Global Tiger Nut Milk Market By Form(Whole, Powder, Oil), By Nature(Organic, Conventional), By End-use(Food Industry, Foodservice Industry, Retail/Household, Others), By Distribution Channel(Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132440

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

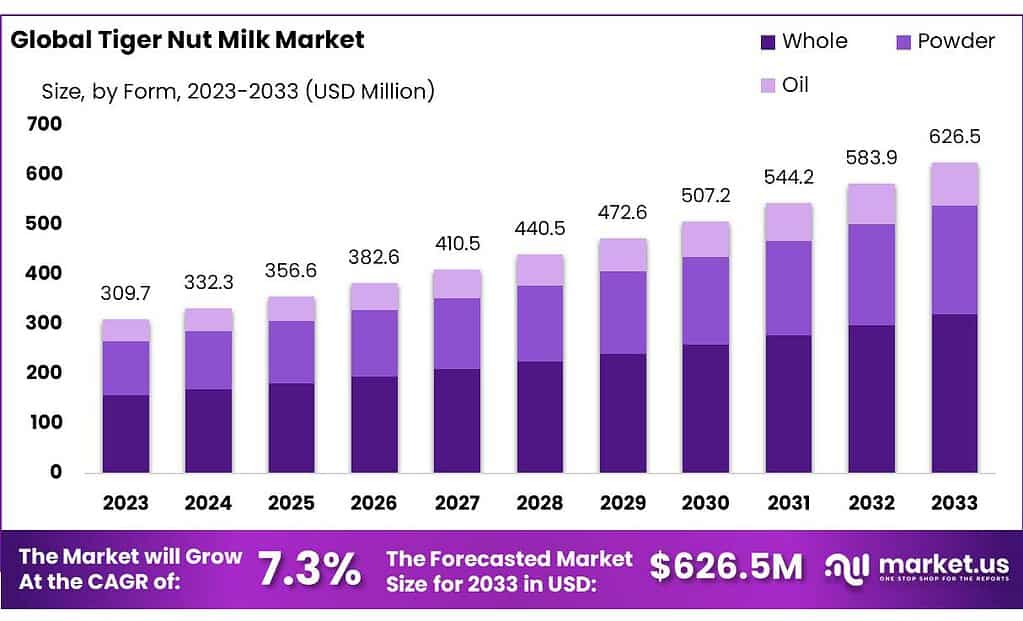

The Global Tiger Nut Milk Market size is expected to be worth around USD 626.5 Mn by 2033, from USD 309.7 Mn in 2023, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

Tiger nut milk, made from the tuber of the tiger nut plant (Cyperus esculentus), is emerging as a popular alternative to dairy milk, particularly in health-conscious markets. This growth is driven by increasing consumer demand for lactose-free and dairy-free options, particularly among those with dietary restrictions or preferences for natural products.

In terms of regulatory frameworks, various countries are updating their food safety standards to accommodate the rising popularity of non-dairy beverages. For instance, Malaysia is revising its 1985 Food Regulations to enhance controls over milk products, including plant-based alternatives like tiger nut milk. The proposed updates aim to prevent food fraud and improve labeling requirements, ensuring that consumers are well-informed about the products they purchase.

From an import-export perspective, tiger nut milk has seen a surge in international trade. Countries such as Spain and the United States are significant players in the production and export of tiger nut milk, with Spain being known for its traditional use of tiger nuts in beverages like horchata. In 2022, Spain exported over $10 million worth of tiger nut products, indicating strong demand in markets across Europe and North America.

Government initiatives promoting plant-based diets have led to increased investments in the tiger nut industry. For example, agricultural programs in the EU are encouraging farmers to cultivate alternative crops like tiger nuts, which can provide economic benefits while promoting sustainability. In 2023, investments in the tiger nut sector are expected to exceed $30 million, highlighting the growing interest in this versatile crop.

Key Takeaways

- Tiger Nut Milk Market size is expected to be worth around USD 626.5 Mn by 2033, from USD 309.7 Mn in 2023, growing at a CAGR of 7.3%.

- Whole tiger nut milk held a dominant market position, capturing more than a 42.4% share.

- Organic tiger nut milk held a dominant market position, capturing more than a 63.4% share.

