Global Trade Lifecycle Management Market Size, Share, Industry Analysis Report By Component (Software, Services), By Deployment Mode (On-Premises, Cloud), By Organization Size (Large Enterprises, Small and Medium Enterprises), By End-User (Banks, Asset Management Firms, Brokerage Firms, Insurance Companies, Others), By Application (Trade Processing, Risk and Compliance Management, Settlement and Clearing, Reporting and Analytics, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 168831

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

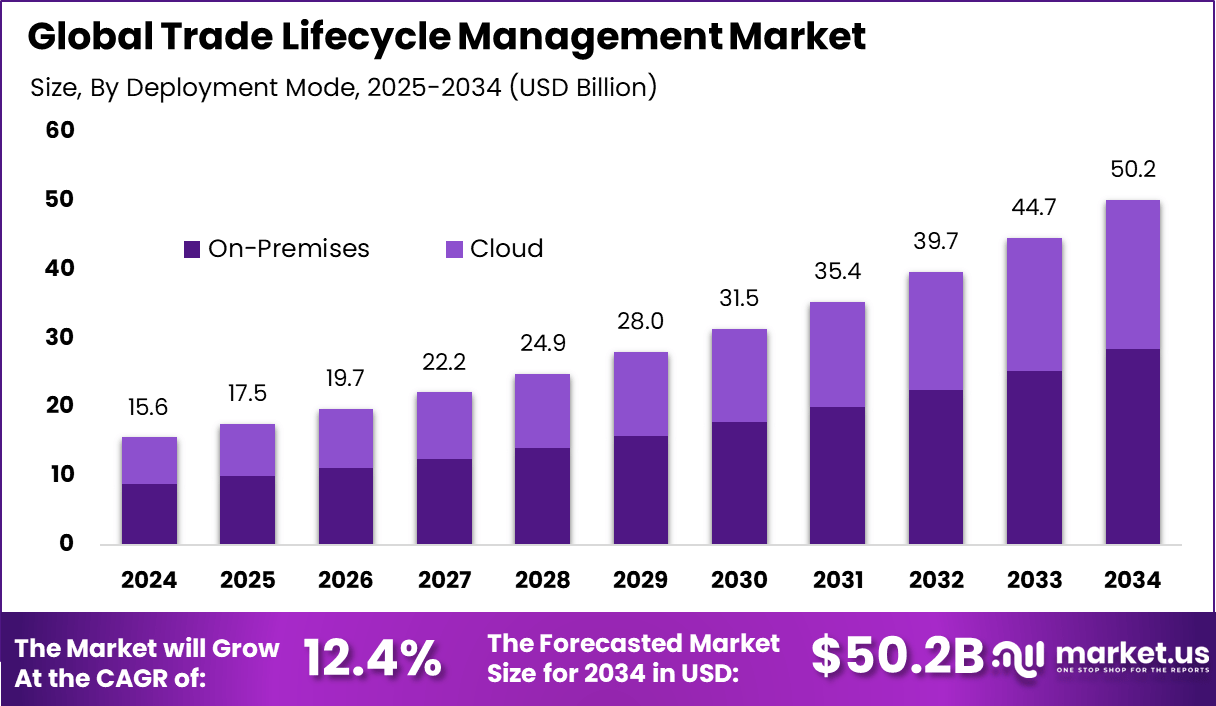

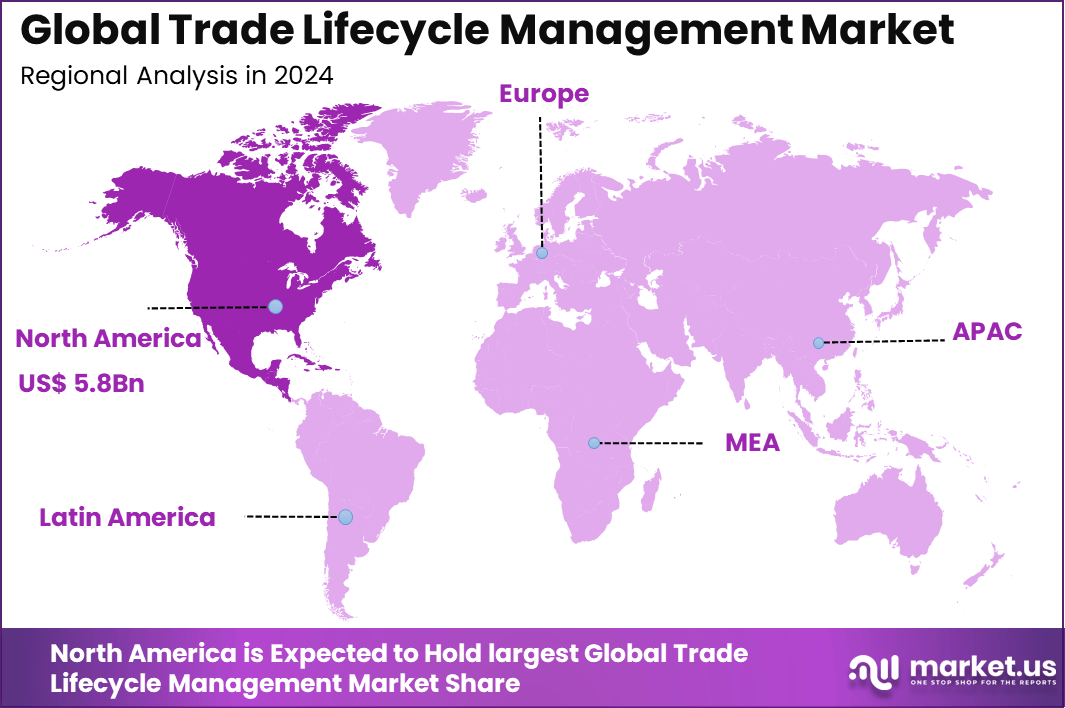

The Global Trade Lifecycle Management Market generated USD 15.6 billion in 2024 and is predicted to register growth from USD 17.5 billion in 2025 to about USD 50.2 billion by 2034, recording a CAGR of 12.4% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 37.2% share, holding USD 5.8 Billion revenue.

The trade lifecycle management market has expanded as financial institutions modernise their front, middle and back office systems to handle increasing transaction volumes, complex asset classes and stricter regulatory requirements. Growth reflects the need for seamless trade capture, validation, risk checks, clearing, settlement and reporting within unified digital platforms. Both buy side and sell side firms rely on lifecycle solutions to manage end to end trade operations with greater efficiency and accuracy.

The growth of the market can be attributed to rising regulatory reporting obligations, the shift toward multi asset trading and stronger expectations for real time risk visibility. Financial institutions aim to reduce operational errors, streamline reconciliation processes and improve intraday oversight. The expansion of electronic trading, increasing use of derivatives and demand for integrated post trade automation further support market development.

Top Market Takeaways

- Software solutions dominated the market with 75.7%, reflecting the strong shift toward automated and integrated trade lifecycle platforms.

- On-premises systems held 56.6%, supported by financial institutions’ focus on security, compliance, and internal data governance.

