Global Terminal Management System Market Size, Share, Statistics Analysis Report By Component (Software, Services), By Project Type (Brownfield Projects, Greenfield Projects), By Industry Vertical (Oil & Gas, Chemicals, Railway, Aviation, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 133295

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

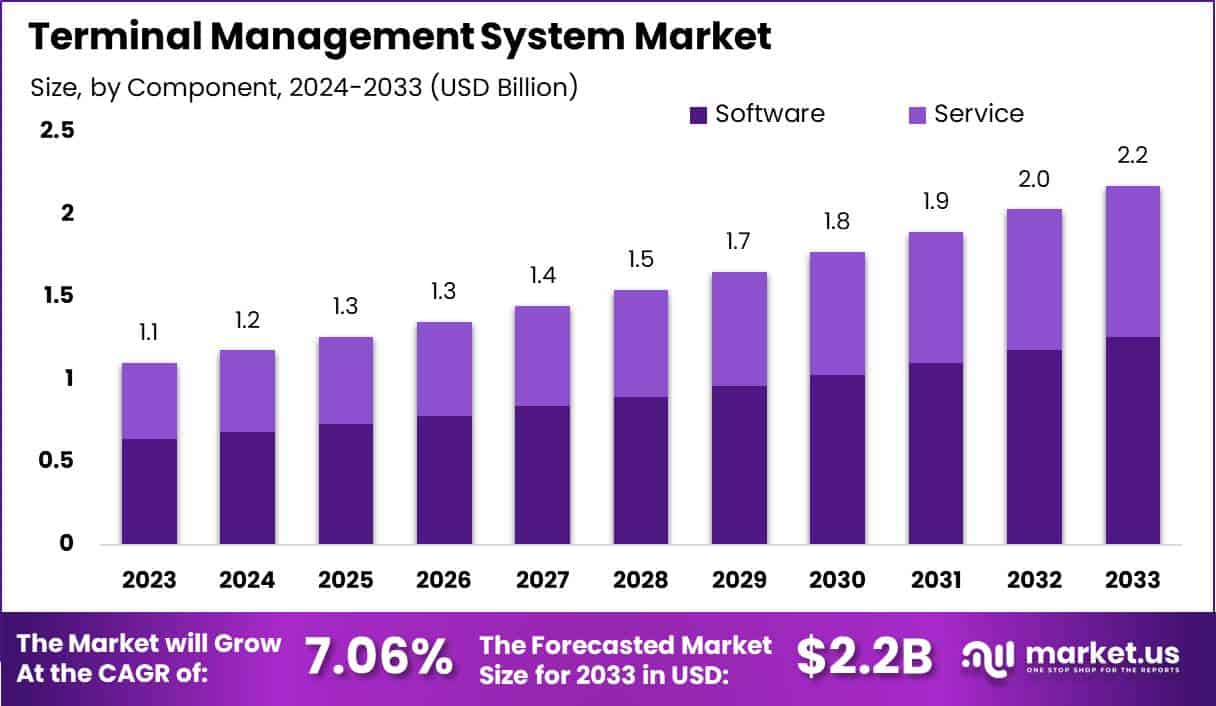

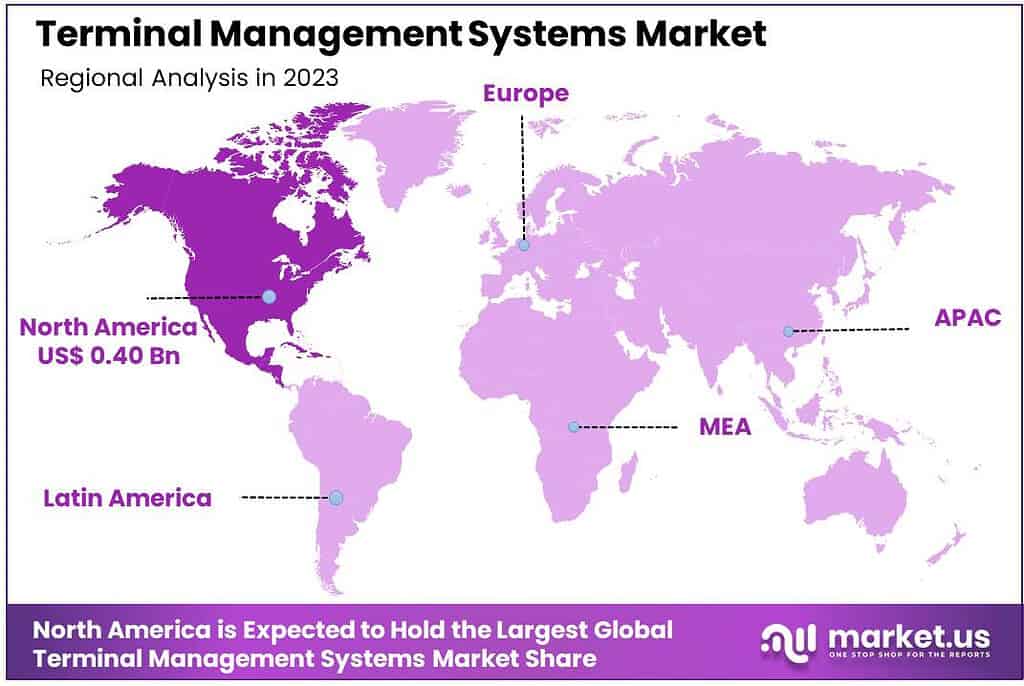

The Global Terminal Management System Market size is expected to be worth around USD 2.2 Billion By 2033, from USD 1.09 Billion in 2023, growing at a CAGR of 7.06% during the forecast period from 2024 to 2033. In 2023, North America captured more than 36.7% of the Terminal Management System market, with revenues totaling approximately USD 0.40 billion, securing a dominant market position.

A Terminal Management System (TMS) is a specialized software solution designed to oversee and optimize the operations of terminals, particularly in industries such as oil and gas, chemicals, and logistics. It facilitates the efficient handling of processes including the receipt, storage, and distribution of products. By integrating various terminal functions, a TMS enhances operational efficiency, ensures safety compliance, and provides real-time data analytics for informed decision-making.

The market for Terminal Management Systems is witnessing substantial growth due to increasing demands for automation across various sectors including oil, gas, and chemicals. As businesses strive for more efficient operations and better compliance with safety regulations, the adoption of TMS is escalating. This market is driven by the expanding global trade of bulk commodities, which necessitates robust solutions to manage terminal operations and optimize logistics.