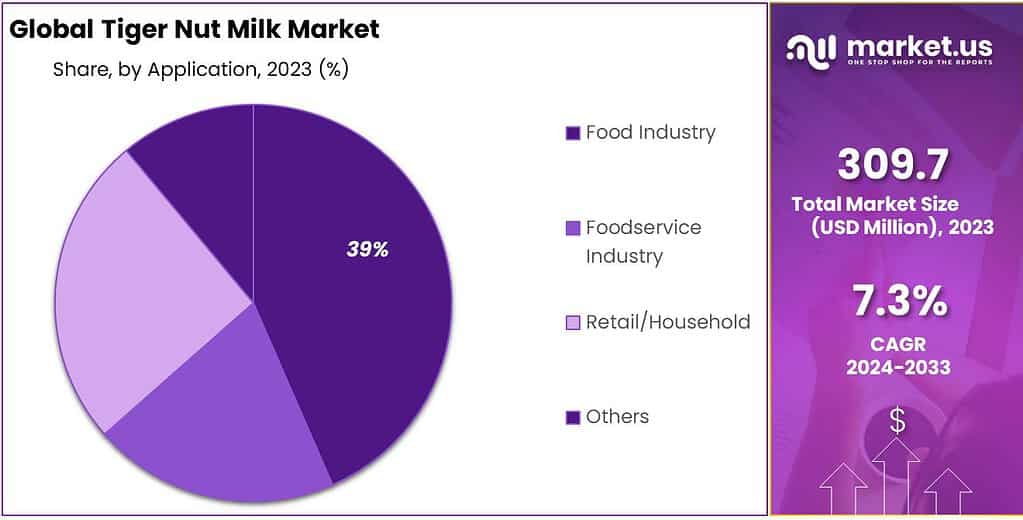

- Food Industry held a dominant market position in the tiger nut milk market, capturing more than a 39.4% share.

- Hypermarkets/Supermarkets held a dominant market position in the distribution of tiger nut milk, capturing more than a 49.3% share.

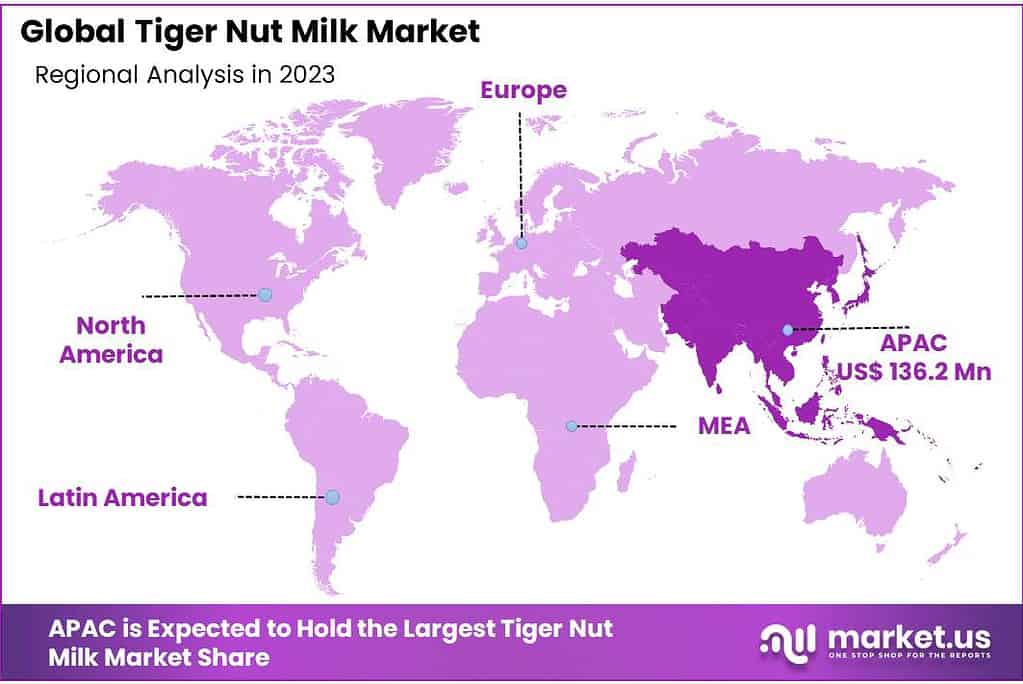

- Asia Pacific Dominating the tiger nut milk market with a 44.2% share, generating revenues of USD 136.2 million.

By Form

In 2023, Whole tiger nut milk held a dominant market position, capturing more than a 42.4% share. This form is particularly popular due to its all-natural composition and the minimal processing it undergoes, making it a favored choice among health-conscious consumers who prefer clean-label products. Whole tiger nut milk is appreciated for its creamy texture and rich flavor, which makes it a versatile ingredient in both beverages and culinary recipes.

