Teleradiology Software Market By Type (Radiology Information System (RIS), Picture Archive and Communication System (PACs), and Vendor Neutral Archive (VNA)), By Deployment (Web-based, Cloud-based, and On-premise), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 124893

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

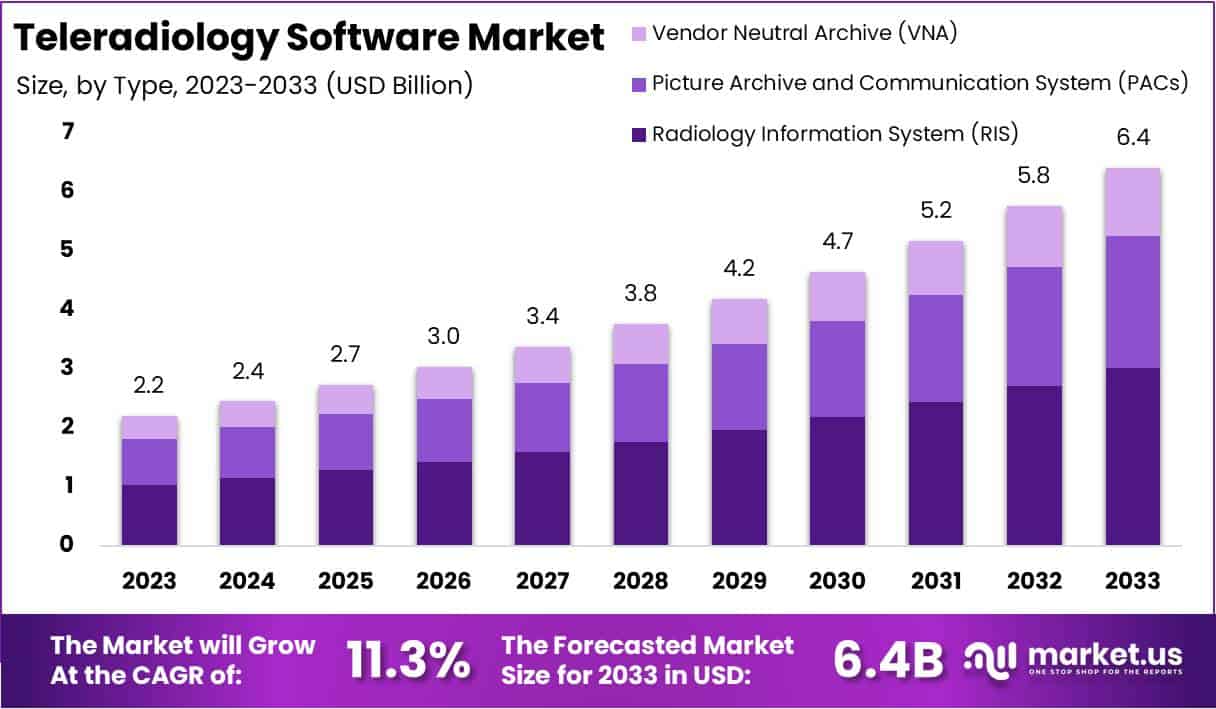

The Global Teleradiology Software Market size is expected to be worth around USD 6.4 Billion by 2033, from USD 2.2 Billion in 2023, growing at a CAGR of 11.3% during the forecast period from 2024 to 2033.

The teleradiology software market is characterized by dynamic growth driven by advancements in medical imaging technology and increasing demand for remote diagnostic services. This market encompasses software solutions that facilitate the transmission, interpretation, and storage of medical images such as X-rays, CT scans, and MRIs over long distances.

Key factors influencing market dynamics include the global shortage of radiologists in certain regions, which is prompting healthcare providers to adopt teleradiology solutions to streamline workflow and improve diagnostic efficiency. Moreover, the rise in chronic diseases and the ageing population worldwide are contributing to the growing demand for diagnostic imaging services, thereby boosting the adoption of teleradiology software.

