Global Tertiary Packaging Market Size, Share, Growth Analysis By Material (Paper & Paperboard, Plastic, Metal, Others), By Product Type (Corrugated Box, Crates, Containers, Trays, Drums, Pallets), By End User (Warehouse & Logistics, Contract Packaging, Pharma Manufacturer, Chemicals Manufacturer, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170378

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

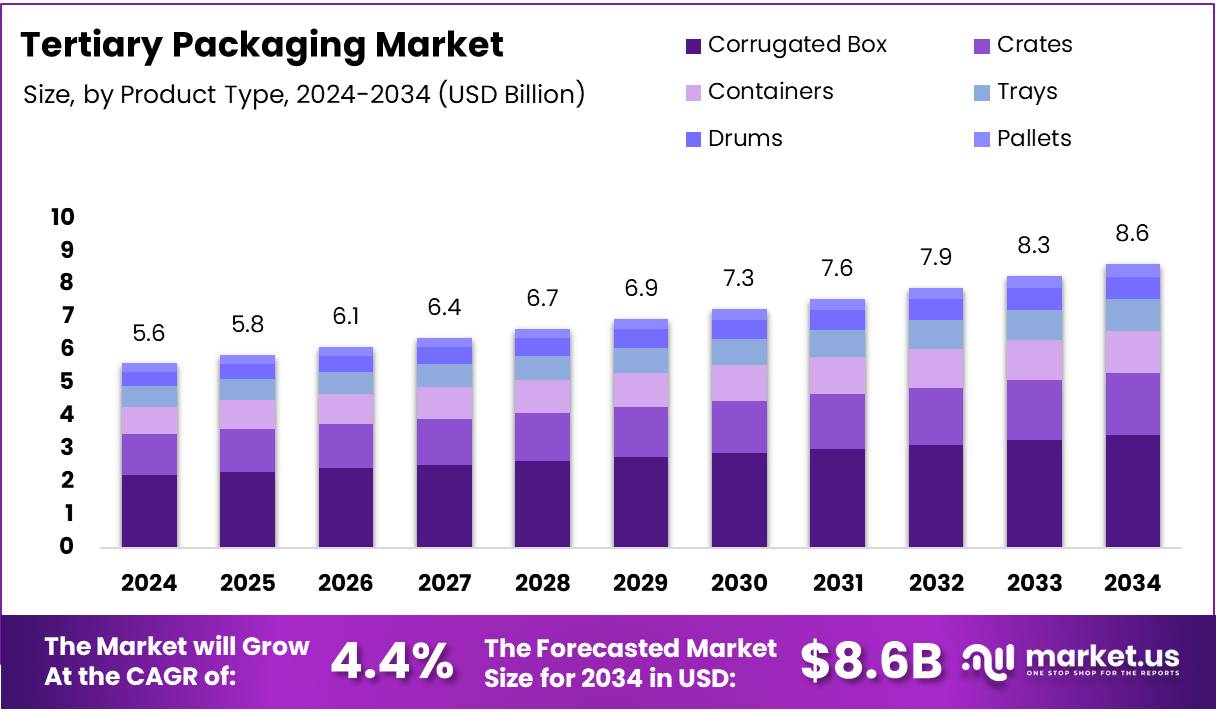

The Global Tertiary Packaging Market size is expected to be worth around USD 8.6 Billion by 2034, from USD 5.6 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

The Tertiary Packaging Market includes solutions that protect and transport goods efficiently during storage and shipment. Products like pallets, shrink wraps, stretch films, and cartons secure items for distribution, reduce damage, and improve supply chain efficiency across industries worldwide.

Demand is rising due to the rapid growth of e-commerce and logistics sectors. Companies are seeking durable, lightweight, and sustainable packaging solutions to lower transportation costs and carbon footprint. This trend creates opportunities for innovative and reusable designs that meet operational and environmental requirements.

Government regulations and environmental policies are significantly influencing the market. Incentives for recycling, restrictions on single-use materials, and sustainability mandates encourage businesses to adopt eco-friendly tertiary packaging. Compliance with these measures enhances brand reputation and supports long-term environmental objectives.