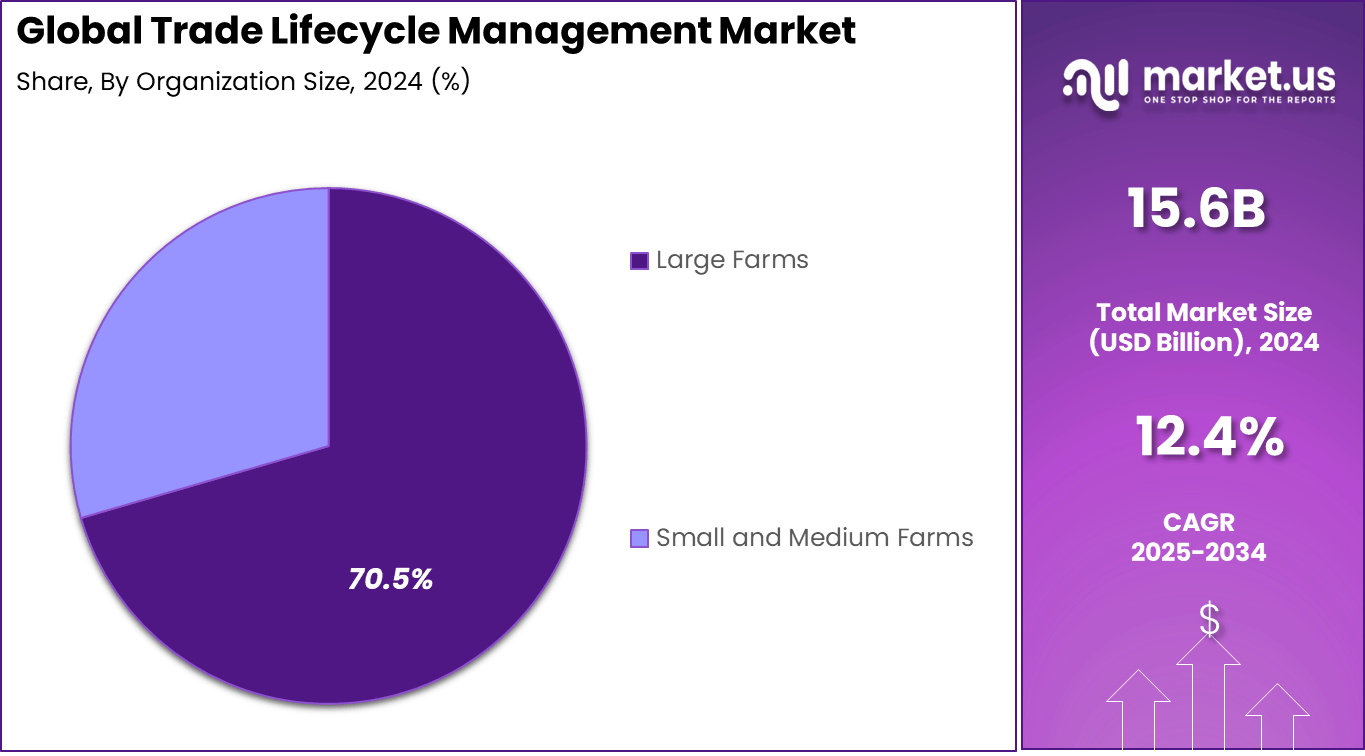

- Large enterprises accounted for 70.5%, as complex, high-volume trading operations depend on end-to-end lifecycle management tools.

- Banks led the end-user landscape with 38.8%, driven by regulatory reporting requirements and the need for real-time trade visibility.

- Trade processing emerged as the leading application with 36.9%, supported by demand for fast reconciliation, clearing, and settlement.

- North America held 37.2% of global revenue, driven by advanced financial markets and strong adoption of digital trading infrastructure.

