Telemedicine Market By Component (Hardware, Software and Services), By Application (Teleradiology, Telepsychiatry, Telepathology, Teledermatology, Telecardiology and Other Applications), By Modality (Store-and-Forward, Real-Time and Other Modalities), By Delivery Mode (Web/Mobile and Call Centers), By Facility (Tele-Hospitals and Clinics, Tele-Home), By End User (Healthcare Providers, Payers, Patients, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 73419

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Analysis

- Application Analysis

- Modality Analysis

- Delivery Mode Analysis

- Facility Analysis

- End User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

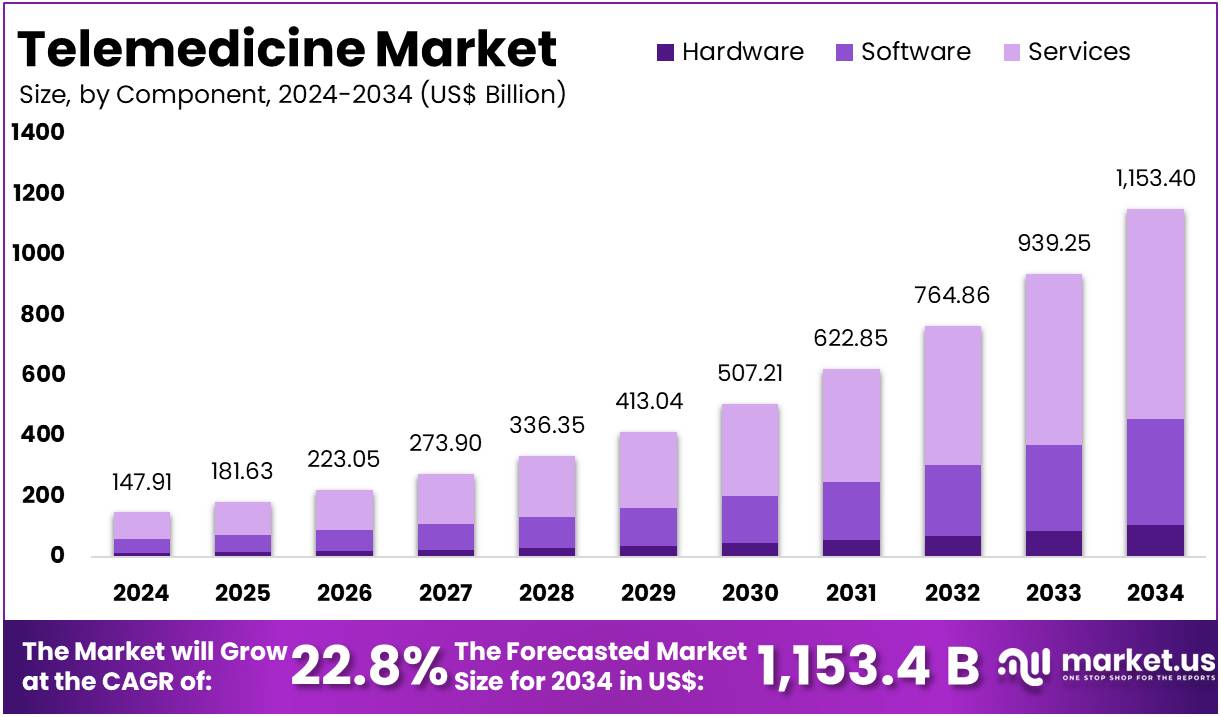

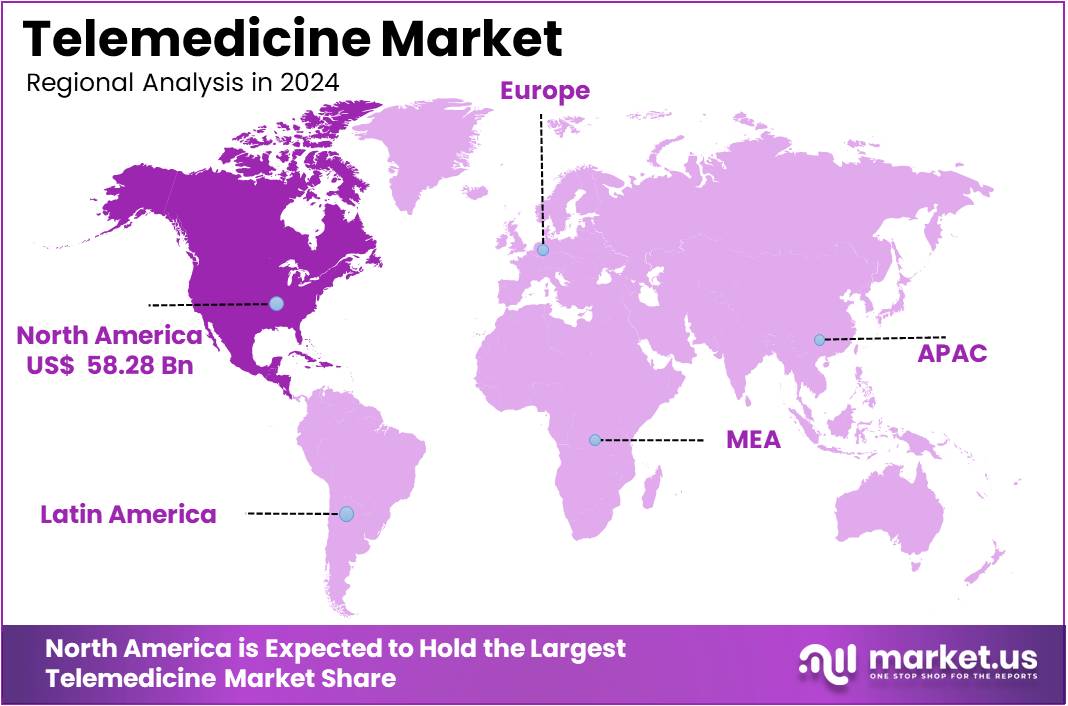

The Telemedicine Market Size is expected to be worth around US$ 1,153.40 billion by 2034 from US$ 147.91 billion in 2024, growing at a CAGR of 22.8% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.4% share and holds US$ 58.28 Billion market value for the year.

Telehealth, also known as telemedicine, has empowered healthcare providers to evaluate, diagnose, and treat patients virtually, ensuring that medical consultations and services are delivered without access barriers. This has led to a healthcare model that is more efficient, cost-effective, and patient-focused, while also generating significant attention and interest.

As one of the most transformative innovations in modern medicine, telehealth continues to expand rapidly. This momentum is expected to carry forward, reshaping not only patient care but also multiple facets of the healthcare industry in the coming years.

