Global Tire Retail Market Size, Share, Growth Analysis By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Off-the-Road (OTR) Vehicles), By Tire Type (Radial Tires, Bias Tires), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152658

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

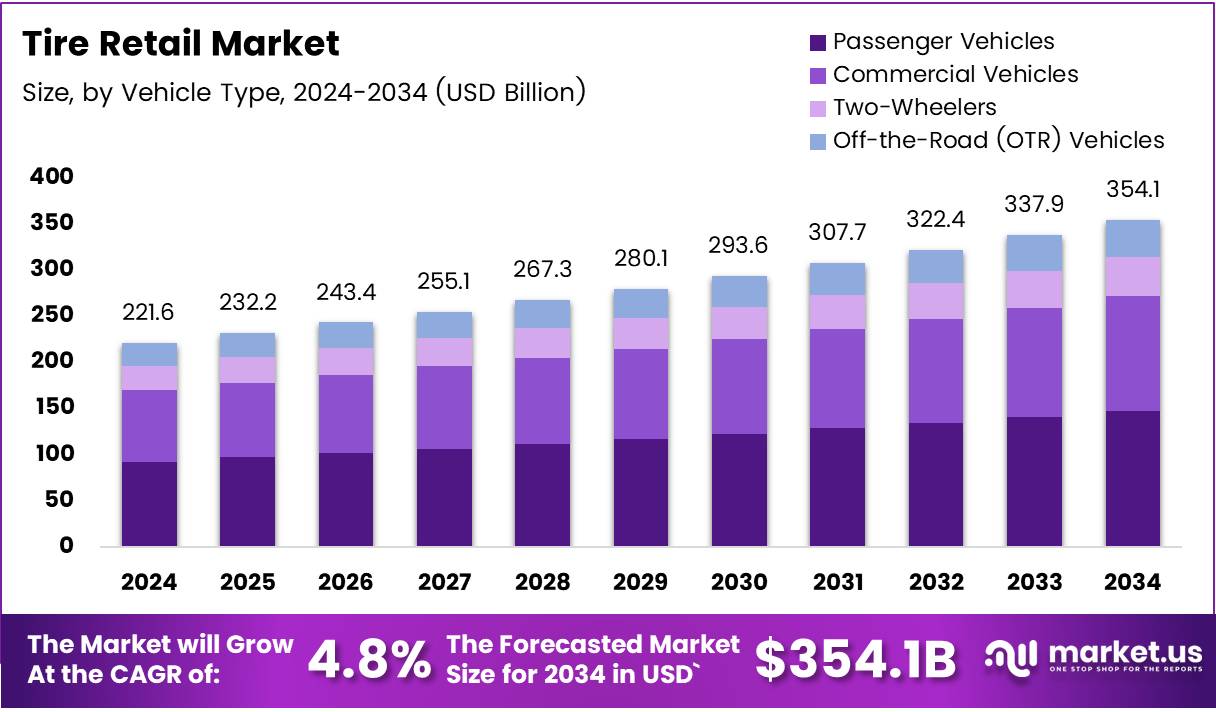

The Global Tire Retail Market size is expected to be worth around USD 354.1 Billion by 2034, from USD 221.6 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

The Tire Retail Market is a crucial component of the automotive industry, focused on the sale of tires through various retail channels such as brick-and-mortar stores, online platforms, and wholesale distributors. It encompasses the distribution of tires for vehicles of all kinds, including passenger cars, trucks, and specialty vehicles. As consumer demands evolve, tire retailers are adapting to new trends and technological advancements to maintain competitiveness.

Growth in the tire retail sector is driven by several factors, including the increasing number of vehicles on the road. According to the Wall Street Journal, as of late 2024, approximately 290 million vehicles were on U.S. roads. Additionally, the average age of passenger cars has been steadily increasing, now at 13.6 years, compared to 8.4 years three decades ago. This demographic shift leads to a growing demand for replacement tires, which directly benefits tire retailers.

The market also presents significant opportunities. A key growth driver is the profit margin of tire sales, which typically ranges between 25% to 50% according to Bayiq. This high-margin environment attracts both new entrants and established players, allowing tire retailers to invest in expanding their product range and service offerings. E-commerce and digital solutions are opening up new avenues for reaching a broader consumer base, making it easier for customers to purchase tires from the comfort of their homes.

