Global Toddler Wear Market Size, Share, Growth Analysis By Product (Apparel, Footwear, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 150656

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

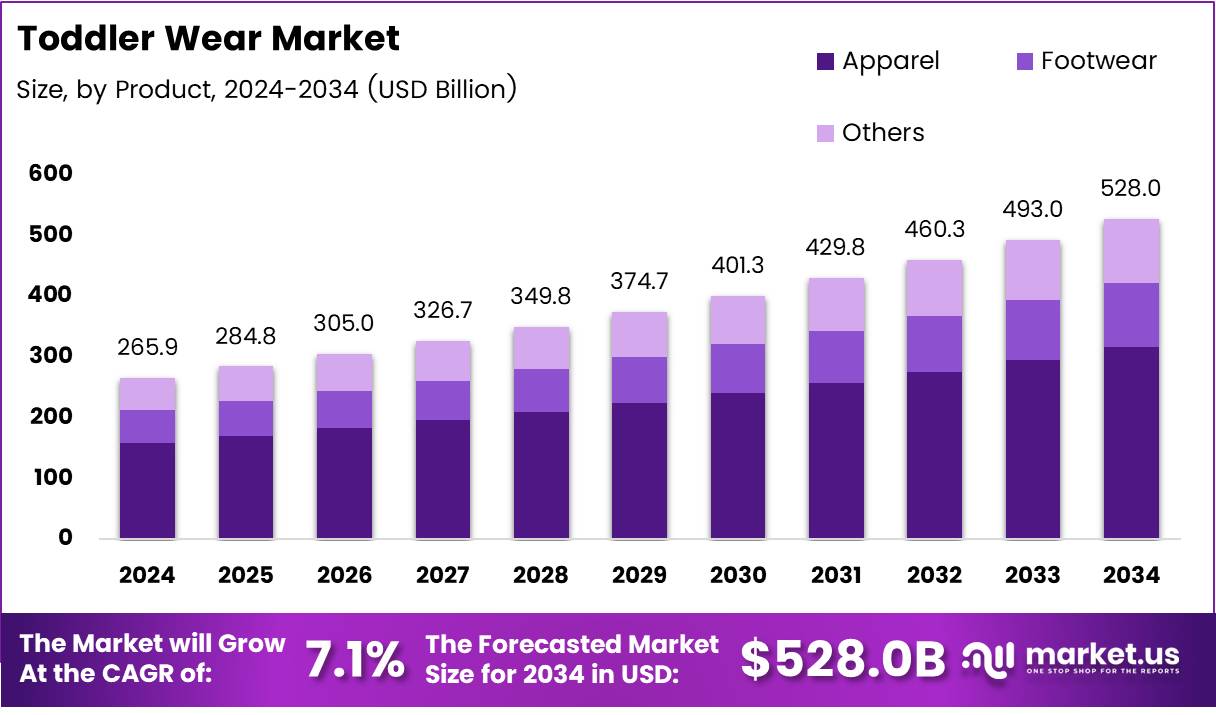

The Global Toddler Wear Market size is expected to be worth around USD 528.0 Billion by 2034, from USD 265.9 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

The toddler wear market is a key segment within the global children’s apparel industry, driven by rising demand for stylish, comfortable, and functional clothing for children aged 0-5 years. The market is growing due to an increase in young families, higher disposable incomes in emerging markets, and greater consumer awareness about sustainable fashion choices.

A major opportunity in this market lies in sustainable and durable apparel. According to CBI, children’s wear makes up 13.3% of the overall apparel market in Europe, demonstrating its significant presence in the fashion industry.

This growth presents an opportunity for brands to specialize in eco-friendly materials and durable designs that align with the increasing demand for sustainable fashion. As eco-consciousness rises among parents, companies will focus more on environmentally friendly production methods.

The average cost of toddler clothing ranges from $50 to $150 per month, depending on the brand, sales, and shopping strategies, as reported by Juniorkids. This price variation indicates an opportunity for brands to target various price segments, appealing to both budget-conscious consumers and those willing to spend more on premium products. This shift in consumer behavior reflects a growing preference for high-quality, long-lasting clothing.

Government investments and regulations are also shaping the toddler wear market. Many governments are supporting sustainable production practices, which encourages brands to adopt more eco-friendly approaches.

Additionally, safety standards for children’s clothing are becoming stricter, requiring compliance from manufacturers. Brands that meet these regulations will gain consumer trust, which is essential for long-term success in the market.

Key Takeaways

- The Global Toddler Wear Market is projected to reach USD 528.0 Billion by 2034 from USD 265.9 Billion in 2024, growing at a CAGR of 7.1% between 2025 and 2034.

- In 2024, Apparel dominated the By Product Analysis segment with a 71.9% market share, highlighting parents’ preference for comfortable and fashionable toddler clothing.

