Global Track and Trace Solutions Market Size, Share and Analysis Report By Component (Hardware, Software, Services), By Technology (RFID, Barcode, GPS, Biometrics, Others), By Application (Serialization & Aggregation, Supply Chain Visibility, Asset Tracking, Pedigree & ePedigree Systems), By End-User Industry (Pharmaceuticals & Healthcare, Food & Beverage, Logistics & Transportation, Retail & Consumer Goods, Automotive & Manufacturing, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 20950

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

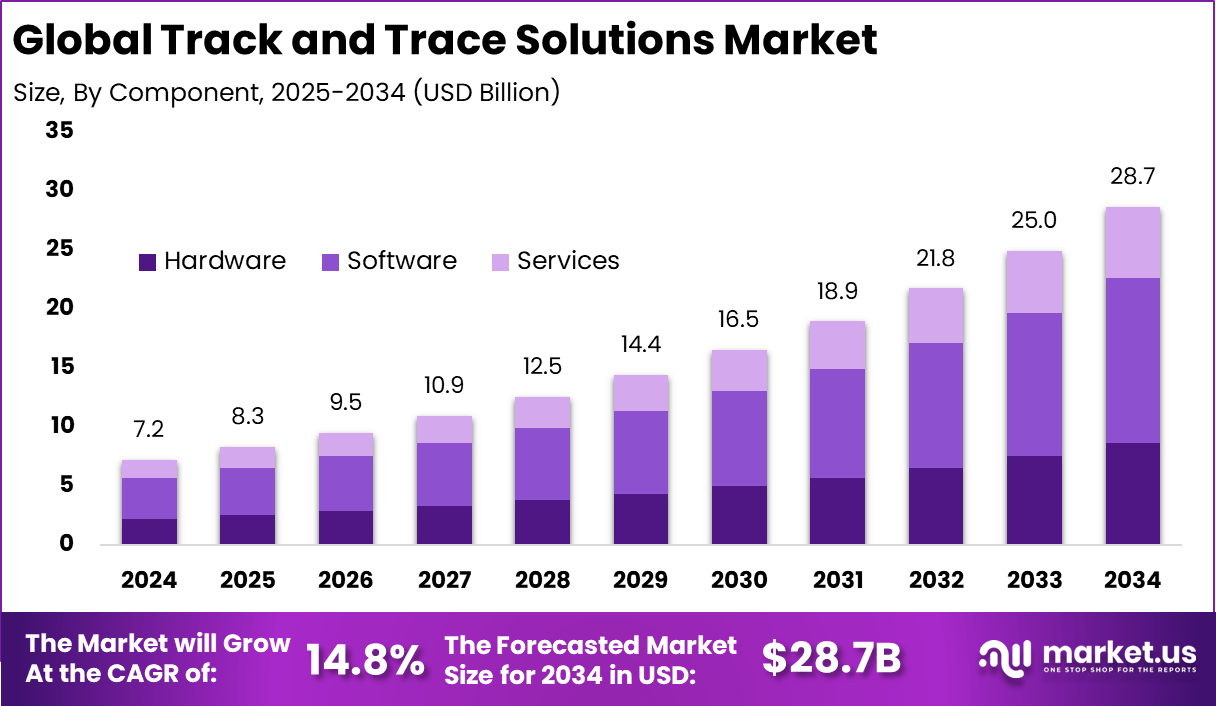

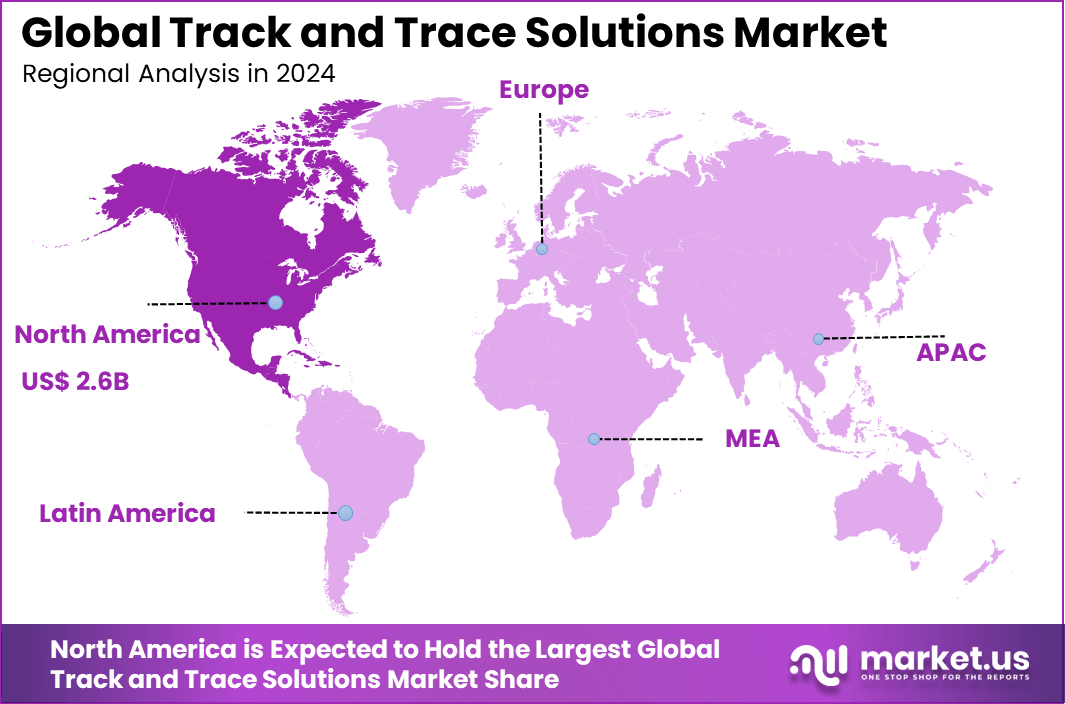

The Global Track and Trace Solutions Market size is expected to be worth around USD 28.7 Billion By 2034, from USD 8.3 billion in 2025, growing at a CAGR of 14.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominan Market position, capturing more than a 36.2% share, holding USD 2.6 Billion revenue.

The track and trace solutions market refers to systems that monitor the movement of products, assets, or materials across supply chains and logistical networks. These solutions use technologies such as barcode scanning, RFID, GPS, and real-time visibility platforms to capture location and status information. By linking this information to centralized monitoring systems, organizations can observe movement, anticipate delays, and verify deliveries. These capabilities support sectors including pharmaceuticals, logistics, food and beverage, manufacturing, and retail.

Growth in the market is driven by increasing demand for transparency, faster delivery times, and improved inventory control. As supply chains become more complex with global sourcing and multiple handling points, the need to capture accurate and timely tracking information becomes more important. Track and trace solutions help reduce losses from misrouting, improve customer satisfaction with delivery visibility, and support compliance with regulatory requirements for product authenticity and safety.

Top Market Takeaways

- Software led the track and trace solutions market with a 48.9% share, as enterprises prioritize real-time monitoring, data analytics, and compliance reporting across supply chains.

- Barcode technology accounted for 62.7%, reflecting its cost efficiency, ease of deployment, and widespread acceptance across industries.