Recent technological advancements such as AI-powered tools, wearable devices, enhanced cybersecurity, and electronic health records (EHRs) have significantly boosted the efficiency of virtual care. At the same time, evolving regulatory frameworks since the COVID-19 pandemic have acknowledged the growing importance of telehealth, introducing guideline changes that expand patient access. Moreover, telemedicine is bridging healthcare access gaps by connecting underserved populations with essential medical expertise, regardless of geographic location.

According to the CDC, in 2021, telemedicine use among primary care physicians declined as the share of visits increased: 53.9% used it for less than 25% of visits, 27.9% for 25%–49% of visits, and 14.7% for 50% or more. A similar trend was seen among surgical specialists, with usage dropping from 63.3% for less than 25% of visits to just 5.5% for 50% or more, though the latter figure was not statistically reliable. Among medical specialists, telemedicine was most common at less than 25% of visits (41.5%), compared with 25.1% at 25%–49% of visits and 27.4% at 50% or more.

Key Takeaways

- In 2024, the market for Telemedicine generated a revenue of US$ 91 billion, with a CAGR of 22.8%, and is expected to reach US$ 1,153.40 billion by the year 2034.

- By Component, the market is bifurcated into Hardware, Software, and Services with Services taking the lead in 2024 with 60.3% market share.