Investments in automation and smart packaging technologies are improving warehouse and distribution operations. AI-enabled tracking, automated handling systems, and advanced monitoring reduce labor costs, enhance supply chain visibility, and ensure secure transportation of goods. These technologies are increasingly integrated into modern logistics operations.

Sustainability is a major growth driver. About 66% of organizations have already implemented reusable packaging systems in their operations. This adoption reflects the market’s shift toward circular economy practices and the growing importance of reducing material waste.

Recycling of packaging materials also impacts market strategies. The overall recycling rate for paper and paperboard packaging is 80.9%, encouraging companies to prioritize recyclable materials. These practices reduce environmental impact, improve compliance with regulations, and support sustainable supply chain goals.

Key Takeaways

- The Global Tertiary Packaging Market is expected to grow from USD 5.6 Billion in 2024 to USD 8.6 Billion by 2034, at a CAGR of 4.4%.

- Paper & Paperboard dominated the By Material segment with a 49.8% market share.

- Corrugated Box led the By Product Type segment with a 39.6% share.

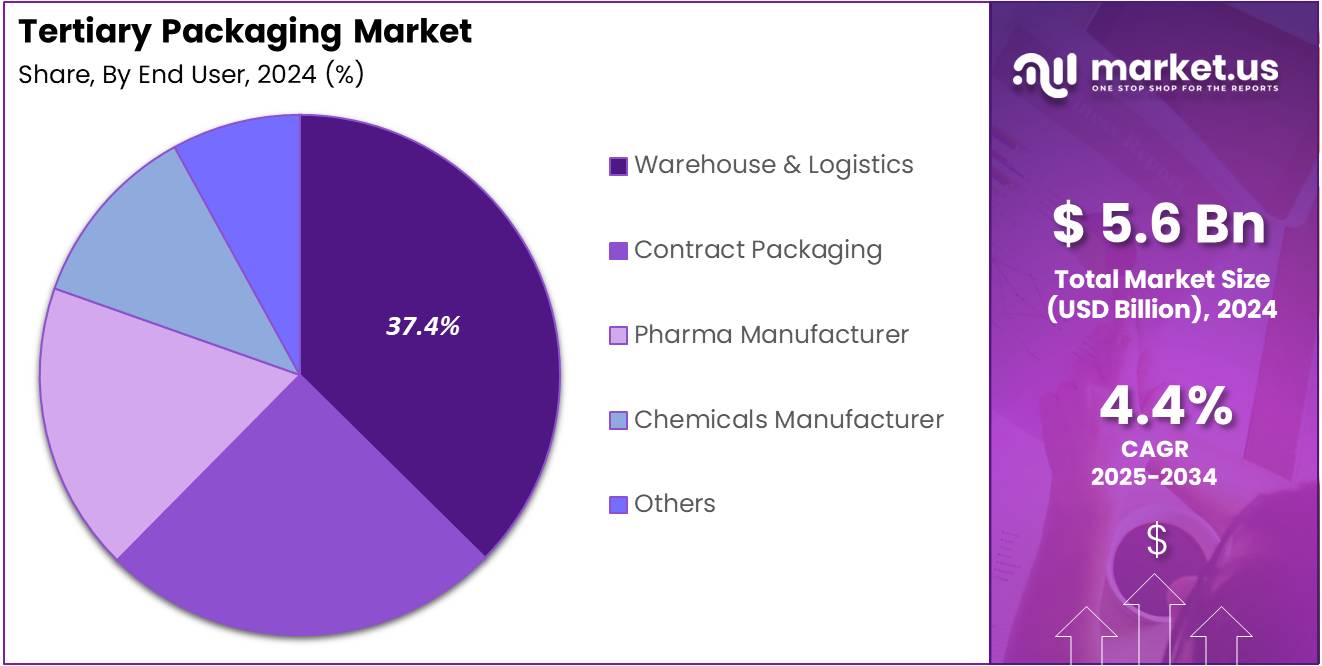

- Warehouse & Logistics was the largest End User segment with a 37.4% share.