Technological advancements in artificial intelligence (AI) and machine learning have further enhanced the capabilities of teleradiology software by enabling automated image analysis, faster image processing, and more accurate diagnosis. These developments are attracting investments from healthcare providers and technology companies, driving innovation and competition within the market.

- According to the National Health Interview Survey In 2021, 37.0% of adults used telemedicine. Telemedicine use increased with age and was higher among women (42.0%) compared with men (31.7%).

- According to United Healthcare Consumer Sentiment Survey statistics in 2019, 37.0% of Americans rely on either online or mobile apps for consultations related to their health conditions.

Key Takeaways

- The teleradiology software market generated a revenue of USD 2.2 billion in 2023 and is poised to reach USD 6.4 billion by the year 2033, accompanied by a CAGR of 11.3%.

- In 2023, the picture archive and communication system (PACs) segment took the lead in the global market, securing 47% of the total revenue share.

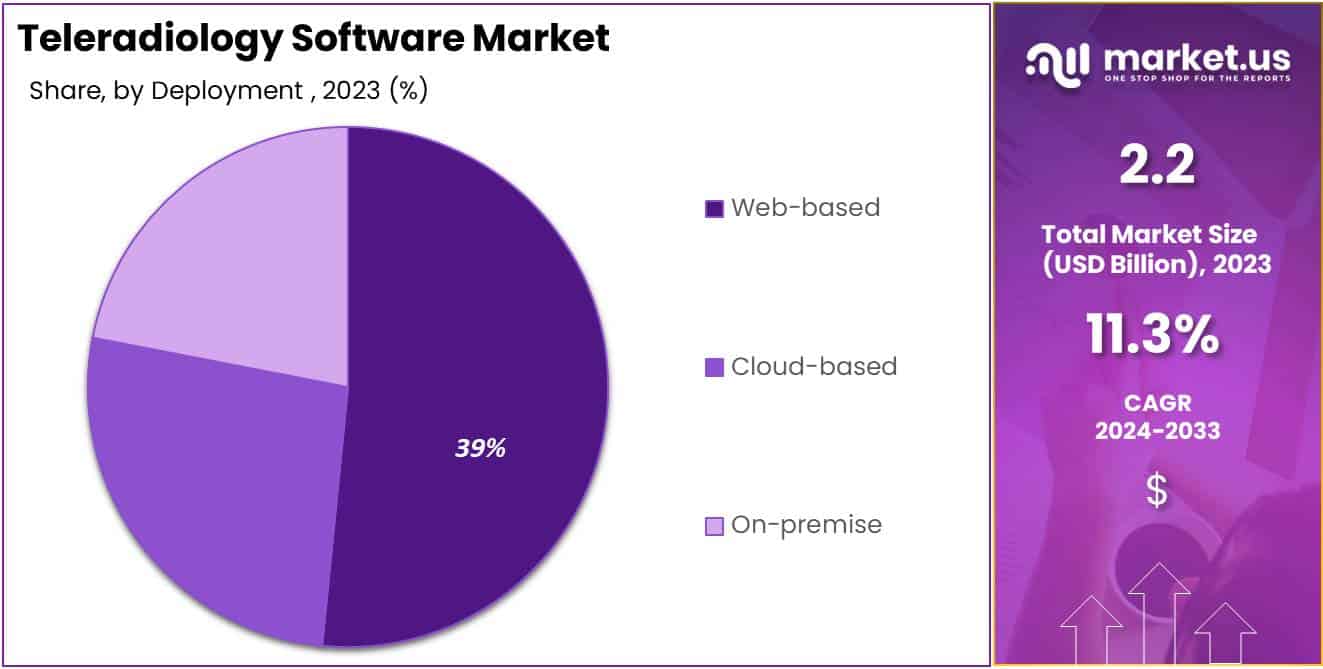

- The web-based segment also dominated, holding the largest revenue share at 39%.