Government regulations and investments also play a crucial role in shaping the tire retail market. Various federal and state regulations, including tire safety standards and environmental policies regarding tire disposal, impact the sector.

Additionally, governments are investing in initiatives to promote safer and more sustainable tires. These actions create opportunities for tire retailers to stay compliant and adapt their offerings to meet changing consumer and regulatory expectations.

Furthermore, tire retailers are facing an evolving landscape with advancements in tire technologies, such as smart tires and eco-friendly products. The growing interest in sustainability is pushing retailers to diversify their product range to include tires with lower environmental impacts. Tire retailers must adapt to these shifts, focusing on the increasing consumer demand for sustainable products.

Key Takeaways

- The Global Tire Retail Market is expected to reach USD 354.1 Billion by 2034, growing at a CAGR of 4.8% from 2025 to 2034.

- In 2024, Passenger Vehicles held the largest market share at 55.9%, driven by a high number of vehicles on the road and increasing vehicle age.

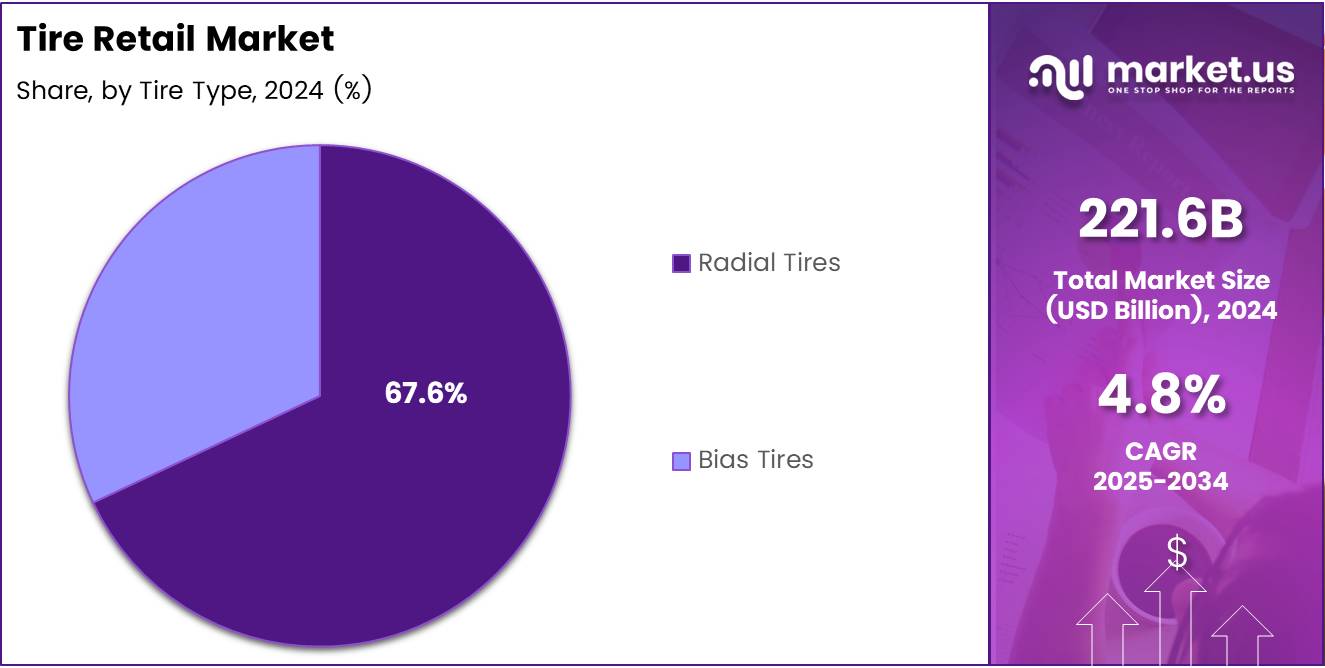

- Radial Tires dominated the market in 2024 with a 67.6% share, due to their durability, fuel efficiency, and comfort.