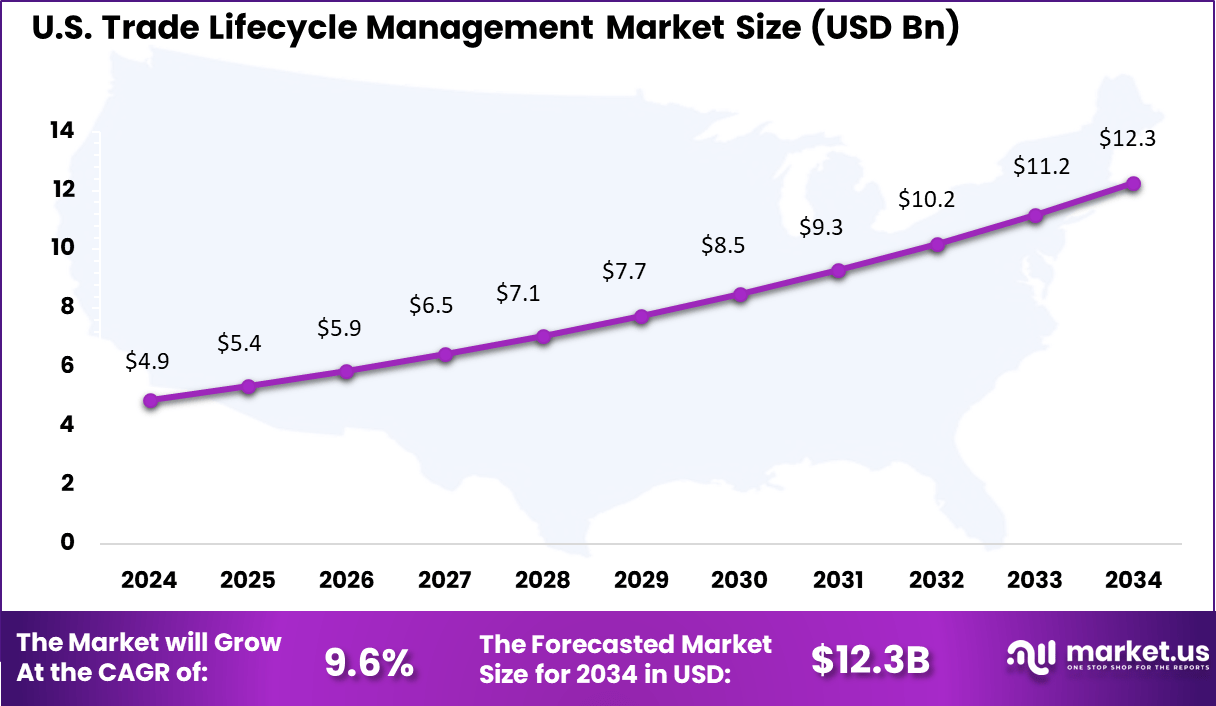

- The U.S. market reached USD 4.94 billion, expanding at a 9.6% CAGR, supported by continued investments in automation and compliance-driven trade operations.

By Component

In 2024, the software segment held 75.7 % share, reflecting the strong shift toward automated and integrated platforms that support real-time processing across the full trade lifecycle. Institutions relied on software to streamline order capture, validation, matching, and settlement activities, reducing operational risk while meeting rising compliance requirements.

The segment benefited from the growing need for unified systems that manage trades across multiple asset classes with accuracy and speed. The second layer of growth came from increasing adoption of configurable modules and analytics tools that helped institutions enhance visibility into trade workflows.

These software platforms allowed trading firms to modernise legacy systems and strengthen connections between front, middle, and back-office environments. As digital transformation accelerated, firms prioritised software-based architectures due to their ability to scale with rising trading volumes and regulatory demands.

By Deployment Mode

In 2024, the on-premises deployment model accounted for 56.6 % share, driven by the financial sector’s strong emphasis on data security, privacy, and regulatory alignment. Many institutions continued to trust on-premises systems because they provided full ownership of critical trade data and ensured compliance with strict governance policies.

The model remained essential for organisations operating with sensitive high-value transactions and complex internal risk controls. The continued reliance on long-established hardware infrastructure strengthened this segment further.

Many firms preferred to integrate new lifecycle systems into existing technology stacks rather than move core operations to external cloud environments. On-premises deployments offered predictable performance, controlled access, and minimal transition risk, making them attractive for institutions with deep-rooted operational frameworks.

By Organization Size

In 2024, large enterprises held 70.5 % of the market, supported by their vast trading activities, multi-asset portfolios, and extensive compliance obligations. These organisations required high-performance platforms to manage large volumes of trades and maintain strong governance across execution, risk monitoring, and settlement functions.

Their ability to invest in comprehensive lifecycle solutions strengthened their dominance in this segment. The complexity of their operations encouraged continuous upgrades to more advanced, integrated systems capable of eliminating manual processes.

Large enterprises focused on strengthening connectivity between trading desks and back-office teams, improving audit trails, and reducing delays in reconciliation. Their demand for sophisticated capabilities ensured steady adoption of lifecycle systems.

By End-User

In 2024, banks accounted for 38.8 % share, making them the largest end-user group due to their central role in global trading and settlement networks. Banks relied on lifecycle platforms to manage high transaction volumes with accuracy, ensuring trades progressed smoothly from execution to confirmation and settlement. Their responsibilities under evolving regulatory frameworks reinforced the need for advanced post-trade systems.

The importance of risk management and reporting further strengthened adoption among banks. Lifecycle platforms helped reduce settlement failures, enhance compliance transparency, and support real-time monitoring of trading activities. As trading environments became more automated, banks continued to prioritise systems that delivered reliability and operational efficiency.

By Application

In 2024, trade processing represented 36.9 % share, reflecting its essential role as the foundation of the trade lifecycle. Institutions depended on automated processing tools to reduce manual intervention and accelerate the movement of trades from initiation to settlement. The application supported improvements in accuracy, workflow transparency, and regulatory compliance.

Growing transaction volumes and multi-asset trading strengthened this segment further. Institutions sought straight-through-processing tools to reduce bottlenecks and improve overall efficiency. Enhanced analytics and monitoring features within trade processing solutions enabled organisations to detect errors early and maintain consistent control over post-trade workflows.