- North America maintained its leading position in the global market with a share of over 40% of the total revenue.

Type Analysis

The picture archive and communication systems (PACs) emerged as the leading segment in the global teleradiology software market, commanding 47% of the total revenue share. This segment is poised to maintain its prominent position throughout the forecast period. The rising prevalence of chronic diseases and ageing populations worldwide has fueled the demand for teleradiology software. Teleradiology software allows healthcare providers to transmit medical images securely over long distances, facilitating remote interpretation and consultation by radiologists.

This capability not only speeds up diagnosis and treatment but also enables healthcare facilities to overcome geographical barriers and shortages of local radiologists. For instance, according to the National Association of Chronic Disease Directions, in 2022, 60% of adult Americans have at least one chronic disease.

Chronic conditions such as diabetes, cancer, and cardiovascular disease are the leading causes of death in the United States. More than two-thirds of all deaths are caused by one or more of five chronic diseases including heart disease, cancer, stroke, chronic obstructive pulmonary disease, and diabetes. This rising prevalence of chronic diseases is creating the need for.

Moreover, teleradiology software supports collaborative healthcare approaches, where specialists can review and discuss cases in real-time regardless of their physical location, ensuring timely and accurate diagnoses. This technology is essential in modern healthcare settings where efficiency, accessibility, and quality of care are paramount.

Deployment Analysis

The web-based segment held a dominant position in the global teleradiology software market in 2023, accounting for the largest revenue share of 39%. This segment is expected to experience significant growth in the forecast period due to their flexibility, accessibility, and scalability. Web-based teleradiology software operates on the principle of cloud computing, where the software application and data storage are hosted on remote servers managed by third-party providers.

This model allows healthcare providers to access the software via web browsers from any location with internet connectivity, eliminating the need for on-premises hardware installations and maintenance costs. It offers seamless integration with existing healthcare IT systems, such as electronic health records (EHRs), picture archiving and communication systems (PACS), and hospital information systems (HIS), facilitating smooth workflow integration and interoperability.

Also, web-based solutions provide real-time access to medical images and patient data, enabling radiologists to interpret studies remotely and collaborate with other healthcare professionals across different facilities or regions. This capability is crucial for providing timely diagnoses and consultations, particularly in emergency situations or when specialist expertise is required.

Key Market Segments

By Type

- Radiology Information System (RIS)

- Picture Archive and Communication System (PACs)

- Vendor Neutral Archive (VNA)

By Deployment

- Web-based

- Cloud-based

- On-premise

Drivers

Rising Adoption of Digital Healthcare Infrastructure

The increasing adoption of digital healthcare systems globally, coupled with the exponential growth in radiology image datasets, is significantly driving the demand for robust healthcare information networks. These networks are crucial for storing, managing, accessing, and interpreting clinical data from diverse patient populations. With the rising volume of medical images generated each year, there is a pressing need for structured reporting systems that can integrate seamlessly with Electronic Health Record (EHR) solutions on an individual basis.

This necessity has led to a notable surge in the adoption of Radiology Information Systems (RIS) among diagnostic centers and healthcare institutions. RIS enables efficient management of radiology workflows, including scheduling, image tracking, and reporting, thereby enhancing diagnostic accuracy and operational efficiency. The integration of RIS with EHRs facilitates comprehensive patient care by centralizing diagnostic information, improving care coordination, and supporting informed decision-making among healthcare providers.

As healthcare providers strive to streamline workflows and improve patient outcomes, the demand for advanced RIS solutions is expected to continue growing, driven by the need for enhanced data management and seamless interoperability within digital healthcare ecosystems globally.

Restraints

High Implementation Costs

Teleradiology software operates in a highly regulated healthcare environment where safeguarding patient privacy and ensuring data security are paramount concerns. Regulations such as HIPAA in the United States and equivalent laws worldwide impose stringent standards on the management of medical data. Compliance with these evolving regulations presents a significant challenge for software providers, necessitating substantial investments in legal expertise, data encryption technologies, and robust security measures.