Tiger nut milk powder follows in market presence, offering convenience and longer shelf life. This form is easy to store and transport, making it ideal for consumers who seek the nutritional benefits of tiger nut milk but require the convenience of a non-perishable product. It’s used widely in smoothies, baked goods, and other recipes where liquid milk might not be suitable.

Tiger nut oil, extracted from the nuts, holds a smaller share of the market but is notable for its high content of monounsaturated fats, similar to olive oil. It is prized in gourmet cooking and in dietary circles for its health benefits, including supporting heart health and lowering cholesterol levels. This oil is also used in the cosmetic industry for skin and hair products due to its moisturizing properties.

By Nature

In 2023, Organic tiger nut milk held a dominant market position, capturing more than a 63.4% share. This segment benefits from the growing consumer preference for organic products, which are perceived as healthier and more environmentally friendly. Organic tiger nut milk is especially popular among health-conscious consumers who value natural, non-GMO, and pesticide-free ingredients in their diets. This preference has driven many manufacturers to focus on organic certification to meet this market demand.

Conventional tiger nut milk still maintains a significant portion of the market. It offers a more cost-effective alternative to the organic variant, appealing to a broader audience that may not prioritize organic certification but still seeks the nutritional benefits of tiger nut milk. Conventional products are widely available and continue to be a staple in many households for their affordability and accessibility.

By End-use

In 2023, the Food Industry held a dominant market position in the tiger nut milk market, capturing more than a 39.4% share. This sector primarily utilizes tiger nut milk in a variety of products due to its nutritional benefits and flavor profile. It’s especially popular as a dairy alternative in vegan and lactose-free products such as ice creams, yogurts, and baked goods. The versatility of tiger nut milk makes it an attractive ingredient for manufacturers looking to cater to the increasing consumer demand for plant-based and allergen-free options.

The Foodservice Industry also leverages tiger nut milk, particularly in cafes and restaurants that offer specialty beverages and vegan menus. This segment appreciates the milk’s creamy texture and nutty flavor, making it ideal for coffee drinks, smoothies, and other culinary creations that appeal to health-focused diners.

For Retail/Household consumption, tiger nut milk is readily available in liquid and powdered forms, making it accessible for daily use in households. It’s gaining popularity among consumers who prefer to have healthy, plant-based milk alternatives at home for drinking, cooking, and baking.

By Distribution Channel

In 2023, Hypermarkets/Supermarkets held a dominant market position in the distribution of tiger nut milk, capturing more than a 49.3% share. These outlets are preferred for their wide selection of food and beverage products, including a variety of tiger nut milk brands and formulations. The convenience of finding multiple options in one location, along with the ability to physically evaluate products before purchase, makes hypermarkets and supermarkets a popular choice among consumers.

Convenience Stores also play a significant role in the distribution of tiger nut milk, offering easy access for quick shopping needs. These stores are ideal for consumers looking to grab on-the-go beverages or small grocery items, including tiger nut milk, which is often available in ready-to-drink formats.

Specialty Stores are important for catering to niche markets, particularly health food shoppers looking for organic or specialty diet products like tiger nut milk. These stores often provide a curated selection that appeals to specific dietary preferences and may offer more specialized brands not widely available in larger retail outlets.

Online Retail has seen significant growth, especially driven by the convenience of home delivery and the availability of a wider range of products. Consumers can easily compare prices, read reviews, and access a broader selection of tiger nut milk products from various brands, which boosts the segment’s appeal.

Key Market Segments

By Form

- Whole

- Powder

- Oil

By Nature

- Organic

- Conventional

By End-use

- Food Industry

- Foodservice Industry

- Retail/Household

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Driving Factors

Increasing Consumer Demand for Plant-Based and Lactose-Free Products

One significant driver propelling the tiger nut milk market is the escalating demand for plant-based and lactose-free alternatives among consumers globally. As dietary preferences shift towards healthier and sustainable options, tiger nut milk emerges as a favored choice due to its nutritional benefits and alignment with vegan and lactose-intolerant diets.

Nutritional Appeal and Health Benefits

Tiger nut milk, derived from the tubers of the Cyperus esculentus plant, is not only naturally sweet and flavorful but also rich in nutrients. It offers a substantial amount of fiber, vitamins, and minerals, including vitamin E and iron, making it a robust alternative to dairy milk.

The milk’s high fiber content is particularly beneficial for digestive health, and its non-dairy nature makes it suitable for those with lactose intolerance. These nutritional benefits meet the growing consumer inclination towards food products that support overall health and wellness.