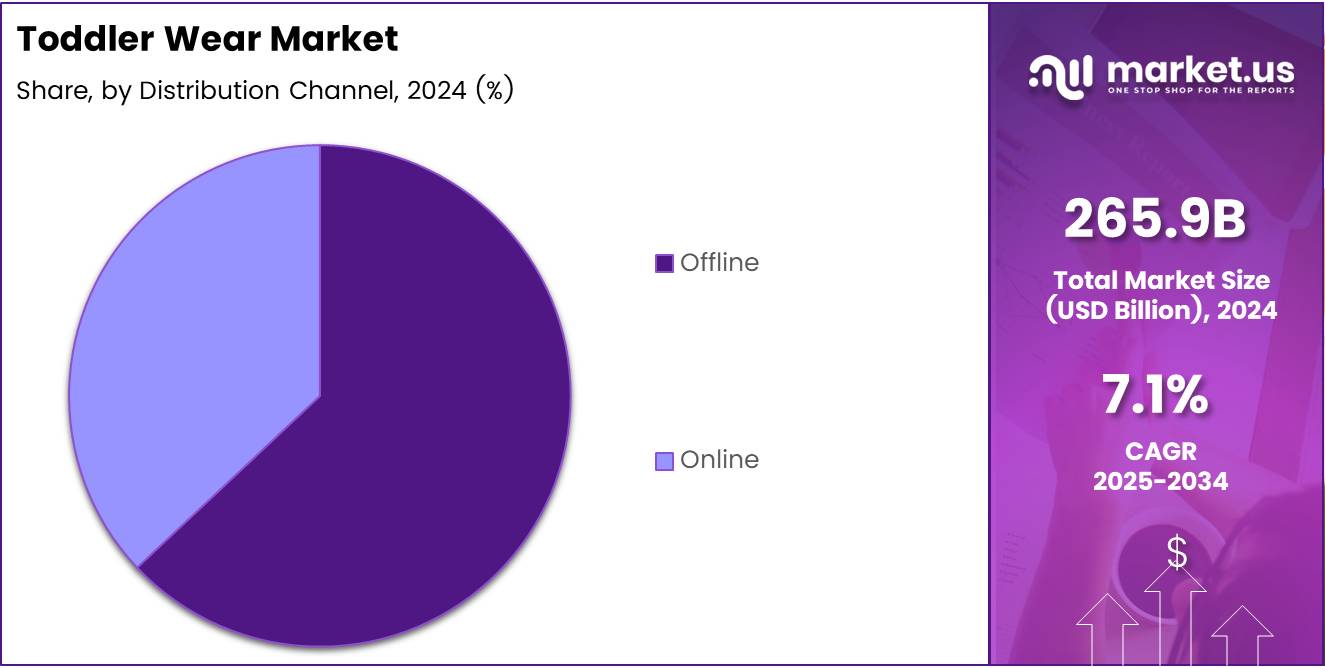

- Offline distribution channels held the dominant position in 2024, with traditional retail stores favored for product quality assurance and in-person consultation.