Failure to comply can result in substantial penalties and damage to reputation, prompting healthcare providers to approach new teleradiology solutions cautiously. The implementation of teleradiology software entails various costs, including software licenses, hardware infrastructure, training for radiologists and healthcare staff, and ongoing maintenance and support.

For smaller healthcare facilities or those with limited resources, these upfront and operational expenses can be prohibitive. Such financial considerations often discourage potential users from adopting teleradiology solutions, thereby restricting access to enhanced diagnostic capabilities for patients. To broaden accessibility, software providers must offer flexible pricing models and cost-effective solutions tailored to the diverse needs of healthcare institutions. This approach is crucial for making teleradiology technology more attainable and beneficial across a wider spectrum of healthcare settings.

Opportunities

New Product Development

New product development plays a pivotal role in driving growth opportunities within the teleradiology software market. Companies in this sector continually innovate through new product launches, enhancements to existing products, strategic mergers and acquisitions, and expansions into new geographic regions. These initiatives not only help companies stay competitive but also enable them to cater to evolving customer needs and technological advancements.

For example, companies like Comarch SA have expanded their global footprint by establishing new offices in strategic locations such as Australia. This expansion not only enhances their market reach but also allows them to tailor their products and services to meet local market demands.

Additionally, focusing on developing hosting services portfolios demonstrates their commitment to providing comprehensive solutions that address the specific needs of their clients.

In addition, Carestream Health’s introduction of the ‘Carestream Motion Mobile X-ray system’ exemplifies how new product launches can drive market growth. This innovative system, designed for basic radiography examinations, offers portability and maneuverability, making it ideal for use in various clinical settings, including compact environments. Its recent launch at a prominent industry event underscores Carestream Health’s dedication to advancing healthcare technology and meeting the demands of healthcare professionals globally.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert a substantial influence on the smart healthcare products market, shaping trends in adoption, investment, and regulatory frameworks worldwide. Economic indicators such as GDP growth, inflation rates, and currency fluctuations play a crucial role in determining healthcare expenditure and investment in technological advancements.

During economic downturns, healthcare budgets often come under pressure, leading to potential delays in adopting expensive smart healthcare technologies, despite their potential long-term advantages. Conversely, periods of economic stability and growth typically prompt healthcare providers and governments to prioritize upgrading healthcare infrastructure and embracing digital health solutions such as telemedicine and remote monitoring systems.

These dynamics highlight the intricate relationship between economic conditions and the advancement of smart healthcare technologies on a global scale.

Trends

The integration of artificial intelligence (AI) and machine learning (ML) technologies into teleradiology solutions. AI-powered algorithms are increasingly being utilized to assist radiologists in image interpretation, enabling faster analysis, enhanced diagnostic accuracy, and improved workflow efficiency. These technologies are particularly beneficial in handling the growing volume of medical imaging data and addressing the global shortage of radiologists by augmenting their capabilities.

Moreover, the adoption of cloud-based teleradiology solutions. Cloud technology offers scalability, flexibility, and cost-efficiency, allowing healthcare providers to store, transmit, and access medical images securely from anywhere with internet connectivity. This shift towards cloud-based platforms enables seamless integration with existing healthcare IT systems, such as Electronic Health Records (EHRs) and Picture Archiving and Communication Systems (PACS), facilitating better collaboration and patient care coordination across different healthcare settings.