US Market Size

In 2024, the U.S. market size for trade lifecycle management was estimated at USD 4.94 billion. This underscores the scale of demand for trade lifecycle management solutions within the country, reflecting the critical role of U.S. based financial institutions in global capital markets. The large volume of trade transactions, regulatory mandates and operational complexity have driven significant investments in platform adoption.

In 2024, the region accounted for approximately 37.2% of the global trade lifecycle management market. North America’s leading share can be attributed to its mature capital markets, high adoption of advanced trade-processing technologies, well-established regulatory frameworks and presence of major banks and financial institutions requiring sophisticated solutions. The demand for integrated platforms to manage complex trades, compliance and reporting underpins this regional dominance.

Emerging Trends

A notable trend in the TLM market is the increasing adoption of advanced technologies such as artificial intelligence, machine learning, and blockchain. These technologies are enabling automation of trade processing workflows, reduction of manual intervention, and improved risk management and compliance reporting. Real-time analytics and automated exception management are emerging as standard features within modern TLM platforms.

Another trend is the shift toward integrated, platform-based solutions that provide end-to-end coverage of the trade lifecycle. Rather than segmented tools for individual stages (trade capture, confirmation, settlement, etc.), institutions increasingly prefer unified systems that link front, middle and back-office operations within a single interface. This reduces complexity and improves consistency across the trade lifecycle.

Growth Factors

Regulatory compliance and regulatory complexity constitute a major growth driver for the TLM market. As global regulatory frameworks evolve and become more stringent – mandating transparency, timely reporting, and auditability – financial institutions and asset managers increasingly require robust systems to ensure compliance, reduce operational risk, and maintain regulatory readiness. This dynamic encourages adoption of full-featured lifecycle management solutions.

Another growth factor is the rising volume and complexity of trades. As markets expand and financial instruments diversify, the number and intricacy of transactions handled by institutions increases. This leads to greater demand for automation, real-time processing, accurate reconciliation, and risk controls that only comprehensive TLM solutions can robustly deliver.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By End-User

- Banks

- Asset Management Firms

- Brokerage Firms

- Insurance Companies

- Others

By Application

- Trade Processing

- Risk and Compliance Management

- Settlement and Clearing

- Reporting and Analytics

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

The growth of trade lifecycle management is driven by the steady rise in transaction volumes across capital markets. The need for accurate trade capture, faster validation, and smooth settlement has become essential as financial institutions handle more complex instruments. This shift has created strong demand for systems that can reduce manual work and improve straight through processing.

The adoption of digital tools is allowing firms to improve accuracy and minimize operational lapses, which strengthens the overall efficiency of trade execution and post trade activities. The driver is further reinforced by the regulatory obligation to maintain transparent and timely reporting.

Institutions are required to track every stage of the trade lifecycle with higher precision, from order initiation to final settlement. As compliance pressure grows, firms prefer integrated platforms that can automate monitoring and reduce the risk of non compliance. This regulatory pull has encouraged the implementation of advanced trade lifecycle solutions across global markets.

Restraint

The adoption of trade lifecycle management platforms is restrained by the high integration cost that many institutions face. Legacy systems are deeply embedded in daily operations, and replacing or integrating them with modern platforms often requires significant investment.

Smaller firms may delay upgrades because of limited technology budgets and concerns around operational interruptions during migration. This cost factor slows down the pace of adoption, particularly in regions where financial institutions are still dependent on older infrastructure. Another restrictive factor is the limited availability of skilled professionals who can manage modern lifecycle systems.

The complexity of multi asset trading, coupled with the need for constant adjustments, increases the demand for technology specialists. Many institutions struggle to maintain the talent required to operate and optimize advanced platforms. This shortage of expertise acts as a barrier for smooth deployment and long term system sustainability.

Opportunity

A major opportunity is emerging from the shift toward real time processing across global trading environments. Institutions are now moving toward instant settlement workflows, and this transition is increasing the demand for intelligent platforms that can analyze, validate, and clear trades without delay.

Vendors offering real time insights, exception management, and automated reconciliation are well positioned to benefit from this transition. The rise of cloud based solutions is also expanding the ability of firms to scale their operations without heavy hardware investment. There is also growing potential in the use of analytics and machine learning within the trade lifecycle.

These tools support predictive risk assessment and help institutions detect unusual trade patterns faster. As firms focus on strengthening risk control and improving operational resilience, the appetite for advanced analytics is increasing. This creates new revenue opportunities for providers that can deliver decision support tools integrated with lifecycle workflows.