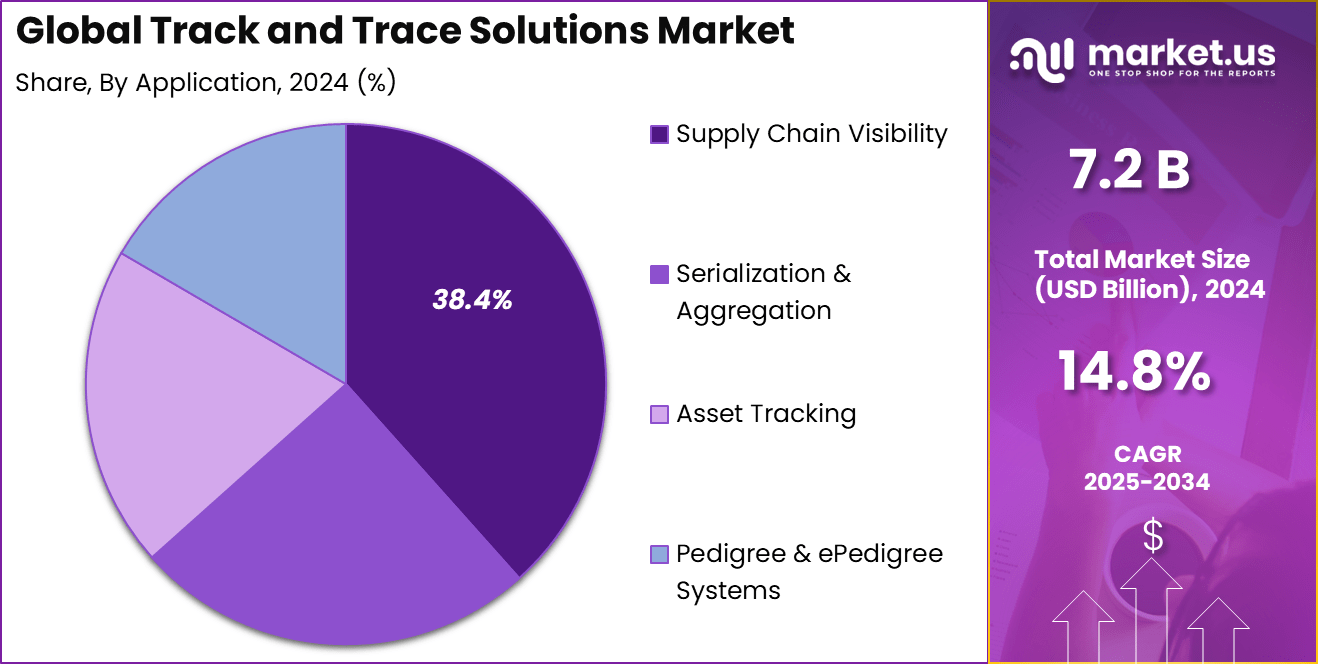

- Supply chain visibility represented 38.4%, driven by demand for end-to-end tracking, inventory accuracy, and disruption management.

- Pharmaceuticals and healthcare captured 41.3%, supported by strict regulatory requirements, drug safety mandates, and serialization needs.

- North America held 36.2% share, backed by advanced logistics infrastructure and strong regulatory enforcement.