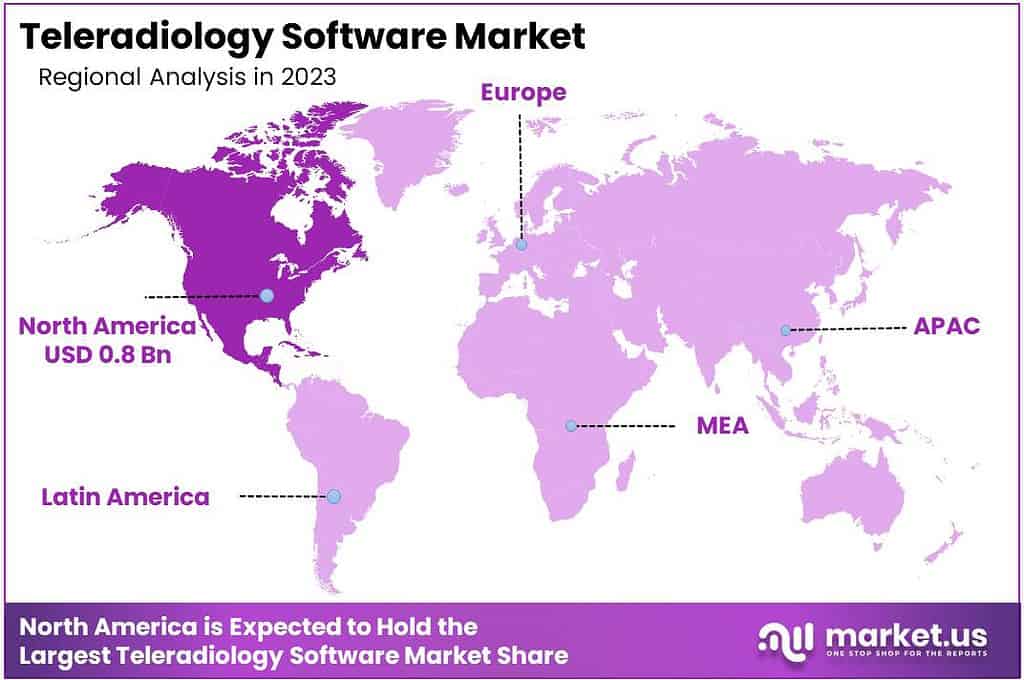

Regional Analysis

North America is leading the Teleradiology Software Market

North America dominated the global teleradiology software market in 2023, capturing over 40% of the total revenue share. The teleradiology software market in North America has experienced robust growth driven by several key factors, including the high prevalence of cancer and cardiovascular diseases, as well as the presence of leading industry players.

North America, particularly the United States, faces significant healthcare challenges due to the high incidence of cancer and cardiovascular diseases. According to the American Cancer Society’s 2023 statistics, approximately 1.9 million new cancer cases are expected in the U.S. alone, with a substantial number of cases affecting both males and females.

This staggering disease burden has heightened the demand for advanced medical imaging solutions, including teleradiology software, which plays a critical role in the timely and accurate diagnosis, staging, and treatment monitoring of cancer patients. Furthermore, the presence of major healthcare technology companies and innovative initiatives within the region has further propelled market growth. For instance, in March 2022, Royal Philips launched its Ultrasound Workspace at the American College of Cardiology’s Annual Scientific Session & Expo (ACC 2022).

his innovative platform integrates various cardiac ultrasound applications into a single workspace, enhancing workflow efficiency and diagnostic accuracy for healthcare providers. Such advancements not only demonstrate technological leadership but also drive the adoption of teleradiology solutions among healthcare institutions striving to improve patient outcomes.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is expected to witness rapid growth during the forecast period. This growth is driven by a significant unmet medical demand stemming from the increasing prevalence of chronic diseases like cancer and cardiovascular conditions across the region. The scarcity of radiologists in countries such as India amplifies the need for efficient medical imaging solutions, including teleradiology, to ensure timely and accurate diagnoses.

Additionally, supportive government initiatives in the digital health sector and the rising adoption of advanced technologies further bolster market expansion in the Asia Pacific. These factors collectively create a conducive environment for the adoption of teleradiology software, enabling healthcare providers to enhance diagnostic capabilities, streamline workflows, and improve patient outcomes.