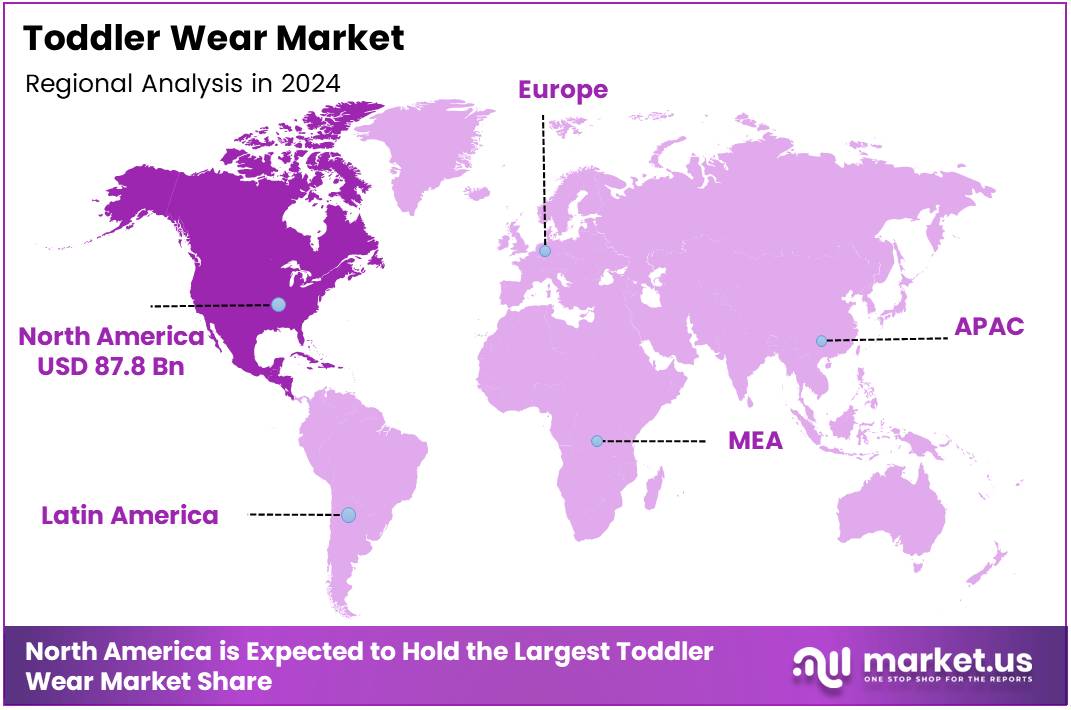

- North America leads the market with a 33.2% share, valued at USD 87.7 billion, driven by high consumer spending and demand for premium, sustainable toddler wear.

Product Analysis

Apparel dominates with 71.9% owing to its high demand in toddler fashion essentials.

In 2024, Apparel held a dominant market position in the By Product Analysis segment of the Toddler Wear Market, with a 71.9% share. This significant dominance reflects the growing emphasis among parents on providing comfortable and fashionable clothing for toddlers. Increased spending on baby apparel, coupled with the availability of a wide range of stylish and functional garments, continues to drive this segment’s growth.

Footwear is gradually gaining traction as parents become more aware of its importance in toddler development and posture support. While it lags behind apparel in market share, the segment is seeing increased innovation in toddler shoe designs, contributing to its slow yet steady growth.

The Others category, including accessories and miscellaneous wearables, accounts for a smaller share but still plays a supportive role in the market. As lifestyle trends evolve, this segment may witness incremental gains, especially with premium and customized offerings entering the space.

Distribution Channel Analysis

Offline dominates due to consumer trust and hands-on product experience.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Toddler Wear Market. Traditional retail stores, including specialty baby shops and department stores, remain the preferred choice for parents, as they allow for physical examination of products. The assurance of quality and the ability to consult sales personnel in-store continue to drive purchases in this channel.

Online distribution is growing steadily as convenience and access to a wider range of options appeal to a digitally savvy parent base. While it currently holds a smaller portion of the market, strategic discounts, easy return policies, and mobile shopping apps are helping this segment expand.

Despite the online surge, offline channels maintain their stronghold due to the tactile nature of toddler clothing shopping, where fit, fabric, and comfort are critical decision factors.

Key Market Segments

By Product

- Apparel

- Footwear

- Others

By Distribution Channel

- Offline

- Online

Drivers

Growing Demand for Sustainable and Eco-Friendly Fabrics Drives Market Growth

Parents are becoming more aware of how clothing affects the environment. This is pushing demand for toddler wear made from organic and eco-friendly materials. Shoppers now prefer natural fabrics like cotton and bamboo, which are gentle on kids’ skin and better for the planet.

Online shopping is also making it easier for parents to find a wide range of toddler clothes. E-commerce platforms offer convenience, variety, and better prices, encouraging more people to shop online for their children’s apparel needs.

In addition, there’s more focus on health and safety in toddler clothing. Parents are avoiding outfits with harmful chemicals or rough textures. This growing concern is helping safer and more skin-friendly clothing gain popularity in the market.

Restraints

High Costs of Premium Toddler Clothing Brands Limit Market Accessibility

High prices of branded toddler clothes can be a big challenge for many families. While parents want the best for their kids, not everyone can afford expensive clothing, especially since toddlers outgrow clothes quickly.

Government rules on safety standards are also strict. Manufacturers need to follow specific regulations regarding fabrics, stitching, and labeling. These rules are good for safety but can increase production costs and slow down product launches, making it harder for smaller brands to grow.

Growth Factors

Rising Popularity of Gender-Neutral Clothing for Toddlers Creates New Market Paths

Gender-neutral clothing is becoming more popular among modern parents. It allows flexibility and can be shared between siblings, making it a smart choice. This trend opens up creative design options and helps brands appeal to a wider customer base.

Another growing area is subscription services for baby and toddler clothes. These services offer regular deliveries of new outfits, saving time for busy parents. It also gives brands a chance to build steady customer relationships.

There’s also increasing interest in custom-made clothing. Parents are looking for personalized outfits that reflect their child’s style or name. This trend is encouraging more brands to offer tailored solutions to meet these demands.

Emerging Trends

Integration of Smart Fabrics in Toddler Clothing Shapes Market Trends

Smart fabrics are being added to toddler clothing, offering features like temperature control or moisture detection. These innovations help improve comfort and health, attracting tech-savvy parents looking for smarter choices.

Social media is also playing a huge role in shaping toddler fashion trends. Platforms like Instagram and Pinterest are influencing parents to follow popular looks for their kids, leading to increased demand for trendy clothing styles.