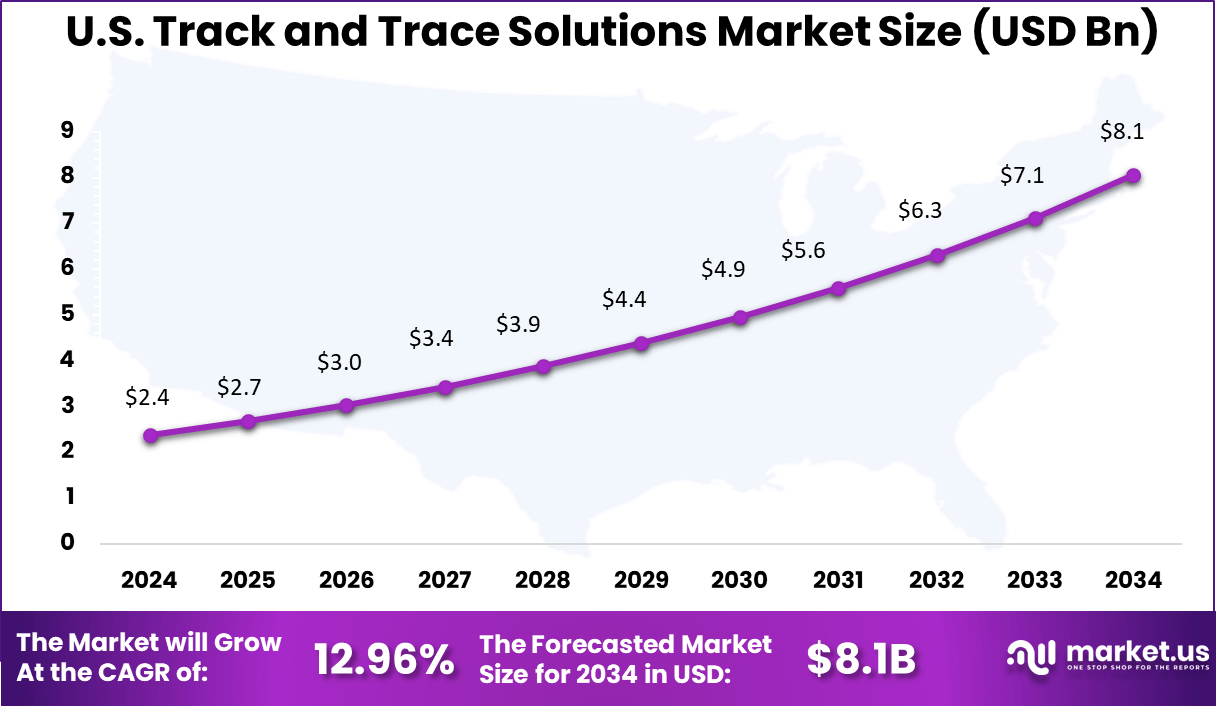

- The U.S. market reached USD 2.38 billion and is expanding at a 12.96% CAGR, driven by digital supply chain investments and rising demand for product traceability.

Quick Market Facts

Adoption Rates by Industry (2025)

- Pharmaceuticals: Adoption remains the highest, with over 75% of the global medicine supply chain now covered by track and trace regulations. Large manufacturers show near-universal adoption, driven by strict serialization rules to address counterfeit drug losses estimated at USD 200 billion annually.

- Food and Beverage: Adoption is accelerating, with the food traceability segment valued between USD 19.72 billion and USD 26.1 billion in 2025. Uptake is strongest in meat and livestock, accounting for nearly 50% of application share, followed by fresh produce where safety and origin tracking are critical.

- General Supply Chain: Traceability has become a strategic priority, with 79% of organizations identifying it as a top corporate objective. However, visibility remains uneven, as 95% of firms monitor Tier-1 suppliers, while only 42% have extended traceability to Tier-2 suppliers or beyond.

By Component

Software accounts for 48.9%, indicating its central role in track and trace systems. Software platforms manage data capture, serialization, reporting, and real-time monitoring across supply chains. These systems help organizations maintain visibility over product movement. Software also supports compliance and audit requirements.

The strong adoption of software is driven by the need for centralized data management. Organizations rely on software to integrate tracking data from multiple sources. Advanced analytics improve decision-making and risk control. Software flexibility supports deployment across industries.

By Technology

Barcode technology holds 62.7%, making it the most widely used tracking method. Barcodes are simple, cost-effective, and easy to implement across supply chains. They support fast identification and scanning of products. This technology remains reliable for large-scale operations.

Adoption of barcodes is driven by compatibility with existing infrastructure. Organizations prefer barcodes due to low hardware investment and minimal training needs. Barcode systems also support high processing speed. These advantages sustain widespread usage.

By Application

Supply chain visibility accounts for 38.4%, highlighting its importance in tracking product movement. Organizations use track and trace systems to monitor inventory across production, storage, and distribution. Real-time visibility helps reduce delays and losses. Accurate tracking improves operational planning.

Growth in this application is driven by demand for transparency and efficiency. Companies seek better control over supply chain disruptions. Track and trace solutions help identify bottlenecks quickly. This supports smoother operations and improved service levels.

By End-User Industry

Pharmaceuticals and healthcare hold 41.3%, making them the leading end-user industry. These sectors require strict tracking to ensure product safety and authenticity. Track and trace systems help prevent counterfeiting and diversion. Regulatory compliance is a key requirement.

Adoption in this industry is driven by patient safety and regulatory standards. Organizations rely on tracking systems to monitor drug movement and storage conditions. Accurate traceability supports recalls and audits. This reinforces continued adoption.

By Region

North America accounts for 36.2%, supported by advanced supply chain infrastructure and regulatory enforcement. Organizations in the region invest heavily in digital tracking systems. High adoption across healthcare and manufacturing supports market growth. Technology readiness remains strong.

For instance, In October 2024, Multi Color Corporation announced the acquisition of Starport Technologies, a smart label solutions provider based in Kansas City, Missouri. The acquisition strengthens MCC’s RFID capabilities and expands its intelligent packaging offerings.

The United States reached USD 2.38 Billion with a CAGR of 12.96%, reflecting steady market expansion. Growth is driven by demand for supply chain transparency and compliance. Enterprises continue to upgrade tracking capabilities. Track and trace solutions remain critical to operations.