Consumer Preferences and Dietary Shifts

The surge in veganism and plant-based diets has significantly contributed to the popularity of tiger nut milk. Consumers are increasingly seeking plant-based alternatives to traditional dairy products, driven by factors such as ethical concerns, environmental impact, and dietary restrictions. Tiger nut milk fits well into this category, offering a palatable and healthful alternative that aligns with current consumer preferences and dietary trends

Restraining Factors

High Production and Processing Costs

One of the significant restraining factors for the growth of the tiger nut milk market is the high cost associated with its production and processing. Tiger nuts require specific growing conditions and are primarily harvested in select geographical regions, which can limit the supply and elevate the cost of raw materials.

Production and Harvesting Challenges

Tiger nuts are typically grown in specific climates and require a substantial amount of water and time to cultivate, which can be a limiting factor in regions where these conditions are not naturally present. The labor-intensive nature of harvesting and the need for specialized equipment further contribute to the overall production costs.

Processing and Manufacturing Expenses

The process of converting tiger nuts into milk involves several steps—cleaning, soaking, grinding, and filtering—which require specialized machinery. Setting up and maintaining the machinery for processing tiger nut milk can be costly, which may deter new entrants from the market and limit the expansion capabilities of existing producers

Market Penetration and Consumer Awareness

Despite its health benefits, tiger nut milk is still relatively unknown to many consumers, especially in markets dominated by almond, soy, and oat milks. The lack of consumer awareness and the niche market position result in lower economies of scale for producers and higher retail prices compared to more established non-dairy alternatives

Growth Opportunity

Expansion in Plant-Based Product Demand

The increasing consumer interest in plant-based diets is a major driver for the tiger nut milk market. As more people seek dairy alternatives due to health concerns, ethical reasons, or dietary restrictions, tiger nut milk stands out due to its nutritional benefits and hypoallergenic properties. The market is anticipated to grow at a compound annual growth rate (CAGR) of 8.1% through 2030, indicating a robust expansion trajectory.

Innovations in Product Offerings

Innovation in product formulation and packaging can serve as a critical growth lever for the tiger nut milk industry. With the market’s openness to clean label and allergen-free products, companies have the opportunity to introduce a variety of flavored and fortified tiger nut milk options, catering to a wider audience.

This aligns with the observed trend where manufacturers are expanding their product lines to include tiger nut milk variations that meet specific consumer needs, such as enhanced taste profiles or added nutritional benefits.

Geographical Expansion and Accessibility

There is significant potential for geographical expansion, especially in markets where plant-based diets are becoming more prevalent. North America and Europe are currently attractive markets for tiger nut milk products due to their high consumer awareness and purchasing power.

However, emerging markets in Asia-Pacific are also showing promising growth rates, which suggests that expanding distribution channels and increasing market penetration in these regions could be highly lucrative. Enhancing the accessibility of tiger nut milk through various retail formats, from supermarkets to online platforms, will be crucial in tapping into these new markets and driving global growth

Latest Trends

Rising Demand for Plant-Based Milk Alternatives

There’s a strong trend toward plant-based diets, which is significantly impacting the demand for tiger nut milk. As consumers become more health-conscious and interested in sustainable food sources, tiger nut milk is increasingly viewed as a nutritious and eco-friendly alternative to dairy milk. This trend is supported by a growing consumer base that prefers allergen-free and lactose-free options due to dietary restrictions or personal health choices

Innovation in Product Flavor and Packaging

Companies in the tiger nut milk sector are actively investing in research and development to diversify their product offerings. This includes the introduction of various flavors such as chocolate, vanilla, and strawberry, which cater to a broader range of consumer tastes.

Additionally, innovations in packaging are being pursued to enhance shelf life and appeal to eco-conscious consumers. These efforts are aimed at improving the taste, texture, and overall product attractiveness to compete with other plant-based milks.

Expansion of Distribution Channels

The availability of tiger nut milk is expanding beyond health food stores to include supermarkets, hypermarkets, and online retail platforms, significantly enhancing its accessibility to consumers. This expansion is facilitated by strategic partnerships and collaborations with retailers, which help brands reach a wider audience and capitalize on the growing demand for plant-based beverages

Regional Analysis

Asia Pacific: Dominating the tiger nut milk market with a 44.2% share, generating revenues of USD 136.2 million, APAC benefits from dietary diversification and increasing health consciousness among its massive population. Countries like China and India are witnessing a surge in demand due to the growing middle class and rising awareness about dietary supplements and healthy lifestyles.

North America: This region is witnessing a steady increase in the consumption of tiger nut milk, driven by rising health awareness and the popularity of non-dairy alternatives among lactose-intolerant consumers. The market is characterized by high consumer willingness to experiment with new dietary trends, making it a ripe environment for tiger nut milk products, particularly in the United States and Canada. Strategic marketing and extensive distribution networks have bolstered product availability across supermarkets and online platforms.