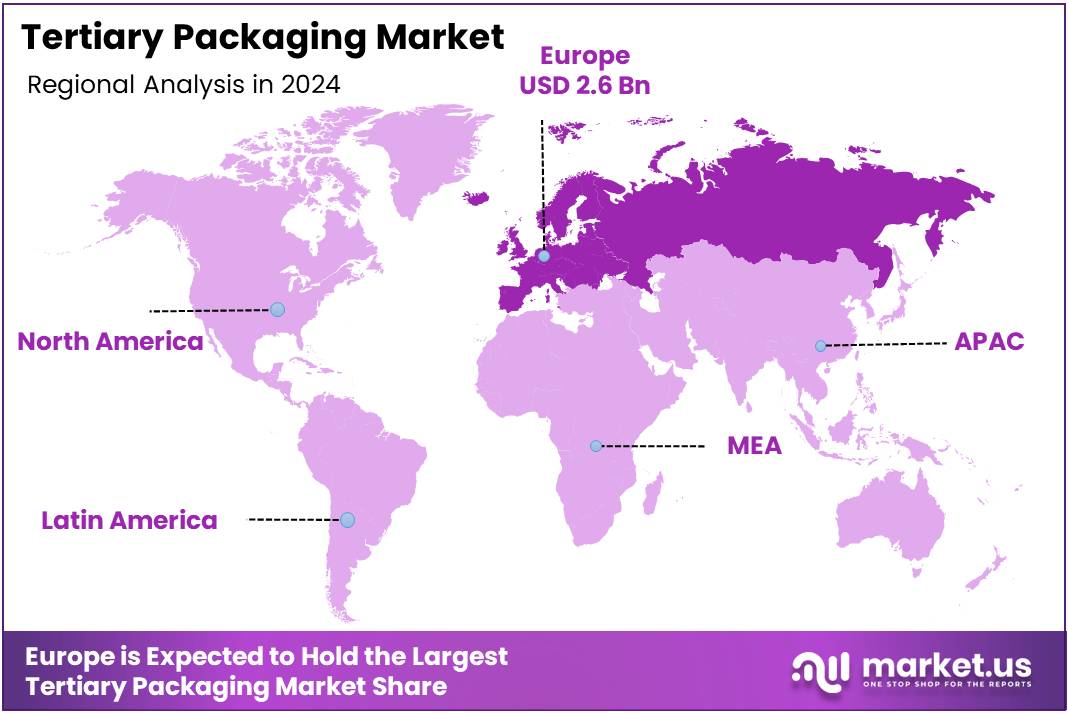

- Europe is the dominating region with 46.8% market share, valued at USD 2.6 Billion.

By Material Analysis

Paper & Paperboard held a dominant market position in the By Material Analysis segment of Tertiary Packaging Market, with a 49.8% share.

In 2024, Paper & Paperboard is preferred for its lightweight and recyclable properties, which reduce transportation costs and support flexible designs. Its sustainability aligns with regulatory trends, boosting adoption across industries. Versatility in packaging applications and increasing eco-conscious consumer demand reinforce its leading position in the tertiary packaging material segment globally.

Plastic is widely used due to durability, moisture resistance, and adaptability. It safeguards goods during transport and storage, supporting long supply chains. Innovations in recyclable and reusable plastics encourage adoption, while environmental concerns limit growth. Despite challenges, plastic remains essential in industrial and logistics packaging applications.

Metal offers superior protection for heavy or sensitive goods, resisting impacts and harsh conditions. Its durability ensures product safety during transport. Although more expensive than other materials, it suits specialized applications in industrial sectors, maintaining steady demand in tertiary packaging markets requiring robust protection.

Others include composite, biodegradable, and innovative materials for niche requirements. These materials provide tailored solutions for specific products and emerging markets. Growing focus on eco-friendly and functional packaging drives adoption, gradually increasing their presence despite a smaller market share.