As healthcare systems in the region continue to modernize and prioritize digital healthcare solutions, the teleradiology software market in the Asia Pacific is poised to grow significantly, addressing critical healthcare challenges and advancing medical imaging capabilities across diverse healthcare settings.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major companies are increasingly investing in the teleradiology software market in response to rising demand for imaging diagnostics. These companies employ various strategic initiatives such as product launches, regulatory approvals, strategic acquisitions, and innovative advancements to expand their global footprint and strengthen their market presence.

For example, in November 2022, OpenRad, a leading radio technology firm, introduced its Enterprise Edition. This platform facilitates advanced mobile fleet management and cloud-based collaborative workflows, catering to the needs of multiple organizations within a unified offering. This strategic move underscores the industry’s commitment to enhancing technological capabilities and meeting the growing demand for efficient and integrated teleradiology solutions worldwide.

Top Key Players in the Teleradiology Software Market

- Carestream Health

- Telerad Tech

- Comarch SA

- Medicentre Theme

- PERFECT IMAGING, LLC

- Impose Technologies Pvt Ltd.

- Radical Imaging LLC.

- OpenRad

- RamSoft, Inc.

- Koninklijke Philips N.V.

- Pediatrix Medical Group

- Other Key Players

Recent Developments

- In November 2022, Radiology reporting specialist OpenRad launched its enterprise remote reporting platform, Enterprise Edition, which enables cloud-based reporting, collaborative workflows across companies, and advanced mobile fleet management in one offering.

- In May 2022, United Kingdom teleradiology services provider Hexarad launched OptiRad, a workflow management software application aimed at improving efficiency for radiology departments.

- In August 2021, GE Healthcare launched Edison True PACS. This AI-enabled transformative system offers decision support to radiologists and helps them adapt to higher workloads and exam complexity, further improving diagnostic accuracy.

Report Scope

Report Features Description Market Value (2023) USD 2.2 Billion Forecast Revenue (2033) USD 6.4 Billion CAGR (2024-2033) 11.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type – Radiology Information System (RIS), Picture Archive and Communication System (PACs), and Vendor Neutral Archive (VNA); By Deployment – Web-based, Cloud-based, and On-premise Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Carestream Health, Telerad Tech, Comarch SA, Medicentre Theme, PERFECT IMAGING, LLC, Impose Technologies Pvt Ltd., Radical Imaging LLC., OpenRad, RamSoft, Inc., Koninklijke Philips N.V., Pediatrix Medical Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the teleradiology software market in 2023?The teleradiology software market size is USD 2.2 billion in 2023.

What is the projected CAGR at which the teleradiology software market is expected to grow at?The teleradiology software market is expected to grow at a CAGR of 11.3% (2024-2033).

List the segments encompassed in this report on the teleradiology software market?Market.US has segmented the teleradiology software market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Radiology Information System (RIS), Picture Archive and Communication System (PACs), and Vendor Neutral Archive (VNA). By Deployment the market has been segmented into Web-based, Cloud-based, and On-premise.

List the key industry players of the teleradiology software market?Carestream Health, Telerad Tech, Comarch SA, Medicentre Theme, PERFECT IMAGING LLC, Impose Technologies Pvt Ltd., Radical Imaging LLC., OpenRad, RamSoft Inc., Koninklijke Philips N.V., Pediatrix Medical Group, Other Key Players

Which region is more appealing for vendors employed in the teleradiology software market?North America is expected to account for the highest revenue share of 36.2% and boasting an impressive market value of USD 3.2 billion. Therefore, the teleradiology software industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for teleradiology software?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the teleradiology software Market.

Teleradiology Software MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Teleradiology Software MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Carestream Health

- Telerad Tech

- Comarch SA

- Medicentre Theme

- PERFECT IMAGING, LLC

- Impose Technologies Pvt Ltd.

- Radical Imaging LLC.

- OpenRad

- RamSoft, Inc.

- Koninklijke Philips N.V.

- Pediatrix Medical Group

- Other Key Players