Challenge

One of the key challenges is the fragmentation of systems used for different stages of the trade lifecycle. Many institutions still rely on separate tools for order management, confirmation, clearing, and settlement, leading to synchronization issues. This fragmentation increases the chance of errors and delays, especially when volumes rise.

Bringing all modules together under a unified architecture requires extensive redesign and long implementation timelines, which can slow down modernization efforts. Another challenge lies in maintaining compliance with rapidly changing regulations across global markets.

Each jurisdiction introduces new reporting rules, data formats, and validation requirements. Firms must continuously update their systems to stay aligned with these guidelines, which adds operational pressure. Keeping platforms flexible and adaptable becomes difficult as the regulatory landscape evolves, making ongoing compliance a complex and resource heavy task.

Competitive Analysis

FIS Global, Broadridge, Finastra, Murex, and Adenza (Calypso) lead the trade lifecycle management market with end-to-end platforms covering trade capture, validation, risk management, clearing, and settlement. Their systems support global banks, asset managers, and market infrastructure firms by ensuring accuracy, regulatory compliance, and straight-through processing.

ION Group, SimCorp, SS&C Technologies, Infosys, TCS, Cognizant, Accenture, and Wipro strengthen the competitive landscape with modular lifecycle automation, portfolio management integration, and multi-asset support. Their solutions help firms reduce operational risk, improve reconciliation efficiency, and streamline middle-office workflows. These providers prioritize interoperability, cloud deployment, and strong managed-service models.

Oracle Financial Services, SAP, SmartStream, Linedata, Quod Financial, Profile Software, and others expand the market with specialized tools for exception management, collateral oversight, corporate actions, and post-trade analytics. Their platforms support real-time monitoring, faster settlement cycles, and greater transparency across trading desks. These companies serve institutions seeking flexible, scalable, and compliance-ready trade lifecycle systems.

Top Key Players in the Market

- FIS Global

- Broadridge Financial Solutions

- Finastra

- Murex

- Calypso Technology (now Adenza)

- ION Group

- SimCorp

- SS&C Technologies

- Infosys

- Tata Consultancy Services (TCS)

- Cognizant

- Accenture

- Wipro

- Oracle Financial Services

- SAP

- SmartStream Technologies

- Misys (now part of Finastra)

- Linedata

- Quod Financial

- Profile Software

- Other

Recent Developments

- November 2025, Broadridge partnered with Xceptor for global tax reclaims and asset servicing. Their joint platform connects data, docs, and decisions to cut costs and errors in post-trade processing. It directly tackles lifecycle bottlenecks in reconciliation and reporting.

- August 2025, FIS launched its Investor Services Suite. This new tool streamlines the full investor servicing process from onboarding to screening, helping fund managers cut down on manual work and stay compliant amid growing regs. It fits right into trade lifecycle needs by automating key steps for better efficiency.

Report Scope

Report Features Description Market Value (2024) USD 15.6 Bn Forecast Revenue (2034) USD 50.2 Bn CAGR(2025-2034) 12.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (On-Premises, Cloud), By Organization Size (Large Enterprises, Small and Medium Enterprises), By End-User (Banks, Asset Management Firms, Brokerage Firms, Insurance Companies, Others), By Application (Trade Processing, Risk and Compliance Management, Settlement and Clearing, Reporting and Analytics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape FIS Global, Broadridge Financial Solutions, Finastra, Murex, Calypso Technology (now Adenza), ION Group, SimCorp, SS&C Technologies, Infosys, Tata Consultancy Services (TCS), Cognizant, Accenture, Wipro, Oracle Financial Services, SAP, SmartStream Technologies, Misys (now part of Finastra), Linedata, Quod Financial, Profile Software, Other. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Trade Lifecycle Management MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Trade Lifecycle Management MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- FIS Global

- Broadridge Financial Solutions

- Finastra

- Murex

- Calypso Technology (now Adenza)

- ION Group

- SimCorp

- SS&C Technologies

- Infosys

- Tata Consultancy Services (TCS)

- Cognizant

- Accenture

- Wipro

- Oracle Financial Services

- SAP

- SmartStream Technologies

- Misys (now part of Finastra)

- Linedata

- Quod Financial

- Profile Software

- Other