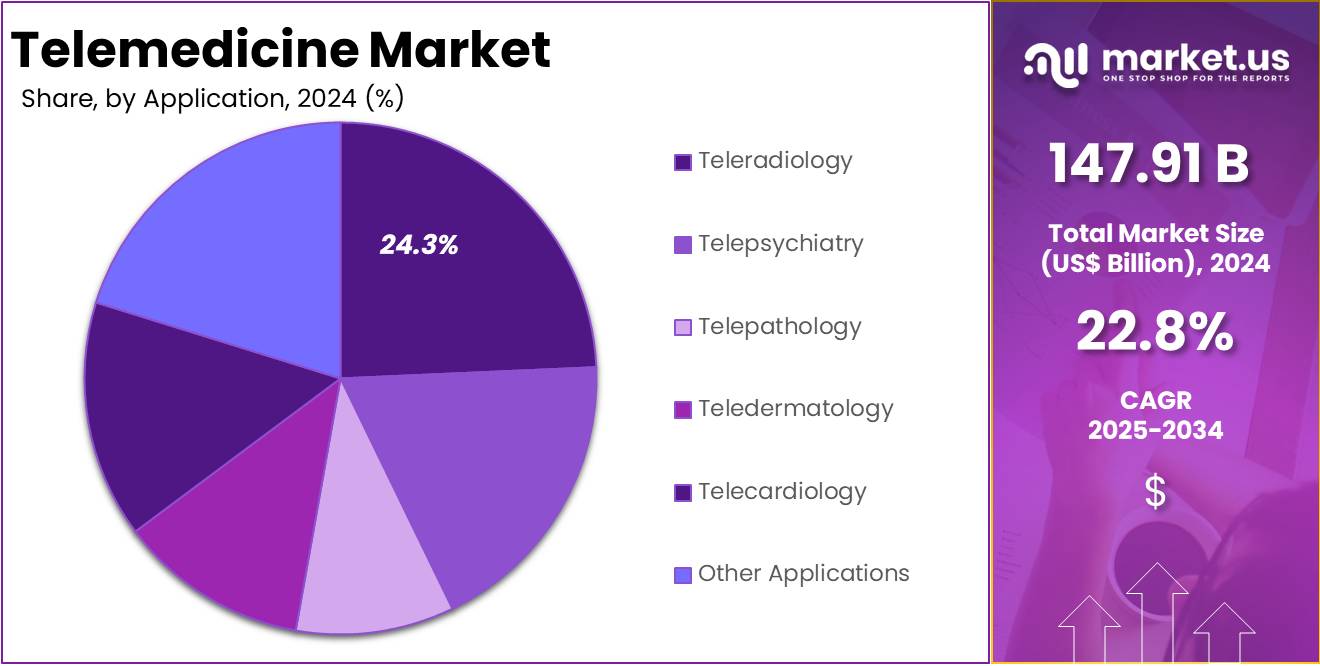

- By Application, the market is bifurcated into Teleradiology, Telepsychiatry, Telepathology, Teledermatology, Telecardiology, and Other Applications with Teleradiology taking the lead in 2024 with 24.3% market share.

- By Modality, the market is bifurcated into Store-and-Forward, Real-Time, and Other Modalities with Real-Time taking the lead in 2024 with 48.6% market share.

- By Delivery Mode, the market is bifurcated into Web/Mobile, and Call Centers with Web/Mobile taking the lead in 2024 with 76.1% market share.

- By Facility, the market is bifurcated into Tele-Hospitals and Clinics, and Tele-Home with Tele-Hospitals and Clinics taking the lead in 2024 with 52.3% market share.

- By End User, the market is bifurcated into Healthcare Providers, Payers, Patients, and Others with Healthcare Providers taking the lead in 2024 with 54.2% market share.

- North America led the market by securing a market share of 39.4% in 2024.

Component Analysis

In 2024, the Services held a dominant market position in the Component Segment of Telemedicine Market, and captured more than a 60.3% share.

Services accounted for the dominant share in the telemedicine market due to their critical role in connecting patients and healthcare providers seamlessly. Teleconsultations, patient monitoring, and specialist referrals form the backbone of telemedicine services, making them indispensable in healthcare delivery. For instance, Teladoc Health reported that over 18.5 million visits were conducted in 2023 through its telemedicine service platforms, highlighting the reliance of both patients and providers on service-based care. Unlike hardware and software, which act as enablers, services directly deliver value to end users, driving higher adoption rates.

Governments worldwide are also expanding service reimbursement models; the US Centers for Medicare & Medicaid Services (CMS) permanently approved reimbursement codes for telehealth services, broadening accessibility. Similarly, India’s eSanjeevani telemedicine service has crossed 150 million consultations, underscoring the scalability and demand for service delivery in underserved regions. The expansion of specialized services such as telepsychiatry and telecardiology further cements the dominance of this segment.