- Offline distribution channels led the Tire Retail Market in 2024 with a 75.2% share, driven by consumer trust and the ability to inspect tires in person.

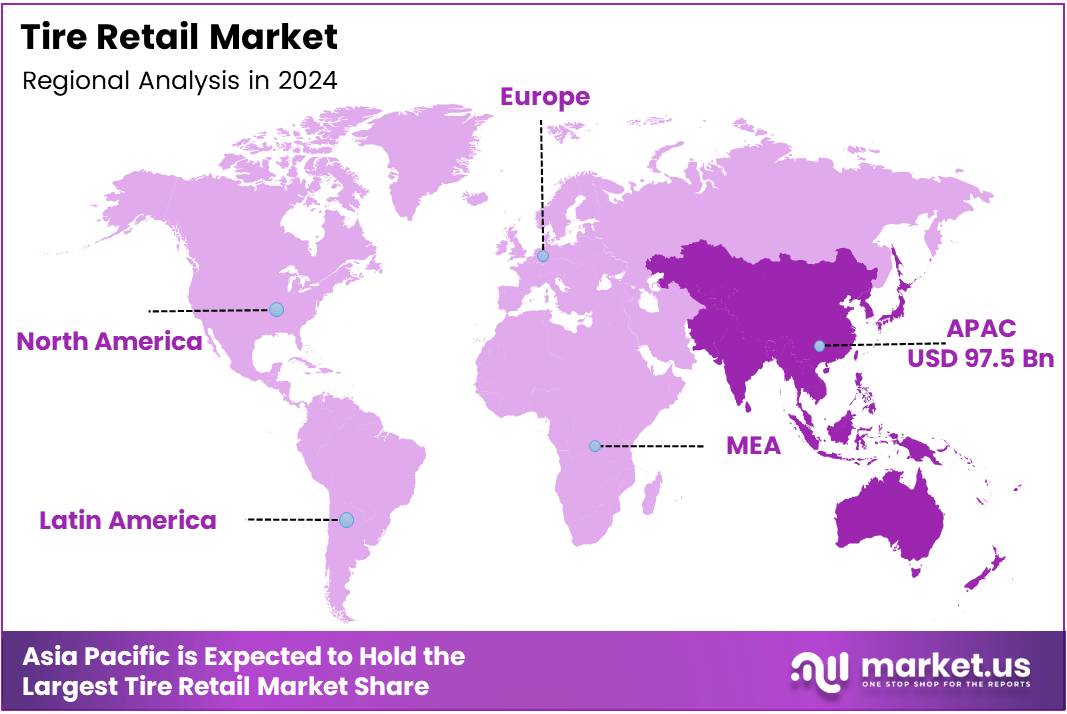

- In 2024, Asia Pacific was the dominant region, holding 43.9% of the market, valued at USD 97.5 Billion, driven by high vehicle sales in China and India.

Vehicle Type Analysis

Passenger Vehicles held a dominant market position with a 55.9% share in 2024.

In 2024, Passenger Vehicles captured the largest share in the Tire Retail Market, holding a dominant position with a share of 55.9%. This segment’s significant market presence is attributed to the large number of passenger vehicles on the road and the ongoing demand for tires due to the increasing vehicle age. Passenger vehicles, such as sedans, SUVs, and hatchbacks, continue to be the primary contributors to tire sales in the retail sector.

Commercial Vehicles accounted for a notable portion of the market, driven by the need for durable and heavy-duty tires that can withstand demanding road conditions. This segment also benefits from the increasing demand in logistics and freight sectors. However, it lags behind Passenger Vehicles, reflecting a slightly lower rate of growth in comparison.

The Two-Wheelers segment follows closely, contributing to the growing demand for lightweight tires for motorcycles and scooters, particularly in regions where two-wheeled transport is common. Meanwhile, the Off-the-Road (OTR) Vehicles segment holds a smaller yet critical market share due to the need for specialized tires used in construction, agriculture, and mining industries.

Tire Type Analysis

Radial Tires dominated with a 67.6% share in 2024.