Europe: Europe stands out for its robust growth in the tiger nut milk market, with a significant consumer base opting for vegan and plant-based products due to health, environmental, and ethical motivations. Countries like Spain, where tiger nuts were traditionally used to make ‘horchata,’ are experiencing a revival in tiger nut milk consumption, supported by both traditional and modern production methods. The region’s stringent regulatory standards for food products also ensure high-quality offerings in the market.

Middle East & Africa: In this region, the market is still nascent but offers significant growth potential. The increasing urbanization and the expanding retail sector are expected to drive the adoption of tiger nut milk. Awareness campaigns and health trends are slowly permeating the consumer base, providing new opportunities for market expansion.

Latin America: While the market for tiger nut milk in Latin America is developing, there is a growing interest in alternative dairy products. The region shows promise with increasing health awareness and consumer preferences shifting towards plant-based diets, particularly in countries like Brazil and Argentina.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The tiger nut milk market is characterized by a diverse range of key players, each contributing unique strengths and innovations that drive industry growth. Among these, Tiger Nuts USA and Levantex are notable for their extensive experience in the cultivation and processing of tiger nuts, positioning them as leaders in providing raw materials and finished products in both the American and European markets.

The Tiger Nuts Company Ltd. and TIGERNUTS TRADERS, S.L. are prominent for their global reach and commitment to organic and non-GMO products, which cater to the increasing consumer demand for natural and health-conscious options.

Organic Gemini, Ludlow Nut Company Ltd., and KCB International are significant for their innovative approaches in product differentiation, including the introduction of flavored tiger nut milk varieties like chocolate and vanilla, which appeal to a broader consumer base. Good Soul Company and ACH Food Companies, Inc. focus on integrating tiger nut milk into health and wellness products, emphasizing its nutritional benefits such as high fiber, vitamins, and minerals essential for a balanced diet.

Further diversifying the market landscape, Jose María Bou, S.L., The Original Chufa Company, and Fontaine De Vie have made significant strides in sustainability and ethical sourcing. Ecoideas and Tradin Organic Agriculture B.V. excel in the organic segment, promoting environmentally friendly practices across their operations.

XUFEX rounds out this group by focusing on expanding distribution channels, particularly through online retail platforms, to increase the accessibility of tiger nut milk worldwide. Collectively, these companies are steering the market towards innovation, quality, and sustainability, meeting consumer expectations and driving global demand in the plant-based milk sector.

Top Key Players in the Market

- Tiger Nuts USA

- Levantex

- The Tiger Nuts Company Ltd.

- TIGERNUTS TRADERS, S.L.

- Organic Gemini

- Ludlow Nut Company Ltd.

- KCB International

- Good Soul Company

- ACH Food Companies, Inc.

- Jose María Bou, S.L

- The Original Chufa Company

- Fontaine De Vie

- Ecoideas

- Tradin Organic Agriculture B.V.

- XUFEX

Recent Developments

In 2023 Levantex’s strategic initiatives include expanding their product line and enhancing their distribution strategies to capitalize on the growing trend towards plant-based diets.

In 2023 Tiger Nuts USA has been a significant player in the tiger nut milk market, particularly in North America, where the sector is anticipated to see substantial growth.

Report Scope

Report Features Description Market Value (2023) USD 309.7 Mn Forecast Revenue (2033) USD 626.5 Mn CAGR (2024-2033) 7.3% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form(Whole, Powder, Oil), By Nature(Organic, Conventional), By End-use(Food Industry, Foodservice Industry, Retail/Household, Others), By Distribution Channel(Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tiger Nuts USA, Levantex, The Tiger Nuts Company Ltd., TIGERNUTS TRADERS, S.L., Organic Gemini, Ludlow Nut Company Ltd., KCB International, Good Soul Company, ACH Food Companies, Inc., Jose María Bou, S.L, The Original Chufa Company, Fontaine De Vie, Ecoideas, Tradin Organic Agriculture B.V., XUFEX Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tiger Nuts USA

- Levantex

- The Tiger Nuts Company Ltd.

- TIGERNUTS TRADERS, S.L.

- Organic Gemini

- Ludlow Nut Company Ltd.

- KCB International

- Good Soul Company

- ACH Food Companies, Inc.

- Jose María Bou, S.L

- The Original Chufa Company

- Fontaine De Vie

- Ecoideas

- Tradin Organic Agriculture B.V.

- XUFEX