In August 2024, Pfizer Inc. launched PfizerForAll, a user-friendly digital platform aimed at simplifying access to healthcare and managing health and wellness for individuals across the U.S. This comprehensive, end-to-end platform is designed to assist millions of Americans each year who are affected by common illnesses such as migraines, COVID-19, and the flu, as well as those seeking to protect themselves through adult vaccinations.

Application Analysis

In 2024, the Teleradiology held a dominant market position in the Application Segment of Telemedicine Market, and captured more than a 24.3% share.

Teleradiology has emerged as the dominating application segment in the telemedicine market, driven by the critical need for rapid and accurate diagnostic imaging services across hospitals and clinics. The rising demand for CT scans, MRIs, and X-rays, coupled with a shortage of radiologists in many regions, has created strong growth momentum. For instance, the American College of Radiology notes that nearly 40% of rural hospitals in the United States lack on-site radiologists, making remote image interpretation indispensable.

Global tele-radiology providers such as vRad (Virtual Radiologic) and Everlight Radiology serve thousands of healthcare facilities by delivering 24/7 diagnostic support. In August 2025, Zoetis Inc., the global leader in animal health, partnered with VitalRADS, a comprehensive teleradiology service, to enhance its diagnostics platform, the Zoetis Virtual Laboratory. This collaboration integrates the expertise of board-certified veterinary specialists directly into clinics via a fully cloud-based diagnostic platform, available 24/7 throughout the year.

Modality Analysis

In 2024, the Real-Time held a dominant market position in the Modality Segment of Telemedicine Market, and captured more than a 48.6% share.

Real-time telemedicine dominated the modality segment, owing to its ability to provide immediate, interactive consultations between patients and healthcare providers. Live video consultations have become the preferred choice for primary care, mental health sessions, dermatology visits, and urgent care. The pandemic accelerated adoption, with the US Department of Health and Human Services reporting a 63-fold increase in Medicare telehealth visits from 2019 to 2020, primarily through real-time platforms.

In April 2023, Honeywell announced the development of a real-time health monitoring system designed to track and record patients’ vital signs both in hospitals and remotely. The solution utilizes advanced sensing technology through a skin patch, which transmits data instantly to healthcare providers via mobile devices and an online dashboard.

Patients value the immediacy of synchronous interactions, which replicate traditional consultations, allowing for direct questioning, visual assessments, and patient reassurance. Providers also benefit from efficiency gains, reducing missed appointments and enabling faster decision-making. Platforms such as Amwell, Doctor on Demand, and Doxy.me have built their core offerings around real-time video capabilities, with integrations into electronic health record (EHR) systems for seamless workflows. Countries such as China and India have also rolled out large-scale real-time teleconsultation services to serve rural populations.

Delivery Mode Analysis

In 2024, the Web/Mobile held a dominant market position in the Delivery Mode Segment of Telemedicine Market, and captured more than a 76.1% share.

Web and mobile platforms dominated the telemedicine market’s delivery mode, as smartphones and internet access have become integral to healthcare delivery worldwide. Mobile applications and web portals offer convenient, cost-effective access to consultations, prescriptions, and medical records. According to GSMA, global smartphone penetration reached over 70% in 2023, enabling widespread use of mobile-first telehealth solutions.

Patients increasingly prefer mobile apps like Teladoc, Babylon Health, and MDLIVE, which provide instant access to licensed professionals and prescription management at the tap of a screen. In countries such as India, government-backed apps like eSanjeevani and Aarogya Setu have further expanded public access to telemedicine services.

Facility Analysis

In 2024, the Tele-Hospitals and Clinics held a dominant market position in the Facility Segment of Telemedicine Market, and captured more than a 52.3% share.

Tele-hospitals and clinics dominate the facility segment, as institutional healthcare providers leverage telemedicine to extend services beyond physical boundaries. Hospitals increasingly adopt tele-ICUs, telecardiology, and telepathology solutions to expand access to specialized care while optimizing resources.

For instance, the Mayo Clinic and Cleveland Clinic have integrated tele-hospital platforms to deliver remote second opinions and critical care support globally. Large hospital networks often partner with telehealth companies such as Amwell or Teladoc to scale services across multiple facilities.

In rural and underserved regions, tele-hospitals bridge specialist shortages by providing remote consultations and diagnostic services. In the US, the American Hospital Association reported that over 76% of hospitals connected patients and consulting practitioners through telemedicine by 2022, reflecting widespread institutional adoption.