In 2024, Radial Tires maintained a strong market position in the Tire Retail Market, commanding a dominant share of 67.6%. Radial tires are preferred for their superior durability, fuel efficiency, and comfort. The widespread adoption of radial tires across passenger vehicles and commercial vehicles alike, driven by consumer demand for high performance, plays a crucial role in this segment’s leadership.

Bias Tires, while holding a smaller share, continue to cater to niche markets such as agricultural and off-road vehicles. These tires are valued for their strength and resistance to damage, but their market share is limited in comparison to radial tires. As tire technology evolves, bias tires are being gradually replaced by more advanced tire types, limiting their future growth potential in the general tire retail market.

The preference for Radial Tires remains strong due to their proven reliability and cost-effectiveness for a broad range of applications. Innovations in tire construction and materials are expected to further solidify the position of radial tires in the market.

Distribution Channel Analysis

Offline held a dominant market position with a 75.2% share in 2024.

In 2024, Offline distribution channels led the Tire Retail Market with a substantial share of 75.2%. Traditional brick-and-mortar stores remain the preferred method of tire purchasing, driven by consumer trust in physical stores and the ability to inspect tires directly. Offline channels offer the advantage of immediate purchase and installation, particularly appealing to customers who prefer hands-on service and expertise.

The Online distribution channel, though growing rapidly, holds a smaller share in comparison. With the increasing trend of e-commerce, more consumers are turning to online platforms for tire purchases due to the convenience of home delivery and the availability of competitive prices. However, online retail faces challenges, such as the lack of immediate product inspection and installation, which makes offline options more attractive for many buyers.

Despite the growing shift toward online retail, Offline channels are expected to maintain their dominance in the short-to-medium term, with customer behavior still leaning towards in-person purchases, especially for high-value and critical products like tires.

Key Market Segments

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Off-the-Road (OTR) Vehicles

By Tire Type

- Radial Tires

- Bias Tires

By Distribution Channel

- Offline

- Online

Drivers

Increasing Number of Vehicle Sales and Ownership Drives Tire Retail Market Growth

The increasing number of vehicles on the road is a key driver for the tire retail market. As more consumers purchase vehicles, the demand for replacement tires rises. This trend is particularly noticeable in emerging markets where vehicle ownership is on the rise.

As vehicles age, tires require replacement, contributing to a steady demand for tires in the market. Additionally, consumers’ growing preference for personal vehicles, especially in regions with expanding economies, further boosts tire sales. These factors are expected to continue driving the growth of the tire retail sector.

Technological advancements in tire manufacturing also play a crucial role in shaping the tire retail market. Modern technologies have led to the development of high-performance tires with better durability and fuel efficiency. Innovations such as self-healing tires and run-flat technology are attracting consumer attention, thereby increasing sales. With improved manufacturing processes, tire manufacturers are now able to produce better-quality products at competitive prices, which benefits the retail market and enhances customer satisfaction.

The expansion of e-commerce in tire retailing is another driving force. More consumers are choosing to purchase tires online, benefiting from the convenience of home delivery and the ability to compare prices easily. E-commerce platforms offer a wide range of tire options, making it easier for consumers to find and buy tires at competitive prices. This shift toward online shopping is expected to contribute significantly to the growth of the tire retail market.

Restraints

Fluctuating Raw Material Prices Restrain Tire Retail Market Growth

Fluctuating raw material prices present a significant challenge for the tire retail market. Tires are primarily made from synthetic rubber, natural rubber, steel, and carbon black, all of which are subject to price volatility. Any fluctuation in the prices of these raw materials can increase manufacturing costs, which in turn impacts the retail pricing of tires. Retailers may face difficulties in maintaining profit margins when the costs of raw materials rise unexpectedly, making it a restraint for market growth.

Stringent environmental regulations on tire manufacturing are also a constraint. Governments worldwide are introducing stricter laws to regulate emissions, waste disposal, and the overall environmental impact of manufacturing processes. Complying with these regulations requires significant investment in cleaner technologies and processes, which can increase costs for tire manufacturers. As a result, the retail market could see higher prices for tires, which may dampen demand among cost-sensitive consumers.