Several factors are propelling the growth of the TMS market. The expansion of global trade has led to increased terminal activities, necessitating efficient management systems. Technological advancements, such as the integration of Internet of Things (IoT) devices and automation, have enhanced terminal operations, further driving market growth. Additionally, stringent safety and environmental regulations have compelled industries to adopt TMS solutions to ensure compliance and mitigate risks.

The demand for TMS is on the rise as industries seek to improve operational efficiency, reduce costs, and enhance safety measures. The oil and gas sector, in particular, has shown significant interest in TMS solutions to manage complex terminal operations effectively. Moreover, the chemical industry is adopting TMS to handle hazardous materials safely and efficiently. The logistics sector also benefits from TMS by optimizing cargo handling and reducing turnaround times.

Opportunities in the TMS market are abundant, especially with the increasing adoption of digital technologies. The integration of cloud-based solutions offers scalability and flexibility, making TMS more accessible to small and medium-sized enterprises. Emerging markets present significant potential due to ongoing industrialization and infrastructure development. Furthermore, the trend towards green logistics and sustainable operations opens avenues for TMS providers to offer eco-friendly solutions.

Technological advancements have played a pivotal role in shaping the TMS market. The incorporation of IoT devices enables real-time monitoring and data collection, facilitating predictive maintenance and operational optimization. Automation technologies streamline processes, reducing human error and increasing efficiency. Additionally, advancements in data analytics provide actionable insights, aiding in strategic decision-making and enhancing overall terminal performance.