By Product Type Analysis

Corrugated Box held a dominant market position in the By Product Type Analysis segment of Tertiary Packaging Market, with a 39.6% share.

In 2024,Corrugated Boxes are lightweight, cost-effective, and provide excellent cushioning. They protect fragile items during storage and transit while being easily recyclable. Industries rely on them for bulk shipments and supply chain efficiency, making them the most widely used tertiary packaging product type globally and a key contributor to market growth.

Crates provide sturdy and reliable solutions for heavy goods and industrial shipments. Their robust construction minimizes product damage during transport. Growing industrial and agricultural logistics drives higher adoption, especially for long-distance transportation, highlighting their role in safe and efficient packaging solutions.

Containers enable organized storage and bulk transport. Stackable designs optimize warehouse space and handling efficiency. Reusable and standardized options support sustainability and smooth supply chain operations, making containers an important choice for companies seeking efficient tertiary packaging solutions.

Trays are widely used for organizing smaller items and reducing damage during storage and transit. Industries such as food, electronics, and pharmaceuticals rely on trays for improved packing efficiency and safe handling. Their convenience and protective features drive steady adoption in tertiary packaging applications.

Drums ensure safe transportation of bulk liquids, chemicals, and hazardous materials. Leak-proof designs comply with regulatory standards. Industrial and chemical sectors maintain stable demand for drums due to operational safety priorities and secure handling of high-risk materials.

Pallets improve handling, storage, and operational efficiency by simplifying loading, unloading, and stacking processes. Wooden and plastic variants dominate the market. E-commerce and logistics growth increase pallet adoption, optimizing supply chain productivity and reducing product damage during transport.

By End User Analysis

Warehouse & Logistics held a dominant market position in the By End User Analysis segment of Tertiary Packaging Market, with a 37.4% share.

In 2024,Warehouse & Logistics companies drive tertiary packaging demand due to large-scale bulk handling needs. Packaging solutions improve storage efficiency, reduce damages, and optimize supply chains. Increasing e-commerce and global trade reinforce reliance on reliable, efficient, and sustainable packaging solutions for smooth operations across industries.

Contract Packaging services adopt tertiary packaging for standardized bulk handling. It ensures consistent quality, reduces product damage, and accelerates operations. Rising outsourcing trends in packaging support growing adoption, as companies increasingly rely on specialized providers for efficient and cost-effective bulk packaging.

Pharma Manufacturers depend on tertiary packaging to transport medicines and sensitive products safely. Compliance with regulatory standards and robust containment ensures product integrity throughout distribution networks. Reliable packaging solutions help reduce losses, prevent contamination, and safeguard patient health.

Chemicals Manufacturers adopt durable tertiary packaging for hazardous materials. Leak-proof designs and regulatory compliance ensure safe transport and storage. Industrial and chemical sectors maintain strong demand due to safety priorities and secure handling requirements for high-risk substances.

Others, including electronics and specialty goods distributors, use tertiary packaging to protect delicate products and improve logistics efficiency. Growing demand for sustainable and functional packaging drives adoption, supporting organized, secure, and cost-efficient supply chain operations across niche markets.

Key Market Segments

By Material

- Paper & Paperboard

- Plastic

- Metal

- Others

By Product Type

- Corrugated Box

- Crates

- Containers

- Trays

- Drums

- Pallets

By End User

- Warehouse & Logistics

- Contract Packaging

- Pharma Manufacturer

- Chemicals Manufacturer

- Others

Drivers

Rapid Growth of Global E-Commerce and Retail Distribution Networks Drives Tertiary Packaging Market

The global rise of e-commerce has significantly increased the need for reliable tertiary packaging solutions. As more products are shipped directly to consumers, companies require packaging that ensures safe and efficient transportation. This trend is driving investments in durable and standardized tertiary packaging.

Retail distribution networks are expanding rapidly across regions, creating a higher demand for bulk packaging solutions. Warehouses and fulfillment centers increasingly rely on tertiary packaging to handle large volumes of goods. This helps streamline operations while reducing handling time and errors during distribution.