Lastly, the increasing competition from online tire retailers is another challenge for the traditional tire retail market. Online retailers offer the advantage of lower operational costs and the ability to cater to a larger customer base. This has forced brick-and-mortar tire stores to reconsider their pricing strategies and customer service offerings. The growing preference for online shopping, coupled with the ease of price comparison, has made it more difficult for physical stores to compete effectively.

Growth Factors

Growing Popularity of Electric and Hybrid Vehicles Creates Tire Retail Market Opportunities

The growing popularity of electric and hybrid vehicles (EVs and HEVs) presents new opportunities for the tire retail market. These vehicles have unique tire requirements, such as lower rolling resistance to improve fuel efficiency. As the adoption of EVs and HEVs increases, demand for specialized tires tailored to these vehicles will also rise. Tire retailers can tap into this market by offering tires designed specifically for electric and hybrid vehicles, presenting a significant growth opportunity.

The expansion of aftermarket tire services is another growth opportunity for the tire retail market. As vehicle ownership increases, car owners are looking for convenient, reliable tire services, including tire replacement, balancing, and repairs. Retailers who offer comprehensive tire services, such as tire fitting and maintenance, can attract customers who prefer a one-stop-shop for all their tire-related needs. This trend is expected to contribute to the growth of the retail sector.

Sustainability is becoming increasingly important to consumers, and tire retailers have the chance to capitalize on the demand for eco-friendly tires. Growing awareness of environmental issues has led to an increase in consumer preference for tires made from sustainable materials. As tire manufacturers focus on producing eco-friendly products, retailers can offer customers options that align with their environmental values, thus benefiting from the rising demand for sustainable tires.

The rise of smart tires, which integrate IoT (Internet of Things) technology for real-time monitoring of tire health, is another growth opportunity. Smart tires provide drivers with data on tire pressure, temperature, and wear, improving vehicle safety and performance. Retailers who embrace this trend and offer smart tires are likely to attract tech-savvy customers, driving further growth in the tire retail market.

Emerging Trends

Advancements in Tire Recyclability and Sustainability Shape Tire Retail Market Trends

Advancements in tire recyclability and sustainability are significant trends in the tire retail market. With increasing environmental concerns, manufacturers are focusing on creating tires that are easier to recycle and made from renewable resources. This shift toward sustainable practices not only helps reduce waste but also aligns with growing consumer demand for eco-friendly products. Retailers who offer these types of products can benefit from the trend toward sustainability.

The integration of artificial intelligence (AI) in tire manufacturing is another emerging trend. AI is being used to optimize the production process, ensuring higher quality and more durable tires. This technology is expected to improve manufacturing efficiency and reduce waste, benefiting the retail sector by providing consumers with better-performing tires at competitive prices. Tire retailers that keep up with technological advancements in manufacturing will be well-positioned to stay ahead of market trends.

Subscription-based tire services are also gaining popularity in the tire retail market. Customers can sign up for regular tire maintenance and replacement, which ensures their vehicles are always equipped with optimal tires. This model provides convenience for customers and consistent revenue for tire retailers, making it an attractive trend in the market. Subscription-based services are likely to become a significant part of the tire retail landscape.

The demand for all-weather and all-terrain tires is growing as consumers seek versatile tire options that can handle various driving conditions. Retailers offering these types of tires are tapping into a market that values flexibility and reliability. As consumer preferences shift toward all-weather and all-terrain tires, retailers who can meet this demand will continue to see growth in their business.

Regional Analysis

Asia Pacific Dominates the Tire Retail Market with a Market Share of 43.9%, Valued at USD 97.5 Billion

In 2024, the Asia Pacific region is the dominating region in the global tire retail market, holding a significant share of 43.9%, valued at USD 97.5 Billion. The region’s growth is primarily driven by the increasing vehicle sales, especially in countries like China and India, alongside the rising demand for tire replacement and maintenance due to a large number of vehicles on the road.

North America Tire Retail Market Insights

North America holds a substantial share in the global tire retail market. The region’s market is supported by high vehicle ownership, a well-established aftermarket industry, and increasing consumer demand for durable, high-quality tires. With the U.S. being a key contributor, the market growth is expected to remain strong due to ongoing vehicle fleet expansion and tire replacement cycles.