Key Takeaways

- The Global Terminal Management System Market size is projected to reach USD 2.2 billion by 2033, up from USD 1.09 billion in 2023, growing at a CAGR of 7.06% during the forecast period from 2024 to 2033.

- In 2023, the Software segment held a dominant market position within the Terminal Management System (TMS) market, capturing more than 58% of the market share.

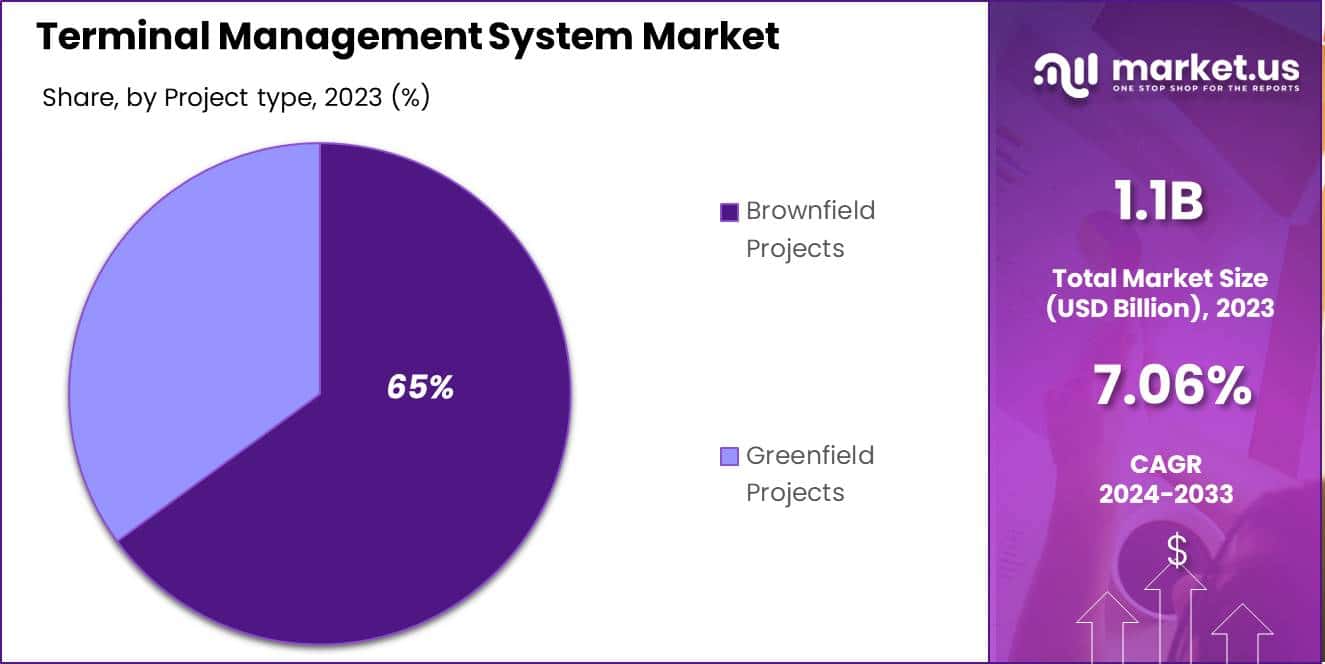

- The Brownfield Projects segment also held a dominant market position in 2023, capturing more than 65% of the market share.

- The Oil & Gas segment was a major player in the Terminal Management System Market in 2023, with a dominant position and more than 52% of the market share. This large share can be attributed to the critical need for efficient terminal operations in the oil and gas industry.

- North America held a dominant market position in the Terminal Management System market in 2023, with more than 36.7% of the market share and revenues of approximately USD 0.40 billion.

Component Analysis

In 2023, the Software segment held a dominant position in the Terminal Management System market, capturing more than a 58% share. This substantial market share is attributed primarily to the increasing need for integrated software solutions that streamline terminal operations, enhance data accuracy, and improve overall efficiency.