Emerging Trends

Shift Toward Integrated Digital and Cloud-Based Platforms

One trend in the track and trace solutions market is the movement toward integrated digital platforms that combine data from multiple sources into unified dashboards. Cloud-based systems allow stakeholders to access real-time information regardless of their location. These platforms support scalability and reduce the need for on-site infrastructure, making it easier for organizations to share data with partners.

Another emerging trend is the use of advanced identification technologies such as RFID and IoT sensor networks. These technologies allow automatic data collection and continuous status updates without manual scanning. When combined with analytics tools, track and trace systems can highlight inefficiencies, detect deviations from expected routes, and support proactive decision making.

Growth Factors

Increasing Demand for Supply Chain Visibility and Regulatory Compliance

A major growth factor for the track and trace solutions market is the ongoing demand for supply chain visibility. Companies seek detailed information about where goods are at every stage of movement. Visibility helps prevent delays, identify bottlenecks, and support accurate delivery timelines. As customers and partners expect transparency, track and trace platforms become essential elements of supply chain operations.

Another growth factor is regulatory pressure. Many governments require documented tracking of certain categories of products to prevent fraud, contamination, and counterfeiting. For example, regulations in the pharmaceutical and food sectors mandate serialization and traceability to ensure safety and quality. Organizations invest in track and trace solutions to comply with these rules and avoid penalties.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Technology

- RFID

- Barcode

- GPS

- Biometrics

- Others

By Application

- Supply Chain Visibility

- Serialization & Aggregation

- Asset Tracking

- Pedigree & ePedigree Systems

By End-User Industry

- Pharmaceuticals & Healthcare

- Food & Beverage

- Logistics & Transportation

- Retail & Consumer Goods

- Automotive & Manufacturing

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Need to Reduce Losses and Improve Inventory Control

A key driver of the track and trace solutions market is the need to reduce losses due to theft, misplacement, or damage. By continuously tracking the movement of goods, organizations can identify where losses occur and take corrective actions. This capability is especially important for high-value items and sensitive shipments that require close monitoring.

Another driver is improved inventory control. Real-time tracking allows companies to maintain up-to-date records of stock levels, expected arrivals, and product readiness. Better inventory visibility supports planning, reduces overstock, and helps firms avoid stockouts. These operational advantages strengthen supply chain performance.

Restraint Analysis

High Implementation Cost and Technical Complexity

A significant restraint in the track and trace solutions market is the cost of implementation. Establishing a robust system may require investment in hardware (such as tags and readers), software licenses, and integration with existing enterprise systems. Smaller enterprises or those with limited budgets may delay deployment until clear benefits are demonstrated.

Another restraint is technical complexity. Track and trace systems must connect with many types of equipment, networks, and data formats. Integration with legacy systems, multiple suppliers, and disparate IT environments can require specialized configuration. This complexity increases deployment time and may require external technical support.

Opportunity Analysis

Expansion Into Small and Medium-Sized Enterprises and Cross-Industry Use Cases

There is a strong opportunity in extending track and trace adoption among small and medium-sized enterprises (SMEs). As the cost of sensors, connectivity, and software declines, these firms can leverage track and trace solutions to improve basic operations and compete with larger organizations. Affordable, modular systems tailored to SME needs can drive wider market growth.

Another opportunity lies in cross-industry applications. Track and trace solutions originally developed for logistics and manufacturing are being applied in healthcare, agriculture, retail, and service sectors. For example, tracking medical equipment, monitoring perishable produce, and tracing repair parts help organizations reduce waste and improve operational reliability. Providers that support diverse use cases can expand market reach.

Challenge Analysis

Data Privacy and Interoperability Issues

A major challenge in the track and trace solutions market is ensuring data privacy and secure sharing among partners. Supply chains often involve multiple organizations with different access requirements. Protecting sensitive information while enabling visibility requires careful permission controls, encryption, and governance policies. Failure to manage data securely can undermine trust and lead to regulatory risks.