Themed and gender-specific clothes, such as cartoon prints or holiday outfits, are also in high demand. These styles add fun and personality to toddler wear, making them a hit during festivals, birthdays, or special events.

Regional Analysis

North America Dominates the Toddler Wear Market with a Market Share of 33.2%, Valued at USD 87.7 Billion

North America leads the global toddler wear market, accounting for a substantial 33.2% market share, valued at USD 87.7 billion. The region’s dominance is attributed to high consumer spending, strong brand presence, and a rising focus on children’s fashion trends. Parents in the U.S. and Canada increasingly seek premium, sustainable, and functionally diverse toddler apparel, further driving market expansion.

Europe Toddler Wear Market Insights

Europe follows closely, with a strong inclination toward sustainable and ethically produced children’s clothing. The market benefits from a well-established retail infrastructure and rising awareness around toddler comfort and fabric safety. Increasing birth rates in countries like France and the UK are also supporting steady demand.

Asia Pacific Toddler Wear Market Trends

Asia Pacific represents a rapidly growing toddler wear market, driven by a large child population and increasing urbanization. Rising disposable incomes in countries like China and India are accelerating the demand for stylish and affordable toddler apparel. The market is also influenced by a growing e-commerce ecosystem that enhances product accessibility.

Middle East and Africa Toddler Wear Market Overview

The Middle East and Africa region is witnessing moderate growth in the toddler wear segment, supported by a rising youth population and improving economic conditions in key markets. Cultural preferences and climate-resilient apparel designs also play a key role in shaping consumer choices.

Latin America Toddler Wear Market Developments

Latin America shows a positive trajectory in toddler wear demand, driven by urbanization and changing family dynamics. Countries like Brazil and Mexico are observing a shift toward modern retail formats, allowing better access to a wider range of toddler clothing options.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Toddler Wear Company Insights

In the 2024 global toddler wear market, several key players continue to shape consumer trends through innovation, sustainability, and brand trust.

Nike, Inc. maintains a strong foothold due to its focus on performance-inspired apparel adapted for toddlers, blending style and function. Its global recognition and consistent product expansion keep it at the forefront of this market segment.

Aretto (SANOSYZO PVT. LTD.) is making notable strides with its ergonomically designed footwear tailored for toddler foot development. The brand’s emphasis on innovation and customization resonates with modern parents seeking both comfort and support for their children.

Cotton On leverages its fast-fashion model to deliver trendy and affordable toddler clothing. The brand’s widespread retail presence, coupled with an increasingly conscious approach to sustainability, strengthens its appeal among budget-conscious and eco-aware consumers.

Hanna Andersson continues to command a loyal customer base with its premium organic cotton clothing. Known for durability and timeless designs, it aligns well with parents who prioritize quality and ethical production in their purchasing decisions.

Each of these players brings a unique value proposition to the toddler wear landscape in 2024, balancing quality, design, affordability, and sustainability. As consumer awareness grows, particularly around health and environmental impact, brands that can adapt quickly to these evolving preferences are well-positioned for long-term success in the global market.

Top Key Players in the Market

- Nike, Inc.

- Aretto (SANOSYZO PVT. LTD.)

- Cotton On

- Hanna Andersson

- Benetton Group

- Greendigo

- Diesel

- Carter’s, Inc.

- Mothercare plc

- Gap Inc.

- BONPOINT

Recent Developments

- In Apr 2024, premium kidswear brand Includ raised $1.5 million in a funding round led by Incubate Fund Asia. The investment is aimed at scaling its retail footprint and enhancing product innovation.

- In Jan 2024, plant-based kids’ clothing brand Kidbea secured $1 million in a Pre-Series A round led by Venture Catalysts. The funds will support brand expansion and sustainable product development.

- In Nov 2024, Suditi Industries acquired Gini & Jony, a well-known kidswear brand. The acquisition strengthens Suditi’s market share and retail presence in the Indian kidswear segment.

- In Apr 2025, LT Apparel Group acquired Elder Manufacturing Company, a move to broaden its portfolio and supply chain capabilities. The deal reflects LT Apparel’s strategy to expand its manufacturing footprint in the U.S.

Report Scope

Report Features Description Market Value (2024) USD 265.9 Billion Forecast Revenue (2034) USD 528.0 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Apparel, Footwear, Others), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Nike, Inc., Aretto (SANOSYZO PVT. LTD.), Cotton On, Hanna Andersson, Benetton Group, Greendigo, Diesel, Carter’s, Inc., Mothercare plc, Gap Inc., BONPOINT Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nike, Inc.

- Aretto (SANOSYZO PVT. LTD.)

- Cotton On

- Hanna Andersson

- Benetton Group

- Greendigo

- Diesel

- Carter's, Inc.

- Mothercare plc

- Gap Inc.

- BONPOINT