As terminals worldwide deal with more complex logistics and compliance requirements, the reliance on advanced software that can handle intricate data management and operational processes has grown significantly. Software solutions in Terminal Management Systems are crucial for automating tasks that traditionally required manual intervention, such as inventory management, transaction management, and compliance reporting.

These software systems are designed to be robust and scalable, enabling terminal operators to efficiently manage large volumes of data and complex logistics workflows. The software also plays a vital role in ensuring regulatory compliance, which is increasingly important in industries dealing with hazardous materials and stringent environmental standards.

The growing adoption of IoT and AI technologies has further boosted the demand for sophisticated software in Terminal Management Systems. These technologies enhance the functionality of TMS software by enabling features like real-time monitoring, predictive maintenance, and advanced analytics. Such capabilities allow terminal operators to make more informed decisions, optimize operations, and reduce downtime, thereby driving the software segment’s dominance in the market.

Moreover, as the global trade landscape evolves and terminals seek to become more competitive, the need for software that can integrate seamlessly with other systems and platforms becomes more critical. This integration capability allows for better collaboration, improved supply chain visibility, and enhanced operational transparency, contributing to the continued growth and dominance of the software segment in the Terminal Management System market.

Project Type Analysis

In 2023, the Brownfield Projects segment held a dominant market position in the Terminal Management System market, capturing more than a 65% share. This predominance can be attributed to the widespread need to upgrade and optimize existing terminal facilities to meet current operational standards and regulatory requirements.

Many terminal operators are focusing on enhancing their current infrastructure to improve efficiency, safety, and compliance without the substantial capital investment required for new constructions. Brownfield projects typically involve the integration of advanced Terminal Management Systems into existing facilities, which often must continue operations during upgrades.

This necessitates sophisticated software solutions capable of being seamlessly integrated with older systems while introducing new functionalities and technologies. The upgrades are aimed at extending the operational life of the facilities, increasing capacity, improving operational safety, and reducing environmental impact, making these projects particularly valuable.

Furthermore, the urgency for digital transformation in the logistics and storage sectors drives the Brownfield segment. Operators are increasingly adopting IoT, AI, and data analytics within their TMS solutions to gain real-time insights into operations, predictive maintenance, and enhanced security measures. Such technological upgrades are essential for maintaining competitiveness and meeting the evolving demands of global trade and stringent environmental regulations.

The focus on sustainability and cost efficiency continues to propel the Brownfield projects segment forward. Operators prefer to retrofit existing terminals with state-of-the-art management systems rather than investing in new sites, given the financial constraints and environmental considerations. This trend is expected to persist as technology advances and regulatory pressures intensify, ensuring the ongoing dominance of the Brownfield projects in the Terminal Management System market.

Industry Vertical Analysis

In 2023, the Oil & Gas segment held a dominant market position in the Terminal Management System market, capturing more than a 52% share. This leadership is primarily due to the critical need for stringent compliance with safety and environmental regulations in the oil and gas industry, which demands highly reliable and efficient management systems.

Terminal Management Systems are vital for these operations, offering robust solutions that ensure safe handling, storage, and distribution of highly volatile substances. The operational complexities in oil and gas terminals, which involve managing vast quantities of liquid products, multiple transfer points, and extensive logistical coordination, necessitate the adoption of advanced TMS solutions.

These systems provide precise control over inventory, real-time monitoring of cargo transfers, and integration with corporate ERP systems, enhancing operational transparency and efficiency. Moreover, the ability to streamline operations helps reduce the likelihood of costly errors or accidents, which is paramount in an industry where safety is a top priority.

Additionally, the global expansion of the oil and gas sector, spurred by increasing energy demands, drives the need for scalable TMS solutions that can adapt to growing operational capacities and more complex supply chains. Innovations in TMS software, such as the incorporation of AI and IoT, offer further enhancements in predictive maintenance, energy management, and security protocols, ensuring the oil and gas segment remains a primary driver of growth in the TMS market.

