuses on its primary business areas.

NICE Ltd. has significantly advanced its trade surveillance offerings through the integration of generative AI into its SURVEIL-X platform. In May 2025, the company announced that this enhancement could reduce false positives by up to 85% and detect up to four times more true misconduct risks.

BAE Systems has been actively expanding its defense capabilities through strategic acquisitions and contracts. In February 2024, the company completed the acquisition of Ball Aerospace, rebranding it as BAE Space and Mission Systems, thereby enhancing its position in the aerospace sector.

Furthermore, in June 2025, BAE Systems, in collaboration with partners from Italy and Japan, received EU approval for a joint venture aimed at developing a sixth-generation combat aircraft under the Global Combat Air Programme (GCAP). These initiatives reflect BAE Systems’ commitment to advancing its technological prowess in defense and aerospace.

Top Key Players Covered

- Software AG

- Nice Ltd.

- BAE Systems, Inc.

- eFlow Ltd.

- Fidelity National Information Services, Inc.

- Nasdaq, Inc.

- SIA S.P.A.

- Aquis Technologies

- B-Next Group

- ACA Compliance Group Holdings, LLC

- Trillium Management LLC

- Others

Recent Developments

- In October 2025, the European Securities and Markets Authority (ESMA) officially approved the use of AI and machine learning in trade surveillance, signaling regulatory endorsement for innovation in financial compliance and promoting more robust market integrity.

- In July 2024, eFlow Global launched an upgraded version of its AI-driven eComms Surveillance tool, addressing the increasing regulatory focus on electronic communications surveillance.

- In March 2024, Refinitiv partnered with IBM to integrate IBM’s Watson for Financial Crimes Detection into its trade surveillance solutions, leveraging AI and machine learning to identify intricate patterns of market manipulation. This move reflects a broader industry trend toward intelligent automation in compliance systems.

- In May 2024, NICE Actimize announced a major investment in its trade surveillance platform, aiming to expand its advanced analytics and machine learning capabilities to strengthen its competitive position.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Bn Forecast Revenue (2034) USD 9.9 Bn CAGR (2025-2034) 18.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions (Risk & Compliance, Reporting & Monitoring, Surveillance & Analytics, Case Management, Other Solutions), Services (Managed Services, Professional Services (Consulting, Deployment & Integration, Support & Maintenance))), By Deployment Mode (Cloud, On-premises), By Organization Size (Small and Medium-sized Enterprises, Large Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Software AG, Nice Ltd., BAE Systems, Inc., eFlow Ltd., Fidelity National Information Services, Inc., Nasdaq, Inc., SIA S.P.A., Aquis Technologies, B-Next Group, ACA Compliance Group Holdings, LLC, Trillium Management LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Trade Surveillance Systems MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Trade Surveillance Systems MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Software AG

- Nice Ltd.

- BAE Systems, Inc.

- eFlow Ltd.

- Fidelity National Information Services, Inc.

- Nasdaq, Inc.

- SIA S.P.A.

- Aquis Technologies

- B-Next Group

- ACA Compliance Group Holdings, LLC

- Trillium Management LLC

- Others