Another important factor is the increasing focus on product protection during transit. Businesses are prioritizing packaging that minimizes damage and losses, ensuring products reach consumers intact. Tertiary packaging such as pallets, shrink wraps, and protective containers play a key role in this.

Technological advancements in automated packaging and handling systems are also supporting market growth. Automated systems reduce labor costs and improve efficiency, allowing faster processing of shipments. Integration of robotics and smart packaging solutions enhances the overall supply chain reliability.

Restraints

Challenges in Adopting Tertiary Packaging Solutions

Strict regulations for sustainable tertiary packaging create significant challenges for manufacturers. Companies must comply with multiple environmental standards, which often differ by region. This adds complexity to production processes and increases costs for businesses trying to maintain regulatory compliance while meeting market demand.

The need for eco-friendly materials often forces companies to change traditional packaging methods. Many organizations face delays in launching new products due to extensive testing and certification processes required for sustainable tertiary packaging. These requirements can slow down market growth and increase operational burdens.

Another major restraint is the limited availability of standardized tertiary packaging materials in certain regions. Companies may struggle to source materials locally, leading to higher import costs and longer lead times. This inconsistency in material supply affects production efficiency and reliability.

Regional disparities in material standards also create challenges for global manufacturers. Packaging designed for one market may not meet requirements in another, forcing companies to maintain multiple supply chains. These factors together slow the adoption of advanced tertiary packaging solutions across the industry.

Growth Factors

Expansion of E-Commerce Logistics Drives Growth Opportunities in Tertiary Packaging

The rapid expansion of e-commerce logistics is creating significant growth opportunities for the tertiary packaging market. As online shopping continues to rise globally, companies are seeking packaging solutions that ensure safe delivery of goods. Efficient tertiary packaging reduces product damage, lowers returns, and improves customer satisfaction, making it a crucial part of the supply chain.

Adoption of smart packaging technologies is another key opportunity. Technologies like RFID tags, QR codes, and IoT-enabled packaging help track shipments in real-time, optimize inventory, and streamline warehouse operations. Companies investing in these solutions can enhance supply chain efficiency and reduce operational costs, giving them a competitive edge.

There is also a growing demand for recyclable and biodegradable tertiary packaging materials. With increasing environmental awareness and stricter regulations, businesses are shifting towards sustainable packaging. Using eco-friendly materials not only meets compliance requirements but also strengthens brand reputation among environmentally conscious consumers.

Emerging Trends

Integration of Technology and Customization Driving Tertiary Packaging Trends

The tertiary packaging market is witnessing a shift towards IoT and RFID integration, enabling real-time tracking of shipments. Companies can now monitor the movement and condition of goods throughout the supply chain, reducing losses and improving delivery efficiency. This technology is becoming a standard expectation for high-value and time-sensitive shipments.

Another key trend is the adoption of lightweight yet durable materials. These materials help lower transportation costs and reduce the carbon footprint of logistics operations. Businesses are increasingly prioritizing materials that can withstand handling while keeping overall package weight minimal, enhancing sustainability and cost-effectiveness.

There is also a growing demand for customized tertiary packaging solutions, especially in the retail sector. Retailers seek packaging that fits specific product dimensions and branding requirements. Tailored solutions help improve stacking efficiency, prevent damage, and enhance the overall customer experience, making it a preferred choice for e-commerce and large distribution networks.

Regional Analysis

Europe Dominates the Tertiary Packaging Market with a Market Share of 46.8%, Valued at USD 2.6 Billion

In 2024, Europe maintained a leading position in the tertiary packaging market, accounting for 46.8% of the global share, valued at USD 2.6 billion. The region benefits from highly developed logistics and transportation networks, strict regulatory standards for product safety, and widespread adoption of advanced packaging technologies. Rising demand for customized and durable packaging solutions in retail and e-commerce sectors further supports market growth.