The reliance on Terminal Management Systems within the oil and gas industry is expected to continue growing, fueled by the sector’s ongoing need to improve operational efficiency and ensure compliance with increasingly stringent international regulations. This trend underscores the segment’s substantial impact on the broader TMS market and its pivotal role in shaping technological advancements in terminal management practices.

Key Market Segments

By Component

- Software

- Services

By Project Type

- Brownfield Projects

- Greenfield Projects

By Industry Vertical

- Oil & Gas

- Chemicals

- Railway

- Aviation

- Others

Driver

Enhanced Operational Efficiency

The adoption of Terminal Management Systems (TMS) is primarily driven by the need to enhance operational efficiency in terminal operations. By automating processes such as inventory management, scheduling, and real-time monitoring, TMS reduces manual errors and accelerates workflows.

This automation leads to optimized resource utilization, decreased operational costs, and improved turnaround times. For instance, in the oil and gas sector, TMS enables precise tracking of product movements, ensuring timely deliveries and minimizing losses.

Restraint

High Implementation Costs

Despite its benefits, the high initial investment required for implementing Terminal Management Systems poses a significant restraint. Costs associated with purchasing software licenses, upgrading existing infrastructure, and training personnel can be substantial, especially for small to medium-sized enterprises.

Additionally, integrating TMS with legacy systems may necessitate further expenditures, complicating the adoption process. These financial barriers can deter organizations from investing in TMS, despite the potential long-term gains in efficiency and productivity.

Opportunity

Integration with Emerging Technologies

The evolving landscape of digital technologies presents a significant opportunity for Terminal Management Systems. Integrating TMS with emerging technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and blockchain can revolutionize terminal operations.

IoT devices enable real-time data collection from various terminal assets, facilitating enhanced monitoring and control. AI algorithms can analyze this data to predict maintenance needs, optimize scheduling, and improve decision-making processes.

Blockchain technology offers secure and transparent transaction records, enhancing trust and compliance in terminal operations. By embracing these technologies, TMS providers can offer more robust and innovative solutions, meeting the growing demands for efficiency and security in terminal management.

Challenge

Cybersecurity Threats

As Terminal Management Systems become increasingly integrated with digital technologies, they face heightened cybersecurity threats. The reliance on interconnected systems and real-time data exchange exposes terminals to potential cyber-attacks, data breaches, and system disruptions.

Ensuring the security of sensitive information and maintaining the integrity of terminal operations require robust cybersecurity measures. Implementing these measures can be complex and resource-intensive, posing a significant challenge for organizations. Moreover, the evolving nature of cyber threats necessitates continuous updates and vigilance, adding to the complexity of managing secure TMS environments.

Emerging Trends

Terminal Management Systems (TMS) are evolving rapidly to meet the demands of modern industries. A significant trend is the integration of advanced technologies like the Internet of Things (IoT) and Artificial Intelligence (AI). These innovations enable real-time monitoring and predictive maintenance, enhancing operational efficiency and reducing downtime.

Another notable development is the shift towards cloud-based TMS solutions. Cloud platforms offer scalability and flexibility, remote access, making it easier for businesses to adapt to changing needs without substantial infrastructure investments.

Furthermore, user-friendly interfaces are becoming a standard feature in TMS design. Simplified dashboards and intuitive controls make it easier for staff to operate the system effectively, reducing the learning curve and minimizing errors. This focus on usability enhances overall productivity and ensures smoother operations.

Business Benefits

Implementing Terminal Management System offers numerous advantages that can significantly enhance business operations. One of the primary benefits is better compliance management. It ensures that operations adhere to industry regulations and standards by maintaining accurate records and facilitating audits.

Improved customer satisfaction is another positive outcome. With more efficient and reliable operations, businesses can meet customer expectations more consistently. Timely deliveries and accurate information foster stronger relationships and can lead to increased customer loyalty.