End User Analysis

In 2024, the Healthcare Providers held a dominant market position in the End User Segment of Telemedicine Market, and captured more than a 54.2% share.

Healthcare providers represent the dominant end-user segment in the telemedicine market, as hospitals, clinics, and private practices are the primary adopters of telehealth technologies. Providers use telemedicine to expand service reach, reduce patient no-shows, and optimize resource allocation. For example, Kaiser Permanente, one of the largest US healthcare systems, reported that telehealth visits outnumbered in-person visits during the pandemic, showcasing how providers leverage telemedicine for efficiency and continuity of care.

Providers also benefit from integrated workflows, with telemedicine platforms linking electronic health records (EHRs) and diagnostics for streamlined decision-making. In Europe, the National Health Service (NHS) in the UK has invested in provider-led telehealth platforms to manage both primary care and specialist services virtually.

Key Market Segments

By Type

- Hardware

- Software

- Services

By Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Other Applications

By Modality

- Store-and-Forward

- Real-Time

- Other Modalities

By Delivery Mode

- Web/Mobile

- Call Centers

By Facility

- Tele-Hospitals and Clinics

- Tele-Home

By End User

- Healthcare Providers

- Payers

- Patients

- Others

Drivers

Rising Demand for Accessible Healthcare

One of the strongest drivers of the telemedicine market is the growing demand for accessible and convenient healthcare services. Telemedicine bridges gaps in healthcare delivery by connecting patients and providers through digital platforms, regardless of geography. For instance, rural populations often face shortages of medical professionals and limited access to specialty care. In the United States, the Health Resources and Services Administration (HRSA) notes that more than 80 million Americans live in Health Professional Shortage Areas, where telemedicine helps fill the gap by providing remote consultations and specialist access.

During the COVID-19 pandemic, platforms such as Teladoc Health and Amwell recorded record surges in usage as patients sought safer, remote alternatives to in-person visits. In July 2023, the impact of the “Doctor for Everyone” grassroots telehealth initiative in Vietnam was revealed through surveys conducted at project sites. This innovative software has transformed healthcare access by allowing individuals to select and schedule appointments with the appropriate healthcare professionals at their convenience.

In India, the government launched the eSanjeevani platform, which has facilitated over 100 million teleconsultations, making healthcare more accessible to underserved communities. Similarly, in sub-Saharan Africa, organizations like Babyl Rwanda provide AI-driven teleconsultations, helping to overcome a critical shortage of physicians. As populations age and chronic disease prevalence rises, the demand for continuous care and monitoring is expected to further expand telemedicine adoption globally, making accessibility a central growth driver of the industry.

Restraints

Data Privacy and Security Concerns

A major restraint in the telemedicine market is data privacy and cybersecurity risks. Telemedicine platforms handle highly sensitive health records, including diagnostic reports, prescriptions, and mental health consultations, making them prime targets for cyberattacks. For example, in 2020, the telehealth provider Babylon Health faced scrutiny after a software error exposed private video consultations to the wrong users.

In the United States, the Health Insurance Portability and Accountability Act (HIPAA) sets strict guidelines for safeguarding patient data, but not all telemedicine applications fully comply, especially smaller startups or those operating across international boundaries with varying regulations.

In Europe, the General Data Protection Regulation (GDPR) imposes additional requirements that further complicate compliance for multinational providers. Cyber breaches not only erode patient trust but also expose providers to legal penalties and reputational damage. Furthermore, many patients remain hesitant to adopt telemedicine due to concerns about who can access their health data or how securely it is stored.

Opportunities

Expansion of Telepsychiatry and Mental Health Services

One of the most promising opportunities lies in the growth of telepsychiatry and digital mental health services. The World Health Organization (WHO) highlights that nearly 1 billion people worldwide suffer from mental health disorders, yet access to qualified professionals remains severely limited. Telemedicine platforms such as BetterHelp, Talkspace, and Teladoc Mental Health are addressing this gap by offering secure, on-demand access to licensed therapists and psychiatrists.

For example, Talkspace reported that its active user base grew by more than 50% during the COVID-19 lockdowns, reflecting heightened demand for remote counseling. In rural or conservative communities where stigma or lack of infrastructure hinders in-person therapy, telepsychiatry provides an accessible, discreet solution. Governments are also recognizing this opportunity: in the United States, Medicare expanded reimbursement for telepsychiatry sessions during the pandemic, and several states have made these provisions permanent.