North America Tertiary Packaging Market Trends

North America demonstrates steady market growth, fueled by the expansion of e-commerce and robust retail distribution networks. The focus on minimizing product damage during shipping has increased the adoption of innovative tertiary packaging solutions. Technological advancements, such as automated packaging systems and smart tracking methods, are also driving efficiency in supply chains across the U.S. and Canada.

Asia Pacific Tertiary Packaging Market Trends

The Asia Pacific region is witnessing rapid growth in the tertiary packaging market due to industrial expansion, urbanization, and increasing consumer demand. Key markets, including China and India, are investing in automation and smart packaging solutions. Rising awareness of sustainability is pushing companies to adopt lightweight, recyclable, and durable packaging materials, enhancing supply chain efficiency.

Middle East and Africa Tertiary Packaging Market Trends

In the Middle East and Africa, market growth is driven by improving logistics infrastructure, expanding industrial sectors, and increasing retail activities. Companies are increasingly adopting durable and reusable tertiary packaging solutions to reduce operational costs and prevent product damage. Environmental regulations and growing awareness of sustainable packaging are further encouraging market adoption.

Latin America Tertiary Packaging Market Trends

Latin America’s tertiary packaging market is gradually expanding, supported by growing industrial output and improvements in transportation networks. Businesses are adopting innovative packaging strategies to ensure product protection during transit. Rising interest in recyclable and eco-friendly packaging materials, along with increasing trade activities, is expected to create new opportunities for market players.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Tertiary Packaging Company Insights

In 2024, DS Smith maintained a strong presence in the tertiary packaging market, leveraging its innovative and sustainable packaging solutions. The company focuses on lightweight, recyclable materials, supporting efficient logistics and reducing environmental impact. Its commitment to sustainability drives adoption across e-commerce and industrial segments.

Becton Dickinson strengthened its market position through advanced packaging solutions designed for healthcare and pharmaceutical products. The company emphasizes product protection and regulatory compliance, catering to sensitive supply chains while ensuring safety and reliability. Its technology-driven approach enhances operational efficiency for clients globally.

Owens Illinois, Inc. expanded its footprint in tertiary packaging through robust glass and specialty packaging solutions. The company prioritizes durability and product integrity during transportation, which is critical for beverages and consumer goods sectors. Its strong manufacturing capabilities support high-volume demand across diverse markets.

WestRock Company focused on integrated packaging solutions, combining corrugated and paperboard systems for improved supply chain efficiency. Innovation in sustainable materials and automation enhances cost-effectiveness and reduces carbon footprint. The company’s diverse offerings cater to retail, e-commerce, and industrial applications worldwide.

Top Key Players in the Market

- DS Smith

- Becton Dickinson

- Owens Illinois, Inc.

- WestRock Company

- Comar

- Amcor plc

- SGD Pharma

- Schott AG

- Gerresheimer AG

- AptarGroup

Recent Developments

- In April 2025, Amcor and Berry Global Group announced they would be combining in an all-stock transaction. This merger aims to create a global leader in consumer and healthcare packaging solutions.

- In January 2025, The International Paper (IP) completed its acquisition of DS Smith. This strategic move strengthens IP’s position in the global packaging market and expands its service offerings.

- In May 2024, Tide Rock finalized the acquisition of US contract packager Premier Packaging. This acquisition enhances Tide Rock’s capabilities in contract packaging and broadens its customer base across North America.

Report Scope

Report Features Description Market Value (2024) USD 5.6 Billion Forecast Revenue (2034) USD 8.6 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Paper & Paperboard, Plastic, Metal, Others), By Product Type (Corrugated Box, Crates, Containers, Trays, Drums, Pallets), By End User (Warehouse & Logistics, Contract Packaging, Pharma Manufacturer, Chemicals Manufacturer, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape DS Smith, Becton Dickinson, Owens Illinois, Inc., WestRock Company, Comar, Amcor plc, SGD Pharma, Schott AG, Gerresheimer AG, AptarGroup Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DS Smith

- Becton Dickinson

- Owens Illinois, Inc.

- WestRock Company

- Comar

- Amcor plc

- SGD Pharma

- Schott AG

- Gerresheimer AG

- AptarGroup