Europe Tire Retail Market Trends

Europe is another key market for tire retail, with steady growth projected due to the region’s robust automotive industry and the increasing trend of electric vehicle adoption. The European market is driven by regulatory policies favoring environmentally friendly transportation solutions, leading to rising demand for eco-friendly and energy-efficient tire options.

Latin America Tire Retail Market Outlook

The Latin American tire retail market is anticipated to grow steadily, driven by increasing vehicle sales and a higher demand for tire replacement services. Although the market is smaller compared to other regions, it shows potential for expansion, particularly in countries like Brazil and Mexico, where automotive production and consumption are on the rise.

Middle East and Africa Tire Retail Market Developments

The Middle East and Africa market for tire retail is expected to grow at a moderate pace, with a focus on countries that have a growing automotive industry, such as the UAE and South Africa. The market growth is supported by increasing infrastructure development and rising disposable income in key urban areas, which fuels the demand for automotive maintenance and tire replacement.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Tire Retail Company Insights

In 2024, the global tire retail market continues to witness significant growth, driven by key players who are expanding their footprints and innovating to meet evolving customer demands.

Sailun Group, a major player, is focusing on enhancing its production capabilities and expanding into emerging markets, making it a competitive force in both the retail and manufacturing segments. The company is expected to maintain its strong position by catering to diverse customer needs with affordable yet reliable products.

Cheng Shin Rubber, known for its premium quality tires, is concentrating on technological advancements to improve performance and sustainability. Its focus on R&D has allowed the company to increase its global market share and remain competitive in the face of rapidly changing consumer preferences.

MRF Ltd., one of India’s largest tire manufacturers, continues to dominate the market with its innovative product lines. Its strong brand presence in both the domestic and international markets is expected to help the company expand further in 2024. The company’s focus on advanced tire technology and high-quality manufacturing makes it a key player in the tire retail market.

Michelin, a global leader in tire innovation, is projected to leverage its strong brand equity and commitment to sustainability in 2024. The company’s focus on electric vehicle tire solutions and continued expansion in high-growth markets allows it to maintain a competitive edge, making Michelin a major player in shaping the future of tire retail globally.

Top Key Players in the Market

- Sailun Group

- Cheng Shin Rubber

- MRF Ltd.

- Michelin

- Pirelli

- Zhongce Rubber

- Goodyear

- Toyo Tires

- Yokohama Rubber Company

- Hankook

- Bridgestone

- Linglong Tire

- Sumitomo Rubber Industries

- Apollo Tyres

- Continental

Recent Developments

- In June 2025, Madison Funding Partners provided US$ 300,000 in funding to support the expansion and growth of a Texas-based tire shop, helping to improve operations and enhance service offerings.

- In May 2025, BKT, a major player in the tire manufacturing industry, set a target to achieve US$ 2.6 billion in sales, marking a significant milestone in its growth strategy.

- In October 2024, BizzyCar successfully secured US$ 15 million in a growth round led by Dealer Tire, which is expected to accelerate BizzyCar’s innovation and expansion in the automotive services sector.

- In August 2024, the owner of Les Schwab Tire began exploring a potential sale of the company, with an estimated valuation of over US$ 7 billion, reflecting its strong position in the tire retail market.

Report Scope

Report Features Description Market Value (2024) USD 221.6 Billion Forecast Revenue (2034) USD 354.1 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Off-the-Road (OTR) Vehicles), By Tire Type (Radial Tires, Bias Tires), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Sailun Group, Cheng Shin Rubber, MRF Ltd., Michelin, Pirelli, Zhongce Rubber, Goodyear, Toyo Tires, Yokohama Rubber Company, Hankook, Bridgestone, Linglong Tire, Sumitomo Rubber Industries, Apollo Tyres, Continental Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sailun Group

- Cheng Shin Rubber

- MRF Ltd.

- Michelin

- Pirelli

- Zhongce Rubber

- Goodyear

- Toyo Tires

- Yokohama Rubber Company

- Hankook

- Bridgestone

- Linglong Tire

- Sumitomo Rubber Industries

- Apollo Tyres

- Continental