TMS provides valuable data analytics capabilities. By collecting and analyzing operational data, businesses can gain insights into performance trends and areas for improvement. This data-driven approach supports informed decision-making and strategic planning, positioning the company for sustained growth and competitiveness.

Regional Analysis

In 2023, North America held a dominant market position in the Terminal Management System market, capturing more than a 36.7% share, with revenues amounting to approximately USD 0.40 billion. This leading position can be attributed to several factors that uniquely position North America at the forefront of the TMS industry.

The region boasts a highly developed oil and gas sector, which demands sophisticated and efficient terminal management systems to handle large-scale operations and compliance with stringent regulatory standards. The presence of major oil refineries and chemical plants in countries like the United States and Canada drives the adoption of advanced TMS solutions that can enhance operational efficiency and ensure safety and compliance.

North America is a hub for technological innovation, particularly in the United States, where many leading TMS providers are headquartered. These companies continuously push the boundaries of what TMS can achieve, incorporating the latest technologies such as IoT, AI, and cloud computing into their solutions. This innovation drive attracts investments and partnerships, further strengthening the region’s market position.

Moreover, the regulatory environment in North America necessitates the adoption of comprehensive management systems. Regulatory bodies such as the Environmental Protection Agency (EPA) in the U.S. enforce strict guidelines on emissions and waste management, prompting terminal operators to invest in systems that can meticulously monitor and manage their operations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Several key players are driving the development and adoption of TMS solutions. Among them, Siemens AG stands out as a leader in the Terminal Management System market, leveraging its extensive technology portfolio and innovation focus to deliver integrated solutions. Siemens’ terminal management systems are known for incorporating advanced automation, digitalization and energy management technologies.

Another significant player, ABB Ltd., excels in offering TMS solutions that emphasize energy efficiency and environmental compliance. ABB’s systems are equipped with smart features like real-time monitoring and control, which help terminal operators optimize their operations while minimizing environmental impact.

DP World Limited, primarily known for its global port operations, also offers sophisticated terminal management systems that are crucial in managing the logistical complexities of port and terminal operations. Their TMS solutions are part of a broader suite of technologies that facilitate efficient cargo handling, vessel loading and unloading, and overall port logistics.

Top Key Players in the Market

- Siemens AG

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd.

- DP World Limited

- Emerson Electric Co.

- Rockwell Automation Inc.

- Konecranes Oyj

- Yokogawa Electric Corporation

- Endress+Hauser Group Services AG

- Hutchison Port Holdings Limited

- INFORM GmbH

- Other Key Players

Recent Developments

- In September 2024, French shipping company CMA CGM agreed to acquire a 48% stake in Brazilian port terminal operator Santos Brasil for $1.2 billion. This acquisition is expected to enhance CMA CGM’s terminal operations and TMS capabilities in Brazil.

- In october 2024, APM Terminals Maasvlakte II B.V. has selected Konecranes’ Automated Horizontal Transport System to help double its capacity at the Port of Rotterdam, Europe’s largest port. The order was placed in Q3 2024, with delivery and commissioning scheduled for 2025.

Report Scope

Report Features Description Market Value (2023) USD 1.09 Bn Forecast Revenue (2033) USD 2.2 Bn CAGR (2024-2033) 7.06% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By Project Type (Brownfield Projects, Greenfield Projects), By Industry Vertical (Oil & Gas, Chemicals, Railway, Aviation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens AG, Schneider Electric SE, Honeywell International Inc., ABB Ltd., DP World Limited, Emerson Electric Co., Rockwell Automation Inc., Konecranes Oyj, Yokogawa Electric Corporation, Endress+Hauser Group Services AG, Hutchison Port Holdings Limited, INFORM GmbH, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Terminal Management System MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Terminal Management System MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens AG

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd.

- DP World Limited

- Emerson Electric Co.

- Rockwell Automation Inc.

- Konecranes Oyj

- Yokogawa Electric Corporation

- Endress+Hauser Group Services AG

- Hutchison Port Holdings Limited

- INFORM GmbH

- Other Key Players