Similarly, in the UK, the National Health Service (NHS) has integrated online cognitive behavioral therapy (CBT) platforms into its mental health services. The increasing prevalence of anxiety, depression, and workplace stress globally, coupled with technological advancements in AI-driven counseling tools, creates significant growth potential for telepsychiatry as one of the most scalable opportunities in telemedicine.

Impact of Macroeconomic / Geopolitical Factors

During economic downturns or recessions, healthcare systems often face budget constraints, driving demand for cost-effective solutions like telemedicine. By reducing overheads related to hospital visits and in-person consultations, telemedicine becomes an attractive alternative. For instance, during the COVID-19 pandemic, the economic strain on healthcare systems worldwide accelerated telemedicine adoption.

In the US, insurance providers expanded coverage for telehealth services, enabling more cost-effective access to care. Similarly, in developing regions, the increasing financial pressure on national healthcare systems has led to the adoption of telemedicine as a way to alleviate burdened physical infrastructures.

Geopolitical tensions or conflicts can disrupt healthcare access, especially in war-torn regions or those experiencing political instability. In such scenarios, telemedicine offers a lifeline by providing remote consultations, diagnostics, and treatments.

For example, in conflict zones such as Syria and Ukraine, telemedicine platforms were used to continue healthcare delivery despite physical infrastructure challenges. Furthermore, policies promoting cross-border telehealth solutions, such as the European Union’s telemedicine directives, are facilitating the expansion of healthcare across borders, allowing patients to access specialists beyond national limitations.

Latest Trends

Integration of AI and Remote Monitoring in Telehealth

A defining trend in the telemedicine market is the integration of artificial intelligence (AI) and remote patient monitoring (RPM) technologies. AI-powered algorithms assist in triaging patients, predicting health risks, and enabling faster diagnosis, thereby improving efficiency in teleconsultations. For instance, Babylon Health’s AI chatbot can analyze symptoms and suggest whether a patient should consult a physician, reducing unnecessary appointments.

Meanwhile, remote monitoring devices—such as connected glucometers, wearable ECG monitors, and smart inhalers—feed real-time data to clinicians, allowing continuous patient oversight without physical visits. Philips and Medtronic have invested heavily in RPM solutions for chronic disease management, including heart failure and diabetes.

In the United States, the Centers for Medicare & Medicaid Services (CMS) has introduced reimbursement codes for RPM, encouraging adoption among providers. AI-driven analytics also help detect early signs of deterioration in patients with chronic conditions, reducing hospital readmissions and lowering healthcare costs.

Regional Analysis

North America is leading the Telemedicine Market

In 2024, North America dominated the global Telemedicine market, accounting for the maximum share with over 39.4% of total sales. This is due to increasingly advanced healthcare facilities, digitization in healthcare, and the adoption of telemedicine solutions.

The presence of key players further contributes to the region’s prominent share. For example, companies Teladoc Health, Inc., MDlive, Inc., American Well Corp., SteadyMD, Inc., Doctor on Demand, Inc., and Zoom Video Communications, Inc.. are located in the United States. These companies are implementing strategic initiatives to expand their market share.

In June 2024, IMG (International Medical Group), a renowned global insurance benefits and assistance services provider, announced an expansion of its partnership with Teladoc Health, the global leader in whole-person virtual care. This expansion will enhance service offerings for IMG customers already using telehealth services and enable the availability of telehealth services through additional IMG plans.

Followed by North America, Asia-Pacific is projected to be the rapidly growing regional market during the forecast period. This fastest growth can be accredited to the presence of a large number of patients, increased use of the internet, and rapid demand for medical support, especially in rural areas. Emerging markets such as China and India are estimated to dominate the regional market in the next few years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Telemedicine market includes Teladoc Health, Amwell, MDLIVE, Doctor on Demand, Babylon Health, PlushCare, Sesame (Sesame Care), HealthTap, Doxy.me, 98point6, Maple, Kry, Zocdoc, Lemonaid Health, MeMD, and Other key players.