Another challenge is interoperability across different systems and standards. Supply chain partners may use varied software, communication protocols, and identification formats. Ensuring that track and trace data flows smoothly between these systems without loss of accuracy or consistency requires standardization efforts and middleware solutions. Addressing interoperability increases both technical workload and project complexity.

Competitive Analysis

Zebra Technologies Corporation, Siemens AG, SAP SE, Oracle Corporation, and Honeywell International, Inc. lead the track and trace solutions market with enterprise platforms that enable end to end product visibility across manufacturing, logistics, and healthcare. Their solutions support serialization, data capture, and real time monitoring. These companies focus on scalability, regulatory compliance, and integration with ERP and supply chain systems. Rising focus on transparency and compliance continues to strengthen their position.

Datalogic S.p.A., Cognex Corporation, Optel Group, TraceLink, Inc., and Antares Vision S.p.A. strengthen the market with advanced barcode scanning, machine vision, and pharmaceutical grade serialization solutions. Their technologies are widely used to ensure product authenticity and supply chain integrity. These providers emphasize accuracy, automation, and interoperability. Growing adoption in regulated industries supports wider deployment.

rfxcel, Adents International, ACG Worldwide, METTLER TOLEDO, WIPOTEC OCS, and other players expand the landscape with specialized track and trace platforms for packaging, inspection, and quality control. Their offerings support mid sized manufacturers and niche compliance needs. These companies focus on modular solutions, fast implementation, and cost efficiency. Increasing global trade and anti counterfeiting regulations continue to drive steady growth in the track and trace solutions market.

Top Key Players in the Market

- Zebra Technologies Corporation

- Siemens AG

- SAP SE

- Oracle Corporation

- Honeywell International, Inc.

- Datalogic S.p.A.

- Cognex Corporation

- Optel Group

- TraceLink, Inc.

- rfxcel Corporation

- Antares Vision S.p.A.

- Adents International

- ACG Worldwide

- METTLER TOLEDO

- WIPOTEC-OCS GmbH

- Others

Recent Developments

- December 2025, TraceLink was named a Leader in the IDC MarketScape 2025 assessment for multi‑enterprise supply chain commerce networks, reflecting the growing adoption of its OPUS‑based track‑and‑trace, MINT, and POET applications as a digital backbone for regulated life sciences value chains.

- In February 2025, Shadowfax launched SF Shield, a technology initiative focused on strengthening logistics security and improving operational efficiency. The framework combines a Track and Trace solution with SF Eye to deliver better visibility, monitoring, and control across logistics networks.

- In January 2025, Infor Nexus introduced NexTrace, a solution designed to enhance supply chain transparency and traceability. NexTrace enables end to end tracking of materials from raw inputs to finished products, supporting greater visibility and accountability across the entire supply chain.

- January 2025, Zebra introduced new AI-powered software, including Zebra Companion, to give retail and logistics workers faster access to real-time inventory status and item-level visibility, strengthening digital track-and-trace workflows across stores and distribution centers

Report Scope

Report Features Description Market Value (2024) USD 7.2 Bn Forecast Revenue (2034) USD 28.7 Bn CAGR(2025-2034) 14.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Technology (RFID, Barcode, GPS, Biometrics, Others), By Application (Serialization & Aggregation, Supply Chain Visibility, Asset Tracking, Pedigree & ePedigree Systems), By End-User Industry (Pharmaceuticals & Healthcare, Food & Beverage, Logistics & Transportation, Retail & Consumer Goods, Automotive & Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zebra Technologies Corporation, Siemens AG, SAP SE, Oracle Corporation, Honeywell International, Inc., Datalogic S.p.A., Cognex Corporation, Optel Group, TraceLink, Inc., rfxcel Corporation, Antares Vision S.p.A., Adents International, ACG Worldwide, METTLER TOLEDO, WIPOTEC-OCS GmbH, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Track and Trace Solutions MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Track and Trace Solutions MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zebra Technologies Corporation

- Siemens AG

- SAP SE

- Oracle Corporation

- Honeywell International, Inc.

- Datalogic S.p.A.

- Cognex Corporation

- Optel Group

- TraceLink, Inc.

- rfxcel Corporation

- Antares Vision S.p.A.

- Adents International

- ACG Worldwide

- METTLER TOLEDO

- WIPOTEC-OCS GmbH

- Others