Key Opinion Leaders

Leader Name Key Opinion Dr. Emily Moore, Chief Medical Officer- Teladoc Health “Teladoc Health has truly pioneered the transformation of virtual care. The company has consistently demonstrated its ability to offer scalable, high-quality care through its robust platform, which supports a wide range of specialties, including primary care, mental health, and dermatology. In my experience, what sets Teladoc apart is its relentless focus on patient experience. The integration of AI-driven triage systems allows for seamless workflows, ensuring that patients are matched with the right healthcare providers in a timely manner. Teladoc’s continuous innovation in virtual consultations and its expansion into areas like mental health services during the pandemic has been nothing short of revolutionary. Looking forward, their efforts to integrate telemedicine into traditional healthcare settings will likely shape the future of the industry.” Amwell – Dr. John Anderson, Telehealth Consultant “Amwell has positioned itself as a leader in the enterprise telemedicine space. The company’s ability to integrate telemedicine into large-scale healthcare systems is unparalleled. Amwell’s focus on partnering with established healthcare organizations has allowed it to build a strong, trusted presence in the market. One of the key advantages Amwell offers is its comprehensive platform, which enables healthcare providers to deliver care efficiently across multiple specialties. The recent advancements in their AI and telemonitoring capabilities are particularly exciting, as they not only streamline the telehealth experience but also ensure that data flows seamlessly between clinicians and patients. As telemedicine continues to evolve, Amwell is well-equipped to lead the charge in delivering accessible, high-quality healthcare.” Doctor on Demand – Dr. Sarah Jennings, Behavioral Health Specialist “Doctor on Demand has been a game changer in the telehealth market, particularly in the mental health sector. As a behavioral health professional, I’ve seen firsthand the impact telemedicine has had on patient care. Doctor on Demand’s platform allows individuals to access mental health care services from the comfort of their own home, removing the stigma and logistical barriers that often prevent patients from seeking help. The ability to offer both virtual therapy and psychiatric consultations is a unique strength of the platform. I believe the company’s proactive approach to expanding mental health services, along with its focus on integrating with healthcare providers and insurers, will continue to drive its success and contribute significantly to meeting the rising demand for mental health support.” Recent Developments

- In February 2025, Teladoc Health, the global leader in virtual care, announced it has signed a definitive agreement to acquire Catapult Health, a prominent provider of virtual preventive care services. Teladoc plans to integrate Catapult Health’s innovative at-home diagnostic testing, patient-centric approach, and high-touch engagement model into its comprehensive suite of industry-leading solutions.

- In January 2025: Avel eCare, the nation’s leading telemedicine provider for clinician-to-clinician services, announced the acquisition of Amwell Psychiatric Care (APC), a division of Amwell®. This acquisition strengthens Avel eCare’s position as a national leader in telemedicine and enhances its Behavioral Health services to address the increasing demand in both rural and urban communities.

- In October 2023: Evernorth Health Services, the pharmacy, care, and benefits solution division of The Cigna Group, announced plans to enhance MDLIVE’s virtual care by acquiring the technology and clinical capabilities of Bright.md, a leader in asynchronous care, triage, and healthcare navigation services.

Top Key Players in the Telemedicine Market

- Teladoc Health

- Amwell

- MDLIVE

- Doctor on Demand

- Babylon Health

- PlushCare

- Sesame (Sesame Care)

- HealthTap

- me

- 98point6

- Maple

- Kry

- Zocdoc

- Lemonaid Health

- MeMD

- Other key players

Report Scope

Report Features Description Market Value (2024) US$ 147.91 billion Forecast Revenue (2034) US$ 1,153.40 billion CAGR (2025-2034) 22.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software and Services), By Application (Teleradiology, Telepsychiatry, Telepathology, Teledermatology, Telecardiology and Other Applications), By Modality (Store-and-Forward, Real-Time and Other Modalities), By Delivery Mode (Web/Mobile and Call Centers), By Facility (Tele-Hospitals and Clinics, Tele-Home), By End User (Healthcare Providers, Payers, Patients, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teladoc Health, Amwell, MDLIVE, Doctor on Demand, Babylon Health, PlushCare, Sesame (Sesame Care), HealthTap, Doxy.me, 98point6, Maple, Kry, Zocdoc, Lemonaid Health, MeMD, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Teladoc Health

- Amwell

- MDLIVE

- Doctor on Demand

- Babylon Health

- PlushCare

- Sesame (Sesame Care)

- HealthTap

- me

- 98point6

- Maple

- Kry

- Zocdoc

- Lemonaid Health

- MeMD

- Other key players